What Is Classified As Income For Qualifying Purposes

Some forms of income that represent revenue to your household may not count as income for qualification purposes. Here are some of the many sources of income and some of the guidelines for using them to qualify for a mortgage. The important thing when it comes to income is to demonstrate consistency and sustainability.

Employment Income – If you are an employee of a company or corporation, the basic guideline for incomeeligibility is that you have been employed for one year with the same employer or at least one year in the same line of work with no probationary period on the new employment.

- Irregular Income such as non-guaranteed hours, overtime, seasonal income, bonuses, tips (provided they are claimed, commissioned sales or short-term contracts are usually acceptable, but you will likely be required to demonstrate sustainability by providing a two or three year track record with the same employer and the average of income over these years would be used for qualifying purposes.

Self-Employed – If you are self-employed, you can still qualify provided you make money and have a track record of consistent income. The standard is a two year average of your net taxable income as shown on your personal tax returns. It gets complicated if the income you show on your personal income taxes is low.

Pension & Disability Incomes – Guaranteed pension and permanent disability incomes are usually acceptable sources of income.

Pension And Disability Income

Short term and long term disability is generally not accepted as income without a return to work date. If your disability is permanent and can provide a letter to confirm it can be used. If you are receiving a guaranteed pension, this is generally acceptable as eligible income when qualifying for a mortgage as well.

Alimony And Child Support

Its not fair, but if your exspouse is a deadbeat who doesnt make regular alimony or child support payments, you may not be able to count that income. Not even if you have a watertight court order or separation agreement. Because youll have to show youve received full, regular and timely payments going back at least six months.

Also, lenders will look at how long you can expect to receive child support. Suppose your child is 16 years old. And that your child supports going to end when shes 18. You cant count that support toward your income for mortgage purposes, because qualifying income must continue for at least three years. Of course, if you have younger offspring who will be supported for three or more years, theirs will still count.

Recommended Reading: Rocket Mortgage Conventional Loan

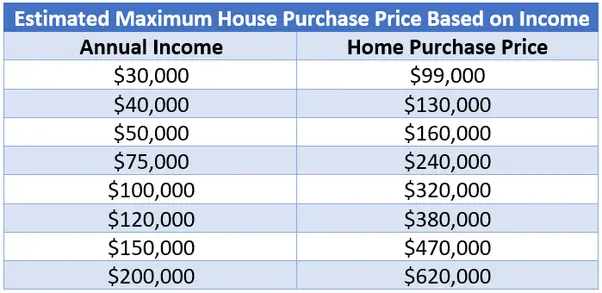

Know How Much Home You Can Afford

Before you even start looking for a home, you need to know exactly how much home you can afford â otherwise, you could spend time looking at homes that are out of your price range. If that happens, it’s hard not to be disappointed later when you view less expensive homes.

To get an idea of what you can afford, you’ll need to take into account the following:

- Your household income

- Your current debts and your monthly payments associated with those debts

- Your estimated monthly housing-related costs, including mortgage payment, property taxes, property insurance, condominium fees, school taxes, utilities and maintenance costs

- Your anticipated closing costs and other one-time costs

- Your current spending practices

Surprising Income Types Mortgage Lenders Still Allow

The news is inundated with stories of lenders making it tough for some borrowers to qualify for mortgage loans. But while that can be true, borrowers with unique circumstances shouldnt be deterred. Many lenders work with unusual borrowers to help them secure mortgages.

Qualifying with unusual income types is mostly a question of documenting consistent monthly income.

Recommended Reading: How Does The 10 Year Treasury Affect Mortgage Rates

When Buying A House Should I Use My Gross Income Or Net Income To Determine What I Can Afford

Theres a big difference between your gross income and your net income. Your gross income is the money you earn each month before taxes are removed. Your net income is that same income after taxes are removed.

No surprise, your net monthly income is usually much lower than your gross monthly income.

When its time to buy a house, though, which figure should you use when deciding how much home you can afford?

This is an interesting question. When you apply for a mortgage loan, your lender will rely on your gross monthly income to determine how many mortgage dollars to lend to you. This doesnt mean, though, that you should rely on gross income to determine how much of a house payment you can comfortably afford each month.

Look at it this way: Your net monthly income is your realistic income. This is how much money you are bringing into your house each month. If you want to make sure that you can afford a monthly mortgage payment of $1,500, $2,000 or $3,000, its more realistic to consider how much of your actual take-home pay your mortgage payment will consume each month.

