Whats The Best Way To Refinance Your Mortgage

There are many ways to start a mortgage refinance, but one of the easiest is to go through an online marketplace, which allows you to get refinance offers from multiple lenders all at the same time while only having to submit your information and requirements once.

An online marketplace lets you compare options without having to reach out to individual banks, credit unions and other lenders one at a time. Getting started is a relatively quick process, which is handy because while conditions for refinancing are still favorable today, they can and likely will change in the future.

While its impossible to predict exactly how quickly interest rates will start to rise again, the one thing thats certain is that they wont remain this low forever. So if youve been worried that you missed your chance to refinance your home, the good news is its not too late. But youll want to start exploring if a mortgage refinance makes sense for you sooner rather than later.

Fees Are Too High Homeowners Say

The YouGov survey found homeowners also worry any savings they might enjoy with a lower interest rate could be lost to lender fees. Sixteen percent of homeowners say they have chosen not to refinance because the fees are too high, the second most popular reason given on the YouGuv survey.

Homeowners are not wrong to be nervous about fees. Depending on your loan amount, the number of discount points you buy and what the lender charges, refinance fees can certainly rack up.

The average closing costs on a mortgage refinance are $5,000, according to Freddie Mac. And, in December, refinancing will get even more expensive, as the Federal Housing Finance Agency plans to tack on an adverse market refinance fee to loans sold to the government-supported entities Fannie Mae or Freddie Mac. That accounts for about 70% of all loans.

Whether homeowners choose to plunk down a few thousand dollars today to save money in the long run comes down to simple cost-benefit analysis. How much will it cost to refinance versus how much will you benefit? Figure out how long it will take to recoup those closing costs. If you plan on moving before youll see any savings, then refinancing probably doesnt make sense.

One cost many homeowners are managing to avoid are appraisals. Appraisal waivers have gained popularity since the beginning of the year, shooting up by 110% since January. Home appraisal costs differ by area, but expect to save between $300 to $550 if you qualify for a waiver.

The Cost To Refinance A Mortgage

Credible Operations, Inc. NMLS# 1681276, Credible. Not available in all states. www.nmlsconsumeraccess.org.

This article first appeared on the Credible blog.

Refinancing your mortgage can help you save money in the long run, as well as lower your monthly payment. However, before you move forward, its important to consider the costs of refinancing and how to avoid or lower some of these fees.

Heres a closer look at the cost to refinance a home loan.

Recommended Reading: Recast Mortgage Chase

Make Sure Your Refinance Is Worth It

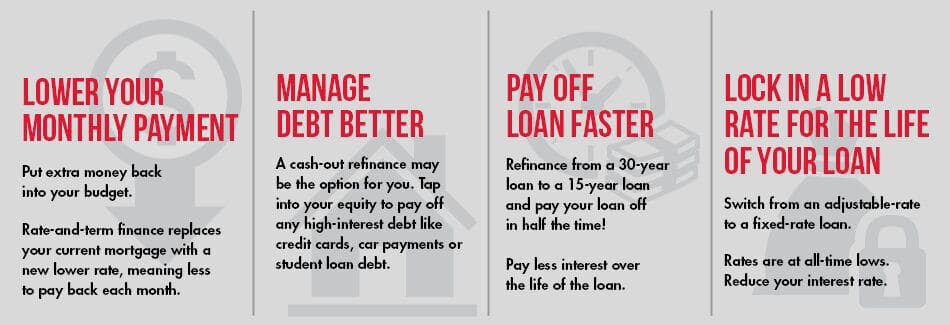

A refinance is typically worth it if you can lower your interest rate and payment or get another financial benefit, like cashing out equity or switching from an adjustable-rate mortgage to a fixed-rate loan.

But a refi isnt always the right decision.

Heres why: Frequent refinancing extends the mortgage term again and again.

Remember, a refinance after five or 10 years resets the loan, often to 30 years. The rate and monthly payment may fall dramatically, but you could still pay more over the life of the loan.

Plus, youll likely have to pay closing costs with each new loan unless you find a no-closing cost loan program.

Sometimes the lowest possible mortgage payment is priority one for a homeowner with limited cash flow. Perhaps a divorce, layoff, or illness reduced income. In these cases, extending the loan term could be a wise move, even if it does cost more in the long run.

But financially stable borrowers should focus on lifetime savings instead of lower monthly payments.

One strategy many homeowners employ is to refinance into a mortgage with a shorter term. Thats why 15-year term refinances are growing in popularity

Or, you could simply make additional principal payments to avoid extending your repayment time frame. With this strategy, you dont have to commit to the higher monthly payments a 15-year mortgage would require.

To Reduce Your Monthly Payments

In general, reducing your monthly payments by lowering your interest rate makes financial sense. But don’t ignore the costs associated with refinancing. In addition to the closing costs and fees, which can range from 2% to 3% of your home loan, you will be making more mortgage payments if you extend your loan terms.

