Navy Federal Credit Union

The Navy Federal Union is only available to people affiliated with the military or their families. Also, the Department of Defense civilian contractors, personnel, and those who live with a Navy Federal Member. The union has refinancing options from 10-year loan terms and will refinance FHA and VA loans.

Details

Days to Close: 30 days

Mortgage Rate: Lower than the national average

Minimum Down Payment: N/A

- The online pre-approval process provides speed.

- Private mortgage insurance is not required.

- Friendly to those with a low credit score.

- Wide range of refinance loan types.

Cons

- Membership is limited to military affiliates.

Bottom Line

- Aside from being suitable for those in or affiliated with the military, Navy Federal is the ideal choice for those with low credit scores. It offers low credit loans just like Carrington Mortgage Services, except that it is only for those related to the military.

Moneys Average Mortgage Rates For October 13 2022

Mortgage rates remain volatile. Borrowers looking for a 30-year fixed-rate loan can expect rates averaging 7.818%, 0.055 percentage points higher than yesterday.

Rates on adjustable-rate mortgages also continued to make big day-to-day changes. The 5/6 ARM is averaging 7.199%, an increase of 0.201 percentage points.

-

The latest rate on a 30-year fixed-rate mortgage is 7.818%.

-

The latest rate on a 15-year fixed-rate mortgage is 6.839%.

-

The latest rate on a 5/6 ARM is 7.199%.

-

The latest rate on a 7/6 ARM is 7.37%.

-

The latest rate on a 10/6 ARM is 7.494%.

Moneys daily mortgage rates are a national average and reflect what a borrower with a 20% down payment, no points paid and a 700 credit score roughly the national average score might pay if he or she applied for a home loan right now. Each days rates are based on the average rate 8,000 lenders offered to applicants the previous business day. Your individual rate will vary depending on your location, lender and financial details.

These rates are different from Freddie Macs rates, which represent a weekly average based on a survey of quoted rates offered to borrowers with strong credit, a 20% down payment and discounts for points paid.

Checking Your Credit Score

You should check your credit score well before you begin the mortgage process so you will know where you stand and the mortgage rate you could qualify for. You can check your credit score for free through several online services. Many banks, credit unions, and credit card providers offer credit scores as a regular feature. Since most major mortgage lenders use your credit score in their decision, it’s worthwhile to obtain all three of your reports to make sure the information on your record is accurate.

It’s a good idea to research your credit score and your credit reports well in advance of making a major purchase so you have time to address any errors or other issues you might discover.

Don’t Miss: How Much Net Income Should Go To Mortgage

Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, Experian and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate a credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

What Fico Score Do I Need To Refinance My House

Related Articles

Most lenders require a minimum credit score in the region of 620 in order to approve a refinancing application. Federal Housing Administration programs typically have lower minimums, although their lenders can insist on higher credit score requirements for some borrowers. If you qualify for a government-backed streamlined refinance, there’s no minimum credit requirement at all.

Read Also: When Will Home Mortgage Rates Go Up

How Are Mortgage Rates Determined

In general, mortgage rates are determined by economic factors. These include the Federal Reserve benchmark interest rates and the job market. Mortgage rates aren’t directly tied to Fed rates, but they tend to trend in the same direction. If the job market is poor and fewer people are working, rates will drop to attract buyers.

Lenders then look at factors like credit score and history, income, and total debts to determine what mortgage rate to offer specific borrowers.

Can I Buy A Car While Refinancing

Mortgage professionals often advise avoiding anything that affects your debts, income, or credit during the weeks or even months when your refinancing application is being assessed. Dropping even a single point on your credit score can make a huge impact on the cost of your mortgage. Auto loans are assessed as part of your DTI ratio calculation when lenders analyze your mortgage application.

If your auto loan means that youll have higher monthly payments, then your DTI ratio will rise, all other things remaining equal. In general, its better to hold off on this kind of purchase until your application is complete.

Don’t Miss: What Is The Monthly Mortgage Payment Formula

How Quickly Can I Refinance A Mortgage

In principle, there is no minimum amount of time that you must wait before refinancing your conventional mortgage. In theory, you could refinance immediately after purchasing your home. However, some lenders have rules that stop borrowers from immediately refinancing under the same lender.

Whether these rules apply to you will depend on the type of mortgage that you have and which lender you are with. Keep in mind that there is also a general requirement that you have a debt-to-income ratio of 36% or less, which will take the average homebuyer a few years to reach.

