What To Consider Before Refinancing

Even if you can refinance right now, it doesnt always mean you should so make sure you consider the drawbacks.

For one, the costs to refinance a home average $5,000, which eat into the money you save on the deal. Once you know the costs and your savings potential, calculate your break-even point to see if its a good move for you.

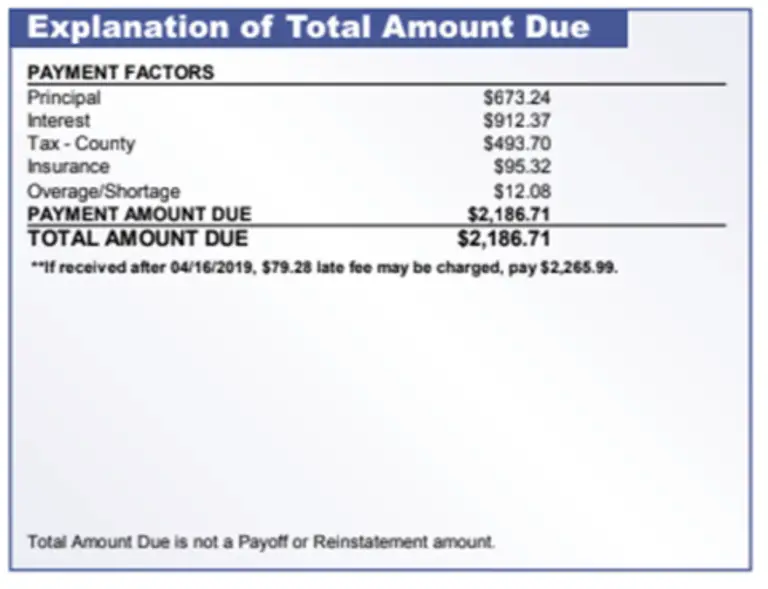

For example:

Its worth also seeing if your lender offers a no-closing-cost refinance. While this makes refinancing more affordable upfront, dont let the name fool you. The lender may wrap the closing costs into the mortgage principal or hike up the interest rate but you still could save money compared to the loan terms you have now.

Youll need to check whether your mortgage comes with a prepayment penalty as well, which is a fee for paying off the home loan early. Check your mortgage documents for details, or ask your lender if your loan comes with this penalty.

Learn More: How to Refinance Your Mortgage With Bad Credit

How Long Does A Refinance Take

First, lets go over the finer points of a refinance. When you refinance your mortgage, you replace your current loan with a different one. Your new loan may have different terms from your current mortgage.

Your interest rate, term length, monthly payment and more may change during a refinance. The funds from your refinance pay off your original mortgage after your closing. Then you make payments on your new loan.

There are a few major reasons why you might want to refinance your mortgage:

- Change your loan terms or your interest rate. If todays rates are lower than your current interest rate or if youre having trouble making your monthly mortgage payments, you may want to consider a rate-and-term refinance, which means that your principal balance remains the same. However, your interest rate or the amount you pay each month changes. You can refinance your loan into a longer term if you want to lower your payments or a shorter term if you want to pay off your loan faster. Also, consider a no cash-out refinance, which will allow you to refinance for less than or equal to your remaining balance. If youre putting more money toward your balance while refinancing, its referred to as a cash-in refinance.

Keep in mind that a refinance might affect your credit score. You may have 14 to 45 days to apply for a refinance before a hard inquiry appears on your credit report.

Get approved to refinance.

Know Your Breakeven Point

An important calculation in the decision to refinance is the breakeven point: the point at which the costs of refinancing have been covered by your monthly savings. After that point, your monthly savings are completely yours. For example, if your refinance costs you $2,000 and you are saving $100 per month over your previous loan, it will take 20 months to recoup your costs. If you intend to move or sell your home within two years, then a refinance under this scenario may not make sense.

Don’t Miss: Do Multiple Mortgage Pre Approvals Affect Credit Score

Cost To Break Your Mortgage Contract

The cost to break your mortgage contract depends on whether your mortgage is open or closed. An open mortgage allows you to break the contract without paying a prepayment penalty.

