If Your Mortgage Rate Is Above 516% Now Is Probably A Good Time To Refinance

The current average for a 30-year fixed-rate loan is 4.16%. One of the indications that a refinance is a good idea is if you can reduce your current interest rate by at least 0.5% to 1%.

If you have a $300,000 balance on your mortgage and you refinance to a new 30-year loan, lowering your interest rate from 3.75% to 3.25% will save around $84 per month or $1,008 per year. If you can reduce the rate by 1%, from 3.75% to 2.75%, your monthly savings would be $165 per month or $1,980 per year.

You also dont have to refinance into another 30-year loan. If your finances have improved and you can afford higher monthly payments you can refinance your 30-year loan into a 15-year fixed-rate mortgage, which will allow you to pay the loan off faster and also pay less interest.

Taking a look at your monthly savings is just one part of the refi equation, however. You also need to factor in the cost of switching out your loan and how long it will take you to recover those costs, or break even.

Just as with a purchase loan, youll have to pay closing costs on a refinance. These costs can include origination and applications fees, appraisal and inspection costs and title search fees. In all, closing costs can run between 3% and 6% of the total loan amount being refinanced.

Find A Mortgage Loan Officer In Colorado

Our local mortgage loan officers understand the specifics of the Colorado market. Let us help you navigate the mortgage process so you can focus on finding your dream home.

Loan approval is subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts. Interest rate and program terms are subject to change without notice. Mortgage, Home Equity and Credit products are offered through U.S. Bank National Association. Deposit products are offered through U.S. Bank National Association. Member FDIC. Equal Housing Lender

Annual Percentage Rate represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. The APR may be increased after consummation for adjustable-rate mortgage loans.

The rates shown above are the current rates for the purchase of a single-family primary residence based on a 60-day lock period. These rates are not guaranteed and are subject to change. This is not a credit decision or a commitment to lend. Your guaranteed rate will depend on various factors including loan product, loan size, credit profile, property value, geographic location, occupancy and other factors.

VA Loans – Annual Percentage Rate calculation assumes a $179,026 loan with no down payment and borrower-paid finance charges of 0.862% of the base loan amount, plus origination fees if applicable.

year U.S. Bank

What Is A Mortgage

A mortgage is a type of secured loan provided by a financial institution to cover the cost of buying a home should you not have enough cash to pay for it upfront. You pay back the lender over an agreed-upon amount of time, including an additional interest payment, which you can consider the price of borrowing money.

Because a mortgage is a secured loan, it means you put your property up as collateral. Should you fail to make your payments over time, the lender can foreclose on, or repossess, your property. Learn more about how a mortgage works here.

Also Check: Requirements For Mortgage Approval

Variable Interest Rate Mortgage

A variable interest rate can increase and decrease during your term. If you choose a variable interest rate, your rate may be lower than if you selected a fixed rate.

The rise and fall of interest rates are difficult to predict. Consider how much of an increase in mortgage payments youd be able to afford if interest rates rise. Note that between 2005 and 2015, interest rates varied from 0.5% to 4.75%.

Consider if youre comfortable with the possibility of interest rates increasing. Determine if your budget could handle higher payments. If not, a fixed interest rate mortgage may be better for you. You may also consider fixed payments with a variable interest rate.

A variable interest rate mortgage may be better for you if youre comfortable with:

- your interest rate changing

- your mortgage payments potentially changing

- the need to follow interest rates closely if your mortgage has a convertibility option

Get information on current interest rates from the Bank of Canada or your lenders website.

Interest Rates For Federal Student Loans

From March 13, 2020, through at least , the interest rates on many federal student loans have been set to 0% due to COVID-19. This was one of the economic provisions of the CARES Act.

Barring another federal stimulus package that makes changes to student loan interest rates, loans distributed between July 1, 2021, and July 1, 2022, have the following rates.

- Perkins Loans: 5%

- Undergraduate Direct Subsidized/Direct Unsubsidized loans: 3.73%

- Graduate or professional Direct Unsubsidized loans: 5.28%

- Parents or graduate/professional Direct Plus loans: 6.28%

Recommended Reading: How Does Rocket Mortgage Work

Trade In Your 30 Year Or 15 Year Mortgage

Do due to the sheer nature of todays interest rate environment brought on by weak economic data, trading in your high rate loan for a new loan with a lower rate and payment is a smart move. Better your financial position with todays market opportunities rather than tomorrows unknown. Start today by getting a complementary mortgage rate quote.

