Choose The Right Mortgage

Once you have your credit and savings in place and a good idea of what you can afford, its time to start searching for a lender, comparing interest rates and terms and finding the right kind of mortgage for your situation.

The main types of mortgages include:

- Conventional loans These are best for homebuyers with solid credit and a decent down payment saved up. Theyre available at most banks and through many independent mortgage lenders.

- Government-insured loans These can be great options for qualified borrowers who may otherwise struggle to buy a home. Government-insured loans are widely available through many institutions, but are targeted at borrowers with less-than-stellar credit. USDA loans have some geographical restrictions, and VA loans can only go to members of the military, veterans or their spouses.

- Jumbo loans These are for the big spenders out there. Conventional loans have a maximum allowable value, and if you need to finance more than that , youll need to get a jumbo loan.

A first-time homebuyer, for instance, might consider an FHA loan, which requires a minimum credit score of 500 with a 10 percent down payment or a minimum score of 580 with as little as 3.5 percent down.

to determine the right time to strike on your mortgage with our daily rate trends.

Example Of Mortgage With Different Rates And Aprs

Here are examples comparing different interest rates and APRs for a $300,000, 30-year fixed-rate mortgage:

| $503,235 | $534,463 |

If youre planning to stay in your home for a shorter period and want to purchase discount points to lower your rate, you need to do the math to determine your break-even point. Bankrates mortgage points calculator will help. Simply put, you need to stay in the home long enough to allow enough time for the rate savings to balance out those extra upfront costs.

How Are Interest Rates Calculated

Interest rates are partially determined by factors that are completely out of your control, such as inflation, the ups and downs of the broader economy and the lender you choose to work with. Because of these factors, mortgages rates are constantly changing. You might see a rate of 3.5 percent today, only to see 3.65 percent tomorrow. This is why mortgage rate locks can be a valuable tool.

However, you have a big say over your interest rate because lenders take a close look at your financial picture your credit history, your debt-to-income ratio, your plans for a down payment and other pieces of your life to set your rate. There is a simple rule with mortgage rates: The higher your credit score, the lower your interest rate will be.

Don’t Miss: Does Rocket Mortgage Service Their Own Loans

Sbi Offering A Discount Of Up To 30 Bps On Home Loan Rates

The State Bank of India had announced that it will be increasing its concession on the interest rates of their home loans in a press release. The new rate of home loans will start at 6.8% for a total loan of up to Rs.30 lakh and for a loan amount of more than Rs.30 lakh, the rate of interest will be 6.95%.

According to the press release, the discount which is being offered of up to 30 bps will be dependent on the loan amount taken and the CIBIL score of the primary applicant. Women applicants of home loans from SBI will be receiving a concession of 0.5% on the interest rates.

13 January 2021

Factor: Mortgage Vs Refinance

Mortgages on refinances, for example, usually cost more than mortgages for purchases. Thats because refinances are deemed higher risk and because refinances cannot be default insured.

Jargon Buster:Default insurance protects the lender in case you dont pay your mortgage. Insurance is either:

- Optional , or

- Mandatory .

Also Check: Can You Get A Reverse Mortgage On A Condo

Factor: Your Property Type

Youll generally get better mortgage rates if you live in the property being financed. Non-owner-occupied properties, for example, tend to have higher rates due to the added risk to the lender. Thats especially true if theyre rented out.

As well, properties that are less liquid rarely qualify for the lowest rates due to potential resale risk if a customer defaults.

Mortgage Interest Rate Vs Annual Percentage Rate

| Mortgage Interest Rate | |

| Is a percentage of the amount of money you borrowed | Is based on your interest rate, points, broker fees, and other costs. |

| Can be found under “Loan Terms” on your loan estimate | Can be found under “Comparisons” on your loan estimate |

| Is typically lower than your annual percentage rate because it’s just one component of your APR | Is usually higher than your mortgage interest rate |

Your annual percentage rate is a more complete picture of how much it costs you to borrow.

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

Whats The Difference Between A Fixed And Variable Rate

- A fixed interest rate will not change during your mortgage term.

- A variable interest rate can change during your mortgage term.

