Length Of A Home Loan Term

The loan term refers to how long you have to pay off a loan. Shorter terms mean higher monthly payments with less interest. Longer terms flip this scenario, meaning more interest is paid, but the monthly payment is lower.

When youre looking at monthly payments, its important to balance dueling goals of affordability while at the same time trying to pay as little interest as possible.

One strategy that might be helpful is to put extra money toward the monthly principal payment when you can. This will result in paying less total interest over time than if you just made your regular monthly payment.

You can also take a look at recasting your mortgage to lower your payment permanently. When you recast, your term and interest rate stays the same, but the loan balance is lowered to reflect the payments youve already made. Your payment is lower because the interest rate and term remain.

One thing to know about recasting is that sometimes theres a fee, and some lenders limit how often you do it or if they let you do it at all. However, it can be an option worth looking into because it might be cheaper than the closing costs on a refinance.

Recommended Reading: How Do I Qualify For A Mortgage With Bad Credit

Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment

Use Our Calculator To Estimate Your Monthly Payment

Most people need a mortgage to finance a home purchase. Use our mortgage calculator to estimate your monthly house payment, including principal and interest, property taxes, and insurance. Try out different inputs for the home price, down payment, loan terms, and interest rate to see how your monthly payment would change.

Mortgage Calculator Results Explained

To use the mortgage calculator, enter a few details about the loan, including:

Read Also: How Does Rocket Mortgage Work

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

The Bottom Line: Keep Track Of Your Principal And Interest

Your monthly mortgage payment has two parts: principal and interest. Your principal is the amount that you borrow from a lender. The interest is the cost of borrowing that money.

Your monthly mortgage payment may also include property taxes and insurance. If it does, your lender holds a percentage of your monthly payment in an escrow account.

Your mortgage payment usually stays the same every month. If you choose a mortgage with an adjustable interest rate or if you make extra payments on your loan, your monthly payments can change.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Don’t Miss: 10 Year Treasury Vs 30 Year Mortgage

How Much Interest Do You Pay

Your mortgage payment is important, but you also need to know how much of it gets applied to interest each month. A portion of each monthly payment goes toward your interest cost, and the remainder pays down your loan balance. Note that you might also have taxes and insurance included in your monthly payment, but those are separate from your loan calculations.

An amortization table can show youmonth-by-monthexactly what happens with each payment. You can create amortization tables by hand, or use a free online calculator and spreadsheet to do the job for you. Take a look at how much total interest you pay over the life of your loan. With that information, you can decide whether you want to save money by:

- Borrowing less

- Paying extra each month

- Finding a lower interest rate

- Choosing a shorter-term loan to speed up your debt repayment

Shorter-term loans such as 15-year mortgages often have lower rates than 30-year loans. Although you would have a bigger monthly payment with a 15-year mortgage, you would spend less on interest.

The Three Numbers Youll Need

There are several factors that go into estimating how much your regular mortgage payments will be. These 3 numbers are particularly important:

1. The total mortgage amount: This is the price of your new home, less the down payment, plus mortgage insurance, if applicable.

2. The amortization period: This is the total life of your mortgage, and the number of years the mortgage payments will be spread across.

3. The mortgage rate: This is the rate of interest you pay on your mortgage.

Also Check: Does Rocket Mortgage Sell Their Loans

Don’t Miss: How Much Is Mortgage On A 1 Million Dollar House

Whats The Necessary Credit Score To Get A Mortgage

In addition to making sure you can afford your mortgage payments, lenders also look at your credit score when deciding both whether to lend to you and the amount of interest to charge you for borrowing.

When lenders look at your credit score, most have a minimum score requirement before you can even get approved for a mortgage loan. This minimum credit score is lower with government-backed loans, including FHA loans, VA loans, and USDA loans than it is for conventional mortgage loans.

For a loan backed by the FHA, you usually need a credit score of 580, although its possible to get a loan with a score as low as 500 under certain circumstances if you make a larger down payment. VA lenders typically require a score between 580 to 620, depending on the lender, while USDA loans typically wont be available to you if your score is less than 640.

Conventional loans, on the other hand, generally require a minimum credit score of 620but you will pay much higher rates and could be stuck with a subprime mortgage if your score is low. To get the most competitive rates on a mortgage, a score of 740 or higher is preferred.

