What Is A Mobile Home Loan

A mobile home loan is a loan for factory-built homes that can be placed on a piece of land. Styles may vary from modest trailers to dwellings that look like houses attached permanently to the land upon which they sit.

Mobile home loans differ from a traditional property loan because most lenders and counties do not consider them real property, but rather personal property. In fact, in many counties, a mobile home is taxed by the department of motor vehicles rather than the property tax assessor. In most cases, if you want to buy a mobile home and place it on land that you lease, your loan will more closely resemble a personal loan, with higher interest rates and shorter terms than a traditional home mortgage.

There are exceptions, however, and weve included them in this list. Some home lenders do have loans for mobile homes if they are attached to the homeowners land. Others, and there are fewer of them, will lend on a mobile home even if it sits on land you lease.

What Credit Score Do I Need To Buy A Mobile Home

The lenders weve reviewed and selected as the best can work with low credit scores in the 500 and 600 range. A credit score lower than 500 may not qualify at all.

Of course, higher credit scores will always get you better rates and terms. Credit scores in the 700s and 800s will get the lowest interest rates.

If you have a credit score on the lower end, look for a lender that is strong in the USDA, FHA, and VA programs. Conventional loans will not be so forgiving of scores below 700. You may get your loan approved, but it will carry higher rates and a term of 20 years or less.

Who Should Get A Mobile Home Loan

Consider a mobile home loan if youre interested in living in a mobile home but cant afford to pay for one in cash. You might also want a mobile home loan if youd like to own a home but might not qualify for a loan on a traditional home.

Its not a good idea to get a mobile home loan if youre not sure if living in a mobile home is right for you. It may be a better idea to rent one first and see how you like it. If you plan on renting a lot, you may need to pay cash for the mobile home or expect to get a personal or chattel loan with a higher interest rate.

Don’t Miss: How Much A Month Is A 500k Mortgage

Best For Low Down Payment: Elend

eLEND

For borrowers who dont have a lot of cash on hand, eLend offers mobile home loans with up to 100% financing available.

-

Low down payment requirement, up to 100% financing available

-

Low mortgage rates

-

Geographic restrictions may apply to some programs.

-

Mixed customer service reviews

eLEND is our best mobile home lender for low down payments because of its use of the government-backed loan programs that often carry zero to 3.5% down payments and its DPA program that further supplements the down payment burden for its borrowers.

eLEND is a division of American Financial Resources, Inc. Company with a lot of experience in the industry. It works to provide affordable home financing options to first-time buyers and existing homeowners. The company utilizes the latest technology and delivers educational resources to customers in an effort to simplify the mortgage process.

The company offers USDA, FHA, VA, conventional fixed, and adjustable-rate loans. If you qualify for its DPA program, you can lower your down payment expense even more. The DPA allows you to use gifted funds toward your down payment. Furthermore, if you are a community service professional, such as a police officer, firefighter, EMT, or teacher, or you work in the medical field or the military, and you are a first-time homebuyer, you can qualify for the DPA.

For mobile home loans, eLEND requires you to own the land. For those wanting to use rented land, they can help you via a related company.

