Whats The Difference Between Fixed Rate And Adjustable Rate Mortgages

Unlike a 30-year fixed rate mortgage, adjustable rate mortgages come with a fluctuating interest rate that rises or lowers along with market conditions.

Minimum monthly payments on these loans depend on external factors, and opting for this mortgage type is usually seen as a greater risk. When mortgage interest rates go up, so do the monthly payments on an ARM.

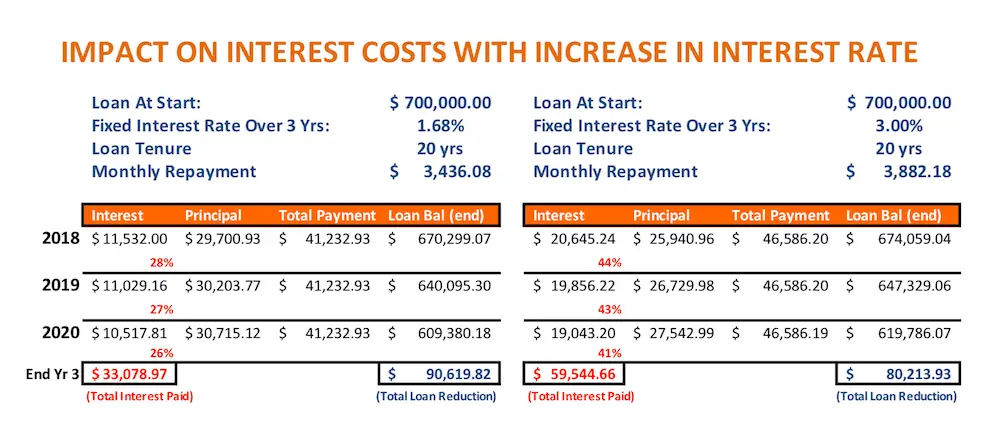

Homeowners cant control the economy or shift the real estate market. If you apply for an ARM and these factors turn against your favor, you could end up paying thousands more in added interest after the ARM expires.

This also makes it difficult to predict how much money youll have for other expenses down the line. If the amount of interest suddenly spikes after your 5-year or 7-year ARM adjusts, youll have to adjust your finances. This makes ARMs a much more volatile lending option than 30-year fixed rate mortgages.

The major advantage of an adjustable rate mortgage is that you could end up saving money over time. The initial interest rates on these loans are typically lower than their fixed rate counterparts. If the mortgage rates continue to dip after the fixed rate period on your ARM expires and your rate adjusts, your rate could decrease even further, lowering your monthly mortgage payments.

Again, this depends entirely on the state of the economy and market trends. In addition to paying a steady rate of interest, 30-year fixed rate mortgages offer a number of financial advantages.

Should I Lock In My Mortgage Rate Today

Locking in a rate as soon as you have an accepted offer on a house can help guarantee a competitive rate and affordable monthly payments on your home mortgage. A rate lock means that your lender will guarantee you an agreed upon rate for typically 45 to 60 days, regardless of what happens with average rates. Locking in a competitive rate can protect the borrower from rising interest rates before closing on the mortgage

It may be tempting to wait to see if interest rates will drop lower before getting a mortgage rate lock, but this may not be necessary. Ask your lender about float-down options, which allow you to snag a lower rate if the market changes during your lock period. These usually cost a few hundred dollars.

What Is The Average 10

As of July 16, 2019, the average interest rate for a 10-year mortgage is 2.875%, according to bankrate.com. With a 10-year fixed loan, youâll pay off your house in 10 years and your monthly principal and interest mortgage payment with stay the same each month. Interest rates are highly dependent on your own credit score, your location, and other situational factors, so ask your preferred lender for your most current rate.

Recommended Reading: Mortgage Rates Based On 10 Year Treasury

What Is A Good Interest Rate On A Mortgage

A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details fit your needs. Consider details such as the loan type , length of the loan, origination fees and other costs.

That said, today’s mortgage rates are near historic lows. Freddie Mac’s average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower or are taking out a non-conforming mortgage, you may see a higher rate. Moneys daily mortgage rate data shows borrowers with 700 credit scores are finding rates around 3.6% right now.

Things To Consider Before A 20

Refinancing into a 20-year mortgage could make sense for you if:

- You already have a 10- or 15-year mortgage and are struggling to meet the monthly payments. Taking out a new loan with a longer repayment period could free up some cash in your budget.

- You have an adjustable-rate mortgage nearing the end of its initial term. A 20-year fixed mortgage will give you more stability, since your rate wont change for the lifetime of the loan.

- You can afford the cost of the new loan. Its important to look closely at your household income and whether your mortgage plus additional housing expenses think homeowners insurance and utilities can fit your new payment into your current budget comfortably.

Keep in mind: You can pay off any mortgage loan at any pace you want as long as you make the minimum payment. By making extra principal payments each month you can turn a 30-year loan into a 20, or a 15 or a 10. This way if you need extra cash, you can skip the additional principal payment any month you like.

