Using A Mortgage Calculator

Does this all sound too hard? Would you prefer to press a button and have all of this worked out for you? Sounds like you could use a mortgage calculator.

These online tools are available from comparison websites like RateCity, as well as from banks and mortgage lenders. All you need to do is enter a few details to get the results, which you can even view as a spreadsheet of repayments, with principal and interest amounts laid out month by month for full loan term. There are a wide variety of different calculators available for solving different personal finance problems.

Keep in mind that mortgage calculators rely on certain assumptions, meaning the results should be considered estimates only, and may not match up exactly with what youd pay in real life. For example:

- Assuming youll be paying the same interest rate for a full 30-year loan term, which is unlikely if you have a variable interest rate.

- Assuming that every year and every month have the same number of days, when we all know that doesnt match our calendars.

- Only being accurate for the values entered into the calculator, and not including fees and extra charges, or the effect of extra repayments, offset and redraw on your mortgage.

- Different lenders may calculate their home loans differently, such as rounding up some numbers or rounding down others, which could affect exactly how much youll pay.

Did you find this helpful? Why not share this article?

Whats Apr Then How Is It Different To A Mortgage Interest Rate

The annual percentage rate is the mortgage interest rate plus other charges, which could include fees, charges and discounts. By the way, a representative APR is the APR at least 51% of successful applicants get.

With Mojo, you can pop in a few details and see what mortgages you can get right now. We’ll clearly show you what rates are on offer and what’s the total cost over the term of the mortgage.

Getting Started With Calculating Your Mortgage

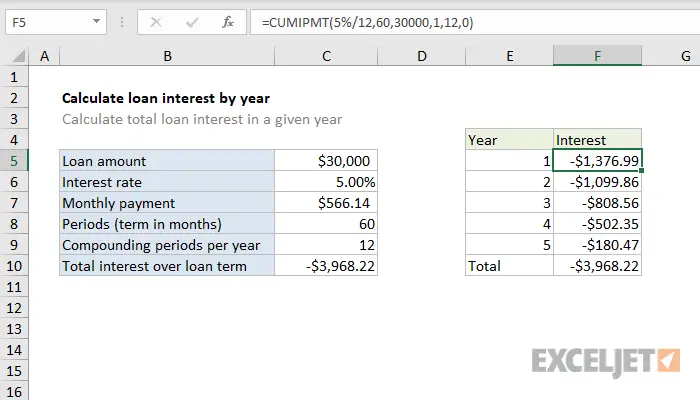

People tend to focus on the monthly payment, but there are other important features you can use to analyze your mortgage, such as:

- Comparing the monthly payment for several different home loans

- Figuring how much you pay in interest monthly and over the life of the loan

- Tallying how much you actually pay off over the life of the loan versus the principal borrowed, to see how much you actually paid extra

Use the mortgage calculator below to get a sense of what your monthly mortgage payment could end up being,

Read Also: Reverse Mortgage Manufactured Home

How Much Can I Save By Prepaying My Mortgage

The benefit of paying additional principal on a mortgage isnt just in reducing the monthly interest expense a tiny bit at a time. It comes from paying down your outstanding loan balance with additional mortgage principal payments, which slashes the total interest youll owe over the life of the loan.

Heres an example of how prepaying saves money and time: Kaylyn takes out a $120,000 mortgage at a 4.5 percent interest rate. The monthly mortgage principal and interest total $608.02. Heres what happens when Kaylyn makes extra mortgage payments.

| Payment method | |

|---|---|

| $89,864 | $9,024 |

Bankrates mortgage amortization schedule calculator can help you determine the impact of extra payments on your mortgage. Click Show amortization schedule to reveal the section that allows you to calculate the effect of additional payments.

Use Bankrates mortgage payoff calculator to see how much interest you can save by increasing your mortgage payments.

