Removing A Name From The Deed

Regardless of which method you use to take your exs name off the mortgage, youll also need to get their name off the deed.

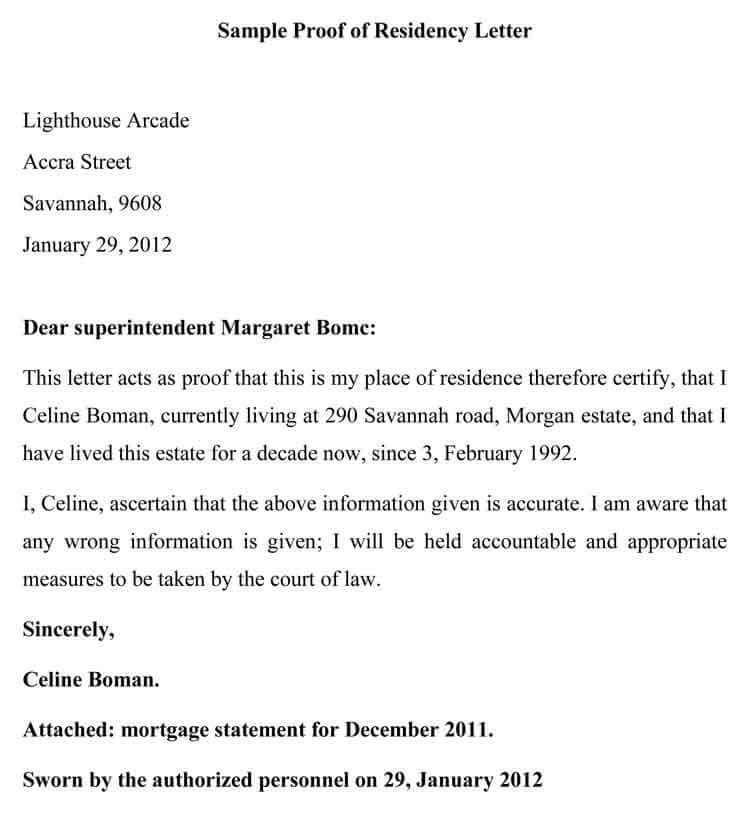

You usually do this by filing a quitclaim deed, in which your ex-spouse gives up all rights to the property.

Your ex should sign the quitclaim deed in front of a notary. One this document is notarized, you file it with the county. This publicly removes the former partners name from the property deed and the mortgage.

If you refinance to remove the borrower, the title company will remove the spouses name from the deed for you.

Discussing Property Ownership Interests

When a few individuals co-own the same property, the first step is to talk to them to reach an agreement about the individuals you need to remove from the title and the reason behind the decision.

If you are the removed party, you need to agree on your property share, the person you want to transfer the shares to, and the ownership structure formed in the deed of conveyance.

Once all the parties involved reach an agreement, you need to obtain a copy of the title deed. With the document in hand, you need to verify the names included in the deed, and then verify how the person you seek to remove currently holds title. In many cases, it is possible to order a copy of the title deed online at the countys official records website. If you can not locate the current deed online, you can find it in your county clerks office or local land registry office.

Transferring Property Ownership After A Divorce

Divvying up assets in the wake of a separation can get complicated especially where real estate is concerned. When a married couple divorces, they have 2 options with their home: one partner can buy out the other partners interest in the property, or both can agree to sell the home to pay off their mortgage so they can start fresh on their own.

Recommended Reading: How Much Would My Mortgage Cost

When Can A Co

After issuing your mortgage based on the pooled financial strength of you and a cosigner or co-borrower, your lender may be reluctant or simply unwilling to remove either party from the loan. It never hurts to ask, however: The lender may be willing to issue a loan modification that leaves you the sole party to the loan.

As a practical matter, however, for you to be able to take over the loan on your own, one or more of these circumstances typically must apply:

How Do I Change/add/remove A Name On A Deed

NOTE: The Recorder of Deeds office does not provide blank forms of any kind.

