Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How To Improve Your Credit Score

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.

Whether youre working to repair your credit after some financial missteps, or preparing to apply for a new mortgage or loan and want to make sure you get the best interest rate, taking steps to improve your credit score is a smart decision. Well walk you through the factors that affect your credit score, seven ways you can improve your credit score and what to consider if youre thinking about hiring a credit repair company.

When You Owe Too Much

The other main category of reason codes concerns the amount of debt youre carrying. FICO looks at the amount of credit you have with the amount used , the balances and number of accounts with balances.

Eventually, you have no more available credit and you cant make your payments.

Fortunately, fixing this changes your score almost immediately. If you have savings to pay off your accounts, consider using it. Its a safe bet that the interest youre getting is a lot less than what your creditors are charging.

If you dont have savings to cover this, you may be able to improve your score by paying off your credit card balances with a personal loan or home equity loan. Lowering your revolving account balances drops the utilization ratio.

Dont do this unless you are 100 percent confident that you will not use your credit cards until the new loan is repaid.

You May Like: Recasting Mortgage Chase

First Things First Heres Why Your Credit Score Is Important:

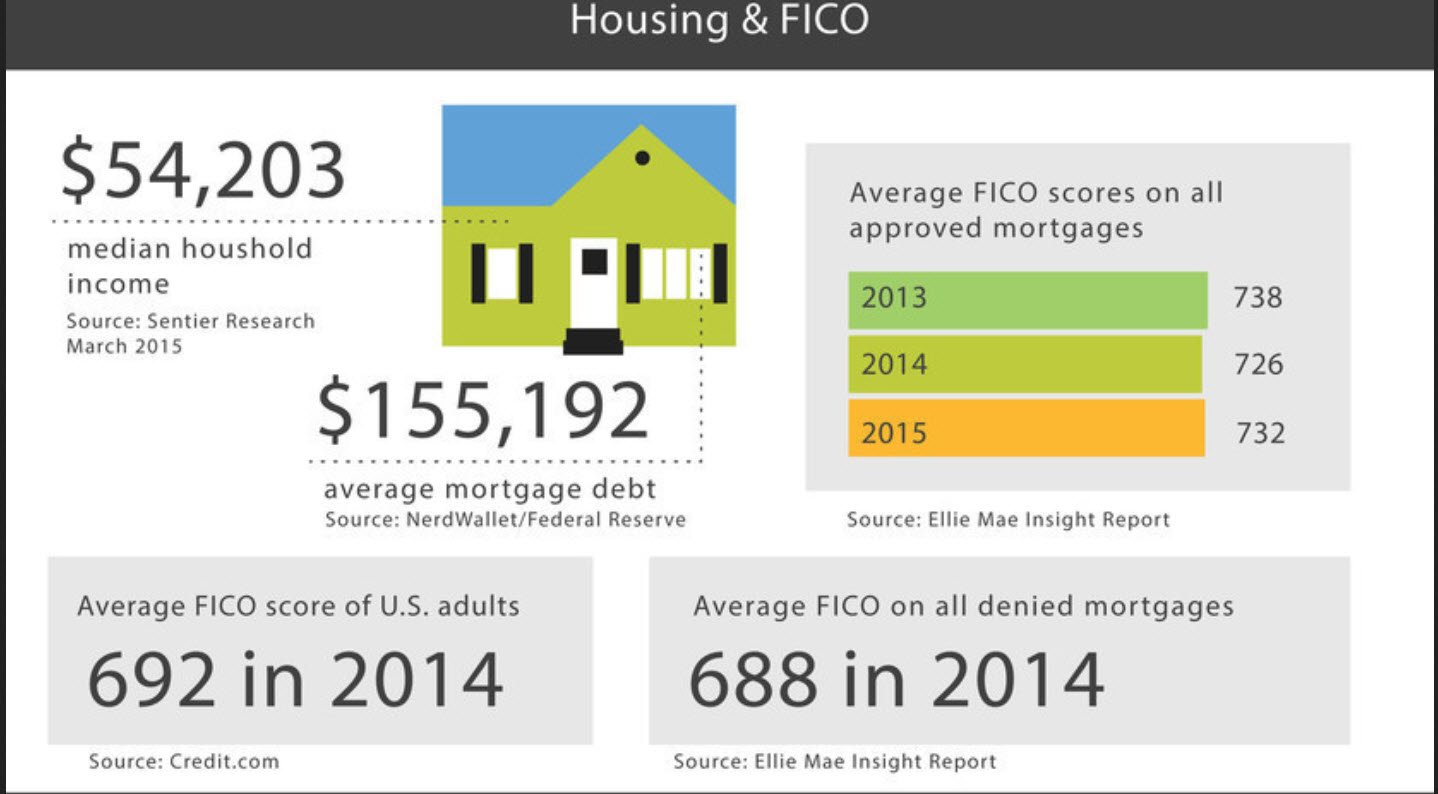

If your credit score is too low, you may not be able to qualify for a mortgage in the first place. Most mortgage lenders wont work with borrowers who have credit scores under 620. So if yours is below that threshold, its a good idea to figure out how to increase your credit score to buy a house before you apply. You should also note that some FHA lenders will lend to those with scores as low as 500.

Your credit score is one of the main factors that determine your mortgage rate. The better it is, the lower your interest rate and monthly mortgage payments will be. Borrowers with below-average credit stand to gain the most by improving their scores. But even if you already have a score in the good range, increasing it could still save you thousands of dollars in interest.

For example, if youre buying a $350,000 house with a 30-year fixed mortgage, you could save as much as $29,000 over the life of the loan by increasing your from 699 to 760.

How A Mortgage Affects Your Credit

