How Many Months Bank Statements Do You Need For A Mortgage Application

Most mortgage lenders will ask to see your latest bank statements dating back at least three months, but some might ask for as much as six months worth. There are also a minority who dont look as far back as this and might be happy with just one-to-two months worth.

To verify the information youve provided, your mortgage lender might contact your bank by phone. More commonly, though, they will complete proof or verification of deposit request forms and ask your bank to verify your account this way. Most banks provide downloadable forms for lenders on their websites to make this process quick and easy.

Understanding How Lenders Verify Bank Statements

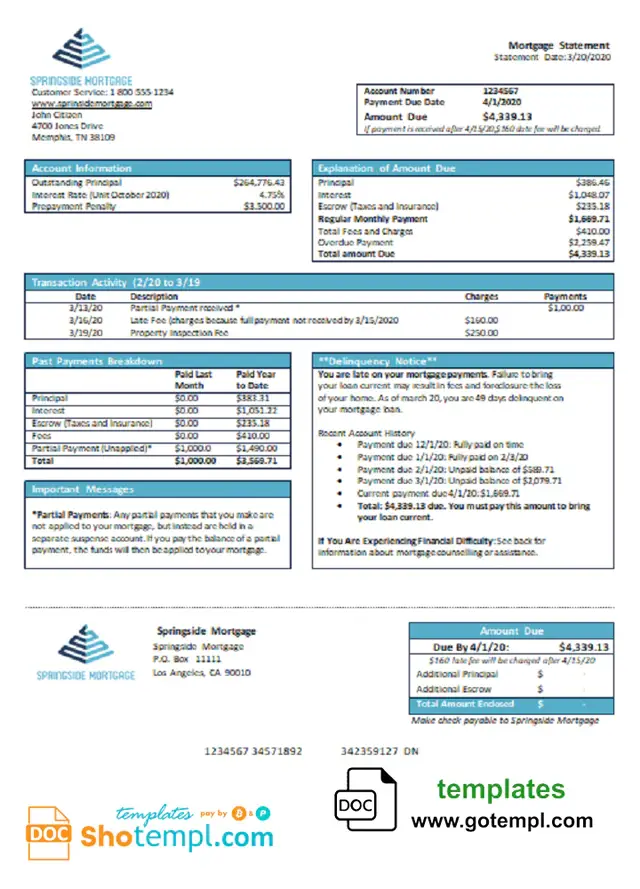

Banks and mortgage lenders underwrite loans based on a variety of criteria including income, assets, savings, and a borrower’s creditworthiness. When buying a home, the mortgage lender may ask the borrower for proof of deposit. The lender needs to verify that the funds required for the home purchase have been accumulated in a bank account and accessible to the lender.

A proof of deposit is evidence that money has been deposited or has accumulated in a bank account. A mortgage company or lender uses a proof of deposit to determine if the borrower has saved enough money for the down payment on the home they’re looking to purchase.

For example, in a typical mortgage, a borrower might put 20% down towards the purchase of a home. If it’s a $100,000 home, the borrower would have to put down $20,000 upfront. The mortgage lender would use a proof of deposit to verify that the borrower actually has a $20,000 in their bank account for the down payment. Also, the lender will need to ensure adequate funds are available to pay the closing costs associated with a new mortgage. Closing costs are additional costs that can include appraisal fees, taxes, title searches, title insurance, and deed-recording fees. A mortgage calculator can show you the impact of different rates on your monthly payment.