Having a fixed rate means that your mortgage rate will not change until your mortgage term is over. You can choose to get a fixed-rate mortgage for a long term length if you think rates will increase soon, or for a short term length if you think rates will stay the same or decrease. The 5-year fixed rate mortgage is the most popular mortgage type in Canada.

On the other hand, avariable mortgage ratecan change at any time. Your mortgage payments will still stay the same, but what changes is the percentage of your payment that goes towards paying off the mortgage principal. If rates decrease, a larger amount of your monthly payments will be going towards your principal. This means that if interest rates decrease, youll be able to pay off your mortgage faster with a variable rate.

If interest rates rise, a larger amount of your monthly payments will go towards your mortgage interest. Your monthly payment amount is fixed for the duration of your term, so you wont have to pay more money if rates rise. However, your mortgage payments must be enough to cover at least your monthly interest cost. If interest rates increase significantly, where your mortgage payment no longer covers the interest cost, then your mortgage payment amount will need to be increased.

What Is A Mortgage Point

Some lenders may use the word “points” to refer to any upfront fee that is calculated as a percentage of your loan amount. Point is a term that mortgage lenders have used for many years and while some points may lower your interest rate, not all points impact your rate. Mortgage points can be found on the Loan Estimate that the lender provides after you apply for a mortgage.

