Private Mortgage Insurance :

Depending on the type of mortgage loan you choose and the amount of your down payment, you may need to pay private mortgage insurance. This insures the lender should a borrower discontinue making payments and default on their home loan. Depending on the type of loan you choose, youll pay PMI until your home equity reaches twenty percent or for the life of the loan.

Consider The Cost Of Homeowners Insurance

Almost every homeowner who takes out a mortgage will be required to pay homeowners insurance another cost that’s often baked into monthly mortgage payments made to the lender.

There are eight different types of homeowners insurance. The insurance policies with a high deductible will typically have a lower monthly premium.

How Much Interest Do You Pay

Your mortgage payment is important, but you also need to know how much of it gets applied to interest each month. A portion of each monthly payment goes toward your interest cost, and the remainder pays down your loan balance. Note that you might also have taxes and insurance included in your monthly payment, but those are separate from your loan calculations.

An amortization table can show youmonth-by-monthexactly what happens with each payment. You can create amortization tables by hand, or use a free online calculator and spreadsheet to do the job for you. Take a look at how much total interest you pay over the life of your loan. With that information, you can decide whether you want to save money by:

- Borrowing less

- Paying extra each month

- Finding a lower interest rate

- Choosing a shorter-term loan to speed up your debt repayment

Shorter-term loans such as 15-year mortgages often have lower rates than 30-year loans. Although you would have a bigger monthly payment with a 15-year mortgage, you would spend less on interest.

Recommended Reading: Reverse Mortgage For Mobile Homes

Know How Much You Own

Its crucial to understand how much of your home you actually own. Of course, you own the homebut until its paid off, your lender has a lien on the property, so its not yours free-and-clear. The value that you own, known as your “home equity,” is the homes market value minus any outstanding loan balance.

You might want to calculate your equity for several reasons.

- Your loan-to-value ratio is critical, because lenders look for a minimum ratio before approving loans. If you want to refinance or figure out how much your down payment needs to be on your next home, you need to know the LTV ratio.

- Your net worth is based on how much of your home you actually own. Having a million-dollar home doesnt do you much good if you owe $999,000 on the property.

- You can borrow against your home using second mortgages and home equity lines of credit . Lenders often prefer an LTV below 80% to approve a loan, but some lenders go higher.

