Prime Rates And Student Loans

Variable interest rate student loans will be affected by the Prime Rate. Variable Rate loans that were previously taken out and loans that will be currently taken will benefit from the lower Prime Interest Rate in the market today. Variable rate student loans have not been offered by the federal government since 2006, whereas private lenders still offer variable rate student loans. Therefore, a majority of college students on fixed rate loans cannot benefit from the low interest rates prevailing in the markets currently.

How High Will Rates Go

Bank of Canada Governor Tiff Macklem has made no secret that the institution will be forceful with rate hikes in an effort to tamp down on surging inflation.

The central bank took a rare 50-basis point step last month to raise its key overnight rate to 1.0 per cent. Some economists are anticipating another half a percentage point hike when next rate announcement comes in June.

Everybodys got an opinion on where they think rates are going and nobody quite knows unless youre in the Bank of Canada, in which case youre probably not telling anyone, Zlatkin says.

Desjardins said in a mortgage rate forecast last week that it expects the central bank to rapidly raise the key rate in the year to come but it will be kept below 2.5 per cent.

The Bank of Canada said last month that it believes the neutral rate the point at which interest rates are neither fuelling or hampering the countrys economic growth is between 2.0 per cent and 3.0 per cent.

If the central bank raises rates that high in the current cycle, variable rates would rise by 100-200 basis points and mortgage holders with this type of loan would immediately set monthly payments to reflect the higher rates.

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score between both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

Don’t Miss: Reverse Mortgage On Condo

The Market Consensus On The Mortgage Rate Forecast In Canada Is For The Central Bank To Increase Mortgage Interest Rates By 125% In 2022

The main tool we have when reading the current mortgage rate market is the Government of Canada Bond Yield. The Canadian bond is essentially a government debt security that pays a return to an investor. The % based return is called the yield and it is considered to be one of the safest investments because the Government would have to go bankrupt, in order for it not to pay its investors.

The Government of Canada 5 year Bond Yield factors in all known economic data on a day to day, and even a minute to minute basis. Simply put when the market/ bond traders think that the Central Bank of Canada will increase rates, the Bond Yield increases. When the Bond market thinks the Central Bank rate will decrease, then the yield drops. In other words, the Bond yield trades, or is priced in anticipation of where the Central Bank of Canada rates will move. The Central Bank of Canada makes its rate decisions, based on the status of the economy.

Currently, the Canadian Bonds are priced in anticipation of a 1.25% increase in rates in 2022. However, the Bond yield at the time of writing is down from an October 2021 high of 1.51%. The trend seems to be downwards, however, there will likely be volatility in this yield in early 2022 as the market digests and prices in a huge amount of economic data.

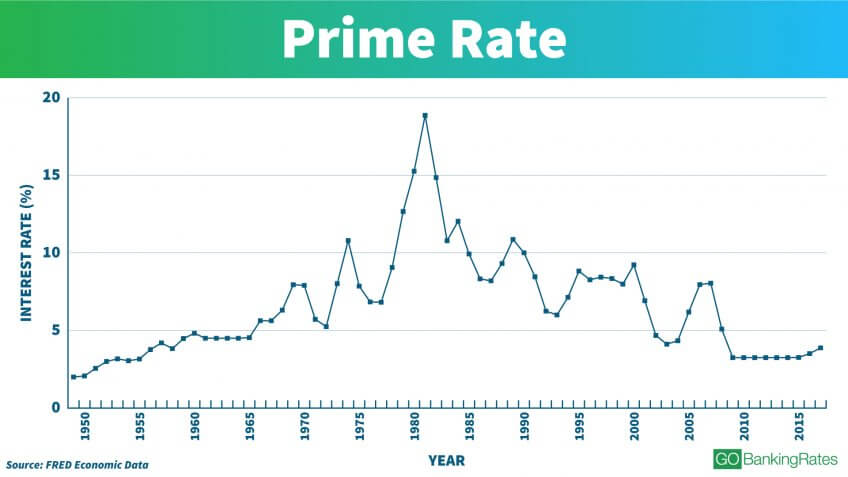

What Is The Current Prime Rate

As of Feb. 8, 2022, the current prime rate is 3.25% in the U.S., according to The Wall Street Journals Money Rates table, which lists the most common prime rates charged throughout the U.S. and in other countries by averaging out the prime rate from the 10 largest banks in each country.

The federal funds rate is currently 0.00% to 0.25%, so with that in mind, you can see how the fed funds plus 3 rule of thumb plays out: 3 + 0.25% = 3.25%.

