What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score between both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

Consider Different Types Of Home Loans

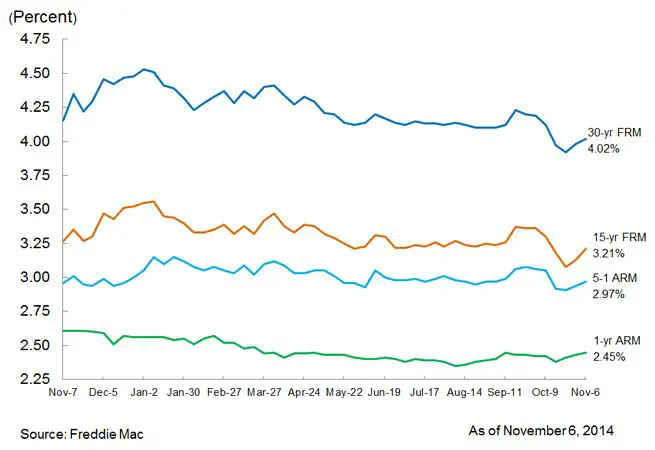

The 30-year fixed rate mortgage is the most common type of home loan, but there are additional mortgage options that may be more beneficialdepending on your situation.For example, if you require a lower interest rate, adjustable-rate mortgages offer a variable rate that may be initially lower than a 30-year fixed rate option but adjusts after a set period of time . Given that ARM loans are variable, the interest rate could end up being higher than with a 30-year fixed rate mortgage that has a locked-in mortgage rate. A 15-year fixed rate mortgage, on the other hand, may offer a lower interest rate that wont fluctuate like an ARM loan but requires a higher monthly payment compared to a 30-year fixed rate mortgage. Consider all your options and choose the home loan that is most comfortable for you.

Why Is My Mortgage Rate Higher Than Average

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan term, interest rate types , down payment size, home location and the loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Read Also: 10 Year Treasury Vs 30 Year Mortgage

Good Mortgage Rates Look Different To Everyone

What is a good mortgage rate? Thats a tricky question. Because many of the rates you see advertised are available only to prime borrowers: those with high credit scores, few debts, and very stable finances. Not everyone falls into that category.

Of course, you can look at average mortgage rates. But how reliable are those as a guide?

On the day this was written, Freddie Macs weekly average rate for a 30year, fixedrate mortgage was 2.99%. But the daily equivalent on Mortgage News Dailys website was 3.13%. So theres clearly a lot of variance across the market.

How Do I Qualify For Better Mortgage Rates

Qualifying for better mortgage rates can help you save tens of thousands of dollars over the lifetime of the loan. Here are a few ways you can ensure you find the most competitive rate possible:

- Raise your credit score: A borrowers credit score is a major factor in determining mortgage rates. The higher the credit score, the more likely a borrower can get a lower rate. Its a good idea to review your credit score to see how you can improve it, whether thats by making on-time payments or disputing errors on your credit report.

- Increase your down payment: Most lenders offer lower mortgage rates for those who make a larger down payment. This will depend on the type of mortgage you apply for, but sometimes, putting down at least 20 percent could get you more attractive rates.

- Lower your debt-to-income ratio: Also called DTI, your debt-to-income ratio looks at the total of your monthly debt obligations and divides it by your gross income. Usually, lenders don’t want a DTI of 43% or higher, as that may indicate that you may have challenges meeting your monthly obligations as a borrower. The lower your DTI, the less risky you will appear to the lender, which will be reflected in a lower interest rate.

Read Also: Does Prequalifying For A Mortgage Affect Your Credit

Whats A Good Mortgage Rate Today

Mortgage rates change all the time. So a good mortgage rate could look drastically different from one day to the next.

Throughout the first half of 2021, the best mortgage rates have been in the high2% range. And a good mortgage rate has been around 3% to 3.25%.

Of course, these numbers vary a lot from one borrower to the next, as we explain below.

