What Is A Mortgage Rate Hold

A mortgage rate hold is the locking in of a specified mortgage rate for a set period of time. This only applies to fixed rate mortgages, since the interest rate of variable rate mortgages can fluctuate.

Once you have a TD Mortgage Pre-Approval, you get a 120-day rate hold which holds the interest rate on your pre-approval term for 120 days subject to all the conditions, even if interest rates go up.

Do I Need Cmhc Insurance

UnderOffice of the Superintendent of Financial Institutions regulations, you are required to purchase CMHC insurance if your down payment is below 20%.

You may beineligible for CMHC insuranceif:

- your purchase price is $1,000,000 or above, or

- your amortization period is longer than 25 years.

In these cases, you must make a down payment of 20% or higher.

Ontarios Housing Market Trend

Ontarios new tagline is A Place to Grow, which is also whats expected for the provinces population. The Ontario Ministry of Finance projects the population of Ontario will increase some 30.2% over the next two decades, bringing the total population to 18.5 million by July 1, 2041.

There are so many incredible aspects to Canadas most populous province, from its lush natural resources to its growing cities. That and solid job growth make the population boom less of a surprise.

As a result of its popularity, home prices in Southern Ontario are expected to continue rising. Prices are particularly prone to inflation in Ontarios Golden Horseshoe region where immigration is high, land is limited by the protected green belt and homes remain in short supply.

That, in turn, implies that Ontario mortgage amounts will grow faster than the national average.

Also Check: Does Pre Approval For Mortgage Affect Credit

What Are The Minimum Requirements

Many lenders have fixed LTV ratio requirements for their home equity loans, meaning you’ll need to have a certain amount of equity in your home to qualify. Lenders will also factor in your credit score and income when determining your rate and eligibility.

Minimum requirements generally include a credit score of 620 or higher, a maximum loan-to-value ratio of 80 percent or 85 percent and a documented source of income.

What Kind Of Rate Can You Get With A Second Mortgage

Like most loans that have collateral, interest rates tend to be lower than that of a credit card or unsecured line of credit, for example. However, its important to note that a second mortgage always has a higher interest rate than a first mortgage. This is because the lender assumes more risk on a second mortgage than the first. If a borrower defaults on the loan or fails to pay it back, the first lender always gets paid out first. The second lender takes more risk than the first lender because the chance of being paid out on time is lower than for the first lender or mortgage.

Fixed and Variable Rates

When deciding on a rate with your lender, you will often have the choice of either a fixed rate or a variable rate. Fixed rates are constant rates that do not change for an agreed-upon period of time. For example, a lender might offer you a fixed rate of 2.8% for 5 years. A variable-rate changes with the market. This means that you could start with a more competitive rate, lets say 1.8%, but it also means that the rate can skyrocket with the market.

Also Check: Does Rocket Mortgage Sell Their Loans

Short Term 2nd Mortgage Loan

Short term 2nd mortgage loans are no longer than a 12 month period or as short as one month. Prime Finance settles 2nd mortgages upon registration of a caveat allowing very fast settlement to occur. This allows your client to obtain very fast funding at the lowest interest rate. Business loans 1%, residential bridging loans 2% per month. Prime Finance can also assist you with refinancing your 2nd mortgage facility with our lowest interest in Australia, as we are the specialists in 2nd mortgage finance and you can rest easy knowing your finances are in the right hands.

2nd mortgages are great for alternative to mainstream lending so if you have been turned away from the banks or other lenders, call Prime Finance today.

What Are The Benefits Of A Second Mortgage

A home equity loan offers many potential benefits, including:

- Tax deductibility The interest paid on a home equity loan may be tax deductible. Be sure to check with your tax advisor regarding the deductibility of interest.

- One low payment If you currently have many monthly bills, consider consolidating them into a single loan with one easy payment.

- Lower interest rate A home equity loan offers very attractive rates. Savings are often dramatic when consolidating higher-interest credit cards.

- Get out of debt faster If your goal is to get completely out of debt, restructuring your debt with a home equity loan may help. With discipline and patience, you may be surprised at how quickly you can eliminate your debts.

If you would like to explore your options and see which home equity loan is right for you, speak with any of our loan officers we love to help!

NMLS #640476

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

Whats A Revolving Loan

A revolving loan, or a revolving credit, allows the borrower to borrow and make repayments at any time. Revolving loans already have a maximum credit limit that was determined when the loan was initially applied for. This means that a borrower can borrow money whenever they need to, as they can easily access the money without needing to make additional applications each time they want to borrow money. Examples include credit cards and lines of credit. For a home equity line of credit, the credit limit is based in part on your home equity.