Are Refinance Rates Going Down

While current mortgage rates remain low, most mortgage experts anticipate rates will continue to drift higher over the coming months and years. The Federal Reserve is expected to begin raising short term interest rates in 2022. The Fed does not set mortgage rates, but lenders tend to increase the price to borrow money when the Fed acts.

Also Check: Rocket Mortgage Launchpad

Know When To Refinance Your Home

There are a number of reasons why you should refinance your home, but many homeowners consider refinancing when they can lower their interest rate, reduce their monthly payments or pay off their home loan sooner. Refinancing also may help you access your homes equity or eliminate private mortgage insurance .

A home loan refinance may make sense particularly if you plan to remain in your home for awhile. Even if you score a lower interest rate, you need to take the loan costs into consideration. Calculate the break-even point where your savings from a lower interest rate exceed your closing costs by dividing your closing costs by the monthly savings from your new payment.

Our mortgage refinance calculator could help you determine if refinancing is right for you.

Todays Mortgage Refinance Rates

Refinancing became a bit more expensive today as 30-year fixed and 15-year fixed refinance mortgages saw their mean rates climb. If youve been considering a 10-year refinance loan, just know average rates also increased.

The refinance averages for 30-year, 15-year, and 10-year loans are:

Compare national home loan rates from various lenders .

You May Like: Rocket Mortgage Requirements

Refinow And Refi Possible

On June 5, 2021, Fannie Mae began to offer low-income mortgage holders a new refinance option through a program called RefiNow, meant to reduce their monthly payments and interest rates. Beginning in late August 2021, Freddie Mac will begin offering the exact same program, which is called Refi Possible. In order to be eligible, homeowners must be earning at or below 80% of their area median income .

Fannie Mae’s RefiNow program offers several benefits for homeowners. First, it requires a reduction in the homeowners interest rate by a minimum of 50 basis points and a savings of at least $50 in the homeowners monthly mortgage payment. Second, Fannie Mae will provide a $500 credit to the lender at the time the loan is purchased if an appraisal was obtained for the transaction, and this credit must be passed on from the lender to the homeowner.

In order to qualify for Fannie Mae’s RefiNow program, a homeowner must meet these qualifications:

- Be in a possession of a Fannie Mae-backed mortgage secured by a 1-unit, principal residence.

- Have a current income at or below 80% of the AMI

- Never missed a mortgage payment in the past six months and no more than one missed mortgage payment in the past 12 months.

- Be in possession of a mortgage with a loan-to-value ratio up to 97%, a debt-to-income ratio of 65% or less, and a minimum 620 FICO score.

Shop Around To Find Your Best Interest Rate

Mortgage lenders personalize your interest rates based on your credit history and other details about your financial life. So you wont know for sure what your rate options look like until you apply and get preapproved.

The first rate youre quoted may not be your best interest rate. Be sure to apply with several lenders so you can compare Loan Estimates and find your best deal.

Also Check: 70000 Mortgage Over 30 Years

Negatively Impacting Your Long

Refinancing can lower your monthly payment, but it will often make the loan more expensive in the end if youre adding years to your mortgage. If you need to refinance to avoid losing your house, paying more, in the long run, might be worth it. However, if your primary goal is to save money, realize that a smaller monthly payment doesnt necessarily translate into long-term savings.

Get Your Mortgage Right And It’s The Easiest Money You’ll Make

Our team of mortgage brokers are whizzes at perfecting a mortgage structure.

Rather than putting all your eggs in one basket at one interest rate, depending on your situation we’ll usually advise splitting your mortgage across different terms and rates. Were pretty clued up about the economy and rate movement so well help you make an informed decision.

Why bother getting so technical?

The devil is really in the detail. When were talking hundreds of thousands of dollars, a fraction of a percent change in interest or repayment rates can save you a packet. This could mean retiring to your super yacht a few years earlier than planned. If that’s your thing.

Are interest rates moving?

The question that is top of mind for most is whether or not interest rates are going to go up or down. This is especially true if youre looking to get into the property market or make a change to an existing portfolio. We might not have a crystal ball, but we keep our blog up to date if you’re after an idea of whats been happening with interest rates lately.

Also Check: Chase Mortgage Recast

How Our Mortgage Interest Rates Are Calculated

We use Bankrates daily mortgage interest rate data for our mortgage rate trends. These overnight rates are based on a specific borrower profile, which only includes loans for primary residences where the borrower has a FICO score of 740+. Bankrate is part of the same parent company as NextAdvisor.

