Average Mortgage Rates Inched Higher At The End Of The 2021 And More Increases Are Likely To Greet Borrowers In The New Year According To A Popular Survey

The COVID-19 pandemic, which is going on its third year, continues to wreak havoc on the economy, with the omicron variant now tearing through the country. While the economic remain low might normally lead to lower borrowing costs, mortgage rates are expected to keep heading north.

Procrastinating homeowners whove made New Years resolutions to finally get around to refinancing will want to do that before todays historically low mortgage rates are history.

Should You Buy A Home Now Or Wait

Mortgage rates may be extremely attractive at the moment, but the housing market doesn’t have a lot of inventory to offer. As such, those attempting to buy right now are grappling with limited choices, inflated asking prices, and bidding wars.

If you’re eager to buy a home so you can capitalize on today’s low mortgage rates, it could actually pay to sit tight for a little while, especially in light of the above. There’s a good chance the housing market will open up some more come 2021, and if that happens, higher supply will lead to lower demand, thereby driving home prices down.

The result? You might manage to score a great price on a home and lock in a competitive mortgage rate. Right now, you may have to compromise on the former in order to snag the latter.

The Motley Fool owns and recommends MasterCard and Visa, and recommends American Express. Were firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

The Motley Fool is a USA TODAY content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. Its content is produced independently of USA TODAY.

Mortgage Bankers Associations Forecast

The highly respected MBA, in its most recent Mortgage Finance Forecast, posted a bold prediction: Mortgage rates will average 4% by the end of the year, although rates in the second quarter may average 3.5%.

In their December 2021 , Mike Fratantoni and Joel Kan with the MBA state the following:

Mortgage rates have been kept lower than they otherwise would have been through the Feds purchases of longerterm Treasuries and MBS. Given this faster rate of tapering and improving economy, we forecast that mortgage rates will rise to 4 percent by the end of 2022 and may be more volatile as the Fed backs away from the market, reducing its role as the largest buyer of MBS.

Given this faster rate of tapering and improving economy, we forecast that mortgage rates will rise to 4 percent by the end of 2022 and may be more volatile as the Fed backs away from the market

Mike Fratantoni and Joel Kan, Mortgage Bankers Association

Fratantoni and Kan also predict a sea change in the mortgage industry.

As rising mortgage rates lead to a drop in refinances, we expect that the strong economy will support an increase in home sales in 2022. Thus, we see 2022 as a transition year, moving from a refinance market to a purchase market.

Also Check: Chase Recast

Mortgage Rate Predictions For Late 2021

Most industry pros expect mortgage rates to rise modestly through December 2021 and into 2022.

Fannie Mae, NAR, and the Mortgage Bankers Association all agree 30-year fixed mortgage rates should average around 3.10% in the fourth quarter of 2021.

Others, like Freddie Mac and the National Association of Home Builders, think mortgage rates will continue to rise, hitting averages of 3.20% or higher by the end of December.

| Housing Authority |

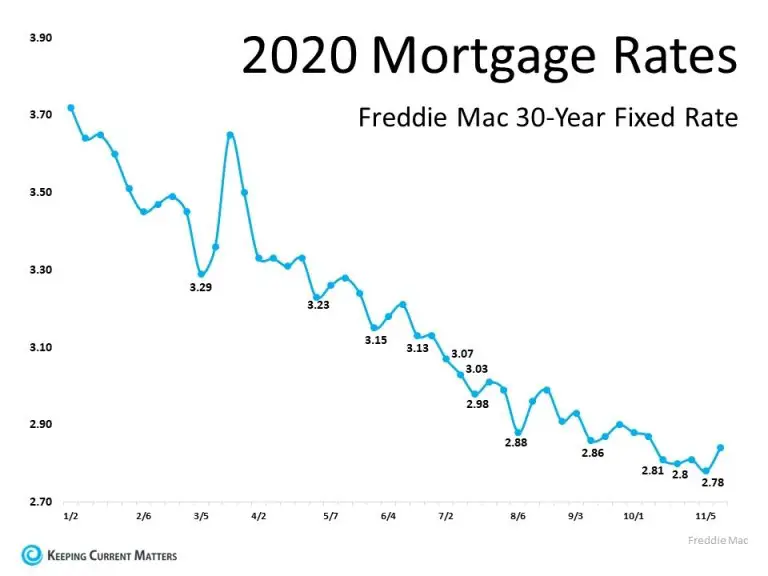

Mortgage rates are moving away from the record-low territory seen in 2020 and 2021.

