Cost Of Mortgage Loan Insurance

The fee you pay for mortgage loan insurance is called a premium. Mortgage loan insurance premiums range from 0.6% to 4.50% of the amount of your mortgage. Your premium depends on the amount of your down payment. The bigger your down payment, the less you pay in mortgage loan insurance premiums.

Find premiums based on the amount of your mortgage:

You can pay your premium by adding it to your mortgage or with a lump sum up front. If you add your premium to your mortgage, you pay interest on your premium. The interest rate is the same rate as youre paying for your mortgage.

Ontario, Manitoba and Quebec apply provincial sales tax to mortgage loan insurance premiums. Your lender cant add the provincial tax on premiums to your mortgage. You must pay this tax when you get your mortgage.

Popularity Of Mortgage Prepayment Options

A lot can happen over a mortgage term that can affect your ability or desire to pay off your mortgage sooner than you had originally anticipated. You may gain access to cash flow you did not expect throughout the term of your mortgage, in the form of a salary increase, bonus or inheritance. Such cash flow influxes are not uncommon therefore, you may want to consider putting this money towards your mortgage, as it will reduce the total amount of interest you will pay. Prepayment options allow you to pay off a mortgage at a faster rate than the original payment schedule outlined by your lender.

In fact, the vast majority of Canadians have the ability to afford higher mortgage payments. In a survey conducted by CAAMP, 84% of respondents said they could handle monthly increases of $300 or more on their monthly payments.

In effect, 36% of mortgage holders did make additional payments on their mortgages in 2011. This includes 16% who increased their monthly payments, 17% who made lump sum payments, and 5% who increased the frequency of their payments1. Since many Canadians do take advantage of prepayment options, it is important to compare prepayment allowances across different lenders.

Conforming Loans Vs Non

Conforming loanshave maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

You May Like: 10 Year Treasury Vs 30 Year Mortgage

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

How Big Is The Uk Mortgage Market

Historically across the United Kingdom, around 65 thousand to 70 thousand mortgages are approved each month. This is from a low of around 30 thousand after the 2008 to 2009 global financial crisis. Prior to the recession, the monthly rate was closer to 80 thousand to 130 thousand mortgages completed each month.

The UK Mortgage Market is Over £1.5 Trillion

In the fourth quarter of 2020, there were £76.5 billion new mortgage originations in the UK, according to the Financial Conduct Authority . At the end of the fourth quarter of 2020, there were £1,438.4 billion in unsecuritised home loans outstanding, with £102.956 billion in securitised home loans. Total residential mortgages to individuals summed of £1.541 trillion across 13,404,487 loans in the fourth quarter of 2020.

Overall mortgage debt tends to grow around 3% to 6% per annum, though there can be significant fluctuations in that rate of growth due to factors like BREXIT, the global economic crisis which happened in 2008, COVID-19 lockdowns, etc. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes tied to foreign property ownership, the localised balance between immigration and construction, etc.

Don’t Miss: What Does Gmfs Mortgage Stand For

How Do I Apply For A Mortgage

You can apply for a mortgage directly to the lender or via a mortgage broker or financial adviser.

To apply youll need to show picture identification, utility bills from your current address, and proof of your income.

If youre employed, you can show your payslips and/or your latest P60. If youre self-employed, youll need two or three years SA302 tax forms or certified accounts.

The lender will also want to see three to six months bank statements to carry out an affordability assessment. It will also carry out a credit check to see how youve handled credit in the past.

Whats The Difference Between Closed And Open Mortgages

Regardless of what type of mortgage you get, youre required to choose between open and closed mortgages. At first glance, open mortgages sound like a good choice since it allows you to pay off your mortgage at any time without having to pay a fee. However, for this privilege, you typically have to pay a fee that comes in the form of a higher interest rate.

Most homeowners choose to get a closed mortgage since it lowers their interest rates. However, if you want to change lenders or pay off your mortgage early, youd have to pay a fee to do so. Thats not to say you cant make additional payments without a cost. Its just that you can only make extra payments that are outlined in your mortgage contract.

