Expert Tips To Pay Down Your Mortgage In 10 Years Or Less

Purchasing a home is a dream for pretty much everyone. But, taking on that massive debt can prevent you from retiring earlier, sending the kids to college, or taking that dream vacation. Like any other debt, if youre able to get rid of your mortgage as soon as possible, the better off youll be down road.

This may sound like an uphill battle that you cant win, but if you follow these 12 expert tips, you may be able to actually pay your mortgage off within a decade.

Related Topics & Resources

Products underwritten by Nationwide Mutual Insurance Company and Affiliated Companies. Not all Nationwide affiliated companies are mutual companies, and not all Nationwide members are insured by a mutual company. Subject to underwriting guidelines, review and approval. Products and discounts not available to all persons in all states. Nationwide Investment Services Corporation, member FINRA. Home Office: One Nationwide Plaza, Columbus, OH. Nationwide, the Nationwide N and Eagle and other marks displayed on this page are service marks of Nationwide Mutual Insurance Company, unless otherwise disclosed. ©. Nationwide Mutual Insurance Company.

How Long Will It Take Me To Pay Off My Student Loan: Uk

In the UK, student loans are repaid as a percentage of earnings, and only when your annual income is over a certain threshold. So when youre not earning or not earning much you dont need to make any loan repayments.

Of course, interest still accrues over this time, so any downtime where youre not paying off your loan means that there will be more to repay in the long run. However, and this is the critical part, the slate is wiped clean in the end there will never be a knock at the door demanding a huge, snowballed sum of money if youve been making low or no repayments.

Depending on the year in which you took out your loan, it will simply be written off after 25 years, 30 years, or when you turn 65. Phew. For this reason, repaying a student loan in the UK can be considered to work a bit like a graduate tax, applied in a similar way as income tax or national insurance.

Also Check: How Does Rocket Mortgage Work

Put Down A Large Down Payment

Some mortgage companies draw people in by promising mortgage approval with a very low down payment, sometimes as low as 3-5% of the purchase price of the residence.

Although this may seem attractive initially , it really is a poor financial decision to obtain a mortgage in which you put down a small amount. In reality, you should scrape together as much as you possibly can to make the payments smaller and get you closer to paying off your home faster.

If you were to offer a 20% down payment, you can avoid PMI private mortgage insurance. PMI is a type of insurance that protects the mortgage lender if a homeowner defaults on the mortgage. So, with PMI, a portion of your mortgage payment goes towards an insurance premium that is put aside to give the beneficiary protection if you should default on your loan.

If you put down 20%, you avoid PMI altogether, which results in major savings for you. You could use that PMI amount to pay down your mortgage even faster.

Make One Extra Mortgage Payment Per Year

Many homeowners choose to make one extra payment per year to pay off their mortgage faster.

One of the easiest ways to make an extra payment each year is to pay half your mortgage payment every other week instead of paying the full amount once a month. This is known as biweekly payments.

When you make biweekly instead of monthly payments, you end up adding one extra payment each year.

However, you cant simply start making a payment every two weeks. Your loan servicer could be confused about getting irregular, partial payments. Talk to your loan servicer first to arrange this plan.

You could also simply make a 13th payment at the end of the year. But this method requires coming up with a lump sum of cash. Some homeowners like to time their extra payment with their tax return or with a yearly bonus at work.

However you arrange it, making an extra payment each year is a great way to pay off a mortgage early.

As an example, if you took out a mortgage for $200,000 on a 30year term at 4.5%, your principal and interest payment would be about $1,000 per month.

Paying one extra payment of $1,000 per year would shave 4½ years off your 30year term. That saves you over $28,500 in interest if you see the loan through to the end.

Paying down your mortgage balance quickly has other advantages, too.

You May Like: 10 Year Treasury Yield Mortgage Rates

You Have No Other Savings

When unexpected expenses pop up, you want to be able to pay for them. That could mean replacing a flat tire on your car or paying a doctors bill when you get a bad case of the flu.

To make sure you have enough cash savings to cover these costs, start building an emergency fund. A fund worth at least six months will go a long way, though you probably need more if you have dependents.

Consider An Offset Account

An offset account is a savings or transaction account linked to your mortgage. Your offset account balance reduces the amount you owe on your mortgage. This reduces the amount of interest you pay and helps you pay off your mortgage faster.

For example, for a $500,000 mortgage, $20,000 in an offset account means you’re only charged interest on $480,000.

If your offset balance is always low , it may not be worth paying for this feature.

