How Do I Compare Mortgage Rates Between Lenders

You can apply for prequalification with multiple lenders. A lender takes a general look at your finances and gives you an estimate of the rate you’ll pay.

If you’re farther along in the homebuying process, you have the option to apply for preapproval with several lenders, not just one company. By receiving letters from more than one lender, you can compare personalized rates.

Applying for preapproval requires a hard credit pull. Try to apply with multiple lenders within a few weeks, because lumping all of your hard credit pulls into the same chunk of time will hurt your credit score less.

Increase Your Down Payment

Did you know that your down payment amount can have an impact on your mortgage rate? That’s because mortgage rates are generally tiered, and typically lower rates are available for those with a down payment of 20% or more. If possible, check with your lender to see if increasing your down payment will lower your mortgage interest rate.

Should I Use An Ontario Mortgage Broker

Ontario mortgage brokers often have the lowest rates in the province, particularly for default-insured mortgages. And theyre generally free of charge for qualified borrowers. Ontario brokers also tend to provide better advice than many lender representatives since they specialize in mortgages and deal with multiple lenders. Note that all brokers must be licensed by the Financial Services Regulatory Authority of Ontario. Heres a link to see if your broker is licensed.

Don’t Miss: Can You Do A Reverse Mortgage On A Condo

How To Get A Good Mortgage Rate

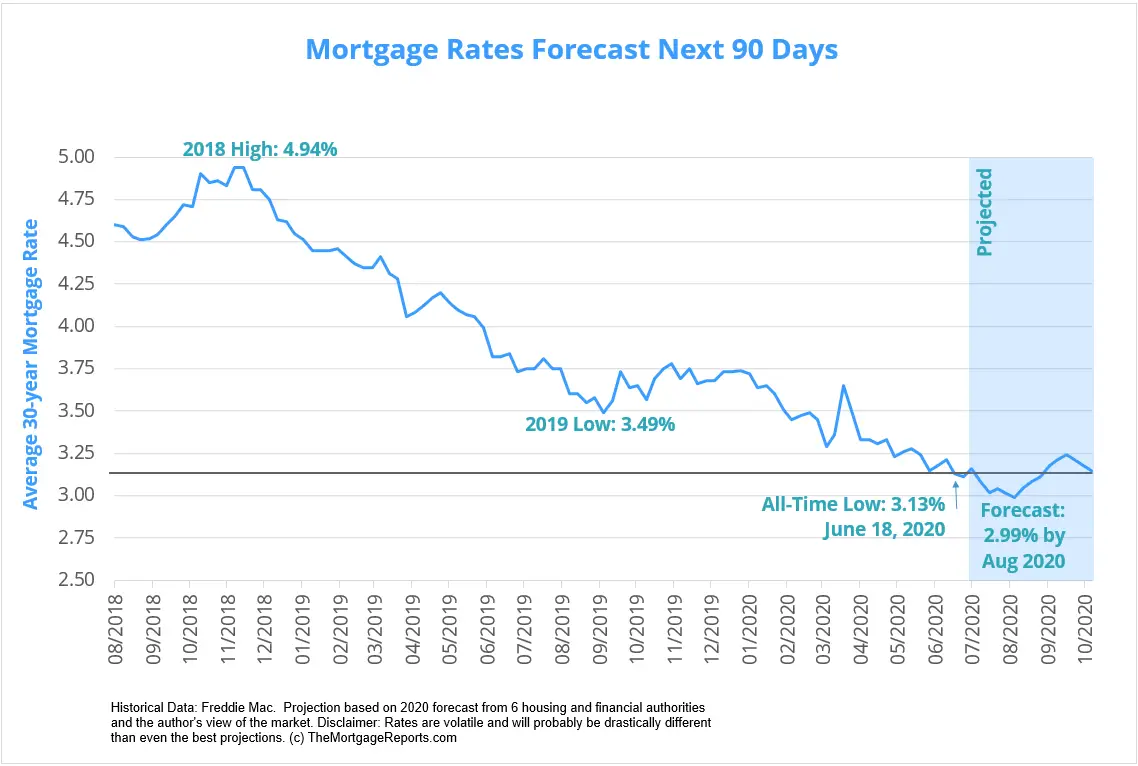

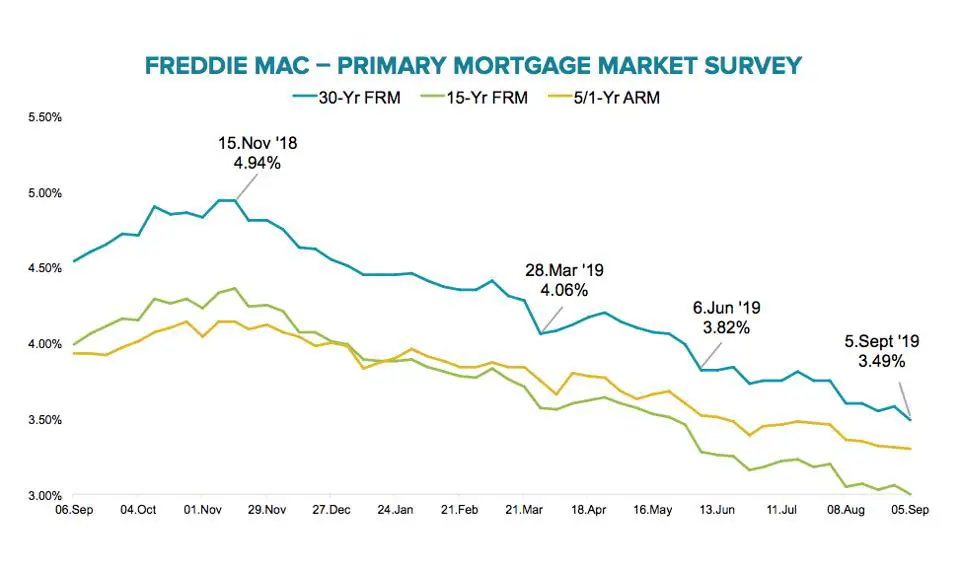

As you can see in the above graph, mortgage rates change year after year, so the factors impacting your potential mortgage rate arent entirely in your hands. Of course, controlling some factors that dictate your mortgage rate are totally in your power. Snagging a lower rate is all about making yourself appear a more trustworthy borrower.

You see, lenders charge different borrowers different rates based on how likely each person is to stop making payments . Since the lender is fronting the money, the lender decides how much risk its willing to take. One way for lenders to mitigate losses is with higher interest rates for riskier borrowers.

