Raise And Resolve Disputes Or Errors

If the servicer made a mistake or charged you a fee you dont owe, correct it as soon as possible. But keep making your regular monthly mortgage payment. Dont subtract the disputed amount from your mortgage payment. Some servicers will refuse to accept what they consider a partial payment. They could return your check and charge you a late fee, or claim that your mortgage is in default and start foreclosure proceedings.

Dont write your dispute on your payment coupon or a copy of your monthly mortgage statement. Instead, contact your servicer in writing and explain the problem

- Use the Sample Complaint Letter to write your request, including your account number and an explanation of why you think your account is incorrect.

- Gather any documents that support your request. Your records should include copies of your statements, coupon book, and paperwork showing that you made your payments . These can serve as proof of your payment history and your interactions with the servicer.

- Send your letter and copies of any documents that support your request to the mortgage servicers customer service address by certified mail, and request a return receipt. This may be a different address from where you send your payments.

- Keep a copy of your letter and the originals of the documents you sent.

Is Tennessee A Tax Lien Or Tax Deed State

Tennessee is a state with redeemable deeds, which are a hybrid of tax liens and tax deeds. When you bid on a redeemable deed auction, like you would on a tax deed auction, you are bidding on the deed to the property, but you do not immediately own it.

Two-year Redemption Period In Tennessee After Foreclosure Sale

In Tennessee, the redemption period after a bank foreclosure sale lasts two years. In other words, the borrower has two years to redeem the home unless the mortgage or deed of trust specifically waives this right, the right of redemption cannot be granted. This period appears frequently in mortgage or deeds of trust documents, and it is critical to be aware of whether it is necessary to protect your rights.

What Is A Mortgage Servicer

A mortgage servicer can be a major bank, community bank, credit union or other financial institution that specializes in loan servicing: collecting payments and handling customer service on a mortgage. A servicer can be small, handling 5,000 or fewer loans large, servicing more than 30,000 loans or somewhere in between.

Small servicers rarely service FHA loans, VA loans or USDA loans, and large servicers mainly service loans owned by Fannie Mae and Freddie Mac. Unsurprisingly, large servicers manage about three of every four mortgages.

Recommended Reading: Do I Have To Refinance To Remove Mortgage Insurance

Check The Mers Online System

If you have a Mortgage Electronic Registration System loan, call the MERS Servicer Identification System toll-free at 888-679-6377 or visit the MERS website. Your mortgage servicer’s identity will be listed in the MERS system if you have a MERS loan.

If you’re unsure about whether you have a MERS loan, you can also get this information from the MERS website.

What Mortgage Servicers Do

The primary job of your mortgage servicer is to collect your monthly payments and allocate them correctly to your principal, interest and escrow. Mortgage lending, by contrast, consists of advertising, working with potential borrowers, underwriting mortgage applications to see if borrowers can afford to repay the loans theyâre requesting and advancing loan funds to borrowers so they can buy homes.

Letâs go into what mortgage servicers do in a bit more detail.

Read Also: How Far Out Can I Lock In A Mortgage Rate

Help Borrowers Resolve Problems

Servicers also have to respond to borrowersâ requests for information about their accounts, including inquiries about errors. If you find an error in your account, your servicer is required to look into it and either correct it or notify you that no error occurred.

Servicers also work with struggling borrowers to help them avoid foreclosure, and they initiate foreclosures when borrowers consistently canât keep up.

- If you fall behind on your mortgage payments, your servicer is required to contact you in writing by the 45th day of your delinquency and tell you what loss mitigation options are available. Loss mitigation options include loan modification and short sale.

- If your mortgage is more than 120 days delinquent, the servicer may be able to start the foreclosure process.

These rules have been significantly altered under the coronavirus pandemic for homeowners whose mortgages are owned by either Fannie Mae or Freddie Mac, the two big government-sponsored entities. The government placed a moratorium through the end of 2020 prohibiting foreclosures on these loans.

