Constant Maturity Treasury Rates

Constant Maturity Treasury rates, or CMT rates, refer to a yield thats calculated by taking the average yield of different types of Treasury securities with varying maturity periods, and using it to adjust for a number of time periods.

Some lenders will use this rate to determine interest for adjustable-rate mortgages . If the CMT goes up, you can expect any loans tied to it to increase their interest rates as well.

How Bonds Affect Mortgage Rates

Contrary to popular belief, mortgage rates are not based on the 10-year Treasury note. They’re based on the bond market, meaning mortgage bonds or mortgage-backed securities. When shopping for a new home loan, many people jump online to see how the 10-year Treasury note is doing, but in reality, mortgage-backed securities drive the fluctuations in mortgage rates.

In fact, it is not unusual to see them move in completely different directions and, without professional guidance, that confusing movement could cause you to make make a poor financial decision.

Mortgage-backed securities are mortgage loans are packaged into groups or bundles of securities and then sold in the bond market. The price of these bundled debt securities is driven by national and global news events, which also affects individual mortgage rates.

The graph below illustrates the 30-year fixed mortgage rate average from 2000 through today:

What Is The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing the money, and it is advertised as a percentage of the loan. , and it includes the interest rate plus other fees associated with the mortgage. So the APR will provide you with a better idea of the total cost of financing the loan. You may find lenders offering the same interest rate and monthly payments, but if one is charging higher upfront fees, then the APR will be higher.

The Federal Truth in Lending Act requires lenders to disclose the APR, but the fees can vary. When comparing APRs between lenders, ask which fees are not included for better comparison.

Read Also: 10 Year Treasury Vs Mortgage Rates

What Is A Mortgage Rate Lock

Mortgage rates change daily, and that can be a problem when it can take more than a month to close a refinance loan. The solution offered by most lenders is a mortgage rate lock.

With a rate lock, your interest rate wont change for a set amount of time. If there are delays in closing your loan and your rate lock will expire before you can complete the refinance, you may be able to get an extension. If that happens, be sure to ask if there are fees for extending the rate lock.

Fixed Interest Rate Mortgages

The interest rate on a fixed-rate mortgage is fixed for the life of the mortgage. However, on average, 30-year fixed-rate mortgages have a shorter lifespan, due to customers moving or refinancing their mortgages.

The rule of thumb used to be that homeowners stayed in their homes an average of seven years. However, thatfigure has been rising. Real estate brokerage Redfin claimed in 2020 that the average homeowner stayed put for 13 years. What’s more, according to a 2020 report by the National Association of Realtors , nearly half of homebuyers said they expected to stay in their home for 16 years or more.

MBS prices are highly correlated with the prices of U.S. Treasury bonds. Usually, the price of a MBS backed by 30-year mortgages will move with the price of the U.S. Treasury five-year note or the U.S. Treasury 10-year bond based on a financial principal known as duration. In practice, a 30-year mortgages duration is closer to the five-year note, but the market tends to use the 10-year bond as a benchmark. This also means that the interest rate on 30-year fixed-rate mortgages offered to consumers should move up or down with the yield of the U.S. Treasury 10-year bond.

Also Check: Rocket Mortgage Launchpad

Very Low Mortgage Rates

Fixed rates are currently near record lows but they are rising. As mortgage rates rise, they reduce homebuying budgets.

The impact of early rate increases on homebuying budgets will be greater than the subsequent rate increases. Prospective homebuyers can take advantage of this effect by getting a pre-approved mortgage 4 months before making a purchase. By the time they find a place they like, rates may have risen, and competing bidders who didnt get a pre-approved committed rate might be saddled with smaller homebuying budgets. If your bank doesnt offer a 4-month rate guarantee with their pre-approval, then talk to a mortgage broker.

How Much Equity Do I Need To Refinance My Home

When you apply for a refinance mortgage, lenders will consider how much equity you currently have in your home. If you dont meet the lenders equity requirements, you may not qualify for a refinance with that lender.

Requirements can vary from lender to lender, and depend on the type of refinance youre doing rate-and-term vs. cash-out refinance.

For a rate-and-term refinance, you may be able to qualify with as little as 5% home equity. But your lender will likely require you to purchase private mortgage insurance. Most lenders will prefer a loan-to-value ratio of at least 20% meaning the amount you owe on your mortgage is no more than 80% of your homes total value.

Generally, for a cash-out refinance, most lenders will want to see that you have a loan-to-value ratio, or LTV, of at least 20%. But some lenders may be flexible if you have good credit, a history of on-time bill payments and are willing to accept a higher interest rate.