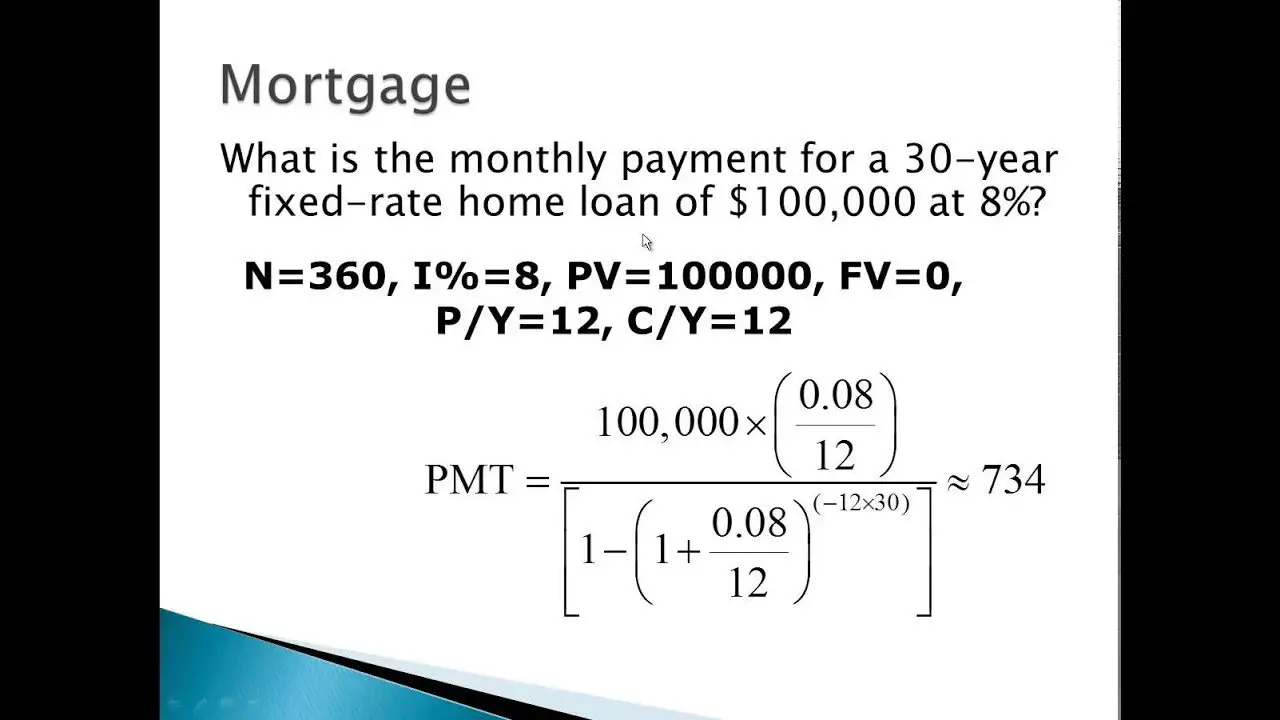

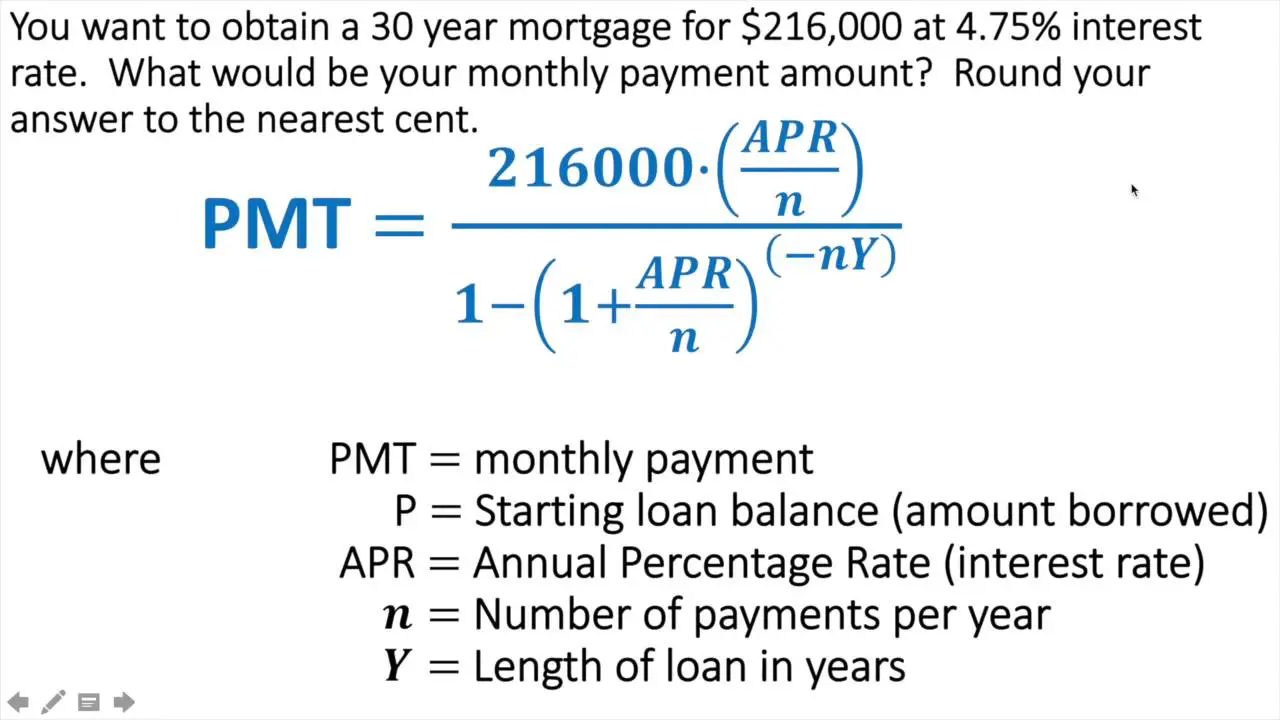

How To Calculate Mortgage Paymentswithout A Mortgage Payment Calculator

By Justin Dallaire on December 16, 2021

If youve ever wondered about the math behind your mortgage payments, or if you simply want to impress a pen-and-paper-loving pal, weve got you covered.

Whether youre a first-time home buyer or a seasoned home owner looking for your next place, youll need to determine how much your monthly mortgage payments will be so that you can budget accordingly. Online mortgage payment calculators are a quick and easy way of doing thatjust input a few key numbers and the calculator does the rest.

But have you ever wondered how mortgage payment calculators work? We break down the math to help illustrate why you end up with that specific payment amount.

Maybe youd like to run the numbers the ol fashioned way with a pen and paper , or maybe youd just like a better understanding how the number that your monthly budget likely revolves around is determined. Whatever your reason, read on to see how to calculate your mortgage payments yourselfno mortgage calculator required.

Don’t Miss: 70000 Mortgage Over 30 Years

The Best Office Productivity Tools

Kutools for Excel Solves Most of Your Problems, and Increases Your Productivity by 80%

- Reuse: Quickly insert complex formulas, charts and anything that you have used before Encrypt Cells with password Create Mailing List and send emails

- Super Formula Bar Reading Layout Paste to Filtered Range

- Merge Cells/Rows/Columns without losing Data Split Cells Content Combine Duplicate Rows/Columns Prevent Duplicate Cells Compare Ranges

