Can I Refinance A Mortgage With A Bad Debt

Yes, you may be able to. The same rules generally apply if youre taking out a new mortgage or refinancing an existing one.

If your debt-to-income ratio has risen significantly since you took out your mortgage, refinancing with the same provider might be difficult, though it all depends on how flexible theyre willing to be.

It is, however, possible to remortgage with a new lender, as you may be a better fit for their affordability and eligibility criteria.

If you have previously remortgaged to consolidate debts then youll be subject to extra scrutiny from underwriters and they may apply a lower debt-to-income threshold.

Make an enquiry and the advisors we work with can talk you through your options and search the whole market to find the best deals.

What Is The Maximum Debt

On the low end, lenders prefer a maximum 36% debt-to-income ratio, but some lenders will go as high as 43%. These are just guidelines set by the government agencies investing or backing the loans. Each lender can make its own decision on a case-by-case basis, allowing them to accept higher DTI ratios if borrowers have compensating factors, such as a high credit score or a large amount of savings on hand.

In the United States, many lenders mandate a maximum 43% debt ratio because thats the highest ratio allowed for a loan to be considered a Qualified Mortgage. A QM is a loan the lender did its due diligence on to ensure you could easily afford it and wont be subject to financial distress.

In Canada, some lenders can accept DTI ratios up to 44%, which is the highest debt ratio allowed for CMHCs Homeowner Mortgage Loan Insurance. This insurance is what allows borrowers to secure financing with less than a 20% down payment.

Whether youre in the US or Canada, the debt-to-income ratio requirements will vary based on your other qualifying factors including the amount of money you put down on the home and your credit score. For example, Fannie Mae allows a DTI ratio up to 45% if you have at least a 660 credit score and 25% or higher for a down payment. In short, the better your other factors are, the higher the DTI ratio a lender can accept.

What Is The Maximum Debt To Income Ratio For A Conventional Mortgage

Conventional loan debt-to-income ratios

loan

Then, what is the maximum debt to income ratio for a mortgage?

The maximum debt-to-income ratio will vary by mortgage lender, loan program, and investor, but the number generally ranges between 40-50%. Update: Thanks to the new Qualified Mortgage rule, most mortgages have a maximum back-end DTI ratio of 43%.

Additionally, what is an acceptable debt to income ratio? Most lenders do not have maximum debt-to-income ratios per se, but rather guidelines that offer some flexibility. In general, lenders want to see monthly housing debt of no more than 28% to 33% of your income and total debt of no more than 38% of your income.

People also ask, can I get a mortgage with high debt to income ratio?

There are ways to get approved for a mortgage, even with a high debt-to-income ratio: Try a more forgiving program, such as an FHA, USDA, or VA loan. Restructure your debts to lower your interest rates and payments. Lenders usually drop that payment from your ratios at this point.

What credit score do you need for a conventional loan?

620-640

Don’t Miss: Can You Get A Reverse Mortgage On A Mobile Home

Put Another Person On The Loan

If youre buying a home with your spouse or partner, your mortgage lender will calculate your DTI using both of your incomes and debts. If your partner has a low DTI, you can lower your total household DTI by adding them to the loan.

However, if your partners DTI is comparable to or higher than yours, then adding them to the loan may not help your situation.

Conventional Loan Lending Guidelines

Conventional loan programs have higher credit standards than FHA insured mortgage programs:

- To qualify for a 3.5% down payment FHA insured mortgage loan, the minimum credit score required is 580

- However, to qualify for a conventional loan, the loan applicant needs a minimum credit score of at least a 620

- However, a 620 credit score is normally considered a poor credit score for a conventional loan

- Those with a low credit score will most likely pay a much higher mortgage rate on a conventional loan

- With FHA loans, as long as borrowers have a 640 or higher credit score, borrowers will most likely get the best FHA mortgage rate

- For a conventional loan applicant to get the best available conventional mortgage rate, they would need a credit score higher than 740

Due to the government guarantee, lenders have less risk with FHA and VA Loans. Lenders are able to offer lower mortgage rates on government loans.

Don’t Miss: How Does 10 Year Treasury Affect Mortgage Rates

How Does Our Income

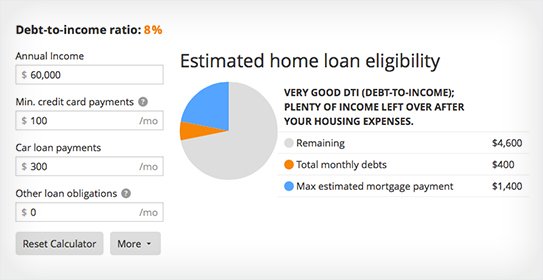

To calculate your DTI ratio using our income-debt ratio calculator, enter the following information:

Annual gross income: Enter your annual gross income the total amount you earn per year before taxes and deductions are taken out. If you dont know what your annual income is, estimate it based on your average monthly income.