Conventional Loan Refinance Credit Score Requirements

To refinance a conventional conforming loan, you typically need a credit score of 620 or higher. Thats true for both a cash-out or no-cash-out refinance.

Conventional refinance FICO score minimums

- Conventional rate-and-term refinance: 620

- Conventional cash-out refinance: 620

If youre hoping to do a cash-out refinance, youll also need plenty of home equity because lenders ask you to leave 20% of your equity in the home after the cash-back amount. You can learn more about how cash-out refinancing works here.

Conventional refinance rates are highly dependent on your credit score. So while you can refinance a conventional loan with a credit score of 620 or higher, youll get a better interest rate with a score above 720.

Read Also: Can You Buy A House With A Reverse Mortgage

Pay All Your Bills On Time

About 35% of your FICO® Score comes from your payment history, making it the single most important factor when it comes to building a great credit score. The fastest and most reliable way to improve yours is to build a solid history of on-time payments for each of your accounts.

Review your bank, loan and credit card statements and figure out exactly how much you owe each month on all of your accounts. Write down each accounts minimum payment and due date in a spreadsheet. Remind yourself to pay each account on time every month by placing your spreadsheet somewhere you’ll run into it often, like on a desk calendar.

You may also want to enable automatic bill pay if your accounts offer it. Automatic bill pay allows you to schedule a date for your minimum payments in advance. From there, your account holders automatically deduct what you owe. This can help you avoid accidentally lowering your score by forgetting a payment.

What Credit Score Is Needed For A Usda Loan

Home loans issued by the U.S. Department of Agriculture are designed to help low- and moderate-income individuals and families buy and improve homes in non-urban America .

There are three types of USDA home loans, including those intended for very low-income applicants, homeowners wishing to improve their property and qualified moderate-income applicants who want a low interest loan with a small down payment. Mortgage rates and borrowing limits on USDA loans vary according to prevailing property values in different parts of the country.

The USDA doesn’t specify minimum credit score requirements for the loans it backs, but the minimum FICO® Score requirement nationwide is about 640.

You May Like: Can You Get A Reverse Mortgage On A Condo

How To Boost Your Credit Score Before Refinancing

Improving your credit score before refinancing can go a long way toward making your application stronger. One of the best ways to quickly boost your score is by addressing your . Focus on paying down debt so that youre using less than 30 percent of your available credit, say Allred and Hackett.

In addition, start or continue paying your bills on time. As you prepare for refinancing, Hackett recommends a quiet period with no credit inquiries in the 90 to 120 days before applying, and having a few lenders lined up so the inquiries they generate all happen within a short time frame, reducing the hit to your score.

In general, stay on top of your credit score. Currently, you can review each of your three scores for free every week at AnnualCreditReport.com. By keeping tabs on your score, youll be able to take care of any inaccurate information well before you need to apply for any loan.

If Your Mortgage Rate Is Above 689% Now Is Probably A Good Time To Refinance

The current average mortgage rate for a 30-year fixed-rate loan is 5.89%, according to Freddie Mac. It is probably worth considering a mortgage refinance if you can reduce your current interest rate by at least 0.5%.

If you have a $300,000 balance on your mortgage and you refinance to a new 30-year loan, lowering your interest rate from 6% to 5.50% will save around $95 per month or $1,140 per year. If you can reduce the rate from 6% to 5%, your monthly savings would be $188 per month or $2,256 per year.

You also dont have to refinance into a 30-year loan. If your finances have improved and you can afford higher monthly payments you can refinance a 30-year loan into a 15-year fixed-rate mortgage, which will allow you to pay the loan off faster and also pay less interest.

Taking a look at your monthly savings is just one part of the refi equation, however. You also need to factor in the cost of switching out your loan and how long it will take you to recover those costs, or break even.

Just as with a purchase loan, youll have to pay closing costs on a refinance. These costs can include origination and application fees, appraisal and inspection costs and title search fees. In all, closing costs can run between 3% and 6% of the total loan amount being refinanced.

Also Check: Can Non Permanent Resident Get Mortgage

Are Refinance Rates Going Down

While current mortgage rates remain low, most mortgage experts anticipate rates will continue to drift higher over the coming months and years. The Federal Reserve began raising short-term interest rates in March 2022. The Fed does not set mortgage rates, but lenders tend to increase the price to borrow money when the Fed acts.

