How Much Should Origination Costs Be

Origination fees are charged as a percentage of the loan amount, so they vary depending on the size of your mortgage and the percentage the lender charges you. Between 0.5% and 1% of the total loan amount is fairly standard. If you’re taking out a loan for $250,000, your origination fee would probably be between $1,250 to $2,500. In 2020, the median origination fee paid on purchase loans was $1,349, according to Home Mortgage Disclosure Act data.

You can try to negotiate these costs. This is yet another reason having mortgage preapprovals can help, as you could try to convince a lender to lower its fees based on another lender’s offer. In a buyer’s market, you could potentially also negotiate to have a home seller chip in toward your closing costs.

Best Mortgage Rates From Top Lenders

We looked at the 40 biggest mortgage lenders in 2020 to see how their interest rates stacked up.

The 25 companies with the best mortgage rates on average are as follows:

| Mortgage Lender | |

| Citizens Bank | 3.27% |

Note that average rates shown in this table are from 2020, when rates were near record lows almost all year. Todays mortgage rates could be higher than whats shown.

You can still use last years interest rates as a tool to compare lenders side by side. But before you lock in a loan, youll want to get custom interest rates from a few different lenders to make sure youre getting the best deal available today.

Are Interest Rate And Apr The Same

Borrowers may notice some lenders offer interest rates and annual percentage rates that are similar, but they are in fact two different things. The interest rate, expressed as a percentage, is the amount a lender intends to charge borrowers for the amount lent . The APR, also expressed as a percentage, includes the interest rate plus all lender charges rolled into the loan, such as application fees, broker fees, origination fees, and any mortgage points.

Recommended Reading: Mortgage Recast Calculator Chase

How Are Mortgage Rates Set In Canada

Each mortgage lender sets rates based on its own relationship to the prime lending rate. But whats the prime lending rate?

The prime lending rate is influenced by the Bank of Canadas interest rate, which currently sits at 5.04%. Each bank has its own prime lending rate. The prime rate currently sits at 2.95%. Your lender will give you an annual interest rate on your mortgage thats based on the prime rate. When the Bank of Canada raises its overnight rate, it gets more expensive for Canadian banks to borrow money. In response, they raise their own prime rates to cover the additional expense.

Other kinds of loans that are affected by the prime rate include car loans, lines of credit and some credit cards.

When you agree to a fixed-rate mortgage, youll select a rate based on what lenders are offering at the time and youll agree to pay that rate for the duration of your mortgage term. A variable rate, on the other hand, is usually determined by adding or subtracting a certain percentage from the prime lending rate. Each lender will determine this percentage on their own. When the prime lending rate goes up or down, the mortgage rates of homeowners who have variable mortgage rates will also go up or down.

How We Chose The Best Jumbo Mortgage Rates

In order to assess the best jumbo mortgage rates, we first needed to create a credit profile. This profile included a credit score ranging from 700 to 760 with a property loan-to-value ratio of 80%. With this profile, we averaged the lowest rates offered by more than 200 of the nations top lenders. As such, these rates are representative of what real consumers will see when shopping for a mortgage.

Keep in mind that mortgage rates may change daily and this data is intended to be for informational purposes only. A persons personal credit and income profile will be the deciding factors in what loan rates and terms they are able to get. Loan rates do not include amounts for taxes or insurance premiums and individual lender terms will apply.

Read Also: Rocket Mortgage Vs Bank

How Do I Lock In A Mortgage Rate

Once youve selected your lender and are moving through the mortgage application process, you and your loan officer can discuss your mortgage rate lock options. Rate locks can last between 30 and 60 days, or even more if your loan doesnt close before your rate lock expires, expect to pay a rate lock extension fee.

How Large Is Your Home Loan Deposit

The deposit you save up may also impact the home loan. This is because home loan lenders typically offer more competitive interest rates to those with bigger deposits. A deposit of at least 20% or more, or a loan-to-value ratio of 80% or less, is seen as more reliable than one with a smaller deposit as it showcases a greater level of financial discipline.