You May Like: Monthly Mortgage On 1 Million

Example: How To Calculate Your Minimum Down Payment

The calculation of the minimum down payment depends on the purchase price of the home.

If the purchase price of your home is $500,000 or less

Suppose the purchase price of your home is $400,000. You need a minimum down payment of 5% of the purchase price. The purchase price multiplied by 5% is equal to $20,000.

If the purchase price of your home is more than $500,000

Suppose the purchase price of your home is $600,000. You can calculate your minimum down payment by adding 2 amounts. The first amount is 5% of the first $500,000, which is equal to $25,000. The second amount is 10% of the remaining balance of $100,000, which is equal to $10,000. Add both amounts together which gives you total of $35,000.

Mortgage Payment Calculator Canada

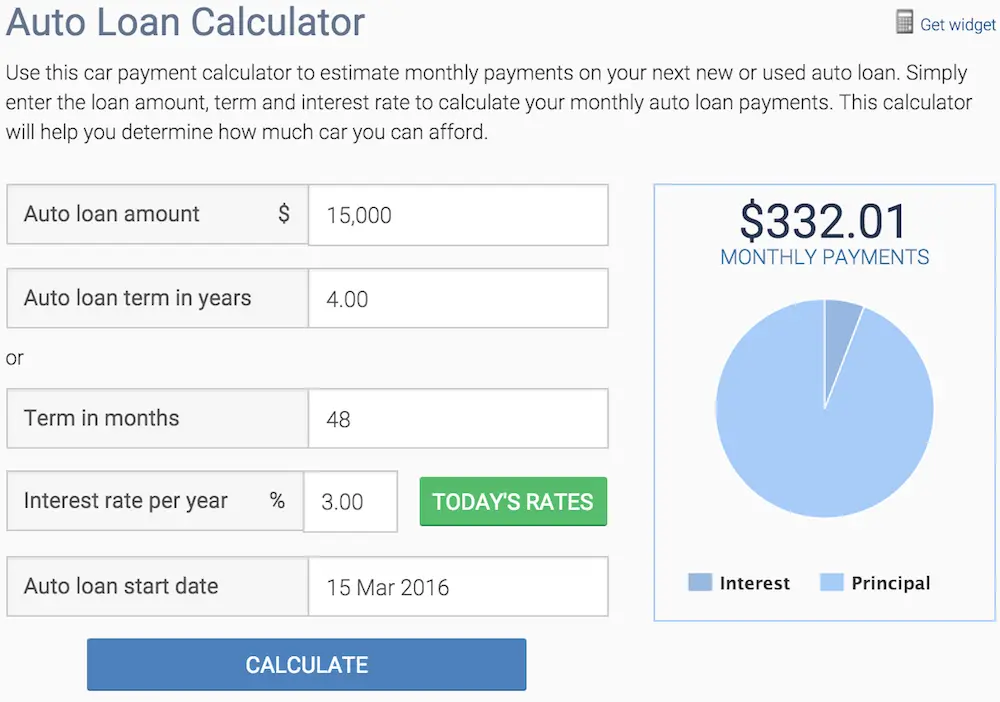

Looking to take out a mortgage sometime soon? Know what you’ll be signing up for with our mortgage payment calculator. Understanding how much your mortgage payments will be is an important part of getting a mortgage that you can afford to service long term.

The mortgage payment calculator below estimates your monthly payment and amortization schedule for the life of your mortgage. If you’re purchasing a home, our payment calculator allows you to test down payment and amortization scenarios, and compare variable and fixed mortgage rates. It also calculates your mortgage default insurance premiums and land transfer tax. Advertising Disclosure

| Select |

Recommended Reading: 10 Year Treasury Vs Mortgage Rates

How To Decide Which Mortgage You Can Afford

When looking to take out a loan, a useful metric to determine whether you can afford to take out that debt is the debt to income ratio of the loan. This compares the total monthly debts of the loan mortgage repayments, insurance, property tax to the amount you earn on an annual basis.