Why Did Your Mortgage Lender Sell Your Loan

If youve ever taken out a mortgage, theres a good chance the lender who made the loan to you sold it to another bank or investor before you made your first payment. Theres also a good chance that if youve had your mortgage for a few years, it may have been sold at least one or two more times. Why all the paper shuffling? The answer is fairly straightforward.

Lenders typically sell loans for two reasons. The first is to free up capital that can be used to make loans to other borrowers. The other is to generate cash by selling the loan to another bank while retaining the right to service the loan. Cash is generated when the old lender charges the new lender a fee for collecting and disbursing the monthly payments. In the end, your loan could be owned by lender A while you make payments to lender B.

On a personal note, I once obtained a mortgage loan from one of the local community banks here in Las Cruces. I was informed at the closing that my loan had already been sold to what financial guru Clark Howard calls a multi mega-bank . In turn, the MMB sold the loan to the General National Mortgage Association . Until the mortgage was paid off, I continued to make my monthly payments to the MMB, who retained the servicing rights, even though Ginnie Mae is the owner of my loan.

See you at closing.

Gary Sandler is a full-time Realtor and president of Gary Sandler Inc., Realtors in Las Cruces. He loves to answer questions and can be reached at 642-2292 or .

Also Check: How Do You Buy Down A Mortgage Rate

How Do I Find Out Who My Servicer Is

You can find out who your mortgage servicer is by looking at your monthly statement. The company that sends you the statement is your servicer. You can receive statements by mail or online.

If you donât have access to your mortgage statements, try the Mortgage Electronic Registration System , a database supported by the mortgage industry that tracks servicer changes, among other things. By entering your name and property address, you may be able to find out who your mortgage servicer is.

You Want To Learn About Loss Mitigation Options

If you’re behind on your payments and want to find out about loss mitigation options, like a loan modification, short sale, or deed in lieu of foreclosure, contact the loan servicer.

Also, if you want to apply for assistance under your state’s Homeowner Assistance Fund program , you can contact your servicer to find out if it participates.

You May Like: What Debt To Income Ratio Is Acceptable For Mortgage

Find Out Who Services Your Loan

More commonly, youll need to know who services your loan. This is the company that youll deal with on a daily basis with standard mortgage questions or issues. Find out who services your loan with any of the following methods:

- Look at your mortgage coupons

- Look at your billing statement

- Visit the MERS website

How To Find Out Who Owns Land You Want

The previous tips will work great for those who have their eye on a dream home, but what if you stumble upon your dream plot of land? An empty land parcel likely wont have its address displayed, and you may not have the option to knock on the current owners door or leave a message in their mailbox.

That doesnt make it impossible to find the owner, though. Take a look at these methods for finding out the owner of a piece of land.

Dont Miss: Can I Have A Co Signer On A Mortgage

Recommended Reading: How To Work For A Mortgage Company

Know Your Rights Under The Law

Under the Real Estate Settlement Procedures Act , your servicer must

- acknowledge your letter in writing within five business days of getting it

- correct your account or determine instead that there is no error generally, within 30 business days

- send you a written notice of the action it took and why, and the name and phone number of someone to contact for more information or help

You have a 60-day grace period after a transfer to a new servicer. That means you cant be charged a late fee if you send your on-time mortgage payment to the old servicer by mistake and your new servicer cant report that payment as late to a credit bureau.

Who Should You Call

In most cases, youll call the mortgage servicer with any questions about your loan. This includes questions about the:

- Payment assistance to avoid foreclosure

- Refinance questions

If you are facing foreclosure, but are unsure about its legitimacy, you would then want the mortgage holder. If the company starting foreclosure proceedings doesnt own your loan or doesnt have the right to start proceedings, you may need to call the owner to fight the foreclosure.

The only other time you may need to know who owns your loan is if you want to apply for a hardship program. Some programs are only reserved for Fannie Mae or Freddie Mac owned loans, for example.

Knowing who owns and services your loan is good information to have. You should find all of this information at the closing, but if you dont, use the above tips to help find out who owns and services your loan.