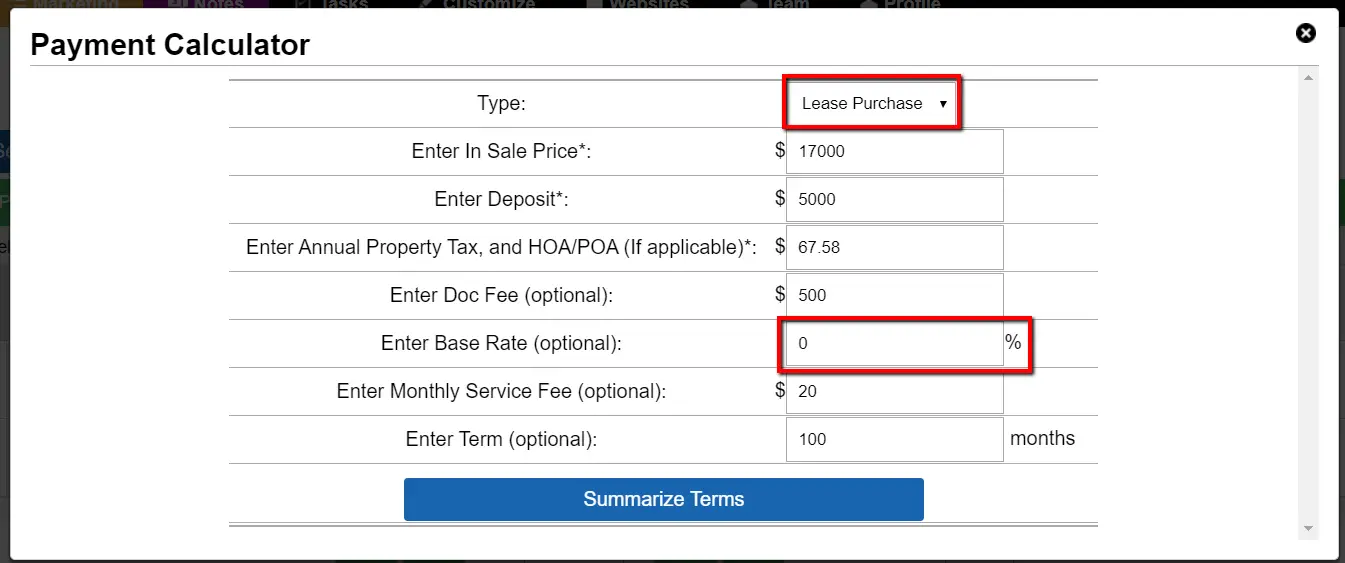

How Do You Calculate A Loan Payment

The first step to calculating your monthly payment actually involves no math at all – it’s identifying your loan type, which will determine your loan payment schedule. Are you taking out an interest-only loan or an amortized loan? Once you know, you’ll then be able to figure out the types of loan payment calculations you’ll need to make.

With interest-only loan options, you only pay interest for the first few years, and nothing on the principal balance – the loan itself. While this does mean a smaller monthly payment, eventually you’ll be required to pay off the full loan in a lump sum or with a higher monthly payment. Most people choose these types of loan options for their mortgage to buy a more expensive property, have more cash flexibility, and to keep overall costs low if finances are tight.

The other kind of loan is an amortized loan. These loan options include both the interest and principal balance over a set length of time . In other words, an amortized loan term requires the borrower to make scheduled, periodic payments that are applied to both the principal and the interest. Any extra payments made on this loan will go toward the principal balance. Good examples of an amortized loan are an auto loan, a personal loan, a student loan, and a traditional fixed-rate mortgage.

