Is It Worth Refinancing For 1 Percent

Refinancing to save 1 percent is often worth it. One percentage point is a significant rate drop, and it should generate meaningful monthly savings in most cases.

For example, dropping your rate 1 percent from 3.75% to 2.75% could save you $250 per month on a $250,000 loan. Thats nearly a 20% reduction in your monthly mortgage payment.

Those monthly savings can be put toward daily living expenses, emergency funds, investments, or paid back into your mortgage to pay the loan off early and save you even more in interest.

Refinancing for a 1 percent lower rate

| Loan Balance | |

| Worth It? | Yes, if you keep the loan ~2 years or longer |

Keep in mind, breaking even with your closing costs isnt the only way to determine if a refinance is worth it.

A homeowner who plans to move or refinance again before the breakeven point might opt for a noclosingcost refinance.

Passing The Mortgage Stress Test

Whether your mortgage is insured or uninsured, youll have to undergo a stress test to ensure you can afford the mortgage. Currently, the benchmark rate is 5.25%. That means homebuyers must prove they can afford a mortgage in addition to utilities and other costs if interest rates rise.

Most brokers will also consider your Gross Debt Service ratio and Total Debt Service Ratio , which can be no more than 39% and 44%, respectively.

The GDS is the percentage of household income covering housing costs, including mortgage and property taxes. The TDS is the percentage of household income covering housing costs and any other debts, including credit cards and car payments.

Mortgage rate: 5.25%

A Gift From A Family Member

For borrowers who are short of cash beyond the down payment, and where the seller is unwilling to pay closing costs, those costs can instead be paid by a gift from a family member.

In fact, the family member can make a gift specifically to cover discount points to lower the interest rate on the loan. This can be done even if the seller pays other closing costs, or if the lender uses premium pricing.

If a gift from a family member is used, the lender will want the family member to execute a gift letter spelling out the amount of the gift, the source of funds, and when it will be paid.

Its also likely theyll want to verify the source of funds, with a copy of a bank statement or a direct account verification from the bank itself.

You May Like: 10 Year Treasury Yield And Mortgage Rates

How To Shop For Loans With Mortgage Points

As of this writing, for instance, one national lender offers a 30year fixed loan at 4.5 percent with no points. You can knock .25 percent off that and get 4.25 percent by paying half a discount point.

But a 4.125 percent rate costs an additional point. Paying more doesnt necessarily get you a better deal.

When shopping for a mortgage with discount points, the easiest way to compare offers is to decide how much you want to spend, then see who offers the lowest rate at that price.

Alternatively, you can decide what rate you want, and see which lender charges the least for it.

When To Buy Mortgage Points

Buying mortgage points might make sense if any of the following situations apply to you:

- You want to stay in your home for a long time. The longer you stay in your home, the more it makes sense to invest in points and a lower mortgage rate. If youre sure youll have the same mortgage for the long haul, mortgage points can lessen the overall cost of the loan. The longer you stick with the same loan, the more money youll save with discount points.

- Youve determined when the breakeven point is. Do some math to figure out when the upfront cost of the points will be eclipsed by the lower mortgage payments. If the timing is right and you know you wont move or refinance before you hit the breakeven point, you should consider buying points.

How do you calculate that breakeven point, you ask? Lets run through a quick example using the numbers referenced earlier.

If you have a $200,000 loan amount, going from a 4.125% interest rate to a 3.75% interest rate saves you $43.07 per month. As mentioned earlier, the cost of 1.75 points on a $200,000 loan amount is $3,500. If you divide the upfront cost of the points by your monthly savings, youll find that your breakeven point is about 82 months , which is equal to roughly 6 years and 10 months. So, if you plan to stay in your house for longer than that amount of time and pay off your loan according to the original schedule, it makes sense to buy the points because youll save money in the long run.

Also Check: Can You Refinance A Mortgage Without A Job

Does Refinancing Hurt Your Credit

Refinancing will hurt your credit score a bit initially, but might actually help in the long run. Refinancing can significantly lower your debt amount and/or your monthly payment, and lenders like to see both of those. Your score will typically dip a few points, but it can bounce back within a few months.

Choosing The Mortgage Term Right For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

You May Like: Chase Mortgage Recast

How Much Could You Save By Purchasing Mortgage Points

Thats a good question and the answer is that it depends largely on several things, including:

- The amount youre borrowing and your down payment

- Your initial interest rate

- The number of points you plan to buy

- How long you plan to stay in the home

Doing the math on discount points can help you figure out if its worth paying them, based on the break-even point. The break-even point is when the amount of money you saved in interest by purchasing points equals the amount you paid to buy them.