Lenders have a number of ways to assess potential borrowers. As a general rule of thumb, lenders believe that someone with plenty of savings, steady income and a good or better score is less likely to stop making payments. It would require a pretty drastic change in circumstances for this kind of homeowner to default.

On the other hand, a potential borrower with a history of late or missed payments is considered a lot more likely to default. A high debt-to-income ratio is another red flag. This is when your income isnt high enough to support your combined debt load, which can include student loans, car loans and credit card balances. Any of these factors can signal to a lender that youre a higher risk for a mortgage.

Canada’s Most Popular Mortgage: The 5

In Canada, out of the $1.2 trillion CAD in outstanding residential mortgages in May 2021, the 5-year fixed rate mortgage takes the crown with over $660 billion, or more than 50%, of all mortgages in Canada. There are more 5-year fixed rate mortgages than all variable rate mortgages combined. The 5-year fixed rate mortgage is so popular that the CMHC uses the Bank of Canada’s 5-Year Benchmark Posted Rate for itsmortgage stress test.

Also Check: Can You Refinance A Mortgage Without A Job

Is It A Better Time To Buy Or Sell A Home

There are more economic factors on balance, putting downward pressure on home prices than upward pressure. However, that was also the case in the first three months of 2021 when Canadians desperate for more living space pushed home values higher.

-

If you believe that the rise in buying activity is explained by Canadians seeking more living space, then the end of pandemic restrictions coming this summer might trigger an end to this economic real estate cycle.

-

If you believe that interest rates are the primary driver of home prices, then the forecasted rise in rates would indicate prices will moderate in the second half of 2021.

-

Population growth is also expected to remain below average in 2021, so population growth shoudnt come into play until 2022.

Homebuyer Advice

If you plan to buy in the next three years, be mindful that there is a risk that prices will fall in the short run, so that a wait-and-see approach may be appropriate.

The low mortgage rates provide more purchasing power for buyers who are still employed than in 2019, but less than six months ago. In a weakened market, low rates are a gift to homebuyers however, it inflates the value of a standard home in markets with low supply.

