Tip #: Sign Up For Auto

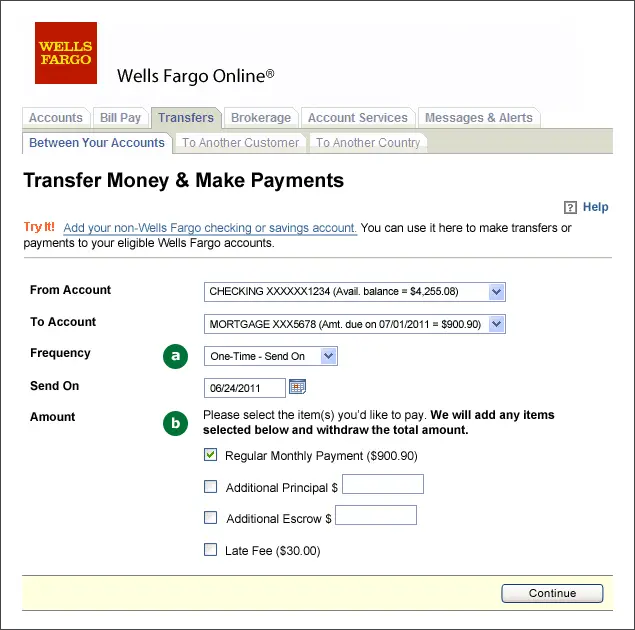

Your first order of business is to set up an automatic payment option, and you can do this either through your bank or through your lender. Youll want to go with the most ideal option for you.

Auto-Pay the Pros

Auto-Pay the Negatives

Can I Access My Loan Information Online

Yes. Once your loan transfer is complete and you have registered and created an account you can view and manage your loan information online. Please contact our Customer Service Department at 1-800-822-5626, Monday through Thursday between 8:00 A.M. and 9:00 P.M. ET, and Friday between 8:00 A.M. and 5:00 P.M. ET if you encounter any difficulties

Consider Biweekly Payments To Pay Off Your Mortgage Early

Rocket Mortgage clients can set up biweekly payments at no cost. By doing this, homeowners pay off their mortgage early and save money on their interest, over the life of the loan. Lets go over how it works.

Every 2 weeks, you would make a half payment, which is applied to your loan when we receive enough to satisfy a full contractual payment. Because of the calendar, there will be 2 months when you make 3 half-payments a month. This third payment is applied directly to your loan principal, so youre making the equivalent of one extra payment directly toward your mortgage balance each year.

You May Like: What Does Gmfs Mortgage Stand For

How To Pay Your Mortgage Faster

This article was co-authored by Ryan Baril. Ryan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.There are 9 references cited in this article, which can be found at the bottom of the page. This article has been viewed 61,398 times.

Prepaying your mortgage can shorten the life of the loan and save you a large amount of money in interest. There are two ways to do this: you could contribute extra money every month or you might be able to take advantage of falling interest rates by refinancing the loan. Whichever method you choose, the important thing is to make consistent payments. This article will show you how to save money by shortening your mortgage.

Is It Possible To Lower My Monthly Mortgage Payment After Applying A Large Sum Of Money To The Principal Of My Loan

If applicable, a Principal Reduction Modification can be executed within 12 months from the time a borrower applies a lump sum of $10,000 or more to the principal balance of their loan. The interest rate and term of the loan will remain the same.

The loan is re-amortized or ‘recast’ based on the lower balance. The loan must have investor approval before this transaction can be completed. Most private investors will not allow a modification to the loan.

Also Check: Rocket Mortgage Requirements

What To Do If I Made A Late Amerisave Mortgage Payment

Its a good idea to avoid a late AmeriSave Mortgage payment at all costs, but mistakes sometimes happen. While you dont want to be too hard on yourself if this happens, you need to consider possible consequences. Case in point: you could see your credit score take a hit if you dont make payments on schedule. Also keep in mind that a late AmeriSave Mortgage payment may remain on your credit report for as many as seven years, which would adversely impact your credit score. What follows is a look at 3 proven strategies you can use to have late mortgage payment information scrubbed from your credit report.

Principal And Interest Of A Mortgage

A typical loan repayment consists of two parts, the principal and the interest. The principal is the amount borrowed, while the interest is the lender’s charge to borrow the money. This interest charge is typically a percentage of the outstanding principal. A typical amortization schedule of a mortgage loan will contain both interest and principal.

Each payment will cover the interest first, with the remaining portion allocated to the principal. Since the outstanding balance on the total principal requires higher interest charges, a more significant part of the payment will go toward interest at first. However, as the outstanding principal declines, interest costs will subsequently fall. Thus, with each successive payment, the portion allocated to interest falls while the amount of principal paid rises.