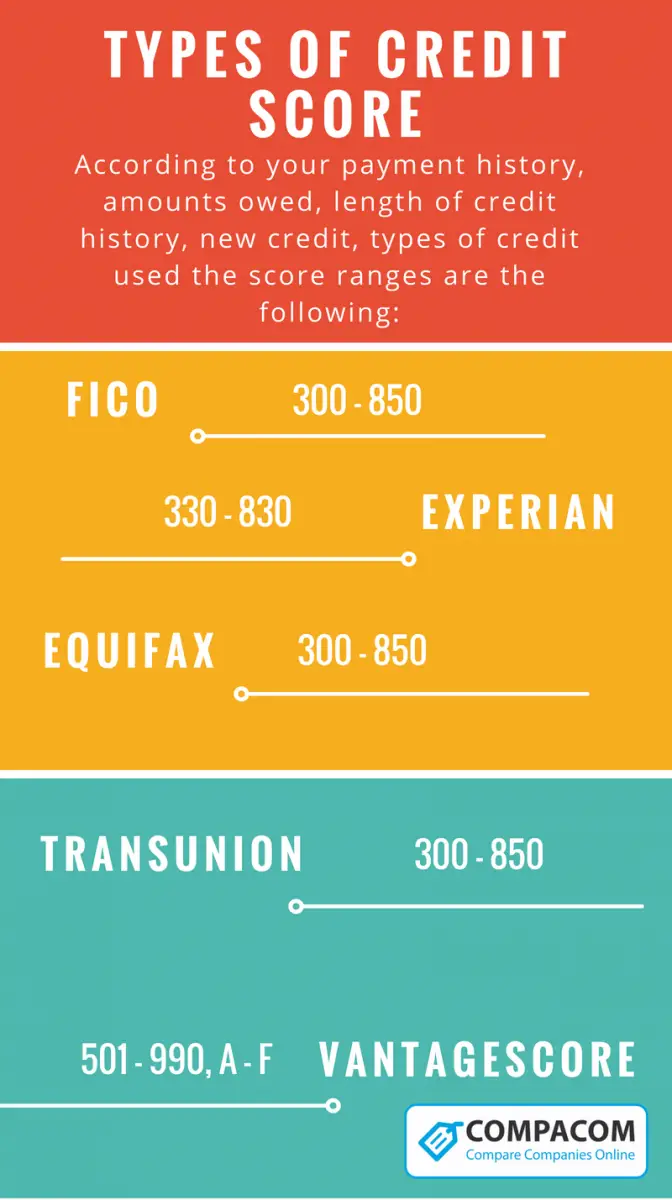

What Goes Into A Credit Score

Your credit score can have slight differences depending on the credit bureau you use, but each bureaus scoring model calculates your score using percentages assigned to certain financial factors. Some factors may be given a higher percentage based on importance and, therefore, make up a bigger chunk of your total score. For example, your payment history is usually given a higher percentage over newer credit.

These are some typical factors that contribute to your credit score: payment history, total debt, credit utilization, age of credit lines, number and type of credit lines on your report, new credit lines and delinquencies. Check your free credit score to learn more about what factors are being considered when it comes to your specific score. Also, before you apply for a loan, its a good idea to review your credit report so you have an idea of what your credit history will look like to a lender.

You May Like: How Much Of Your Monthly Income For Mortgage

Mobile Homes Manufactured Homes And Modular Homes: Whats The Difference

- Manufactured homes: Manufactured homes are usually built in a factory. Traditional homes are built onsite. Once completed, manufactured homes are moved to their final destinations on a truck and placed onto foundations, making them permanent. You will need to own the land on which the manufactured home foundation is built.

- Modular home: Modular homes are primarily constructed in a factory, but the house is transported in pieces to the home site, where construction is finished. Once built, a modular home cant be moved.

- Mobile home: A mobile home is built in a factory but on a permanently attached chassis. It is then transported to the site by being towed or on a trailer. They are often left always or semi-permanently in one place but can be moved. You can rent space in a mobile home community or own the land on which its located.

What If I Dont Meet The Fhas Credit Requirements

One of the first actions you can take if you arent eligible for an FHA loan is to raise your credit score and reduce your debt. If that isnt an option or might take longer than anticipated, try putting down a larger down payment or getting a co-borrower.

You can also consider buying a more affordable home, which will lower the amount of money youll need to borrow and your monthly payments.

Don’t Miss: Who Is Rocket Mortgage Owned By

Requirement Of Vanderbilt Mortgage

Vanderbilt Mortgage and Finance manufactured home loans are available for the people that want to get homes and pay over a longer period of time through credit and interest payments. The Vanderbilt Mortgage and Finance is a valued partner of the Clayton Homes. It promises to provide you with the home ownership in a smooth, fast and easy procedure.

It provides the conventional mortgage system, the bi-weekly advantage mortgage, homeland mortgage and the FHA-approved mortgages. Depending on your needs and abilities, you can select the desired program. For example, if you cannot pay for the monthly payment at once, you can opt for the bi-weekly mortgage offer in which you will be required to make the payments after two weeks rather than the one payment at the specified date of the month.

The requirements for the Vanderbilt Mortgage or home loan are not clearly stated. However, if you have a good credit history, and you do not default on your payments and have a good credit score, you should be able to acquire the loan for a mortgage or new home. You can contact them by e-mail or their website and get in touch and know more about the requirements.