Does Refinancing Your Mortgage Impact Your Credit Scores

Refinancing your mortgage can be a great way to lower your interest rate and reduce your monthly mortgage payment, but it can also impact your credit scores.

Reading time: 4 minutes

Refinancing a mortgage is the process of taking out a new home loan and using that loan to pay down the balance on your original mortgage. Refinancing can be a great opportunity to change the terms of your loan: You might refinance to shorten the duration of your loan or, more commonly, to secure a lower interest rate. If interest rates have dropped significantly since you first took out your mortgage, your long-term savings could be substantial.

However, keep in mind that, despite the benefits of an adjusted loan, a mortgage refinance could have a negative impact on your credit scores. Here are three things to know about your credit reports before you begin the refinancing process:

Don’t Miss: What Is The Effect Of Paying Extra Principal On Mortgage

What Credit Score Do You Need To Refinance A Home

The exact credit score youll need to refinance your mortgage depends on the type of loan, as well as your specific lenders requirements. In many cases, your loan-to-value ratio , will also determine what credit score youll need to qualify.

| Loan type | Min. credit score |

|---|---|

| Conventional | 620 to 720, depending on your loans LTV, your debt-to-income ratio, and how much you have in cash reserves |

| FHA |

|

| FHA | |

| USDA | No specific minimum, but will need to demonstrate your ability to manage debt |

Keep in mind that these are minimum credit scores for the loan programs. Lenders that offer these loans might require a higher credit score to lessen the risk.

Find Out: Does Refinancing Your Mortgage Hurt Your Credit? Heres the Truth

Sometimes It Pays To Refinance

The FHA cash-out refinance option allows homeowners to pay off their existing mortgage, and create a larger home loan that provides them with extra cash. The amount of money that can be borrowed depends on the amount of equity that’s been built up in the home’s value. To be eligible for an FHA cash-out refinance, borrowers will need at least 20 percent equity in the property based on a new appraisal. Equity is the difference between the current value of a property and the amount owed on the mortgage.

In the following example, a borrower obtained an FHA loan of $275,000 to purchase a home. He makes his monthly payments as agreed. As of today, the value has increased to $350,000 with a balance of $250,000 owed on the mortgage. In this example, a loan of up to 80 percent of the appraised value of the home would be permissible . When subtracting the amount that is still owed on the existing mortgage leaves a maximum cash-out amount of $30,000 .

Read Also: How Much Do Points Cost On Mortgage

What Do You Need To Refinance Your Mortgage

If you want to refinance your mortgage, there are certain things that you need for it to be successful. You need to prove your creditworthiness and income like any other loan, but home equity is also significant. Here is what you need to refinance your mortgage:

1.Low Debt-to-Income Ratio

You have a good chance of getting your application approved if your income has stayed the same or increased while the debt has decreased.

2.Healthy FICO Credit Score

Most lenders require a minimum of 620 but can go as low as 580.

3.Loan to Value Ratio of 20% and More

Typically, most mortgage lenders ask for a loan to value ratio of 80% while the home equity is 20%.

Multiple Credit Inquiries Can Affect Your Credit Report

When you refinance, youll generally want to shop around with different lenders to find the best loan terms possible. However, remember that when you apply for a loan and the potential lender reviews your credit history, it results in a hard inquiry on your credit reports. Hard inquiries remain on your credit reports for 24 months and may affect your credit scores, depending on your credit history and borrowing habits. To help minimize the number of hard inquiries on your credit reports, start by researching lenders and rates online and then make a short list of the ones with which youll apply.

Before you start shopping, it may be worth your time to pull a copy of your credit reports to get a sense of how you’ll look to potential lenders. You can get six free copies of your Equifax credit report each year when you sign up for a myEquifax account. You can also get your free weekly credit report through www.annualcreditreport.com. These reports are included in the free weekly Equifax credit reports currently offered on www.annualcreditreport.com through April 2022. If you see something that appears to be inaccurate, you can dispute the information you believe to be inaccurate or incomplete. Review all the information on your credit reports for accuracy before you begin applying for a refinance.

Review all the information on your credit reports for accuracy before you begin applying for a refinance.

