Should You Apply If Your Score Is Borderline

Owning a home is a dream for many Canadians, one that unfortunately is increasingly out of reach. If you want to get into the market but your credit score is on the edge, first pause to evaluate why. Have you hit the limit on the amount of credit available to you ? Are you missing payments on your loans or bills? Are you an overzealous credit card churner?

If you have a strong financial foundation but some unfavorable credit habits due to lack of organization or discipline, get them in order before you apply. A borderline score can be improved with small changes, and that can significantly alter your ability to afford the home you want.

That said, in some circumstances it might make sense for a borrower with a lower credit score to obtain a mortgage from an alternative or private lender. If youve thoroughly considered the reasons why you must obtain a short-term mortgage instead of a traditional mortgage have put an attainable plan in place to close the gap between where you are vs. where you need to be and arent stretching yourself to the limit financially, then that type of financing option might be worth it for you. You can improve your score by steadily paying off the mortgage, and then eventually refinance into a more affordable loan once your score is in better shape.

How Do I Get A Mortgage If I Have Bad Credit

Bad credit can limit your ability to get a mortgage. You may have options available to you, but the interest rates youâll qualify for wonât be cheap. If you donât want to put off purchasing a new home, there are immediate steps you can try taking to get a mortgage with bad credit. If youâre willing to wait, you should take time to improve your credit score and qualify for better mortgage options. Here are ways you can get a mortgage with bad credit.

Make a larger down payment

If your credit score isnât great, there are other ways to demonstrate your financial stability to lenders. Making a large down payment of 20% or above provides you with more leverage when working with lenders. It shows that you have a sizeable income and demonstrates your budgeting skills. It will also help you reduce your regular mortgage payments, making them more manageable in the long-run. In short, a larger down payment will often make you a more attractive borrower to mortgage lenders. You could also take advantage of first-time home buyer programs to get additional incentives and tax credits if you’re buying your first home.

Use an alternative mortgage lender

If your credit score falls below 600, you will have a very difficult time getting approved from Canadaâs major banks. Youâll more than likely have to work with an alternative lender.

Get a co-signer or a joint mortgage

Improve your credit score

Pay Your Bills On Time

This step is essential yet straightforward when it comes to improving FICO scores. Do not ever miss a repayment schedule. You always have to pay in full and on time. To ensure that you never miss any repayment schedule, you can choose to apply for an auto-deduction from your bank account.

Note that your payment history plays a massive role in the computation of your score. If you missed a single repayment schedule, it would reflect poorly on your record. Do this on all of your credit accounts. It would help if you did not allow a single account to have an unpaid bill.

Don’t Miss: 10 Year Treasury Yield Mortgage Rates

Home Equity Loan Credit Score 650

If you have a 650 credit score, you must be wondering if you have a chance of qualifying for a home equity loan. Although the requirements may vary according to lender, a credit score is a common requirement for loans. However, aside from credit, other significant factors can affect your eligibility for a home equity loan.

Answer these questions to know if you can qualify:

- Do you have at least 20 percent home equity?

- Is your debt-to-income ratio lower than 43 percent?

- Do you have at least two years steady employment?

If you answer yes to all of these, you have an excellent chance of getting approved for this type of loan because the minimum credit score needed for a home equity loan is just 620.

As in a mortgage, your credit score can also affect the kind of interest rate you can get for a home equity loan. The higher your credit score, the better. If you have a lower credit score than when you applied for your first mortgage, we advise thinking further if its an excellent time to take on this loan.

If your main worry is your credit score, the good news is, home equity loans are a lot more lenient about bad credit compared to mortgage applications. As a result, youd be more likely to qualify for a home equity loan than a personal loan. All you have to do is take a chance!

Understanding Apr And Your Credit Score

The APR or annual percentage rate of a mortgage is the loan’s total cost and the interest rate on your loan. It is not the interest rate you are charged every month as a part of the repayment cycle. However, the interest of your mortgage does affect the APR rate. This level is also influenced by private mortgage insurance, an FHA mortgage insurance premium, and other finance charges required when paying back your loan.