If, for example, you have been making payments for seven years on a 30-year mortgage and refinance into a new 30-year loan, remember you will be making seven extra years of loan payments. The refinance may still be worthwhile, but you should roll those costs into your calculations before making a final decision.

Comparing the amortization schedule of your current mortgage to the amortization schedule of the new mortgage will reveal the effect a refinance will have on your net worth.

Read Also: Rocket Mortgage Payment Options

Refinancing To Get More Suitable Loan Terms And Features

You probably arent the same person you were when you initially settled your mortgage, so why should your mortgage stay the same? If your needs and financial circumstances have changed, you might want to update your loan to reflect this.

For example, if you have built up savings, opening an offset account can be a great way to reduce your home loan interest charges.

Or perhaps you plan on making some extra repayments that youd possibly like to tap into in the future. Consider opening a redraw facility.

The Pitfalls Of Refinancing Your Mortgage

While refinancing has many positive benefits, it could come with pitfalls if you’re not prepared.

To begin with, refinancing loans have closing costs just like a regular mortgage. The mortgage lender Freddie Mac suggests budgeting about $5,000 for closing costs, which include appraisal fees, credit report fees, title services, lender origination/administration fees, survey fees, underwriting fees and attorney costs. It all depends on where you live, the value of your house and the size of the loan you’re taking out.

Some lenders might offer a no-cost refinance, but that usually just means the closing fees are being wrapped up into the amount of your loan. If you refinance with your existing lender, you may get a break on mortgage taxes, depending on your state’s laws.

“That’s a carrot that they dangle,” says English. However, you should always compare rates, terms and programs.

Once you calculate your closing costs, do some quick math to make sure that you’ll make that money back by saving on your new monthly payment. If your closing costs are $5,000 and you save $500 per month on your new mortgage, it would take 10 months to break even. However, if you only saved $200 per month, your “break-even point” would be 25 months . Stay in the home for less time than that, and you won’t truly be saving money long-term.

You May Like: Does Rocket Mortgage Sell Their Loans

Refinancing A Mortgage In Canada: Your Step

Owning a home allows you to build credit, grow equity and invest in your future. Whether you are shopping for your very first home or youre a long-time homeowner, its important to understand how to navigate the mortgage process, especially when it comes to refinancing a mortgage.

When you first apply for your mortgage loan, especially if you have never applied for one before, you may get interest and finance terms that are less than ideal. The good news is that you dont have to endure the terms of your mortgage loan forever. Refinancing a mortgage may allow you to secure a much more favorable loan term and interest rate, which can make a significant difference when it comes to your long-term financial picture.

Are Mortgage Refinance Rates Still Low

When the COVID-19 pandemic first hit in March of 2020, the Federal Reserve devised a monetary policy to help stabilize financial markets and soften the economic impact of the virus. Part of that policy included reducing the federal funds rate the interest rate banks charge each other for short-term loans to near zero.

The Fed also pledged to purchase $40 billion worth of mortgage-backed securities, and $80 billion in Treasury notes and other financial instruments per month to inject money into the economy and encourage investing and lending.

However, with the economy continuing to show signs of improvement, the central bank announced at its November meeting that it would begin to taper its asset purchasing program. The Fed has begun reducing its purchases of Treasury notes by $10 billion each month and of MBS by $5 billion per month.

The net effect of these policies was to drive mortgage rates down, with the average rate for a 30-year dropping below 3% for the first time in history in July 2020. Rates reached a record low of 2.65% on January 7 of this year. Since then, rates have trended higher but hovered around 3%. After rising to a high of 3.14% on October 28, rates dropped again and are currently averaging 3.12%.

Still, if youre considering a refinance, it may be best to act sooner rather than later. Most economists agree that mortgage rates will increase in 2022, with rates ending the year between 3.5% and 4%.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

Lower Your Interest Rate

Known as a rate-and-term refinance, this is the most popular reason homeowners refinance a home loan. Homeowners with a higher interest rate on their current loan may benefit from a refinance if the math pans out especially if theyre shortening their loan term.

Right now, the economy is in a low-rate environment And, while the connection between the Federal Reserves target rate and mortgage rates is complicated, the fact that low rates make money less expensive to borrow could provide you with a way to come out ahead.

Shorter-term mortgages typically have lower interest rates than longer-term mortgages because youre paying back the loan in less time, but your monthly payment will likely go up. A rate-and-term refinance can result in big savings for a homeowner if theres room in their budget for it, says Kurt Johnson, senior vice president with Mr. Cooper, a Dallas-based mortgage lender.

If you can afford to shorten the term of the loan and you are substantially lowering your rate, it could be a win-win as youre paying off your mortgage faster and saving a ton of money on interest, Johnson says.

Where To Learn More About Mortgage Refinancing

To truly understand if itâs a good idea to refinance your mortgage, you should speak to a licensed Canadian mortgage broker. Theyâll be able to assess your personal situation at no cost to you, and help you understand what your options are. If youâre ready to refinance then they can also find you the best deals and guide you through the process.

Read Also: Bofa Home Loan Navigator

Refinancing To Switch Lenders

Perhaps a new lender offers lower interest rates or access to better features, but there are other reasons to consider switching lenders.

