Minimum Credit Score By Mortgage Loan Type

The minimum credit score you need to qualify for a mortgage in 2021 depends on the type of mortgage youre trying to obtain. Scores differ whether youre applying for a loan insured by the Federal Housing Administration, better known as an FHA loan one insured by the U.S. Department of Veterans Affairs, known as a VA loan or a conventional mortgage loan from a private lender:

|

Type of loan |

|

|

FHA loan requiring 3.5% down payment |

|

|

FHA loan requiring 10% down payment |

500 – Quicken Loans® requires a minimum score of 580 for an FHA loan. |

|

VA loan |

Mortgage Basics And Why Income Matters

When buying a house, most people only pay a small portion of the total cost upfront. This is called the down payment and the minimum in Canada thats required is 5% for amounts under $500,000, 10% for those between $500,000 and $1 million, and 20% for those more than $1 million For the remainder, the homebuyer takes out a long-term loan called a mortgage. This means a lender covers the rest of the home cost. The borrower then repays the lender based on the loans term, with five-year terms being the most popular in Canada. Payments are based on loan amortization, with longer amortization periods having smaller payments. Twenty-five years is the most common amortization length in Canada.

The buyer also pays the lender interest on the loan, which is determined by the mortgage rate set during the term. Interest rates determine how much money youll spend over the life of the loan. A home mortgage with a slightly lower interest rate could save you tens or even hundreds of thousands of dollars over the time you spend paying off your mortgage.

Bad Credit Score Home Loans

A bad credit score is usually one thats lower than 640. While you might be able to get a home loan with bad credit, the potential drawbacks include:

- Needing a larger down payment

- Paying a higher interest rate

- Spending more money on mortgage insurance premiums

Why would you spend more money on mortgage insurance?

With bad credit, you might be able to secure an FHA loan, a VA loan, a higher down payment conventional loan, or a USDA Loan:

Find Out: Can You Buy a House with Bad Credit?

Recommended Reading: How Much Is Mortgage On 1 Million

Buying A Home The First Step Is To Check Your Credit

Buying a home is exciting. Its alsoone of the most important financial decisions youll make. Choosing a mortgageto pay for your new home is just as important as choosing the right home.

You have the right to control the process. Check outour other blogs on homebuying topics, andjoin the conversation on Facebook and Twitter using #ShopMortgage.

Research shows that people who plan carefully for big purchases, like owning a home, are less likely to run into financial trouble later. So if you are thinking about buying a home this year, lets make a plan. The first step: Check your credit.

Its always a good idea to review your credit reports and scores periodically, even if youre years away from shopping for a home and a mortgage. If youre planning to buy a home this year, we recommend checking your credit reports and scores as soon as possible.

The better your credit history, the more likely you are to receive a good interest rate on your mortgage loan. Lenders will use your credit reports and scores as important factors in determining whether you qualify for a loan, and what interest rate to offer you. If there are errors on your credit report, you may have trouble qualifying for a loan. So, dont delay in checking your credit. Review your credit reports and take steps to fix any errors.

Its the first step to building a strong financial foundation for your new home.

Keep reading to:

Va Refer/eligible Purchase Or Refinance

If for some reason the VAs algorithm doesnt approve you, you may still be able to get a loan under the refer/eligible route. These loans undergo the human scrutiny of manual underwriting. An underwriter will go through your documentation and see if you qualify.

Loans that dont qualify for automated approval are usually those with certain negative credit items in their past. This could include late mortgage payments, past bankruptcies or foreclosure.

To qualify based on manual underwriting at Rocket Mortgage, you need a minimum median FICO® Score of 640 or better. Your DTI can also be no higher than 45%. If you are refinancing, you have to leave at least 10% equity in the home.

Recommended Reading: 10 Year Treasury Vs 30 Year Mortgage

What Scores And Models Are Used When Applying For A Mortgage

FICO® created different scoring models for each credit bureauExperian, TransUnion and Equifax. The commonly used FICO® Scores for mortgage lending are:

- FICO® Score 2, or Experian/Fair Isaac Risk Model v2

- FICO® Score 5, or Equifax Beacon 5

- FICO® Score 4, or TransUnion FICO® Risk Score 04

Mortgage lenders will often get a single report that contains your credit reports from each of the three credit bureaus and the associated FICO® Scores. It may base the lending decision on your middle credit score or, if you’re applying jointly with a partner, the lower middle score.

Keep this in mind when you’re trying to figure out what . If you’re looking for a mortgage that requires a minimum credit score of 580, you may need your middle score to be at least 580 based one these specific FICO® Score models.

There are exceptions, though. Mortgage lenders could use different credit scoring models for loans that aren’t secured or bought by Fannie Mae or Freddie Mac. You might even be able to get a mortgage if you don’t have a credit history or score at all.

Additionally, there’s a review underway that could open up the use of different credit scoring models for mortgages, even if they’re secured or bought by Fannie Mae or Freddie Mac. However, until there’s a change, many mortgage lenders will continue to use these three classic FICO® Scores.