The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. Once the user inputs the required information, the Mortgage Payoff Calculator will calculate the pertinent data.

Aside from selling the home to pay off the mortgage, some borrowers may want to pay off their mortgage earlier to save on interest. Outlined below are a few strategies that can be employed to pay off the mortgage early.:

You May Like: Can You Get A Reverse Mortgage On A Condo

Yes We Offer An Array Of Options For Making Your Mortgage Payment Online

Yes, we offer an array of options for making your mortgage payment online.

It’s easy to make a mortgage payment using PNC Online Banking and there is no fee. Pay your mortgage from a PNC or non PNC Checking or Savings account by clicking Make a Payment from your account activity page. Make a one time payment for today or pay later with a future dated or recurring monthly payment.

You can automate your monthly mortgage payments and avoid writing checks and paying for postage each month. To authorize an automated payment, complete the online form and follow the mailing or fax instructions. Once you get setup, your mortgage payment is automatically paid each month on the same day.

Take Advantage Of Prepayment Privileges

Pay off your home quicker with mortgages that have prepayment privileges. Lenders offer open, closed and convertible mortgages Opens a popup.. Open mortgages usually have higher interest rates than closed mortgages, but they’re more flexible because you can prepay open mortgages, in part or in full, without a prepayment charge. Closed and convertible mortgages often let you make a 10% to 20% prepayment. Your loan agreement explains when you can make a prepayment, so get the details from your lender beforehand. Also, decide which privileges you want before finalizing your mortgage.

Recommended Reading: Reverse Mortgage On Condo

Refinance To A Shorter Term

Another option involves refinancing, or taking out a new mortgage to pay off an old loan. For example, a borrower holds a mortgage at a 5% interest rate with $200,000 and 20 years remaining. If this borrower can refinance to a new 20-year loan with the same principal at a 4% interest rate, the monthly payment will drop $107.95 from $1,319.91 to $1,211.96 per month. The total savings in interest will come out to $25,908.20 over the lifetime of the loan.

Borrowers can refinance to a shorter or longer term. Shorter-term loans often include lower interest rates. However, they will usually need to pay closing costs and fees to refinance. Borrowers should run a compressive evaluation to decide if refinancing is financially beneficial. To evaluate refinancing options, visit our Refinance Calculator.

Frequently Asked Questions About Dovenmuehle Mortgage

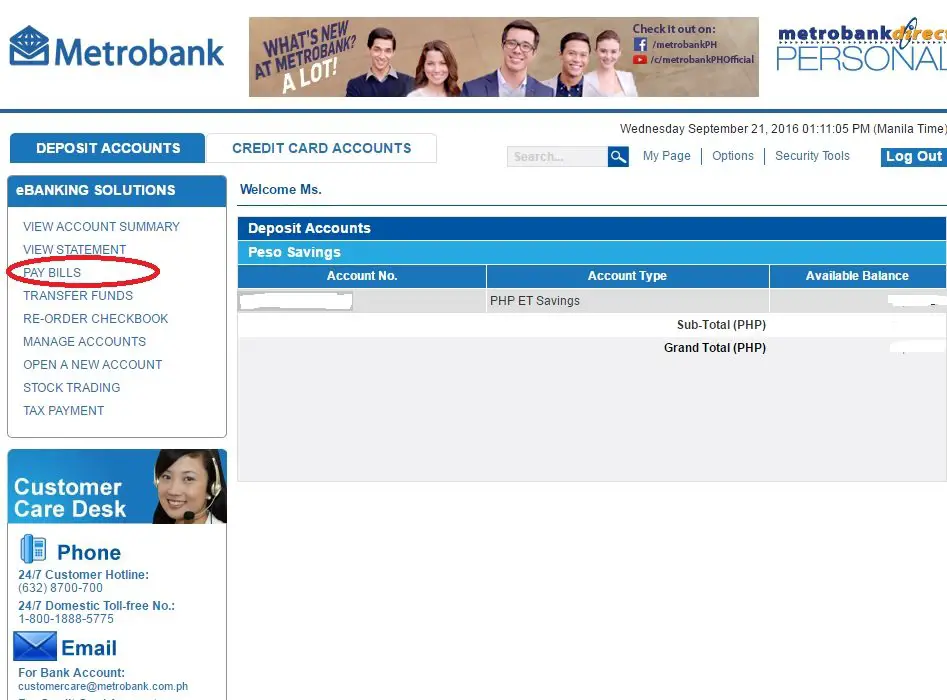

Whats the fee to develop a personalized loan payment schedule?