Best For Bad Credit: 21st Mortgage Corporation

21st Mortgage Corporation

If your credit score isnt where youd like it to be, 21st Mortgage Corporation offers mobile home loans with no minimum credit score requirements and no prepayment penalties.

-

Good for borrowers with poor credit

-

Available in 45 states

-

Will finance used mobile homes

-

Not available in AK, HI, MA, NJ, or RI

-

Borrowers arent able to prequalify

-

High interest rates

21st Mortgage Corporation was founded in 1995 in Knoxville, Tennessee, and now has over 800 employees. The company became a subsidiary of Clayton Homes after an acquisition in 2003. It lends in the contiguous United States with the exceptions of Massachusetts, Rhode Island, and parts of Illinois. Its the best for borrowers with bad credit because it does not have a credit score minimum and can finance homes placed in mobile home parks.

21st Mortgage Corporation offers innovative fixed-rate loan products for manufactured homes. It can also finance manufactured homes in a park or community on leased land, for both permanent and non-permanent home foundations.

Financing options are available for both new and pre-owned mobile homes with a minimum loan amount of $22,000 for person-to-person lending and $14,000 for property that is purchased through a retailer.

The company requires the borrowers debt-to-income ratio to be under 43% to qualify for a loan without having a co-signer or additional documentation.

21st Mortgages interest rates are relatively highbetween 5% and 10.99%.

Recommended Reading: What Kind Of Mortgage Loan Should I Get

What Are Todays Mortgage Rates

For todays U.S. home buyers, the Federal Housing Administration mortgage is among the most lenient and forgiving mortgage programs available. Find out whether youre FHA-eligible.

Get todays live mortgage rates now. Your social security number is not required to get started, and all quotes come with access to your live mortgage credit scores.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

Also Check: Are Current Mortgage Rates Good

One Mortgage Application = Either Three Or Six Credit Reports And Fico Scores

If youre like most people, a home is likely the largest purchase you will ever make. Because youre asking to borrow such a large amount when taking out a mortgage loan, the lender will be very thorough when it reviews your creditworthiness.

A credit card issuer or an auto lender will generally only check one of your credit reports and scores when you apply for financing. A mortgage lender, on the other hand, will review your credit information from all three of the primary credit reporting agencies: Experian, TransUnion, and Equifax.

And, if you have a co-applicant, the lender is going to review all three of their credit reports as well.

That means one home loan application can equal as many as six credit reports and scores. In mortgage lending, because of the Federal Housing Finance Agency mandate, the only scores that can be used currently are three of FICOs older scoring models, although that may eventually change.

And, in a process that only exists in mortgage lending, the lender bases its decision not on your highest credit score, not on your lowest score, but rather on the middle numeric score. If your three FICO scores were 700, 709, and 730, the lender would use the 709 as the basis for its decision.

Reviewing this large collection of credit reports and credit scores gives the mortgage lender a more comprehensive picture of your credit risk. Your three credit reports likely arent identical, and its equally unlikely your scores will be the same.

Which Fico Score Do Mortgage Lenders Use

John Ulzheimer is an expert on credit reporting, credit scoring, and identity theft. The author of four books on the subject, Ulzheimer has been featured thousands of times in media outlets including the Wall Street Journal, NBC Nightly News, New York Times, CNBC, and countless others.With over 30 years of credit-related professional experience, including with both Equifax and FICO, Ulzheimer is the only recognized credit expert who actually comes from the credit industry.He has been an expert witness in over 600 credit-related lawsuits and has been qualified to testify in both federal and state courts on the topic of consumer credit. In his hometown of Atlanta, Ulzheimer is a frequent guest lecturer at the University of Georgia and Emory University’s School of Law.

Edited by: Lillian Guevara-Castro

Lillian brings more than 30 years of editing and journalism experience, having written and edited for major news organizations, including The Atlanta Journal-Constitution and the New York Times. A former business writer and business desk editor, Lillian ensures all BadCredit.org content equips readers with financial literacy.

When you apply for a loan or credit card, its practically a given that a lender will check one of your credit reports and one of your credit scores as part of the underwriting process. Credit scores help lenders assess the risk of doing business with you and ultimately decide whether its a wise investment to loan you money.