Checking Your Credit Score

You should check your credit score well before you begin the mortgage process so you will know where you stand and the mortgage rate you could qualify for. You can check your credit score for free through several online services. Many banks, credit unions, and credit card providers offer credit scores as a regular feature. Since most major mortgage lenders use your credit score in their decision, it’s worthwhile to obtain all three of your reports to make sure the information on your record is accurate.

It’s a good idea to research your credit score and your credit reports well in advance of making a major purchase so you have time to address any errors or other issues you might discover.

Also Check: Reverse Mortgage For Mobile Homes

Can I Get A Mortgage If My Credit Score Is Low

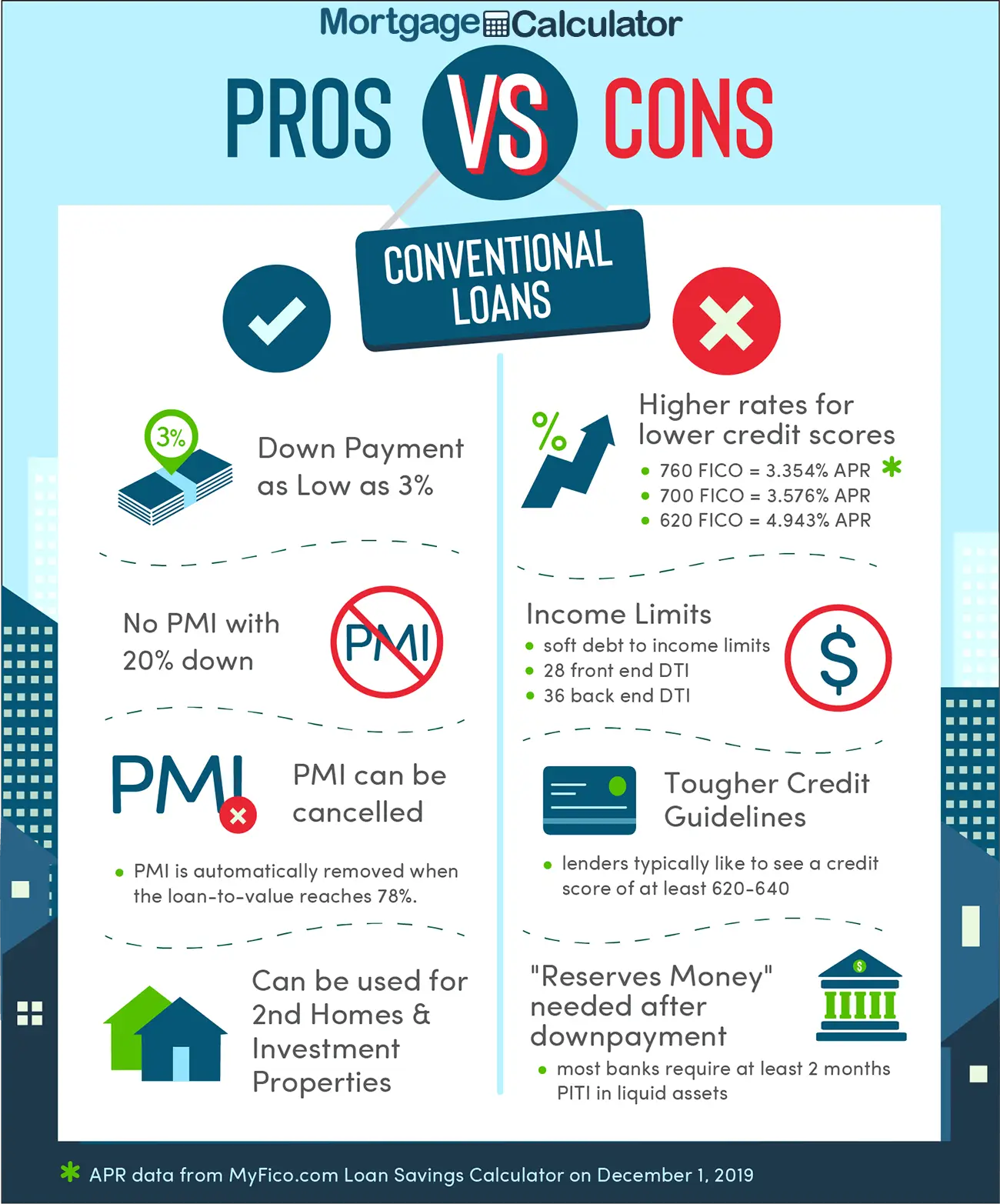

When we talk about minimum credit scores required to get approved for a mortgage, were talking about conventional lenders, such as big banks. These traditional lenders are usually quite stringent about their mortgage approval requirements, including the credit scores needed for mortgage approval.

There are options for bad credit borrowers who are looking for a mortgage to finance a home purchase. Credit unions, trust companies, and subprime lenders are potential sources for mortgages for borrowers who cant qualify with their banks because of their sub-par credit scores. These sources often deal with people who may be viewed as risky to conventional lenders.

Have you considered a bridge loan to help purchase the home of your dreams?

It should be noted that if you do plan to apply for a mortgage with one of these lenders with a bad credit score, you will likely pay a higher interest rate than you would if you had a higher credit score and applied with a conventional lender.