The opposite of a revolving loan is an installment loan, such as a home equity loan or a private mortgage. With these types of loans, you cant borrow more money and your loan repayments are controlled through regularly scheduled payments. You may also even be chargedprepayment penaltiesif you make more payments then your lender allows for in a certain time period.

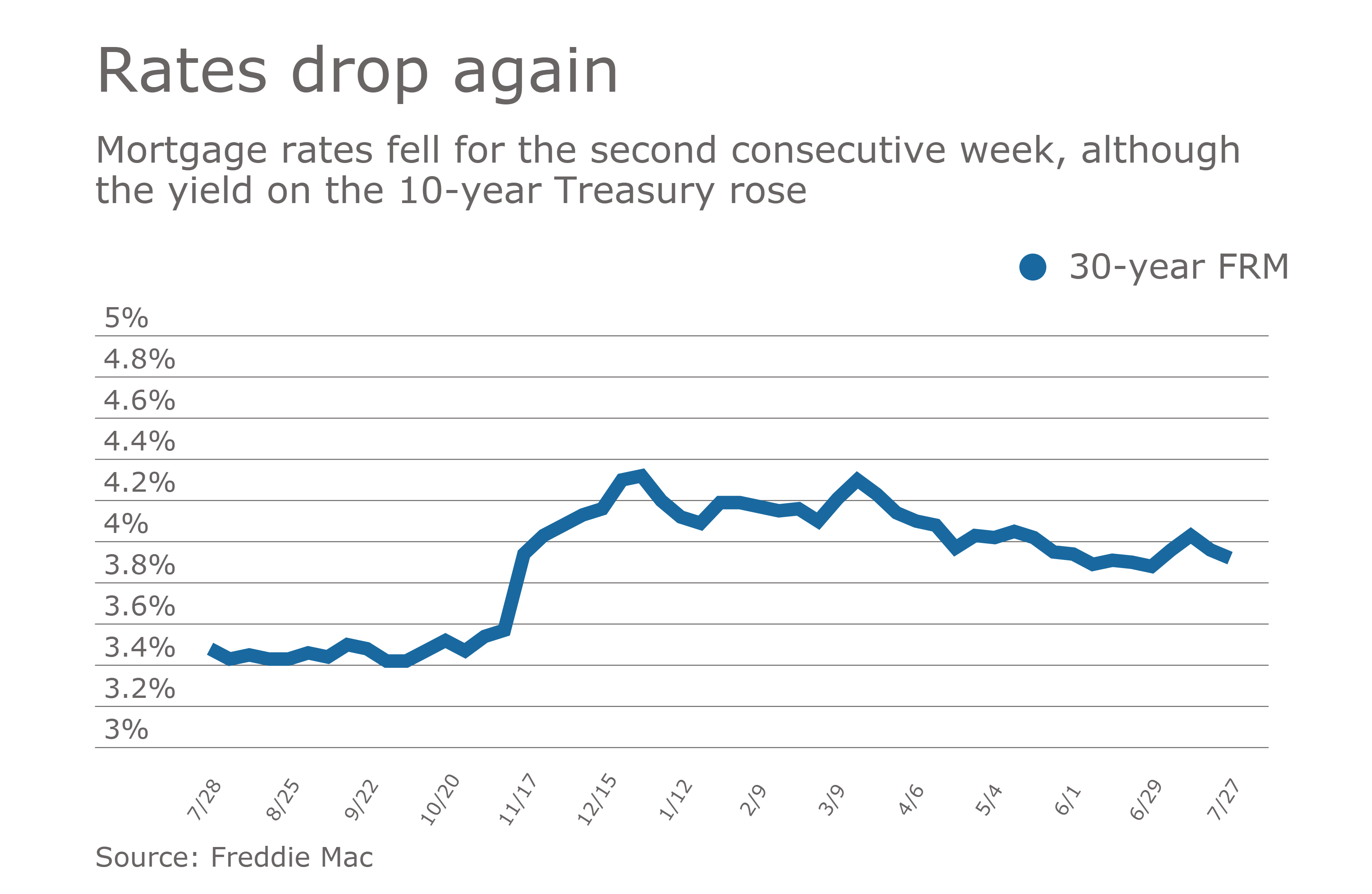

Mortgage Rates: Looking Forward

Looking forward, housing experts predict a continuation of the same trend rates will continue increasing through the end of the year and into 2022 citing inflation as a key factor. Federal Reserve Gov. Christopher Waller said in a recent statement that the committee may have to pivot away from near-zero interest rates as a result of the surge of inflation.

