Average Mortgage Rates Today

We present the average 30- year, 15- year, and 5/1 ARM rates for all 50 states and the District of Columbia. These current rates update on a weekly basis and vary according to your state of residence.

Our current mortgage rates reflect several assumptions: The most important of these include the loan amount and loan-to-value ratio .

If your mortgage balance is greater than the $200,000 baseline used to find these averages, then your rate will likely be higher as well. For LTV, our mortgage rate averages assume a value of 80%equal to a down payment of 20%.

A lower down payment means a higher LTV, resulting in a rate estimate that’s higher than average.

| Loan Type | |

|---|---|

| 3.76% | 2.38%7.75% |

Rates assume a loan amount of $200,000 and a loan-to-value ratio of 80%. ARM rates apply to the initial fixed-rate period, after which rates can change based on market conditions.

On the other hand, having a lower mortgage balance or larger down payment means that your quoted rates might fall below the average rates of the loan types you request.

Mortgage lenders may also offer lower rates to applicants based on credit scores and debt-to-income ratios .

A higher credit score leads to more favorable loan terms, including a lower interest rate.

DTI is calculated as your total monthly debt payments divided by monthly gross income, so a lower DTI:

- Indicates better financial health

- Reduces the mortgage rates you’ll be offered.

How Does The Federal Reserve Affect Mortgage Rates

Home loans with variable rates likeadjustable-rate mortgages andhome equity line of credit loans are indirectly tied to the federal funds rate. When thefederal funds rates increase, it becomes more expensive for banks to borrow from other banks. The higher costs for the bank can mean a higher interest rate on your mortgage. ARM loans that are in their fixed period are not impacted by this increase. However if you suspect a federal increase is about to happen or it has just happened, you’ll want to move fast if you’re looking to make changes or have yet to lock in a fixed-rate mortgage.

Todays Mortgage Rates And Your Monthly Payment

The rate on your mortgage can make a big difference in how much home you can afford and the size of your monthly payments.

If you bought a $250,000 home and made a 20% down payment $50,000 you would end up with a starting loan balance of $200,000. On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments

- At 4% interest rate = $955 in monthly payments

- At 6% interest rate = $1,199 in monthly payments

- At 8% interest rate = $1,468 in monthly payments

You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay. A home affordability calculator can also give you an estimate of the maximum loan amount you may qualify for based on your income, debt-to-income ratio, mortgage interest rate and other variables.

Other factors that determine how much you’ll pay each month include:

Loan Term:

Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

Fixed vs. ARM:

The mortgage rates on adjustable-rate mortgages reset regularly and monthly payments change with it. With a fixed-rate loan payments remain the same throughout the life of the loan.

Taxes, HOA Fees, Insurance:

Homeowners insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. Check with your real estate agent to get an estimate of these costs.