43% is usually the upper limit that mortgage providers will accept. The sweet spot for borrowers is between 28% and 36%.

You can calculate your DTI by adding up your monthly debt payments rent or expected mortgage payments, credit card debt, student loan debt and child support. Include the new loan too, as some providers factor this into DTI.

Compare this against your post-tax wages, taking away tax and national insurance fees. Include any income that is earned away from your main job, including freelance work, investment earnings and property earnings.

Then divide your total monthly debt by your total monthly income and multiply the resulting figure by 100.

So, for example, if your debts amount to £900 and your monthly income is £2,800 your DTI would be 32%, which would contribute well to your ability to achieve a mortgage.

What Is An Interest

An interest-only mortgage is a home loan that allows you to only pay the interest for the first several years you have the mortgage. After that period, you’ll need to pay principal and interest, which means your payments will be significantly higher. You can make principal payments during the interest-only period, but you’re not required to.

Also Check: Rocket Mortgage Loan Types

How Are Mortgage Repayments Calculated

You essentially have two different things that you need to pay off when it comes to your mortgage – the sum you have borrowed, referred to as the capital, and the interest charged on that loan.

With a repayment mortgage, your monthly payment is made up of two different parts. Part of the monthly payment will go towards reducing the size of your outstanding debt, while the rest will go towards covering the interest charged on that debt.

Let’s look at an example. Say you’ve borrowed £200,000 for 25 years, at an interest rate of 3%.

Over the lifetime of the mortgage, you’ll be charged £84,478 in interest, meaning you need to pay back £284,478 over 300 months .

Your monthly repayment will be £284,478/300 = £948.

- Find out more: mortgage repayment calculator

Take A Longer Mortgage Term

The longer your mortgage term, the lower your monthly payment. If you take a longer term, you spread your payments over a larger number of months and years, which reduces the amount youll owe each month. While taking a longer term will increase the amount you pay in interest over time, it can free up more cash to keep your DTI low.

Recommended Reading: Chase Recast Mortgage

Calculations For Different Loans

The calculation you use depends on the type of loan you have. Most home loans are standard fixed-rate loans. For example, standard 30-year or 15-year mortgages keep the same interest rate and monthly payment for their duration.

For these fixed loans, use the formula below to calculate the payment. Note that the carat indicates that youre raising a number to the power indicated after the carat.

Payment = P x x ^n] / ^n – 1

How Do Fixed Vs Variable Interest Rates Work

When people research how do mortgages work in Canada, they usually want to know the difference between fixed and variable mortgages. The differences are pretty simple, but they can have a significant impact on your finances.

With fixed rate mortgages, your interest rate stays the same for the length of your term. If the prime rate increases, your mortgage wont since youre on a fixed rate. In addition, youll know in advance how much of your payments are going towards your principal. Of course, since youre getting security with a fixed rate mortgage, theyll be more expensive than variable rate mortgages.

As for variable rate mortgages, they can increase and decrease during the term of your mortgage. For example, if the prime rate goes up or down, so would the interest rate on your mortgage. In addition, some variable mortgages are set, so the amount youre paying actually changes with the interest rate. However, you can also get a fixed payment variable interest rate where your monthly payment is the same. The principal payment changes if the prime rate increases or decreases.

Traditionally, variable rate mortgages have been cheaper than fixed rate mortgages in the long run, but getting a fixed rate is highly appealing in a low interest rate environment.

Read Also: Reverse Mortgage Mobile Home

What Will My Mortgage Cost

See examples of costs for different mortgage types, payment terms and interest rates.

The monthly payment and rate you’ll pay until your introductory period ends.

Follow-on payments and rate

The payments and rate you’ll pay after your introductory period ends if you dont change anything.

Use the annual percentage rate of charge to compare the cost of our mortgages, including interest and fees, with those from other lenders.

Mortgage fee

You can pay this fee when you submit a mortgage application, or add it to the amount you borrow.

Total of monthly payments

The information below shows roughly how your monthly payments will affect your mortgage balance over time. But they don’t include any other fees or payments you may need to make.