Read Also: How Does Mortgage Protection Insurance Work

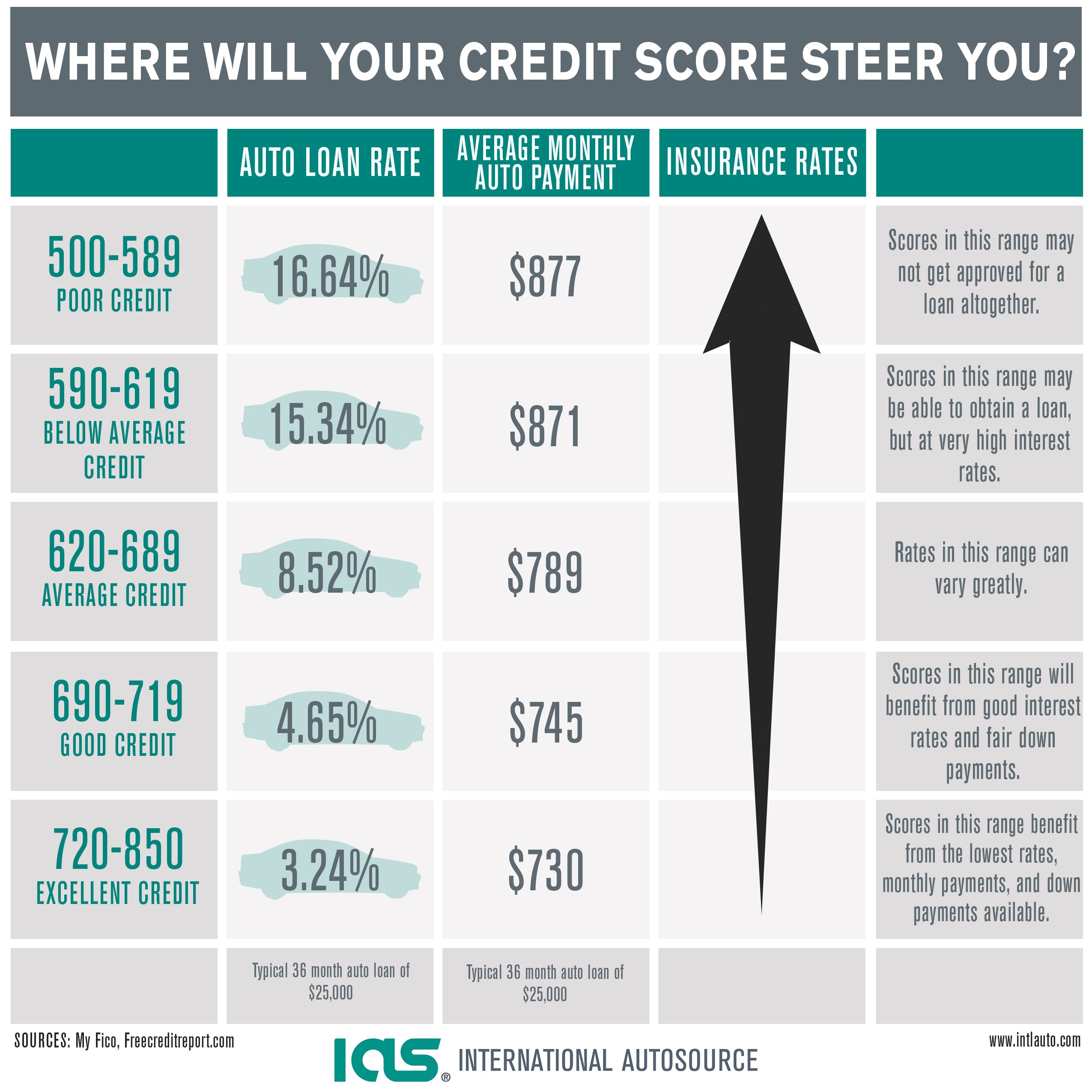

How Does Credit Score Affect Refinance Rates

Your credit score doesnt just impact your refinance approval. It also affects the interest rate lenders will offer you. Everything else being equal, a high score should earn you a lower rate while a bad credit score means youll pay more for your refinance loan.

You can use FICOs loan savings tool to give you a rough idea of just how much your credit score affects your mortgage rate and monthly payment. In turn, this will have a big impact on your total interest cost over the life of the loan.

We show one example below using a 30-year, fixed-rate mortgage with a $400,000 loan amount.

| $2,490 | $495,270 |

*Annual percentage rates reflect the nationwide average according to FICO.com on April 26, 2022. Interest rates change daily and rates shown here do not reflect the rate you will be offered.