Who Is This Calculator For

This calculator is most useful if you:

- Are a new potential homeowner needing to know your budget constraints

- Have decided on a new home but want to ensure you can afford it

- Are looking to plan and budget for the future

Once you’re entered your information and obtained your results, you can use the Get FREE Quote box at right to request personalized rate quotes tailored to you from mortgage lenders. This will give you a better idea of what interest rate to expect and help gage your ability to qualify for a mortgage.

How Much Income Is Needed For A 250k Mortgage +

A $250k mortgage with a 4.5% interest rate for 30 years and a $10k down-payment will require an annual income of $63,868 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a wider range of interest rates.

Calculating The Income Required For A Mortgage

You’ve got a home or a price range in mind. You think you can afford it, but will a mortgage lender agree? Or you want to take cash out for a refinance and are not sure what loan amount you can qualify.

Mortgage lenders tend to have a more conservative notion of what’s affordable than borrowers do. They have too, because they want to make sure the loan is repaid. And they don’t just take into account what the mortgage payments will be, they also look at the other debts you’ve got that take a bite out of your paychecks each month.

- FAQ: To see if you qualify for a loan, mortgage lenders look at your debt-to-income ratio .

That’s the percentage of your total debt payments as a share of your pre-tax income. As a rule of thumb, mortgage lenders don’t want to see you spending more than 36 percent of your monthly pre-tax income on debt payments or other obligations, including the mortgage you are seeking. That’s the general rule, though they may go to 41 percent or higher for a borrower with good or excellent credit.

For purposes of calculating your debt-to-income ratio, lenders also take into account costs that are billed as part of your monthly mortgage statement, in addition to the loan payment itself. These include property taxes, homeowner’s insurance and, if applicable, mortgage insurance and condominium or homeowner’s association fees.

You May Like: Rocket Mortgage Requirements

Use The Mortgage Affordability Calculator To Help Determine What You Could Pre

Getting pre-qualified for a mortgage is an informal way for you to get an idea of how much you can afford to spend on a home purchase. Mortgage pre-qualification is an important first step for anyone who is considering buying a home and is unsure if they are financially ready. Our mortgage pre-qualification calculator will look at several factors and indicate whether you meet minimum requirements for a home loan as well as tell you the maximum amount you can afford and how much you can be pre-qualified to borrow.

Results

My Result Shows I Can Afford My New Home What Should I Do Next

First of all, congratulations! You are now one step closer to owning the home you desire. The next step is to reach out to our team of top-notch mortgage lenders and get started on securing yourself the perfect deal.

Click Get FREE Quote, answer a few simple questions about yourself and the loan you are seeking to obtain personalized rate quotes from lenders doing business in your area. This service is totally FREE of charge and makes it easy to comparison shop for your best deal on a home loan. Take your next step today – it couldnt be simpler!

Read Also: Mortgage Recast Calculator Chase

Have A Question About Our Mortgage Calculators

What is a mortgage calculator?

Its a tool that gives you an estimate of how much you could borrow from us or what your monthly repayments and other costs might be, for a mortgage in the UK.

We have different calculators that can help you in different ways each calculator does something slightly different.

Who is a mortgage calculator for?

Its for you if youre a first time buyer, youre looking to remortgage, move or buy an additional home, or youre a buy-to-let landlord.

What information do I need to use a calculator and how do you decide what I can afford?

When you apply for a mortgage or use our calculator, well ask you for information like

- How many people are applying

- Your income

- How much you regularly spend on things like your credit or store cards, loans, overdrafts, maintenance and pension

- Why youre applying for example, buying your first home, moving home, or buying a second home

We wont ask about groceries, utility bills or travel.

How much can I afford to borrow?

Our calculators give you a idea of what you might be able to borrow from us to buy a home, and what your monthly and total mortgage payments could be, for different types of mortgages.

Which mortgage calculator is right for me?

The most popular place to start is our borrowing calculator or our affordability calculator.

The Advantages Of Paying 20% Down

- Improves your chances of loan approval: Paying 20% down lowers risk for lenders. A larger down payment also makes you look like a more financially responsible consumer. This gives you better chances of qualifying for a mortgage.

- Helps lower your interest rate: Paying 20% down decreases your loan-to-value ratio to 80%. LTV is an indicator which measures your loan amount against the value of the secured property. With a lower LTV ratio, you can obtain a lower interest rate for your mortgage. This will help you gain interest savings over the life of your loan.