To change, add or remove a name on your deed a new deed needs to be recorded reflecting the change. Many people think they can come into the office and change the present recorded deed with a form, but that is not the case. Once a deed is recorded it cannot be changed. We recommend you consult a real estate attorney or title company to prepare a new deed.

If a married couple held the property jointly as tenants by entireties and one spouse dies, it is not necessary to remove that spouses name from the deed. If/when the survivor sells or mortgages the property, he/she simply explains in the new deed or mortgage that the other spouse is deceased. A special instance due to a particular legal situation could occur where the name should be deleted, therefore, we recommend consulting an attorney or title company for specific advice.If someone marries, it is not required to change the name on the deed to the married name, but because of a particular legal situation it may be desirable, therefore we again recommend consulting an attorney or title company for specific advice.Our office cannot recommend a real estate attorney or title company. The following organizations may be able to provide recommendations:

Also Check: How Much Will An Extra Mortgage Payment Save

Can A Joint Mortgage Be Transferred To One Person

Yes, thats absolutely possible. If youre going through a separation or a divorce and share a mortgage, this guide will help you understand your options when it comes to transferring the mortgage to one person.

A joint mortgage can be transferred to one name if both people named on the joint mortgage agree.

In this guide youll find:

Whats A Quitclaim Deed

A quitclaim deed is used to sign over property to another person. When someone signs a quitclaim deed, it means theyre effectively giving up their claim or rights to the property. There is no exchange of money or warrantees, so it offers the lowest level of buyer protection.

Because theyre high-risk, quitclaim deeds are usually between people you trust a family member or spouse, for example. Keep in mind that a quitclaim deed doesnt affect the mortgage. So even if you remove a person from the deed, all parties on the mortgage are still responsible for payments.

Don’t Miss: What Does Buying Mortgage Points Mean

Summary Of Options To Remove A Name From A Mortgage Without Refinancing

Removing a name from a mortgage without refinancing is possible in more than a few ways. Loan assumption is the simplest option, but its not always an option that lenders are willing to agree with. Be sure to speak with the lending company to determine what options are available and how to move forward with removing a name legally and without having to refinance the mortgage.

Why You Want To Remove Name From Property Title

How do I get my ex off the mortgage? After a separation or divorce, you and your ex may already have an agreement on who is taking over a mortgage and the payments. Even if you have an arrangement with the co-borrower on who is taking over the mortgage payments, the lender will still hold both of you accountable if the worst happens until your spouses name is taken off both the mortgage and the deed. This means that if you do not change name on house title Ontario, you are both considered jointly and severally liable for that loan. This means that if payments are late, the lender can come after both of you.

The best way to handle a joint mortgage split up is getting the name off the mortgage legally. The best part is, the process of how to get a name off the mortgage is not complicated. If the co-borrower no longer wants to be part of a loan that they co-signed, you can refinance the mortgage, especially if you have sufficient equity, a good credit score and a steady income that will continue for at least 3 years.

Read Also: How To Check Credit Score For Mortgage

How To Remove A Name From A Mortgage Without Refinancing

- Mortgages & Financing

- How to Remove a Name from a Mortgage Without Refinancing

Removing a name from a mortgage is possible under a few different circumstances. The main ways to remove a name from a mortgage without having to refinance include:

- A loan assumption

- Pay off your home

Obviously, some of these options are more realistic than others, but well work to explain the various options available. Knowing how a mortgage works can play a role in helping you understand your options. Also, it helps to know that if you wish to remove a name from the mortgage, you must receive permission from your lender, no matter the reason.

Can I Transfer A Mortgage If Im Self

If youre self-employed, work freelance or as a contractor, then you might worry about transferring your joint mortgage to a solo one, as its trickier to prove that you can afford to take on the payments when you dont have a regular monthly income.

Lenders will usually want to see at least twelve months worth of regular income, which may be trickier if youre self-employed. But you can use other ways to show evidence of your earnings, such as perhaps company dividends or accounts. The best thing to do if youre self-employed and want to transfer your mortgage to a solo one is speak to a specialist mortgage broker. They can advise you on what your options are and will have access to specialist lenders.