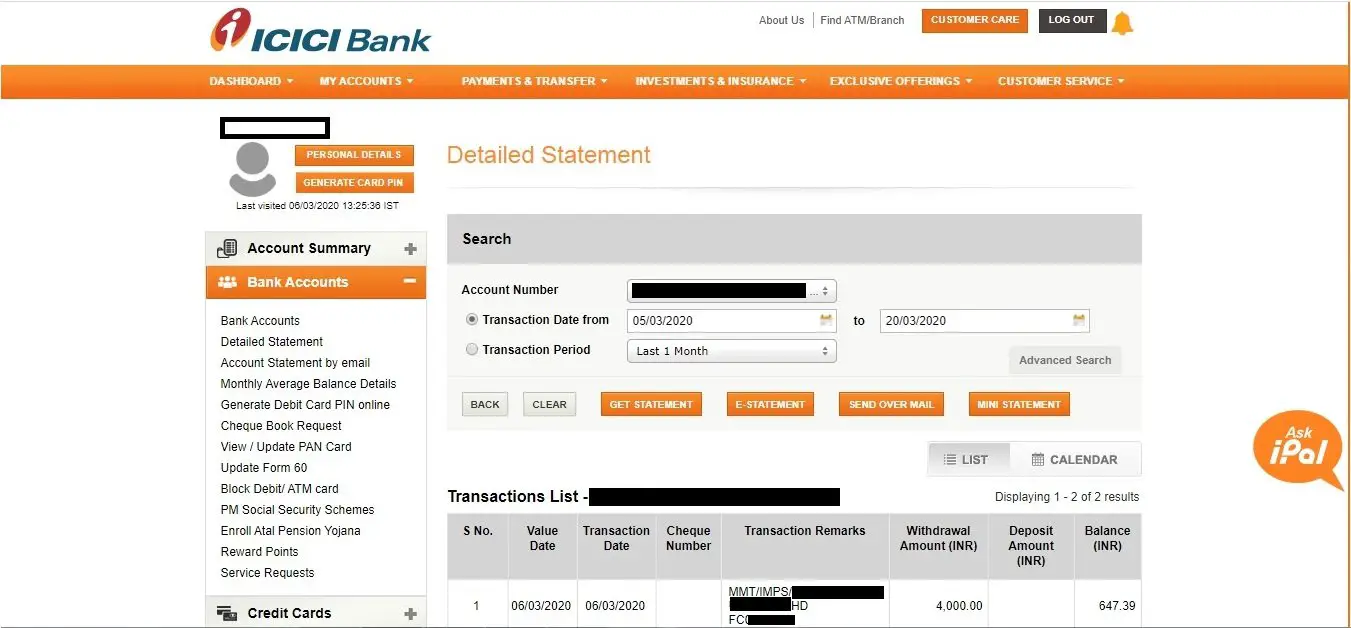

The borrower typically provides the bank or mortgage company two of the most recent bank statements in which the company will contact the borrower’s bank to verify the information.

How Many Months Worth Of Bank Statements Do I Need For A Loan

It depends. On most of our personal and business bank statement loans, we require the last 12 or 24 months worth of bank statements.

In some cases, we do allow two-month bank statement loans. If youre only providing two months worth of bank statements, you will need to attest and declare your qualifying income and your account balance must be positive.

Recommended Reading: Why Is Rent Higher Than Mortgage

Maintaining A Clean Bank Statement

How many months

When applying for a loan, we will request two months bank statements. We will ask for all pages, including the junk pages. If your statement says page 1 of 4, then we will require all 4 of the pages. Online statements are acceptable but screenshots are not.

Multiple account holders

Is your bank account held jointly? Is there somebody listed on the account that is not on the loan you are applying for? If so, well need a joint access letter from the other account holder stating that you has 100% access to all funds in the account.

Transfers from other accounts

The best thing you can do is limit the transfers. Any account you are transferring money from will have to be verified, especially if the transfers are large*. If you introduce another account, well need two months of that statement. If you have large transfers into this new account, well need to verify where those funds came from as well. The best thing you can do is limit the transfers over a 60 day period. *More on large deposits below.

What Will Du Require For Depository Assets

Asset Verification Documentation

When DU requires assets to be verified, DU will indicate the minimum verification documentation requirements necessary for the lender to process the loan application. This level of documentation may not be adequate for every borrower and every situation. The lender must determine whether additional documentation is warranted.

DU will not require documentation of assets for refinance transactions when the total funds to be verified are $500 or less.

Depository Assets

For depository assets , DU will require the following:

- two consecutive monthly bank statements for all purchase transactions, or

- one monthly statement for all limited cash-out and cash-out refinance transactions.

Monthly bank statements must be dated within 45 days of the initial loan application date.

Quarterly bank statements must be dated within 90 days of the initial loan application date, and the lender must confirm that the funds in the account have not been transferred to another asset account that is verified with more current documentation.

A Verification of Deposit ) can be obtained in place of bank statements.

When DU validates assets, DU issues a message indicating the acceptable documentation. Compliance with the DU message satisfies the requirement for documenting assets. This documentation may differ from the requirements described above. See B3-2-02, DU Validation Service.

