Who Is Responsible For Quality Control

The short answer is: You are. Some lenders will say, My investors perform quality control. Or, My correspondent bank performs quality control. Thats true, but it does not alleviate the financial institution that originated the loan from performing QC on their files.

If you choose to outsource your quality control, you are still responsible for validating that the person or company performing your QC has the appropriate qualifications and experience and is completing the review within the required timeframes.

S To Take If Your Mortgage Loan Is Denied In Underwriting

Before we dive into the steps you should take if your loan is denied in underwriting, its important to understand the difference between a mortgage preapproval and underwriting approval. Preapproval is based on a lenders preliminary review of your loan application, credit and initial documents you provide. In most cases, you wont make it to the underwriting stage if your credit history, income or down payment funds dont meet the mortgage programs basic guidelines.

The mortgage underwriting process entails a deeper dive into all the details of your credit, income and saving history, as well as a detailed look at the home youre purchasing. If your loan is denied, take the following six steps before you give up on your home purchase:

How Easy Is It To Transition To Metasource

Transitioning from another QC company or from an internal system is simple.

All we need is a short questionnaire and agreement from you, and we can get you started. After you send us your closed loan list, well send you the list of loans selected for audit and the instructions to submit your files. It takes just a few minutes to set up your web folder, and then you can just drag and drop selected files into our system. If you already use a paperless document management system, we can retrieve the files directly from the system.

Also Check: What Does Gmfs Mortgage Stand For

Conditional Approval Loan Approved In Principle

Expected duration: 3-5 days

Now its time to sit back and wait for the bank to assess your home loan application.

It usually takes between 3 to 5 days for your home loan application to progress through the queue, be picked up by a credit officer and then receive conditional approval.

It will take longer if the information is missing, so this is why we take a little bit more time in Step #2 to make sure we have all the information up front.

How Wipfli Can Help

Wipfli offers secondary market quality control services. When you outsource with Wipfli, you get the benefit of knowing your QC is completely independent and that everyone doing the QC has the necessary underwriting background and knowledge to do that work.

If you prefer to keep the QC process in house, we can assist your internal staff with development of your policy and testing procedures to help them become more proficient, and ensure they are consistent with investor guidelines. We can also help you stay current on best practices in secondary market quality control, so you can proactively make procedural changes to your QC program.

Contact us to get started, or continue reading on:

You May Like: Requirements For Mortgage Approval

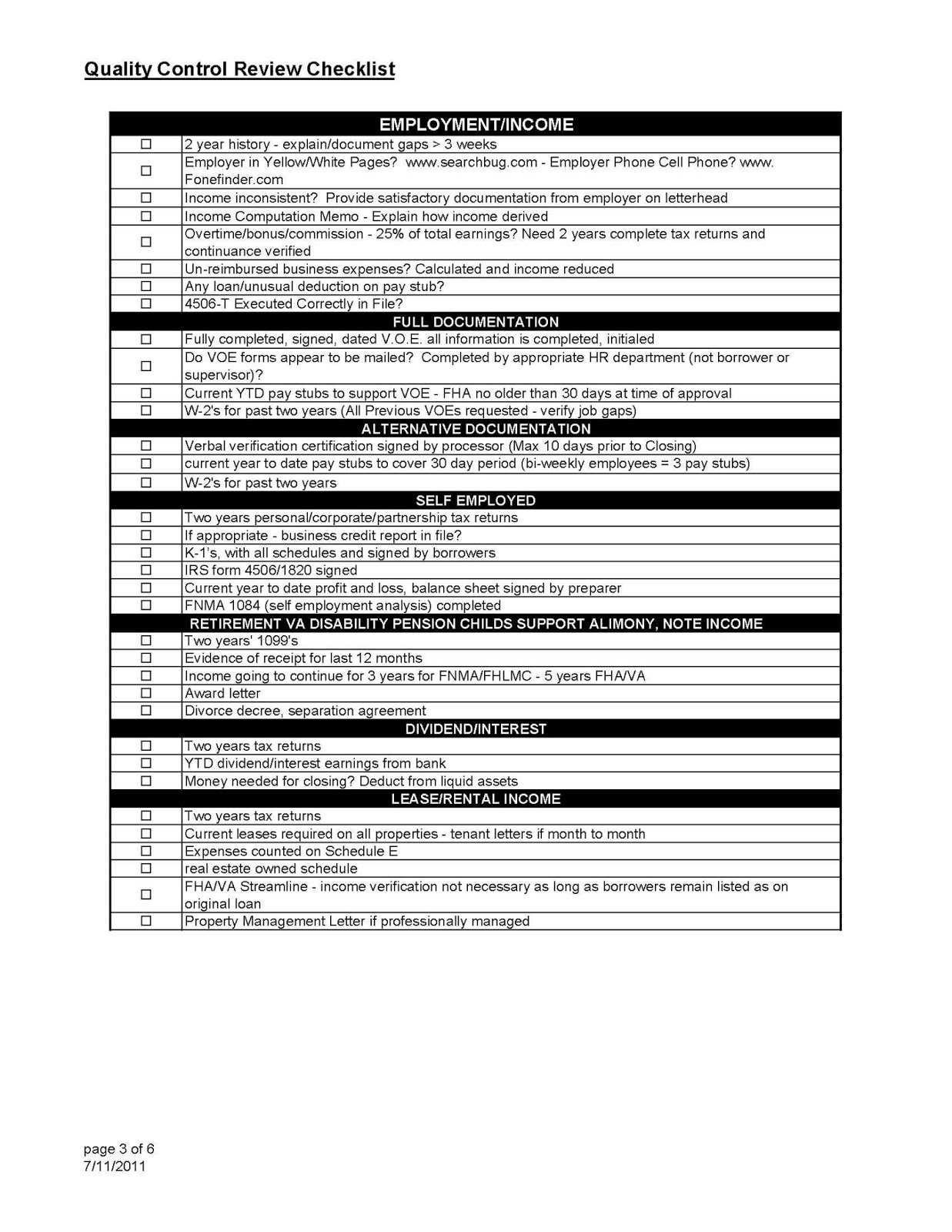

Loan Application: Common Errors And Red Flags

Figure 1

Maintain data integrity by completing all fields on the 1003 form. Details should be cross-checked against title documents. In figure 1 above, we see the application is missing the zip code and a legal description of the subject property. This can make it difficult to verify the information against the title documents.

For refinanced loans, be specific about the purpose of the refinance. Tell the story of what the loan applicant is doing .

Figure 2

In figure 2 we note that marital status is not completed. This information is important for issues like title theft, spousal acknowledgment of a mortgage, or spousal support obligations.

Number of years at the present address is also blank, although from figure 1 we can see that the mortgage loan was first acquired in 2019. The instructions say that if the applicant has lived at their present address for less than two years, a former address is required.

In addition, the address of the employer is missing, so the reviewer will be unable to reconcile the data on the 1003 to the VOE.

Figure 3

In the written VOE , we noted that the applicants employer reported past year earnings of $54,170, of which $1,500 was overtime and $4,750 was bonus. The VOE also indicated that overtime was not likely to continue.

Also in figure 3, we see a simple human error in which hazard insurance and real estate taxes have accidentally been dropped from the proposed housing expense.

Figure 4

Figure 5

Who We Are And What Makes Us An Expert

This blog is brought to you by Expert Mortgage Assistance. We are a specialized provider of back-office support services to mortgage companies and lenders based in the US. Mortgage quality control service is one of the services we specialize in. To know more about our services get in touch with our experts now.

Also Check: Rocket Mortgage Qualifications

How You Can Complete The Quality Quality Control Practices Templates Form On The Web:

By using SignNow’s complete platform, you’re able to carry out any required edits to Quality Quality control mortgages form, create your personalized electronic signature in a couple fast actions, and streamline your workflow without the need of leaving your browser.

Create this form in 5 minutes or less

Respond To All Lender Requests Quickly And Provide Complete Documentation

Its a good idea to respond quickly if the lender asks you to sign disclosures, return requested documentation or acknowledge time-sensitive documents like the Closing Disclosure so that mandatory waiting periods can begin. This will require some extra diligence on your part, but the effort pays off once the loan is disbursed.