Know the fundamentals. Your measures your ability to pay back debts. You only earn so much money so keeping your amount of debt in good proportion to your income is essential. This is called your debt-to-income ratio.

Keeping it no higher than 36% is considered optimum with no more than 28% going to your mortgage. If you know you will purchase a home in the near future, dont take on other debt obligations. Keep your debt-to-income ratio low.

However, do continue to build your . A little credit is better than no credit as far as your credit score is concerned. And of course, paying your mortgage on time is good for your credit history.

You May Like: Rocket Mortgage Qualifications

Make Sure Your Credit Report Is Accurate

The first thing you should do is get access to your credit reports for free. You can do this once every 12 months for each of the three major credit bureaus Equifax, Experian, and TransUnion. The information on your credit report is exactly what credit-scoring companies use to calculate your score.

Once you have your credit reports in front of you, make sure everything on them is accurate.

Keep an eye out for any negative information on your reports to verify its accuracy.

If there is a negative item on your report and that information is incorrect, dispute it immediately. The same goes if you discover youve been a victim of identity theft.

You can try disputing the item with the creditor directly, but youll also want to file a dispute with the credit bureau from which the report was pulled. This is where maintaining detailed financial records is essential. Make your case with proof, and be honest during the dispute for the best chance of success.

Want to Save 30% on your monthly mortgage repayments? Find Out How!

How Do My Fico Scores Affect My Ability To Get A Mortgage

Lending a huge amount of money is risky business. Thats why mortgage lenders need a good way to quantify the risk, and your FICO® scores with all of the data and research that go into them fit the bill.

Different lenders have different requirements for their loans. And because there are many different types of mortgages from many different types of lenders, theres no one single minimum FICO® score requirement.

Also Check: Does Rocket Mortgage Service Their Own Loans

Pay Down Your Credit Card Balances

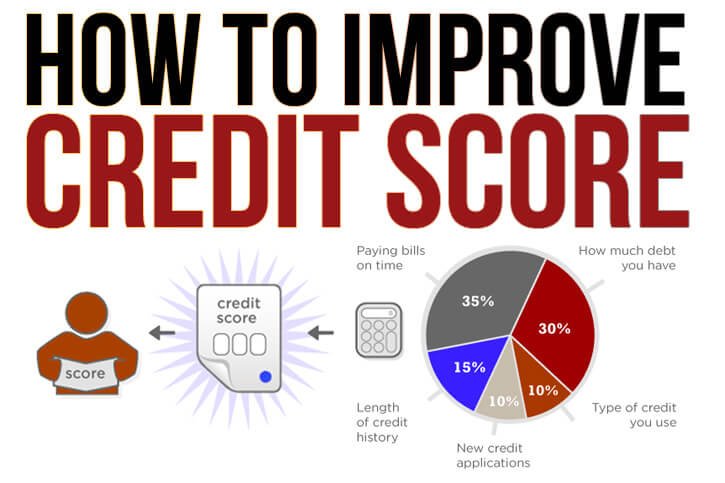

The amount of available credit you are using is called your . This ratio makes up 30% of your FICO score. Only your payment history, which accounts for 35% of your score, has a bigger impact on your credit score.