It costs $15 to create a customized loan payment schedule that reflects the impact of different possible changes to variables affecting the cost of your loan payments.

If a mortgage loan payment is late, what is the late fee?

The amount charged for late payments is usually between 2-5% of the payment amount due.

If I forget my password, what are my options?

Head over to the Your Loan Servicing Centreyourmortgageonline.com and press the Forgot Password? link that is located beneath the login box. Type in your username and press Submit. You will receive an email with a link allowing you to reset your password.

What should I do if I forget my username?

Navigate to the Your Loan Servicing Centreyourmortgageonline.com and press the Forgot Username? link located beneath the login box. Type in your email and press Submit. You will receive an email with a link permitting you to get your username.

You May Like: Requirements For Mortgage Approval

Pay Your Mortgage Online By Registering Your Amerisave Account

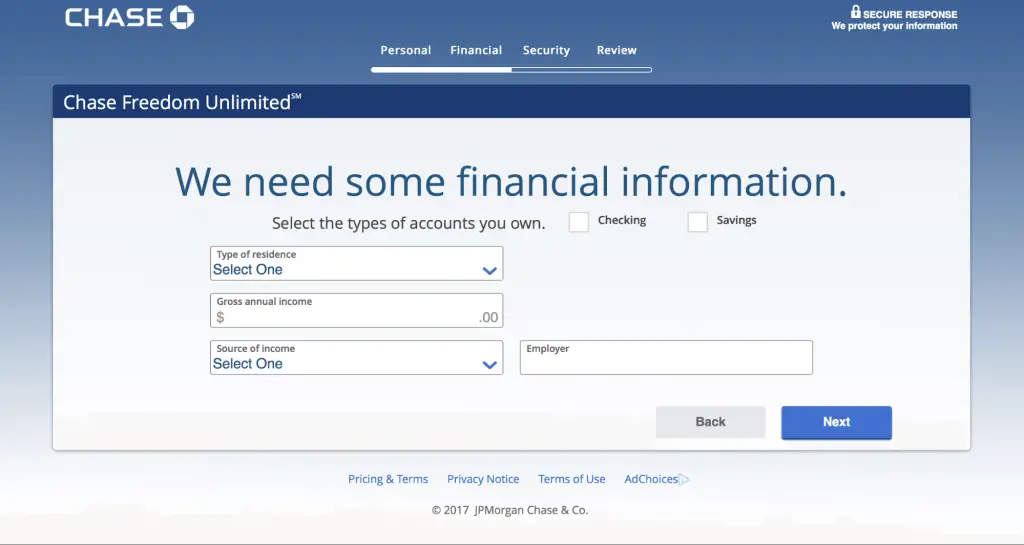

If you wish to pay your AmeriSave mortgage over the Internet, go to the AmeriSave Loan Servicing Center and register your account by doing the following:

- Type in your Loan Number.

- Enter the final four digits of your SSN or TIN.

- Enter the Zip Code of your property.

- Accept the Privacy Policy and the Terms of Use. Select Next.

- Type in your Username on the next page.

- Type in your Email Address and then confirm it.

- Enter your Password and then confirm it.

- Select Submit.

- After completing the aforementioned steps, you will receive a confirmation email that includes a link to finalize the registration. Click on this link.

Any time you wish to access your online portal, you will need to enter your username and password.

When Does It Make Sense To Charge Your Mortgage To A Credit Card

If the timing is such that you can’t mail in your monthly payment then it can be worth the cost of a convenience fee to avoid making a late payment, as late payments will show up on your credit report and have a significantly negative effect on your credit score. Another scenario where it can make sense is if the value of any credit card rewards in the form of cash back, points or airline miles is greater than the cost of the transaction convenience fee.

Don’t Miss: Mortgage Rates Based On 10 Year Treasury

If I Am Closing On My House Or Have Requested A Payoff Statement Do I Still Need To Make My Payment This Month

Yes. It is important that you continue to submit your monthly payment as you normally would.

If your payment is submitted using our Electronic Funds Transfer program, notify us at least 10 days in advance of the next scheduled draft so your EFT can be canceled. Should the payment be deducted from your bank account after your loan is paid in full, we will return it to you within two weeks. You may also go to PNC Online Banking to log-in to your secured account and cancel your existing EFT payment.

Automatic Payments Made By Ach

To schedule a recurring monthly payment from an account held at KeyBank or another U.S. bank or financial institution, complete and submit our ACH form. You select the date you want your payment withdrawn monthly, so youll know your payments are made on time. Remember, if that date happens to fall on a weekend or federal holiday, your payment will be processed the next business day.