For example, say you want to buy a $300,000 home with a 30-year term. The lender offers you the option of getting a mortgage at 3.5% with no points or paying two points to reduce your rate to 3%. Youd need to pay $6,000 to cover the points but that would reduce your monthly principal payment from $1,347 to $1,265. Youd hit your break-even point in approximately 6.1 years.

But what about the interest savings? If you were to stick with your original rate of 3.5%, youd pay $184,968 in interest charges over the life of the loan. But if you were to spend the $6,000 to buy down points that would reduce the interest paid on the mortgage to $155,332. Once you deduct the $6,000 you paid for points the result would be a net interest savings of $23,636.

How Are Mortgage Points Factored Into Advertised Rates

Whether you find a rate on a mortgage lenders website or through a third party, the mortgage rates you see advertised might or might not include points. One rate might even seem attractively low, but that could be due to points already factored in that you might not want to pay. On Bankrate, we specify whether advertised mortgage rates include points so you can make a fair comparison between lenders.

Recommended Reading: Requirements For Mortgage Approval

The Downside Of Paying Mortgage Points

Paying mortgage discount points is not the best use of your money.

Here are some reasons why:

- You may not have the mortgage for 11.5 years. Most people either refinance their mortgage or move to a new home within that timeframe. If you do either before you reach the 11.5-year mark, you will have lost money by paying the discount points.

- If money will be tight when you purchase the home. Paying discount points may be a needless extravagance .

- If the seller is paying the discount points but insists that the final sales price be adjusted upward to compensate for the cost of the points, you will be trading a higher sales price and mortgage for a lower interest rate. Dont fall for this offer its a bad deal for you.

- Paying discount points out of your own pocket can leave you with less cash after closing cash youll probably need as you prepare to move into your new home.

How Do Mortgage Points Work With Arm Loans

Mortgage points on an adjustable-rate mortgage work like points for a fixed-rate mortgage, but most ARMs adjust at five years or seven years, so its even more important to know the breakeven point before buying points.

Factor in the likelihood that youll eventually refinance that adjustable rate because you may not have the loan long enough to benefit from the lower rate you secured by paying points, says McBride.

Recommended Reading: Can You Get A Reverse Mortgage On A Condo

Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment

What Are Origination Points

A different type of mortgage point that you might have to pay is an “origination point.” Origination points won’t reduce your interest rate they’re fees you pay to the lender for agreeing to provide and process your loan. Sometimes origination points are called an “origination fee.” These points vary from lender to lender and are sometimes negotiable, but not usually.

This article focuses mainly on discount points.

Recommended Reading: What Does Gmfs Mortgage Stand For

Lets Evaluate Your Results

After considering upfront costs of 00

Lets break it down:

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Is Buying Mortgage Points A Good Idea

There are a handful of things to consider before you decide to purchase discount points. The break-even point is a good place to start when determining whether it’s worth it for you, but here are some more specific examples of when you might want to consider it.

- You don’t plan to sell or refinance anytime soon. If you’re settling down for a while and rates are low enough that you don’t anticipate refinancing your mortgage, you may end up staying in the home long after the break-even point. In this case, it makes sense to spend a little more upfront to save in the long run.

- You have the means to buy points. Saving for a down payment while also maintaining an emergency fund and contributing toward other goals, including retirement, can be challenging. If you have the cash to spare, it’s worth considering using some of it to buy down your rate.

On the flip side, there are some situations where it’s likely not a good idea to take advantage of discount points:

Carefully go over all of your options and consider speaking with a mortgage professional to determine if buying discount points is right for you.

Also Check: Reverse Mortgage For Mobile Homes

How Much Does A 1% Difference In Your Mortgage Rate Matter

Modified date: Nov. 24, 2021

When you start looking to buy a house, youre going to hear all about mortgage rates and how much it sucks that theyre going up, how great it is if theyre going down, or even why low mortgage rates arent always a good thing.

Your mortgage rate is simply the amount of interest charged by whomever you took a loan out with to purchase your house.

So how do you get to this percentage? And how will it really affect how much you pay? For the purposes of this article, Ill take a look at how just a 1% difference in your mortgage rate can seriously affect how much you pay.