You May Like: What Score Does Mortgage Companies Use

Homeowner Wishes To Remove Ex

Q: My ex-spouse will sign a quitclaim deed on the house. Will that remove her name from the mortgage? Her name is not on the loan promissory note, but she is on the mortgage and some of the other documents.

How can I remove her name on the mortgage document without refinancing the loan?

A: Lets start with the difference between the promissory note and the mortgage document. These are two separate things. The promissory note is the obligation to repay the loan. The person who signs the promissory note is the person who had the credit to get the loan and is legally responsible for repaying the amount owed. The mortgage document is the document that creates the lien against the property.

In your email, you said your ex-spouse is on the mortgage, but not on the promissory note. The short answer is that the quitclaim deed will only transfer whatever ownership interest your ex-spouse had in the house to you and nothing more. If your ex-spouses name is on the mortgage, her name will remain there until the loan gets paid off or if your lender is willing to release her name from the mortgage.

Usually the easiest way to get a person off the mortgage is to refinance the mortgage. We understand that refinancing may be difficult, especially if you have to qualify for the loan on your own. And, refinancing may be costly, especially now that interest rates have jumped so dramatically.

What You Can Do

If you are facing unexpected financial hardship, it is worth contacting your lender and asking for a break on the monthly mortgage payments or switching to interest-only payments. This can be done without damage to your credit report . Although your credit score will not be affected it is worth noting that you may not be able to remortgage when wanting a new mortgage deal for several months after.

You also have three other options available:

In order to buy them out, you must be able to afford the mortgage without assistance. To ensure that you get the outcome you desire, its highly recommended that you consult with an expert before approaching your current lender as this limits your options and a potential decline could damage your chances of success.

Check out our guide on Mortgage Affordability Checks

Also Check: What Is 10 Over 30 Mortgage

What Is The Difference Between Quitclaim Deed And Warranty Deed

A quitclaim deed is a document given to the buyer to show that the seller has transferred their entire interest in the property to the buyer. This deed has no warranties or title and only works as an indication that the seller of the property has turned it to the buyer.

On the other hand, a warranty deed is issued to show the rightful owner of a property who is legally eligible to transfer its ownership after a sale or exchange. This document has no outstanding claims on the property. It just shows a statement that the named person owns the property, and it is free and clear of all liens.

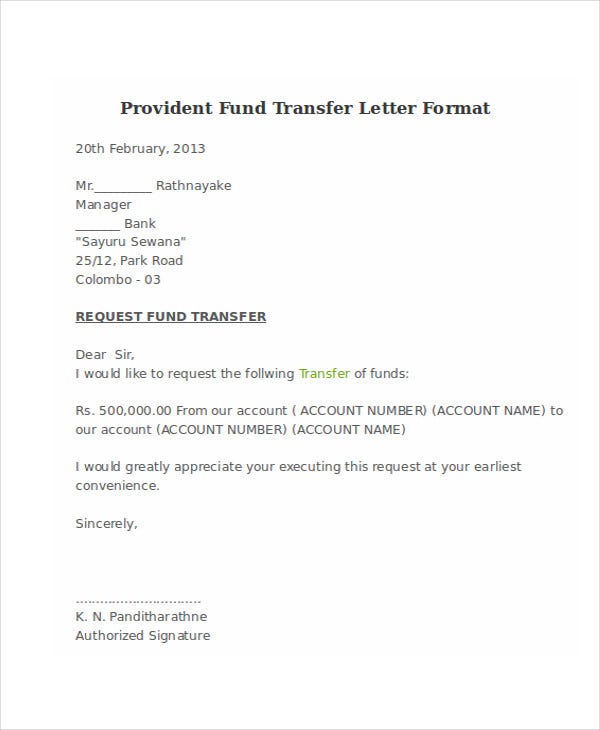

How To Transfer A Mortgage

If you both decide you want the mortgage to be transferred to one person, you do this through a legal process known as a transfer of equity.

A transfer of equity is when you transfer a joint mortgage to one of the owners, or to a new person. The Equity you have in a property just means how much of the property you legally own. Its the amount youve paid in through your mortgage repayments.

