What Factors Affect The Amount Of Interest You Pay

The following factors will affect the amount of your interest payments:

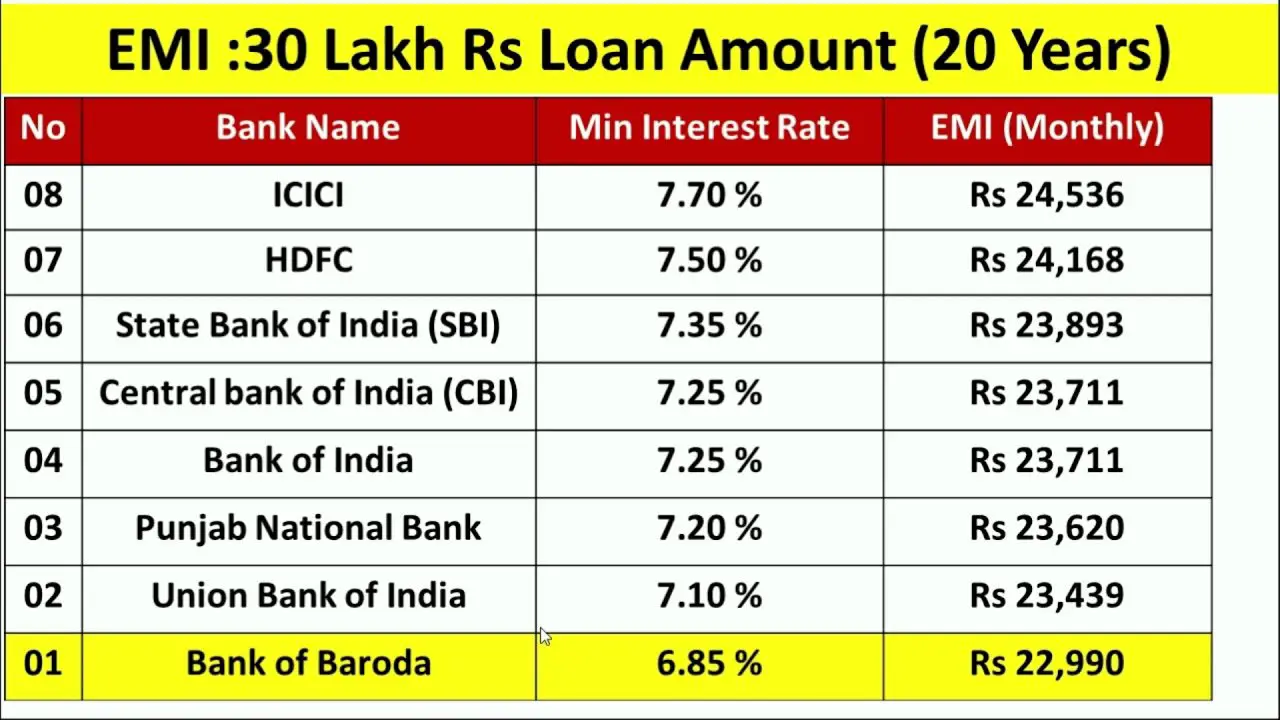

- The mortgage interest rate. This is the rate at which the bank charges you interest on the loan. Even a small difference in the interest rate can add up to thousands over the life of the loan.

- The federal funds rate. The interest rate on your loan is loosely tied to the federal funds rate set by the Federal Reserve, which dictates the rate at which banks lend money to each other overnight. If you have a variable interest rate, paying attention to the federal funds rate can help you predict what your interest rate will do.

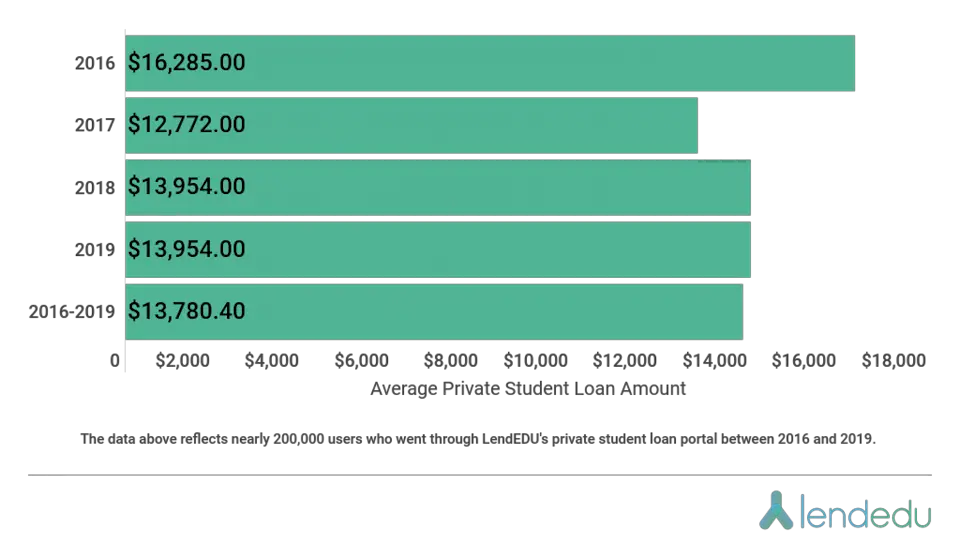

- The amount you borrow. The more you borrow from your bank, the more interest youll need to repay. For example, 5% of $1 million will always be a larger amount than 5% of $500,000.