ACH activation usually takes five business days after we receive your completed form, so continue to make your payments with another method until you receive written confirmation of your enrollment in ACH from KeyBank Mortgage.

If your mortgage servicing was transferred to KeyBank and you were already using ACH for payments, you dont need to complete a new form your payments will remain uninterrupted.

Recommended Reading: Reverse Mortgage Manufactured Home

How Does Amerisave Work

If you want to apply for a mortgage loan with AmeriSave or to check out mortgage options offered by AmeriSave, go to the companys website www.amerisave.com and complete the steps that follow:

Yourmortgageonlinecom: Dovenmuehle Mortgage Payment Options

Dovenmuehle Mortgage, an American mortgage subservicing business, services loans at the behest of banks, mortgage banking entities, credit unions, and housing finance agencies at the state and local levels across the country. The Lake Zurich, Illinois-based company, which started up in 1844, has a portfolio of 250+ financial institutions as well as thousands of mortgage loans.

A great many lenders retain Dovenmuehle to handle payment collections. Dovenmuehle not only collects payment on behalf of its clients but also contacts borrowers in loan default matters.

Don’t Miss: Chase Recast

Already Made A Payment

I Paid RoundPoint Mortgage Servicing Corporation

Via RoundPoint Online or Phone: If you submitted a payment to us online or by phone, please allow 1 business day for the amount to reflect on your account. Please note: It could take up to 3 business days for the funds to be withdrawn from your bank account.Via Check: If you mailed a payment to us, please allow 710 days to account for mailing and receipt. If the payment has not been posted after that time, please confirm the payment was cleared with your financial institution. If the check has been cleared, please be prepared to share that record when you reach out to us.Via Bill Payment Service: If you submitted a payment to us using a third-party bill payment service, the payment may have been withdrawn from your bank account before being paid to us. You can contact the bill payment service to find out the status of the payment to help us locate the funds.

I Paid My Previous Servicer

If you submitted a payment to your prior servicer, but your loan has been transferred to us, the payment will be forwarded to us within 60 days of the transfer date. Please allow 710 days to account for mailing and receipt. If the payment has not been posted after that time, please confirm the payment was cleared with your financial institution. If the check has been cleared, please be prepared to share that record when you reach out to us. Instructions on where to send future payments can be found here.

Pay Phh Mortgage Online Through Prism App

You can also use Prisms mobile app to pay your PHH mortgage online. This app is in no way affiliated with PHH mortgage. The Prism app is solely curated to pay bills and get transactions done online. You can download the app and use it to make your PHH mortgage payments online too. It is pretty easy to use and can help you get your job done in no time.

Also Check: Does Rocket Mortgage Service Their Own Loans

Other Methods For Payment Of Phh Mortgage

There are also a lot of times when you might be in the need of a PHH mortgage payment mailing address. For all those people who do not want to go through the virtual world and want to get their task done themselves, they can opt for the mailing method.

Sending your PHH mortgage through the mailing system can be safe and foolproof. What we advise you is that you try to send it a few days ahead if you plan on mailing it. This way, it will reach the mailing address on time and you wont have to worry about any late fees. Dont wait until the last day to send in your payment if you intend on sending it through the mailing system. You can use the following mailing address to send in your payment.

P.O. Box 5452

What Are The Downsides Of Using A Card To Pay Your Mortgage

The cost of the convenience fee is probably the biggest downside of using a credit card to pay your mortgage but another, often overlooked, issue is that it can dramatically increase your credit utilization level. Depending on your credit limit credit utilization can go up over 30% for many cardholders, a level below which credit scores tend to be optimized. As credit utilization grows credit scores can decrease accordingly.

Also Check: Does Prequalifying For A Mortgage Affect Your Credit

Choose Accelerated Weekly Or Accelerated Biweekly Payments

If you switch to an accelerated weekly payment schedule, you’ll increase your mortgage payments from 12 to 52 payments annually a payment every week instead of monthly, and one extra monthly payment every year.

If you switch to an accelerated biweekly payment schedule, youll increase your mortgage payments from 12 to 26 annually a payment every 2 weeks instead of monthly, and one extra monthly payment every year.

Make Multiple Payments Per Month

Enroll in our Flexible Payment plan using the link below. If your chosen payment date falls on a weekend or holiday, your payment will be applied the next business day. Please make sure your account has the available funds the day before your scheduled payment date.

Please note that the starting draft date you select must allow for the full monthly payment to be collected by the end of the next grace period. As an example, if your payment is due on the 1st of the month and your grace period ends on the 15th of the month, your full mortgage payment for that month must be received by the 15th.

You May Like: Can You Do A Reverse Mortgage On A Condo