How To Use Our Mortgage Rate Table

Our mortgage rate table is designed to help you compare the rates youre being offered by lenders to know if it is better or worse. These rates are benchmark rates for those with good credit and not the teaser rates that make everyone think they will get the lowest rate available. Of course, your personal credit profile will be a significant factor in what rate you actually get quoted from a lender, but you will be able to shop for either new purchase or refinance rates with confidence.

Refinancing Will Slow In 2021

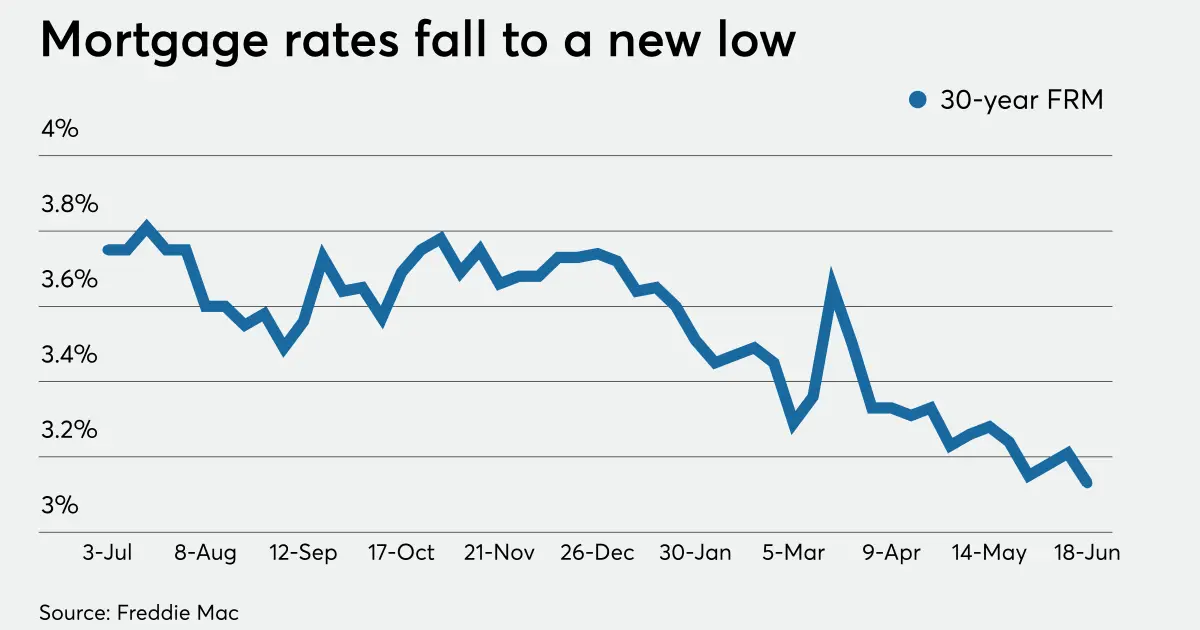

As mortgage rates continue to climb, fewer homeowners will be able to save money by refinancing their mortgages.

Were seeing this happen in real time. In February, 18 million homeowners were refinance eligible, that is they could reduce their interest rate by 0.75% or more, according to data from Black Knight, a mortgage technology, data and analytics provider. But as rates surged above 3%, the number of eligible candidates shrunk to just 12.9 million homeownersa 30% reduction in less than a month.

The MBA predicts that refinancing volume will fall from $2.149 trillion in 2020 to $1.191 trillion in 2021, mainly due to rising rates. There will be an even sharper decline of refinancing volume in 2022 to $573 billion, according to MBAs latest forecast. The refinance share of all mortgage originations is predicted to drop to 41% in 2021 from 57% in 2020.

Refinance activity will depend on rates. Even if rates rise a few basis points above where were at now, we can expect a pretty robust refi demand market in 2021, says Odeta Kushi, deputy chief economist for First American Financial Corporation, a title insurance provider. There are still many homeowners who can save money by refinancing.

As rates rise, the pool of people who can save money by refinancing their mortgage will start to shrink again. If rates hit 3.13%, 6.2 million borrowers will no longer be able to cut costs with a new mortgage.

How To Reduce Your Risk Against Mortgage Interest Rate Increases And Save The Most On Your Mortgage

If you decide to take a variable rate mortgage, the best way to take advantage of the lower rate and reduce your risk is to increase your payment to what you would be paying on a 5 year fixed rate mortgage.