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

What Affects Mortgage Rates

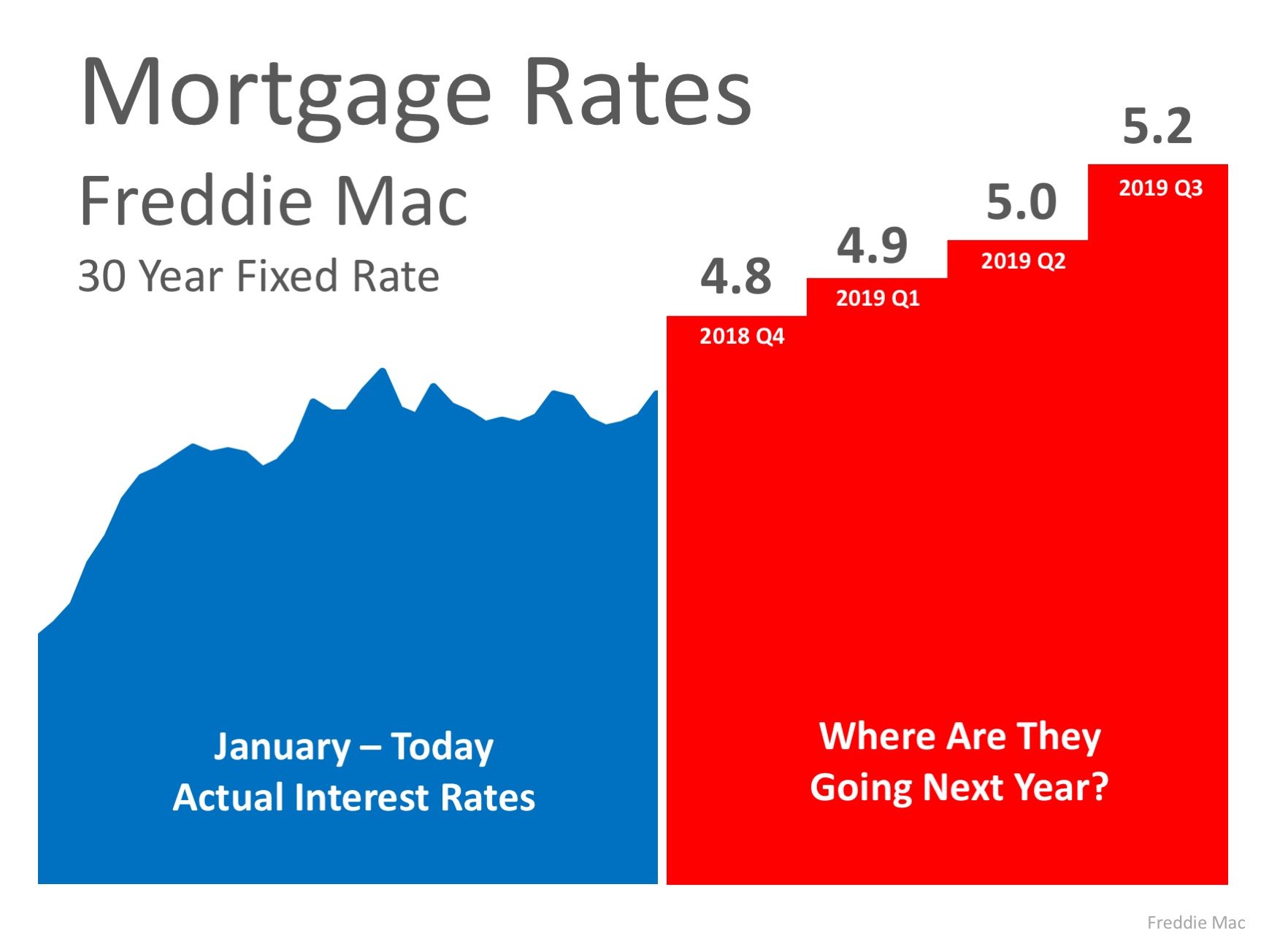

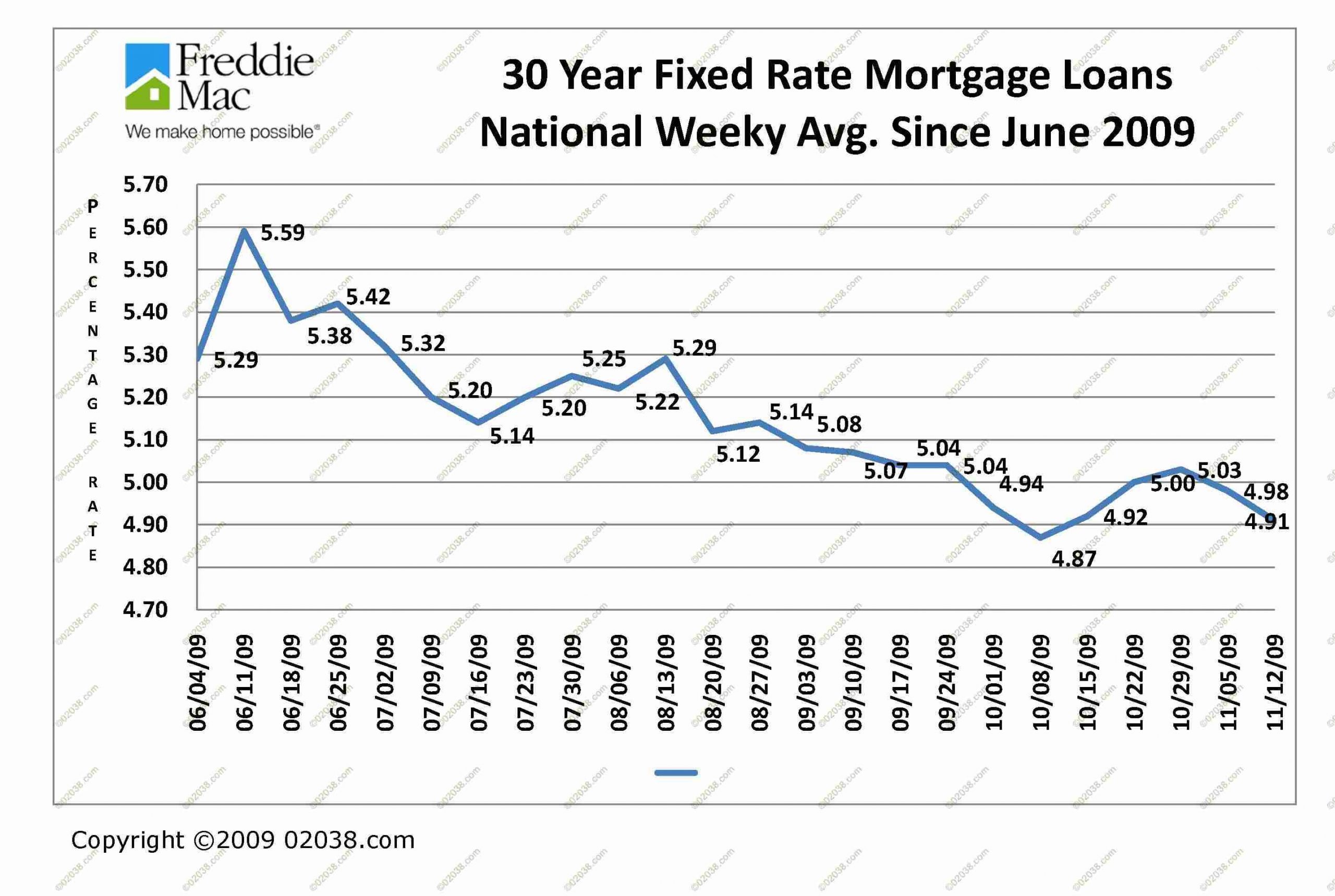

Why do mortgages cost what they do? How can you figure out whether this is even a good time to buy a home? Many different components will shape what you are paying for your mortgage. Get smarter about mortgage rates and what you can expect in the future so you have the tools to make the wisest choices in today’s economic environment.

Mortgage rates seem to be a continually changing number that is generally hard to track. There are a few specific indicators that can give you a good idea of future rates. The better you can predict what the rates may be down the line, the better you can make financial decisions.

If you’re thinking about buying, selling or refinancing your home, mortgage rates will play a key role in how much financial sense those decisions will make. For example, what moves should you be thinking about if rates are rising? And what should you do, if a lower rate is in the wind? Don’t jump into a purchase before learning how to read that forecast and what the different weather could mean for you.

What Is A Mortgage Rate Hold

A mortgage rate hold is the locking in of a specified mortgage rate for a set period of time. This only applies to fixed rate mortgages, since the interest rate of variable rate mortgages can fluctuate.

Once you have a TD Mortgage Pre-Approval, you get a 120-day rate hold which holds the interest rate on your pre-approval term for 120 days subject to all the conditions, even if interest rates go up.

Also Check: Can You Do A Reverse Mortgage On A Mobile Home

How Do I Choose The Best Mortgage Lender

You should always compare several different lenders when shopping for a home loan. Not only will the rates and fees vary, but the quality of service as well. Regardless of what lender you end up working with, its important to find someone that can help your individual challenges. For example, if youre a military veteran getting a VA loan, youll want to work with someone who has experience with those types of loans.