If youre unhappy with the customer service your current lender provides, dont be afraid to look elsewhere. A new lender might also offer an improved repayment system or more support.

Reason #: You Cant Afford The Closing Costs

Refinancing can save you money and even help you pay your loan off faster but it does you no good if you dont have enough money on hand to cover the closing costs. If you cant pony up the cash up front, you may be able to roll the closing costs over into your loan but there are some drawbacks.

Even if your closing costs are relatively low, adding them into the loan can tack on several thousand dollars to your mortgage. Not only are you taking a bite out of your equity, youre potentially making your monthly payments higher. Over the long term, adding the closing costs to your mortgage can eat away at any savings youd get from refinancing. If you cant afford to pay the closing costs before you sign on the dotted line, it might be better to put the refinance on the backburner until you can save up the cash.

You May Like: How Does 10 Year Treasury Affect Mortgage Rates

Find The Best Refinance Rates

To find the best refinance rates, youll have to do some work, but it wont take much time. Look at banks, credit unions and online comparison sites. You also can work with a mortgage broker if you want someone to do the legwork for you and potentially get you access to lenders you wouldnt find on your ownlenders that might offer you better terms.

Submit three to five applications to secure formal loan estimates. The government requires the loan estimate to show your estimated interest rate, monthly payment and closing costs on a standard form that makes it easy to compare information across lenders.

On page 3 of the loan estimate, youll see the annual percentage rate, and on page 1, youll see the interest rate. When youre buying a car, it usually makes sense to pick the loan with the lowest APR, because APR includes a loans fees.

With mortgages, its different. The APR assumes that you will keep the loan for its full term. As weve already seen, that doesnt usually happen with home loans. You might be better off with a loan that has a higher APR and a higher monthly payment but no fees.

Instead of putting cash toward closing costs, you could keep that money in your emergency fund or use it to pay down debt with a higher interest rate than your mortgage.

Another problem is that if youre comparing the APRs on a 30-year and a 15-year loan, the 15-year loan might have the higher APR despite being much less expensive in the long run.

Are Refinance Rates Going Down

While current mortgage rates remain low, most mortgage experts anticipate rates will drift higher over the coming months and years. The Federal Reserve is expected to begin raising short term interest rates in 2022. The Fed does not set mortgage rates, but lenders tend to increase the price to borrow money when the Fed acts.

Don’t Miss: What Does Gmfs Mortgage Stand For

Access Other Sources Of Cash

Find a guarantor, borrow from family, apply for zero-interest balance transfer credit cards there are many alternatives for financing. Many of these options can help you reduce your debt load with better terms than mortgage refinancing.

Our options that fit your mortgage needs and help you with financial planning.

Will The Savings Be Enough To Make Refinancing Worthwhile

Youll spend an average of 2% to 5% of the loan amount in closing costs, so you want to figure out how long it will take for monthly savings to recoup those costs. This is often called the break-even point of a mortgage refinance. For instance, it would take 30 months to break even on $3,000 in closing costs if your monthly payment drops by $100. If you move during those 30 months, youll lose money in a refinance.

» MORE:Calculate your refinance savings

Think about whether your current home will fit your lifestyle in the future. If youre close to starting a family or having an empty nest, and you refinance now, theres a chance you wont stay in your home long enough to break even on the costs.

Homeowners who have already paid off a significant amount of principal should also think carefully before jumping into a refinance.

You might reduce your mortgage rate, lower your payment and save a great deal of interest by not extending your loan term.

If youre already 10 or more years into your loan, refinancing to a new 30-year or even 20-year loan even if it lowers your rate considerably tacks on interest costs. Thats because interest payments are front-loaded the longer youve been paying your mortgage, the more of each payment goes toward the principal instead of interest.

» MORE:When to refinance into a shorter mortgage

Don’t Miss: Rocket Mortgage Loan Requirements

Refinancing Starts Your Loan Over

Since refinancing replaces your current mortgage with a new one, it starts the loan over. And in many cases, borrowers reset the clock with another 30year term.

Starting a fresh 30year loan term can offer the biggest monthly savings. Yet this isnt always the smartest move, depending on the number of years left on your existing mortgage.

If youve had the original loan for five, 10, or even 15 years, starting over with a new 30year mortgage means youll pay interest on the home for a total of 35 to 45 years. That could increase the total amount of interest you pay over the life of the loan even if your monthly payments go down.

Of course, this doesnt always happen.

Some people receive a payoff date thats similar to their original loan. For this to happen, you have to refinance into a shorter term.

Lets say youve already had the original mortgage for five years. Instead of another 30year mortgage, you can refinance into a 15 or 20year mortgage. Or, if youve had the original loan for 20 years, you could refinance into 10year mortgage.

Just note that shorterterm loans almost always have higher monthly payments. Thats because you have to repay the same loan amount in a shorter time frame.

But, as long as your new interest rate is low enough, you should see significant overall savings with a shorter loan term.