For example, if you have a credit card with a $1,000 credit limit and maintain a balance of $500 on it, your credit utilization ratio is 50%, which is considered very high.

Use Credit Monitoring To Track Your Progress

are an easy way to see how your credit score changes over time. These servicesmany of which are freemonitor for changes in your credit report, such as a paid-off account or a new account that youve opened. Also, they typically give you access to at least one of your credit scores from Equifax, Experian, or TransUnion, which are updated monthly.

Many of the best credit monitoring services can also help you prevent identity theft and fraud. For example, if you get an alert that a new credit card account that you dont remember opening has been reported to your credit file, you can contact the credit card company to report suspected fraud.

Recommended Reading: Chase Mortgage Recast Fee

How Long Does Improving Your Credit Score Take

There is no set minimum, maximum, or average number of points by which your credit score improves every month, and there is no set number of points that each action will gain. How long it takes to improve your credit depends on the specifics for why your credit score is low. If the major negatives on your credit score are credit utilization, and then you pay off your balances, your score can improve drastically in a single month. If your credit is low because of multiple collections and poor payment history, then it will take several months of on-time payments to see any positive movement in your score.

What Can Affect How Long It Takes

Your score is determined by the three credit bureaus , but its up to your lenders to contact them to report information about you. It can be as simple as your credit card company reporting that you made a monthly payment on time, increased your debt or decreased your balances. These are all positive influences on your score, but there may be a slight lag in timing due to the reporting process.

In addition to a potential delay in the telephone game between your credit issuer and the credit bureaus, certain financial events can linger on your credit history for years. Unfortunately, the more harmful events are often the ones that stick around the longest, so its best to know what actions will be the biggest burdens:

| Event | |

|---|---|

| Chapter 7 bankruptcy | 10 years |

This may seem ominous, but heres the good news: recency bias is alive and well in the credit scoring world. Even if theyre still present, the old items that appear on your report have less weight than your newer ones.

Recommended Reading: Can You Refinance A Mortgage Without A Job

How Fico Scores Are Calculated

Now that you know what a FICO score is, you may be wondering what factors go into this number. Since much of your creditworthiness hinges upon this number, understanding these components is key to ensuring your credit score is in tip-top shape. Heres how it breaks down:

-

Payment history This shows whether youve made your payments on time

-

Outstanding balances This shows how much you owe versus how much available credit you have

-

Age of credit history The longer your accounts are open, the better

-

New credit lines and inquiries Going on a credit application spree in a short amount of time can represent a risk and lower your score

-

Types of credit/account diversity Having a mix of credit cards, auto loans, student loans and mortgages is better than just having one type

Its worth noting that the percentages above can vary depending on your individual credit background. For example, if youre a new borrower, you probably wont have an extensive credit history but thats okay because in many cases, FICO will adjust the other items and redistribute the percentages accordingly.

Re: How To Increase My Mortgage Fico Score

Scores are the RESULT of a robust credit profile. Focus on your profile … how many tradesline you have? how old are they? are the all in good standing? do you have any baddies on your report? Are your reports 100% accurate?

I can’t give useful recommendation of raising scores other than the above.

Also Check: Can You Get A Reverse Mortgage On A Manufactured Home

Get A Credit Card If You Dont Have One

Its true that you dont need a credit card to build credit. But, if used responsibly, a credit card is a powerful tool to help you improve your credit score whether its already in pretty good shape and you want to reach even greater heights, or if you need to rebuild credit after some missteps.

The primary consideration when looking at a new card is whether your issuer reports the account and payment activity to all three consumer credit bureaus most do, but not all. If youre using a card that only reports to one or two credit bureaus, thats a missed opportunity.

If you have poor or fair credit, consider applying for a secured credit card. With a secured card, youll submit a deposit to the issuer in the amount of your desired credit limit, and this protects the issuer in case you dont pay back what you owe. But in other respects, a secured card functions just like any other credit card and can help add positive information to your credit reports.

And if you have good-to-excellent credit, youve got options. A cash back credit card can reward you while you build credit, while a card with a 0% introductory APR period can give you some breathing room if you need to finance a big-ticket purchase or transfer high-interest debt youre carrying on another credit card.

