How Much Mortgage Can I Get Approved For With A Poor Credit History +

Your credit score plays a crucial role in the type of mortgage that you will be eligible for. This is because that score is what is used to predict how likely you are to repay your new mortgage loan. Your chances of getting a good mortgage value hinges on how good a credit score you have, so it is important to request a copy of your credit report and credit score about a couple of months before you start making your maximum mortgage calculations.

How To Qualify For An Eidl Loan

Both EIDL and COVID-19 EIDL loans have size requirements. A common standard thats used is a business with 500 employees or fewer. In addition to small businesses, sole proprietors and independent contractors are also eligible to apply for a COVID-19 EIDL loan. EIDL loan applicants must also prove economic injury due to a declared disaster. Applicants for the COVID-19 EIDL must demonstrate economic injury because of the pandemic.

How Much Income Is Needed For A 200k Mortgage +

A $200k mortgage with a 4.5% interest rate over 30 years and a $10k down-payment will require an annual income of $54,729 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a broader range of interest rates.

Don’t Miss: Can You Do A Reverse Mortgage On A Mobile Home

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that will play a role in determining your mortgage rate.

When Do Consumers Choose An Arm

Adjustable-rate mortgages , on the other hand, have interest rates that change depending on market conditions. ARMs usually start with a low introductory rate or teaser period, after which the rate changes annually for the remaining term.

ARMs come in 30-year terms that can be taken as a straight adjustable-rate mortgage with rates that change annually right after the first year. However, borrowers usually take them as a hybrid ARM, which come in 3/1, 5/1, 7/1, and 10/1 terms. For example, if you get a 5/1 ARM, your rate remains fixed for the first 5 years of the loan. After the 5-year introductory period, your rate adjusts every year for the rest of the payment term.

When does taking an ARM make sense? ARMs are usually chosen by consumers who plan to sell their house in a few years or refinance their loan. If you need to move every couple of years because of your career, this type of loan might work for you. ARMs usually have a low introductory rate which allows you to make affordable monthly payments, at least during the teaser period. Before this period ends, you can sell your home, allowing you to avoid higher monthly payments once market rates start to increase.

Recommended Reading: Does Getting Pre Approved Hurt Your Credit

What Kind Of Mortgage Is Right For Me +

The answer to this question is totally dependent on your present situation. To determine what kind of mortgage is right for you, you would need to realistically consider your financial situation. Some important questions you would need to answer include whether you are able to make a down payment, the length of time you would spend in the house, the state of things with your annual salary for the period of the mortgage as well as your credit history.

How Much Can I Afford

How much you can afford to spend on a home in Canada is most determined by how much you can borrow from a mortgage provider. That is, unless you have enough cash to purchase a property outright, which is unlikely. Use the mortgage affordability calculator above to figure out how much you can afford to borrow, based on your current situation.

You May Like: Does Pre Approval For Mortgage Affect Credit

How Can I Qualify To Borrow More

If youre disappointed by the how much can I borrow results, remember that there are many factors at work. Small improvements in one or more can make a substantial difference:

A bigger down payment always helps. The more money you put down, the better youll look in the eyes of the lender.

Be a tactical buyer. If school districts wont play a role in your family for years, consider finding a home in a transitioning neighborhood maybe buying a starter home rather than a forever home. Youll likely get a better home value and wont need to borrow as much.

Reduce debt even a little. Paying off or down a credit card or two can help in several ways. Your debt-to-income ratio will go down and you may even get a nice bump in your credit score.

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Also Check: How Much Is Mortgage On 1 Million

Login And Check Your Sba Portal

We frequently receive reports about EIDL portal changes due to bugs. Sometimes the loan amount is removed, reverts to a previous amount, or another change occurs. Normally these resolve on their own, but it’s recommended that you check your EIDL portal often to keep abreast of your account status. If you find a discrepancy, the faster you report it to your loan officer or customer service, the better.

How Much House Can I Afford With An Fha Loan

are available to homebuyers with credit scores of 500 or more, and can help you get into a home with less money down. If your credit score is below 580, youll need to put down 10 percent of the purchase price. If your score is 580 or higher, you can put down as little as 3.5 percent.

Youll still need to crunch all the other numbers, but these lower downpayment thresholds should be a shot in the arm for your budget.

Don’t Miss: Does Prequalification For Mortgage Affect Credit Score

Being Careless With Credit

A mortgage lender will pull your credit report at preapproval to make sure things check out and again just before closing. Your lender wants to make sure nothing has changed in your financial profile.

How this affects you: Any new loans or credit card accounts on your credit report can jeopardize the closing and final loan approval. Buyers, especially first-timers, often learn this lesson the hard way.

What to do instead: Keep the status quo in your finances from preapproval to closing. Dont open new credit cards, close existing accounts, take out new loans or make large purchases on existing credit accounts in the months leading up to applying for a mortgage through closing day. Pay down your existing balances to below 30 percent of your available credit limit, if you can, and pay your bills on time and in full every month.

