Why Credit Scores Matter When Applying For A Business Loan

With all of this information in mind, you may be wondering why your credit score especially your personal credit score is so important when applying for business loans in the first place. During the small business loan underwriting process, underwriters evaluate risk to the lender meaning the possibility that the borrower will not repay their debt. Several factors can signal potential risk: a business is too new or revenue is too low, for example. So, how does your credit score come into play?

Your credit score is a historical measurement of your financial responsibility. So, if you were unable to repay your personal debts on time in the past, its a reasonable bet that youre not going to pay off your businesss debts on time, either.

On the other hand, if your personal financial history is mostly free of faults , then theres a good chance youll stay on top of your businesss financials, too. Of course, you may also have a business credit score. While lenders typically put more emphasis on personal credit scores, having strong personal and business credit scores will only help you qualify for the most affordable financing options . Let’s explore what goes into both personal and business credit scores so you can understand how to best set your business up for success.

What Credit Score Do You Start With

Credit scores start at 300 sometimes higher, depending on which scoring system is used. According to FICO, you must have at least one credit account that’s been open for at least six months, and one credit account that’s been reported to credit bureaus within the past six months to have a credit score.

Auto Loan Rates For Fair Credit

Theres no single minimum credit score needed for a car loan. But generally speaking, credit scores in the fair range may limit your options to loans with higher rates and less favorable terms.

Building your credit over time is a good way to potentially get access to better terms, but thats not an overnight process. If youre on a shorter time frame, there are a few things you can do to help.

Compare car loans on Credit Karma to see your options.

You May Like: What Type Of Mortgage Is Best For First Time Buyers

How To Improve Your 675 Credit Score

A FICO® Score of 675 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 675 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range .

35% of consumers have FICO® Scores lower than 675.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll find some good general score-improvement tips here.

Rolling Your Existing Car Loan Into Your New One

You may see advertisements that say something like “we’ll pay off your trade, no matter how much you owe.” Well, if the value of your trade is less than the amount you owe, many finance companies will add the difference to your new car loan. This is how people end up with a $35,000 loan for a $30,000 car — avoid this type of situation at all costs.

Recommended Reading: How Much Is The Average Mortgage Insurance

How To Solve Common Credit Issues When Buying A House

If your credit score or credit history is standing in the way of your home buying plans, youll need to take steps to improve them.

Some issues like errors on your credit report can be a relatively quick fix and have an immediate impact on your score. Other issues can take much longer to resolve.

You should start checking your credit early on, ideally six to 12 months before you want to buy a house. This will give you time to identify issues with your score or report and work on solving them before you apply for mortgage pre-approval.

Shopping For The Best Rates On Loans And Credit Cards For A Credit Score Under 675

If you are ever on the market for high-priced items, such as home appliances, it is very common for people to walk into the store and get offered a discount or an otherwise excellent financing deal.. .but only if they open up a credit card account with that store.

Why do stores offer these credit cards? The reason why is because theres usually a high interest rate or multiple fees that go along with them. Those rates and fees can be found on the small fine print of the credit card deal, but of course, the store doesnt tell you.

A golden rule of credit cards is that you should only apply for credit that is a necessity for your financial life. When applying for a credit card from a retail store, youre probably only going to use it once, twice, or three times maximum. You could just as easily be using an existing credit card that you already have.

Heres why this is so critical: applying for multiple credit cards within a few months of each other will be very harmful to your overall credit score. Never apply for a credit card that you dont need.

Now, when you do decide to apply for credit cards and loans in general, there are a few factors that you will want to remember, including:

Also Check: How Much Would Mortgage Be On A 500 000 House

Whats Considered A Good Credit Score

If youre trying to build or maintain healthy credit, knowing whats considered a good score can be helpful. A good credit score can help you get approved and lock in better rates for loans and other credit.