Read Also: Mortgage Recast Calculator Chase

Send Payments As Principal Payments

Send in your extra payments separate from your regular payment and clearly designate them to apply to principal only. This will ensure your extra payments are not credited to unearned interest. Combining the payments can cause confusion for the servicer, particularly when you send it in for the first time. Keep copies of your checks, or records of your online payments. Track your extra payments using a payment calculator.

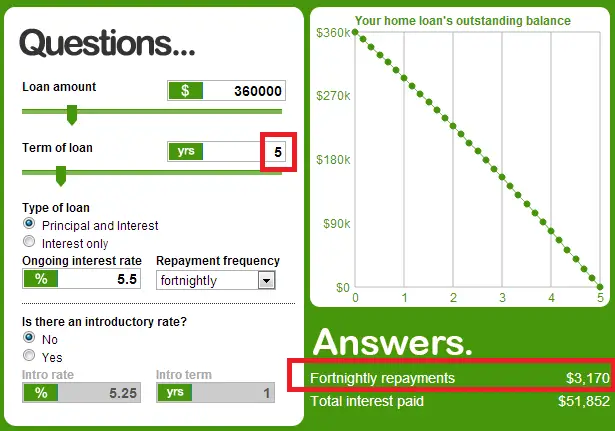

Tip

Use an online mortgage calculator that allows you to enter periodic or regularly occurring extra payments download it into your favorite spreadsheet program.

Round up your mortgage payment to the nearest $100. This little bit by itself can help shave months off your mortgage.

Refinance into a lower interest-rate mortgage, but keep making the old, higher payment amount to further accelerate your loans payoff date.

Warning

Making extra payments when they are not required can be challenging. Some people procrastinate sending the extra payment, even though it is within their budget. Refinance into a 10-year mortgage to force yourself to pay the extra money.

References

How I Paid Off $100000 Of Debt

- Feature Image By:Nicetoseeya | Shutterstock

I started 2019 with about $142,000 in debt. The debt was a combination of student loans, , an auto loan, and some debt in collections. I had been burying my head in the sand and pretending that the debt didnt exist, but after a long, hard conversation with my boyfriend about our future, I knew I had to get it under control.

Original debt breakdown by category:

- Car Loan: $12,381.66

- Student Loans: $98,099.52

TOTAL: $142,138.33

Also Check: Rocket Mortgage Payment Options

How To Pay Off A Loan Faster

The first rule of overpaying is to speak to the lender to ensure that any extra money you send comes off the principal debt, and not the interest. Paying off the principal is key to shortening a loan. Our Loan Payoff Calculator shows you how much you might save if you increased your monthly payments by 20%.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Recommended Reading: Can You Do A Reverse Mortgage On A Condo

Refinance To A Lower Rate

Homeowners can save money by refinancing to a lower rate, or by converting an adjustable rate mortgage into a fixed rate which remains locked for the life of the loan. If you would make higher payments if forced to, but would otherwise struggle to make the higher payments then it may make sense to opt for a 15-year mortgage rather than a 30-year loan. The shorter duration loan will typically have a lower interest rate & since the loan will be paid off faster you’ll spend far less on interest. For your convenience, here are current rates in your local area.

One thing to note about refinancing is there are some fixed costs in setting up a new mortgage even for streamlined refinancing. If you will live in your home for many years then locking in a lower rate makes a lot of sense, but if you plan on moving in the next few years it may not be worth the cost of refinancing unless you needed to get cash out or had another reason to set up the new loan. In cases where a homeowner needs a small sum of money a HELOC may be a superior option to refinancing the entire mortgage.

Was Paying Off Our Mortgage Actually Possible

When we first started thinking about it, we had a traditional 30-year mortgage, and the monthly mortgage payment was reasonable. We really had no trouble making the mortgage payment, but we certainly didnt have a ton of extra money lying around.

I was big into finance years ago, and I read about how much money you could save if you were to refinance your mortgage to a 15 year fixed rate. That would mean our mortgage would go up to possibly more than we would like to pay, but much more money would be going to principal rather than interest.

Well, about five years ago we did just that. We refinanced to a 15-year fixed-rate mortgage and decided we would do everything in our power to pay off our mortgage in 5 years or less. We decided to take on this lofty goal and eliminate our mortgage to pay for things that added value to our lives like more vacations!

We also made sure to keep track of every penny spent so we wouldnt spend any unnecessary cash. It wasnt easy at times because there are some expenses that arent necessarily necessary, but they add value to life.

Ruban Selvanayagam of UK sell house quickly company Property Solvers comments: its also worth remembering that inflation gradually erodes the value of the mortgage debt you have against your house, which is an added bonus!