Each bank has the ability to set its own prime rate. Most base it off the national average listed under the WSJ prime rate, but some could charge more or less depending on their goals.

Read Also: Can You Get A Reverse Mortgage On A Manufactured Home

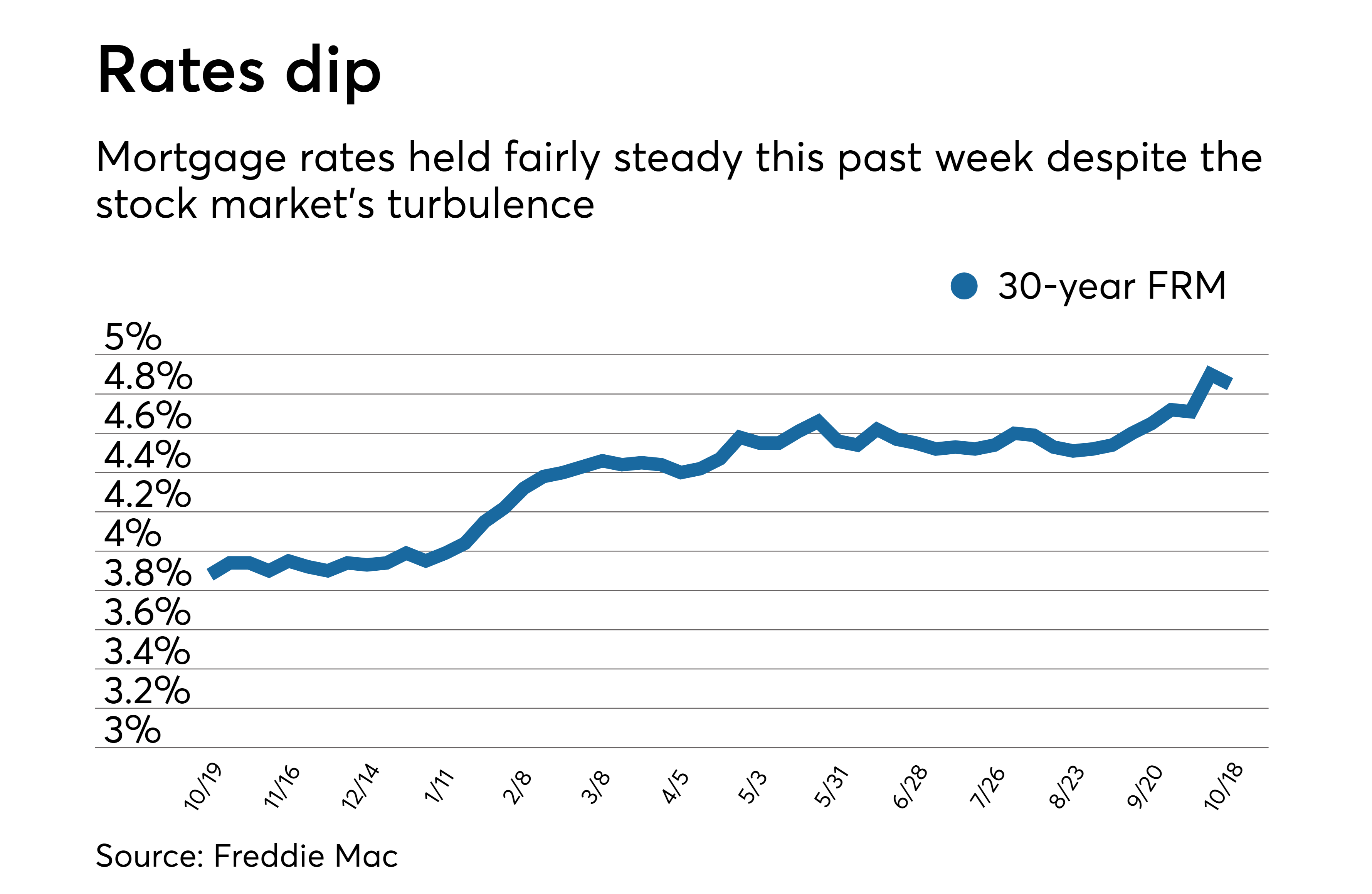

What Is A Good Interest Rate On A Mortgage

A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details fit your needs. Consider details such as the loan type , length of the loan, origination fees and other costs.

That said, today’s mortgage rates are near historic lows. Freddie Mac’s average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower or are taking out a non-conforming mortgage, you may see a higher rate. Moneys daily mortgage rate data shows borrowers with 700 credit scores are finding rates around 3.6% right now.