Higher is generally better, but its hard to say specifically what a good score is. Whats considered a good score can differ by lender and the type of credit youre applying for. The score you see when you obtain credit monitoring or buy a credit score along with your credit report may not be the score that the lender is using. There are also different scoring models. That said, read on to learn what a good credit score range is when you check your score with TransUnion. Plus, youll find tips on how to maintain healthy credit.

Fha Loan With 675 Credit Score

FHA loans only require that you have a 580 credit score, so with a 675 FICO, you can definitely meet the credit score requirements. With a 675 credit score, you should also be offered a better interest rate than with a 580-619 FICO score.

Other FHA loan requirements are that you have at least 2 years of employment, which you will be required to provide 2 years of tax returns, and your 2 most recent pay stubs. The maximum debt-to-income ratio is 43% .

Something that attracts many borrowers to FHA loans is that the down payment requirement is only 3.5%, and this money can be borrowed, gifted, or provided through a down payment assistance program.

Don’t Miss: Can You Get A Mortgage Loan On Unemployment

Can I Get A Rewards Credit Card With Fair Credit

You may struggle to get approved for a cash back or travel rewards credit card with fair credit. While you might be able to find a card that earns a limited amount of cash back on purchases, the most-rewarding credit cards generally require good or excellent credit.

If a top-notch rewards card is your ultimate goal, dont be discouraged. You may be surprised by how much good, persistent habits can affect your credit scores.

And thats one nice thing about credit cards. Even the ones that arent the absolute best can help you build credit by reporting your account activity to the three major credit bureaus. This information makes its way into your credit reports and ultimately can impact your credit scores. So, as long as you make on-time payments and follow the other credit-building tips outlined above, you can put yourself in a position to qualify for a better credit card in the future.

Compare offers for on Credit Karma to learn more about your options.