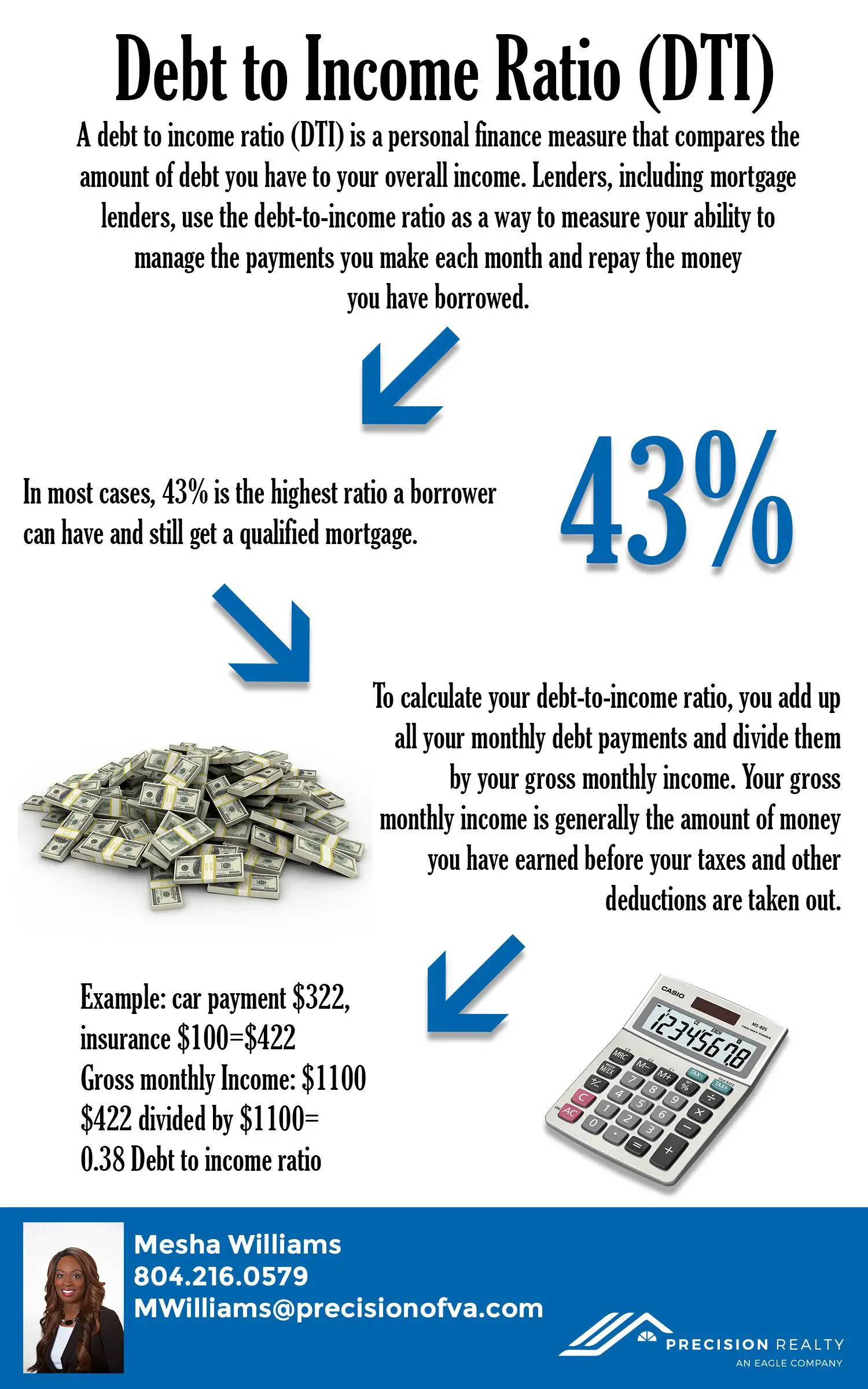

Heres another tricky matter: Most mortgage lenders today say that your total monthly debt including your mortgage payment should total no more than 43 percent of your gross monthly income. Again, thats your income before taxes are removed.

What Can Be Used To Measure Net Interest Margin

Interest income, interest expense, and average income can be used to determine a banks net interest margin, which indicates whether the bank is making a smart investment. After you identify the interest income, interest expense, and average income in the banks income statement, you can calculate the net interest margin.