Better unemployment numbers are also contributing to rising interest rates. The pandemic-high unemployment rate of 14.8% was in April of 2020. According to the U.S. Bureau of Labor Statistics , the unemployment rate this past October was down to 4.6%.

With inflationary pressures and unemployment slowly returning to pre-pandemic levels, the Federal Reserve has less of an incentive to take actions that would drive down mortgage rates.

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

Can You Avoid Higher Rates On A Second Home Mortgage

When you apply for a mortgage loan, you must declare how you intend to use the property. And lenders take such declarations seriously. Thats because they dont want to finance riskier investment properties with residential financing.

It might be tempting to list your second home as a primary residence, and profit from lower interest rates or easier qualification. But its unwise to do so.

Lying on a mortgage application can land you fines in the thousands. In very serious cases, mortgage fraud can even lead to jail time.

So always be truthful with your lender. And ask plenty of questions if youre not clear on the loan rules. For instance:

- Are you allowed to have overnight rentals?

- Are there limits regarding how many nights you can rent?

- How much time must you spend there for it to qualify as a vacation home instead of an investment property?

- Can you have an accessory dwelling unit?

Get answers in writing to ensure you fully understand the requirements for your second mortgage.

And if youre having trouble qualifying with one lender, or finding the loan program you need, try another lender. They all have different loan options and rates.

Ways To Save On Toronto Mortgage Rates

In large Canadian real estate markets such as Toronto, it pays to do your mortgage homework. Homes are so expensive that the savings from getting a lower rate are magnified.

With the average Toronto home selling for about $900,000 at the start of 2020, thats roughly 75% more than the average home nationally. That means youll pay about 75% more interest, other things equal. A 0.1% savings on the average Toronto home means youll pay over $3,000 less interest over five years, assuming a standard 5-year fixed mortgage with 20% down.

Also Check: Recast Mortgage Chase

What Are The Pros And Cons Of A Second Mortgage

While it may seem instantly tempting to take out a second mortgage and claim a lump sum of equity, it may or may not be the best financial decision for you. Below are some of the advantages and disadvantages to consider before taking out a second mortgage:

- Large borrowing amount

- Higher interest rates than first mortgage

How Hard Is It To Get A Second Mortgage

Qualifying for a second mortgage is relatively easy if you meet the requirements of lenders. However, lenders will stick to their requirements strictly because they have less of a claim on your home than the primary lender if you do not keep up with payments. Even so, data shows that millions of Canadians have taken out a second mortgage.

You May Like: Does Pre Approval For Mortgage Affect Credit

How Much Can I Save By Comparing Mortgage Interest Rates In Canada

Because of the significant amount of money being borrowed under a mortgage, even the slightest difference in the mortgage interest rate may result in you saving money over the course of a mortgage term, and even more over an entire amortization period. While the mortgage rate is a very important consideration, you should also be sure to evaluate the terms and conditions of each type of mortgage to make sure you choose the right one for you.

What Are Prepayment Options

Prepayment options outline the flexibility you have to increase your monthly mortgage payments, or pay down your mortgage principal as a whole. The monthly prepayment option is a percentage increase allowance on your original monthly mortgage payment.

For example, if your monthly mortgage payment is $1,000 and your prepayment allowance is 25%, then you can increase your monthly payments up to $1,250. The lump sum prepayment option on the other hand, applies to the original mortgage amount. So, if your lump sum prepayment allowance is 25% on a $100,000 mortgage amount, then you can pay $25,000 off the principal every year.

Also Check: Chase Mortgage Recast

Fairway Independent Mortgage Corporation: Best For First

With more than 700 branches, Fairway Independent Mortgage Corporation can offer an in-person experience to both first-time and repeat homebuyers across the U.S.

Strengths: TIf youve never taken out a mortgage before, Fairway has an extensive glossary of mortgage terms you can read up on, several mortgage calculators and a homebuyer guide with a checklist, dos and donts and more. The lender also offers first-time homebuyer-friendly loans, including FHA loans, and a mobile app, FairwayNow, where you can send direct messages and track your loan status.

Weaknesses: Youll have to talk to a loan officer to find out rates and fees these arent available readily on Fairways website.