The table below compares todays average rates to what they were a week ago, and is based on information provided to Bankrate by lenders nationwide:

Current average mortgage interest rates| Loan type |

|---|

What Is A Good Interest Rate For A 30 Year Fixed Mortgage

4.9/5read here

Today’s Mortgage and Refinance Rates

| Product | |

|---|---|

| 3.450% | 3.750% |

Additionally, is 3.375 a good mortgage rate? The lowest rate I’ve seen advertised by the top 10 mortgage lenders is the 3.375% on offer at Flagstar Bank. At U.S. Bank you can get a jumbo 30-year fixed as low as 3.625% with similar APR. Their FHA 30-year fixed is currently 3.5%, but APR is over 5% because of pricey mortgage insurance premiums.

Then, is 4.75 A good mortgage rate?

*Interest rates assume a good credit rating and 20% down payment. **Amount doesn’t include property taxes, homeowners insurance, or HOA dues . The Cost Savings of Different Interest Rates for a $200K 30-Year Fixed Loan.

| Interest Rate* |

|---|

| $175,592 |

Is 3.875 a good mortgage rate?

Historically, it’s a fantastic mortgage rate. The average rate since 1971 is more than 8% for a 30-year fixed mortgage. To see if 3.875% is a good rate right now and for you, get 3-4 mortgage quotes and see what other lenders offer.

Also Check: Rocket Mortgage Loan Types

Can You Refinance Into A Shorter Term

If you have 20 years left on your mortgage and you refinance into a new 30-year mortgage, you may not save money over the long run .

However, if you can afford to refinance that 20-year mortgage into a 15-year mortgage, the combination of a lower interest rate and a shorter term will substantially reduce the total amount of interest youll pay before you own the house free and clear.

-

Negatively impacting your long-term net worth

What Is A Good Interest Rate On A Home Mortgage

Locking in low mortgage and refinance rates can save you thousands of dollars over the life of your loan. Here’s how you can get a good interest rate on a home loan.

When applying for a home loan, one of the most important factors you should pay attention to is your interest rate. Having a lower mortgage interest rate could save you tens of thousands of dollars over the life of your loan.