But keep in mind that rates are still ultra-low from a historical perspective.

Just three years ago, in November 2018, 30-year rates were at nearly 5 percent . And in November of 2019 they were averaging between 3.5 and 4.0%.

So if you havent locked a rate yet, dont lose too much sleep over it. There are still great deals to be had especially for borrowers with strong credit.

Just make sure you shop around to find the best lender and lowest rate for your unique situation.

What Is A Good Mortgage Rate

A good mortgage rate depends a lot on your personal situation and the type of mortgage youre getting. Loans for second homes or investment properties typically have higher rates. And if youre doing a cash-out refinance, you should also expect to have a slightly higher interest rate.

Right now, average 30-year fixed rates are around 3%, and the 15-year fixed rate average is about 2.3%. Even though these are slightly higher rates than we had six months ago, from a historical perspective they are still amazing. Your credit score and loan-to-value ratio factor into what rate youre eligible for. But even if your credit score is lower than youd like, an interest rate of 3.5% or 4% is still an affordable rate compared to what rates have been in the past.

Recommended Reading: Reverse Mortgage Manufactured Home

How Long Will Mortgage Rates Stay Low

If we had workable, crystal balls, would not or not its simpler to foretell traits, and what, the longer term, would carry? Nonetheless, since most havent discovered, their private model of a dependable type of these, it would make sense, to raised perceive, among the indicators, and omens, which is likely to be helpful, in offering us, with extra info, to make an knowledgeable resolution! One among these related points, is, associated to mortgage charges, and figuring out, whether or not/ if, and, for, how lengthy, these rates of interest, will stay, as low , as theyre, at the moment. With that in thoughts, this text will try and, briefly, contemplate, look at, evaluation, and focus on, some related elements, to focus upon, in these concerns, and evaluations.

2. Outdoors influences: What is likely to be the ramifications of the potential, escalation of commerce wars, due to the tariffs, imposed, and/ or, the rhetoric of President Donald Trump? If the conflict of wills, with China, continues for a big interval, it is going to make every little thing dearer, comparable to constructing provides, electronics, equipment, and so forth. If, Japan and the present administration, fail to return to some mutually acceptable settlement, this may create further stress on the system. How in regards to the impacts, from our conflicts with our allies, together with NATO, the European Union , United Kingdom , and so forth?

Key Points For The Home Buyer

Buying a home is, without much doubt, the largest financial decision that anyone will make in their life. With the median price of a home in the DC area at $635,000, a small saving on the mortgage rate can make a big difference, both in the month-to-month expenses, and the overall amount of interest paid out over the life of the loan.

For example, on a $500,000 30-year fixed-rate mortgage at 2.67%, the monthly payment is $2020, with a total interest paid of $227,229. That same mortgage at 3.3% will cost $2189 monthly with a total interest paid of $288,319.

So while the price of a home is important, equally if not more important is the interest rate of the loan. It is vital to realize that just because rates are so low, you may or may not qualify for that low rate. Lenders use a host of benchmarks to determine your actual rate, and it is based on many factors. If you are seriously considering a home purchase or even a refinancing, it is important that you reach out to a quality lender to research where you stand in the realm of their underwriting.

Some important factors determining your rate are:

Be sure to speak with a knowledgeable mortgage specialist at First Savings Mortgage to help you with this important decision!