Read Also: Rocket Mortgage Requirements

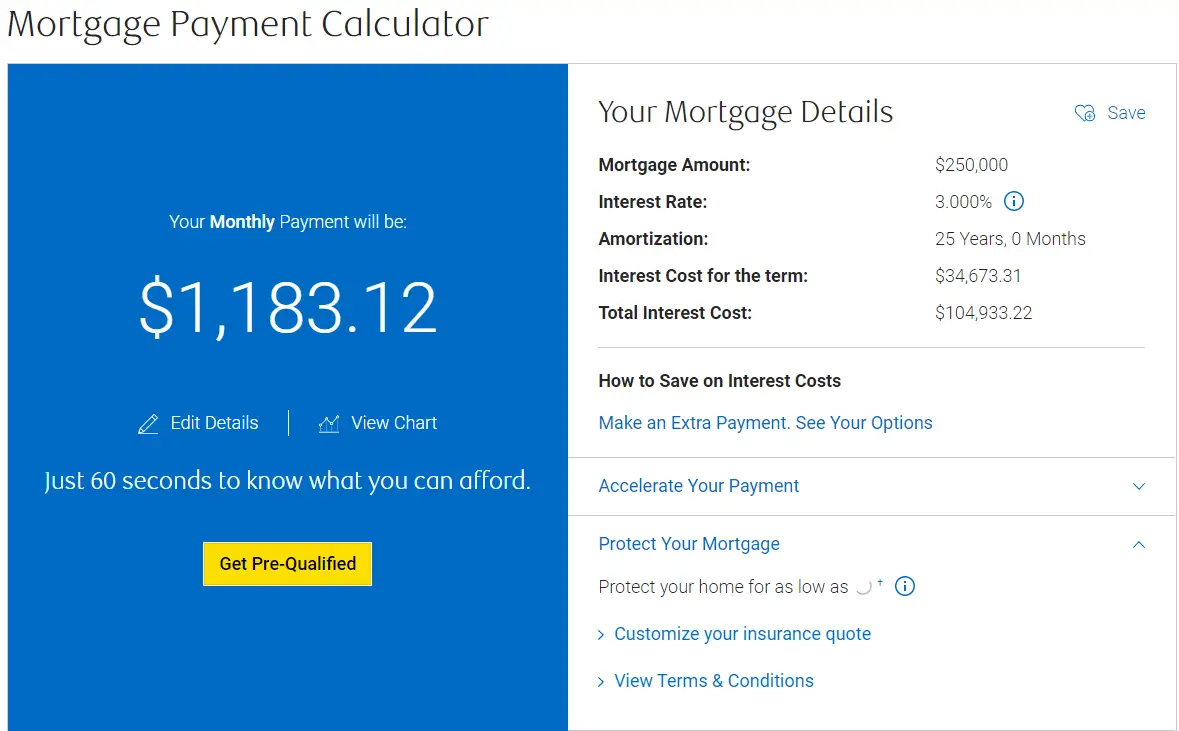

Using An Online Calculator

You can find online mortgage calculators to determine all these values on numerous financial news and information sites, as well as through some lenders. If you prefer not to type your information into a website, you can also find templates for Microsoft Excel and other spreadsheets to do the job for you.

What Is Mortgage Formula

The formula for mortgage basically revolves around the fixed monthly payment and the amount of outstanding loan.

Fixed Monthly Mortgage Repayment Calculation = P * r * n /

where P = Outstanding loan amount, r = Effective monthly interest rate, n = Total number of periods / months

On the other hand, the outstanding loan balance after payment m months is derived by using the below formula,

Outstanding Loan Balance=P * /

You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Mortgage Formula

You May Like: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

The High Cost Of Quick Decisions

Between 2015 and 2016, nearly one in three UK consumers chose mortgage products which cost them more than £550 per year. They got more expensive options over cheaper alternatives that were readily available and which they also qualified for. This fee difference amounts to 12.7% of what consumers spend annually on their mortgage.

The remortgage market is more competitive amongst lenders than the first-time buyer market. So only around 12% in that category opted for strongly dominated product choices. About 18% of first-time buyers fall into the strongly dominated product choice category, and well over 20% of mover mortgages fall in this category. Movers who are in a rush often make emotionally driven or time-sensitive decisions. This compromises their ability to obtain the best deal the way a person who is remortgaging can.

About 14% of borrowers in the top credit score quartile secured strongly dominated products, while more than 20% of consumers in the bottom quartile did not. In general, people who are young, including borrowers with low incomes, low credit scores, and limited funds for deposit are more likely to get an unfavourable mortgage deal. If there are factors that make your transaction more complex, you might find it more challenging to obtain a good loan.

Can I Clear My Mortgage With Early Repayment

Paying off your mortgage early has the big advantages that you cut the total cost of your mortgage and own your own home sooner.

If your savings earn less interest than you pay on your mortgage, it makes financial sense to put that money towards your mortgage, while retaining some savings for emergencies.

However, do check your lenders rules about repayments, to avoid charges. Many lenders limit overpayments to up to 10% of the outstanding mortgage balance each year.

The disadvantage of mortgage early repayment is that you cant use the money for something else such as clearing more expensive debts, or ploughing into investments and pensions.

It can also be hard to get money out again, unless you go to the time, trouble and expense of remortgaging or selling the property.

If you are wondering whether you should pay off your mortgage early or invest the money instead check out our article here.

Read Also: Recasting Mortgage Chase

How Do You Compare Loan Offers

In any loan scenario, you have to make underlying assumptions such as:

- If you are likely to remortgage the loan again.

- When you are likely to remortgage.

- Where you think interest rates are headed.

- If you think you will sell the home soon.