For example, lets say the hypothetical monthly payment calculation on a 5 year fixed rate mortgage is $2000 and the monthly payment calculation on a variable rate mortgage is $1750. The strategy is to use mortgage prepayment, to increase your variable rate mortgage payment to $2000 per month. In other words you are now paying an extra $250 per month, of pure principal payment, against your mortgage while rates are low.

As long as the regular variable rate payment is lower than what your fixed rate payment would have been, you are getting ahead on your mortgage and saving on interest. Then at some point, perhaps 2 years down the road, once your variable rate is equivalent to what your fixed rate would have been, you could decide to remove the pre payments if youd rather have the extra cash flow.

At this point in early 2022, it does not appear that these kinds of higher 1.50% + rate increases are likely over the next 5 years.

Also Check: Rocket Mortgage Conventional Loan

Canadas Real Estate Market Faces Uncertainty

What was shaping up to be a hot spring housing market has fizzled due to concerns over the coronavirus.

Real estate markets across the country have seemingly been frozen due to concerns by both buyers and sellers over the full economic impact of the virus. Although, we wont know for certain the full impact until the data is released about a month from now.

We expect to see a drop in sales, but this will take a month or two to filter through into the actual results, John Lusink, president and broker of record at Right at Home Realty, toldYahoo Finance Canada.

Others remain optimistic that the strong demand for housing seen prior to the pandemic will persist.

So far, we have not seen anything that makes us think that we are going to have a drastic shift in activity, Christopher Alexander, Re/Maxs regional director for Ontario and Eastern Canada, told the Globe & Mail. There is a still a big housing shortage across the country, and interest rates are rock, rock bottom.

In its Spring 2020 Canadian Outlook Report, the Conference Board of Canada said it expects housing to remain strong throughout the year.

What’s The Reaction So Far

As might be expected, many borrowers are moving to lock in rates now on the expectation that mortgage rates could climb higher, according to Alex Elezaj, chief strategy officer at Pontiac-based United Wholesale Mortgage.

“The market is changing very fast,” Elezaj said.

While refinancing has slowed down in general for the industry, he said, there continues to be a strong demand from many homeowners who continue to refinance in order to take cash out of their homes as home values have gone up.

Some people want that cash now because they’re remodeling their homes or paying down other higher cost debt, he said. The available homes for sale remain limited in many markets, he said, giving homeowners more reason to remodel their existing home and not move elsewhere.

“I think people will continue to tap into the equity,” he said.

As for home buyers, Elezaj said, 30-year mortgage rates continue to be available now in the low 3% to mid-3% range for those who qualify and shop around.

“We do see it trending upward, for sure,” he said. The expectation is that mortgage rates would see a bigger increase in the summer and later this year.

Working with a local independent mortgage broker, he said, can help people shop around and discover options for first-time homebuyers, veterans and others. UWM powers a website called FindAMortgageBroker.com.

Studying what’s available by just reviewing rates on the internet may not be enough.

“You just Google it, good luck.”

Recommended Reading: Can You Get A Reverse Mortgage On A Condo

Real Estate Associations Call For End To Open Houses

Two of the countrys major real estate associations have called for an end to open houses during the COVID-19 pandemic.

I am calling on all Realtors to cease holding open houses during this crisis and advise their clients to cancel any that are planned, said Sean Morrison, President of the Ontario Real Estate Association.

The Toronto Regional Real Estate Board made a similar appeal to members.

TRREB is strongly recommending that Members stop conducting in-person open houses during the Ontario State of Emergency, and continue to offer best practices due to the uncertainty were faced with in dealing with COVID-19, it said in a statement.

Just days before, two of the countrys largest brokerages, RE/MAX and Royal LePage, issued a similar call for their members to stop staging open houses.

What Is A Mortgage Rate Lock

A mortgage rate lock allows you to lock in the interest rate your lender quotes you for a certain period of time. This gives you a chance to close on the loan without risking an increase in the mortgage interest rate before you finalize the loan process.

Once you find a rate you like, lock it in as soon as possible because rates can change overnight. If they rise, then you could end up paying more on your mortgage.

