What Credit Score Is Used For Home Loans

There are five different FICO score models currently used by most lenders of all types. The vast majority of mortgage lenders use the same ones: FICO Score 2, 4 and 5. These are the models used by the credit bureaus Experian, TransUnion and Equifax respectively. They’re called FICO mortgage scores.

FICO Score 2, FICO Score 4 and FICO Score 5: remember these names when comparing the credit scores you get for free.

How Quickly Will Paying Off Debt Affect My Credit Score

You were finally able to zero out that credit card balance, thanks to a holiday cash gift and income from your side hustle. Go you!

A week later, you check the credit score posted on your credit card statement and it doesnt look any different. How long should it take for your credit score to go up after paying off debt?

That depends. Again, it can take up to 45 days for a creditor to give that info to a credit reporting agency. Try not to obsess over seeing the number change right away. Instead, wait at least one month to check, and prepare to wait up to an extra couple of weeks. If youre not able to pay back your debt as quickly as youd like, check out a as an alternative to building your credit.

Dont Miss:

How Often Should You Check Your Fico Score

There is no hard and fast rule as to how often to check your score. It makes sense to keep an eye on it though. If youre a high net worth individual, having the score monitored by a financial product may make sense. For the rest of us, checking it before applying for credit, if we suspect something is wrong or we may have been a victim of identity theft are usually the times we check it.

Don’t Miss: Does Rocket Mortgage Sell Their Loans

After Paying Off Collections

The length of time it takes for credit scores to update after paying off collection accounts can range from 15 to 45 days, depending on when your final check arrives relative to the agency reporting cycle.

There are thousands of collection agencies that operate throughout the country. Each might have a different day of the month when they report the most recent payment information to the bureaus.

- 15 days: your check arrives close to the end of a cycle

- 45 days: your money posts close to the beginning of a cycle

When Do Creditors Report To Bureaus

So even though creditors arent required to report to credit bureaus, the majority of lenders will report information to the three main credit bureaus. So, when do they report this information?

Each credit provider has its own schedule of when they report to credit bureaus. Credit bureaus dont require the information to be reported at a specific date. But you can expect it to happen every 30 to 45 days. The exact dates will vary from lender to lender. Also, remember, the same information might not reach all credit bureaus at the same time. So, a lender could report your information to TransUnion this week, but it only reaches Equifax next week.

As a result, it is very typical for your credit score to be in constant flux. It can change within days or even hours as different lenders send information to the credit bureaus. Your credit score will also not be the same with each credit bureaus. Every new report a creditor makes to the bureaus could mean adjustments to your credit report and credit score.

Recommended Reading: Can You Get A Reverse Mortgage On A Condo

What Do Credit Score Changes Mean

Your , but don’t rely on these small movements – whether up or down – as an indication as to whether your credit is improving overall. Instead, gauge the movement of your credit score over a period of time, several weeks or months, to get an idea of where your credit is headed.

On the other hand, if you see a big drop in your credit score, you should investigate it further to see what’s caused such a major change in your credit score. There may have been new negative information added to your credit score, like a late payment, a new account, or a large credit card balance amount. Occasionally, old information falling off your credit report can cause your credit score to drop. In some cases, your credit score can drop even if an old collection account falls off your credit report.

Most negative information can only be included in your credit report for seven years. The two exceptions to this rule are: 10 years for bankruptcy or two years for hard inquiries.

You can monitor daily changes to your Equifax and TransUnion credit scores via and monthly changes to your Experian credit score via Credit Sesame. Both services are free and don’t require a credit card or trial subscription to enroll. They’re both great services to track changes to your credit scores and include tools to let you know how the information in your credit report has changed. This makes it easier to gauge what credit report information is contributing to movements in your credit score.

Fico 8 Vs Fico : What Are The Differences

FICO 9 is similar to FICO 8 but differs when it comes to collections and rent payments. FICO 9 counts medical collections less harshly than other accounts in collections, so a surgery bill in collections will have less of an impact on your than a credit card bill in collections.

Additionally, FICO 9 ignores accounts in collections that have a zero dollar balance. If you had a credit card account go to collections but later paid it off, FICO 9 will no longer use said collections account against your score. This is different than FICO 8, which factors all collections amounts of $100 or more into your FICO scoreeven if theyre completely paid off.

Just because collections with a zero balance are ignored by FICO 9 does not mean that lenders will ignore them. Credit bureaus will still show these collections on your full credit report, and lenders will see them when they reviews your full credit history.

Finally, FICO 9 factors rental history into your credit score. This makes it easier for people with no credit to build a high credit score with their monthly on-time rent payments. Unfortunately, this is dependent on your landlord actually reporting rent payments to credit bureaussomething not yet seen on a large scale.