These charges are typically spread out over the loan’s life and are not paid all at once. As a result, the APR is usually higher than the interest rate you pay on your mortgage. That said, the APR is affected by your credit score only in a roundabout manner. While it won’t be affected directly by a 650 credit score, the different factors that influence your APR will be affected.

As a result, it is worth talking about the different factors that change your APR and how your credit affects them. In this way, you can better understand how your lenders are setting your APR and just how vital your overall credit score is for this process.

Don’t Miss: Rocket Mortgage Launchpad

What It Means To Have A Credit Score Of 650

A credit score is a number that indicates to a lender your worthiness of borrowing money for a car, home or other lines of credit. It is a 3 digit number that is determined by looking at your credit history. The following chart shows what is taken into account when calculating your credit score.

The can be anywhere from 350-850 anything below 350 means that you have no credit history. So where does your 650 credit score fall in the scheme of things? According to credit.com to have a rating of excellent credit your score would fall between 750 850. This is difficult to achieve, but the benefits are worth the work. Good credit is considered to be a score of 700-749. A 650 credit score falls on the low end of the fair range. 650-699 is a fair credit score, while 350-649 is the poor range.

Dont Take Out New Credit Accounts Or Loans

Whether youre a firsttime homebuyer or a homeowner on your third purchase, when it comes to debt, less is always best especially when youre looking to qualify for a new home loan.

Opening new credit accounts or any other type of loan will not only have a negative impact on your debttoincome ratio, but the hard inquiries required to qualify for a loan can lower your credit score by several points each.

Similarly, avoid closing existing lines of credit, like credit cards, to keep your available credit limit higher. his is beneficial to your overall credit utilization ratio. Plus, the average age of your credit is also a factor in determining your credit score range.

Don’t Miss: 10 Year Treasury Vs 30 Year Mortgage

Credit Score Home Loan Steps

- Step 1: Visit the 650 credit score mortgage rate official website of the bank 650 credit score car loan

- Step 2: Log into 650 credit score home loan internet banking portal with your user ID and password.

- Step 3: Select Card Activation

- Step 4: Type in your credit card number, your date of birth, and the expiry date.