How To Use The Maximum Mortgage Calculator

Not sure where to start? Let us help you:

Don’t Miss: Does Chase Allow Mortgage Recast

Estimate How Much House You Can Afford

To help you get started, you can use our calculator on top to estimate the home price, closing costs, and monthly mortgage payments you can afford based on your annual income. For our example, lets suppose you have an annual income of $68,000. Youre looking to get a 30-year fixed-rate loan at 3.25% APR. For your down payment and closing costs, youve saved $55,000. See the results below.

- Annual income: $68,000

| Total Monthly Mortgage Payment | $1,587 |

Based on the table, if you have an annual income of $68,000, you can purchase a house worth $305,193. You may qualify for a loan amount of $252,720, and your total monthly mortgage payment will be $1,587. Since your cash on hand is $55,000, thats less than 20% of the homes price. This means you have to pay for private mortgage insurance . Take note: This is just a rough estimate. The actual loan amount you may qualify for may be lower or higher, depending on your lenders evaluation.

The following table breaks down your total monthly mortgage payments:

| Monthly Payment Breakdown | |

|---|---|

| Total Monthly Mortgage Payment | $1,587 |

According to the table, your principal and interest payment is $1,099.85. When we add property taxes and home insurance, your total monthly mortgage payment will be $1,481.34. But because you must pay PMI, it adds $105.30 to your monthly payment, which results in a total of $1,587 every month.

What Monthly Expenses Do You Have

! Please enter an amount less than }.

Estimate your monthly expenses such as groceries, transportation, child care, insurance, shopping, media and regular contributions to savings.

Please do not include rent or housing expenses.

If you’re buying a home with a spouse, partner, friend or family member, include their monthly expenses as well.

If this amount is higher than your monthly income before taxes, please contact us to discuss your options.

Step 6 of 6

Don’t Miss: What Does Rocket Mortgage Do

Fixating On The House Over The Neighborhood

Sure, you want a home that checks off the items on your wish list and meets your needs. Being nitpicky about a homes cosmetics, however, can be short-sighted if you wind up in a neighborhood you hate, says Alison Bernstein, president and founder of Suburban Jungle, a real estate strategy firm.

Selecting the right town is critical to your life and family development, Bernstein says. The goal is to find you and your brood a place where the culture and values of the match yours. You can always trade up or down for a new home, add a third bathroom or renovate a basement.

How this affects you: You could wind up loving your home but hating your neighborhood.

What to do instead: Settle on what your priorities are in a community, and do your homework. Depending on your needs or preferences, you might want to research school ratings, commute time and other factors. You could visit the neighborhood at different times to get a sense of traffic flow and see if its an area thatd appeal to you.

What Is The Maximum Mortgage Calculator +

Our maximum mortgage calculator helps you calculate the maximum monthly mortgage payment and total mortgage amount you can afford. The calculator also helps you determine the effects of different interest rates and levels of personal income on how much mortgage you can afford. This calculator is for you if you are reviewing your financial stability as you get ready to purchase a property.

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

Should You Rent Or Buy A Home

Having the ability to buy something does not mean that one necessarily should. Owning a home is both a significant commitment and a serious lifestyle choice. Renting a home is a more flexible arrangement than buying. Here are some factors to consider beyond the above financial ratios.

Do you plan on living in the area for an extended period of time? Real estate transactions are typically large, leveraged, high-friction transactions. Between closing costs, real estate commissions & other related fees, many home buyers may spend about eight or nine percent of the home’s price between buying and selling it. If you live in a place for a significant period of time the home appreciation can more than offset any costs, but if you only live there a couple years before moving again it is likely to cost you as the first few years of a loan’s payments go primarily toward interest.

How secure is your source of income? If your job may require you to move then owning a home may harm your career flexibility. If you are in a field with high employee churn then renting may be a better option.

Will you be adding to your family in the near future? If you buy a house & quickly outgrow it, there’s no guarantee that it will be easy to simulaneously sell your current home and buy a larger one.

Calculator: Start By Crunching The Numbers

Begin your budget by figuring out how much you earn each month. Include all revenue streams, from alimony and investment profits to rental earnings.

Next, list your estimated housing costs and your total down payment. Include annual property tax, homeowners insurance costs, estimated mortgage interest rate and the loan terms . The popular choice is 30 years, but some borrowers opt for shorter loan terms.

Lastly, tally up your expenses. This is all the money that goes out on a monthly basis. Be accurate about how much you spend because this is a big factor in how much you can reasonably afford to spend on a house.

Input these numbers into our Home Affordability Calculator to get a clear idea of your homebuying budget.

You May Like: Does Rocket Mortgage Sell Their Loans

How To Calculate Your Eidl Loan Amount

Editors note: Lantern by SoFi seeks to provide content that is objective, independent and accurate. Writers are separate from our business operation and do not receive direct compensation from advertisers or partners. Read more about our Editorial Guidelines and How We Make Money.