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

Basics Of Rapid Rescoring

A “rapid rescore” is a service that lenders use to get recent updates to your account history reflected in your credit reports in an accelerated time frame. Instead of waiting for information in your credit reports to be updated by the next billing cycle, you can have that information updated with the help of your lender within days.

The goal of the service is to improve the information in your credit history and thereby obtain a higher , which is why lenders generally recommend the service when your existing credit score is a few points shy of what you need to get a lower interest or more favorable loan terms. By removing negative items, reducing loan balances, and fixing errors, you can improve your chances of getting approved for a low-cost loan.

Rapid rescoring isnt something you can do on your own. To use the service, youll need to have a lender request a rapid credit rescore on your behalf. Your lender has the information needed to determine if a quick update to your credit score will be helpful, as well as relationships with any third-party credit vendors that handle the logistics of updating your credit.

How To Get A Rapid Rescore

A rapid rescore gives lenders the most up-to-date version of your credit report. Mortgage lenders often request rapid rescores if youre trying to raise your credit score a few points to get approved for a loan or to qualify for a better interest rate.

Rapid rescore works when you have proof of a credit report error or youre able to pay off an account right away and need the deleted error or paid-off balance to change your credit report and score immediately.

Don’t Miss: Can You Do A Reverse Mortgage On A Mobile Home

How Quick Do Mortgage Scores Update

wrote:Hello.We have started our process however mid score was way lower than anticipated. We have paid off 1 Cc and half the balance e of another which haven’t been reported yet. We will be paying all others to 30% this weekend. Then to 10. How long does it take for the mortgage scores to show this or even the myfico?I am hoping to get at least a 20 point boost to my mid score.Also they’re requesting I pay off a collection account which is concerning me it will drop my scores.Simulator on my fico shows if I pay this amount the scores will raise question is does that raise the mortgage score and often does it update?

I suggest to change from 30% to less than 28% , and the 10 to less than 8.9% .

The simulator is for FICO 8 and is not reliably accurate. Don’t even try to gauge a mortgage score off it. When your statements cut for each credit card, the new balances usually report within 5 days. But I would advise to hit your ultimate goal on utilization before pulling your 3B report for mortgage scores. They can change within a day with reported balances, to a new month, with Feb 1st upon us . If you are a subscriber on the monthly not quarterly report, you will get scores same day each month. But you will not get a version of the FICO here that will reflect example +17 on TU, due to a paid off credit card. Do not expect it to yield the same number of points on mortgage scores, they are a different algorithm for scoring calculation.

How To Improve Your Credit Score

If you want to improve your credit score, you should not worry about the daily fluctuations of your score and instead worry about improving your credit score in the long term. Here are some things that you can do to improve your credit score:

- Make Timely Payments Making timely payments on your credit cards and loans is the single most important thing that you can to improve your credit score, accounting for 35% of your credit score. So, make sure that you pay your credit cards on time and make timely payments on loans, such as your auto loan, student loan, and home loan. Making timely payments on your accounts is extremely important because it shows lenders that youre reliable, meaning you only borrow what you can afford to pay back, which is the entire reason that we have credit scores to begin with. So, always make timely payments and you should see your credit score improve.

- Keep Low Balances The second most important thing you can do to improve your credit score is to pay down balances on your accounts. So, if you have a credit card that has a high balance, try to pay down that balance because this decreases your credit utilization. Having low credit utilization shows lenders that youre not relying heavily on credit, indicating that youre not in a financial crunch and you can therefore afford to pay down your debts. Lenders like to see a persons credit utilization below 30%, so always try to keep your credit utilization below this threshold.

Also Check: Who Is Rocket Mortgage Owned By

What Is A Credit Report

Essentially, a is a very detailed look at your credit history and at yourself as a borrower. Information is collected by the two Canadian , TransUnion and Equifax, where all credit reports are created. These reports, in turn, are used by lenders to examine an individuals creditworthiness.

to find out how you can get a free copy of your credit report.

So, what exactly goes into a credit report? Well, the answer is quite a bit of valuable information. The report includes:

- Personal Information This includes your name, address, social insurance number, and employment history.

- Detailed Summary Of Your Credit History This includes the number of accounts you have, as well as all the necessary information about those accounts, including their credit limits and their ages. These reports generally only retain negative information for a period of 7 years, so if your report isnt so good at the moment, it will eventually turn around as long as you pay your bills on time, use your credit wisely and dont apply for new credit too often.

Read this to learn how long information stays on your credit report.

Why Isnt Experian On Credit Karma

You may have noticed that one of the nationwide credit bureaus is missing from your Credit Karma update: Experian.

Why isnt Experian part of Credit Karma? Well, .

What does this mean?

