How To Find An Affordable Home

Would-be buyers in expensive areas may need to think creatively about how to buy a home. For example, if you live in a high-cost area and are planning to buy a home for your family you can try getting an FHA loan or find a seller willing to do a rent to own.

A rent to own is when a tenant rents the house for an extended period of time and then, after all those months are up they can purchase it. Youll still need to make monthly payments on rent as you would owning your own home but how much is different depending on how many years youre renting the property before the home purchase.

Its often less expensive than buying up front, or you can also find a seller willing to give a private mortgage. Or you may have to look for a smaller home in a more affordable area or a condo.

What Are Mortgage Statements

A mortgage statement outlines important information about your mortgage. Mortgage statements are usually an annual statement, with it being sent out by mail between January and March rather than once every month. You may also choose to receive your mortgage statement online.

For example, TD only produces mortgage statements annually in January, while CIBC produces them between January and March. If you have an annual mortgage statement, it will usually be dated December 31. You may also request a mortgage statement to be sent.

Information on a mortgage statement are up to the end of your statement period and include:

- Current interest rate

Year Mortgage Payment On 200 000

Mortgage Loan Calculator Overview. There are many different mortgage options to choose from whether you are setting up a new mortgage to purchase a home or to refinance a mortgage on a home that you already own. There are fixed rate mortgages, fixed to adjustable rate mortgages and adjustable rate mortgages to choose from.

Mortgage Payment Calculator 4.50% Monthly Payment. 4.5% for $100,000 30 Years Fixed Mortgage $507 4.5% for $200,000 30 Years Fixed Mortgage $1,013

Mortgage Payment Calculator Loan Amount = $200000. Payment number beginning balance interest payment principal Payment Ending balance cumulative interest Cumulative Payments 1: $200,000.00: $750.00: $263.37

100% No Doc Commercial Loan :: No Down Payment :: Real Estate The ideal commercial loan for professionals and others who are tired of renting and want to own their own building or office condo. Ideal for small businesses looking to buy. All commercial real estate property types considered. 100% NO DOC COMMERCIAL LOAN NO MONEY DOWN

Cost of Repayments on 200000 Mortgage All the values are in pounds sterling for the years provided and this is the monthly repayment for each month of your 200,000 mortgage. Please see our mortgage calculator to see different rates, the total repayments youll make over the life of the loan and the total interest paid.

You May Like: Does Rocket Mortgage Service Their Own Loans

Skip A Mortgage Payment

Many mortgage lenders offer flexible mortgage payment options, such as the ability to skip a payment or to defer your mortgage payments. Most of Canadas major banks allow you to skip a mortgage payment, with the exception of CIBC and National Bank.

Generally, you wonât be able to skip mortgage payments for mortgages that are insured. Having a CMHC-insured mortgage means that your amortization cannot go over 25 years. For insured mortgages, youâll need to have made a mortgage prepayment that would be equivalent to the amount that you want to skip for you to be able to skip a mortgage payment in the future.

Lenders also have conditions in order to be able to skip a mortgage payment. Your mortgage must not be in arrears, and your current mortgage balance must not be more than your original mortgage balance at the start of your term.

How Much Is The Monthly Interest On A 200000 Mortgage

Below you can see how a repayment mortgage compares with an interest-only mortgage, based on monthly payments and a term of 25 years.

The lower column illustrates how much monthly interest you would pay on a £200k mortgage at various interest rates.

| Interest Rate | |

|---|---|

| £666 | £834 |

For more accurate figures, or if you want to see if a repayment mortgage might be right for you, drop us a line. Well connect you with an expert who can help you see if this is the best fit for you.

You May Like: 10 Year Treasury Yield Mortgage Rates

Rated Excellent By Our Customers

Professional staff

Professional staff, especially Steve, he has dedicated all his time and energy to come up with the best solution for us and very fast. Very satisfied about the service.

Silvia, 27 days ago

OMA pulled out all the stops

Great staff and good communication. Helped us understand the process and gone over and above to help in a difficult situation. Other companies couldn’t even be bothered but Thank you so much OMA.

Anneke Woolley, 12 days ago

Our advisor was amazing from the start!

Aaron went above and beyond. He worked late and kept in contact with me and worked tirelessly to find me the best mortgage he could

James, 10 days ago

Where Can I Find A Mortgage Calculator

Theres a huge number of variables when it comes to getting a mortgage your credit history, income sources, deposit size and monthly outgoings being just a few of them. As such, calculators can only give you the most general idea of what is available.