Minimum monthly credit card payment: This is the amount on your credit card bills you must pay, at a minimum, each month.

Auto loan payment: Include your auto payment for a leased or purchased vehicle, along with any monthly payments toward a spouse or another family members vehicle.

Other loan obligations: Also include any other loan obligations you may have, such as student loans, personal loans, home equity loans, and other debts that appear on your credit report.

After inputting these numbers, our calculator will show you how much money you have left over each month after paying your total monthly debts and your estimated maximum mortgage payment.

The more money you have remaining after paying your existing monthly debts, the more you can afford in a monthly mortgage payment. However, its important not to overextend your housing budget. Consider the other costs of homeownership homeowners association dues, maintenance, repairs, and future improvements when figuring out a comfortable monthly housing payment.

Max Dti Ratio For Fha Loans

- General guideline is max ratios of 31/43

- Though it can potentially be much higher

- Based on the findings from an automated underwrite

- Potentially as high as 55%

The max DTI for FHA loans depends on both the lender and if its automatically or manually underwritten. Some lenders will allow whatever the AUS allows, though some lenders have overlays that limit the DTI to a certain number, say 55%.

These limits can also be reduced if your credit score is below a certain threshold, such as below 620, a key credit score cutoff.

For manually underwritten loans, the max debt ratios are 31/43. However, for borrowers who qualify under the FHAs Energy Efficient Homes , stretch ratios of 33/45 are used.

These limits can be even higher if the borrower has compensating factors, such as a large down payment, accumulated savings, solid credit history, potential for increased earnings, a minimal housing expense increase , and so on. Yet another reason to build credit and save up money before applying for a mortgage!

To sum it up, if you can prove to the lender that youre a stronger borrower than your high DTI ratio lets on, you might be able to get away with it. Just note that this risk appetite will vary by mortgage lender.

Also note that mortgage insurance premiums are included in these figures.