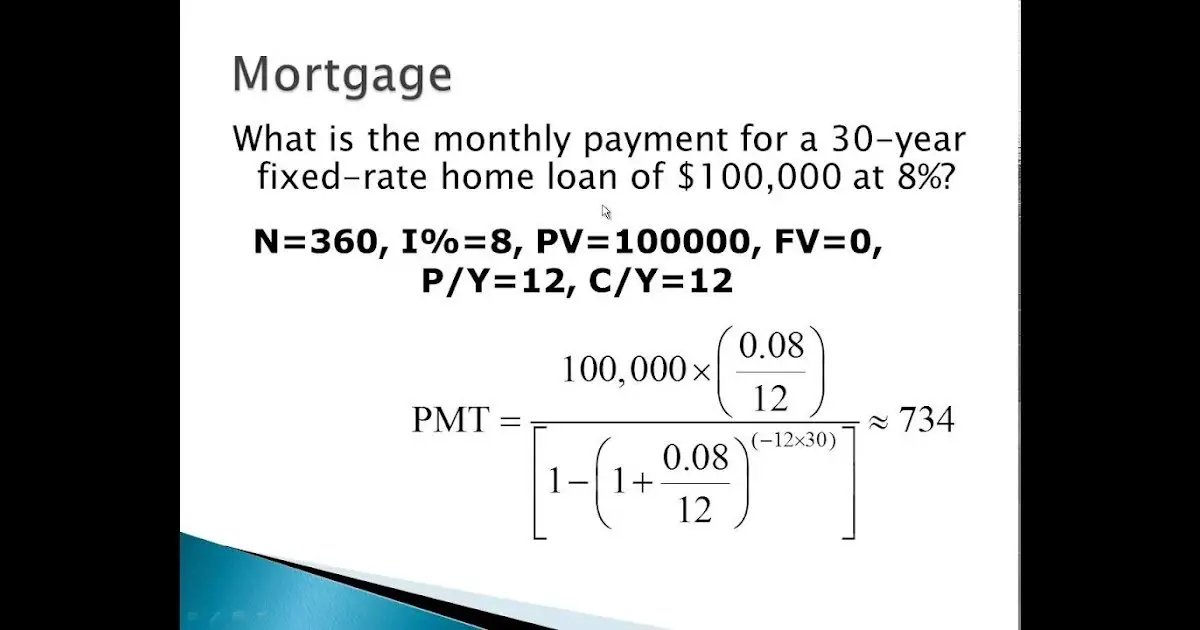

Calculate The Number Of Payments

The most common term for a fixed-rate mortgage is 30 years or 15 years. To get the number of monthly payments you’re expected to make, multiply the number of years by 12 .

A 30-year mortgage would require 360 monthly payments, while a 15-year mortgage would require exactly half that number of monthly payments, or 180. Again, you only need these more specific figures if you’re plugging the numbers into the formula an online calculator will do the math itself once you select your loan type from the list of options.

Don’t Miss: How Does 10 Year Treasury Affect Mortgage Rates

How Does An Amortization Schedule Work

If you have a fixed rate loan, the amortization schedule will provide you with a table that lists all the fixed payments over the life of your loanincluding a breakdown of both interest and principal. Note: The payments are fixed but the ratio between the amount of principal paid each month and amount of interest paid will constantly shift.

Its typical for the first half of the loan to emphasize interest payments over principal. After a certain point, which will be evident in your amortization schedule, you will begin paying more principal and less interest until finally the loan is paid in full.

The Bottom Line: Keep Track Of Your Principal And Interest

Your monthly mortgage payment has two parts: principal and interest. Your principal is the amount that you borrow from a lender. The interest is the cost of borrowing that money.

Your monthly mortgage payment may also include property taxes and insurance. If it does, your lender holds a percentage of your monthly payment in an escrow account.

Your mortgage payment usually stays the same every month. If you choose a mortgage with an adjustable interest rate or if you make extra payments on your loan, your monthly payments can change.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Also Check: Mortgage Recast Calculator Chase

How To Calculate Mortgage Interest

Many banks and other mortgage lenders calculate your interest daily, and charge you monthly, when you make your scheduled home loan repayment.

You can find the interest charged on your home loan each day by using this formula:

P x = A

- A = amount of money in this case, the daily interest charge

- P = principal the loan amount still owing on your mortgage

- R = rate of interest keep in mind that for use in these calculations, your advertised interest rate percentage will need to be divided by 100, hence the name percent which is Latin for out of 100.

- N = amount of time Because interest rates are per annum or yearly , this figure should be how many of the time unit youre looking for takes place in one year e.g. 12 months, 26 fortnights, 52 weeks etc.

For an example, if you had a $500,000 mortgage and were paying interest at a rate of 3% per annum, heres how you could work out your initial daily interest charge:

$500,000 x = $41.10

Assuming youre in a month with 30 days, this would mean that your lender will charge you around $1233 in interest on your $500,000 in the first month.

Keep in mind that as you lower your mortgage principal by making mortgage repayments each month, the daily interest youre charged will change.

Los Angeles Homebuyers Can Refinance At Historically Low Mortgage Rates Today

The spread of coronavirus caused financial market volatility, with the 10-Year Treasury Notes reaching all-time record lows. Mortgage rates tend to follow 10-Year Treasury movements. Savvy homeowners across the country are taking advantage of this opportunity to refinance their homes at today’s attractive rates.