- Reduces your monthly payment: A large down payment also significantly decreases your monthly mortgage payments. Though you spend more now, having lower monthly payments will make your budget more manageable. This gives you room to save extra money for emergency funds, retirement savings, or other worthwhile investments.

- Helps build home equity faster: Paying 20% down means paying off a larger portion of your loan. This allows you to pay off your mortgage sooner. If you plan to make extra payments on your mortgage, having 20% equity will help speed up this process, allowing you to cut a few years off your loan term.

- Eliminates private mortgage insurance : As mentioned earlier, PMI is an added cost on a conventional loan if you pay less than 20% on your mortgage. Consider paying 20% down to avoid this extra fee.

Know the Closing Costs

Recommended Reading: Rocket Mortgage Conventional Loan

How Much Should I Spend On A House

Anaffordability calculatoris a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

Impact Of New Cmhc Rules On Borrowers

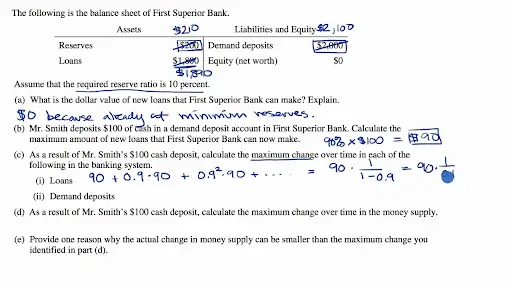

Gross/Total Debt Service Ratios

The higherdebt service ratiorequirements will allow more borrowers to participate with higher leverage and take out larger mortgages relative to their income. Debt service ratios measure how much of your income will be spent on paying the mortgage, bills associated with your home and payments on other debt.

The lower credit score requirement of 600 will allow borrowers who have missed bill payments or have a limited credit history to participate in the CMHC insurance program and be eligible for a downpayment as low as 5%.

Read Also: How Much Is Mortgage On 1 Million

Do I Qualify For A Mortgage

A mortgage calculator can be helpful when estimating your home buying budget. But remember even if you can afford the monthly payments, you still need to qualify for a home loan.

To see if you qualify for a mortgage, a lender will check your:

- : Borrowers with higher credit scores tend to have more loan options. But mortgages are secured loans, which means you dont always need stellar credit to qualify. Some lenders can approve FHA loans for borrowers with FICO scores as low as 580

- Loan-to-value ratio : LTV measures your loan amount against your new homes value. For example, borrowing $200,000 to buy a $200,000 home equals 100% LTV. Lenders can offer VA or USDA loans at 100% LTV, but not everyone is eligible for these programs. FHA loans cant exceed 96.5% LTV, which leaves 3.5% as the minimum down payment. Conventional loans can reach 97% LTV, meaning they allow a 3% down payment

- Home appraisal: A home appraisal identifies the homes value. Lenders wont approve loan amounts that exceed the homes value, regardless of the homes listing price or agreed-upon purchase price

- Personal finances: Lenders must verify your income to make sure you can afford the loan payments. Theyll check W-2s, bank statements, and employment records. If youre self-employed, a lender will likely ask to see tax records

You can ask for a mortgage pre-approval or a prequalification to see your loan options and real budget based on your personal finances.

How Can I Estimate The Mortgage Amount I Can Qualify For

You’re about to leave AdditionFi.com for one of our trusted partner websites

Links to other web sites found on the Addition Financial web site are provided to assist in locating information. The fact that there is a link between this web site and another does not constitute a product or program endorsement by Addition Financial or any of its affiliates. Addition Financial does not operate these web sites and therefore has no responsibility for content of the web sites found at these links, or beyond, and does not attest to the accuracy or propriety of any information located there. Be aware that privacy and security policies may differ from these practiced by Addition Financial.

Read Also: How Does The 10 Year Treasury Affect Mortgage Rates

How To Calculate Your Debt

To find your debt-to-income ratio, first add together all of your monthly debt payments. For example, if you pay $200 each month on a student loan, $400 on a personal loan and $500 on an auto loan, your total debt payments are $200 + $400 + $500, which equals $1,100.

Next, determine your gross monthly income.