Read Also: Rocket Mortgage Conventional Loan

What Term Should I Choose

The most common term length in Canada is 5 years. Unless you have specific concerns, a 5-year term generally works well. Longer terms will have higher mortgage rates, which can be bad for those struggling to pass themortgage stress testas you may be tested at a higher mortgage rate. This is a particularly significant issue for homebuyers inTorontos housing marketor inVancouvers housing market. However, you wont have to worry about requalifying for a mortgage as often as a short mortgage term. Each lender will offer different options for term length and rates contact your lender or broker for more details.

How Do I Switch My Mortgage

Firstly compare mortgage rates for switchers on bonkers.ie to find out who’s offering the best rates and whether it makes financial sense to switch. Our mortgage calculator lets you easily compare interest rates, offers and cashback incentives from all of Irelands mortgage lenders and will quickly show you what your new monthly repayments would be and how much you could save by switching.

Next step is to start the switch. You can request a callback from your new lender through bonkers.ie or else choose to be put in touch with one of our experienced brokers wholl guide you along the way.

Once you’ve chosen your new lender they’ll issue you with a mortgage switching pack which you’ll need to fill out.

You’ll also need to get an up-to-date professional valuation of your home. This is so that your new lender knows how big your mortgage is in relation to the value of your home and therefore how much equity you have. The more equity the better. The fee will be around 150 and the lender you’re looking to switch to will give you the name of an approved valuer to use.

Don’t Miss: 70000 Mortgage Over 30 Years

Typical Mortgage Amounts In Montreal

The size of your mortgage will depend on where you live, your down payment and your mortgage interest rate. The benchmark price for a detached home in Montreal is $471,900 as of November 2020, according to the Canadian Real Estate Association. For a buyer with a 20% down payment , the mortgage would be $377,520. This amount doesnt include interest paid over the lifespan of the mortgage, which depends on the mortgage interest rate.

Remember: if your down payment is less than 20%, youre required to buy CMHC mortgage insurance. This will increase the cost of your mortgage and the amount of interest youll pay. CMHC insurance premiums depend on the size of your down payment. Your mortgage insurance premium can be paid as a lump sum, or added to the cost of your mortgage.

Should You Remortgage Now

While the above deals are available now, they may not be around for long. So its essential to check your mortgage rate now and see if you can lock in a better deal. Its important to find out if youll need to pay any fees such as an early repayment charge if you switch. However, even if you do have fees to pay if you switch deals, you could still save money in the long run. But it will depend on your circumstances so speak to a broker to chat through your options.

Don’t Miss: Does Prequalifying For A Mortgage Affect Your Credit

Is The Lowest Ontario Mortgage Rate The Best Rate

Not always. The lowest rates usually come with more limitations. These restrictions can cost you much more than the small rate savings. Such terms are common with low frills mortgages and typically kick in when you try to port, break or increase the mortgage after closing. When comparing mortgage rates, dont be afraid to ask potential lenders questions to ensure you understand the terms and conditions of your mortgage.

How Do I Qualify For Better Mortgage Rates

Qualifying for better mortgage rates can help you save tens of thousands of dollars over the lifetime of the loan. Here are a few ways you can ensure you find the most competitive rate possible:

- Raise your credit score: A borrowers credit score is a major factor in determining mortgage rates. The higher the credit score, the more likely a borrower can get a lower rate. Its a good idea to review your credit score to see how you can improve it, whether thats by making on-time payments or disputing errors on your credit report.

- Increase your down payment: Most lenders offer lower mortgage rates for those who make a larger down payment. This will depend on the type of mortgage you apply for, but sometimes, putting down at least 20 percent could get you more attractive rates.

- Lower your debt-to-income ratio: Also called DTI, your debt-to-income ratio looks at the total of your monthly debt obligations and divides it by your gross income. Usually, lenders don’t want a DTI of 43% or higher, as that may indicate that you may have challenges meeting your monthly obligations as a borrower. The lower your DTI, the less risky you will appear to the lender, which will be reflected in a lower interest rate.