As Seen In

Recommended Reading: Does Prequalifying For A Mortgage Affect Your Credit

Consider The Cost Of Property Taxes

A monthly mortgage payment will often include property taxes, which are collected by the lender and then put into a specific account, commonly called an escrow or impound account. At the end of the year, the taxes are paid to the government on the homeowners’ behalf.

How much you owe in property taxes will depend on local tax rates and the value of the home. Just like income taxes, the amount the lender estimates the homeowner will need to pay could be more or less than the actual amount owed, which could result in a bill or a refund come tax season.

You can typically find your property tax rate on your local government’s website.

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

Also Check: Can You Get A Reverse Mortgage On A Manufactured Home

What Is Mortgage Amortization

When you establish a mortgage account, the lender determines your interest costs based on an amortization schedule. Amortization is simply a method of reducing an installment loan debt until it reaches zero. It takes into account both payments toward the loan balance and payments of interest. An amortization table lists the amount of interest and principal paid every month over the life of the loan, as well as the principal and interest totals paid to date, in a convenient and simple-to-follow format.

To Estimate Your Monthly Mortgage Payment Use Our Mortgage Calculator With It You Are Able To Input A Different Home Price Down Payment Interest Rate And Loan Term To See How Your Monthly Payments Will Change

The number of people who prefer owning a home to paying rent has skyrocketed in the past decade, and for a good reason. For starters, owning a home is less expensive than renting in the long term. Plus, you get to enjoy your space while making a few changes to the house, such as repainting or adding an extra room without breaking the bank.

But do you know how to calculate your mortgage so you save money in the long term? If not, this article is for you. Heres how to calculate your mortgage and save money long-term.

Recommended Reading: Can I Get A Reverse Mortgage On A Condo

What Is The Prepaid Interest Charged On A Mortgage

See Mortgage Rate Quotes for Your Home

Prepaid interest charges on a mortgage loan represent the amount of interest that you owe between signing your loan agreement and making your first monthly payment. Also known as interim interest, prepaid interest is charged by lenders as part of the upfront closing costs in a mortgage.

How Do Lenders Calculate Mortgage Interest

It is understandable why homebuyers would want to understand how their mortgage provider calculates interest on their loan after all, a mortgage is the biggest financial commitment that most of us will ever make.

With that in mind, in this article, were going to take a closer look at how lenders break down and calculate the monthly payments for mortgaged properties.

Recommended Reading: Recasting Mortgage Chase

What To Do Next

- Get preapproved by a mortgage lender. If youre shopping for a home, this is a must.

- Apply for a mortgage. After a lender has vetted your employment, income, credit and finances, youll have a better idea how much you can borrow. Youll also have a clearer idea of how much money youll need to bring to the closing table.

| Loan Type |

|---|

How Your Credit Rating Affects Your Interest Rate

Lenders look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a mortgage. If you have good credit history, you may be able to get a lower interest rate on your mortgage. This can save you a lot of money over time.

Also Check: What Does Rocket Mortgage Do

How Do I Calculate A Monthly House Payment For A 30

Related Articles

Calculating a 30-year fixed-rate mortgage is a straightforward task. In order to find out what your monthly payments might be, you can use a mortgage formula or a calculator. This will give you a good estimation of whether you can afford the mortgage. Home loans are amortized over 30 years with monthly payments that are the same each month. As you begin to pay your mortgage, you will actually pay more in interest. Over time, as the loan decreases, more of your money goes toward the principal.

Make a note of the interest rate, the loan amount and the terms of payment. Fixed-rate mortgage payments stay the same for the life of the loan. Example: $500,000 mortgage loan at 5 percent interest for 30 years making 12 payments a year — one per month.

Multiply 30 — the number of years of the loan — by the number of payments you make each year. For example, 30 X 12 = 360. You are making 360 payments over the course of the loan.

Divide your mortgage interest rate by your total payments. For example, 5 percent interest with 12 payments is 0.05 / 12 = 0.004.

Use this mortgage formula and plug in the appropriate numbers:

Monthly Payments = L/, where L stands for “loan,” C stands for “per payment interest,” and N is the “payment number.”

Monthly Payments = 500,000 /

Monthly Payments = $2684.10

- Check your work with a mortgage calculator.

Warnings

- You should also add insurance and taxes on to your monthly payment.

Writer Bio

Why Do Interest Rates Change

There are a number of things the RBA will take into account when deciding whether to change the cash rate. Chief among them are domestic conditions, such as employment and inflation, though global financial conditions are also important.

If the economy is booming and high demand is pushing up prices, the RBA might increase the cash rate to make sure inflation doesnât spiral out of control. And if the economy is weak and demand is low, the RBA might decrease the cash rate to encourage spending, borrowing and investment.