Take your total debt payments and divide that number by your gross monthly income. Lets say for this example that your monthly income is $4,000. Then your total monthly debt payments divided by your gross monthly income is $1,100 ÷ $4,000, or 0.275. We can convert the result to a percentage: 0.275 x 100% = 27.5%.

The Mortgage Qualifying Calculator Says I Cant Afford My Dream Home What Can I Do

It can be disappointing to learn that the home you have set your heart on is out of financial reach, but dont give up hope! It may be that you can reach your goal by adjusting some of your other constraints. Perhaps you can save for a little longer in order to amass a larger down payment, or wait until your credit card and loans are paid off.

These small but significant changes could make all the difference and enable you to get the mortgage you require. If the down payment is causing you an issue, you might consider an FHA loan, which offers competitive rates while requiring only 3.5 percent down, even for borrowers with imperfect credit.

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

How Much Mortgage Might I Qualify For

Our Mortgage Calculator Disclaimer

Results received from this calculator are designed for comparative purposes only. Paragon does not guarantee the accuracy of any information available on this site and is not responsible for any errors, omissions or misrepresentations. This calculator does not have the ability to pre-qualify or pre-approve you for any loan program. Qualification for loan programs may require additional information such as credit scores, income information and cash reserves, which are not gathered in this calculator. Information such as interest rates and pricing are subject to change at any time and without notice. Additional fees such as homeowner association dues are not included in calculations. All information, such as interest rates, taxes, insurance, private mortgage insurance payments, etc., is estimated and should be used for general comparison only. Paragon does not guarantee any of the information obtained by this calculator.

You May Like: Mortgage Rates Based On 10 Year Treasury

How Much Down Payment Should You Save

Before buying a house, be sure to give yourself enough time to save for a down payment. While the amount depends on your budget, the homes price, and the type of loan you have, most financial advisers recommend saving for a 20% down payment. This is a sizeable amount, which is more expensive if your homes value is higher.

In September 2020, the median sales price for new homes sold was $326,800 based on data from the U.S. Census Bureau. If this is the value of your home, you must save a down payment worth $65,360. Paying 20% down lowers risk for lenders. Its a sign that you can consistently save funds and reliably pay back your debts.

Down Payments Vary

Down payment requirements are different per type of loan. However, many conventional mortgage lenders require at least 5% down. For government-backed loans such as an FHA loan, a borrower with a credit score of 580 can make a down payment as low as 3.5% on their loan. Take note: A smaller down payment subjects you to a higher interest rate.

Nonetheless, its still worth making a larger down payment on your mortgage. Heres why paying 20% down is more beneficial for homebuyers.

Td Bank Mortgage Affordability

Before you get a mortgage from TD Bank, it is important to know how TD calculates your mortgage affordability. TD takes into account the following factors:

- The location of your future home

- Whether your future home is a detached home or condo

- Your household income

- Your down payment

- Your monthly bills and expenses including groceries, transportation, shopping, and insurance.

- Your monthly debt payments to loans and lines of credit including credit cards, car loans, student loans, and leases.

Your location and property type are used to provide estimates for your potential property taxes, utilities, and condo fees.

TD calculates your mortgage limit using the current qualification rate and a maximum gross debt service ratio of 39% and a maximum total debt service ratio of 44%. This means that your mortgage payment, property tax, heating costs, and half of your condo fees cannot take up more than 39% of your gross income. In addition, this amount plus your total debt payments cannot take up more than 44% of your gross income.

Another factor in determining your mortgage affordability is your down payment. According to TD, home buyers must have a minimum 5% down payment for homes worth less than $500K. For homes between $500K and $1M, home buyers must have at least 5% for the first $500K and 10% for the remaining amount. For homes worth more than $1M, home buyers must have a minimum 20% down payment.

Read Also: How Much Is Mortgage On 1 Million

How Can I Qualify To Borrow More

If youre disappointed by the how much can I borrow results, remember that there are many factors at work. Small improvements in one or more can make a substantial difference:

A bigger down payment always helps. The more money you put down, the better youll look in the eyes of the lender.

Be a tactical buyer. If school districts wont play a role in your family for years, consider finding a home in a transitioning neighborhood maybe buying a starter home rather than a forever home. Youll likely get a better home value and wont need to borrow as much.

Reduce debt even a little. Paying off or down a credit card or two can help in several ways. Your debt-to-income ratio will go down and you may even get a nice bump in your credit score.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Rocket Mortgage Qualifications