What Is Fico Score And Why Is It Important

FICO is one of the main credit scoring companies in the U.S., and most major creditors use one of FICOs credit scores when making a lending decision. If you apply for a mortgage, auto loan, personal loan, or credit card, theres a good chance that the creditor will check your .

FICO creates different types of credit scores. Its base FICO Scores, created for multiple types of lenders, range from 300 to 850. It also offers industry-specific scores for auto lenders and credit card issuers that range from 250 to 900. In either case, a poor score is often a score below 580, while having a good score means your score is in the high 600s, at least.

You wont necessarily know which type of FICO Score a lender will use when reviewing your credit. But thats okay because you can take similar actions to improve all of your FICO Scores. So, dont get led astray by the myths and misconceptionshere are 10 ways to actually raise your FICO Scores:

Recommended Reading: Reverse Mortgage Manufactured Home

Request A Credit Limit Increase

You can ask your credit card providers to increase the limits on all the cards you own. If you have a history of timely payments with your credit card provider, theres a good chance they will negotiate. This will improve your credit-utilization rate, which is the amount of debt youre carrying versus your total credit limits and is a major contributing factor to your credit score.

Want to Save 30% on your monthly mortgage repayments? Find Out How!

What Is A Good Credit Score

There’s no single, universal credit rating or score that a lender will use when deciding whether or not to accept you as a customer. Neither is there such a thing as a ‘credit blacklist’.

The scores you may have seen advertised by credit reference agencies , such as Experian, are simply indicators of your creditworthiness, which is based on the information held in your credit report.

Each of the UKs three main credit reference agencies has a scale for what it considers a ‘good’ or an ‘excellent’ credit score.

- Equifax 531 to 670 is good 811 to 1,000 is excellent

- Experian 881 to 960 is good 961 to 999 is excellent

- TransUnion 604 to 627 is good 628 to 710 is excellent

While it can help to have a ‘good’ or ‘excellent’ credit score, on its own, its not a guarantee that all lenders will extend credit to you or treat you in the same way. Each lender has its own system for deciding whether or not to lend to you – meaning you could be rejected by one, but accepted by another.

If you have a low or bad credit score, you’ll more likely find you are turned down when you apply to borrow money and you should take steps to improve your score. Read on for 12 tips to improve your rating.

Find out more:how to check your credit score for free

Also Check: 10 Year Treasury Yield And Mortgage Rates

Check Your Credit Reports And Scores

The first step in prepping your credit for a mortgage is learning where your credit currently stands. That means checking your scores, and getting your credit reports from all three credit bureaus to review the factors affecting them. You can get a free credit report from Experian, Equifax and TransUnion at AnnualCreditReport.com.

Review each credit report carefully to make sure it accurately reflects your credit history. If you get all three reports at the same time, don’t be surprised if there are minor differences between them. Your lenders may not report all of your accounts to every credit bureau, or may send updates to the credit bureaus on slightly different schedules. So there’s no need to be alarmed if, for instance, your Experian report reflects the most recent payment on your credit card but your TransUnion report doesn’t show it yet.

Here are some things to look for when you get your reports:

- High account balances relative to your credit limits. Paying down your balances will help your credit scores.

- Past-due accounts, charge-offs and accounts in collections. If possible, bring all accounts current and pay off any outstanding collection accounts.

- Loans or credit accounts that shouldn’t be there , and payments incorrectly listed as late or missed. If any inaccuracy exists, follow the dispute process for the relevant credit bureau as soon as you can.

When preparing to apply for a mortgage, the following steps are generally advisable to all borrowers.

No : Use Credit Wisely

Scott says there are three golden rules for maximizing your FICO score:

“Do not over extend yourself,” says Arzaga. “If your goal is to improve your credit score and qualify for better rates and terms, then manage your household cash flow,” he says. Having better household cash flow will reduce the risk of late payments.

Another tip: Keep revolving credit card accounts to a minimum. Johansson says that seeing several revolving accounts on a credit report is a subtle red flag and, in some cases, can show the potential for overspending.

Also Check: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Dont Close Your Old Accounts

Average Age of Accounts = 10% of your FICO Score

If youre like most people, you probably have a credit card or two you never use for one reason or another. Instead of closing the account, its actually best to leave it open. Because the average age of your open accounts makes up 10% of your score, the longer your accounts are open, the better.