Read Also: Rocket Mortgage Conventional Loan

Diy Extra Payment To Prepay Mortgage

Lets say you want to budget an extra amount each month to prepay your principal. One tactic is to make one extra mortgage principal and interest payment per year. You could simply make a double payment during the month of your choosing or add one-twelfth of a principal and interest payment to each months payment. A year later, you will have made 13 payments.

Make sure you earmark any additional principal payments to go specifically toward your mortgage principal. Lenders typically have this option online or have a process for earmarking checks for principal payments only. Ask your lender for instructions. If you dont specify that the extra payments should go toward the mortgage principal, the extra money will go toward your next monthly mortgage payment, which wont help you achieve your goal of prepaying your mortgage.

Once you have built sufficient equity in your home , ask your lender to remove private mortgage insurance, or PMI. Paying down your mortgage principal at a faster rate helps eliminate PMI payments more quickly, which also saves you money in the long run. You can also refinance your mortgage to eliminate PMI altogether.

Should You Compare Mortgage Rate Or Apr

When comparing loan offers with the same terms and similar fees, the mortgage with the lowest interest rate is usually the best deal.

After you submit a mortgage application, the lender provides a three-page document called a Loan Estimate. Page 3 of the Loan Estimate has a “Comparisons” section that lists not only the APR but also how much the loan will cost in the first five years. This includes the loan costs, plus 60 months of principal, interest and any mortgage insurance.

The “Comparisons” sections of the Loan Estimates are useful in side-by-side comparisons of all the mortgage offers you receive.

Read Also: Chase Recast

Amortization And Compound Interest

Compound interest is when the unpaid or accumulated interest at the end of the first period is added to the principal for the second period , allowing the interest to compound. This is often referred to as interest on interest. As you can imagine, this results in higher interest payments.

The good news is that compound interest is not a common method for determining interest for home mortgages here in the U.S.** Your mortgage interest is actually calculated on a backward-looking monthly basis, which is to say its paid in arrears.

For example,* the September payment on your mortgage is for August interest and September principal. That’s why when you close your loan you don’t make your first payment the next month you make it the following month and just pay interim interest for the month you close in. A September 10th closing date, for example, would mean a November 1st first payment that includes October interest. At closing, youll pay the interim interest for September on the amount you borrowed .*

It can all sound a little confusing, but if you look at your loan estimate and particularly your closing disclosure, there should be a table that accounts for future projected payments over 360 months . Thats the beauty of an amortization schedule: It creates visibility into the entire repayment of the loan + interest. There are no surprises.

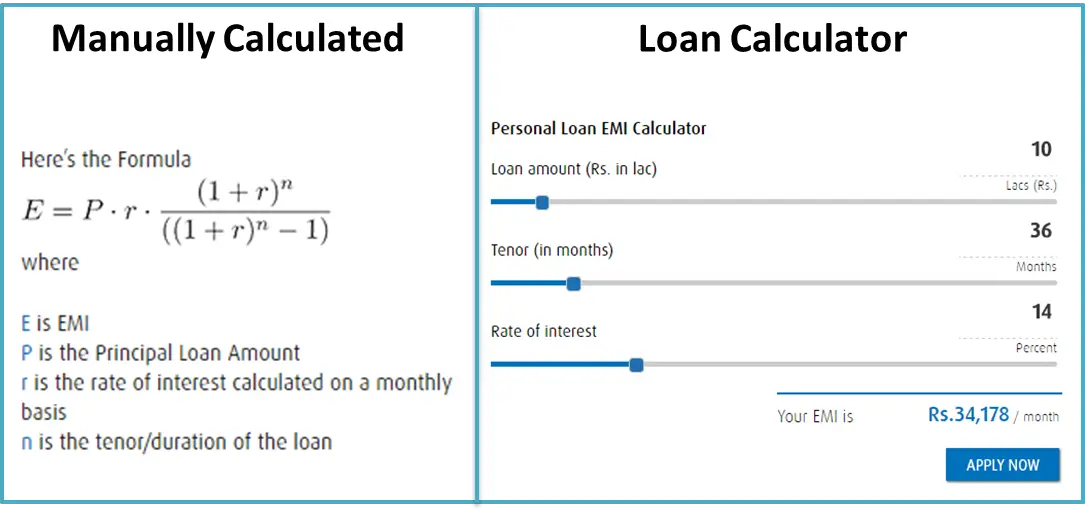

Amortization formula: total monthly payment and interest payment

M = P /

P = principal loan amount

Example*

Month two:*