To find a trusted lender, you can look at online reviews, or even better, ask around. Your real estate agent and friends who recently purchased a home are great sources for mortgage lender recommendations. Try comparing a variety of different mortgage lenders. The best mortgage lender for you may be a bank, credit union, mortgage broker, or an online mortgage lender, depending on your situation.

Should I Choose A Fixed Or Variable Rate

Variable rates allow you to take advantage of future decreases in interest rate. On the other hand, fixed rates are preferable if interest rates rise in the future. Unfortunately, long-term fluctuations in the prime rate are difficult if not impossible to predict.

However, a2001 studyfound that between 19502000, choosing a variable interest rate resulted in lower lifetime mortgage cost than a fixed rate up to 90% of the time. According to the study, if you are comfortable with the risks involved, a variable rate may reduce your long-term mortgage cost.

Don’t Miss: Mortgage Recast Calculator Chase

The Basics Of Mortgage Interest Rates

Buying a mortgage can be intimidating. There are different mortgage types, interest rates, and mortgage insurance. The process, for many, has proved to be a frustrating one.

The interest rate you pay will greatly affect the total cost of your mortgage. Mortgages can typically last up to 30 years. The choices you make can affect your finances for up to that length of time, so its vital to understand how interest rates work. In order for you to get this right as you start off, we’ve provided the scoop on exactly how interest rates work.

Using a mortgage calculator is a good resource to budget these costs.

How Do I Pay For Cmhc Insurance

Your lender is actually the party responsible for payingCMHC insurancecosts. In the majority of cases, your lender will pass these costs down to you by adding the CMHC insurance premium to your mortgage loan amount. This will slightly increase your monthly or bi-weekly payment.

In some cases, your lender may allow you to pay CMHC insurance costs as a lump-sum, or not pass down the cost to you at all. Contact your lender for more details.

You May Like: Rocket Mortgage Payment Options

What You Can Do To Protect Yourself If Interest Rates Rise

If the interest rate rises, your payments increase. Make sure that you can adjust your budget in case your payments increase.