To calculate your loan-to-value ratio, simply divide your loan balance by the current value of your home. For example, if your homes value is $350,000 and you owe $325,000, your LTV is just under 93% and you may have difficulty qualifying for a refinance.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at and your question might be answered by Credible in our Money Expert column.

Read Also: Rocket Mortgage Qualifications

/1 Arm Interest Rates

A 5/1 ARM has an average rate of 4.29%, which is a climb of 20 basis points from the same time last week.

An adjustable-rate mortgage is ideal for individuals who will sell or refinance before the rate changes. If thats not the case, their interest rates could end up being significantly higher after a rate adjusts.

For the first five years, a 5/1 ARM will typically have a lower interest rate compared to a 30-year fixed mortgage. Keep in mind that your rate could climb higher and your payment might grow by hundreds of dollars a month.

Factors That Can Affect Your Personal Interest Rate

Itâs important to understand that the best mortgage rate you qualify for may change depending on your unique borrowing profile. Here are some of the factors that influence what mortgage rate you qualify for:

The type of mortgage: If your mortgage is for a refinance, rather than a purchase or renewal, youâll be eligible for higher rates. For individuals with an existing mortgage who have good credit and more than 20% equity in their homes, in addition to refinancing, you can also explore a home equity line of credit .

Your down payment: If youâre purchasing a home andyour down payment is less than 20% of the purchase price and the value of the home you are purchasing is less than $1 million, youâll be required to purchase mortgage default insurance . This insurance is added to your mortgage amount and, while it will cost you money, it will result in a lower mortgage rate as your mortgage is less risky for your lender. If youâre renewing your mortgage, in order to be eligible for the lowest mortgage rates you would have needed to purchase CMHC insurance on the original mortgage.

Your intended use of the property: Your mortgage rate will be higher if you plan to rent your property out vs. live in it as your primary residence.