Home Seller Advice

Unemployment is still high, and if we use past recessions as a guide, there will likely be a weakening in home valuations.

Like this report? Like us on .

Mortgage Interest Rates Today

Here’s what you need to know to lock in the best rate possible for that home loan.

Now’s the time to get an awesome mortgage rate on your dream home.

In response to market volatility at the outset of the COVID-19 pandemic, the Federal Reserve cut its benchmark interest rate for the first time in more than a decade, creating a ripple effect in the market. For homebuyers, this has meant home mortgage rates at historic lows. It’s a great time to investigate the mortgage rate you could qualify for on a future home.

Recommended Reading: Mortgage Rates Based On 10 Year Treasury

How Do I Get A Mortgage

Getting a mortgage is the most important part of the homebuying process. Its likely the largest loan youll ever take out. So finding the right lender and getting the best deal can save you thousands of dollars over the life of the loan.

Heres what you need to do.

There are lots of different types of lenders. Looking at the loans and programs that banks, credit unions, and brokers offer will help you understand all of your options.

If youre looking for a specific type of loan, like a VA loan or a USDA loan, then make sure that the lender offers these mortgages.

2. Apply for preapproval

Before you start shopping for a home, youll need a preapproval letter. A mortgage preapproval is different from a formal loan application in that it doesnt affect your credit and doesnt guarantee youre approved. But it does give you an idea of your likelihood of approval.

3. Submit an application

Once youre ready to start comparing loan offers, submit an application. Until you apply, the lender wont be able to give you an official estimate of the fees and interest rate you qualify for.

To find the lowest rate and fees, you should submit applications with two or three lenders. Once you have each Loan Estimate in hand, its easier to compare and determine which offer is best for you.

4. Underwriting and closing

Reverse Mortgage Fixed Rates

- Payment options: Single lump sum disbursement.

- Interest rate:Fixed rate for the life of the loan. The interest rate remains the same for the life of the loan but requires a single lump sum disbursement at the time of closing.

If you are using the reverse mortgage for a new home purchase or are already taking most of your available funds at closing to pay off another mortgage balance you might find this plan the most appealing.

Read Also: Reverse Mortgage Mobile Home

How Much Can I Save By Comparing Mortgage Interest Rates In Canada

Because of the significant amount of money being borrowed under a mortgage, even the slightest difference in the mortgage interest rate may result in you saving money over the course of a mortgage term, and even more over an entire amortization period. While the mortgage rate is a very important consideration, you should also be sure to evaluate the terms and conditions of each type of mortgage to make sure you choose the right one for you.

Pros And Cons Of A Fixed

As with all financial products, there are several pros and cons to fixed-rate mortgages in Canada. As far as the pros, borrowers get a stable payment that will never change over the life of their loan. This is unlike variable-rate mortgages in which the rate may change several time over the course of the loan. With the rate change in a variable-rate mortgage comes a change in the amount of the monthly minimum payment that is required. The second pro of a fixed-rate mortgage in Canada flows from the first. Since the mortgage rate and payment amount are stable over the lives of loans with fixed mortgage rates, it is much easier for homeowners to budget their money and make future plans for investing, saving and much more. If you like consistency and stability, a fixed-rate mortgage is probably the right choice for you.

Another con related to fixed-rate mortgages is that with a variable-rate mortgage, your interest rate might actually go down over the course of your loan. It may be even cheaper to pay the mortgage in the future with a variable-rate loan than it is when you first sign for the funds. This never happens when you choose a fixed-rate mortgage.

Recommended Reading: Does Rocket Mortgage Sell Their Loans

Does Refinancing Still Make Sense

Generally speaking, homeowners could save thousands with a rate and term refinance if their new rate is 0.75% to 1% below their current rate. And the number of homeowners with rates well above the current market rates has dwindled dramatically as rates have risen.

In this hot housing market, the ability to turn the equity in your home into cash with a home equity line of credit has become increasingly popular. A HELOC can be a reasonable option for financing home repairs or improvements, just be sure to understand all of the fine print regardless fees, the interest rate and the repayment schedule..

How Are Mortgage Rates Set

Several economic factors influence rates, from inflation to monetary policy. Likewise, different lenders charge different mortgage rates for a variety of reasons, including varying operating costs, risk tolerance and even how much they want new business. Your personal financial informationincluding credit score, debt-to-income ratio and income historyalso have a significant impact on interest rates.