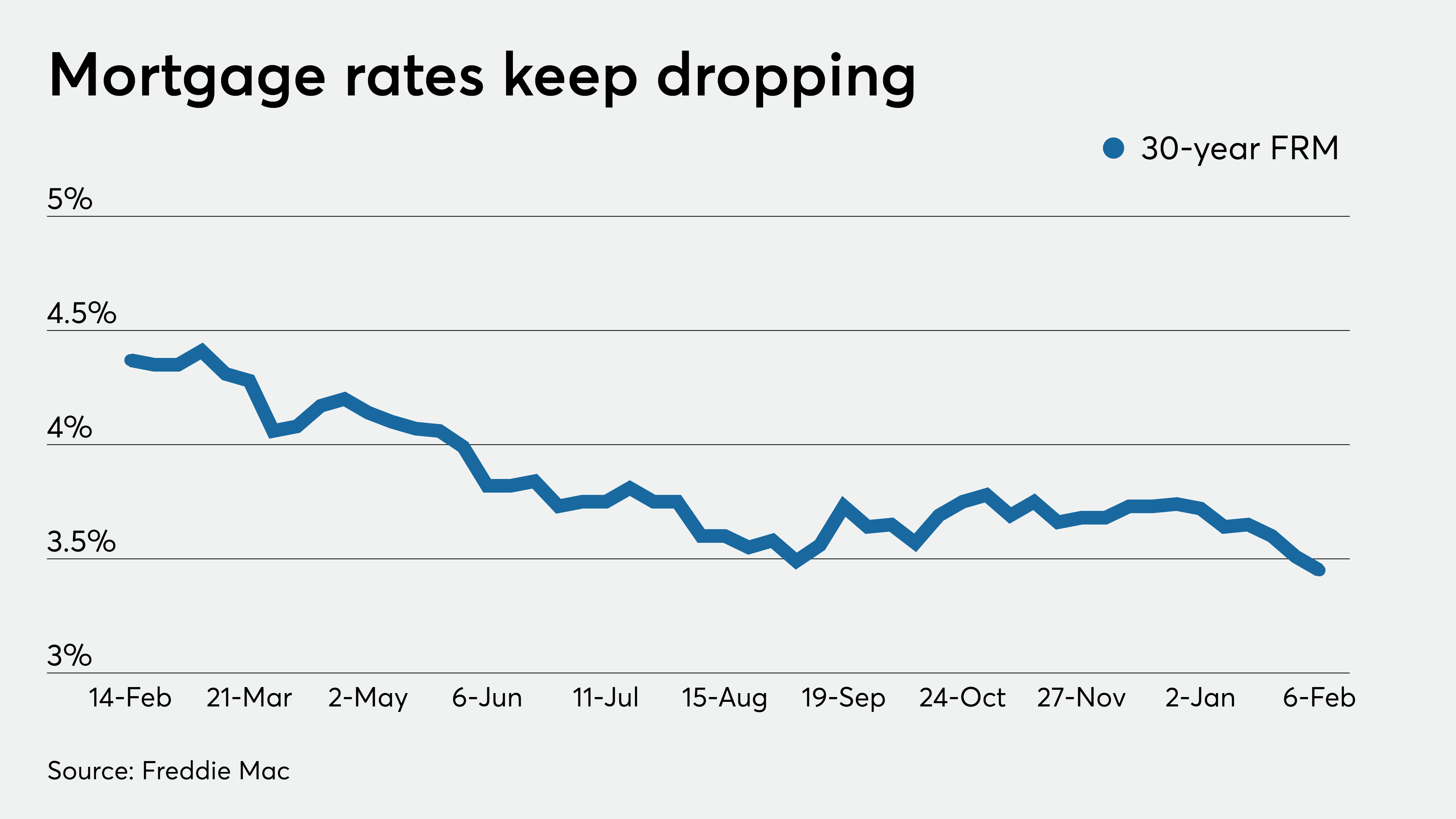

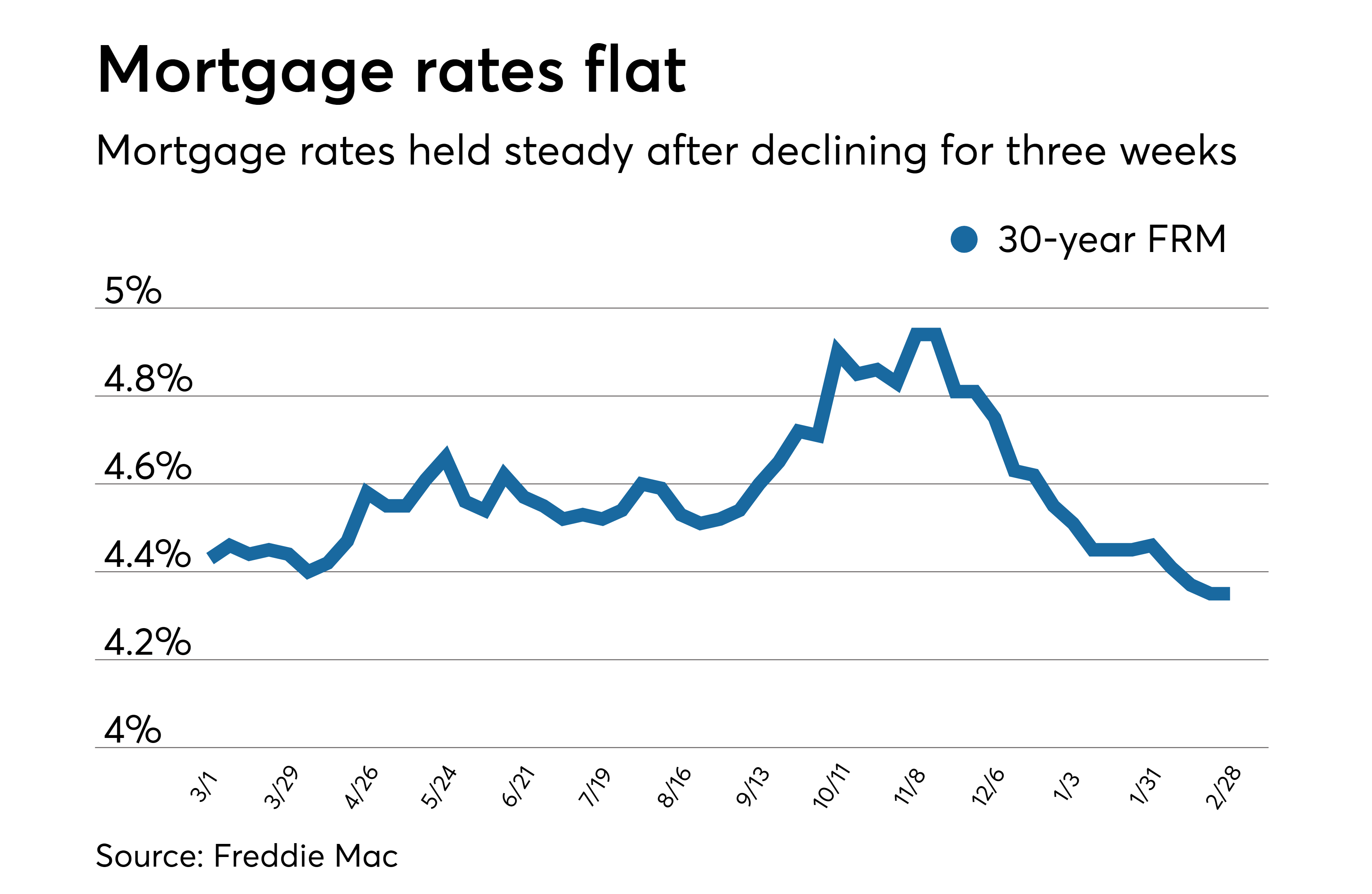

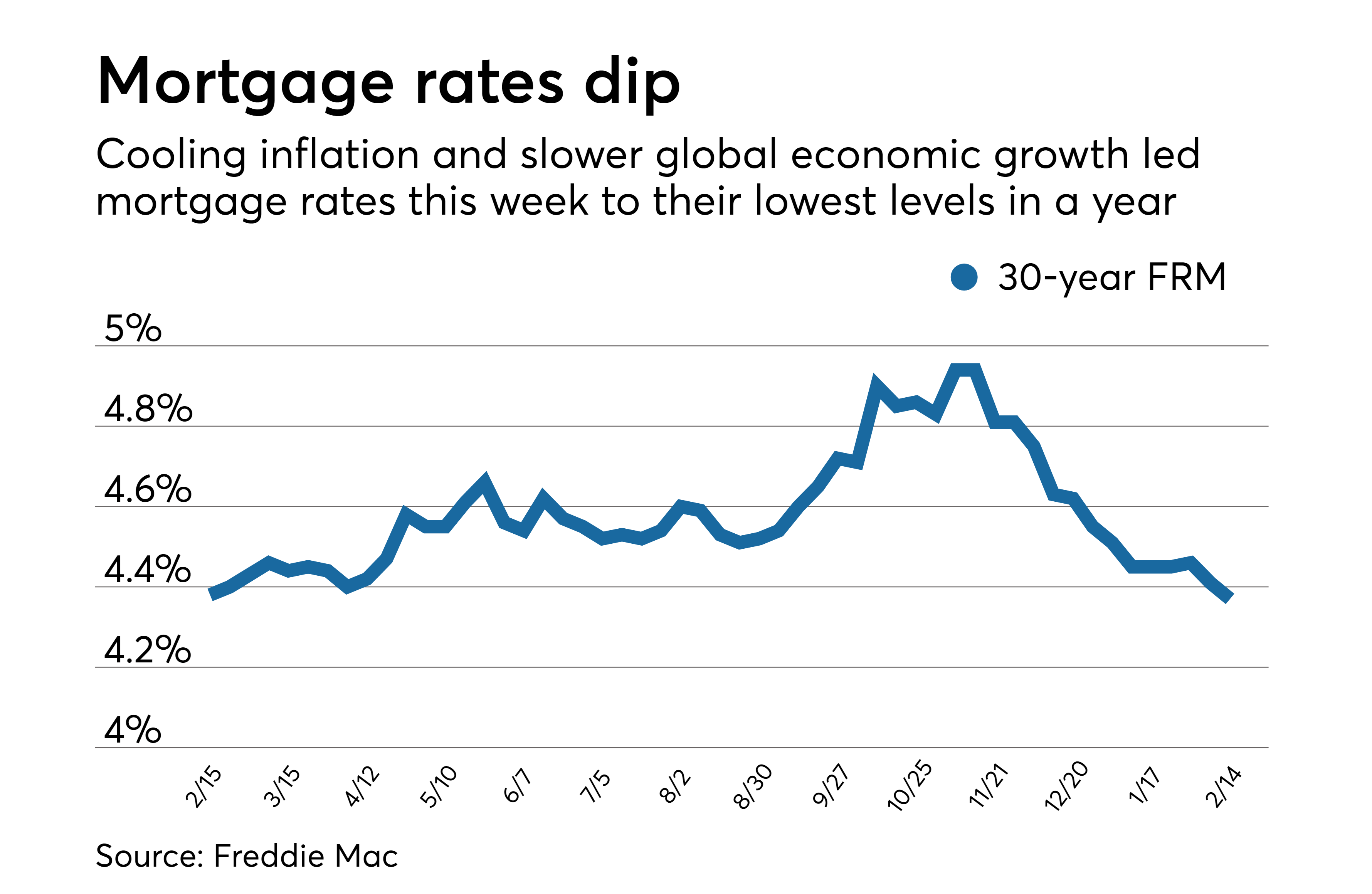

Generally, the best time to apply for a mortgage or mortgage refinance is when national interest rates are low. However, the market rate does not always match the rate you could be given once you apply, since personal factors will also come into play. For the past few years, mortgage rates have remained historically low around 3% to 4% for a 30-year fixed-rate mortgage, according to Freddie Mac. However, just 30 years ago, rates were as high as 9% and 10%.

Getting a good interest rate on your mortgage relies on a variety of factors, but it’s important to determine what a good mortgage rate really means. You can explore mortgage rates across multiple lenders on Credible without affecting your credit score.

What is a good mortgage rate right now?

You can check out Credibles mortgage calculator for your potential monthly mortgage payment, including how much interest youll pay.

You May Like: Rocket Mortgage Vs Bank

Average 5/1 Arm Rates

Average 5/1 ARMs tend to feature lower rates than comparable 30-year and 15-year home loans, at least during the initial 5 year promotional period.

Rates will adjust to market rates, plus a spread, following the expiration of the initial 5 year period.

Here are the current average 5/1 adjustable rates mortgage rates for each state.

Average 5/1-ARM Rates by State

| State |

|---|

Rates assume a loan amount of $200,000 and a loan-to-value ratio of 80%.