You May Like: 10 Year Treasury Yield Mortgage Rates

What Happens At The End Of A Term

At the end of each term, you have the option to renew or refinance your mortgage.

- Renewing your mortgageinvolves signing for another term with your existing lender. Your monthly payment and mortgage interest rate may change.

- Refinancing your mortgageinvolves signing a new term agreement, possibly with a different rate or lender. Refinancing allows you to take advantage of lower mortgage rates or better options not offered by your current lender. You can also borrow more money by using your home equity and receiving it in cash.

Your mortgage lender might not reassess your credit score or debt service ratios if youre renewing at the same lender. If youre switching to a new lender, youll need to be reassessed and you may need to pass the mortgage stress test.

Open Vs Closed Mortgages

If youâre wondering whether to get an open or closed mortgage, the answer is, while an open mortgage may make sense in certain circumstances, the overwhelming majority of Canadians opt for a closed mortgage. While open mortgages have extra flexibility that you might need, closed mortgages are by far the more popular choice not only due to their lower rates, but also because most home buyers do not intend to pay off their mortgages in the short term. Moreover, fixed-rate open mortgages do not exist and variable-rate mortgages are very rare. The most common type of open mortgage is the Home Equity Line of Credit . Below are some quick facts about the differences between open and closed mortgages, and you can also find more detailed information about them here.

Recommended Reading: How Much Is Mortgage On 1 Million

Ontarios Housing Market Trend

Ontarios new tagline is A Place to Grow, which is also whats expected for the provinces population. The Ontario Ministry of Finance projects the population of Ontario will increase some 30.2% over the next two decades, bringing the total population to 18.5 million by July 1, 2041.

There are so many incredible aspects to Canadas most populous province, from its lush natural resources to its growing cities. That and solid job growth make the population boom less of a surprise.

As a result of its popularity, home prices in Southern Ontario are expected to continue rising. Prices are particularly prone to inflation in Ontarios Golden Horseshoe region where immigration is high, land is limited by the protected green belt and homes remain in short supply.

That, in turn, implies that Ontario mortgage amounts will grow faster than the national average.

The State Of Housing In Ontario

Overall, the state of the housing market in Ontario is moving in a positive direction. In recent years, the number of housing starts was much higher than the actual demand, but beginning in 2012, this has started to change. By 2013, housing starts are estimated to be about 64,500, which is significantly lower than the nearly 68,000 housing starts recorded in 2011. As supply gets closer to meeting actual demand, homeowners will not need to worry too much that their home values will remain stagnant. Lower supply means that housing prices will level off and even increase in the years ahead.

MLS sales are predicted to increase by over 46,000 residences from 2012 to 2013 because of stabilization in housing prices and the demand for homes as people move into the area. The average selling price for a home in Ontario was just under $391,000 in February 2012, which did not prevent an increase in total residential units sold from 2011 to 2012. Approximately 15,000 housing units were sold in February 2012 versus 13,500 in the same month a year before. Housing prices should decline slightly in 2012 but are predicted to rebound in 2013, so 2012 is probably an excellent time to take advantage of current mortgage rates. Ontario home buyers will get more house for less money throughout the year.

Read Also: Reverse Mortgage On Condo

Base Rate Rises For A Fourth Time

Last week, the Bank of England increased the base rate for the fourth time since December. It now stands at 1%, having risen by 0.25 percentage points.

The rises come as the Bank battles soaring inflation, which hit 7% in March, well above the target of 2%.

The base rate dictates the cost of borrowing for banks and building societies, so a higher rate usually means more expensive borrowing for consumers.

Four quick-fire increases have resulted in mortgage rates more than doubling from the historic low of 0.79% recorded last October, when more than 100 sub-1% fixed-rate mortgages were available.