Home Equity Loan Pros And Cons

-

Can’t take out more for an emergency without another loan

-

Have to refinance to get a lower interest rate

-

May lose your home if you can’t make payments

A home equity loan provides you with a one-time lump sum payment that allows you to borrow a large amount of cash and pay a low fixed interest rate with fixed monthly payments. This option is potentially better for people who are prone to overspending, like a set monthly payment they can budget for, or have a single large expense they need a set amount of cash for, like a down payment on another property, college tuition, or a major home repair project.

Its fixed interest rate means borrowers can take advantage of the current low interest rate environment. However, if a borrower has bad credit and wants a lower rate in the future, or market rates drop significantly lower, they will have to refinance to get a better rate.

Recommended Reading: Are Discount Points Worth It

Second Mortgages Help With Bad Credit

If you have bad credit, then borrowing money to consolidate or pay off debt can be challenging. Those with poor credit scores often think obtain a second mortgage is impossible, but ironically, this is likely one of the best tools to help them repair that credit.

Gaining access to your equity can allow you to pay off all of those overdue bills, immediately, and give you piece of mind to get your finances back in order.

A simpler, single payment setup, can also make it easier to have a single target to hit monthly.

Most traditional banks, and even many brokers and alternative lenders, do not offer second mortgages for bad credit borrowers. Its important to speak with a mortgage professional not tied down by these burdensome restrictions, because second mortgages are possible even with a poor credit score. Canada is filled with lenders to work with, and you need someone who will help you find them.

Is The Lowest Ontario Mortgage Rate The Best Rate

Not always. The lowest rates usually come with more limitations. These restrictions can cost you much more than the small rate savings. Such terms are common with low frills mortgages and typically kick in when you try to port, break or increase the mortgage after closing. When comparing mortgage rates, dont be afraid to ask potential lenders questions to ensure you understand the terms and conditions of your mortgage.

Also Check: Chase Mortgage Recast Fee

How Does My Amortization Period Affect My Mortgage

When deciding between a short amortization or a long amortization, you will need to take into account your financial situation. A long amortization means that your individual mortgage payments will be smaller, which might allow you to qualify for a larger mortgage amount based on your futuredebt service ratios. Likewise, higher mortgage payments from a shorter amortization may reduce themortgage amount that you can afford.

You wont be able to get a CMHC-insured mortgage if your amortization is more than 25 years. While your monthly mortgage payment might be higher with an amortization that is 25 years or less, youll be able to make a smaller down payment that can be as low as 5%. Otherwise, youll need to make a down payment of at least 20% for an uninsured mortgage with an amortization greater than 25 years.

You can use ourmortgage amortization calculatorto see how changing your amortization period can affect the cost of your mortgage. For example, the table below compares the cost of a mortgage and the amount of each monthly mortgage payment for different amortization periods.

How To Calculate Your Home Equity

To calculate your home equity estimate the current value of your property by looking at a recent appraisal, comparing your home to recent similar home sales in your neighborhood, or using the estimated value tool on a website like Zillow, Redfin, or Trulia. Be aware that these estimates may not be 100% accurate. When you have your estimate, combine the total balance of all mortgages, HELOCs, home equity loans, and liens on your property. Subtract the total balance of what you owe from what you think you can sell it for to get your equity.

Because both home equity loans and HELOCs use your home as collateral, they usually have much better interest terms than personal loans, , and other unsecured debt. This makes both options extremely attractive. However, consumers should be cautious of utilizing either. Though racking up credit card debt can cost you thousands in interest if you can’t pay it off, becoming unable to pay off your HELOC or home equity loan can result in losing your home.

Home equity loans give the borrower a lump sum upfront, and in return, they must make fixed payments over the life of the loan. Home equity loans also have fixed interest rates. Conversely, home equity lines of credit allow a borrower to tap into their equity as needed up to a certain preset credit limit. HELOCs have a variable interest rate, and the payments are not usually fixed.

Read Also: Rocket Mortgage Requirements

Home Equity Loan/private Mortgages

A home equity loan is a fixed-amount of money that you borrow based on your home equity. While HELOCs have variable interest rates that change with theprime rate, home equity loans can have either a variable rate or a fixed rate.

You can borrow up to a combined 80% of the value of your home with your existing mortgage and a home equity loan. To learn more about loan-to-value and to see if the amount that you want to borrow is under the 80% limit, visit ourLTV calculator.

Private mortgages are also home equity loans, but they differ in that they are offered by private lenders and have less strict lending requirements. Private lenders may even allow you to borrow up to 95% of the value of your home. To learn more about private lenders, visit ourprivate mortgage lenderspage or ourprivate mortgage ratespage.