The Bottom Line: Mortgage Calculators Can Help You Decide How Much House You Can Afford

Mortgage calculators are great for giving you an estimate of what you might expect when purchasing or refinancing a home. While not an official qualification, the act of using a calculator is a nice starting point.

If youre ready to take the next step and get started, you can do so online with Rocket Mortgage®.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

What Can A Mortgage Calculator Help Me With

Whichever mortgage calculator you use, its objective should always be to help you feel more informed on how to get a mortgage and your budget for buying a home, or to decide whether to move forward with a refinance. It all depends on your lifestyle and personal goals.

Below are some of the questions a mortgage calculator can answer.

Not All Mortgages Require An Escrow Account

Not all banks require you to escrow money for taxes and insurance. Federal Housing Administration loans require an escrow account. This protects the banks investment in your property by making sure that the taxes and insurance get paid.

You can escrow your taxes and insurance even if your lender doesnt require it. This may simplify budgeting for these expenses.

Read Also: How Does Rocket Mortgage Work

What Is An Escrow Cushion

An escrow cushion is an extra amount above your mortgage payments that your lender or servicer is allowed to collect and hold. The cushion amount cant exceed two monthly escrow payments. In some states, a cushion may be limited to a smaller amount.

If your cushion is too large at the time of your yearly escrow analysis, the lender or servicer is required to refund that money, or you can put it toward the loan principal on your mortgage.

Video Result For Mortgage Escrow Payment Calculator

Know this about your monthly mortgage payment and…

Mortgage Escrow Explained Simply

mortgagepaymentmortgageescrowpayment

trendwww.calculator.net

paymentmortgagepaymentmortgage

paymentmortgagepayment

mortgagepaymentpaymentpayment

mortgagepayment

mortgagepaymentpaymentmortgagemortgagemortgagemortgagemortgage

bestwww.mortgagecalculator.org

mortgagemortgagepayment

paymentpayment

mortgagepaymentescrow

trendwww.nerdwallet.com

mortgagepaymentescrow

mortgagepayment

mortgagepaymentpaymentmortgagepaymentmortgage

mortgagepaymentescrowpaymentmortgage

trendsmartasset.com

paymentmortgagemortgagepaymentpayment

mortgagepaymentescrow

Know this about your monthly mortgage payment and…

How Do Mortgage Escrow Accounts Work

Mortgage Calculator Amortization Table – Part 1

Don’t Miss: Monthly Mortgage On 1 Million

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

Recommended Reading: 10 Year Treasury Vs Mortgage Rates

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

What Is Mortgage Escrow

An escrow account, also known in some areas as an impound account, is set up by a mortgage lender to cover the cost of property taxes and homeowners insurance. These expenses are typically billed once or twice per year and the payments can be relatively large. The escrow account allows a homeowner to make monthly deposits for these payments. A portion of each months mortgage payment is deposited into the account so that the correct amount is available when an insurance premium or real estate tax payment is due.

You May Like: Can You Get A Reverse Mortgage On A Mobile Home

Escrow Fraud And Scams

Keeping informed about your escrow account is essential, and not just from a budgeting perspective. Due to the often large amount of money held in escrow, these accounts have become targets for scammers.

The types of scams vary, but one common scheme is duplicating your lenders or servicers website or email communications in an attempt to get your login credentials or have you wire funds to a fraudster. Some scams even set up official-sounding phone numbers as another way to build trust and get you to reveal your login information.

Always carefully review any communications relating to your escrow account, and alert your lender or servicer if you suspect fraudulent activity.