Read Also: Does Rocket Mortgage Service Their Own Loans

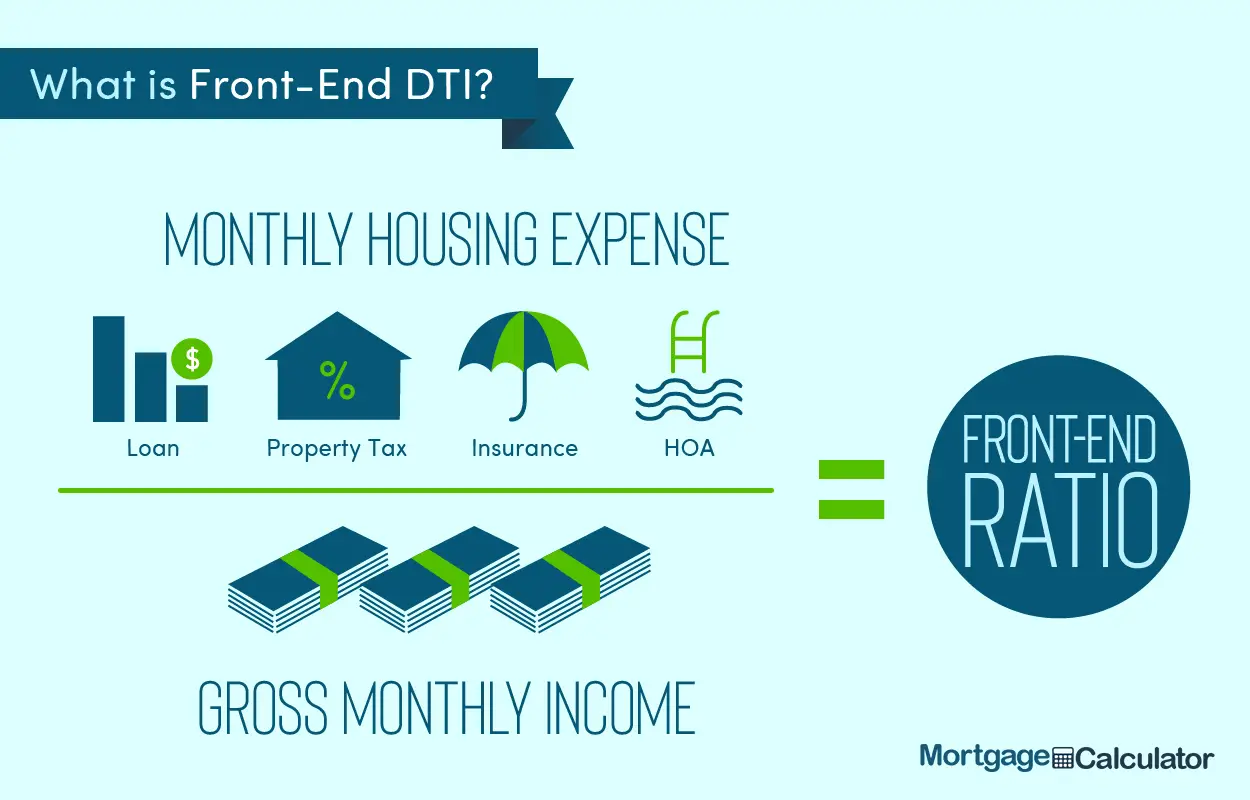

Front End And Back End Ratios

Lenders often divide the information that comprises a debt-to-income ratio into separate categories called front-end ratio and back-end ratio, before making a final decision on whether to extend a mortgage loan.

The front-end ratio only considers debt directly related to a mortgage payment. It is calculated by adding the mortgage payment, homeowners insurance, real estate taxes and homeowners association fees and dividing that by the monthly income.

For example: If monthly mortgage payment, insurance, taxes and fees equals $2,000 and monthly income equals $6,000, the front-end ratio would be 30% .

Lenders would like to see the front-end ratio of 28% or less for conventional loans and 31% or less for Federal Housing Association loans. The higher the percentage, the more risk the lender is taking, and the more likely a higher-interest rate would be applied, if the loan were granted.

Back-end ratios are the same thing as debt-to-income ratio, meaning they include all debt related to mortgage payment, plus ongoing monthly debts such as credit cards, auto loans, student loans, child support payments, etc.

Guidelines For An Affordable Mortgage

Everybody wants an affordable mortgage that leaves them enough money each month to enjoy life to the fullest while paying off their home.

The following tips will help you acquire an affordable mortgage:

1. Keep Monthly Costs Below 42% of Your Income: Keep all credit cards, loans, home insurance costs, bank obligations, mortgage principal, and interest lower than 42% of your gross income.

2. Understand the Benefits of 5% Down Payments: If you have 5% to put down on a property, some lenders will give you mortgages with no closing costs. However, you must make sure you can truly afford this deposit. First-time homebuyers who cant afford a large down payment but would otherwise qualify for a home loan may be eligible for a 3% down payment mortgage.

3. Plan Ahead for Future Maintenance: Consider monthly maintenance costs and factor these into your budget.

4. Dont Be Greedy: Loan approvals arent always perfect for your circumstances. Weigh your financial situation before agreeing to something that you cant afford.

5. Factor in all Expenses: Remember to work out moving expenses, home inspections, appraisal fees, utilities, furniture, and temporary storage.

Buying a new home is an exciting process. However, you must do the math and figure out what percentage of income will be saved for your mortgage while still living comfortably. Luckily, we can help. If youre buying a new home, we can help get you pre-approved and funded for a super-fast loan.

Don’t Miss: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Figure Out Where You Spend Your Money

Track your spending for a week or two. In addition to making you more mindful of your spending, expense tracking will help you identify all the splurges that accumulate too much outflow.

Identify places where you can cut back , because youll need the extra money to reduce your existing debt payments.

What Is Considered A Good Debt

Lenders consider different ratios, depending on the size, purpose, and type of loan. Your particular ratio in addition to your overall monthly income and debt, and credit rating are weighed when you apply for a new credit account. Standards and guidelines vary, most lenders like to see a DTI below 3536% but some mortgage lenders allow up to 4345% DTI, with some FHA-insured loans allowing a 50% DTI. For more on Wells Fargos debt-to-income standards, learn what your debt ratio means.

Read Also: Reverse Mortgage On Mobile Home

Getting A Loan With High Dti Ratio Faq

What is the highest debt-to-income ratio to qualify for a mortgage?

According to the Consumer Finance Protection Bureau , 43% is often the highest DTI a borrower can have and still get a qualified mortgage. However, depending on the loan program, borrowers can qualify for a mortgage loan with a DTI of up to 50% in some cases.

What is a good debt-to-income ratio?

While lenders and loan programs all have their own DTI requirements typically, a good DTI is 36% or lower.

What happens if my debt-to-income ratio is too high?

Borrowers with a higher DTI will have difficulty getting approved for a home loan. Lenders want to know that you can afford your monthly mortgage payments, and having too much debt can be a sign that you might miss a payment or default on the loan. If youre in this situation, try to pay down or restructure some of your bigger debts before applying for a home loan.