- If rates head higher and your rate resets well above the initial offer, will your wages be enough to cover payments?

Look Beyond the Monthly Payment

Its important to consider the overall mortgage costs, not just the monthly payment amount. Borrowers will find interest-only payments affordable. However, compared to a full repayment mortgage, you immediately build equity in your home. This bring you closer to home ownership, stability, and grants you further life flexibility. In contrast, interest-only payments do not build equity. It does not provide financial cushion which helps protect you against shifting market conditions.

If one loan amortises and the other does not, then you have to look at how much equity you build in a home. This is a key factor in determining value. Most people also do not want to pay mortgages for the entire lifetime, or until they hit a tough patch and risk foreclosure.

Example Loan Comparison from a Reader

The key to being able to accurately compare mortgage offers is to only adjust a single variable at a time. This way you can easily see the differences between offers, instead of trying to compare apples to oranges.

The example below is based on a question from one of our users named Dan.

| Year |

|---|

Identify The Taxes You Have To Pay

Finally, you also need to factor in the taxes that you have to pay in calculating for your monthly mortgage payment. Property taxes are often collected by a lender and secured in a separate account, which is commonly referred to as the escrow or impound account. At the end of the taxable year, the lender will pay your due taxes to the government using the money collected in your impound account. The amount of property tax that you need to settle usually depends on the local tax rate in your jurisdiction, as well as the value of your home.

You will be able to have an exact calculation of your monthly mortgage payment by leveraging available calculators online which are specifically designed for this purpose. However, it is better if you have an idea of how it works and what variables are factored in the computation. In this way, even without the calculator, you will know how to compute your monthly mortgage payment for you to align your budget or finances accordingly.

Recommended Reading: How Does 10 Year Treasury Affect Mortgage Rates

Calculate The Monthly Interest Rate

The interest rate is essentially the fee a bank charges you to borrow money, expressed as a percentage. Typically, a buyer with a high , high down payment, and low debt-to-income ratio will secure a lower interest rate the risk of loaning that person money is lower than it would be for someone with a less stable financial situation.

Lenders provide an annual interest rate for mortgages. If you want to do the monthly mortgage payment calculation by hand, you’ll need the monthly interest rate just divide the annual interest rate by 12 . For example, if the annual interest rate is 4%, the monthly interest rate would be 0.33% .

How Do I Manually Calculate House Payments

Related Articles

If you are in the market for a new place to call home, one of the most significant questions you are probably asking yourself is, “Can I afford this?” After all, with home prices soaring in the San Francisco area, committing to purchasing a home is a weighty decision that carries with it a series of long-term implications. That being said, it is possible to take a proactive approach toward your property search by learning how to manually calculate what your house payments would likely be if you purchased any one of your preferred properties. Fortunately, this can be accomplished relatively easily if you have the correct information on hand.

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

Fixed & Variable Rates

The standard variable rate is the basic interest rate lenders use for mortgages. Each lender sets their default SVR. Its the default rate mortgages revert to after the introductory period of a loan, which is usually 2 to 5 years. SVR mortgages usually have higher interest rates than other mortgage options.

Standard variable rates move based on fluctuations in the Bank of England base rate. When rates reset higher, borrowers must be prepared to make higher monthly payments. To avoid reverting to the SVR, borrowers would remortgage to a new deal with a favourable rate.

In recent years, standard variable rates have been on the rise. Because of this, many consumers find fixed-rate mortgage options more attractive. According to the Bank of England, since 2016, fixed-rate options are more preferred by borrowers, especially first-time homebuyers.

In the third quarter of 2020, 91.2% of all mortgages used fixed-rate loans. The average fixed-rate mortgage was priced at 1.91%. In contrast, the average variable rate mortgage was priced at 1.85%, bringing the overall market average to 1.91%.

What is a Fixed Rate?