Difference between debit and credit cardWhen is it best to use a debit card? When bandwidth is the best option. When the other party must be paid immediately. Because direct debit transactions are processed almost immediately, this is also the fastest payment method. If you are concerned about swiping your card, debit is the best option. If you have automated your finances and are on a tight budget.What is a debit ca

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

Know Whats Standing In Your Way

Unfortunately, not everyone is financially ready to buy a home. This Mortgage Income Calculator will show some people that buying, at least at this point, is not within their grasp and offer an understanding of what financial obstacles stand in the way.

This calculator may show you that not enough down payment is your problem. Or maybe its too much debt. Perhaps you simply need to earn more to buy the home you want and need. Or, if you reassess your ambitions, can you afford a less-expensive home?

How Do You Go About Getting A Mortgage If You Are Self

There is still a stigma surrounding the difficulty self-employed mortgage applicants have in obtaining a mortgage offer, despite the vast majority of lenders accepting self-employed applicants.

In reality, so long as you are financially prepared and can satisfactorily evidence your income, it is no more difficult for a self-employed applicant than it is for a more traditionally employed applicant.

You May Like: How Does 10 Year Treasury Affect Mortgage Rates

There Might Be A Potential Problem With Your Income If

- You are unemployed or not employed in Canada.

- You are on maternity leave without a guaranteed return-to-work date.

- You are on probation at your job or started a totally new career within last the 6-9 months .

- You have had your current income source/job for less than two years and your hours / shift fluctuate and are not guaranteed.

- You have become self-employed within the last 2 years.

- You have a lot of personal debts relative to your income.

- You are not up-to-date on your personal income taxes or owe the government taxes.

- Your income benefit is subject to review/ non-permanent.

- You are separated / divorced and there is not yet a legal separation agreement

# Potential Problems?______

To qualify for a mortgage today you should have:

First: What Is A Mortgage Payment

Mortgage payments are the amount you pay lenders for the loan on your home or property, including principal and interest. Sometimes, these payments may also include property or real estate taxes, which increase the amount you pay. Typically, a mortgage payment goes toward your principal, interest, taxes and insurance.

Many homeowners make payments once a month. But there are other options, such as a twice a month or every two weeks.

Recommended Reading: Rocket Mortgage Payment Options

Can I Get A Mortgage With Low Income

Yes, its definitely possible to get a mortgage on a low income. But it will be more difficult than if you had higher or more straightforward earnings. Youll probably need help from a specialist mortgage broker to make your application look as good as possible.

Getting a mortgage can be a daunting process, especially if you have a low income or complex earnings such as self-employed or contractor. Lenders look at a lot of things when checking your mortgage application – this includes verifying your income.

Mortgage lenders will need to assess and verify your income as part of the application process. They need to make sure you’ll be able to afford the monthly repayments without struggling.

The way you show your income will depend on whether youre self-employed, or employed by a business thats not your own.

In this Guide, youll find all the information about making a mortgage application with a low income, plus links to other useful Guides to help you with your mortgage application.

In this Guide, youll find:

What Other Income Is Taken Into Account For A Mortgage

As well as providing proof of salary for a mortgage, you may have other sources of income that could be taken into account.

The table below will give you an idea of what counts as additional income for a mortgage in the eye of most UK lenders will accept and what percentage of them theyre likely to take into account

| Income Type | |

|---|---|

| Overseas income | 0-100% |

You May Like: Can You Get A Reverse Mortgage On A Mobile Home

Do Mortgage Lenders Contact My Employer

Each lender is different, but most will want to check your employment. Submitting your payslips is usually enough proof, but some lenders may call your workplace to check the salary information you’ve given is correct. This doesn’t happen often – usually only when they need to clarify something in your application.

What Counts As Income For Your Mortgage

When you submit an application for a mortgage, its the lenders job to see that you are in a situation where you can cover the costs of the debt.A large part of this process is determining how much income you have. Its not the only part of what qualifies you for a mortgage, but obviously the more income you have, the bigger mortgage youll qualify for. Even if you dont end up taking the entire mortgage amount thats offered to you in fact, its recommended that you dont take it all in order to leave yourself some wiggle room for incidentals one you become a homeowner its better to get approved for a mortgage larger than what you want or need then getting approved for a smaller mortgage and then having to scrape together the difference to buy the home that you want.There are many types of income that can be used to qualify you for a mortgage but all income isnt created equal. Although everything ends up as cash in your bank account, some types of income are stronger than others in terms of consistency and how easily it can be verified. Here are some of the most common types of income that you can use to qualify you for your mortgage, some of which may give you more buying power than you think.