Ask your lender if they offer:

- an interest rate cap: a maximum interest rate your lender can charge on a mortgage. You never have to pay more in interest than the maximum cap, even if the interest rates rise

- a convertibility feature: where, at any time during your term, you can convert or change your mortgage to a fixed interest rate

Note that if you choose a convertibility feature and change your mortgage to a fixed interest rate:

- you usually have to pay a fee

- certain conditions may apply

Is Now The Time To Lock In A Fixed

Jimmy Jean, chief economist at Desjardins, tells Global News that the Bank of Canadas plans to rapidly raise interest rates could end the popularity of variable-rate mortgages following years rock-bottom rates influenced by the pandemic economy.

Weve seen a lot of take up for variable-rate mortgages. But the more we go , the more that spread is going to narrow. It might make sense in this context to lock in interest rates that we can get now, he says.

Sung Lee, mortgage agent with RATESDOTCA, tells Global News that in the short-term theres still a compelling reason to go with a variable mortgage today even with more rate hikes on the horizon. He points to the roughly 150-basis-point spread between most variable offers and the current fixed rate.

Read more: Home prices could rise 15% in 2022 despite efforts to cool market, says Royal LePage

Though she cautions that she doesnt have a crystal ball, Zlatkin expects an increase of 0.75 per cent total in the central banks overnight rate before the end of 2022. For that reason, she says variable rates will remain the cheaper option in the long-term. But she notes that the bottom line isnt the biggest priority for more risk-averse market watchers.

If youre the kind of person thats going to be watching those Bank of Canada announcements every single time having a heart attack, its not worth it, she says. Just pay a couple of hundred dollars extra and go with a fixed rate.

Don’t Miss: Rocket Mortgage Conventional Loan

How Can I Calculate How Much My Ontario Mortgage Payments Would Be

Our Ontario Mortgage Payment Calculator will help you figure out how much youll pay with any rate you find on the site. It only takes a few minutes to use, so give it a try. You can modify the mortgage amount, mortgage term and type, amortization and payment type to see how your mortgage options and payment amount are impacted.

Hybrid Or Combination Mortgages

You could choose to opt for a hybrid or combination mortgage. In these mortgages, part of your interest rate is fixed and the other is variable.

The fixed portion gives you partial protection in case interest rates go up. The variable portion provides partial benefits if rates fall.

Each portion may have different terms. This means hybrid mortgages may be harder to transfer to another lender.

You May Like: Does Prequalifying For A Mortgage Affect Your Credit

About Our Data Source For This Tool

The lenders in our data include a mix of large banks, regional banks, and credit unions. The data is updated semiweekly every Wednesday and Friday at 7 a.m. In the event of a holiday, data will be refreshed on the next available business day.

The data is provided by Informa Research Services, Inc., Calabasas, CA. www.informars.com. Informa collects the data directly from lenders and every effort is made to collect the most accurate data possible, but they cannot guarantee the datas accuracy.

Dcb Bank Cuts Down The One

DCB Bank has cut down the marginal cost of fun based lending rates or MCLRs recently by 0.18%. previously, the one-year rate of MCLR was 9.85%. However, now it has been reduced to 9.671%.

The bank has cut down the rates by the said percentage across different tenures of the MCLR. The new rates will be effective from the 8th of December 2020.

9 December 2020

You May Like: Chase Recast Calculator

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points If a larger down payment could help you avoid paying PMI premiums, for example.

Comparing Current Mortgage Rates

Borrowers who comparison shop tend to get lower rates than borrowers who go with the first lender they find. You can compare rates online to get started. However, to get the most accurate quote, you can either go through a mortgage broker or apply for a mortgage through various lenders.

The advantage of going with a broker is you do less of the work and youll also get the benefit of their lender knowledge. For example, they might be able to match you with a lender whos suited for your borrowing needs, this could be anything from a low down payment mortgage to a jumbo mortgage. However, depending on the broker, you might have to pay a fee.

Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you dont have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time wont show up on your credit report as its usually counted as one query.

Finally, when youre comparing rate quotes, be sure to look at the APR, not just the interest rate. The APR reflects the total cost of your loan on an annual basis.

Also Check: Chase Recast