The UK government provides subsidy programs in Help to Buy and Help to Buy London. These government schemes offer mortgage deposit assistance. However, few lenders in the UK provide loans which have fixed rates extending beyond 5 years.

Which Loans Structures Do Most Buyers Prefer?

Only 1 in 50 mortgages come with a fixed rate longer than 5 years.

How To Calculate Monthly Mortgage Payments

Answering the question how to calculate mortgage payments is far simple than you imagine. To fulfill this need you can find so many financial tools in the internet which could help you to calculate monthly mortgage payment. Before using the online mortgage calculator you should know what are the input requirements you will be asked to enter as input.

To calculate monthly mortgage payment make sure you are having the following information readily on your hand.

- Principal amount

- How much you need to pay as a down payment

- Interest rate

- Total money that will be needed in your escrow account

Lets see about the requirements of online mortgage calculator in detail.Principal AmountPrincipal amount depicts the original price of your mortgage. Normally the average term for any mortgage is thirty years. So you can calculate the monthly mortgage payment

Monthly mortgage payment = / 12.

If you pay only the monthly mortgage payment then you will need to pay for the entire 30 years. If you can pay off little extra apart from the compulsory amount, you are actually decreasing your principal amount. So you can reduce the total amount that needed to pay over your life time. Also note when your principal amount gets lower you are also decreasing the interest rate too.

Closing Costs

Down Payment

Interest Rate

Private Mortgage Insurance

Escrow

Don’t Miss: Mortgage Rates Based On 10 Year Treasury

What If The Math Still Doesn’t Add Up

If these two steps made you break out in stress sweats, allow us to introduce to you our third and final step: use an online loanpayment calculator. You just need to make sure you’re plugging the right numbers into the right spots. The Balance offers for calculating amortized loans. This loan calculator from Calculator.net can do the heavy lifting for you or your calculator, but knowing how the math breaks down throughout your loan term makes you a more informed consumer.

How Do I Calculate A Monthly House Payment For A 30

Related Articles

Calculating a 30-year fixed-rate mortgage is a straightforward task. In order to find out what your monthly payments might be, you can use a mortgage formula or a calculator. This will give you a good estimation of whether you can afford the mortgage. Home loans are amortized over 30 years with monthly payments that are the same each month. As you begin to pay your mortgage, you will actually pay more in interest. Over time, as the loan decreases, more of your money goes toward the principal.

Make a note of the interest rate, the loan amount and the terms of payment. Fixed-rate mortgage payments stay the same for the life of the loan. Example: $500,000 mortgage loan at 5 percent interest for 30 years making 12 payments a year — one per month.

Multiply 30 — the number of years of the loan — by the number of payments you make each year. For example, 30 X 12 = 360. You are making 360 payments over the course of the loan.

Divide your mortgage interest rate by your total payments. For example, 5 percent interest with 12 payments is 0.05 / 12 = 0.004.

Use this mortgage formula and plug in the appropriate numbers:

Monthly Payments = L/, where L stands for “loan,” C stands for “per payment interest,” and N is the “payment number.”

Monthly Payments = 500,000 /

Monthly Payments = $2684.10

- Check your work with a mortgage calculator.

Warnings

- You should also add insurance and taxes on to your monthly payment.

Writer Bio

You May Like: Reverse Mortgage Mobile Home

Understanding Mortgage Loan Basics

When you buy property, you’ll often take out a mortgage loan to pay for some of the cost. You will give the lender a right to auction off or take possession of the property if you don’t pay back the money and usually commit to making a monthly payment over a certain loan term, such as 30 or 40 years.

Each payment will include a mix of paying back loan principal, or the amount you initially borrowed, and interest, the extra percentage you pay to the lender in exchange for being able to take out the loan. As you continue to make payments, the percentage of each payment going toward principal will rise. As less principal is owed, less interest will be charged.

There may be other items paid through your mortgage payments, including homeowner’s insurance premiums, property tax and fees paid to a condo or homeowner’s association.