Don’t Miss: How Do I Get A Mortgage Statement

Using The Mers Database

If the Fannie Mae and Freddie Mac loan lookup tools dont bear results, and you cant track down your mortgage servicer to ask questions, there is another online lookup option. The Mortgage Electronic Registration System, MERS, tracks homeownership across the country. Its searchable database is used by professionals across all aspects of real estate lending, as well as consumers.

You can search the MERS database at mers-servicerid.org/sis or call 888-679-6377. You can search by inputting an 18-digit mortgage identification number, details about yourself and the property or data from your Federal Housing Administration, Veterans Affairs or Mortgage Insurance certificate.

Things To Know About Property Titles

A title is the legal documentation that includes the specifics about the property you are purchasing and who owns it, often in the form of a deed. One of the steps in buying a home is to have a title search completed prior to closing. Many first time buyers may not have heard much about this process. A title search is performed to ensure that the title is clear and that there are no unexpected surprises. While most home purchases are completed with very little hassle, some do involve issues with the title. Although most are minor problems and easily resolved, it is important to understand what to expect.

1. Purchasing Title Insurance

Once you are under contract on a house, one of the first things you will do is buy title insurance. There are two kinds of policies:

- Owners title insurance protects the buyer

- Lenders title insurance protects the lender

An owners policy provides coverage equal to the amount you are paying for the property. It protects the owner if a problem is discovered after the search is completed. The insurance company provides legal assistance and pays any valid claims. Paid at closing, this type of policy provides protection for as long as you own the home.

Although you will have very little involvement with the actual title search or resolution, its important to have title insurance. Understanding the process can give you peace of mind through the home-buying experience.

2. Prior Claim to the Title

- Previous owner failed to pay state or local taxes

Recommended Reading: Who Has The Best Reverse Mortgage Rates

Manage And Track Borrowers Monthly Payments

Mortgage servicers must provide borrowers with a statement for each billing cycle. The statement must show the current payment due, the previous payment made, any fees the servicer has charged , any transaction activity and the servicerâs contact information.

In lieu of statements, the mortgage servicer may give the borrower a coupon book if the loan has a fixed interest rate.

When you send your monthly payment to your mortgage servicer, it sends your principal and interest to the mortgage holder. If youâre paying mortgage insurance premiums, the servicer collects that money and sends it to the right place, as well. When you have enough equity to cancel private mortgage insurance, youâll work with your servicer to get that taken care of.

Confirm Your Loan Balance And Account Information

If youre looking to refinance or pay off your loan balance before the end of the loan term, youll need to confirm the payoff amount with the servicer. The payoff amount is what you still owe on your loan. Its not the same as your current loan balance because the payoff amount includes the interest accrued up through the day you expect to pay off the loan, and any fees you havent yet paid. Call your servicer to get your payoff amount as of a specific date.

Before you decide to pay off your mortgage, consider these questions.

1. Will you owe a prepayment penalty? Check your monthly billing statement, coupon book, or the paperwork you signed at the loan closing to see whether youll owe a prepayment penalty if you pay your loan back early. Usually, a penalty applies only if you pay off the entire loan .

2. Do you owe other money? It may make more sense to pay off other loans, credit cards, and car loans first especially if youre paying a higher interest rate on them.

3. Whats your situation? Decide whether it works in your favor to pay the loan early. Do you plan to stay in your home for the long term? Are you nearing retirement? Will there be tax implications to paying off your mortgage? Does any benefit offset having to pay a penalty?

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

Recommended Reading: Can I Get A Mortgage With A 730 Credit Score

Tracking Down Your Mortgage Company

Before you go through the process of using a mortgage lookup tool, there are some things you can do to find out who owns the note on your home loan. But first its important to know the difference between a mortgage servicer and the mortgage holder. The holder may also service your loan, but in some cases, your loan is sold off, but the servicer remains the same.

To find out who owns your home loan, first look up the most recent communication youve received from your mortgage company. You should get a payment booklet and escrow statement once each year, and this documentation could have the name of the owner of your loan. If not, you can still contact the company receiving your payment each month and ask if your loan is owned by them, Fannie Mae, Freddie Mac or some other entity.