After a disaster strikes, your small business may be derailed. But there is some help available. The US Small Business Administration offers emergency loans when your business is impacted by a disaster. The Economic Injury Disaster Loan program provides loans for small businesses impacted by declared disasters. There is also a separate COVID-19 EIDL loan program. For both, the amount you borrow depends on your companys financials as well as the maximum limits associated with each type of loan.

Related: What Is working capital & how do you calculate it?

How To Get An Eidl Increase In 5 Steps

There are only 45 days left until the Small Business Administration’s Covid EIDL program ends. There is still around $100 billion left in EIDL funding, meaning that millions of small businesses can still apply for these incredibly low-interest loans. If you have applied for an EIDL loan but want to increase your loan amount, we have you covered. Here’s how to get an EIDL increase in 5 steps.

Recommended Reading: How Does Rocket Mortgage Work

How Much House Can I Afford

Your house will likely be your biggest purchase, so figuring out how much you can afford is a key step in the home-buying process. The good news is that coming up with a smart budget is pretty straightforward and not too time-consuming especially with the Bankrate Home Affordability Calculator.

Fairway Independent Mortgage Corporation: Best For First

With more than 700 branches, Fairway Independent Mortgage Corporation can offer an in-person experience to both first-time and repeat homebuyers across the U.S.

Strengths: TIf youve never taken out a mortgage before, Fairway has an extensive glossary of mortgage terms you can read up on, several mortgage calculators and a homebuyer guide with a checklist, dos and donts and more. The lender also offers first-time homebuyer-friendly loans, including FHA loans, and a mobile app, FairwayNow, where you can send direct messages and track your loan status.

Weaknesses: Youll have to talk to a loan officer to find out rates and fees these arent available readily on Fairways website.

You May Like: Does Pre Approval For Mortgage Affect Credit

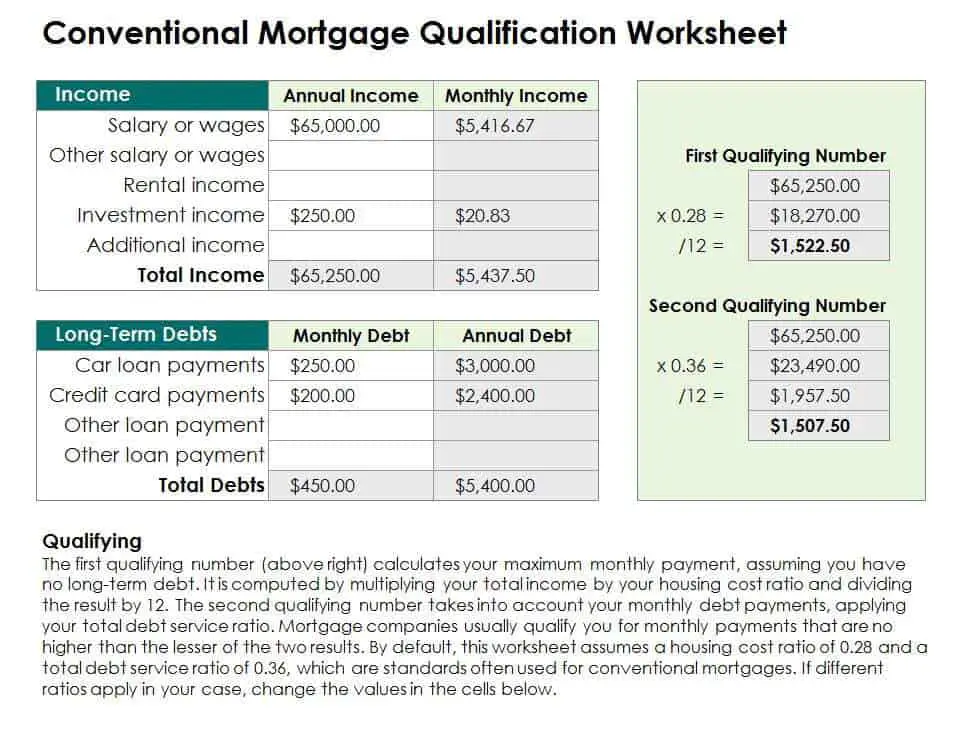

Notes On Using The Mortgage Income Calculator

This calculator provides a standard calculation of the income needed to obtain a mortgage of a certain amount based on common industry guidelines. These guidelines assume that your mortgage payments, including taxes, insurance, association fees and PMI/FHA insurance, should be no greater than 28 percent of your monthly gross income.

- FAQ: These guidelines assume that your mortgage payment and other monthly debt obligations combined should not exceed 36 percent of your monthly gross income.

Those are the base guidelines however, borrowers with excellent credit and healthy financial reserves can often exceed those guidelines, going as high as 41 percent of gross monthly income for mortgage payments and debt obligations combined. You may wish to take that into account when considering your own situation.