- Step 5: Select Submit

- Step 6: Enter your ATM PIN and choose Submit

- Step 7: You will get an OTP on your mobile phone

- Step 8: Enter the OTP and select Continue

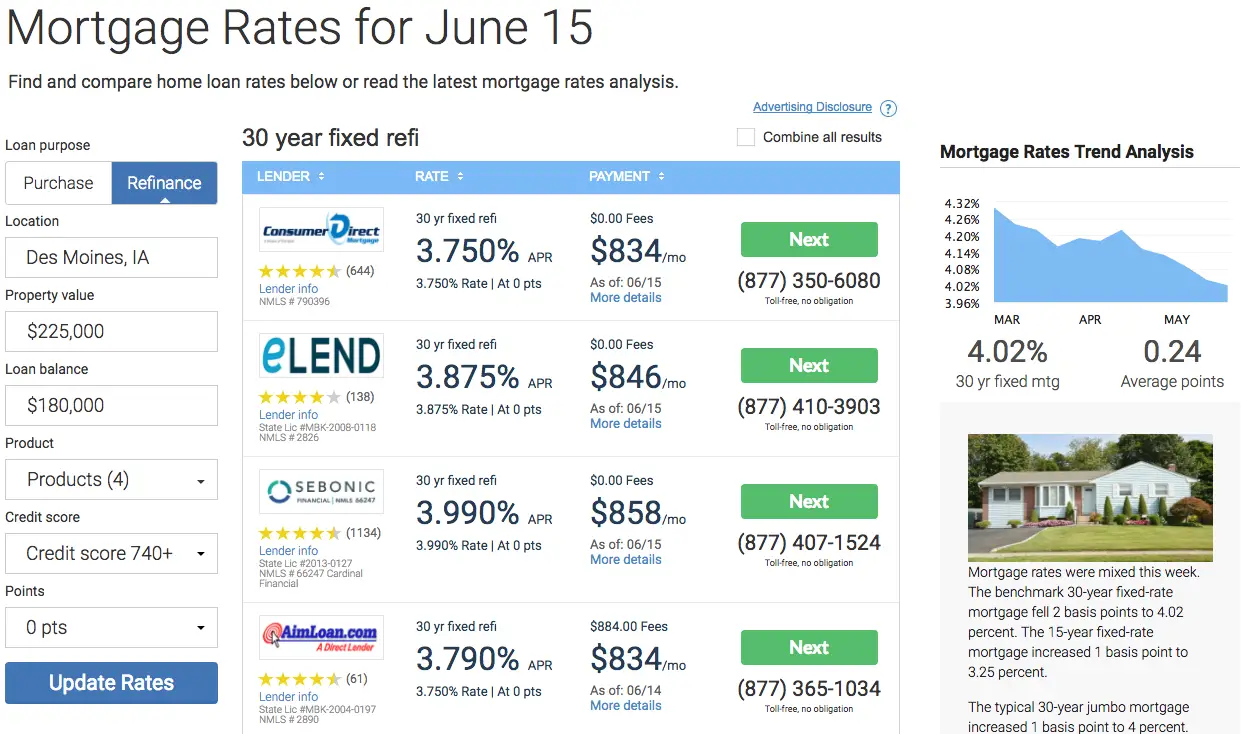

What Are Todays Mortgage Rates

On Thursday, December 23, 2021, according to Bankrates latest survey of the nations largest mortgage lenders, the average 30-year fixed mortgage rate is 3.190% with an APR of 3.350%. The average 15-year fixed mortgage rate is 2.500% with an APR of 2.710%. The average 5/1 adjustable-rate mortgage rate is 2.740% with an APR of 4.070%.