If you break your closed mortgage contract, you normally have to pay a prepayment penalty. This can cost thousands of dollars.

Before breaking your mortgage contract, find out if you must pay:

- a prepayment penalty and, if so, how much it will cost

- administration fees

- appraisal fees

- reinvestment fees

- a mortgage discharge fee to remove a charge on your current mortgage and register a new one

You may also have to repay any cash back you received when you got your mortgage. Cash back is an optional feature where your lender gives you a percentage of your mortgage amount in cash.

Should I Refinance My Mortgage To Pay For Home Renovations

Home renovations and home improvements can add value to your home and increase your enjoyment of your home. A mortgage refinance would make sense to pay for home renovations if you expect your renovations to cost a sizeable amount. Thats because the cost of refinancing, which is around $2,000, might mean that a refinance would not make sense for smaller renovations.

For example, perhaps youre looking to renovate your kitchen, which on average costs around $30,000. It wouldnt make much sense to refinance your entire mortgage and pay $2,000 in fees just to borrow $30,000. The fees alone would cost 6.6% upfront, let alone your mortgage refinance rate.

For larger home renovations, a refinance would allow you to borrow a large amount of money at a low, fixed mortgage rate.

Read Also: What Is Needed To Get Approved For A Mortgage

It Depends On Your Current Loan

If you have a conventional mortgage, there are typically no restrictions between when that mortgage was closed and when you can refinance as long as youre not taking cash out.

Government-backed loans impose a refinance waiting period between six and seven months, depending on the loan issuer. Additionally, borrowers must make payments on time for at least three months, and there must be a demonstrated benefit to the refinance .

What Does It Mean To Refinance

Simply put, refinancing is replacing your current home loan with a brand new one. Heres why that might be an option, even if you have a decent rate already:

- You want to reduce monthly payments with a lower interest rate or a longer-term

- Youd like to pay off your mortgage faster by shortening the terms

- Youve re-evaluated having an adjustable-rate mortgage and want to convert it to a fixed-rate mortgage

- Youve got financial hardships, home improvements, or a major purchase on the horizon and you want to tap into your home equity

- Your credit rating has improved making you eligible for a better rate

- You want to get rid of PMI that came with your original loan

- Youve since gotten married or divorced, and you want to add or subtract someone from the loan

You May Like: How Many Bank Statements Are Needed For A Mortgage

Work On Your Credit Score

Natural disaster forbearances and those issued as a result of COVID-19 are noncredit impacting, so the forbearance shouldnt have an impact. On the other hand, forbearances outside of these special exemptions will likely be reported as delinquencies by lenders because youre not repaying according to the original terms of the loan at that point. This can hurt your .

There are a couple of things you can do to make sure you get your credit back in shape before you know it. The first is to make sure you keep up with any payments you have once the forbearance is over for all accounts. Youll also want to avoid taking on a bunch of new credit and debt. Thats a sign for lenders that you may be stretching your budget and can hurt your score.

Finally, youll want to pay down debt in general, but lets get to that next.

What Documents Do I Need To Refinance My Mortgage

To refinance your mortgage, youll need to supply identification, income verification and credit information. Be sure to ask your lender for a list of documents youll need. The faster you can give the lender everything they need to process your loan, the quicker youll be able to close.

Heres a general checklist:

- W-2s or 1099s

- Appraisal

Don’t Miss: Why Are Mortgages So Hard To Get

Taking A Lower Interest Rate

Have interest rates lowered since you got your refinance? You may want to refinance again to take advantage. You can almost always save money if youre able to lower your interest rate without changing the term of your loan.

Just a small change in your interest rate can save you hundreds, or even thousands, of dollars. For example, lets say you currently have a 20-year mortgage loan with $150,000 left on your principal and you pay an interest rate of 4.5%.

You have the chance to refinance your loan with the same terms and an interest rate of 4% APR. If you dont refinance, you pay $77,753.84 in interest by the time your loan matures. If you take the refinance, you pay $68,152.95 total in interest. Lowering your interest rate just 0.5% means you’ll save over $9,601 in interest.