- The outstanding loan amount. As you gradually pay off the money you borrow, you will be paying interest on a smaller loan amount and your interest payments will slowly reduce.

- The loan term. The time you take to pay off your loan will affect the amount of interest you pay paying your loan off over a shorter period of time will minimize your interest.

Knowing Your Mortgage Interest Rate

Before you even apply for a mortgage, you have to get preapproved. That means going to your bank, telling them you have the intent to buy a home, and submitting some basic information about your credit and finances. Once youâre preapproved, youâll get a loan estimate document, which, in addition to your mortgage amount and any up-front costs, will also list your estimated interest rate.

Get essential money news & money moves with the Easy Money newsletter.

Free in your inbox each Friday.

Sign up now

Preapproval is the first step in the mortgage process. After you lock down a home you like, you need to get approved. Before the mortgage is official, youâll receive a closing disclosure, which lists your actual mortgage amount and interest rate. Once you sign, these become what you have to pay.

Monthly Interest Rate Calculation Example

To calculate a monthly interest rate, divide the annual rate by 12 to reflect the 12 months in the year. You’ll need to convert from percentage to decimal format to complete these steps.

Example: Assume you have an APY or APR of 10%. What is your monthly interest rate, and how much would you pay or earn on $2,000?

Want a spreadsheet with this example filled in for you? See the free Monthly Interest Example spreadsheet, and make a copy of the sheet to use with your own numbers. The example above is the simplest way to calculate monthly interest rates and costs for a single month.

You can calculate interest for months, days, years, or any other period. Whatever period you choose, the rate you use in calculations is called the periodic interest rate. Youll most often see rates quoted in terms of an annual rate, so you typically need to convert to whatever periodic rate matches your question or your financial product.

You can use the same interest rate calculation concept with other time periods:

Recommended Reading: 10 Year Treasury Vs 30 Year Mortgage

How Much Interest Do You Pay On A Mortgage

The overall interest you’ll pay on your mortgage depends on the interest rate you receive, whether it’s a variable or fixed rate and how long it’ll take you to repay the loan. While you may refinance or move before the end of the loan’s term, you can find your loan’s monthly interest payment breakdown by reviewing your loan’s amortization table.

What Is A Mortgage Rate

A mortgage rate is the interest rate on a mortgage. Its also known as the mortgage interest rate. The mortgage rate is the amount youre charged for the money you borrowed. Part of every payment that you make goes toward interest that accrues between payments.

While interest expense is part of the cost built into a mortgage, this part of your payment is usually tax-deductible, unlike the principal portion.

Read Also: 70000 Mortgage Over 30 Years

How Much Prepayment Penalties Can Cost

The way your prepayment penalty is calculated varies from lender to lender. Federally regulated financial institutions, like banks, have a prepayment penalty calculator on their website. You can visit your banks website to get an estimate of your cost.

Your cost depends on factors such as:

- the amount you want to prepay

- the number of months left until the end of your term

- interest rates

- the method your lender uses to calculate the fee

The prepayment penalty will usually be the higher of:

- an amount equal to 3 months interest on what you still owe

- the interest rate differential

The lender will usually use the IRD calculation if:

- the interest rate on your mortgage is higher than the current interest rate and

- you signed your current mortgage contract less than 5 years ago

The calculation of the IRD may depend on the interest rate in your mortgage contract. Lenders advertise interest rates for the mortgage terms they have available. These are called posted interest rates. When you sign your mortgage contract, your interest rate may be higher, or lower than the posted rate. If your interest rate is lower, its called a discounted rate.

Typical Costs Included In A Mortgage Payment

- Principal: This is the amount you borrowed from the lender.

- Interest: This is what the lender charges you to lend you the money. Interest rates are expressed as an annual percentage.

- Property taxes: Local authorities assess an annual tax on your property. If you have an escrow account, you pay about one-twelfth of your annual tax bill with each monthly mortgage payment.