Also Check: Rocket Mortgage Vs Bank

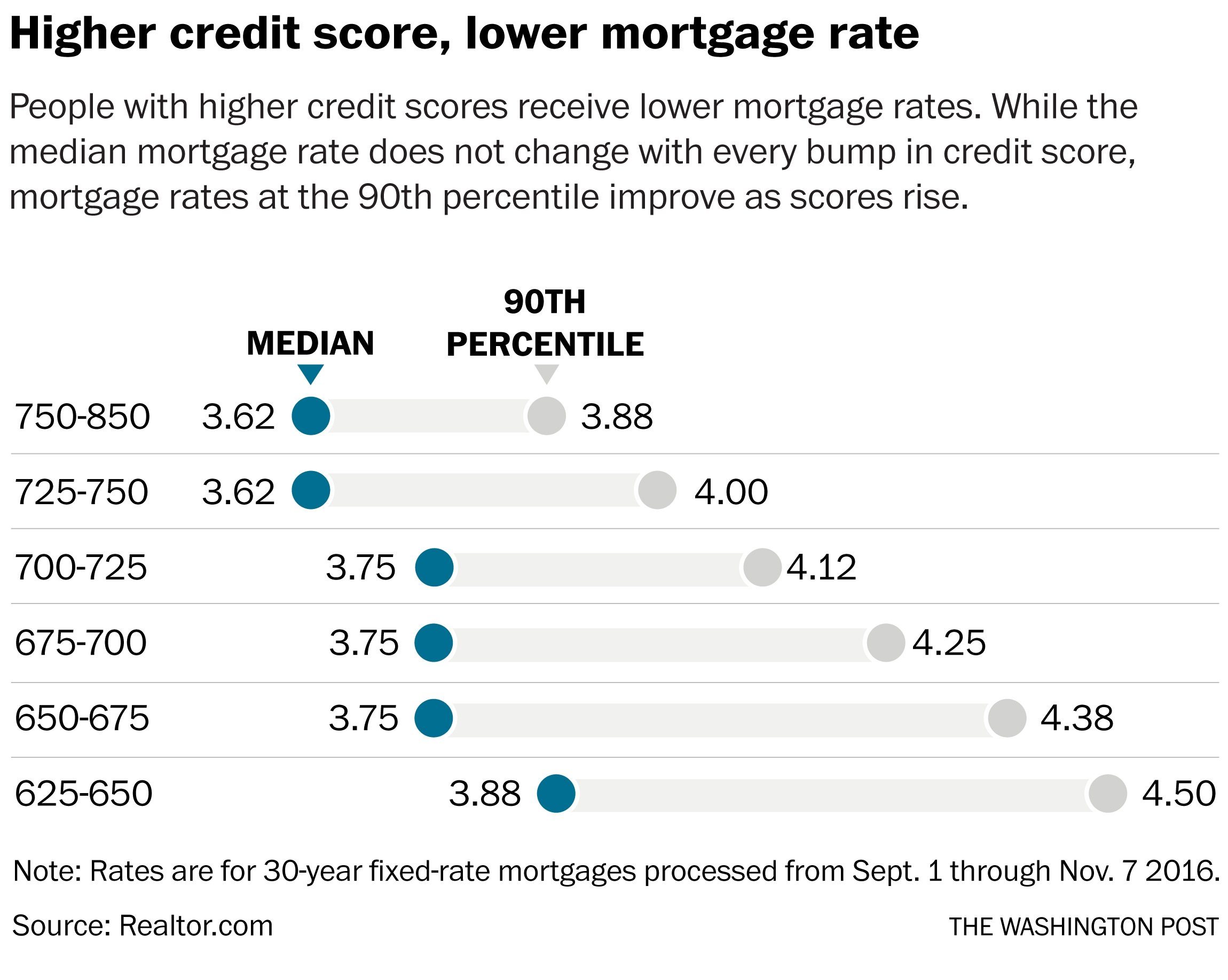

Heres How Much Your Credit Score Affects Your Mortgage Rate

Mortgage rates have climbed higher over the past week, making it even more important for consumers to do everything they can to get the lowest rate possible when buying a home.

A lot goes into determining your mortgage rate. But boosting your credit score, one of the main factors lenders look at when determining whether you qualify for a loan, can give you a much better chance of landing a low mortgage rate, housing experts say.

Thats especially true for home buyers with lower credit scores, says Jonathan Smoke, chief economist for Realtor.com.

Smoke analyzed 170,000 mortgage loans processed between Sept. 1 and Nov. 7 to compare the rates borrowers were able to lock in for 30-year fixed-rate mortgages, based on their credit scores.

People with higher credit scores, which typically measure creditworthiness on a scale of 300 to 850, were generally able to lock in lower mortgage rates. Even raising your score by 25 points can lead to big savings, he found.

But once consumers went beyond a certain threshold, the benefits of having a higher score diminished, Smoke found. After a certain point, borrowers need to rely on other factors to improve their rate, such as their income or the type of loan, housing experts say. That is especially true for borrowers with credit scores above 700, they say.

700 to 725: The median rate offered is still 3.75 percent. But borrowers with the costliest loans had rates of 4.12 percent and up.

Read more:

Improving Your Credit Score Vs Getting A Mortgage Now

You could spend several months or more improving your credit. But what will happen to interest rates during that time?

- If they go up, you may not save any money despite your improved credit.

- If they go down, you could save money from both your improved credit and the markets lower rates.

No one knows where interest rates are headed. The countrys most educated guess comes from the Federal Reserve, so thats a good source to consult.

In the press release section of the Federal Reserve website, look for the most recent economic projections from the Federal Open Market Committee . Do they think the federal funds rate is headed up or down?

If they think its headed up, mortgage rates could be headed up. Right now, they expect the federal funds rate to stay around zero through 2021 and possibly 2022. But thats a prediction, not a guarantee.

You May Like: What Does Gmfs Mortgage Stand For

How To Build Your Credit

If you want to build and maintain good credit over time, all you have to do is use the five factors that your credit score is made up of as guiding principles. Through these principles, you learn to make regular payments, keep debts down, maintain a healthy credit utilization ratio and have diverse credit. Some factors, such as your credit history length, are out of your control and just require patience.

Dont let an inaccurate credit score keep you from your dreams work to repair your credit with Lexington Law instead

Finalizing Your Potential 650 Credit Score Mortgage

Ensure that you carefully discuss any other questions you may have about mortgages with a loan officer before buying a home. While the information contained in this article is up-to-date and as comprehensive as possible, there is a chance that a unique situation could occur when you try to buy a home. If you can’t find the answer to a vital question on mortgages in this article, your loan officer should be able to help.