Can You Get A Mortgage With A Bad Credit Score

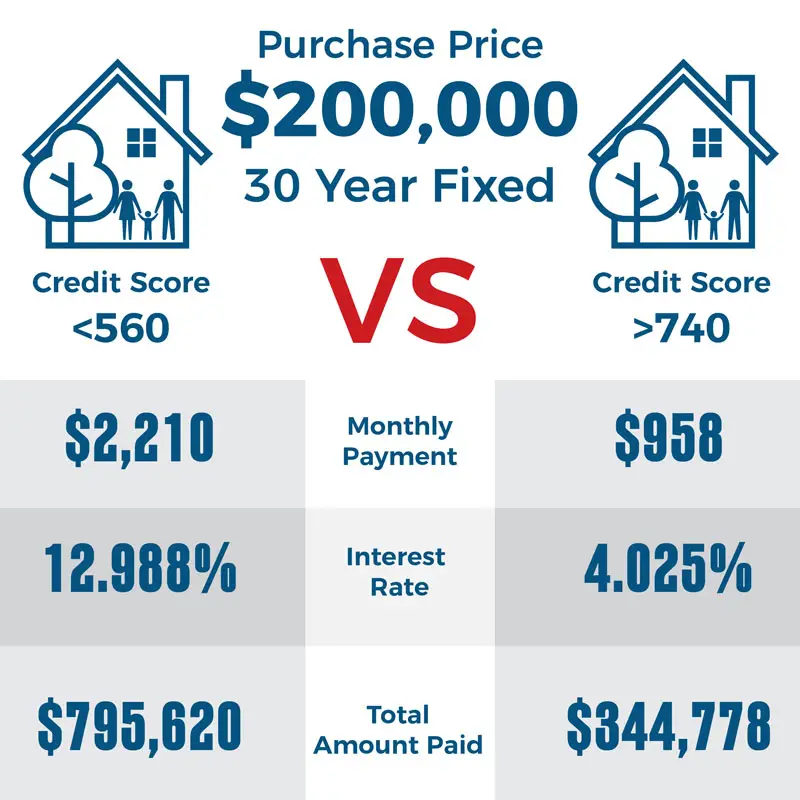

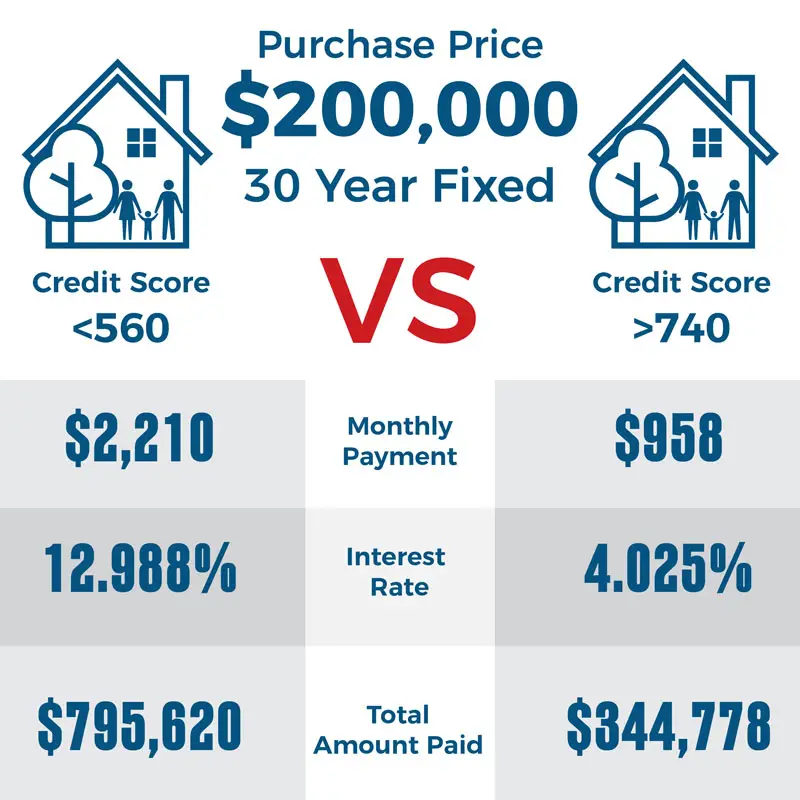

It’s possible to get approved for a mortgage with poor credit. But just because you can, it doesn’t necessarily mean you should. As previously discussed, even a small increase in your interest rate can cost you tens of thousands of dollars over the length of a mortgage loan.

If you’re planning on buying a home and you have bad credit, here are a few tips that can help you potentially score a decent interest rate:

- Think about applying for an FHA loan.

- Make a large down payment to reduce the risk to the lender.

- Get preapproved with multiple lenders.

- Consider working with a mortgage broker who may be able to match you with a specialized loan program.

- Pay down large credit card balances to reduce your .

- Work on paying down other debts to reduce your DTI.

- Consider asking someone with good or exceptional credit to apply with you as a cosigner.

There’s no guarantee that these actions will help you qualify for a mortgage loan with good terms, but they can improve your odds.

Recommended Reading: How Much Is A Mortgage On A Mobile Home

Shopping Around For A Car Loan Can Help

Perhaps the most important suggestion I can give you, especially if you have so-so credit, is to shop around for your next car loan. You may be surprised at the dramatic difference in offers you get.

Many people make the mistake of accepting the first loan offer they get . It’s also a smart idea to get a pre-approval from your bank as well as from a couple of other lenders. Online lenders and credit unions tend to be excellent sources for low-cost loan options. Not only are you likely to find the cheapest rate this way, but you’ll then have a pre-approval letter to take to the dealership with you.

The best part is that applying for a few auto loans won’t hurt your credit. The FICO credit scoring formula specifically allows for rate shopping. All inquiries for an auto loan or mortgage that occur within a 45-day period are treated as a single inquiry for scoring purposes. In other words, whether you apply for one car loan or 10, it will have the exact same impact on your credit score.

The Basics What Is A Credit Score

Your credit score isnt just for getting a mortgage. It paints an overall financial picture. The term credit score most commonly refers to a FICO score, a number between 300 and 850 that represents a persons creditworthiness the likelihood that, if given a loan, she will be able to pay it off. A higher number corresponds to higher creditworthiness, so a person with a FICO score of 850 is almost guaranteed to pay her debts, whereas a person with a 300 is considered highly likely to miss payments.