- Homeowners insurance: Your insurance policy can cover damage and financial losses from fire, storms, theft, a tree falling on your home and other hazards. If you live in a flood zone, youll have an additional policy, and if youre in Hurricane Alley or earthquake country, you might have a third insurance policy. As with property taxes, you pay one-twelfth of your annual insurance premium each month, and your lender or servicer pays the premium when it’s due.

- Mortgage insurance: If your down payment is less than 20 percent of the homes purchase price, youll probably be on the hook for mortgage insurance, which also is added to your monthly payment.

Read Also: Rocket Mortgage Requirements

What Is Mortgage Interest

Interest is charged by lenders in exchange for allowing you to borrow money. For borrowers, mortgage interest is charged based on your mortgage principal balance. The mortgage interest charged is included in your regular mortgage payments. This means that with every mortgage payment, you will be paying both your mortgage principal and your mortgage interest.

Your regular mortgage payment amount is set by your lender so that youll be able to pay off your mortgage on time based on your selected amortization period. This is why your mortgage payment amount can change when yourenew your mortgageorrefinance your mortgage. This can change your mortgage rate, which will impact the amount of mortgage interest due. If you now have a higher mortgage rate, your mortgage payment will be higher to account for the higher interest charges. If youre borrowing a larger amount of money, your mortgage payment may also be higher due to interest being charged on a larger principal balance.

However, mortgage interest isnt the only cost that youll need to pay. Your mortgage might have other costs and fees, such as set-up fees or appraisal fees, that are necessary to get your mortgage. Since youll need to pay these extra costs in order to borrow money, they can increase the actual cost of your mortgage. Thats why it can be a better idea to compare lenders based on theirannual percentage rate . A mortgages APR reflects the true cost of borrowing for your mortgage.

The Structure Of Mortgage Interest Rates

On any given day, Jones may pay a higher mortgage interest rate than Smith for any of the following reasons:

- Jones paid a smaller origination fee, perhaps receiving a negative fee or rebate.

- Jones had a significantly lower credit score.

- Jones is borrowing on an investment property, Smith on a primary residence.

- Jones property has 4 dwelling units whereas Smiths is single family.

- Jones is taking cash-out of a refinance, whereas Smith isnt.

- Jones needs a 60-day rate lock whereas Smith needs only 30 days.

- Jones waives the obligation to maintain an escrow account, Smith doesnt.

- Jones allows the loan officer to talk him into a higher rate, while Smith doesnt.

All but the last item are legitimate in the sense that if you shop on-line at a competitive multi-lender site, such as mine, the prices will vary in the way indicated. The last item is needed to complete the list because many borrowers place themselves at the mercy of a single loan officer.

You May Like: Who Is Rocket Mortgage Owned By

How Do I Get The Best Mortgage Interest Rate

The right deal for you will depend on your circumstances and what you want from a mortgage. In most cases you’ll need to meet certain conditions to qualify for the most competitive rates on offer.

Follow these steps to increase your chances of getting a great deal:

- Have a good credit record. Lenders are very thorough in checking your credit history when assessing your application – they want to know that you are good at repaying debt, so the better your credit score, the better your chances of being approved. Find out more in our guide to how to improve your credit score.

- Build a bigger deposit. The best rates are reserved for people borrowing at a lower loan to value ratio – i.e. borrowing a relatively small percentage of the property price. You can achieve this by saving a bigger deposit, or, if you already own a property, increasing your equity by paying down your mortgage each month.

- Shop around. There are dozens of different mortgage lenders, from the big, high-street names you are familiar with to challenger brands that are exclusively online. Each will have a range of different products on offer, and it pays to take time working out the most suitable deal for you.

- Use an independent, whole-of-market mortgage broker. Not only are mortgage brokers familiar with the different products on offer and able to advise on the lenders most likely to accept you, but they have access to mortgage deals which you can’t get by applying directly.

What Are The Ongoing Costs For Reverse Mortgages

Ongoing costs are added to your loan balance each month. This means that each month you are charged interest and fees on top of the interest and fees that were added to your previous months loan balance. Ongoing costs may include:

- Interest

- Servicing fees paid to your lender to cover such costs as sending you account statements, distributing your loan proceeds, and making certain that you keep up with the loan requirements

- Annual mortgage insurance premium which is 0.5% of the outstanding mortgage balance and

- Property charges such as homeowners insurance and property taxes, and if applicable, flood insurance.

The larger your loan balance and the longer you keep your loan, the more you will be charged in ongoing costs. The best way to keep your ongoing costs low is to borrow only as much as you need.

Note: This information only applies to Home Equity Conversion Mortgages , which are the most common type of reverse mortgage loan.