Which Bank Has Lowest Interest Rate

Which bank has the lowest interest rate on a personal loan? If you have a strong credit score, you can receive the lowest interest rate through LightStream. LightStream has rates as low as 2.49% if you enroll in autopay. Other lenders, like SoFi, PenFed, Wells Fargo, Marcus and U.S. Bank, offer rates as low as 5.99%.

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

What Is The Prime Rate And Why Is It Important

The prime rate acts as a starting point for interest rates to be set on financial products like credit cards, auto loans, personal loans and mortgages. Lenders look to the prime rate to decide what interest rates to set for consumers.

The prime rate also can have a big impact on your existing loans that have variable interest rates, like adjustable-rate mortgages and many credit cards. For example, if your , or you have an adjustable-rate mortgage, its likely your rate will fluctuate along with the prime rate.

So if the prime rate goes up, its more than likely that variable APR on your credit card will, too. And in the case of a mortgage, when the prime rate goes down, it could be time to consider refinancing your mortgage to get a better rate.

Who Gets The Prime Rate

Banks usually only charge the prime rate to large, corporate customers with lots of financial resources. Thats because they have more money and assets to pay the loans back. Since individual consumers do not have the same resources, banks typically charge them the prime rate plus a surcharge based on the product type they want. A credit card rate might be the prime rate plus 10%, for instance.

On the other end of the spectrum, a banks very best borrowers may be able to negotiate lower than the prime interest rate. This kind of negotiation happened more frequently in the 1980s, Garretty notes, when interest rates were much higher. Lenders would try to attract blue chip borrowers by offering interest rates lower than the prime rates.

Also Check: How Does Rocket Mortgage Work

What Is A Mortgage Rate

A mortgage rate is the interest rate on a mortgage. Its also known as the mortgage interest rate. The mortgage rate is the amount youre charged for the money you borrowed. Part of every payment that you make goes toward interest that accrues between payments.

While interest expense is part of the cost built into a mortgage, this part of your payment is usually tax-deductible, unlike the principal portion.

How The Td Bank Prime Rate Affects Fixed Mortgage Rates

Unlike variable-rate mortgage, fixed-rate mortgages are not immediately affected by changes in the TD Bank prime rate. When you get a fixed-rate mortgage, your mortgage rate is guaranteed not to change for the entire term. This mitigates your risk in the event rates go up, because your rate wont change. However, if rates go down you wont enjoy the added benefit. Fixed rates are best if you think mortgage rates will go up, or if you want the stability of knowing exactly what rate youll be paying regardless of what happens in the market.

Don’t Miss: Recasting Mortgage Chase

Should I Lock In My Mortgage Rate Today

Locking in a rate as soon as you have an accepted offer on a house can help guarantee a competitive rate and affordable monthly payments on your home mortgage. A rate lock means that your lender will guarantee you an agreed upon rate for typically 45 to 60 days, regardless of what happens with average rates. Locking in a competitive rate can protect the borrower from rising interest rates before closing on the mortgage

It may be tempting to wait to see if interest rates will drop lower before getting a mortgage rate lock, but this may not be necessary. Ask your lender about float-down options, which allow you to snag a lower rate if the market changes during your lock period. These usually cost a few hundred dollars.

How Are Mortgage Rates Impacting Home Sales

The total number of mortgage applications inched lower during the week ending December 17, 2021. The 0.6% decline was driven by a decrease in the number of purchase loan applications, according to the Mortgage Bankers Association.

- The total number of purchase loan applications decreased by 6% week-over-week, breaking a five-week run of increases. Compared to the same week last year, there were 9% fewer applications.

- Refinance applications, on the other hand, increased by 2% from the week prior but were 42% lower year-over-year. Refis made up a little over 65% of all applications.

Recommended Reading: Reverse Mortgage Mobile Home

When Will The Prime Rate Change

The Bank of Canada makes interest rate announcements eight times a year. They can change the overnight rate during these announcements and that impacts the prime rate. The dates for 2022 are January 26, March 2, April 13, June 1, July 13, September 7, October 26, and December 7.

Have questions about the prime rate? Leave them in the comments.

Best Promotions & Deals this month

How Does The Prime Rate Affect You

While the interest rate on most financial products is dependent on the prime rate, the actual rate you receive is rarely the same exact amount. Typically, your interest rate is above the prime rate, but the amount can be greater depending on the lender. For instance, the average credit card APR on accounts assessed interest is currently 15.78% the prime rate plus 12.53%.