You Could Face A Prepayment Penalty

Although uncommon, there might also be a prepayment penalty, or a fee youre charged if you pay the loan before the term is up, which can add to your costs. Make sure to read the fine print of your loan to see if there is a penalty, and, if so, consider whether paying it is worth it in the long run.

Recommended Reading: How To Figure Out The Mortgage Payment

Get Ready For Your Appraisal

Your new lender will usually require a home appraisal when you get a refinance. Just like when you went through the home buying process, a refinance appraisal tells the lender that they aren’t loaning you more money than your home is worth. However, if you have an FHA, VA or USDA loan, your lender can waive the appraisal so you can move forward with a no appraisal refinance.

Ideally, your appraisal will come back for more money than you paid for your home. If your assessment comes back low, you may need to adjust the amount youre asking for in your refinance.

Its never too early to begin setting yourself up for a successful appraisal. Here are a few things you can do during the early stages of your refinance to ensure your appraisal comes back strong.

- Do your research. Local property values influence the amount that your property is worth. Do some research and see how home values are trending in your area. Have recent sales data showing that local property values have increased? You may want to keep this information handy for the day of your appraisal.

- Keep upgrade documents in order. Permanent upgrades you make to your home increase its overall value. Keep receipts, contracts and permits handy, so you have proof of any updates youve made to your home since you moved in. This information will give your appraiser a more accurate estimate of the condition of your house.

How Much Will It Cost To Refinance My Mortgage

You will need to pay for legal fees,home appraisalfees, and mortgage registration fees, but can avoid paying for prepayment penalties and mortgage discharge fees under certain circumstances. The mortgage discharge fee can be avoided if you stay with the same lender. If you leave your current lender to refinance with another lender, you will have to pay a mortgage discharge fee.

If you wait until the end of your term to refinance, you wont have to pay mortgage penalties. If you refinance before your term is over, you will be charged penalties if you choose to refinance at current mortgage rates. However, you can choose to blend and extend your mortgage rate, which mixes your mortgage rate with current rates. This allows you to avoid paying for mortgage penalties, although your interest rate will not be fully adjusted to current interest rates.

These fees can add up to a hefty amount depending on which fees apply to you.

It becomes clear when adding up these refinancing fees that mortgage prepayment penalties will be the largest cost to a refinanced mortgage, but some fees are also avoidable. Here are the total costs for refinancing your mortgage for a typical mortgage:

-

Refinancing with your current lender at the end of your term:

$1,120 to $1,920

-

Refinancing with a different lender before the end of your term:

$1,320 to $2,270 plus mortgage penalties

Recommended Reading: How Long To Pay Off 70000 Mortgage

Process Of Refinancing A Mortgage

The process of refinancing has multiple steps. You will need to prepare yourself for the process, so you dont feel surprised or unprepared by anything. Researching the process and your options will make you better prepared for choosing the right lender and finding the best interest rates.

First, get an idea of your homes worth and determine how much equity you have. Generally, lenders wont refinance if you have less than 5% equity in your home. Ideally, you want 20% equity or more in your home for the best chances at qualifying for a refinance.

A lot of the refinancing process requires research. Not all lenders offer the same interest rates, and your credit score and other personal factors will affect how much you pay. You need to compare rates from several lenders and find out what fees they charge. Check with the mortgage companies to see what paperwork they need hard copies of. Many can connect electronically to various financial institutes, so you dont require printouts of financial documents.

Once youve done your research, apply for a loan to get an estimate for refinancing. You should get an estimate within three days. If you approve of the terms, the loan process continues with the lender carefully reviewing your application documents.

At this stage, you need to get an appraisal. In some cases, your lender may set up this inspection or ask you to do it. After appraising the home, the reviewer will send a report about the homes value to both you and the lender.

Getting An Fha Loan After Forbearance

In mid-September 2020, HUD released a mortgagee letter detailing waiting periods for FHA loans post-forbearance.

Similar to Fannie and Freddie, those who entered a forbearance plan but continued to make all their monthly mortgage payments can get a home loan with no wait provided the forbearance plan is terminated prior to or at closing.