Don’t Miss: Does Rocket Mortgage Service Their Own Loans

Tips For Buying An Affordable Home

- Set aside funds for home maintenance and emergencies. Unexpected expenses are par for the course for homeowners, so youll want to make sure you can cover them without taking on debt. Whether its a broken appliance or a pipe that springs a leak, home repairs always seem to happen at inconvenient times and wind up costing more than youd expect. State Farm recommends setting aside 1 percent to 4 percent of your homes value for emergency repairs each year.

- Plan for income changes. If you or your partner or co-borrower wants to switch up the employment situation after moving, youll want to make sure to factor that into your budget. You dont want to wind up taking out a mortgage that you can no longer afford.

- Shop around to save on homeowners insurance. Comparing mortgage offers isnt the only way to save. Youll also want to solicit quotes from multiple insurers to make sure youre getting the best deal.

- Stay within your means. A lender might be willing to offer you a larger mortgage than youre comfortable with or able to pay. Dont buy a house just because the bank tells you you can afford it only commit to monthly payments that actually fit into your overall budget.

| Loan Type |

|---|

Choosing A Rapid Weekly/bi

As you may be aware, if you apply a rapid payment option to any loan or mortgage, you will pay it off early. A rapid biweekly payment is 50% of the monthly payment, slightly higher than a regular biweekly payment, which equates to 12 monthly payments spread over 26 bi-weekly periods.

On a regular bi-weekly repayment, each installment is less than 50% of the monthly payment. Choosing a rapid payment option requires a minor adjustment to your monthly budget, but the long-term impact is significant. If you were to select rapid payments on a brand new mortgage with a 25-year amortization, you would pay the mortgage off almost four years ahead of schedule.

Also Check: Can You Refinance A Mortgage Without A Job

Should I Lock In My Mortgage Rate Today

Locking in a rate as soon as you have an accepted offer on a house can help guarantee a competitive rate and affordable monthly payments on your home mortgage. A rate lock means that your lender will guarantee you an agreed upon rate for typically 45 to 60 days, regardless of what happens with average rates. Locking in a competitive rate can protect the borrower from rising interest rates before closing on the mortgage

It may be tempting to wait to see if interest rates will drop lower before getting a mortgage rate lock, but this may not be necessary. Ask your lender about float-down options, which allow you to snag a lower rate if the market changes during your lock period. These usually cost a few hundred dollars.

Of Calculating Interest Rates

Interest rates for a Reverse Mortgage float on a base of an established benchmark interest rate index and adjust periodically within maximum allowed adjustments and within interest rate caps.

The bullets below show how the HECM Reverse Mortgage loan program calculates interest.

- Index Base Rate: The Index Base Rate is the interest rate of the publicly published financial index upon which the Fully Indexed Rate is based. These rates fluctuate over time.

- The margin is the lenders profit margin above the value of the publicly published financial index. The interest rate margin is bounded by maximums and minimums, but varies company by company.

- MIP Margin: In addition to the upfront fee, all HECM Reverse Mortgages involve an annual margin applied towards premiums for federal Mortgage Insurance. As of July-2021, this MIP is 0.5% of the loan balance.

- Periodic Rate Adjustments: Periodic Rate Adjustments refers to the periodic adjustment to the Fully Indexed rate. It applies only to Adjustable Rate Reverse Mortgage programs.

- Interest Rate Caps: Interest Rate Caps are a preset maximum Margin used to calculate the maximum Fully Indexed Rate of the reverse mortgage loan. The loan may or may not reach this maximum depending on the change in Index Base Rate.

- Initial Fully Indexed Rate: This is the actual interest rate charged at the beginning of the loan, calculated by adding Index Base Rate + Margin = Fully Indexed Rate.

You May Like: How Does Rocket Mortgage Work

Types Of Reverse Mortgage Rates

CHIP Reverse Mortgage rates are available in two different formats: fixed terms or variable terms. Variable term rates are determined by the HomeEquity Bank prime rate, which tends to change when the Bank of Canada adjusts its benchmark rate. A variable rate may fluctuate up or down over the course of the term, which is why it is called variable and is not locked in for a particular term . A fixed term rate, on the other hand, is set for a determined period, which is why it is called fixed. The CHIP Reverse Mortgage fixed term rates are available for a six-month, 1-year, 3-year or 5-year period. Clients typically prefer longer terms, such as the 5-year, but the choice is yours!

At the end of your reverse mortgage rate term, your renewal rate will be the interest rate that is posted here when your rate term expires. Lets look at a couple of examples to understand reverse mortgage rates offered by CHIP.

How To Calculate The Interest Rate Differential

The Interest Rate Differential compensates the lenders for lost interest when the borrower decides to break the mortgage contract before the end of the term. Because lenders borrow the money they use to fund mortgages, they rely on revenue from mortgage interest to meet their borrowing obligations . Also, mortgage lenders profit from the spread between the two rates.

Read Also: Mortgage Recast Calculator Chase