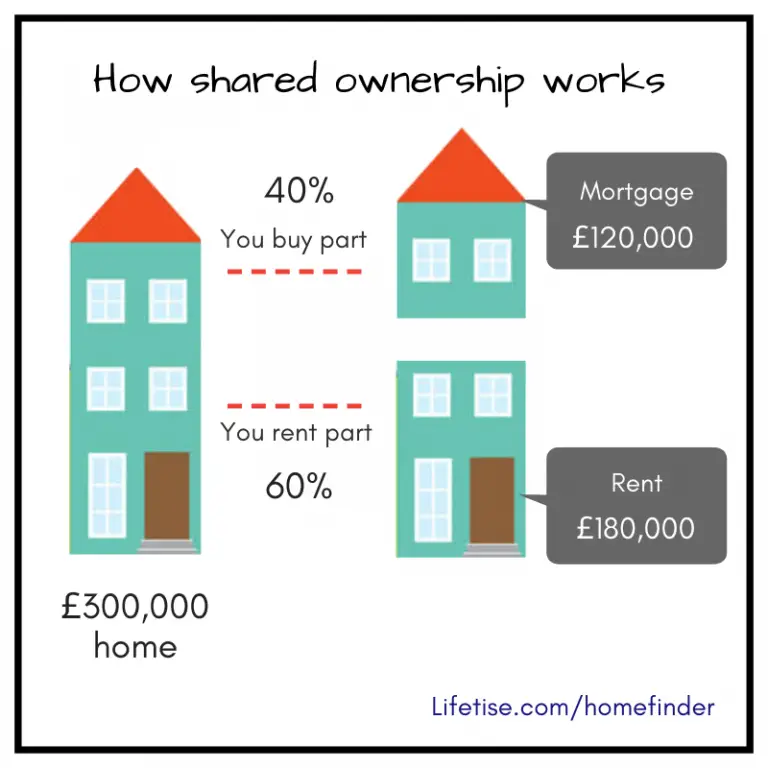

How To Compare Mortgages

Banks, savings and loan associations, and credit unions were virtually the only sources of mortgages at one time. Today, a burgeoning share of the mortgage market includes nonbank lenders, such as Better, loanDepot, Rocket Mortgage, and SoFi.

If youre shopping for a mortgage, an online mortgage calculator can help you compare estimated monthly payments, based on the type of mortgage, the interest rate, and how large a down payment you plan to make. It also can help you determine how expensive a property you can reasonably afford.

In addition to the principal and interest that youll be paying on the mortgage, the lender or mortgage servicer may set up an escrow account to pay local property taxes, homeowners insurance premiums, and certain other expenses. Those costs will add to your monthly mortgage payment.

Also, note that if you make less than a 20% down payment when you take out your mortgage, your lender may require that you purchase private mortgage insurance , which becomes another added monthly cost.

If you have a mortgage, you still own your home . Your bank may have loaned you money to purchase the house, but rather than owning the property, they impose a lien on it . If you default and foreclose on your mortgage, however, the bank may become the new owner of your home.

Recommended Reading: What Is The Shortest Mortgage Term Available

The Importance Of The Mortgage Electronic Registration System

While MERS doesnt have much impact to borrowers and homeowners, it is important for lenders. If a loan is tracked by MERS, lenders wont have to submit new paperwork every time a loan is sold. If a loan is sold often during its lifetime, which does happen, this can save lenders a significant amount of time and paperwork.

Get approved to refinance.

Who Are The Top Mortgage Loan Servicers

Some mortgage loan servicers maintain better relationships with their customers than others.

J.D. Powers Mortgage Servicer satisfaction study asks homeowners what they think of their mortgage servicers in five areas: communication, customer interaction, billing and payment process, and escrow account administration.

Here are the 15 servicers that came out on top for satisfaction .

Top mortgage servicing companies for 2021

| Mortgage Servicing Company | |

| BB& T | 787/1,000 |

1Top 15 mortgage servicing companies according to J.D. Powers 2020 U.S. Primary Mortgage Servicer Satisfaction Study. See the full report here

Recommended Reading: How Long Do You Need To Pay Mortgage Insurance

Also Check: How To Calculate Net Rental Income For Mortgage