Loan to value

The percentage of the property value that you’re going to borrow. We divide your mortgage amount by the property value to work out the LTV.

Early repayment charge

The amount you’ll pay if you want to pay off the mortgage early or make an overpayment that’s more than we’ve agreed to.

Fixed-rate

Your rate stays the same for a set period, so your monthly payments remain the same even if our base rate changes.

Tracker

Your rate is a certain amount above our base rate. If base rate goes up or down, your payments will too .

Offset

Money you have in another account with us is used to lower the mortgage balance we charge interest on. All our offset mortgages are trackers.

Filter your results

What To Consider When Choosing A Mortgage

A key factor when choosing a mortgage is your loan-to-value . Your LTV is the proportion of the propertys value you are borrowing as a mortgage. For example, if you buy a £200,000 property with a £20,000 deposit and £180,000 mortgage, your LTV will be 90%.

Every mortgage product has a maximum LTV. Some are set as low as 60% these will be the cheapest deals. First-time buyers typically borrow at LTVs of 90% or 95%. In general, the lower your LTV, the lower the interest rate youll pay. You should only apply for a mortgage if you meet the LTV requirements.

The interest rate on a mortgage dictates how much it will cost you to borrow the money. The interest rate will either be fixed for a set amount of time, or variable. You may also have to pay an arrangement or booking fee to secure your mortgage, plus a lenders valuation fee. These fees can vary between lenders and different mortgage deals.

You should also look at the early repayment charges attached to a mortgage deal. You will almost certainly have to pay ERCs for leaving a fixed rate mortgage before the fixed term ends.

You May Like: Chase Mortgage Recast

Do Mortgage Lenders Accept Income From Commission And Bonuses

Since the COVID pandemic in 2020, lenders will accept income from commission and bonus but will look to see current commission levels earned in the last 3 months.

Where annual bonuses are paid lenders will seek to gain some form of confirmation of the current years bonus. As high net worth brokers our job is to place the business with a lender that understands and appreciates our clients total compensation package.

Other assets are taken into consideration including vested shares and allowances such as car and living allowances.

How To Use The Mortgage Payment Calculator

To use the calculator, start by entering the purchase price, then select an amortization period and mortgage rate. The calculator shows the best rates available in your province, but you can also add a different rate. The calculator will now show you what your mortgage payments will be.

Our calculator also shows you what the land transfer tax will be, and approximately how much cash youll need for closing costs. You can also use the calculator to estimate your total monthly expenses, see what your payments would be if mortgage rates go up, and show what your outstanding balance will be over time.

If youre buying a new home, its a good idea to use the calculator to determine what you can afford before you start looking at real estate listings. If youre renewing or refinancing and know the total amount of the mortgage, use the Renewal or Refinance tab to estimate mortgage payments without accounting for a down payment.

Read Also: Can You Get A Reverse Mortgage On A Condo

How Can I Drop My Ltv Band If Im Remortgaging

If youre remortgaging your home, the exact same rule of thumb applies you want to aim for the lowest LTV possible but instead of raising a big deposit you get to use the equity in your home.For example: Say you raised a deposit of £40,000 and borrowed £360,000 to buy a home valued at £400,000 .Now the five-year fixed-rate deal has ended, you want to remortgage to a new fixed-rate mortgage.

Youve since paid off £40,000 from the principal debt so you owe the lender £320,000 and your home has gone up in value to £420,000.

Assuming you want to get a new mortgage for the same amount £320,000, with £100,000 in equity you would have an LTV of just 76%.

However, a 76% LTV mortgage will most likely have the same rates as an 80% LTV mortgage.

To drop to a 75% LTV you would need to add £5,000. Alternatively, you could try and get a slightlyhigher valuation for your home, which would help you drop to a 75% LTV.If youre remortgaging to unlock money for home improvements or other expenses, remember to keep your LTV tier in mind.

If you can stay within a lower LTV tier, perhaps by borrowing slightly less, youll save a lot more in interest repayments in the long-term.