- Select Duplicate or Unique Rows Select Blank Rows Super Find and Fuzzy Find in Many Workbooks Random Select

- Exact Copy Multiple Cells without changing formula reference Auto Create References to Multiple Sheets Insert Bullets, Check Boxes and more

- Extract Text, Add Text, Remove by Position, Remove Space Create and Print Paging Subtotals Convert Between Cells Content and Comments

- Super Filter Advanced Sort by month/week/day, frequency and more Special Filter by bold, italic

- Combine Workbooks and WorkSheets Merge Tables based on key columns Split Data into Multiple Sheets Batch Convert xls, xlsx and PDF

- More than 300 powerful features. Supports Office/Excel 2007-2019 and 365. Supports all languages. Easy deploying in your enterprise or organization. Full features 30-day free trial. 60-day money back guarantee.

Office Tab Brings Tabbed interface to Office, and Make Your Work Much Easier

Calculate The Monthly Interest Rate

The interest rate is essentially the fee a bank charges you to borrow money, expressed as a percentage. Typically, a buyer with a high , high down payment, and low debt-to-income ratio will secure a lower interest rate the risk of loaning that person money is lower than it would be for someone with a less stable financial situation.

Lenders provide an annual interest rate for mortgages. If you want to do the monthly mortgage payment calculation by hand, you’ll need the monthly interest rate just divide the annual interest rate by 12 . For example, if the annual interest rate is 4%, the monthly interest rate would be 0.33% .