Toptier borrowers could see mortgage rates in the 2.53% range at the same time lowercredit borrowers are seeing rates in the high3% to 4% range.

In addition, looking forward in 2021, interest rates seem likely to increase. So a good mortgage rate later this year could be substantially higher than what it is today.

What Is The Difference Between Interest Rate And Apr

Interest rate is a percentage of the total loan balance paid to the lender on a monthly basis . The annual percentage rate, or APR, is the total borrowing cost as a percentage of the loan amount, which includes the interest rate plus any additional fees like discount points and other costs associated with procuring the loan.

You May Like: Chase Recast Calculator

Mortgage Rates: Current Home Interest Rates

Rate, points and APR may be adjusted based on several factors including, but not limited to, state of property location, loan amount, documentation type, loan type, occupancy type, property type, loan to value and your credit score. Your final rate and points may be higher or lower than those quoted based on information relating to these factors, which may be determined after you apply.

Tools and calculators are provided as a courtesy to help you estimate your mortgage needs. Results shown are estimates only. Speak with a Chase Home Lending Advisor for more specific information. Message and data rates may apply from your service provider.

FHA loans require an up-front mortgage insurance premium which may be financed, or paid at closing and monthly premiums will apply.

For the Adjustable-Rate Mortgage product, interest is fixed for a set period of time, and adjusts periodically thereafter. At the end of the fixed-rate period, the interest and payments may increase. The APR may increase after the loan consummation.

Results of the mortgage affordability estimate/prequalification are guidelines the estimate isn’t an application for credit and results don’t guarantee loan approval or denial.

All home lending products except IRRRL are subject to credit and property approval. Rates, program terms and conditions are subject to change without notice. Not all products are available in all states or for all amounts. Other restrictions and limitations apply.

What Is The Difference Between Apr And Interest Rate

The mortgage APR is the interest rate plus the costs of things like discount points and fees. This number is higher than the interest rate and is a more accurate representation of what you’ll actually pay on your mortgage annually.

Why is it important to understand the difference between the interest rate and APR? When you’re shopping around for lenders, you may find that one charges a lower interest rate, so you think that company is the obvious choice. But you might actually find out the APR is higher than what you can get with another lender because it charges hefty fees. In reality, it might not be the best deal.

Don’t Miss: 10 Year Treasury Yield And Mortgage Rates

What Is A Good Loan Term

When picking a mortgage, it’s important to consider the loan term, or payment schedule. The loan terms most commonly offered are 15 years and 30 years, although you can also find 10-, 20- and 40-year mortgages. Mortgages are further divided into fixed-rate and adjustable-rate mortgages. For fixed-rate mortgages, interest rates are fixed for the life of the loan. For adjustable-rate mortgages, interest rates are fixed for a certain number of years , then the rate adjusts annually based on the market rate.

When deciding between a fixed-rate and adjustable-rate mortgage, you should take into consideration how long you plan to stay in your home. Fixed-rate mortgages might be a better fit for people who plan on staying in a home for a while. Fixed-rate mortgages offer greater stability over time compared to adjustable-rate mortgages, but adjustable-rate mortgages can sometimes offer lower interest rates upfront. If you don’t plan to keep your new home for more than three to 10 years, though, an adjustable-rate mortgage could give you a better deal. There is no best loan term as a rule of thumb it all depends on your goals and your current financial situation. It’s important to do your research and know your own priorities when choosing a mortgage.