Your marital status doesnt affect your ability to transfer a mortgage to one person. Whether youre married, divorced or cohabiting, lenders treat your situation the same. Anyone who is named on a mortgage is responsible for paying it off, regardless of whether they remain married or not.

When you transfer a mortgage to one person, you can either stick with your current lender, or consider looking around for a new lender.

Its important to speak to your current lender as soon as you can. Lenders have different criteria when it comes to transferring the mortgage ownership to one person. Theyll want to know the person can afford to pay the full monthly mortgage payments. Its good to know what youll have to do up front before you commit to it. If youre not happy with what your current lender is asking, you can consider remortgaging with a new lender.

Don’t Miss: How To Get A Mortgage At 21

What Do I Do With A Quitclaim Deed

You can prepare a quitclaim deed using the Do-It-Yourself Quitclaim Deed tool. If you are the person giving your share of the property to your ex-spouse, sign the quitclaim deed in front of a notary. Then give the quitclaim deed to your ex-spouse or your ex-spouses lawyer. You may deliver it by mail or in person, or someone else may deliver it for you.

A notary can usually be found at a bank or the court clerk’s office.

Property transferred in a divorce is usually exempt from county and state real estate transfer taxes. But in some situations, transfer taxes may be due. The person who is not keeping the property is responsible for paying these taxes, unless you agree to a different arrangement. Transfer taxes must be paid before recording the quitclaim deed. You can find out if transfer taxes will be due in the Do-It-Yourself Quitclaim Deed tool.

If you are the person keeping the property, take the deed to the Register of Deeds and record it after your ex-spouse has signed it and delivered it to you. There will be a $30 recording fee.

If you prepare a quitclaim deed using the Do-It-Yourself Quitclaim Deed tool, detailed instructions on what to do next will print out along with the deed.

Is It Possible To Remove Your Name From A Mortgage

When two or more people buy a home together, they will all be named as owners on the deed. If they borrow money to buy the home, they will all sign the mortgage. A mortgage gives the bank an interest in the home as collateral for the loan. The mortgage alone does not create a debt. Although all of the people who are named on the deed must sign the mortgage, they do not all have to sign the note.

The note is the document that states the terms of the loan. The note is the promise to pay the money back. It is possible to be one of the home buyers named on the deed, but not be one of the borrowers listed on the note. The note is the document that determines if the mortgage will be reported on a homeowners credit report.

Sometimes things dont work out between co-owners.

Clients ask me, Can I take my name off the mortgage?

It is helpful to review the clients closing papers. First I must know who is on the deed. The deed tells me who owns the property.

Mortgage companies generally do not release one party from the note under any circumstances, unless one party files bankruptcy.

If a co-owner quit claims the property and receives a Chapter 7 discharge, then they will have no ownership in the home and no obligation on the mortgage.

Their name will still be written on the mortgage document, but it will have no further effect.

So in summary, there are three ways to remove your name from the obligation of a mortgage debt.

Timothy M. Pletter

Read Also: What Is A Good Home Mortgage Rate

Filing A Quitclaim Deed

Once you’ve been informed that your refinance has been approved, you should have your spouse’s name taken off of the deed to the property as well as the mortgage. Typically, you do this by filing a quitclaim deed, in which your spouse gives up any right to the property. Once you have the quitclaim form filled out, you’ll need to have your spouse come in to the lender who is handling your refinance and sign the quitclaim with you in front of the loan officer, who will then notarize the document, taking your spouse’s name off of the property deed as well as the mortgage. Remember, you should do this only after you have secured your refinancing for the house.

Get A Fha Or Streamline Refinance

FHA-backed loans are typically among the most secure. If you have this type of mortgage, you can also try streamlining your refinance. This allows you to remove your ex-spouse from the mortgage while simultaneously lowering your monthly payments .

In certain cases, you can qualify for a streamline loan without needing to provide income documentation. All you need to prove is that you obtained the FHA loan over six months ago and that you have completed at least six payments by yourself. If you are a veteran, you can apply for a VA streamline refinance.

Read Also: How Much Will Lenders Give For Mortgage