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

How A Mortgage Calculator Can Help

- The loan length thats right for you. If your budget is fixed, a 30-year fixed-rate mortgage is probably the right call. These loans come with lower monthly payments, although youll pay more interest during the course of the loan. If you have some room in your budget, a 15-year fixed-rate mortgage reduces the total interest you’ll pay, but your monthly payment will be higher.

- If an ARM is a good option. With fixed rates at record lows, adjustable-rate mortgages have largely disappeared. But as rates rise, an ARM might be a good option for some. A 5/6 ARM which carries a fixed rate for five years, then adjusts every six months might be the right choice if you plan to stay in your home for just a few years. However, pay close attention to how much your monthly mortgage payment can change when the introductory rate expires.

- If youre spending more than you can afford. The Mortgage Calculator provides an overview of how much you can expect to pay each month, including taxes and insurance.

- How much to put down. While 20 percent is thought of as the standard down payment, its not required. Many borrowers put down as little as 3 percent.

Mortgage Loan Calculator For Refinancing Or Home Purchase Payments

Get estimates for home loan payments to help you decide what you can afford.

This simple Mortgage Loan Calculator enables you to calculate what your monthly mortgage payments will be – including the principal, interest, property taxes and home insurance . The result you get will be relevant for a wide variety of different mortgage types. It will also display your projected repayment schedule, taking into account your principal loan amount, interest rate, and any additional prepayments you intend to make

Don’t Miss: Mortgage Recast Calculator Chase

Rate: Each Periods Interest Rate In Percentage Terms

Lenders usually quote interest rates on an annual basis but this data point uses a periodic interest rate . Since we are calculating the monthly payment, we want to find the periodic rate for a single month. To do this, well divide the interest rate by the number of periods to find the monthly interest rate.

For example: Say you want to calculate a monthly mortgage payment using a 5% interest rate. Youd enter: 5%/12 or 0.05/12, or the corresponding cell /12. Once you enter the interest rate, type a comma to move to the next data point.

Caution: If you simply enter 5/12 instead, Excel will interpret this as a 500% annual rate paid monthly. Entering 5 will result in a 500% interest rate each month.

How To Calculate Mortgage Payments

Calculating mortgage payments used to be complex, but mortgage payment calculators make it much easier. Our mortgage payment calculator gives you everything you need to test different scenarios, to help you decide what mortgage is right for you. Heres a little more information on how the calculator works.

Read Also: Chase Mortgage Recast

Conforming Loans Vs Non

Conforming loanshave maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

Why Should I Use A Mortgage Calculator

Don’t Miss: 10 Year Treasury Vs Mortgage Rates

What Is An Amortization Schedule

An amortization schedule shows your monthly payments over time and also indicates the portion of each payment paying down your principal vs. interest. The maximum amortization in Canada is 25 years on down payments less than 20%. The maximum amortization period for all mortgages is 35 years.

Though your amortization may be 25 years, your term will be much shorter. With the most common term in Canada being 5 years, your amortization will be up for renewal before your mortgage is paid off, which is why our amortization schedule shows you the balance of your mortgage at the end of your term.

How To Choose The Right Mortgage Lender

Choosing the right lender takes a fair amount of research and requires a thorough review of your situation before you even start your search. For example, if you are a first-time buyer, some lenders might be better than others for your situation. Other factors that can help determine the right lender for your situation might include:

- Do you have a high credit score, or are there issues here?

- Are you looking for a 30-year mortgage or perhaps one with a 15-year term?

- Are you a veteran?

The key factors to consider when starting your search include:

- Your credit score

- The amount of your down payment

- The loan term you are seeking

- Extra fees and closing costs associated with the mortgage

- The interest rate

The types of lenders you might consider include:

- Banks

- Online lenders

In some cases, it might make sense to work with a mortgage broker who can help you look across the mortgage lender spectrum and can often help you obtain a suitable deal. Some online mortgage sites offer access to several different lenders, much like a traditional mortgage broker.

Don’t Miss: How Much Is Mortgage On 1 Million

How Do You Calculate A Loan Payment

Heres how you would calculate loan interest payments.

then What is the formula for calculating a 30 year mortgage? Multiply the number of years in your loan term by 12 to get the number of total payments for your loan. For example, a 30-year fixed mortgage would have 360 payments .

Which formula should be used to correctly calculate the monthly mortgage payment? Use the formula P= L / to calculate your monthly fixed-rate mortgage payments. In this formula, P equals the monthly mortgage payment.