Read Also: Reverse Mortgage On Condo

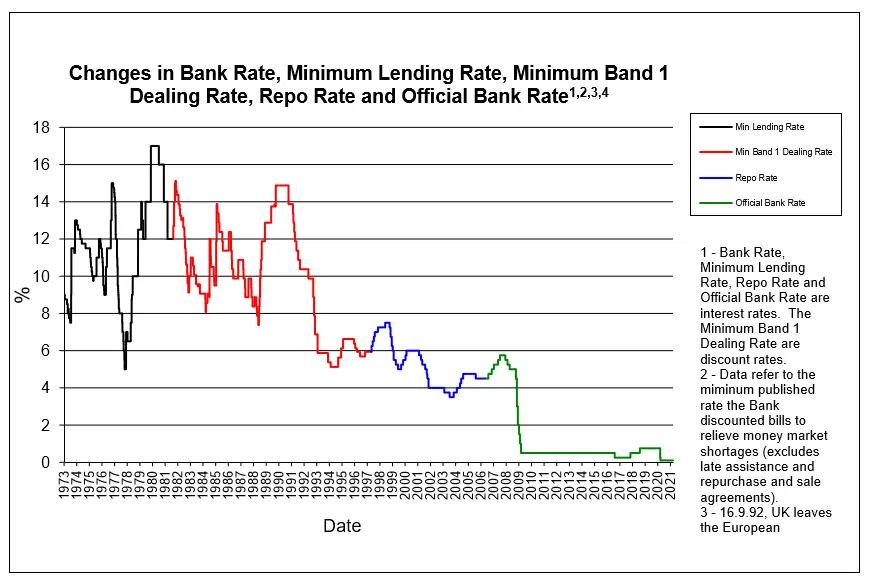

Economist Warns More Rises To Come

“To be clear, interest rates had to go up from the record lows, the emergency lows, they hit in COVID,” he said on News Channel.

“That makes sense, how much and how fast, well, the Reserve Bank is clearly leaning towards more and sooner. And that may end up being what we need, but it’s got to thread a needle.”

“The risks are if you go too hard, too fast and we’re already seeing consumer sentiment, the thing that we’re looking to drive the economy, consumer spending, we’re seeing that weaken quite a lot and quite fast, the Chinese economy weaken, there is a risk that they over-do it.

“The other risk is they underdo it and some of the inflation gets baked in and we need more pain stretched out over a long time. They’re trying to thread that needle but so far they’re leaning towards big increases happening fast.”

How Big Of A Down Payment Do I Need

Depending on what type of loan you borrow, you may not need to pay a down payment. Some government-backed loans for veterans and farmers may not require a down payment, while conventional loans or Federal Housing Administration loans typically require 3% or more.

To see all your options, visit our loan types page to see what kind of mortgage may be best for you.

Recommended Reading: Reverse Mortgage For Condominiums

Jamie David Business Director Of Mortgages

Jamie David is the Business Director of Mortgages at Ratehub.ca. A graduate of the Systems Design Engineering program at the University of Waterloo, she has over 15 years of business, marketing, and engineering experience in the financial technology, banking, education, energy and retail industries. She has worked in top organizations like TD Bank, Trading Pursuits, Petro-Canada, and the TTC. Her passion for personal finance, investing, education, and business strategy brought her to Ratehub.ca where she heads a very talented, cross-functional team that is dedicated to providing Canadians with the best mortgage experience all the way through from online search to funded mortgage.

Comparing Mortgage Amortization Periods

| $165,315 |

When comparing 20-year and 30-year amortizations to the 25-year amortization at a 2% mortgage rate:

- A 20-year amortization increases your monthly mortgage payment by $412/month, but reduces your total interest cost by $28,116

- A 30-year amortization reduces your monthly mortgage payment by $269/month, but increases your total interest cost by $30,139

If you can handle higher monthly mortgage payments, a shorter amortization period can save you thousands of dollars. Many banks and mortgage lenders also allow you to shorten your amortization period by making additional mortgage prepayments, such as through lump-sum principal prepayments, doubling your regular payment amount, and increasing your payment schedule.