Don’t Miss: Recast Mortgage Chase

How Mortgage Rates Have Changed Over Time

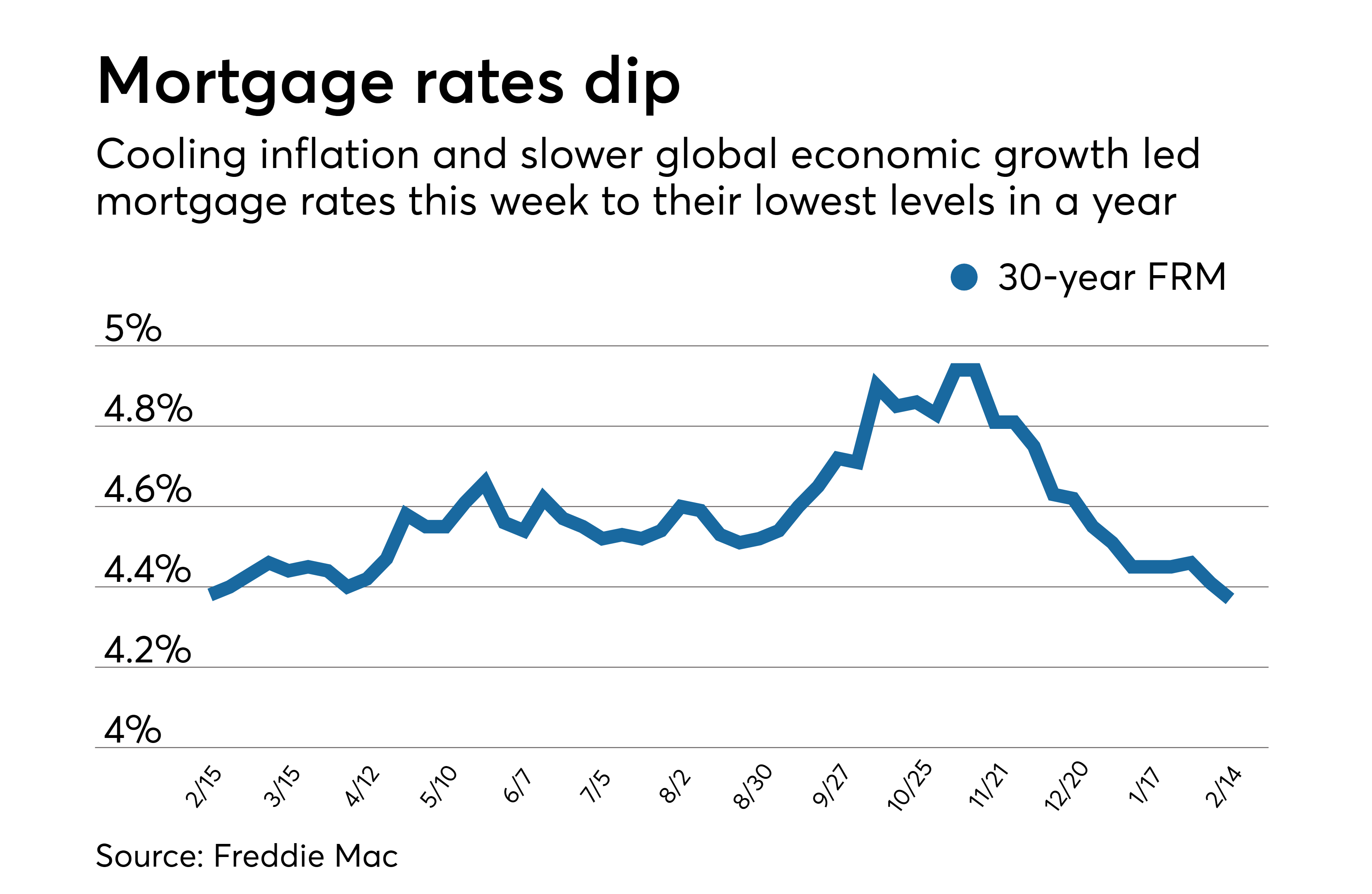

Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac 16.63% in 1981. A year before the COVID-19 pandemic upended economies across the world, the average interest rate for a 30-year fixed-rate mortgage for 2019 was 3.94%. The average rate for 2021 was 2.96%, the lowest annual average in 30 years.

The historic drop in interest rates means homeowners who have mortgages from 2019 and older could potentially realize significant interest savings by refinancing with one of todays lower interest rates.

If youre ready to take advantage of current mortgage refinance rates that are below averages for other types of credit like credit cards, you can use Credible to check rates from multiple lenders.