Recommended Reading: How Does Rocket Mortgage Work

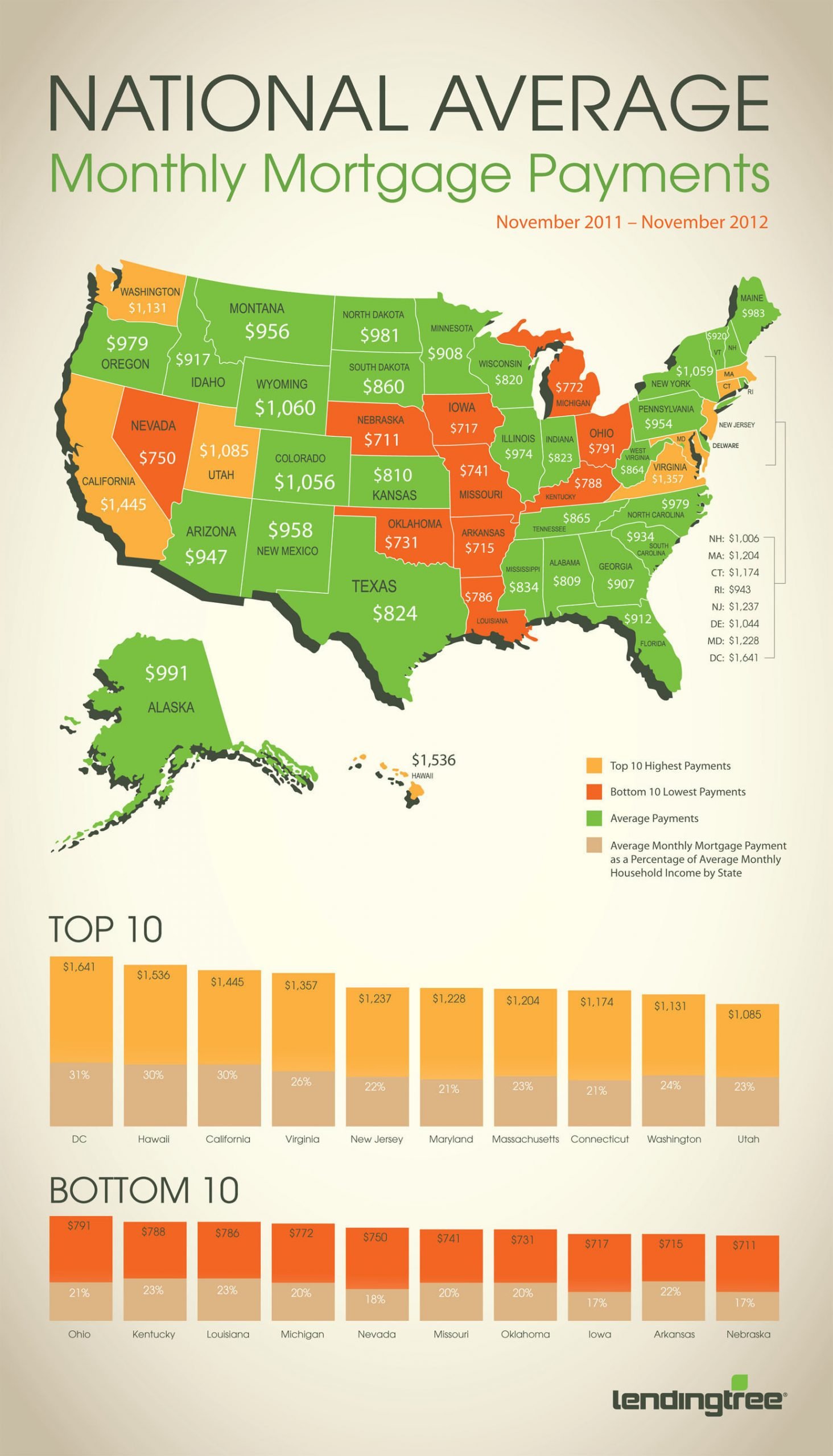

Mortgage Payments By State

While some states have relatively low home values, homes in states like California, Hawaii, and New Jersey have much higher home costs, meaning people pay more for their mortgage each month. Additionally, mortgage interest rates vary by state.

Data from the 2018 American Community Survey shows that homeowners paid a median amount of $1,556 per month. This figure includes a mortgage payment, as well as insurance costs, property taxes, utilities, and HOA fees where necessary.

Here’s how all 50 US states stack up:

| State |

| $1,428 |

Whats The Average Mortgage Payment

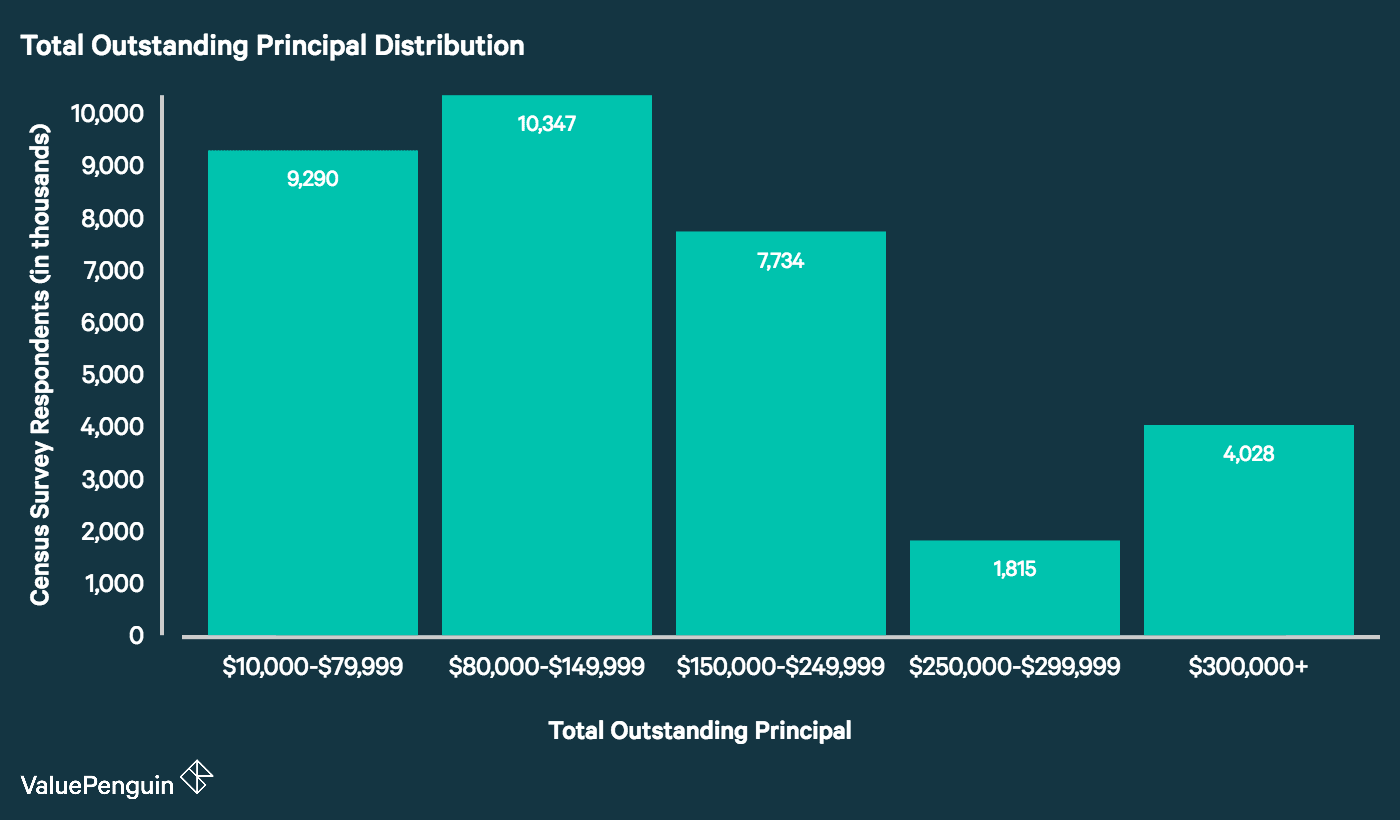

We dont want to waste your time, so lets get down to business. The median monthly mortgage payment is just over $1,600, according to the U.S. Census Bureau.1 That can vary of course, based on the size of the house and where you live, but thats the ballpark number.

If youre the kind of person who doesnt need to know how we came up with the number $1,600, feel free to skip to the next section. But if you want more detailsincluding how to calculate your own average paymentread on!

Also Check: Does Prequalification For Mortgage Affect Credit Score

What Are Origination Fees

An origination fee is what the lender charges the borrower for making the mortgage loan. The fee may include processing the application, underwriting and funding the loan as well as other administrative services. Origination fees generally do not increase unless under certain circumstances, such as if you decide to go with a different type of loan. For example, moving from a conventional to a VA loan. You can find origination fees on the Loan Estimate.

How Much Does 1 Point Lower Your Interest Rate

The exact amount that your interest rate is reduced depends on the lender, the type of loan, and the overall mortgage market. Sometimes you may receive a relatively large reduction in your interest rate for each point paid. Other times, the reduction in interest rate for each point paid may be smaller. Each lender has their own pricing structure, and some lenders may be more or less expensive overall than other lenders – regardless of whether you’re paying points or not. When comparing offers from different lenders, ask for the same amount of points or credits from each lender to see the difference in mortgage rates.

Don’t Miss: Rocket Mortgage Requirements

How To Get A Low Interest Rate On Your Mortgage

Here are some tips for landing a good interest rate on your mortgage:

- Save for a down payment. With a conventional loan, you may be able to put down as little as 3%. But the higher your down payment, the lower your rate will likely be. Rates should stay low for a while, so you probably have time to save more.

- Increase your credit score. Many lenders require a minimum credit score of 620 to receive a mortgage. But the higher your score, the better your rate will be. To improve your credit score, be sure to pay all your bills on time. You can also pay down debts or let your credit age.