Well, FICO and VantageScore are essentially two companies, offering different models for credit scoring. Both are widely used when it comes to making lending decisions, but they differ slightly when it comes to how credit scores are calculated and predicted via the use of a credit score simulator.

Both FICO and VantageScore use their scoring models so that your credit report is turned into an updated credit score for each of the three main consumer credit bureaus TransUnion, Experian, and Equifax.

Therefore, as Equifax and TransUnion both use the VantageScore scoring model, it makes sense to combine them. This allows for the most accurate reflection of your credit score based on the VantageScore approach.

As there is no Credit Karma FICO score check, its a good idea to access your Experian FICO Score as well. The credit bureau also has a feature known as Experian Boost. This is a tool that can potentially boost your credit score if youre making regular payments on your account for things like your mobile phone contract or your Netflix subscription. Equifax and TransUnion dont provide such a service.

Read Also: Rocket Mortgage Vs Bank

When Do Credit Reports Update

Your scores may change when your file is updated. Credit bureaus regularly add to your report to ensure that all information pertaining to your current credit and credit history remains relevant.

Your credit score isnât included on any weekly reports generated by the three bureaus, but is updated about once a month. Credit reports differ from credit score checks in that they describe details pertaining to your financial habits that help compose your credit score. Such details include:

One: Payments you’ve made. Credit bureaus consider if youâve made timely or late payments, or if youâve missed payments completely.

Two: Changes in your credit card balances. While most of us have many regular expenses such as car payments, rent, and utility bills, we may spend more at different times of year, like during the holidays. Having a higher credit utilization ratio, as a result, will impact your score. Pay attention to your credit limit to avoid getting flagged for strange behaviour.

Three: Your total outstanding debt.

Four: New credit applications you’ve made or new loans or credit accounts you’ve opened.

Problems With Credit Reporting

Heres where it gets complicated. Some businesses only provide information to the CRAs when an account is past due or has been written off and/or turned over to a collection agency. Creditors will write off a debt when it is deemed uncollectible.

Some of these creditors include:

- Utility companies

- Doctors and hospitals

- Lawyers and other professionals.

The three reporting agencies are making increasing efforts to gather monthly information from utility companies, phone companies and local retailers. That increases the amount of data in an individuals credit profile, which cuts down on the guesswork.

You May Like: Mortgage Recast Calculator Chase

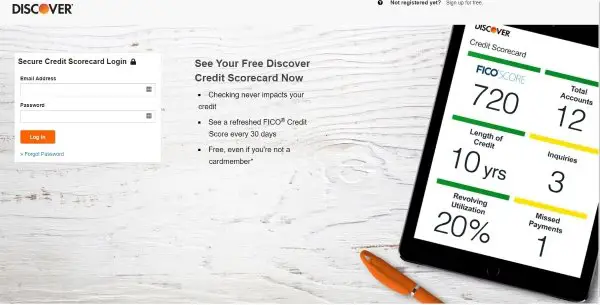

Vantagescore: The Free Credit Score From Creditkarma Creditsesame Nerdwallet

These are non-FICO scores, most often based on your credit history at a single bureau.

The free credit score from is TransUnions VantageScore. free credit score is a VantageScore based on your credit history at Experian. Your free credit score from is from Equifax or TransUnion using the VantageScore score model. NerdWallet’s free credit score is a TransUnion VantageScore as is Capital Ones free CreditWise and TransUnions free credit score direct from their website.

How does your VantageScore free credit score compare to your FICO credit score for a mortgage loan?

VantageScore is from a single bureau, not a FICO score, and not a FICO mortgage score model. Three strikes.

It’s a different formula than FICO with a different score range off to a bad start. There has been one in-depth analysis of VantageScore vs. FICO: a 2012 statistical study by the Consumer Financial Protection Bureau. Their result?

The mean VantageScore was 36 points higher than the FICO credit score for the same credit file.

Our recent experience with our clients using the current model has also been that the VantageScore is most often higher than the FICO mortgage score. More importantly, certain account activity can cause a significant increase in the VantageScore with no increase in the FICO mortgage score. The difference can be quite large and very disappointing to homebuyers.

Fico Score 9the Newest Fico Score Versionis The Most Predictive Fico Score To Date

Many lenders have already upgraded to, or are in the process of upgrading to, FICO®Score 9. Its our newest FICO® Score version, and it has a few important updates that make it the most predictive FICO Score yet.

- Third-party collections that have been paid off no longer have a negative impact

- Medical collections are treated differently than other types of debt. Unpaid medical collections will have less of a negative impact on FICO Score 9.

- Rental history, when its reported, factors into the scorethis may be especially beneficial for people with a limited credit history

Read Also: Can I Get A Reverse Mortgage On A Condo