If you get a floating rate lock, then you can lock in a lower interest rate if rates fall, but you wont be obligated to pay higher interest rates than you were quoted if they go up.

While 30-day rate locks are typically included in the cost of a mortgage, a floating rate lock could cost extra. Depending on how volatile the rate environment is, you might find that a floating lock is worthwhile.

Read Also: 10 Year Treasury Yield And Mortgage Rates

Date All The Cost Of Living Payments Will Be Made

These are the mortgages you can access using a mortgage broker.

Lewis Shaw, founder of Shaw Financial Services, said: “This time last year, Halifax had a two-year remortgage deal available for 0.83% for buyers with a 40% deposit .

“From tomorrow, it will be 3.33% for identical circumstances – it shows how the market can change rapidly.”

A two-year fixed rate mortgage for a buyer with a 10% deposit will go up from 3.24% to 3.66% with no fees.

On a £200,000 25-year mortgage, repayments on the lower rate would be £974 a month.

At the new higher rate, they would be £1,018 a month – an extra £528 a year.

A five year fix will increase from 3.26% to 3.76%.

Monthly repayments on a £200,000 mortgage at the new rate would be £1,029.

Is It A Better Time To Buy Or Sell A Home

There are more economic factors on balance, putting downward pressure on home prices than upward pressure. However, that was also the case in the first three months of 2021 when Canadians desperate for more living space pushed home values higher.

-

If you believe that the rise in buying activity is explained by Canadians seeking more living space, then the end of pandemic restrictions coming this summer might trigger an end to this economic real estate cycle.

-

If you believe that interest rates are the primary driver of home prices, then the forecasted rise in rates would indicate prices will moderate in the second half of 2021.

-

Population growth is also expected to remain below average in 2021, so population growth shoudnt come into play until 2022.

Homebuyer Advice

If you plan to buy in the next three years, be mindful that there is a risk that prices will fall in the short run, so that a wait-and-see approach may be appropriate.

The low mortgage rates provide more purchasing power for buyers who are still employed than in 2019, but less than six months ago. In a weakened market, low rates are a gift to homebuyers however, it inflates the value of a standard home in markets with low supply.

Home Seller Advice

Unemployment is still high, and if we use past recessions as a guide, there will likely be a weakening in home valuations.

Like this report? Like us on .

You May Like: Does Rocket Mortgage Sell Their Loans

How Do I View Personalized 30

Use the loan widgets on this page or head to our primary rates page to see what kind of rates are available in your situation. You just need to give us a little information about your finances and where you live. With that data, Bankrate can show you real-time estimates of mortgages available to you from a number of providers.

Ali Wolf Is The Chief Economist At Zonda A California Housing Data And Consultancy Firm

The turbulent January forced forecastors to recalculate their guesses as to what will happen to the year, Wolf says. Zonda initially forecast rates to be 3.5% by the end of the year, with an average of 3.3%. Thats now up to 3.8% by the end of the year, with an average of 3.6%.

We arent expecting a straight line up for mortgage rates, she says. We saw interest rates jump at the beginning of this year, but we think the markets going to have a lot more volatility moving forward.

The Federal Reserves interest rate increases could contribute to future rises in home loan rates, but those dont necessarily go hand-in-hand, she says. The key issue to watch is not necessarily what the Fed does but how the economy responds.

We expect that as costs go up for the banks consumers are going to see their costs go up as well, but we think its really going to depend on how effective that policy is on taming inflation and how the economy evolves this year, she says.

Recommended Reading: Chase Recast Mortgage

What The December 2021 Mortgage Rate Forecast Means For You

Todays rates are still exceptionally low compared to historical rate standards. If rates remain in a similar ballpark in December, thats great news for borrowers who havent refinanced yet, or those who could potentially benefit from refinancing again. Low rates and rising home prices have given homeowners all sorts of options to refinance. You could tap your home equity with a cash-out refinance to consolidate high-interest debt or finance a home improvement project. A rate and term refinance could lower your interest rate and reduce your monthly payment.

Keep in mind that your interest rate isnt everything. Make sure your plan accounts for what youll pay upfront in closing costs, specifically the lender fees, which can greatly increase the cost of refinancing.