Recommended Reading: 10 Year Treasury Vs 30 Year Mortgage

What Is A Conditional Mortgage Loan Approval

Mortgage Conditions can be things that need to be reviewed and checked off by underwriters in order for the issuance of clear to close.

Examples of conditions are the following:

- title

- other items that may need verification on what the mortgage loan applicant has listed on the mortgage application

Once borrowers submit all the conditions, the processor prepares the file for clear to close. Underwriter checks off all of the items received to see if they can issue a clear to close. Most mortgage companies will have the underwriter issue a clear to close. However, there are some lenders where the file that has been underwritten by a mortgage underwriter needs to go through the companys Quality Control Desk prior for the original underwriter to be able to issue a CTC.

One Trick To Keep Your Mortgage Options Open

If you want to fix your mortgage rate but are unsure whether to do it now or later, you could hedge your bets by getting a mortgage offer in place now and not completing for, say, 6 months. That way you have a good fixed-rate deal ready to go and can still take advantage of your current low flexible rate for a few more months. Obviously, you must bear in mind that you will likely incur non-refundable valuation charges, whether or not you actually decide to complete in the end, and the lender could technically withdraw their offer before you accept. But these are risks that you would face even if you fixed now.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers – Habito, Vouchedfor

Read Also: 10 Year Treasury Yield Mortgage Rates

Some Advantages Of Qa/qc Services Check Now Save Money Later

Rather than developing a top-end QA/QC program from the ground up, most of the innovative players in mortgage loan processing choose to onboard a highly trained, experienced, and professional team of specialists. Outsourcing a qualified QA/QC staff is a smart move for all of the reasons you might have already guessed.

- Well-trained professionals

- No additional duties for existing staff

- Reduces overhead

- No vacation expenses

Importance of Mortgage Quality Assurance & Quality Control Why Wait?

While many things can make a mortgage broker or lender rise to the top of the field in a marketplace, there are two things that you must do, or you’ll never get there! Be Fast and Be Accurate. An established Quality Assurance & Control team can help you make that happen. Don’t wait for the competition to get there first!

Once All That Is Done

You can sit back and wait for settlement.

The bank or your solicitor will take over from here so you can chill and wait to hear from your Mortgage Broker who will confirm the exact date of settlement.

The settlement will go through when your loan has been drawn down, and your Mortgage Broker will let you know as soon as the lender tells us.

Congratulations youve made it through the entire home loan process!

Don’t Miss: Rocket Mortgage Loan Requirements

How To Make An Esignature For The Quality Control Mortgages Form Right From Your Smartphone

Get quality control practices template signed right from your smartphone using these six tips:

The whole procedure can take less than a minute. As a result, you can download the signed your mortgages practices online to your device or share it with other parties involved with a link or by email. Due to its cross-platform nature, signNow works on any device and any OS. Choose our eSignature tool and leave behind the old days with security, efficiency and affordability.

What Makes The Mortgage Closing And Post

With millions of dollars going down the drain after the economy came to a halting stop in 2009, public demand and the general unrest of things made the government sit up and take notice of the lax practices in the mortgage business field prevalent at that time. As a result, mortgage lenders are faced with more stringent lending regulations and paperwork today. The mortgage closing process and the mortgage post-closing process have also seen an increase in scrutiny, thereby necessitating proper documentation of all forms, disclosures, affidavits, sale deed reports, etc. before the transfer of ownership is initiated to the investor or homeowner.

Auditing the closing and post-closing process is therefore extremely important, as unlike before, lenders are extremely apprehensive and judicious in treating this process as part of their profit cycle.

Read Also: Monthly Mortgage On 1 Million

What Is The Timeframe Requirement For Post

HUD & VA require that FHA and VA loans be audited within 90 days of closing. Freddie Mac says that the results of the quality control reviews must be reported in writing to senior management within 90 days of the selection of the files for review.