Mortgage Rate Forecast: What Drives Changes In Mortgage Rates

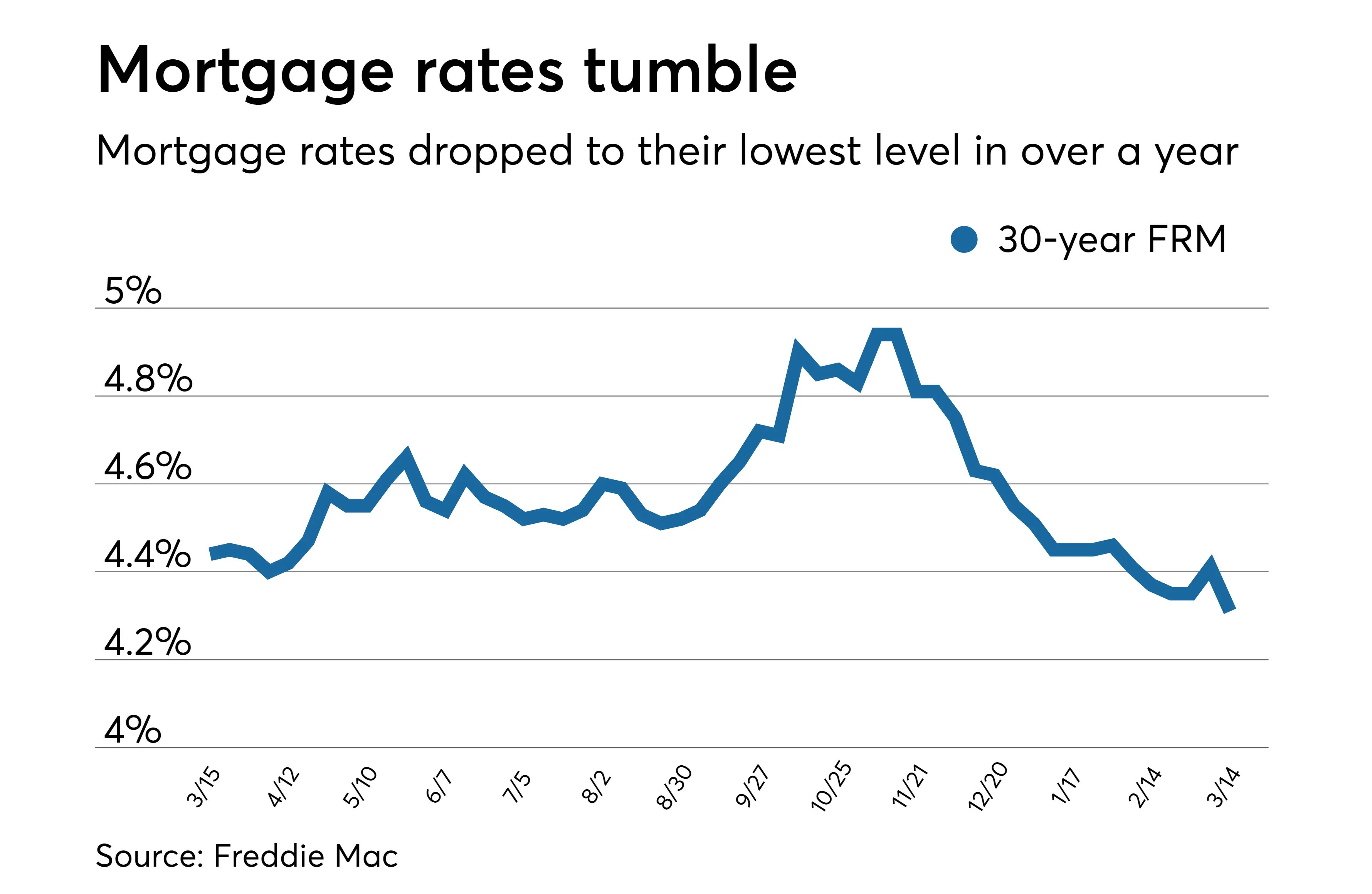

Mortgage rates have increased because of a variety of economic factors so far this year. Persistently high inflation is a big one, Jacob Channel, senior economic analyst at LendingTree told us. Mays inflation report shows 8.6% inflation, the highest level in 40 years. To combat this inflation, the Federal Reserve increased its benchmark short-term interest rate. Since inflation remained higher than expected, the Fed raised rates by 50 basis points in May and by 75 basis points in June.

Following the inflation report, mortgage rates spiked ahead of the Feds announcement. I think what were seeing is that lenders had already anticipated that the Fed was going to raise the Fed funds rate by 75 basis points and they began to preemptively push mortgage rates up, Jacob Channel, senior economist at LendingTree, told us.

In addition to the COVID lockdown in China and Russias invasion of Ukrainian territory, financial markets are still reacting to other global factors. We have a lot of factors like that that are putting upward pressure on mortgage rates, Channel says. The volatility has been through the roof, Shashank Shekhar, founder and CEO of InstaMortgage, told us. The market has been adjusting to a new news cycle practically every single day.

Don’t Miss: Rocket Mortgage Conventional Loan

How Much Can I Save By Comparing Mortgage Interest Rates In Canada

Because of the significant amount of money being borrowed under a mortgage, even the slightest difference in the mortgage interest rate may result in you saving money over the course of a mortgage term, and even more over an entire amortization period. While the mortgage rate is a very important consideration, you should also be sure to evaluate the terms and conditions of each type of mortgage to make sure you choose the right one for you.

How We Calculate Our Mortgage Rates

To see where mortgage rates are going, we rely on information collected by Bankrate, which is owned by the same parent company as NextAdvisor. The daily rates survey focuses on home loans where the borrower has a FICO score of 740 or more, 20% equity or more, and lives in the home.

The average rates listed below and based on the Bankrate mortgage rate survey:

Average mortgage interest ratesAlso Check: Chase Mortgage Recast

Health Of The Economy

Mortgage rates vary based on how the economy is doing today and its outlook. When the economy is doing well meaning unemployment rates are low and spending is high mortgage rates increase. When the economy isn’t doing as well , including high unemployment rates and a lower demand for oil, mortgage rates fall.

What Is A Discount Point

A discount point is a fee you can choose to pay at closing for a lower interest rate on your mortgage. One discount point usually costs 1% of your mortgage, and it reduces your rate by 0.25%. So if your rate on a $200,000 mortgage is 3.5% and you pay $4,000 for two discount points, your new interest rate is 3%.

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

When Should I Lock In A Mortgage Rate

You should lock in a mortgage rate if you find a rate you’re comfortable with and you can afford the monthly payments. In some cases, home buyers will wait to lock in their mortgage rate just in case interest rates go down. But because interest rates are unpredictable, this is risky.

A mortgage rate lock guarantees your interest rate for a certain period of time, typically until your closing date. It usually lasts from the initial loan approval until you get the keys to your new home.