The formula for calculating a FICO score was developed by Fair, Isaac and Company , and while the specifics remain a secret so that no one can game the system, FICO has made the components of the score public. The formula takes into account the following factors, in descending order of importance:

Also Check: When Do Mortgage Rates Come Out

Fha Minimum Credit Score Requirements

Technically, you can get approved for an FHA loan with a median FICO® Score of as low as 500, but there are some serious drawbacks to an FHA loan with a score that low.

The first is that youll need a down payment of at least 10%. Secondly, when qualifying with a score that low, its considered a subprime loan. What that means from a practical perspective is that even if you can get the loan, you wont get the best terms and could end up with a much higher annual percentage rate .

Also, most lenders, including Rocket Mortgage®, wont do the loan if your median score is below 580. Well get into this below.

Finally, you have to have some very low qualifying ratios. To qualify with a median FICO® Score of below 580, you need to pay close attention to two ratios: your housing expense ratio and your overall debt-to-income ratio .

Learn More About Your Credit Score

A 675 FICO® Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to check your credit score to find out the specific factors that impact your score the most and get your free credit report from Experian. Read more about score ranges and what a good credit score is.

Also Check: Can Someone Be Added To A Mortgage

Keeping Your Credit Card Balance Low

The very act of having credit cards will impact your credit rating. Regardless of whether its positive or negative, it has an impact.

But something else that you want to ensure you do is keep the balance on your credit card low. The balance on your credit cards can influence over one third of your total credit score. The higher your balance is, the lower your score will be.

What you want your credit card history to show is that you have been reducing your balance on an active basis by making your minimum monthly payments on time and using your credit cards responsibly.

A good rule to follow is for your balance on your credit card to be 35% of the total limit on that card. So if you have a limit of $1,000 on your card, you want your balance to be $350 at the very highest. This holds true regardless of whether you have one credit card or multiple cards. In the long run, this will not only prevent your overall credit score from dropping, but it could also cause it to increase.

The reason why this is so important is because most lenders these days want you to stay as far away from the limit as possible in order to have the best credit scores. In fact, most experts would recommend that you never use more than fifty percent of your total available credit. If you use any more than that, or if you max out your limit, your overall credit score will drop.

Where To Go From Here

Its important to know which factors make up your credit score. As you can see in the image below, there are 5 factors that make up your credit score.

Pay down your balances and keep your credit utilization under 30%. Its also wise to have different types of credit accounts to establish a solid credit mix because it accounts for up to 10% of your FICO score. So, youll want to have both installment and revolving credit showing up on your credit report.

Of course, you also want to focus on making timely payments from here on out. Even one late payment can be very damaging to your credit.

Length of credit history also plays an essential role in your credit scores. You want to show potential creditors that you have a long, positive payment history.

Building excellent credit doesnt happen overnight, but you can definitely speed up the process by making the right moves. So give Lexington Law a call for a free credit consultation at and get started repairing your credit today! The sooner you start, the sooner youll be on your way to having exceptional credit.

Categories

Read Also: What Is A Modified Mortgage

Mortgage Rates For Fair Credit

The average credit score it takes to buy a house can vary widely depending on where youre looking. With that said, it can be more challenging to get a mortgage with good terms if your credit is in the fair range.

There are several types of mortgages out there, some of which are meant specifically for those who may not qualify for a conventional loan. These loans, which are made by private lenders but are backed by the government, may allow a smaller down payment than youd need with a conventional loan.

Common types of government-backed loans include

These options can be easier to get than a conventional loan, but they arent for everyone. If you have fair credit and plan to apply for a conventional loan, you may find it difficult to qualify without having to pay high interest rates and fees.

Its important to shop around to understand your options and what competitive rates look like in your area. As with auto loans, you have a window of time when multiple inquiries are only counted as one for your credit scores. While that shopping window can be longer, keeping multiple inquiries to a period of 14 days is the safest bet.