How to lower your debt-to-income ratio

A commonsense approach can help reduce your DTI before beginning the home buying process. Increasing the monthly amount you pay toward existing debt, avoiding new debt, and using less of your available credit can all help lower DTI. Recalculating your DTI ratio each month will help you measure your progress and stay motivated.

Debt-to-income vs credit utilization

What Are Common Debt Ratios

The total debt service ratio is the percentage of gross annual income required to cover all other debts and loans in addition to the cost of servicing the property and the mortgage .

The gross debt service ratio is the percentage of the total of annual mortgage Ratio payment relative to annual household income.

You May Like: Can You Do A Reverse Mortgage On A Condo

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Tips For Getting A Mortgage

- If you cant get a mortgage for the amount you want, you may need to lower your sights for now. But that doesnt mean you cant have that dream home someday. To realize your housing hopes, consider hiring a financial advisor who can help you plan and invest for the future. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- The debt-to-income ratio is just one of several metrics that mortgage lenders consider. They also look at your credit score. If your score is less-than-stellar, you can work on raising it over time. One way is always to pay your bills on time. Another is to make small purchases on your credit card and pay them off right away.

Recommended Reading: Reverse Mortgage Manufactured Home

Real World Example Of The Dti Ratio

Wells Fargo Corporation is one of the largest lenders in the U.S. The bank provides banking and lending products that include mortgages and credit cards to consumers. Below is an outline of their guidelines of the debt-to-income ratios that they consider creditworthy or needs improving.

- 35% or less is generally viewed as favorable, and your debt is manageable. You likely have money remaining after paying monthly bills.

- 36% to 49% means your DTI ratio is adequate, but you have room for improvement. Lenders might ask for other eligibility requirements.

- 50% or higher DTI ratio means you have limited money to save or spend. As a result, you won’t likely have money to handle an unforeseen event and will have limited borrowing options.

What Are Conventional Loans

In order for lenders to be able to sell conventional loans they fund on the secondary market, the loans they originate and fund need to meet Fannie Mae and/or Freddie Mac Guidelines:

- A conventional loan is also known as a conforming loan

- Conventional Loans are also called conforming loans because they need to conform to Fannie Mae and/or Freddie Mac Mortgage Guidelines

- Conforms to the standards, lending guidelines and loan limits set by Fannie Mae and Freddie Mac

- Fannie Mae and Freddie Mac are GSE, which stands for a Government Sponsored Enterprise

- Fannie Mae and Freddie Mac are the two Government Sponsored Enterprises, GSE

Conventional loans that do not meet Fannie Mae and/or Freddie Mac mortgage lending guidelines are known as non-conforming loans.

Recommended Reading: Chase Mortgage Recast Fee

What If You Have A High Dti Ratio

If your DTI is higher than 41%, the above residual income rule may be able to help you. With 20% more in residual income per month, you can qualify for a VA loan even with a higher-than-allowable debt-to-income ratio.

However, if coming up with that extra residual income is not possible, you can also work on improving your DTI instead.

To do this, you would need to either reduce your debts or increase your income. This might entail getting a side gig, having your spouse seek employment, or, if theyre already employed, asking for a raise or more hours.

Searching for a lower-priced home or making a larger down payment can help, too. The less you need to borrow, the smaller your mortgage payment will be. Since your mortgage payment is a big part of your back-end DTI, buying a more affordable home can help lower it, improving your chances of qualifying for the loan.

What Is A Debt

Your debt-to-income ratio is all your monthly debt payments divided by your gross monthly income. This number is one way lenders measure your ability to manage the monthly payments to repay the money you plan to borrow.

To calculate your debt-to-income ratio, you add up all your monthly debt payments and divide them by your gross monthly income. Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out. For example, if you pay $1500 a month for your mortgage and another $100 a month for an auto loan and $400 a month for the rest of your debts, your monthly debt payments are $2,000. If your gross monthly income is $6,000, then your debt-to-income ratio is 33 percent.

Evidence from studies of mortgage loans suggest that borrowers with a higher debt-to-income ratio are more likely to run into trouble making monthly payments. The 43 percent debt-to-income ratio is important because, in most cases, that is the highest ratio a borrower can have and still get a Qualified Mortgage.

There are some exceptions. For instance, a small creditor must consider your debt-to-income ratio, but is allowed to offer a Qualified Mortgage with a debt-to-income ratio higher than 43 percent. In most cases your lender is a small creditor if it had under $2 billion in assets in the last year and it made no more than 500 mortgages in the previous year.

Also Check: Rocket Mortgage Vs Bank