When thinking about a refinance, its also a good idea to explore different kinds of loans and loan terms to determine whats best for you and your budget. Refinancing into a conventional fixed-rate loan from an FHA loan could result in sizable cost savings since these government-insured loans usually have costly insurance premiums.

You May Like: Can You Do A Reverse Mortgage On A Condo

Best Mortgage Rates In Canada

- home equity line of credit

| Rate |

|---|

-

Answer a few quick questions and see the lowest rates you can qualify for.

-

Apply online

Apply for your mortgage instantly and easily using our secure online application.

-

Connect with our mortgage advisors

Questions or comments? Book a call and one of our mortgage advisors will walk you through all the details

How Does A 20

A 20-year fixed mortgage has a flat interest rate for the full 20 years. Monthly mortgage payments remain the same, while principal and interest totals vary withamortizationthroughout the life of the loan. A5-year ARM, or adjustable-rate mortgage, has a fixed interest rate for an initial period of 5 years thenadjusts for the remaining length of the loan meaning the monthly payments can increase after the first 5 years.

You May Like: How Does The 10 Year Treasury Affect Mortgage Rates

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score between both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

Fees To Consider With A 20

The costs and fees with a 20-year mortgage are similar to those of mortgages with other repayment terms. Expect to pay an average of about 2 to 4 percent of the loans principal amount at closing in fees, including origination fees and third-party costs like title insurance. Its possible to wrap these fees into the loan, but doing so will cost you in the long run because you’ll wind up paying more in interest.

You May Like: Chase Mortgage Recast Fee

Is A 20 Year Mortgage Right For You

The 20 year mortgage offers unique benefits that make it an attractive option for purchasing or refinancing a home. Just like the more common 30 year fixed rate mortgage, a 20 year mortgage offers the security of a fixed rate and consistent payment, making it a good choice for a first-time homebuyer mortgage. But like the shorter 15 year mortgage, a 20 year mortgage may allow borrowers to secure lower loan rates and save on a number of years of interest payments. A 20 year mortgage may be especially attractive to a homeowner who wants to refinance a mortgage and doesnt want to extend the life of the loan with a new 30 year conventional loan.

Trying to determine whether a 20 year mortgage is the best home loan option for you? The mortgage specialists at eLEND can help! As a leading mortgage company, we offer a broad range of mortgage programs and can help you compare mortgages and current home mortgage rates to find the right product for your unique financial situation and financial goals.

How Do You Find The Cheapest Long Term Fixed Rate

To find a cheap long term fixed rate, call us on 1300 889 743 or complete our free online assessment form and let our mortgage brokers shop around for you. We specialise in finding our customers the best interest rates from our panel of lenders and we can let you know which banks are willing to discount their rates below those advertised on their websites.

Lenders tend to update their fixed rates & comparison rates on a regular basis so there are no single websites that have up to date information that covers all the bank and non-bank lenders.

Due to the way our banks are funded and the regulations imposed on our banks it is a very high risk for them to offer longer term fixed rates. Their exposure to financial meltdowns and economic downturns is multiplied by offering longer term fixed rates.

As a result, few banks will offer anything longer than 5 years. Some of them have 10 years fixed rate term but none will offer longer than this.

Don’t Miss: How Much Is Mortgage On 1 Million

Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether it’s the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider a mortgage refinancing if your current mortgage rate exceeds today’s mortgage rates by 0.75 percentage points. Some say a refi can make sense if you can reduce your mortgage rate by as little as 0.5 percentage point . It doesn’t make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings.

Many of the best mortgage refinance lenders can give you free rate quotes to help you decide whether the money you’d save in interest justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and you’d pay off your house sooner.

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example:

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . You’ll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.

How Big Of A Down Payment Do I Need

Nowadays, mortgage programs dont require the conventional 20 percent down.

In fact, first-time home buyers put only 6 percent down on average.

Down payment minimums vary depending on the loan program. For example:

- Conventional home loans require a down payment between 3% and 5%

- FHA loans require 3.5% down

- VA and USDA loans allow zero down payment

- Jumbo loans typically require at least 5% to 10% down

Keep in mind, a higher down payment reduces your risk as a borrower and helps you negotiate a better mortgage rate.

If you are able to make a 20 percent down payment, you can avoid paying for mortgage insurance.

This is an added cost paid by the borrower, which protects their lender in case of default or foreclosure.

But a big down payment is not required.

For many people, it makes sense to make a smaller down payment in order to buy a house sooner and start building home equity.

Recommended Reading: Does Bank Of America Do Mortgage Loans

How Much Of A Mortgage Am I Qualified For

Youll need to apply for mortgage preapproval to get an estimated loan amount you could qualify for. Lenders use the preapproval process to review your overall financial picture including your assets, credit history, debt and income to calculate how much theyd be willing to lend you for a mortgage.