Unfortunately for homebuyers, todays hot housing market has pushed prices higher. Many buyers may be eligible for rock-bottom rates, only to have potential savings erased by the need to pay more to get an offer accepted. Some experts see signs that home prices are starting to cool, ever so slightly. But dont expect prices to drop. They are likely to continue to increase, just at a slower pace. Rather than trying to time the market, its best to understand how much house you can afford and stay within your budget. If now is the right time for you to buy, then consider expanding your search to more affordable areas.

Where Are Mortgage Rates Going From Here

Last year, economists predicted that mortgage interest rates wouldnt exceed 4% in 2022. Then came rising inflation, Russias war on Ukraine, pandemic lockdowns in China, and lasting supply chain disruptions and labor shortages that conspired to raise mortgage rates.

Economists anticipate that rates will rise at least a bit more before the end of the year. In the first week of May, the Mortgage Bankers Association said that it anticipates mortgage rates to plateau somewhere around current levels.

The odds of them going back down to where they were in 2021 are pretty, pretty small, Channel said. I dont think people should hold their breaths for rates below 4% over the next few years.

Read Also: Recast Mortgage Chase

Mortgage Rate Forecasting Explained

The constant mortgage rate fluctuations over the last few months may have left even the most informed consumers scratching their heads. They may also have you wondering what exactly goes into predicting future rates.

There are a few key factors that experts use in mortgage rate forecasting:

- Federal Reserve policy: The Fed doesnt directly set interest rates, but it sets short-term rates, which can influence long-term rates.

- Economic growth: As the economy improves, interest rates tend to rise, and vice versa. Indicators of economic growth include employment numbers and gross domestic product .

- Inflation: Inflation refers to the increase in the price of goods and services. As inflation rises, so do interest rates so that lenders can ensure a profit on their loans.