Recommended Reading: 10 Year Treasury Vs 30 Year Mortgage

How Is Rental Income Calculated For A Mortgage Application

The way in which your rental income will be calculated when youre trying to qualify for a mortgage will depend on the documentation being used to justify it.

How is rental income calculated with federal tax returns?

When federal tax returns are used to calculate qualifying rental income, the lender must add back in any deducted expenses depreciation, interest, homeowners association dues, taxes or insurance to the borrowers cash flow before doing any calculations. Any nonrecurring property expenses may be added back in, provided that they were documented accordingly.

The income is then averaged over however many months that the potential borrower used the property as a rental unit during the last tax year.

How is rental income calculated with leases and appraisals?

For leases and appraisals, the lender will take a portion of the projected income and use it for their calculations. They usually use 75%, with the other 25% accounting for projected vacancies.

How does rental income factor into DTI?

Your debt-to-income ratio is an important factor that lenders look at when deciding whether to approve your loan application. Its essentially the sum of your recurring monthly debt divided by your total monthly income. Typically, lenders look for a ratio thats less than or equal to 43%. Though, the lower your ratio is, the better.

The math would look like this:

/ $5,000 = 0.36

In this case, your debt-to-income ratio would be 36%.

Rental income calculation worksheets

What Are The Income Requirements For Refinancing A Mortgage

Mortgage refinancing options are reserved for qualified borrowers, just like new mortgages. As an existing homeowner, youll need to prove your steady income, have good credit, and be able to prove at least 20 percent equity in your home.

Just like borrowers must prove creditworthiness to initially qualify for a mortgage loan approval, borrowers have to do the same for mortgage refinancing.

Also Check: Rocket Mortgage Loan Types

Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit a mortgage payment at 28 percent of your gross that is after-tax monthly income. So, if you simply multiply your annual income by 0.28, then divide by 12, youll find your maximum monthly mortgage payment.

The amount a borrower agrees to repay, as set forth in the loan contract.

How This Site Works

We think it’s important you understand the strengths and limitations of the site. We’re a journalistic website and aim to provide the best MoneySaving guides, tips, tools and techniques, but can’t guarantee to be perfect, so do note you use the information at your own risk and we can’t accept liability if things go wrong.

- This info does not constitute financial advice, always do your own research on top to ensure it’s right for your specific circumstances and remember we focus on rates not service.

- We don’t as a general policy investigate the solvency of companies mentioned , but there is a risk any company can struggle and it’s rarely made public until it’s too late .

- Do note, while we always aim to give you accurate product info at the point of publication, unfortunately price and terms of products and deals can always be changed by the provider afterwards, so double check first.

- We often link to other websites, but we can’t be responsible for their content.

- Always remember anyone can post on the MSE forums, so it can be very different from our opinion.

MoneySavingExpert.com is part of the MoneySuperMarket Group, but is entirely editorially independent. Its stance of putting consumers first is protected and enshrined in the legally-binding MSE Editorial Code.

You May Like: Reverse Mortgage Mobile Home

Do Benefits Count Toward A Mortgage Application

As you can see from the table above, most lenders are happy to consider some types of benefits when assessing income.

The benefits that are accepted vary considerably, though there are lenders out there who will take the following into account and allow borrowers to use them to supplement their mortgage application

- Child tax credit

- Widows Pension

- Carers Allowance

There may be caveats attached for borrowers who are planning to use some of the above in conjunction with a mortgage application. See below for examples.

Your Income Is Probably Ok For A Mortgage If

- You have been at a permanent job with a guaranteed minimum hours/salary for more than 3 months and have some experience or training in your field.

- You have had the same income source for at least 2 years, even if the income/hours are not guaranteed.

- You have been self-employed for 2 years or more and can prove it.

- You make enough money to pay the new mortgage and your current payments.

- Your personal taxes are filed and paid.

- You have permanent disability or pension income.

- Any income coming from child tax benefits or from the ex- as alimony or child support payments represents 1/3rd or less of your total income.

# Probably OKs?______

Recommended Reading: Who Is Rocket Mortgage Owned By

How Much Income Is Needed For A 200k Mortgage +

A $200k mortgage with a 4.5% interest rate over 30 years and a $10k down-payment will require an annual income of $54,729 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a broader range of interest rates.

Increase Your Credit Score

The higher your credit score, the greater your chances are of getting a lower interest rate. To increase your credit score, pay your bills on time, pay off your debt and keep your overall balance low on each of your credit accounts. Don’t close unused accounts as this can negatively impact your credit score.

Also Check: What Does Gmfs Mortgage Stand For