Lastly, make sure that you always choose to buy a home that you can comfortably pay back over a lengthy period. This advice may seem redundant, but many people pick a mortgage rate outside of their ability to pay. As a result, they can get stuck in a negative cycle that will profoundly affect the rest of their lives.

For example, what will happen if you refinance a mortgage a few years before retirement and end up owing money on the home for another 25 years? You could struggle to make ends meet with a limited retirement fund or savings account. You could also negatively impact your credit score and make it more challenging to maintain your payments. Staying within your financial needs is a critical way of improving your credit score and keeping it at a high level for years to come.

Resources

Don’t Miss: Does Rocket Mortgage Service Their Own Loans

Whats The Minimum Credit Score For A Mortgage In Canada

When my wife and I started looking for our first home in late 2020, we had a lot of unresolved questions. What could we afford? Where should we get our mortgage? Was buying a home even worthwhile? Admittedly though, we never stopped to ask ourselves how or if our credit scores would factor into our path to homeownership. But they definitely did.

After going through the process and learning about all the ingredients lenders look at when evaluating a mortgage application, we realized that a credit score of about 650 is usually the minimum score one should shoot for. But its not a hard and fast rule. Some borrowers with a score below 650 might manage to get approved for a mortgage, while others should probably wait until their score is comfortably above that.

No matter what financial situation youre in, your credit score and credit history have material impacts on your potential mortgage. Understanding the facts, nuances, and many grey areas associated with this topic will only help you on your homeownership journey.

In This Article:

Can You Do A Conventional Loan With 3% Down

Yes! The conventional 97 program allows 3% down and is offered by many lenders. Fannie Maes HomeReady loans and Freddie Macs Home Possible loans also allow 3% down with extra flexibility for income and credit qualification.

Can I buy a house with 3% down?

In most cases you can buy a home with only 3% down. There are also buyer assistance programs that can help cover your down payment and possibly closing costs. Funding from those programs can often be combined with financial gifts from your family and friends to reduce the cost of your home purchase.

What credit score do you need for 3% down?

Fannie Maes minimum qualifications require a FICO credit score of at least 620 for a 3% down mortgage. However, be aware that many people who are approved for a conventional mortgage have credit scores in the 700s or better, and that it can be difficult to get approval with a score at the bottom.

Recommended Reading: Does Prequalifying For A Mortgage Affect Your Credit

What Credit Card Can I Get With A 650 Credit Score

As someone with fair credit, you may have access to a number of unsecured credit cards. Unlike secured cards, an unsecured card doesnt require you to put down a security deposit.

Thats a plus, but there are other factors to consider. For example, many unsecured cards available to applicants with fair credit may charge an annual fee. These cards may also come with a high variable APR on purchases, which can translate to high interest charges if you carry a balance instead of paying off at least your statement balance each month.

With fair credit, you might be approved for a credit card with a relatively low credit limit though some issuers will automatically review your credit limit after several months of on-time payments. Your credit limit is important, because its directly correlated with your credit utilization rate.

Getting A Mortgage With A 650 Credit Score

At React Mortgage we encompass A to Z lending. Meaning we source solutions and help in any situation when it comes to your borrowing needs:

To start off, a 650 credit score is considered fair. So just keep that in mind as youre shopping around for a mortgage. A lot of borrowers dont know this, but there is no set minimum credit score required to buy a house. Many lenders set their own credit score requirements, which is why it pays to go through a broker instead of a bank. With Banks, you are stuck with them as the lender, but brokers can shop around many, if not hundreds of lenders to find the right one for your situation. Now take your fair score of 650 many lenders would jump at the opportunity to get your mortgage. Its all about finding the right one.

There are other factors that lenders consider besides credit score when looking at your situation. For example:

- How much you have saved for a down payment

- Debts you may have in collections

- What your income level is

- Your overall amount of debt

These factors, along with your 650 score will help lenders determine what you are eligible for when it comes to a home loan. Now for your score, wed recommend to save up as much as you can for a down payment to help get the best rate.

Remember, your 650 is made up of the following 5 things:

- Payment History 35%

- Type of Credit 10%

Read Also: Mortgage Recast Calculator Chase