Locking in your rate isn’t necessarily just about getting the best rate. A lock also protects you against any rate hikes that happen before closing. It can let you know from the beginning of the process what your monthly payments will be and help you avoid surprises come closing day.

It may seem like there’s a lot to learn about buying a home, especially if you’re a first-time buyer. If you’re still feeling overwhelmed, check out our beginner’s guide to home loans. It can help you navigate all the steps, including how to find the best mortgage rates today.

How Are Interest Rates Determined

The interest rate is the amount charged on top of the principal by a lender to a borrower for the use of assets. The interest rate charged by banks is determined by a number of factors, such as the state of the economy. A country’s central bank sets the interest rate, which each bank uses to determine the range of annual percentage rates they offer.

When the central bank sets interest rates at a high level, the cost of debt rises. When the cost of debt is high, it discourages people from borrowing and slows consumer demand. In addition, interest rates tend to rise with inflation.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

Are Current Mortgage Rates Good For Buying A Home Right Now

2022 started off with dramatic rate increases. But from a historical perspective, mortgage rates remain at comparatively normal levels.

With a combination of limited supply of homes and strong demand, home prices are up significantly from before the pandemic. The higher costs to build homes and the massive demand from buyers is also contributing to the surge. This, plus higher mortgage rates, makes the overall cost of homeownership more expensive for the borrower.

The difference of a half a point or so can equal a lot of money over a 30-year mortgage. But its best not to try to time the market to get the best mortgage rate. Experts say, instead, to focus on finding the right house, and make moves when your personal lifestyle and financial situation indicate its the right time.

Rates between mortgage lenders can vary significantly. Make sure to shop around between a few different mortgage lenders to ensure youre getting the best current deal. The rate highly impacts your monthly affordability for as long as you will hold this home, Skylar Olsen, principal economist at Tomo, a digital real estate and mortgage company, told us. It is actually a critical piece of this decision, and that takes shopping around.

Where Mortgage Rates Are Headed

Worries about a resurgence of coronavirus cases are weighing on stocks and on U.S. Treasury yields, which were in the range of 1.46 percent Wednesday. Last month, yields had climbed as high as 1.65 percent. Meanwhile, the Federal Reserve signaled Wednesday that it will raise rates in a move to rein in inflation.

Mike Fratantoni, chief economist at the Mortgage Bankers Association, says the average rate on a 30-year mortgage will reach 3.5 percent by mid-2022 and 4 percent by late 2022.

Inflation is running well above target, and the job market is booming, Fratantoni says. That is why it was no surprise that the Federal Reserve moved to accelerate their taper of Treasury and purchases, and signaled that the first rate hike will be coming sooner rather than later. Moreover, the median member now expects three rate hikes in 2022.

The Mortgage Bankers Association expects refinancing activity to disappear as rates rise. But it also expects a strong home-sales market in 2022.

Mortgage experts offer mixed predictions about the direction of rates in the next week in Bankrates latest survey.

Meanwhile, the Federal Reserve last month announced its long-anticipated taper of asset purchases, and the Fed has since said it might accelerate the pace of the taper. While that move creates upward pressure, mortgage rates are unlikely to spike as a result of the taper. However, the Feds changing stance does set the stage for a gradual rise in rates.

Read Also: Reverse Mortgage Manufactured Home

Real Estate On Zillow

In 2018, Kori McClinton started looking for a home in New Orleans, but then halted the search and continued to rent after having no luck finding the right one.Years later, her grandmother urged her to try again, advising the 26-year-old disability analyst to take advantage of low interest rates before it’s too late.”My grandmother actually called me and was telling me how she saw the news about the Federal Reserve saying that the interest rates were going to go up fast, and how I needed to hurry up and get a home,” McClinton said.

McClinton was able to secure a $220,000 loan this year with an interest rate of 2.9% a number she thought was extraordinarily low.

“I was shocked,” she said. “I asked the lender multiple times, ‘Are you sure this is for the entire loan? Seriously?'”

The US has been experiencing all-time low mortgage rates for almost two years. But all of that is changing.

Low mortgage rates are usually reflective of a struggling economy. Rates plummeted in 2020 when the coronavirus pandemic began, people lost jobs, businesses closed, and the Fed lowered the federal funds rate to 0% to 0.25%. They stayed at record lows throughout 2020 and 2021.

Mortgage rates have started rising in the beginning of 2022, though. Yes, the US economy is still working its way back from the damage caused by the pandemic. But it’s also successfully added more jobs, more people are joining the workforce, and inflation has soared.