You can use the loan amount printed on your preapproval letter as a guide for your house hunting journey. But, be careful not to stretch your budget too thin and borrow to the maximum your preapproval amount doesnt factor in recurring bills that arent regularly reported to the credit bureaus, such as gas, cellphones and other utilities, so youll need to retain enough disposable income to comfortably cover these monthly bills, plus your new mortgage payment.

Benefits Of Geddes Federal 25 Year Mortgage Rates Near Syracuse Ny

Geddes Federal Savings and Loan Association offers affordable 25 year mortgage rates near Syracuse, NY. We offer competitive 25 year mortgage rates with bi-weekly payment terms, making your dream of home ownership affordable.

25 year mortgage rates include lower monthly payments compared to shorter mortgage terms. This is because you’re paying off your mortgage over a longer period of time, allowing for low monthly or bi-weekly payments that fit your budget. This also allows you more financial flexibility to save toward your goals.

You May Like: Does Prequalifying For A Mortgage Affect Your Credit

What Are Prepayment Options

Prepayment options outline the flexibility you have to increase your monthly mortgage payments, or pay down your mortgage principal as a whole. The monthly prepayment option is a percentage increase allowance on your original monthly mortgage payment.

For example, if your monthly mortgage payment is $1,000 and your prepayment allowance is 25%, then you can increase your monthly payments up to $1,250. The lump sum prepayment option on the other hand, applies to the original mortgage amount. So, if your lump sum prepayment allowance is 25% on a $100,000 mortgage amount, then you can pay $25,000 off the principal every year.

Mcglone Mortgage Group Best Overall

McGlone Mortgage Group, owned by Homestead Funding Corp., is available in 45 states and Washington, D.C.

Strengths: McGlone Mortgage Groups convenient mobile app allows you to prequalify for a loan, begin your application, scan and upload documents and calculate estimated mortgage payments.

Weaknesses: The rates on 20-year mortgages and other types of loans arent displayed on McGlone Mortgage Groups website. Youll have to fill out a short questionnaire to get in touch with the lender and learn what you might qualify for.

Also Check: Rocket Mortgage Qualifications

Nerdwallets Mortgage Rate Insight

On Tuesday, December 28th, 2021, the average APR on a 30-year fixed-rate mortgageremained at 3.105%. The average APR on a 15-year fixed-rate mortgagerose 1 basis point to 2.315% and the average APR for a 5/1 adjustable-rate mortgage remained at 2.880%, according to rates provided to NerdWallet by Zillow. The 30-year fixed-rate mortgage is4 basis points higher than one week ago and12 basis points higher than one year ago.

A basis point is one one-hundredth of one percent. Rates are expressed as annual percentage rate, or APR.

Do Different Mortgage Types Have Different Rates

Different mortgage types usually have different rates, so do your research. For instance, adjustable-rate mortgages have lower initial rates but will fluctuate afterward depending on current market conditions. Fixed-rate mortgages may be higher but borrowers dont need to worry about rates changing throughout the entirety of the loan term.

Recommended Reading: Rocket Mortgage Conventional Loan

How Does My Credit Score Affect My Mortgage Rate

Your credit score directly affects your mortgage ratethose with low credit scores wont be able to qualify for the best rates out there. What this means is that borrowers could end up paying more throughout the loan. Even a quarter of a percent difference could mean saving thousands of dollars in interest.

The reason why your credit score is so important to lenders is that its an indicator of your risk profileit shows the chances youll pay back your loan on time and in full. Lenders want to see a higher score as it shows that borrowers have a record of on-time payments to their creditors.

Your credit score is made up of information from your credit report, which includes information about open and closed credit accounts, your payment history, and more. These reports are created by credit bureausEquifax, Experian, and TransUnion. Because your credit history is so vital to your score, experts recommend checking your credit report to check for any discrepancies or what could be affecting your score before applying for a loan.

What Is The Difference Between Interest Rate And Apr

Another important figure youll come across while shopping for 30-year mortgage rates is the annual percentage rate or APR.

Not to be confused with interest, the APR is also expressed as a percentage of the overall loan amount. However, rather than signifying the annual cost of a mortgage, the APR outlines the amount to be paid each year in home loan expenses, factoring in the loans cost at the time of closing plus what youve paid in interest over the life of the mortgage.

Developed as a way to provide accurate and transparent mortgage information to buyers, the APR lays out where your scheduled payments are going and allows consumers to compare loan scenarios from various lenders and understand who is really offering the best deal.

A home sales closing costs, mortgage insurance and loan origination fees all factor into the APR, providing the buyer with an overview of what they are paying month after month. As a part of the Federal Truth in Lending Act, lenders must disclose accurate APRs before the loan is finalized. This gives prospective buyers a solid basis for comparing their home buying options. For a better look at how your 30-year mortgage will be paid off over time, your lender will provide an amortization schedule.

You May Like: How Does 10 Year Treasury Affect Mortgage Rates