Recommended Reading: Which Mortgage Lender Should I Use

Fha Credit Score Requirement Drops 60 Points

Its getting easier for borrowers to get an FHA-backed home loan.

Major lenders will now approve 96.5 percent FHA mortgage applications for borrowers with FICO scores of 580. It marks a 60-point improvement over previous years, when FHA lenders required 640 FICO scores or better to get approved.

The news comes at a time when FHA loans are in demand.

The programs 3.5% downpayment minimum is among the most lenient for todays home buyers and underwriting requirements on an are flexible and forgiving.

FHA loans account for close to one-quarter of all loans closed today.

Vanderbilt Mortgage And Finance Reviews And Complaints

Vanderbilt Mortgage and Finance has been accredited with the Better Business Bureau since 1974 and has an A+ rating as of July 2022 after closing 46 official customer complaints in the last three years. The lender has a 1 out of 5 star rating based on 17 customer reviews.

Reviews on other sites are much more favorable. On Consumer Affairs, Vanderbilt gets 4.5 stars based on 176 online customer reviews, and on Google Reviews, the company gets a solid 4.6 out of 5 stars from 2,797 customers.

Positive feedback describes an easy application process and helpful loan officers, while negative feedback focuses on rude and unresponsive customer service representatives.

Recommended Reading: What Is The Interest Rate For Home Mortgage

What Documents Do I Need For An Fha Loan

If youre applying for an FHA loan, youll need documentation. These documents include a state-issued identification, proof of a Social Security number and 2 years worth of pay stubs, W-2 forms or tax returns. FHA lenders can provide you with a specific list of what youll need, and they can walk you through the process.

Fewer Fha Investor Overlays Means More Approvals

FHA mortgage guidelines define which loans the Federal Housing Administration will, and will not, insure. However, U.S. lenders dont underwrite loans to the FHA guidelines as theyre written, to the letter.

Lenders impose additional restrictions known as which make it harder for an applicant to qualified for an FHA-backed loan.

One such overlay is linked to the FHA Streamline Refinance.

According to the official FHA guidelines, with an , lenders are not required to verify income, employment or credit scores. Yet, many lenders choose to verify regardless.

This is because the FHA penalizes banks for making too many bad loans and verifications can cut down on defaults.

Another important overlay is linked to your credit score.

The FHA rules state that it will insure home loans for which the borrower has a credit score of 500 or higher. Banks, however, are reluctant to make such loans.

Buyers with credit scores of 500 are highly likely to default in the next 6 months, which would negatively affect a banks FHA default rate, leading to fines, penalties, and perhaps, termination from the FHA insurance program.

Beginning in late-2011, most banks enforced a minimum credit score for FHA loans of 640. That minimum score has since been lowered.

U.S. home buyers can now get an FHA loan with credit scores of just 580.

Furthermore, with the domestic economy improving and U.S. housing expanding, its not unexpected that minimum FHA FICOs would drop again soon.

You May Like: Can You Repay A Reverse Mortgage

What Is A Credit Score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Compare Mobile Home Loan Lenders

Since mobile home loans are different than traditional mortgages, its important to find a lender that supports them. Here are some factors to consider when deciding on a mobile home lender:

- Rates: The lower the rates on the loan, the less youll end up paying in interest over time. While mobile home loan rates are typically slightly higher than traditional mortgage rates, you should look with a lender with reasonable rates and fees.

- Loan options: If you need a specific type of mobile home loan, or if you plan to take advantage of a government-backed loan program, you should make sure the lender offers that particular type of loan.

- Down payment requirements: Many mobile home loans have flexible down payment requirements. If you dont have a sizable down payment already saved up, you should look for a lender that doesnt require too much money down.

- It can be more difficult to get approved for a loan if you have poor credit. That said, many lenders are willing to work with borrowers with poor to fair credit, so you should look for a lender with flexible credit requirements if your credit score isnt where you want it to be.

- Geographic availability: Not all lenders operate in all 50 states, so you should be sure to go with a lender that is available in your area.

- Customer service: Look for lenders with a history of strong customer service and few customer complaints.

Recommended Reading: Who Pays Mortgage Broker Fees