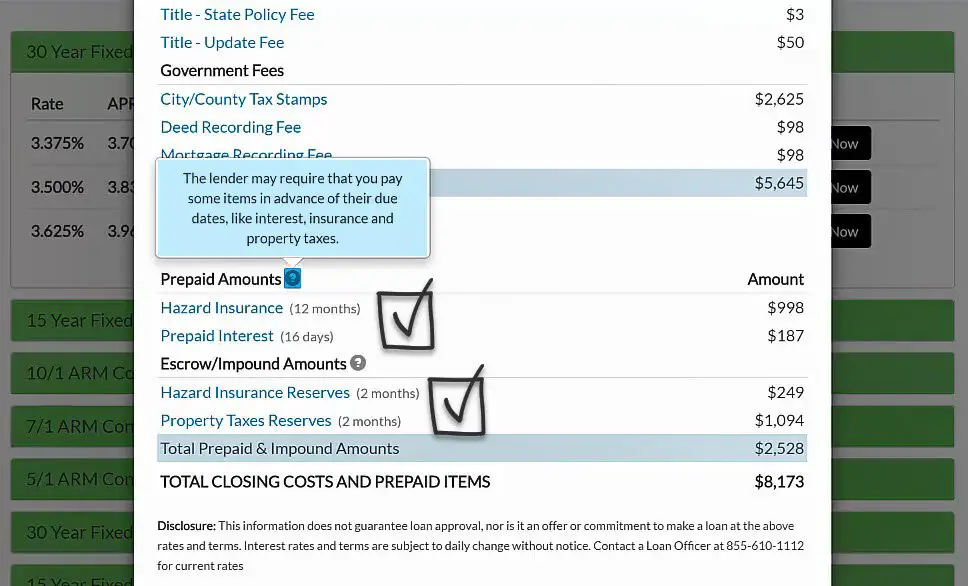

Initial Escrow Payment At Closing

The initial escrow payment is the money you deposit with the lender that the lender will use to pay future homeowners insurance and property taxes. If you set up an escrow account, deposit 2-months of homeowners insurance and 2-months of property taxes when you close.

Initial Escrow Payment = 2-months of homeowners insurance + 2-months property taxes.

In the example, the buyers initial escrow payment is $895.

Don’t Miss: Chase Recast Calculator

Mortgage Calculator With Escrow

- Mortgage calculators are used to help a current or potential real estate owner determine how much they can afford to borrow on a piece of real estate.

- online financial tools available on many sites that allow potential buyers to plug in various personal financial figures to arrive at a mortgage value they can afford.

- Mortgage calculators are a good way to calculate your monthly mortgage repayments. Calculate your mortgage interest to ensure that you are getting the very best mortgage deal. By using one of these free mortgage calculators, you can save yourself a lot of time and money.

mortgage calculator

mortgage calculator with escrow I’D Rather

Escrow on the couch

mortgage calculator with escrow

Issues To Consider Before Canceling Your Escrow Account

Before waiving or canceling your escrow account, you should consider whether you really want to get rid of it. Some borrowers prefer to have one as a convenience. With an escrow account, the servicer assumes responsibility for making sure property taxes and insurance are paid. That’s fewer bills you have to deal with. Also, if you’re not good at saving money, having an escrow account might be a good idea. With an escrow account, it’s easy to put aside money for bills that become due later because you contribute small amounts toward them with each mortgage payment.

In addition, even if the lender waives or cancels the escrow requirement, it might require you to provide evidence that you’ve made the payments for taxes and insurance, which can be a hassle. And, if you don’t keep up with the taxes and insurance premiums, the servicer can pay the taxes for you or buy insurance coverage on your behalf, and you’ll then have to repay those amountsotherwise, the lender might foreclose.

If you’re facing a potential foreclosure, consider contacting an attorney to find out about your options.

Don’t Miss: Rocket Mortgage Payment Options

What Is A Mortgage Escrow Payment And How Does It Work

A mortgage escrow is an agreement made with your mortgage lender that has a straightforward, two-fold job: hold money, and make home insurance and tax payments for the homeowner. After the transaction is finalized, and the buyer begins making mortgage payments, the escrow account holds a portion of each payment and uses it to pay property taxes and insurance premiums.

With an escrow account your mortgage bill isnt just paying for the principle and interest on your loan some of the money is for insurance and property taxes. The lender simply puts this money in the escrow account each month. When the time comes for insurance and taxes to be paid, the escrow service takes care of it for you.

An escrow service is a useful tool for making sure property taxes and insurance costs are paid and in a timely fashion. In a sense, an escrow is an automated payment service that handles the legwork for the homeowner. In many real estate transactions, an escrow account is mandatory because it helps make sure both insurance and taxes get paid.

Understanding How To Calculate Escrow And What It Means

How to calculate escrow is an important part of determining a mortgage payment, and knowing what you can afford. For this reason, you need to look not only at the price of a house, but also the taxes and insurance costs associated with the property.

If youre in need of escrow services for a home or business purchase, we can help. Contact us today to discuss your escrow needs.