Those in forbearance plans who paused payments will be subject to a three-month waiting period once the forbearance plan has been completed. In other words, they must make three monthly payments post-forbearance.

That rule applies to both home purchase loans and rate and term refinances.

For cash out refinances, the borrower must have completed their forbearance plan AND made at least 12 consecutive monthly payments post-forbearance.

A borrower who is still in a mortgage forbearance plan at the time of case number assignment, or has made less than 3 consecutive monthly mortgage payments post-forbearance, is eligible for a Credit Qualifying streamline refinance provided they meet the other streamline loan requirements.

For Non-Credit Qualifying streamline refinances, you must have made three consecutive monthly mortgage payments post-forbearance and meet the other general requirements for a streamline refinance.

Read Also: A& m Mortgage Merrillville Indiana

Alternatives To Refinancing For Smaller Projects

If youre only looking to borrow a small amount, such as to pay for a small renovation project or to pay off a small credit card bill, then a home equity line of credit would be a great alternative to a refinance. A HELOC is just like a refinance in that you can only borrow up to 80% of the value of your home, but it differs in that you can borrow and repay freely without having to pay fees each time you borrow. This is great for homeowners that want a line of credit that is easily assessable and easily payable. However,HELOC ratesare higher than mortgage refinance rates. HELOC rates are also usually variable rates, which means that your interest rate will not be fixed, unlike a mortgage refinance that can have a fixed rate.

Another alternative to refinancing would be home equity loans. Home equity loans aresecond mortgagesthat allow you to borrow money on top of your existing primary mortgage. Some lenders, particularlyprivate mortgage lenders, allow you to borrow a larger amount with a home equity loan, such as up to 90% or 95% of your homes value. However, second mortgages and home equity loans havehigher interest rates.

Does It Make Sense To Refinance My Mortgage

You should refinance your mortgage if you are able to refinance at a lower mortgage rate that covers the cost of any mortgage penalties for breaking your term early, along with other mortgage refinancing fees. You can also refinance if you are looking to borrow from your home equity. However, your savings from borrowing using a mortgage refinance should exceed the penalties for breaking the mortgage if you refinance mid-term.

For fixed-rate mortgages, most major banks charge a mortgage break penalty that is either three months worth of interest or something called an interest rate differential . IRD is the difference between interest on your current non-discounted mortgage rate and the interest on a mortgage for the same time period remaining on your mortgage term at the current posted rate. You can use a mortgage refinance calculator to calculate how much you can save or pay if you decide to refinance your mortgage.

Lets say that you have a $500,000 fixed-rate mortgage at 3.00% for a five-year term, and you have two years remaining. You notice that mortgage refinance rates are currently as low as 2.00%.

If you choose not to refinance, you will pay $29,029 in interest at 3% for the next two years. If you do refinance, you will pay a total of $19,320 in interest at 2% for the next two years. This results in $9,709 in interest savings.

You May Like: How Much Per 1000 On Mortgage

Refinance Savings Should Outweigh Costs

Refinancing only makes sense if you plan to live in your home long enough to enjoy the financial benefits. . . That means youll need to determine the break-even point of your refinance by calculating how long it will take to offset your initial investment and start reaping the rewards of refinancing.

Every home loan includes closing costs, which are usually around 2-5% of your loan balance. If you plan to refinance again or sell your home before you realize the savings, then a refinance will, ultimately, cost you moneynot help you save it.

Even if you choose a no-cost refi option, where out-of-pocket costs are rolled into your loan, youll still want to consider the impact of their additional expense. Note that no-cost refinances do not mean your closing costs are non-existent instead, theyll be applied to your loan balance and thus incur interest.

Our break-even refinance calculator can help you discover how quickly youd recoup any closing costs and fees on a new refinance.

Keep in mind, closing costs include fees for third-party services, such as the appraisal, title search and insurance, and credit report. Many lenders also charge loan origination, application, and underwriting fees but you can avoid those kinds of costs by working with Better Mortgage. Weve built technology to streamline the entire mortgage process from start to finish, making it less expensive to generate your loan. Naturally, we pass on the dollar and time savings on to you.