Of course, most credit cards set variable ranges for interest rates, meaning you can receive an APR anywhere on a preset scale, such as 12% to 24%. Consumers with excellent credit will likely qualify for rates as low as 12%, whereas someone with good credit may receive rates closer to 24%.

When prime rate changes , your credit card APR also fluctuates. The change follows the same pattern as the prime rate meaning a decrease in the prime rate results in a decrease in your card’s APR. The exact change in your interest rate depends on how much the prime rate changes take for instance, the two recent adjustments that resulted in .50% and 1% APR reductions. A 1% decrease means a 14.99% variable APR would decrease to 13.99%. This change often takes one to two billing cycles.

Fixed-rate financial products, such as many personal loans and auto loans, won’t fluctuate since you lock in your interest rate when you open the loan.

You May Like: Who Is Rocket Mortgage Owned By

Prime Rate In 201: Stable At 395%

Canada’s Prime rate in 2019 remained stable at 3.95% as the Bank of Canada maintained its target overnight rate at 1.75%. Despite increasing asset prices with the S& P/TSX Composite index growing 19% in 2019 and stable global economic growth, pressures from Canada’s lagging energy sector and uncertain trade relationships with US and China created a headwind to further tightening of monetary policy and rising interest rates.

How Is The Prime Rate Set

Each bank sets its own prime rate, but the big five banks usually all have the same prime rate. The prime rate is primarily influenced by the policy interest rate set by the Bank of Canada , also known as the BoC’s target for the overnight rate. When the BoC raises the overnight rate, it becomes more expensive for banks to borrow money, and they raise their respective prime rates to cover the added costs. Conversely when the BoC lowers the overnight rate, banks usually lower their prime rates by the same amount.

This chart shows the relationship between the overnight rate and the prime rate over time. As you can see, the rates usually move in lockstep, but not always. In recent years, there have been times when the BoC has lowered the overnight rate, but the banks have not passed on the full discount to their customers.

You May Like: Rocket Mortgage Loan Requirements

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points If a larger down payment could help you avoid paying PMI premiums, for example.

Wall Street Journal Prime Rate

The Wall Street Journal Prime Rate, also called the WSJ Prime Rate, used to be based on the prime rate posted by at least 23 out of the 30 largest banks in the United States. Now, the WSJ Prime Rate is based on the prime rate that is posted by at least 70% of the top 10 largest banks that the Wall Street Journal surveys.

The WSJ prime rate is widely used since it is the average of prime rates at the largest and most influential banks in the country. However, since the Wall Street prime rate is heavily influenced by the federal funds rate, the Wall Street prime rate generally moves in tandem with any rate hike or rate cut announcements by the Fed. Being the first bank to lower or increase their prime rate wont have a significant impact, as the rest of the banks will generally follow, however aggregating it into a Wall Street prime rate makes it a more accurate reflection of Wall Street rates. While small and regional banks can always set their own prime rate, they usually use the Wall Street Journal prime rate for their own lending products.

Don’t Miss: How Does 10 Year Treasury Affect Mortgage Rates

The Beginnings Of Canada’s Central Bank In 1935

The Bank of Canada was created as part of the Bank of Canada Act in 1935. It was recommended by the Royal Commission in response to the economic conditions of the Great Depression. In March 1935, the Bank of Canada was opened to the public as a private institution with shares sold to public investors. It was quickly nationalized as a public institution by an amendment to the Bank of Canada Act in 1938.

Why The Prime Lending Rate Matters For Your Mortgage

Although a baseline from which lenders start to determine interest rates on mortgages, personal loans, credit cards and other financial products, the prime rate is not the actual interest rate that you can expect to pay on any money you borrow. Rather, the actual interest rate that youll be asked to pay will likely be above the prime rate as determined by your financial lender. In other words, when determining interest rate versus APR and calculating monthly payments, prime rate will exert a large influence and impact over the ultimate size of these sums but it wont be the final determinant.

By way of illustration, you may find that APRs on many credit cards may top 15 20%, as determined by individual financial institutions and influenced by your credit history and credit score. The current prime rate can also exert considerable influence over real estate loan products that come with variable interest rates attached such as adjustable rate mortgages and home equity lines of credit . If youre wondering what your monthly payments on these loan products may look like, it helps to note that prime rate may impact various housing matters such as:

Also Check: 10 Year Treasury Vs 30 Year Mortgage