When Should I Lock My Mortgage Rate

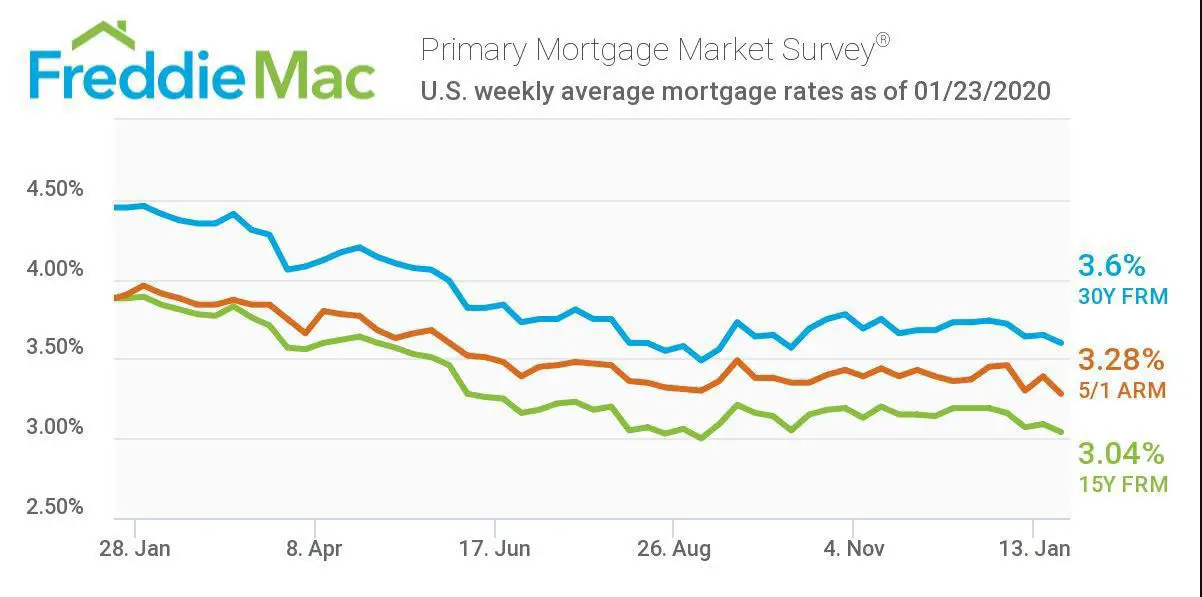

Right now, mortgage rates are historically low, so its a good idea to lock your rate as early in the mortgage application process as possible. Rates move up and down from day to day, and knowing exactly where theyll move is impossible. A rate lock will protect you from potential interest rate increases, which could unexpectedly increase the cost of your home loan.

If youre concerned about interest rates dropping after you lock in your rate, ask your lender for a float down. With this option, you get the lower of the two rates. Pay attention to the fine print, though. Typically, you can only reduce your mortgage rate if it drops by a certain percentage, and there are likely to be fees associated with this option.

Read Also: Rocket Mortgage Launchpad

How To Shop For Mortgage Rates

There are a few things to keep in mind when shopping for mortgage rates:

- Make sure you look at national and local lenders to find the best possible rates.

- Avoid applying for mortgages in multiple places as this can hurt your credit score. Instead, pull your credit report and get a keen picture of your credit history that you can share with potential lenders. Ask them to provide you with the rates based on that information. This way you preserve your credit score while getting the most accurate information for your credit profile.

- Use our rate table to help you identify whether lenders are offering you a competitive rate based on your credit profile.

How Do I Find Current Va Mortgage Rates

NerdWallets mortgage rate tool can help you find competitive, customized VA mortgage rates. In the Refine results section, enter a few details, and in moments youll get a rate quote tailored to meet your needs, without having to provide any personal information. From there, you can start the process of getting approved for your VA home loan. Its that easy.

Also Check: How Does 10 Year Treasury Affect Mortgage Rates

Tips To Get The Lowest Mortgage Rate

If you want the lowest mortgage rate available, you have to shop around. Thats the number one rule.

But there are other strategies you can use to get lower offers from the lenders you talk to.