You May Like: How Much Is Mortgage On A 1 Million Dollar House

Avoid Taking On Other Debts

If youre committed to aggressively paying off your mortgage, you likely wont have the financial bandwidth to take on other debts. This means making your current car last for as long as possible and not going back to school right away.

Paying off medical debt can be financially draining, so make sure your health insurance will cover you should the need arise before you dedicate a large chunk of your disposable income to owning your house outright.

Or Refinance To A Shorter Term

You can also get a 30-year mortgage and then refinance it into a shorter term after you buy. This can help you save a chunk of money, especially if your current mortgage is fixed rate and rates are lower now than when you signed your original mortgage. Though understand that youll have to pay closing costs again when you refinance, so factor that into your payoff plan.

Michael Shea, CFP®, EA at Applied Capital, elaborates: Especially during times when interest rates have fallen, refinancing has created an opportunity for homeowners to lock in a lower interest rate and decrease their monthly payment. And he notes that if you were able to continue making the same monthly mortgage payment after refinancing, you would also be able to pay off the mortgage earlier. This doesnt change their budget, but increases the amount they are putting towards their principal.

Read Also: Rocket Mortgage Launchpad

Keep Your Payments The Same When Changing Your Mortgage

When you renew your mortgage, you may be able to get a lower interest rate.

Some mortgage lenders may allow you to extend the length of your mortgage before the end of your term. Lenders call this early renewal option the blend-and-extend option. They do so because your old interest rate and the new terms interest rate are blended.

When your interest rate is lower, you have the option to reduce the amount of your regular payments. If you decide to keep your regular payments the same, you can pay off your mortgage faster.

Payoff In 14 Years And 4 Months

The remaining term of the loan is 24 years and 4 months. By paying extra $500.00 per month, the loan will be paid off in 14 years and 4 months. It is 10 years earlier. This results in savings of $94,554.73 in interest.

If Pay Extra $500.00 per month

| Remaining Term | 14 years and 4 months |

| Total Payments |

| 24 years and 4 months |

| Total Payments |

The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options, including making one-time or periodic extra payments, biweekly repayments, or paying off the mortgage in full. It calculates the remaining time to pay off, the difference in payoff time, and interest savings for different payoff options.

Don’t Miss: Reverse Mortgage For Mobile Homes

Do You Have Any Other More Expensive Debts

Expensive debts are those that cost a lot to pay off over time.

Other expensive debts could include unsecured loans, where the interest rate is much higher than the cost of your mortgage borrowing.

Always pay off more expensive debts before thinking about reducing your mortgage but be careful not to rack them up again.

Reduce Your Balance With A Lumpsum Payment

An alternative to recasting is to make lumpsum payments to your principal when you can.

Have you inherited money, earned large bonuses or commission checks, or sold another property? You could apply these proceeds to your mortgages principal balance and be debtfree a lot sooner.

Since VA and FHA loans cannot be recast, lumpsum payments might be the next best thing. Also, youll save yourself the bank fee for recasting.

With some mortgage servicers, you must specify when extra money is to be put toward principal. Otherwise the extra money could be split between the interest and the principal as it is divided within a regular monthly mortgage payment.

Check with your servicer if you dont know how additional payments will be applied.

Don’t Miss: Does Pre Approval For Mortgage Affect Credit

Remind Yourself Why Youre Doing This

Are you going to throw an amazing party when its all over? Go on a luxury vacation to some gorgeous beach? Take up an expensive hobby youve really missed?

Whatever your reason is, keep it top of mind by making it part of your mortgage payment process so you never forget your why.

Put it in your budgeting app as a note for your mortgage payment or in your calendar every two weeks when the automatic payment pulls from your bank account. Make it effortless to remember the why behind your aggressive repayment schedule. Itll help keep you motivated.

Header Image Source:

All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement or any affiliation with HomeLight.

Continue To Touch Base With Your Household To Adjust

Keep each other motivated and on track, and assess how well your strategies are working.

Your repayment process will go much more smoothly if everyone is still on board with the plan and any short-term sacrifices that may come along with it, whether that means giving up fancier vacations or kids sharing a room or bathroom instead of having their own.

Recommended Reading: 10 Year Treasury Vs 30 Year Mortgage

You Have No Retirement Savings

Saving for retirement should be a priority for you. If you donât have money set aside in a retirement account, whether you opt to use a 401 or an IRA, now is the time to start saving and investing. Even if youâre only in your 30s, waiting five years or more to start saving will cause you to miss out on significant earnings from compound interest alone.

And since the stock market has historically had returns that average about 10%, you can likely make more through an investment for retirement than from paying off a mortgage with a low interest rate.