Getting the expert advice is the best way to find out if youre eligible for a £200k mortgage, or what repayments on a £200k mortgage might cost you.

Speak to one of the brokers we work with to get the best advice for your unique circumstances they can help clear up the confusion and connect you with the right lender for you.

Read Also: Rocket Mortgage Loan Requirements

Choosing The Mortgage Term Right For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

Does Mortgage Payments Include Property Tax

Many mortgage lenders require you to payproperty taxesthrough your lender in your regular mortgage payment, with your lender then paying your municipality. This is because failing to pay your property taxes can lead to your municipality placing a lien on your property, which will be placed in the front-of-the-line before your lender’s claim on your home.

If you pay your property taxes through your lender, then your lender will estimate an amount that would need to be paid every month in order to cover the total amount of property taxes for the entire year. If the amount that the lender collected is not enough to cover the actual property tax due, then the lender will advance the due amounts to the municipality and charge you for the shortfall.

Your lender may charge you interest on the amount of any shortfall. The lender may pay you interest if you have overpaid and have a surplus. Property tax bills or property tax notices are required to be sent to your lender, as failing to send it may mean the collected property tax amounts are not accurate.

Some lenders allow you to pay property taxes on your own. However, they have the right to ask you to provide evidence that you have paid your property tax.

If paying property taxes on your own, your municipality may have different property tax due dates. Property tax might be paid one a year, or in installments through a tax payment plan. Installments might be monthly or semi-annually.

Don’t Miss: How Does 10 Year Treasury Affect Mortgage Rates

What Is The Required Debt

Online resource Investopiea.com explains that the lower an applicants debt-to-income ratio, the greater the chances that the borrower will be approved for a credit application.

As a customary rule, 43 percent is the highest debt-to-income read DTI ratio a borrower can have and still be qualified for a mortgage.

However, lenders prefer a debt-to-income ratio lower than 36 percent, with no more than 28 percent of that debt as a mortgage or rent payment.

In reality, though, the maximum DTI ratio varies from lender to lender.

Add Other Costs Like Pmi Hoa Fees And Property Tax Or Let Us Estimate These To Get A More Accurate Estimate Of Your Monthly Payment

What if i pay a bigger down payment? Assuming you have a 20% down payment , your total mortgage on a $250,000 home would be $200,000. Easily calculate your monthly mortgage payment based on home price, loan term, interest rate and see how each affects your monthly payment. Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule. To determine how much income you need for a $200,000 mortgage, keep in mind that the amount of the monthly payment on that mortgage will depend on your credit score and other factors.

A year later, you will have made 13 payments. Use this calculator to see the total principal and interest youâll owe each month. Assuming you have a 20% down payment , your total mortgage on a $250,000 home would be $200,000. The parts of a mortgage payment you can approximate the monthly payments on a $200,000 home loan by using a mortgage calculator with an average interest rate. You make deposits into a sinking fund earning an effective annual interest rate of 12% in such a way that the total outlay is x for the first 10 years and x + 10, 000 for.

Use this to calculate a loan for anything, such as a vehicle, business loan, home, rv, motor home, mobile home, manufactured home, real estate, land, vacation property, education, or any type of debt.

Read Also: 10 Year Treasury Yield And Mortgage Rates

Understanding Your Mortgage Payment

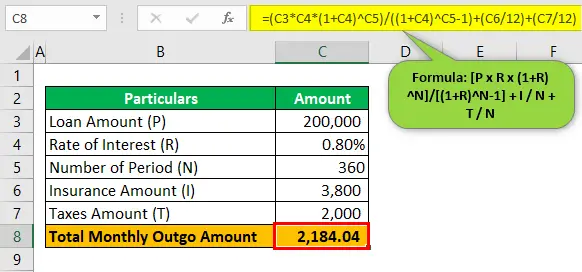

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

Do Your Own Research For A $200k Mortgage

Our final piece of advice is simple: do your own research. Were confident that weve put together a solid guide here for a 200k mortgage, but its not the be-all and end-all. We dont tackle your specific financial or personal situation , nor can we provide advice for every single location on the planet. And ultimately, a lot of what weve said is subjective and a matter of opinion.

We recommend taking the resources and advice weve pointed you to and then doing some more leg work. That final call to buy a home is ultimately yours to make.