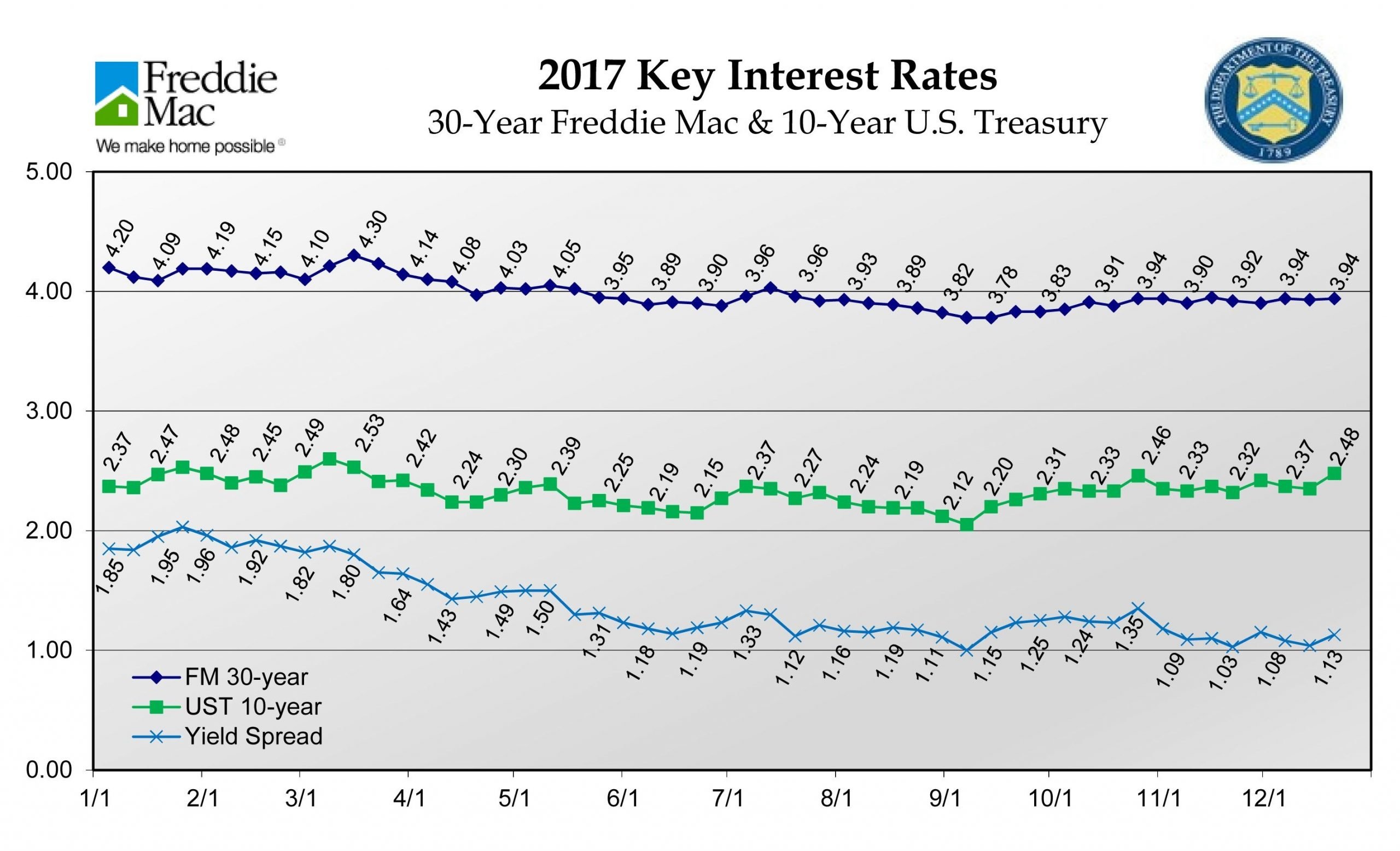

- Bond rates: Mortgage rates and bond rates are interconnected. First, mortgages are repackaged and sold as bonds, and so mortgage rates have to be high enough to make those bonds an attractive investment. Additionally, mortgage lenders often use the 10-year Treasury bond as a benchmark for mortgage rates.

Using the information listed above, historic mortgage rates, and other economic factors, financial experts can make mortgage interest rate forecasts.

Each quarter, Freddie Mac publishes a quarterly report with its mortgage rate predictions. Using the economic outlook at past and current rates, Freddie Macs Economic & Housing Research Group forecasts what we can expect from rates in the coming months.

What’s The Best Loan Term

When picking a mortgage, remember to consider the loan term, or payment schedule. The most common loan terms are 15 years and 30 years, although 10-, 20- and 40-year mortgages also exist. Mortgages are further divided into fixed-rate and adjustable-rate mortgages. For fixed-rate mortgages, interest rates are the same for the life of the loan. For adjustable-rate mortgages, interest rates are the same for a certain number of years , then the rate fluctuates annually based on the current interest rate in the market.

One factor to consider when choosing between a fixed-rate and adjustable-rate mortgage is the length of time you plan on living in your home. For those who plan on living long-term in a new house, fixed-rate mortgages may be the better option. Fixed-rate mortgages offer greater stability over time in comparison to adjustable-rate mortgages, but adjustable-rate mortgages might offer lower interest rates upfront. If you aren’t planning to keep your new house for more than three to 10 years, however, an adjustable-rate mortgage may give you a better deal. The best loan term is entirely dependent on your situation and goals, so be sure to consider what’s important to you when choosing a mortgage.

Find the Best Refinance Rates with the CNET Rate Alert

Recommended Reading: How Much Is Mortgage On A 1 Million Dollar House

Will Mortgage Rates Go Down In December

Mortgage rates keep trending sideways, only making small moves week-to-week driven by the opposing pulls of worsening coronavirus numbers and an improving economy. However, the latest news from the Federal Reserve points to rate hikes on the horizon for 2022.

Mortgage rates inched up as a result of economic improvement and a shift in monetary policy guidance, said Freddie Mac Chief Economist Sam Khater.

We expect rates to continue to increase into 2022 which may leave some potential homebuyers with less room in their budgets on the sideline.

Most housing experts are expecting an overall upward trend through the end of 2021 and into 2022. And thats because the forces pushing mortgage rates higher arent going away:

- Inflation Higher inflation typically leads to higher rates. And the annual U.S. inflation rate was at a 30-year high in October

- Economic recovery Retail sales increased by a wider margin than expected in October. And unemployment claims fell to their lowest level since March 2020. Both are strong indicators of an improving economy, which should lead to increased rates

- Fed policy changes As the Federal Reserve continues to pull back on its Covid-era stimulus, mortgage rates should continue to rise

But there are other forces working to pull rates down, which is why weve seen spikes and drops over the past few weeks.

As has been the case since 2020, Covid trends are one of the biggest indicators for mortgage rates right now.