Read Also: How Does Rocket Mortgage Work

Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether it’s the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider a mortgage refinancing if your current mortgage rate exceeds today’s mortgage rates by 0.75 percentage points. Some say a refi can make sense if you can reduce your mortgage rate by as little as 0.5 percentage point . It doesn’t make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings.

Many of the best mortgage refinance lenders can give you free rate quotes to help you decide whether the money you’d save in interest justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and you’d pay off your house sooner.

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example:

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . You’ll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.

Summary Of Current Mortgage Rates

This week’s rate averages were lower for all loan types:

- The current rate for a 30-year fixed-rate mortgage is 3.05% with 0.7 points paid, 0.07 percentage points lower week-over-week. Last year, the average rate was 2.66%.

- The current rate for a 15-year fixed-rate mortgage is 2.30% with 0.7 points paid, a of 0.04 percentage points from last week. A year ago the average rate was 2.19%.

- The current rate on a 5/1 adjustable-rate mortgage is 2.37% with 0.4 points paid, down by 0.o8 percentage points from last week. The average rate was 2.79% last year.

- Categories

Read Also: Reverse Mortgage For Condominiums

A Historic Opportunity To Potentially Save Thousands On Your Mortgage

Chances are, interest rates won’t stay put at multi-decade lows for much longer. That’s why taking action today is crucial, whether you’re wanting to refinance and cut your mortgage payment or you’re ready to pull the trigger on a new home purchase.

The Ascent’s in-house mortgages expert recommends this company to find a low rate – and in fact he used them himself to refi . and see your rate. While it doesn’t influence our opinions of products, we do receive compensation from partners whose offers appear here. We’re on your side, always. See The Ascent’s full advertiser disclosure here.

Interest Rates To Stay Low

The Federal Reserve did not announce a date when it will back off on bond purchases. And the Fed Chairman also confirmed the plan to keep interest rates low for the foreseeable future.

The overnight rate set by the Federal Reserve doesn’t have a direct impact on mortgage loan rates . However, it can still indirectly affect the cost of a mortgage. When the Fed cuts rates, for example, there may be more interest in 10-year Treasury yields. This is because rate cuts can portend economic trouble, and Treasury yields are considered a safe investment. The Federal Reserve’s position on interest rates is also a strong indicator of its overall economic policy.

The Fed says it will watch for progress on vaccinations before it changes its current economic stance. As such, it’s clear it believes that recovery is tied directly to getting the pandemic fully under control — which will, unfortunately, likely take time.

As long as the central bank maintains the status quo, the low cost at which banks can borrow from each other coupled with inflated competition for bond purchases should continue to maintain downward pressure on mortgage rates. This is a recipe for low rates for years to come.

Also Check: Can You Get A Reverse Mortgage On A Mobile Home

What That Forecast Got Correct

I look at that year-ago prediction in two ways. The forecasters were wrong in their aggregated prediction that mortgage rates would stay about the same. But they were right about something more important: that rates, when averaged for the year, wouldn’t be higher in 2021 than in 2020.

That prediction wasn’t exactly bold, but it wasn’t intuitive, either. Mortgage rates were low in 2020, with little room to go down and a lot of room to go up. The COVID-19 recession looked like it was ending, and vaccines were on the way. An economic recovery would tend to push mortgage rates higher.

But mortgage rates didn’t move much in 2021 until they turned upward in late September. The forecast is for them to assume an upward trend throughout 2022.

How Interest Rates Affect The Housing Market

Mortgage loans come in two primary formsfixed rate and adjustable ratewith some hybrid combinations and multiple derivatives of each. A basic understanding of interest rates and the economic influences that determine the future course of interest rates can help you make financially sound mortgage decisions. Such decisions include choosing between a fixed-rate mortgage and an adjustable-rate mortgage or deciding whether to refinance out of an ARM.