- Loans offered: Conventional, jumbo, FHA, VA, fixed-rate, adjustable-rate rate-and-term and cash-out refinancing construction and renovation loans

- Available: Available in all U.S. states

- Min credit score: 620 for conventional loans 700 for jumbo loans 580 for FHA loans 620 for VA loans

Recommended Reading: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

How To Account For Closing Costs

Once you’ve calculated the total principal and interest expense on your mortgage, factoring in closing costs or fees will be straightforward. Since closing costs are paid in full when you close on the loan, you can simply add them to your overall loan cost without using any long formulas. Some examples of upfront closing costs include the following:

- Mortgage lender fees

- Third-party mortgage fees

- Prepaid mortgage costs

While there may be other categories of upfront fees, the process for calculating them remains the same: Just add them to the total cost of the mortgage loan. Keep in mind that this will exclude any added monthly expenses paid in escrow, like taxes or homeowner’s insurance. Our next section explains how to factor in monthly expenses.

What Are The Repayments For A 200k Buy

Rules for buy-to-let mortgages are usually stricter and slightly different from residential mortgages. Lenders will have higher minimum income requirements and require more significant deposits.

Some may consider rental income forecasts and require that the projected rental payments cover 125% to 130% of the 200k mortgage monthly repayments.

You can make most buy-to-let mortgage repayments on an interest-only basis, and this will be more tax-efficient and flexible for you as a landlord. Youll have the option to quickly sell the property when you wish to clear the loan balance.

Read Also: Who Is Rocket Mortgage Owned By

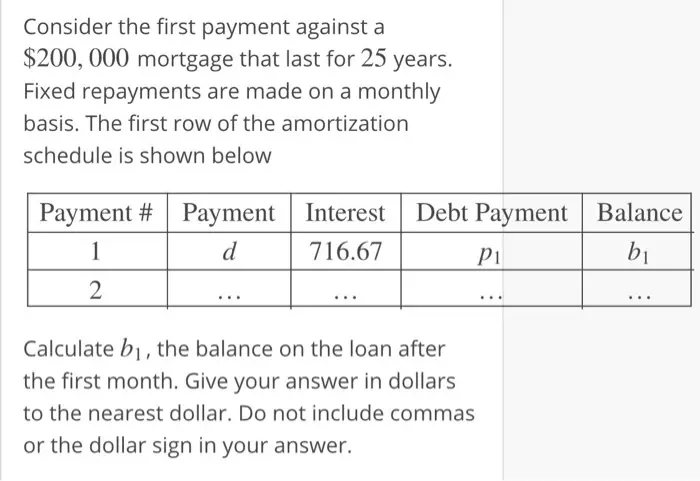

Amortization Schedule For A $200k Mortgage

Amortization for a mortgage shows the process of paying both the interest and principal off on a mortgage. Initially, you will pay mostly interest on your $200k mortgage and eventually pay mostly principal.

An amortization schedule shows each payment towards a mortgage until the predetermined term ends.