Read Also: When To Refinance Your Mortgage Rule Of Thumb

If Your Deposit Is From Savings

If we need to see the deposit in your bank account statements, well let you know in your Decision in Principle.

The number of bank statements well need depends on the location of your savings account:

- Within the UK and European Economic Area well need to see 1 statement.

- Outside of the UK and EEA well need to see 3 months of statements.

- If we do not need to see your deposit, we wont ask to see any bank statements.

If You Meet The Following Criteria You May Be Eligible For A Bank Statement Loan:

- You must have been a business owner or self-employed for at least two years.

- You must have at least 10% down , as well as a 35% down payment for two-month bank statements.

- You must have four months of PITI reserves in the bank for loan amounts under $1 million and six months for loan amounts over $1 million.

- You may qualify with as little as 2-months bank statements.

- You must have a credit score of 620 or above to qualify.

- The minimum loan amount is $100,000, and the maximum loan is $5,000,000.

Think you qualify for a loan? Contact us today to find out!Contact Us

Think you qualify for a loan? Contact us today to find out!

Read Also: Can There Be A Cosigner On A Mortgage

What If I Dont Have Enough Bank Statements

Most lenders will ask for hard copies of your most recent bank statements. If you dont have them, you can always contact your bank and ask them to print them off and send them to you. Moreover, you can pop into your nearest branch and have them printed off on site.

Ask a quick question

We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in all different mortgage subjects.Ask us a question and we’ll get the best expert to help.

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage.

*OMA Mortgage Approval Guarantee is subject to you providing satisfactory documentation. See T& Cs.

Maximise your chances of approval, whatever your situation – Find your perfect mortgage broker

Speak To A Dedicated Mortgage Advisor In Hull

Whether youre a First-Time Buyer, Moving Home or Self-Employed, its always important to keep on top of your finances. If you have a bad credit history and are unsure of what to do, you can always enquire for Specialist Mortgage Advice in Hull by Getting in Touch with us today. Well advise as best as we can, to further you through your mortgage journey.

Last edited 14/07/2022

Don’t Miss: Can You Cancel A Reverse Mortgage

A Bank Vod Wont Solve All Bank Statement Issues

Verifications of Deposit, or VODs, are forms that lenders can use in lieu of bank statements. You sign an authorization allowing your banking institution to hand-complete the form, which indicates the account owner and its current balance.

VODs have been used to get around bank statement rules for years. But dont count on them to solve the above-mentioned issues.

- First, the lender can request an actual bank statement and disregard the VOD, if it suspects potential issues

- Second, depositories are also required to list the accounts average balance. Thats likely to expose recent large deposits

For instance, if the current balance is $10,000 and the two-month average balance is $2,000, there was probably a very recent and substantial deposit.

In addition, theres a field in which the bank is asked to include any additional information which may be of assistance in determination of creditworthiness.

Thats where your NSFs might be listed.

There are good reasons to double-check your bank statements and your application before sending them to your lender. The bottom line is that you dont just want to be honest you want to avoid appearing dishonest.

Your lender wont turn a blind eye to anything it finds suspicious.

If Your Deposit Is A Gift

When you apply, youll need to let us know if someone has gifted you money in the last year. If your gift is more than £10,000, well need you to fill in a gifted deposit form. The person gifting you the money, also called the donor, may have to provide us with bank statements to prove that the deposit amount came from their account.

The number of bank statements well need to see depends on where your donors savings account is:

- Within the UK we wont need any statements.

- Within the European Economic Area well need 3 months of statements.

- Outside of the UK and EEA well need 6 months of statements.

You May Like: How To Figure Out Mortgage Budget

Activities To Avoid Between Mortgage Pre

This is a guest post by Blair Warner, senior credit consultant and founder of Upgrade My Credit

You’ve just found out you’ve been pre-approved for a home loan!

That’s great news! Whether you’ve found a home you want to buy or you’re still out there house shopping, there’s something you need to know now that you’ve secured the financial backing of a lender: it’s important to keep your credit in good standing from now until closing day. What does that mean, exactly? Follow our tips below to learn more:

How Underwriters Analyze Bank Statements On Regular Deposits

One of the things that a mortgage loan underwriter will analyze is regular deposits. For example, with regular payroll checks automated deposited electronically to a bank account every other week, that will be looked at as normal and no further explanation is necessary. The mortgage underwriter will look at the electronic deposit and notice being payroll check being electronically deposited by the employers payroll service and that is okay. If there are other regular deposits on a regular basis to the bank account, whether it is electronically or a physical deposit, the underwriter will ask and question what the source of the deposit is. Borrowers with part-time jobs that are being cashed by the employer and depositing that cash, that cash deposit cannot be used.