Fannie Mae requires that the entire post closing quality process be completed within 120 days from the month of loan closing, with the following breakdown: Loans must be selected for audit within 30 days, the quality control review and rebuttal must be completed within 60 days, and the results of the audits must be reported to senior management with in 30 days.

At Culp QC, our method of operation is to provide the lender with a Preliminary Audit Report with in 50 days from the date we receive the selected files for audit. Once we receive the lenders response to the Preliminary Audit Report, we issue the Final QC Audit Report within 60 days from the receipt of the selected files.

Outsource Your Mortgage Closing And Post

At Flatworld Solutions, we believe that an efficient closing and post-closing process not only helps you remain in compliance, but also works for you in many different beneficial ways long after a homeowner has moved in to the new house.

With an in-depth understanding of US and UK mortgage laws combined with our mortgage domain expertise of 18 years, we have catered to the specific needs of retail lenders, investors, wholesale lenders, service providers, and even private mortgage insurance companies. Our clients have nothing but the best to say about our services, as we continuously evolve and streamline our mortgage outsourcing process to deliver better value for our clients.

Contact us right away for any queries you might have about the mortgage closing process, and partner with an experienced service provider who would help you achieve your long-term goals in a short time!

Don’t Miss: 10 Year Treasury Yield And Mortgage Rates

Role Of The Qc Review Mortgage Underwriter

Depending on the mortgage lender, a QC Review Underwriter is often a different underwriter that cross-checks the original underwriters work:

- The QC Underwriter goes through everything the original mortgage underwriter has done to see that there are no errors

- The QC Review underwriter often times will run a soft credit check pull to make sure borrowers have not incurred any additional debt

- Also makes sure there are no fraud alerts issued

- Once QC Review underwriter signs off on the QC Review, it goes back to the original mortgage underwriter for them to sign off on a clear to close

- The QC Review process normally takes 24 to 48 hours

How To Research The Best Mortgage Deals Yourself

Alternatively, if you do want to go it alone the first thing you need to work out is what fixed rate you will get. This will depend on, among other things, the amount you want to borrow compared to the value of your property , your credit rating, your earnings and the type of mortgage you want.

A good starting point is our mortgage calculator , powered by Habito. This can give you an idea of the best and cheapest deals you may be eligible for.

Read Also: Does Rocket Mortgage Service Their Own Loans

Remortgaging In 2022 Is Now The Right Time To Fix & For How Long

This remortgage guide is broken into two parts. First, the short answer which will quickly help you decide whether to fix your mortgage, how long for and secure you the best fixed-rate mortgage deal. The longer answer will explain in detail:

- Why you should consider fixing your mortgage now

- When interest rates are likely to rise

- How long you should fix your mortgage for

- How to find the best fixed-rate mortgage deal

Final Closing & Funding

Youve finally made it its the closing day! After the 3-day period passes, you can sign your documents and send them back to your lender for one final review. Once theyre accepted, the loan will be disbursed, and your new mortgage will be recorded within your local area. Congrats! Youre now officially a new homeowner.Interest rates are a common deterrent for first-time buyers. But dont be deterred. Find out everything you need to know about interest rates from .

Read Also: Rocket Mortgage Launchpad

What Does A Clear To Close Mean

A clear to close is what the main goal is in the mortgage approval process. A clear to close means that the lender is ready to prepare docs and fund the loan. Lenders have different policies on how they issue a clear to close. Many lenders allow mortgage underwriters to issue a clear to close once he or she approves all the conditions. However, other mortgage lenders have a QC Review process after the initial original underwriter signs off on conditions.

Average Closing Time For A Conventional Loan

It takes approximately 47 days to close on a conventional mortgage loan in accordance with Fannie Mae’s qualified lending standards. Conventional refinances are faster and take around 35 days to close on average.

Conventional mortgage loans follow the most traditional path from application through closing and funding. Unlike FHA and VA loans, there typically arent specialized underwriting, appraisal or approval requirements over and above Fannie Mae or Freddie Mac guidelines. Generally speaking, refinances will take significantly less time to close than new purchase loans.

Also Check: How Does Rocket Mortgage Work