Don’t Miss: Chase Recast Calculator

How Much Does It Cost To Refinance

If you refinance your mortgage, closing costs typically range from 3% to 6% of the loan amount. For a $300,000 loan thats $9,000 to $18,000 in fees.

But, each lender will assess your personal situation differently. So its important to shop around and compare offers. Everything from where the property is located to the type of loan youre refinancing into can change what youll pay to refinance.

Should I Lock In My Mortgage Rate Today

Locking in a rate as soon as you have an accepted offer on a house can help guarantee a competitive rate and affordable monthly payments on your home mortgage. A rate lock means that your lender will guarantee you an agreed upon rate for typically 45 to 60 days, regardless of what happens with average rates. Locking in a competitive rate can protect the borrower from rising interest rates before closing on the mortgage

It may be tempting to wait to see if interest rates will drop lower before getting a mortgage rate lock, but this may not be necessary. Ask your lender about float-down options, which allow you to snag a lower rate if the market changes during your lock period. These usually cost a few hundred dollars.

Also Check: Can You Do A Reverse Mortgage On A Mobile Home

What Are Prepayment Options

Prepayment options outline the flexibility you have to increase your monthly mortgage payments, or pay down your mortgage principal as a whole. The monthly prepayment option is a percentage increase allowance on your original monthly mortgage payment.

For example, if your monthly mortgage payment is $1,000 and your prepayment allowance is 25%, then you can increase your monthly payments up to $1,250. The lump sum prepayment option on the other hand, applies to the original mortgage amount. So, if your lump sum prepayment allowance is 25% on a $100,000 mortgage amount, then you can pay $25,000 off the principal every year.

How Interest Rates Affect Your Available Loan

You may have heard of recent changes to the Federal Housing Administration-insured reverse mortgage program, the Home Equity Conversion Mortgage program.

The agency announced in late august that it would be making several changes to HECM loans that will impact borrowers- both in terms of how much they will pay to get a reverse mortgage, and how much theyll be able to borrow.

One of the big changes is that the amount you will be able to borrow with a HECM loan depends largely on current interest rates.

The amount of home equity you can borrow is tied directly to the interest rate available at the time you get your reverse mortgage.

Just like in the forward mortgage market, your interest rate determines the amount of interest youll pay.

But in the reverse mortgage market, the current interest rate also determines the amount you can borrow.

All HECM reverse mortgages use a specific table provided by the Department of Housing and Urban Development to determine loan amounts for borrowers.

This amount is called the principal limit. The principal limit depends mainly on three factors: the borrowers age, the home value, and current interest rates.

From home to home and borrower to borrower, every loan amount will be different. The percentage of home equity that borrowers can access will range from 50-60%.

Older borrowers can access a greater percentage of home equity than their younger counterparts.

| 71.7% | $970,800 |

You May Like: What Does Gmfs Mortgage Stand For

How Do I Pay For Cmhc Insurance

Your lender is actually the party responsible for payingCMHC insurancecosts. In the majority of cases, your lender will pass these costs down to you by adding the CMHC insurance premium to your mortgage loan amount. This will slightly increase your monthly or bi-weekly payment.

In some cases, your lender may allow you to pay CMHC insurance costs as a lump-sum, or not pass down the cost to you at all. Contact your lender for more details.

What To Know About The Above Purchase Mortgage Rates:

Rates shown are based on a conforming, first-lien purchase mortgage loan amount of $250,000 for a single-family, owner-occupied residence with a maximum loan-to-value ratio of 75%, a 0.25% interest rate discount,1 2 for a qualified client with eligible KeyBank checking and savings or investment accounts, mortgage rate lock period of 60 days, an excellent credit profile including a FICO score of 740 or higher, and a debt-to-income ratio of 36% or lower. Your actual rate may be higher or lower than those shown based on information relating to these factors as determined after you apply.

For your personalized rate quote, contact a Mortgage Loan Officer today.

*Adjustable Rate Mortgage interest rates and payments are subject to increase after the initial fixed-rate period and assume a 30-year repayment term.

FHA, VA and other mortgage loan terms and programs are available.

Learn more about estimated mortgage payments.

Interested in refinancing your home? View our refinance rates.

Todays purchase mortgage interest rates for KeyBank clients in ColoradoRates effective as of 10:00 AM ET on Monday, December 27, 2021

| Mortgage Type |

|---|

| 2.957% |

Read Also: Rocket Mortgage Payment Options