- Lower your debt-to-income ratio. Your DTI is the amount you pay toward debts each month, divided by your gross monthly income. Most lenders want to see a DTI of 36% or less, but an even lower DTI can result in a better rate. To improve your DTI, pay down debts or consider opportunities to increase your income.

- Choose a federally backed mortgage. If you’re qualified, you might think about a USDA loan , a VA loan , or an FHA loan . These loans typically come with lower interest rates than conventional mortgages. As a bonus, you won’t need a down payment for USDA or VA loans.

Improving your financial situation and choosing the right type of mortgage for your needs can help you get the best interest rate possible.

Are Mortgage Rates The Same For Every State

No. For instance, Mortgage rates in Orlando Florida are different than mortgage rates in New York. One of the key factors is loan sizes. Lenders make a portion of their yield based on loan sizes. New Yorks median home prices are much higher than of Florida, thus enabling a lender to offer a lower rate in states with higher home prices.

Don’t Miss: How Does 10 Year Treasury Affect Mortgage Rates

How Does Your Credit Score Affect Your Mortgage Rate

One of the most important factors that determines your mortgage rate is your credit score. The lower the credit score, the higher the interest rate. Usually any borrower with a credit score of 740 and higher receives the same rate as someone with a credit score of 800. On the other hand, below 740 credit scores, the lenders typically break up the rate adjustment every 20-point increment. For instance, a borrower with a credit score of 700 will have a higher rate than a borrower with a 720 credit score. This does not mean that a borrower with a 680 credit score cannot get the same rate as a borrower with an 800 score.

How To Get The Best Rate Quotes When Buying A Home

Apply for a mortgage with three different mortgage lenders, brokers or banks and compare their rates by obtaining an official loan estimate on the same exact day since mortgage rates change daily. Pay attention to the adjusted loan origination charges associated with each rate quote and the annual percentage rate to determine which quote gives you the best effective rate.

Also Check: Does Rocket Mortgage Sell Their Loans

Year Mortgage Rates Chart: Where Are Rates Now

Mortgage interest rates fell to record lows in 2020 and 2021 during the Covid pandemic.

Emergency actions by the Federal Reserve helped to push mortgage rates below 3% and keep them low.

But, with the economy in recovery mode, mortgage interest rates have risen since their alltime low in January 2021. And theyre likely to keep rising in 2022.

Find A Mortgage Loan Officer In Florida

Our local mortgage loan officers understand the specifics of the Florida market. Let us help you navigate the home-buying process so you can focus on finding your dream home.

Loan approval is subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts. Interest rate and program terms are subject to change without notice. Mortgage, Home Equity and Credit products are offered through U.S. Bank National Association. Deposit products are offered through U.S. Bank National Association. Member FDIC. Equal Housing Lender

Annual Percentage Rate represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. The APR may be increased after consummation for adjustable-rate mortgage loans.

The rates shown above are the current rates for the purchase of a single-family primary residence based on a 60-day lock period. These rates are not guaranteed and are subject to change. This is not a credit decision or a commitment to lend. Your guaranteed rate will depend on various factors including loan product, loan size, credit profile, property value, geographic location, occupancy and other factors.

VA Loans – Annual Percentage Rate calculation assumes a $179,026 loan with no down payment and borrower-paid finance charges of 0.862% of the base loan amount, plus origination fees if applicable.

year U.S. Bank

You May Like: Does Prequalifying For A Mortgage Affect Your Credit

Amerisave Mortgage Corporation: Best For Refinancing

AmeriSave Mortgage Corporation is an online mortgage lender, available in every state except New York, offering an array of loan products. Along with conventional loans and refinancing, the lender also offers government loans, and is one of Bankrates best FHA lenders in 2021.

Strengths: Like other online mortgage lenders, AmeriSave Mortgage Corporation has some of the most competitive rates out there, and about half of consumers have had their loans closed in 25 days. The lender also doesnt charge a separate origination fee.

Weaknesses: Youll still need to pay a flat $500 fee.

> > Read Bankrate’s full AmeriSave Mortgage Corporation review

Costs To Expect When Buying A Home In Florida

One of the costs that youll likely incur during the home-buying process is paying for a home inspection. While technically not mandatory, its a crucial step before the final OK on a real estate contract. The burden of discovering any home defects usually lies on the homebuyer, even with an extensive sellers disclosure. It makes sense: Youll be living in the home, so its your responsibility to ensure that you know as much as you can prior to buying the home.