Don’t Miss: How Does Filing Bankruptcy Affect Your Mortgage

How Underwriters Analyze Bank Statements Of Borrowers

In this article, we will discuss and cover How Underwriters Analyze Bank Statements for mortgage borrowers. For borrowers applying for a mortgage loan application, one of the most important things an underwriter will require is 60 days of bank statements. Two months of bank statements are required. Mortgage Underwriter will closely analyze borrowersfunds in a bank. The underwriter will look for regular deposits, irregular deposits, large deposits, and overdrafts. Many folks have multiple bank statements. Just because of having multiple bank statements, borrowers do not have to provide all of the bank statements. When an underwriter request 60 days of bank statements, they are not requesting all of the bank accounts. The only bank statement or bank statements needed is the bank statement or bank statements that have the sourced down payment and/or closing costs.

What Should You Do If Your Mortgage Has Been Declined Because Of A Bank Statement Issued

Here are the steps you can take to get your bank statements back on track if you submitted them to your lender, but they rejected you for something they didnt like.

Our brokers have strong working relationships with mortgage lenders and can offer second chances to borrowers who have been rejected.

These lenders are also known for being flexible and overlooking issues other banks cannot.

Send us an enquiry today to find your perfect mortgage broker.

Also Check: What To Look Out For With Mortgage Lenders

We Can Help You Find The Right Broker

You do not want to choose a random broker. We are here to help you find the right broker for you.

Our broker-matching service is free and will quickly assess your situation to match you with the best mortgage advisor. You can be sure they will find the best solution for you if there is an issue with your bank statements.

How Many Bank Statements Do Mortgage Lenders Require

Lenders typically request two months of statements for each of your bank, brokerage, and investment accounts.

Deposits made into your accounts prior to the most recent two months asset statement are considered seasoned and do not have to be sourced. The seasoning requirement for most lenders is typically statements covering the most recent 60 days prior to closing.

Theyre looking for where the cash came from, to determine whether you have received a gift or some other factor that will make you look good at that point in time but wont be available in the future to help you make your required mortgage payments.

The source of your funds is not necessarily where the funds are transferred from a savings account into a checking account, but they will look for more verification that the funds have been in your account, and can be documented on the most recent two months statements.

Deposits made into your account prior to the most recent two months asset statement are considered seasoned and do not have to be sourced. The seasoning requirement for most lenders is typically statements covering the most recent 60 days prior to closing.

Read Also: What Does A Mortgage Include

Do Lenders Check Bank Statements Before Closing

Yes, they do.

One of the final and most important steps toward closing on your new home mortgage is to produce bank statements showing enough money in your account to cover your down payment, closing costs, and reserves if required.

When youre buying a new home and approaching the finish line, emotions are high and timing is tight.

This is NOT the time to find out that your loan officer did not properly explain how important your bank statements will be at the closing table.

I received a question from one of our readers last week. Reading deeper into the question, theres much more here than meets the eye.

Can I Get A Mortgage With 3 Months Employment

Yes. It is possible to obtain a mortgage if your contract has recently changed with the same employer. However, the issue is that you may not have earnings history for last 3 months as required by many lenders and as a result they may consider your application in the same way that they would consider a change of job.

Recommended Reading: What Is A Good Tip For Mortgage

Do Lenders Look At Bank Statements Before Closing

Your loan officer will typically not re-check your bank statements right before closing. Lenders are only required to check when you initially submit your loan application and begin the underwriting approval process.

However, there are a few things your lender will re-check before closing, including:

- Employment and income

You should avoid financing any large purchases or opening new lines of credit between mortgage approval and closing.

New debts can affect your credit score as well as your debt-to-income ratio , and could seriously affect your loan approval and interest rate.

In addition, if anything changes with your income or employment prior to closing, let your lender know immediately. Your loan officer can decide whether any changes to your financial situation will impact your loan approval and help you understand how to proceed.