While ARMs do offer lower monthly payments in the short run, the variable interest rates on 5/1 ARMs means that your monthly payments adjust to market rates upon expiration of the temporary promotional rate period.

This means that your monthly payments may increase significantly on an annual basis, especially if interest rates are on the rise.

This makes them a risky proposition unless you’re committed to selling or refinancing the property within a few years.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Average Heloc Rates By Market

Your potential HELOC rate also depends on where your home is located. Some of the lowest HELOC rates in the largest U.S. markets are in the New York metro area, the D.C. metro area, Boston and San Francisco, while some of the highest are in Chicago, Houston and Los Angeles. As of Aug. 2, 2021, the current average HELOC interest rate in the 10 largest U.S. markets is 4.75 percent.

| 4.75% | 1.99% – 7.24% |

Don’t Miss: 10 Year Treasury Yield And Mortgage Rates

Is It Cheaper To Refinance With My Current Lender

Not necessarily. While it is possible having an established relationship with your current lender may lead to more favorable rates, its not a guarantee. Your best option for finding the best mortgage rate is to shop around and consider different types of lenders, including banks, mortgage brokers, private lenders and credit unions.

What Are The Best Ways To Use Home Equity

Its typically a good idea to use your home equity for major life expenses that enhance your overall financial picture. Some popular uses for home equity loans include:

Consolidating higher-interest debt, such as credit cards.

Buying a vacation home or investment property.

Paying for college tuition or expenses for yourself or a child.

Starting a business.

Also Check: Reverse Mortgage For Mobile Homes

Whats Currently Happening With Mortgage Rates

If youve been looking at mortgage rates, youve likely heard that theyre at an all-time low.

COVID-19 pushed interest rates down, but theyre up slightly from the record low they reached a few weeks ago, as demand continues to increase. Still, a 3.65% interest rate is much lower than where rates sat one year ago, at 4.28% .

Considering that back in the 80s, a typical mortgage rate was between 10% and 18%, that number is even more impressive.

These days, a higher mortgage rate is considered over 4%. Of course, the cost of real estate has risen, but mortgage rates are still substantially lower than they could be.

Still, youll want to do all you can to get a lower rate. The first step is to shop around to get the lowest rates available.

is an online marketplace where you can get competitive mortgage rates from multiple, vetted lenders in real time. It makes the entire mortgage process easy, from getting preapproved to closing, and requesting rates wont affect your credit. Youll start by filling out a quick application that will give you quotes from multiple lenders. If you like one of the quotes, you can link up to your bank accounts and upload documents to make the process not only quick, but paperless.