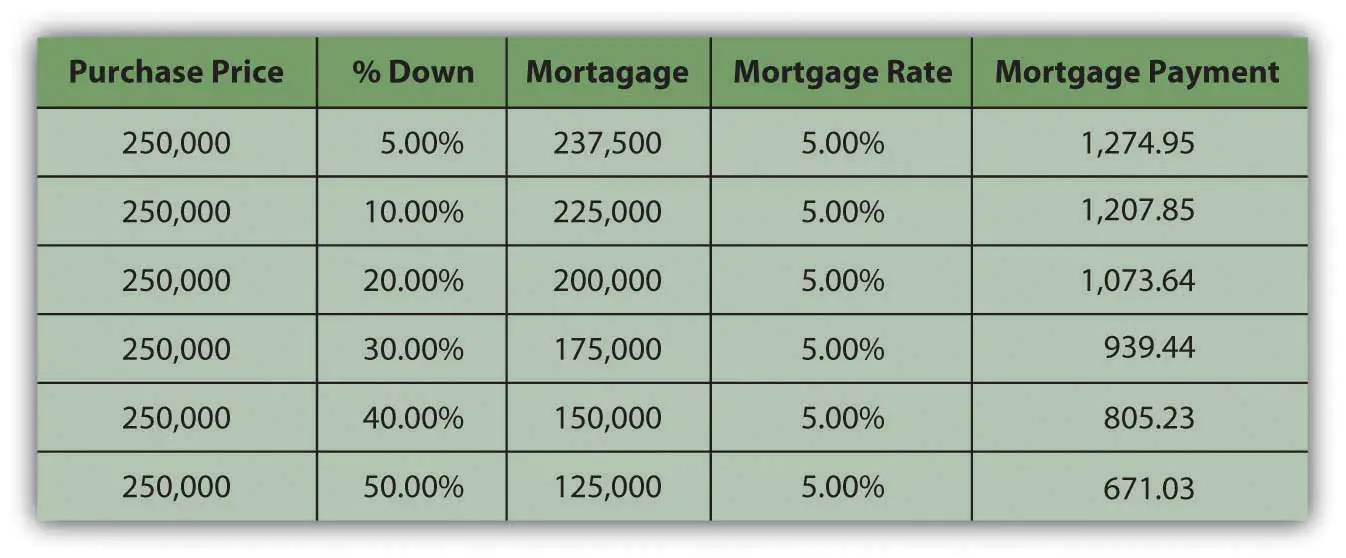

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that will play a role in determining your mortgage rate.

Recommended Reading: How Much Is Mortgage On 1 Million

What Amortization Period Should I Choose

Here are some general guidelines for choosing an amortization period for your mortgage:

- Most mortgages in Canada have an amortization period of 25 years. Unless you require a longer amortization period due to cash flow concerns, or you can afford to shorten your amortization, a 25 year amortization works well in most cases.

- Choosing a shorter amortization means that youll be paying off your mortgage principal balance faster. This will lower your lifetime interest cost, but it will also result in a higher monthly or bi-weekly mortgage payment.

- Insured high-ratio mortgages cannot have an amortization that is over 25 years. If you choose an amortization period of over 25 years, you must make at least 20% down payment.

$200000 Mortgage: Monthly Payment Interest Rate And Down Payment

So you are considering getting a $200,000 mortgage but want to know what it will end up costing you.

There are many aspects to consider when applying for a $200,000 mortgage. This includes the down payment, interest rate, mortgage length, and monthly payments.

A 15-year $200k mortgage could save you a considerable amount of money compared to a 30-year mortgage when taking interest into account.

Below you will find how much you could expect to pay each month with various interest rates. On top of that, you will also find the different down payment options explained in detail so you can choose the best way to go about getting a $200,000 mortgage.

This post may contain affiliate links. For more information, see our disclosure policy.

Recommended Reading: Requirements For Mortgage Approval

What Is Mortgage Required Income

Lenders consider two main points when reviewing loan applications: the likelihood of repaying the loan and the ability to do so .

Nerdwallet.com explains that mortgage income verification, even if they have impeccable credit, borrowers still must prove their income is enough to cover monthly mortgage paymen

How Much Income Do I Need For A 200k Mortgage

Before you invest 200k into a home, youll want to be sure you can afford it.

To be able to borrow a 200k mortgage, youll require an income of $61,525 per year.

The income you need is calculated using a 200k mortgage on a payment that is 24% of your monthly income. In your situation, your monthly income should be about $5,127.

Recommended Reading: 10 Year Treasury Vs 30 Year Mortgage

Short History Lessons Of Mortgages

Before the subprime mortgage crisis of 2008-2009, just about anyone could get a mortgage . Lenders pushed sub-prime loans on people with poor credit knowing they probably could not keep up with the payments and would default on their loans and lose their homes.

The lending habits were not healthy and this led to a sharp increase in those high-risk mortgages ending up in default. This contributed to the most severe recession in decades. Some have blamed lenders for inappropriately approving loans for subprime applicants, despite signs that people with poor scores were at high risk for not repaying the loan. By not considering whether the person could afford the payments if they were to increase in the future, many of these loans may have put the borrowers at risk of default.

I used to work in the Underwriting Department at SunTrust in 2012, and the criteria they used to determine whether to make a loan is more rigorous.

However, that does not mean that millennials would have a tough time getting a mortgage it is just important to do your research first and make sure youre financially prepared to take on a mortgage payment.

In order to get a solid grasp on the terms and processes of buying a home. Take the time to understand the process and requirements of being a first-time home buyer.

1. Do the research

Your credit score and any credit issues in the past few years:

How much cash you can put down:

Shop for loan programs:

2. Prepare the paperwork

3. Find a lender