Recent Posts

Recommended Reading: Chase Mortgage Recast

Who Manages The Escrow Account

The escrow bank account is managed by your lender. Its the bank or mortgage company responsibility to pay your bills on time. Your lender is liable for penalties should there be a missed or late payment.

Lets get you closer to your new home.

Prequalification helps you see how much you might be able to borrow.

Do I Qualify For A Tax Exemption

Depending on the regulations of your local taxing authority, you may or may not qualify for a tax exemption. A few reasons you may qualify for a tax exemption could be

- If you are a disabled

- If you are a disabled veteran

- If you pay the mortgage and live in the home

There are several other scenarios that could qualify you for a tax exemption. To find out if you qualify, contact your local property assessor.

Check out the full Escrow guide for helpful information on mortgage escrow.

Also Check: Reverse Mortgage On Condo

How Can You Lower Your Escrow Payment

Because it is directly tied to your property taxes and homeowners insurance, the best way to lower your monthly escrow payment is to lower the cost of one or both of those variables.

Shopping around for a new homeowners insurance provider may help you find a better rate that can, in turn, lower your monthly escrow payment. Disputing your property taxes, meanwhile, may be helpful if you believe your payments are too high for your homes value, but any reduction will be dependent upon an appeal by a local assessor.

Benefits Of Mortgage Escrow Accounts

Many homeowners like the convenience of an escrow account, despite that fact that it means higher monthly mortgage payments. In most cases, property tax and insurance bills are sent directly to the lender for payment and dont need to be tracked by the homeowner. An annual escrow statement is sent to the homeowner showing escrow deposits and bill payments. The statement will also explain what to do if therere a shortage or overage. Because of these benefits, some homeowners ask their lender to set up an escrow account to help with the budget for home-related expenses even though the lender doesnt require it.

Homeowners who dont have escrow accounts with their mortgages are responsible for budgeting for taxes and insurance, which can be large expenses to pay at one time. They also must keep track of when payments are due. Failing to pay on time could result in fines and penalties, as well as having the payment amounts added to their loan balance and an escrow account added to the home loan. A lender may also sign up for new homeowners insurance on behalf of the homeowner, then send the bill to the homeowner for payment. This forced-plan insurance can be more expensive than typical homeowners insurance and should be avoided if at all possible.

References

Recommended Reading: Can You Do A Reverse Mortgage On A Condo

What Happens If Escrow Is Short

If your escrow account is short of funds when it comes time to pay your insurance and taxes, your lender will pay these amounts to ensure they are paid on time and then likely will give you a couple of options. … For example, if your escrow account was short by $300, your monthly payment would increase by $25.

What Does Escrow Mean

Escrow refers to a third-party service thats usually mandatory in a home purchase. When a buyer and seller initially arrive at a purchase agreement, they select a neutral third party to act as the escrow agent. The escrow agent collects what is known as earnest money from the buyer: a deposit that is equal to a small percentage of the sale price. In exchange, the seller takes the property off the market. Until the final exchange is completed, both the buyers deposit and the sellers property are said to be in escrow.

Escrow accounts have more to do with your monthly mortgage payment than the initial home purchase. When you borrow money from a bank or a direct mortgage lender, youll usually be given an escrow account. This account is where the lender will deposit the part of your monthly mortgage payment that covers taxes and insurance premiums. By collecting a fraction of those annual costs each month, the escrow account reduces the risk that youll fall behind on your obligations to the government or your insurance provider.