Don’t Miss: 10 Year Treasury Yield And Mortgage Rates

Which Factors Influence How Interest Rates On Mortgages Are Set

There are many factors that impact how much mortgages cost. Lenders will first consider the general cost of borrowing in the economy, which is based on the state of the economy and government monetary policy. Personal factors, such as , income, and the type and size of the loan you are after, will then come into play to determine how much you’ll be charged to get a loan to buy a house.

How We Got Here And Where Things Are Headed

As the economic shutdown set in during March 2020, the Federal Reserve dropped interest rates to basically zero, nearly overnight. In Feb. 2020, the interest rate was roughly 1.5%. Two months later, it was 0.05%.

The Fed’s actions contributed to a steady decline in mortgage rates, where the average 30-year mortgage rate hit a low of 2.65% in Jan. 2021. Since then, the average mortgage rate has climbed to 3.56% as of Jan. 21 matching rates prior to the first shutdowns and hitting a 22-month high. And it’s not looking like they will slow down as several Federal Reserve members have stated they are predicting three interest rate hikes to fight back against inflation rates not seen in over 40 years. However, no finite decisions have been made as of yet.

Josh Westreich, branch manager at U.S. Mortgage of New Jersey told Select it’s “doubtful that rates slow down until the makes a decision.” He added that the only two factors driving this spike are “speculation and uncertainty.”

And while borrowing money for a home has been historically cheap throughout the pandemic, home prices have not mirrored that. Because of a lack of housing supply and record-low mortgage rates home prices have skyrocketed since March 2020. In Q1 2020, the median home sale price was $329,000. In Q3 2021, it was $404,700.

You May Like: Recasting Mortgage Chase

Will Mortgage Rates Go Down In December

Mortgage rates keep trending sideways, only making small moves week-to-week driven by the opposing pulls of worsening coronavirus numbers and an improving economy. However, the latest news from the Federal Reserve points to rate hikes on the horizon for 2022.

Mortgage rates inched up as a result of economic improvement and a shift in monetary policy guidance, said Freddie Mac Chief Economist Sam Khater.

We expect rates to continue to increase into 2022 which may leave some potential homebuyers with less room in their budgets on the sideline.

Most housing experts are expecting an overall upward trend through the end of 2021 and into 2022. And thats because the forces pushing mortgage rates higher arent going away:

- Inflation Higher inflation typically leads to higher rates. And the annual U.S. inflation rate was at a 30-year high in October

- Economic recovery Retail sales increased by a wider margin than expected in October. And unemployment claims fell to their lowest level since March 2020. Both are strong indicators of an improving economy, which should lead to increased rates

- Fed policy changes As the Federal Reserve continues to pull back on its Covid-era stimulus, mortgage rates should continue to rise

But there are other forces working to pull rates down, which is why weve seen spikes and drops over the past few weeks.

As has been the case since 2020, Covid trends are one of the biggest indicators for mortgage rates right now.

Do The Math For A Refinance

In many ways, refinancing a mortgage is much easier than purchasing a home, especially in this market. However, you should approach a mortgage refinance with the same due diligence as you would a home purchase. Paying attention to your refinance rate, the fees and also how long you plan to keep the new loan.

One general guideline to follow is to refinance your home loan when you can reduce your interest rate by 1% or more. However, there are other factors to consider on top of that. You want to make sure that youll be keeping your home long enough for the savings from refinancing to outweigh upfront closing costs. One way to calculate this is to take the upfront fees and divide them by your monthly savings. So if you had $10,000 in refinance closing costs and your monthly payment is $300 less, then it would take roughly 34 months, or just under three years, to break even.

The loans repayment term affects not only your monthly payment, but also your mortgage rate. Shorter-term mortgages typically have lower interest rates than longer-term loans. So a 15-year mortgage will have a better rate than a 30-year mortgage, if all else is equal.

The tradeoff with the lower rate you can get with a shorter mortgage term is that the monthly payment will be higher. Although, a higher monthly payment will allow you to pay off your mortgage more quickly. So ultimately, the decision needs to line up with your current financial situation and your long-term goals.

You May Like: 10 Year Treasury Vs Mortgage Rates