Find the Best Refinance Rates with the CNET Rate Alert

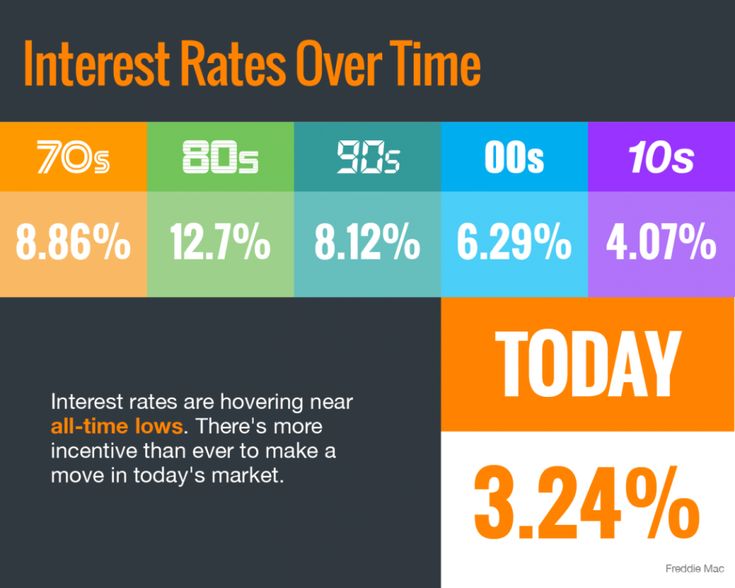

Where Are Rates Headed

Experts agree that rates are likely to keep heading higher, though theyre divided over how high theyll go and how quickly theyll get there.

Another year of strong economic growth combined with the Feds tighter policy stance will put upward pressure on rates, and as the Fed reduces its MBS purchases, we also expect some volatility as other investors step into the market but without the steady purchase flow of the Fed, said Joel Kan, associate vice president of economic and industry forecasting at the Mortgage Bankers Association.

Rates have hit the 4 percent mark sooner than MBA predicted, with a forecast earlier this year suggesting that level wouldnt be seen until the fourth quarter.

Logan Mohtashami, a housing analyst at HousingWire, said global markets are going to continue influencing mortgage rates in the U.S., so theres some unpredictability on the horizon.

The trick is that for rates to stay above 4 percent and higher, we would need global yields to keep heading higher and economic data to stay firm here in the U.S., Mohtashami said. He expects German and Japanese bonds to play a particularly important role in the markets future trends.

Also Check: Recasting Mortgage Chase

Is 425 A Good Interest Rate

is 4.25rates

. Also question is, is 4.25 a good interest rate for a home?

It depends on your state, but 4.125% with credits towards your closing costs if you are getting separate mortgage insurance. If you are getting mortgage insurance included with the rate, then 4.25% is a great rate.

Likewise, is 4% a good mortgage rate? Right now, an interest rate around 4 percent is considered good, says Tim Milauskas, a loan officer at First Home Mortgage in Millersville, Maryland. Mortgage lenders are usually interested in several months’ of timely payments, Milauskas says. Next, pay down your debt if you have extra cash.

Subsequently, one may also ask, is 4.75 a good interest rate?

For an auto loan, 4.75% is probably a good interest rate. That’s under the current 5-year new auto loan average rate for banks. But if you have excellent credit, you may be able to get even lower if you shop around.

What is a good interest rate on a mortgage?

Forecasts for 2020 say rates will average around 3.7%. But rates could fluctuate greatly around that range. For instance, rates could bounce between 3.5% and 4% all year, and you’d get an average of around 3.7%. But when you lock during that range is important.

Best Mortgage Rates For December

If youre looking for a 2 year fix, Halifaxoffers the lowest rate at 1.10%. Youll pay a £995 arrangement fee and youll need at least a 40% deposit. But its only available if youre buying a property. The lowest rate for a 2 year fix if youre remortgaging is with Yorkshire Building Society at 1.12%. Youll need a 25% deposit and it has an arrangement fee of £1,495.

The lowest rate on a 3 year fix is with Nationwide. If youre buying a house Nationwide offers a rate of 1.24%. Youll need a 40% deposit and theres an arrangement fee of £999. However if youre remortgaging, Nationwide will offer a rate of 1.34%. Again youll need a 40% deposit. Theres an arrangement fee of £999, but youll get £500 cashback.