Also Check: Can You Refinance A Mortgage Without A Job

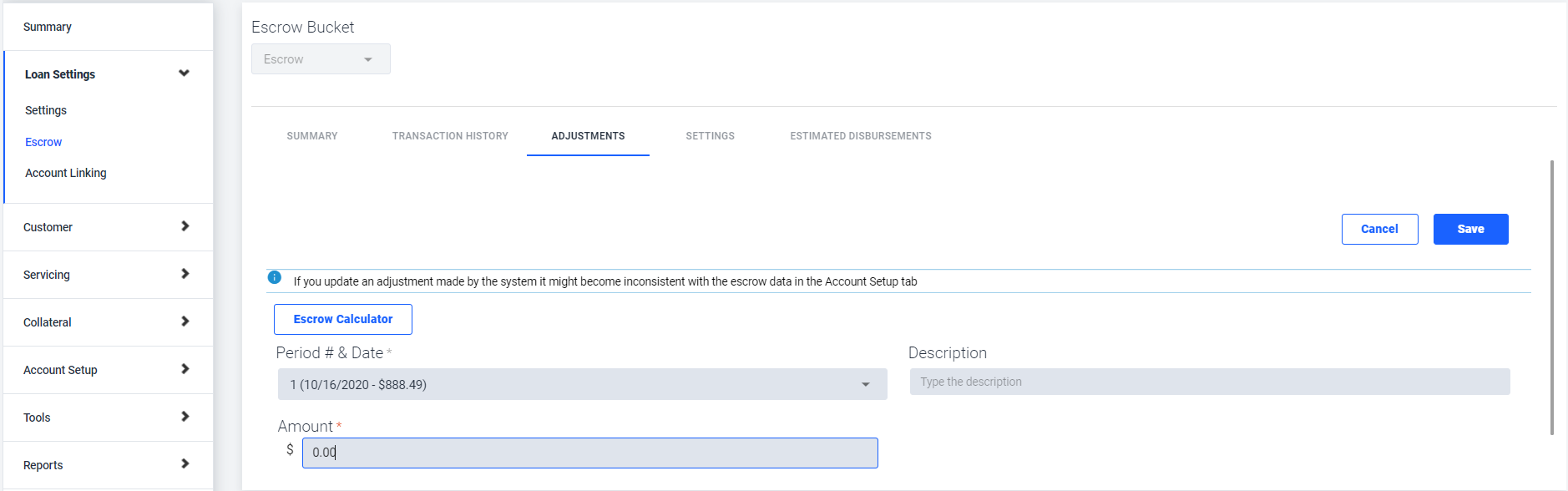

How Are Tax And Insurance Projections Calculated For The Next Year

Each year we project how much youll need in your escrow account for the upcoming year. We base it on the amount of taxes and/or insurance you paid during the past 12 months. The total paid is divided by 12 to get your projected monthly escrow payment.

Sometimes, your payment must be adjusted to ensure your monthly balance remains above a required minimum balance during the next 12 months. This minimum balance is typically equal to two months of escrow payments.

If your taxes and/or insurance change during the next year or your monthly escrow balance falls below the required minimum amount, you could have a shortage or surplus in your account when we do an Annual Escrow Analysis next year.

What States Require Escrow

The so-called escrow states are California, Washington, Oregon, Texas, Nevada, New Mexico and Arizona. Also, when Hawaii became a state, it continued to follow the Spanish escrow system. Escrows are used on occasion in other states, but closings are not conducted exclusively through escrow in those states.

Recommended Reading: Reverse Mortgage Mobile Home

What Are Escrow Fees

Its common for the escrow agent involved in the sale of a home to take a fee of 1 percent of the purchase price, though this percentage can vary widely depending on location.

In addition, some mortgage lenders might allow you to waive the escrow requirement and pay your insurance and tax bills directly for a fee.

Should You Set Up An Escrow Bank Account

The answer to this question depends on whether or not you are disciplined about your finances and able to set aside the funds needed for property taxes and insurance payments. If youre not a good saver or are tempted to spend extra cash perceived as left over, then you are probably better off having your lender handle these payments, especially since failure to pay can result in penalty charges, a lapse in insurance coverage or even a lien on your home. If you are disciplined at saving, you may prefer to control the process since tax payments usually are due only once or twice a year.

Read Also: Does Rocket Mortgage Service Their Own Loans

Escrow For Securing The Purchase Of A Home

After you make an offer on a home, and that offer is accepted, youll typically come up with earnest money. You will deposit this money into an escrow account to show the home seller that you are serious about buying their home.

Once the real estate deal closes and you sign all the necessary paperwork and mortgage documents, the earnest money is released by the escrow company. Usually, buyers get the money back and apply it to their down payment and mortgage closing costs.

How much youll have to pay in earnest money varies, but you can usually count on having to come up with 1% 2% of your homes final purchase price. If youve agreed to pay $200,000 for your new home, youll typically have to deposit $2,000 $4,000 in earnest money into an escrow account.

If a home sale falls through, buyers might not get their earnest money returned. For instance, if you change your mind and decide not to purchase the home, the seller typically keeps the earnest money. However, if the sale falls through because a home inspection finds serious problems with the house or it doesnt appraise for a high enough value, the buyer might be able to receive a refund of their earnest money.