Inspections tend to range from $250 to $375 in Florida, depending on the company you choose and the size of the home to be inspected. If you wish to add popular additions such as termite, mold, radon or wind mitigation, you can usually arrange it through your primary home inspector, if he or she offers the service. While not usually required, its helpful for any homeowners with allergies or other concerns to know the full scope of the property prior to closing on the home.

Some of the largest upfront fees in the home-buying process are during the closing process. Closing costs account for a number of mortgage lender fees , title company fees, and a number of other administrative charges that are collected by various entities. These fees will vary depending on lender and the location of the property youve purchased.

Don’t Miss: How Much Is Mortgage On 1 Million

Home Loan Program Options

FL banks, mortgage bankers, brokers, credit unions and lenders offer purchase and refinancing for conventional, jumbo, FHA, VA, Home Equity, HELOC and USDA loans. Which loan program fits your financing needs? Which type lender may be best suited to help you secure the lowest rates and quick processing for a fast closing?

For example, each of these borrowers and their situations may call for a different kind of loan, with different mortgage rates. Florida borrowers might choose the following options depending on their desired financing goals:

- Qualifying veterans and those currently serving in the military will find great deals with VA loans, which require no money down up to a generous limit. VA mortgage rates in Florida and elsewhere are competitive with conventional loans as well.

Why Is My Mortgage Rate Higher Than Average

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan term, interest rate types , down payment size, home location and the loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Don’t Miss: Chase Recast

Florida Jumbo Loan Rates

Across the U.S., the conforming loan limit is generally $548,250. Home loans in excess of the countys limit are considered non-conforming or more commonly, jumbo loans. They cant be sold by your lender to government mortgage corporations Fannie Mae and Freddie Mac. That, plus the fact that theyre larger loans, means jumbo loans are more risky for lenders to take on and therefore come with higher interest rates.

Certain areas are more expensive than average, however. In those places, the conforming loan limit is higher than $548,250, which means you can get a bigger loan without being bumped into the jumbo loan category. As of 2021, only one Florida county has a conforming loan limit above $548,250: Monroe County, with a limit of $608,350.

The average Florida 30-year fixed jumbo loan rate is 2.66% .

What Is The Difference Between Mortgage Rate And Annual Percentage Rate

Your mortgage rates is used to determine your principal and interest payment. Your annual percentage rate is the true cost of the loan once you consider the origination charges and PMI factors associated with your home loan. The higher the origination charges for a mortgage rate and the higher the pmi factor, the higher the APR on a mortgage. Therefore, whenever your see a rate advertised you will also see an APR next to the rate. When comparing different loans its important to compare the APR as well.

Don’t Miss: 10 Year Treasury Vs Mortgage Rates

What Is A Mortgage Point

Some lenders may use the word “points” to refer to any upfront fee that is calculated as a percentage of your loan amount. Point is a term that mortgage lenders have used for many years and while some points may lower your interest rate, not all points impact your rate. Mortgage points can be found on the Loan Estimate that the lender provides after you apply for a mortgage.

Interfirst Mortgage Company Best For Refinancing

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] Mortgage Rates & Payments by Decade [INFOGRAPHIC]](https://www.mortgageinfoguide.com/wp-content/uploads/mortgage-rates-payments-by-decade-infographic-tami.png)

If youre looking to refinance your mortgage in The Sunshine State, Chicago-based Interfirst Mortgage Company could be a worthwhile candidate to consider. Since it doesnt charge any lender fees, your transaction will be cheaper overall. Youll also be able to take advantage of the convenience of e-signing your documents a key point of differentiation during the pandemic.

Strengths: Doesnt charge lender fees A+ rating from the Better Business Bureau

Weaknesses: Doesnt advertise rates online requires a minimum down payment of 15 percent

Read Bankrate’s Interfirst Mortgage Company review

Read Also: Chase Mortgage Recast

Today’s Mortgage Rates In Florida

| Product |

|---|

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Not sure how much you can afford? Try our home affordability calculator.

Total Monthly Payment

Based on a $350,000 mortgage

Based on a $350,000 mortgage

| Remaining Mortgage Balance |

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Not sure how much you can afford? Try our home affordability calculator.