For a 5 year fix, Halifax offers the lowest rate at 1.31% youll need a deposit of at least 40% and it has an arrangement fee of £995. However, its only available if youre buying a house. If youre remortgaging, Santander offers the lowest rate for a 5 year fix at 1.34%. Youll need a 40% deposit and it has an arrangement fee of £999. Plus youll get £250 cashback.

Recommended Reading: Chase Recast

How To Compare Mortgage Rates

Borrowers who comparison shop tend to get lower rates than borrowers who go with the first lender they find. You can compare rates online to get started. However, to get the most accurate quote, you can either go through a mortgage broker or apply for a mortgage through various lenders.

The advantage of going with a broker is you do less of the work and youll also get the benefit of their lender knowledge. For example, they might be able to match you with a lender whos suited for your borrowing needs, this could be anything from a low down payment mortgage to a jumbo mortgage. However, depending on the broker, you might have to pay a fee.

Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you dont have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time wont show up on your credit report as its usually counted as one query.

Finally, when youre comparing rate quotes, be sure to look at the APR, not just the interest rate. The APR reflects the total cost of your loan on an annual basis.

When Should You Lock In Your Mortgage Rate

When you receive a mortgage loan offer, a lender will usually ask if you want to lock in the rate for a period of time or float the rate. If you lock it in, the rate should be preserved as long as your loan closes before the lock expires.

If you dont lock in right away, a mortgage lender might give you a period of timesuch as 30 daysto request a lock, or you might be able to wait until just before closing on the home.

Once you find a rate that is an ideal fit for your budget, its best to lock in the rate as soon as possible, especially when mortgage rates are predicted to increase. While its not certain whether a rate will go up or down between weeks, it can sometimes take several weeks to months to close your loan.

If you dont lock in your rate, rising interest rates could force you to make a higher down payment or pay points on your closing agreement in order to lower your interest rate costs.

Don’t Miss: Rocket Mortgage Loan Types

Is 325% A Good Mortgage Rate

Let’s preface this by mentioning that some borrowers are scoring rates in the 2s. Others, meanwhile, also timed the process right and locked in a 3% mortgage rate.

But don’t be discouraged if you end up with a 3.25% rate. Even a 0.75% difference, when compared to a 4% rate, will prove to be worthwhile in the long run.

What Is A Discount Point

A discount point is a fee you can choose to pay at closing for a lower interest rate on your mortgage. One discount point usually costs 1% of your mortgage, and it reduces your rate by 0.25%. So if your rate on a $200,000 mortgage is 3.5% and you pay $4,000 for two discount points, your new interest rate is 3%.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

How Are Mortgage Rates Impacting Home Sales

The total number of mortgage applications inched lower during the week ending December 17, 2021. The 0.6% decline was driven by a decrease in the number of purchase loan applications, according to the Mortgage Bankers Association.

- The total number of purchase loan applications decreased by 6% week-over-week, breaking a five-week run of increases. Compared to the same week last year, there were 9% fewer applications.

- Refinance applications, on the other hand, increased by 2% from the week prior but were 42% lower year-over-year. Refis made up a little over 65% of all applications.

Benefits And Drawbacks To A 4

Most mortgage shoppers dont set out specifically in search of a 4-year fixed term. Instead, 4-year mortgage terms are often an afterthought.

On occasion, however, they can offer a decent balance between payment stability and interest expense.

Still, just 1 in 16 borrowers choose a 4-year fixed mortgage term, or about 6%.

Below, we explore more of the benefits and drawbacks of this largely overlooked term.

Also Check: How Does Rocket Mortgage Work

How Do You Calculate A Mortgage Payment

In addition to your principal and interest payments, a monthly mortgage payment may also include several fees, like private mortgage insurance , taxes and homeowners association fees.

Your lender will be able to provide you with a line-item breakdown of your mortgage payment. Using a mortgage calculator is an easy way to find out what your monthly payments will be. You can also look at an amortization schedule, which shows you how much youll pay over time.