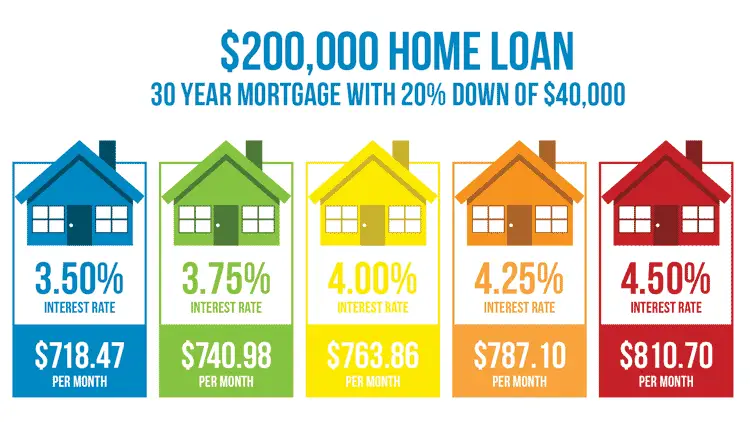

As youll see in the table below, a 1% difference in mortgage rate on a $200,000 home with a $160,000 mortgage, increases your monthly payment by almost $100. Although the difference in monthly payment may not seem that extreme, the 1% higher rate means youll pay approximately $30,000 more in interest over the 30-year term. Ouch!

Whats Ahead:

Where Can You Learn About Points In Your Loan

Your lender must disclose points in both your loan estimate and your closing disclosure.

You can find information about points on Page 2, Section A of both your loan estimate and your closing disclosure.

Always check your loan estimate and closing disclosure carefully, and go over all the provided numbers with a fine toothed comb.

Ask your lender to clarify any points of confusion, and walk you through your payment schedule over time. That way, you can make sure discount points are right for you before you buy.

Header Image Source:

Don’t Miss: Chase Recast

About Mortgage Discount Points

Discount points are a common feature of mortgages, but they can be confusing for many borrowers. Just how do they work?

Discount points are a type of pre-paid interest. So by paying part of your interest up front, you can get a lower rate. And what you save in interest over the long haul can be a lot more than what you paid for the points up front. The question is, will you save enough to make it worth the initial cost?

The key is to calculate the break-even point how long it will take for your interest savings from a lower mortgage rate to exceed what you paid for your discount points. If you can recoup your costs in five years or so, that’s often a good deal.

A big consideration is how long you expect to have the mortgage. If you sell the home or refinance the mortgage before reaching your break-even point, you’ll have lost money. Or if you do so only a year or two after reaching it, your savings might not be enough to make it worthwhile.

Discount points work best for someone who expects to stay in their home and not refinance for a long time. Over 20-30 years, the savings can be substantial in the tens of thousands of dollars. However, if it takes a long time to reach your break-even point, say 10-15 years, you have to ask yourself whether the small savings you’ll realize each month are worth the trouble, even if you expect to stay in the home longer than that.

How We Got Here

To use the Should I buy points? mortgage calculator, type your information into these fields:

-

Desired loan amount

-

Interest rate without points

-

Number of points

-

Interest rate with points This shows what your rate would be if you paid for points. In general, lenders drop the interest rate by a quarter of a percentage point for each point purchased, up to a limit. But maybe a lender has offered you a rate thats different for buying this number of points. If so, type in that rate to ensure the accuracy of your results.

Don’t Miss: Chase Recast Mortgage

How Much Does A 1% Difference In A Mortgage Rate Make

Homes have been flying off the market because the supply is so low and buyers greatly outnumber sellers in most markets. Many people are jumping into the market in hopes of becoming a homeowner before mortgage rates rise.

Lets say rates do rise a full 1 percent by the end of the year. How much does a 1% difference in a mortgage rate make? How about a 0.5% difference? 0.25%? 0.125%?

Before we dive in to the numbers, lets go through some basic info on mortgages.

Mortgage rates are usually offered in increments of 0.125%. You might see rates advertised as 3.96 or 3.99% APR, but the rate you be paying will probably be 3.875% or 4%. APR factors in the total cost of the loan including fees and other costs such as processing fees, underwriting fees, discount points, origination points, etc. Sometimes lenders give a credit for those fees up front if you agree to take a higher rate.

There are many different mortgage products, but the 30-year fixed is the most common. Some other common mortgages are the 15-yr fixed, 7/1 ARM , and the 5/1 ARM. In my experience as a realtor, almost all first-time homebuyers have opted for the 30-year fixed. Personally, I have two mortgages right now. One is a 30-yr fixed. The other is a 7/1 ARM. Im planning to pay the ARM off early or sell that property. ARMs are especially risky right now. Dont get one unless you know what they are.

Related: Paying Off a 30 Year Mortgage in 5 Years