Thats why its best to consider taking the time to improve your credit score before applying for a mortgage. That way youll have an easier time getting approved for a home loan and clinch a lower rate, which will make your mortgage less expensive.

Loans Canada Lookout

Stated Income Mortgages: What Are They

A stated income mortgage is one in which the borrower simply states their income, providing little or no documentation as evidence. As long as the stated income is roughly aligned with industry standards , the lender takes them at their word. These mortgages typically carry a high interest rate i.e. 5.99 – 14.99% , with 2-3% in lender fees .

Today, major lenders are no longer willing to qualify you for a mortgage simply because you report a large income. Instead, youll need to work with a private lender.

Between the stated income mortgage and the traditional, fully qualified mortgage, theres a third option: the non-traditional income confirmation mortgage. In this scenario, the lender will still verify your income, but theyll do so using alternative documentation. Rather than strictly looking at your declared income, they might review your bank statements, transaction records, customer invoices, and so on. This option will give you lower interest rates than a stated income mortgage, though not as low as a conventional mortgage. The required down payment may also be higher than for a conventional mortgage.

Recommended Reading: Reverse Mortgage Manufactured Home

How Your Credit Score Affects Mortgage Rates

Your credit score plays a role in determining the interest rate and payment terms on a mortgage loan. That’s because lenders use what’s called a risk-based pricing model to determine loan terms.

The more likely you are to pay your bills on time, based on your credit history, the lower your interest rate may be. With a less-than-stellar credit score, however, you may end up paying more.

For example, let’s say you’re hoping to get a mortgage loan for $250,000 over 30 years. If you have great credit and qualify for a 4% interest rate, your monthly payment would be $1,371 , and you’d pay a total of $243,560 in interest over the life of the loan.

But if your credit needs some work and you qualify for a 5% interest rate instead, that increases your monthly payment to $1,446 and your total interest burden to $270,560a difference of $27,000.

Mortgage lenders don’t just look at your credit score when determining your rate, though. They’ll also consider your debt-to-income ratio how much of your gross monthly income goes toward debt paymentsas well as your down payment and available savings and investments.

So while it’s important to work on your credit score before you apply for a mortgage, avoid neglecting these other important areas of your financial situation.

Consider A Debt Consolidation Loan

A debt consolidation loan or balance transfer takes all of your outstanding debts on different accounts and combines them into a single monthly payment. They may help improve your credit utilization rates and can help you avoid missed payments. A debt consolidation loan or balance transfer can be a great option for you if you have multiple lines of credit that you have trouble keeping up with.

You make a hard inquiry on your credit report when you apply for a debt consolidation loan. This means that your credit score will usually drop by a few points immediately after your inquiry. Focus on making on-time payments above the minimum required amount after you get your debt consolidation loan.

You May Like: Rocket Mortgage Payment Options

Home Equity Lines Of Credit

A HELOC is a secured form of credit. The lender uses your home as a guarantee that youll pay back the money you borrow. Most major financial institutions offer a HELOC combined with a mortgage under their own brand name. Its also sometimes called a readvanceable mortgage.

HELOCs are revolving credit. You can borrow money, pay it back, and borrow it again, up to a maximum credit limit. It combines a HELOC and a fixed-term mortgage.

You usually have no fixed repayment amounts for a home equity line of credit. Your lender generally only requires you to pay interest on the money you use.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Read Also: Reverse Mortgage On Condo

How Credit Scores Affect Mortgage Interest Rates

Your credit score can have a major impact on the overall cost of your loan. Each day, FICO publishes data that shows how your credit score could affect your interest rate and payment. Below is a snapshot of the monthly cost of a $200,000, 30-year fixed-rate mortgage in December 2021:

| 4.424% | $1,004 |

That’s an interest variance of over 1% and a $178 difference in monthly payment from the 620 to 639 credit score range to the 760+ range.

Those differences can really add up over time. According to the Consumer Financial Protection Bureau , a $200,000 home with a 4.00% interest rate costs over $40,000 more overall over 30 years than a mortgage with a 2.75% interest rate.

If Youre In The Market For A Home But Dont Have A Lot Of Cash For A Down Payment A Conventional 97 Home Loan Is An Option Worth Considering

A Conventional 97 home loan lets you borrow 97% of the homes value, so youll only have to put 3% down. If your credit is pretty good and you want an affordable low down payment alternative to an FHA mortgage, a Conventional 97 home loan might be worth considering.

Heres a closer look at what a Conventional 97 home loan is, who qualifies and how it compares to other programs.

Read Also: Requirements For Mortgage Approval

The Bottom Line: Take Control Of Repairing Your Credit Score

The best route to a better credit score when looking into a home loan? First, know what makes a good credit score, which is a range between 670 739. Then, know what makes up your score, including payment history, current loan and credit card debt, length of credit history, credit account diversification and recent activity.

As we covered earlier, you can improve your credit score by taking the following actions or any combination of steps:

Theres no quick fix that will fix your credit to buy a house overnight. However, there are plenty of small steps you can take every day that will lead to a better score over time.

Ready to get started on your home search? Check out more premortgage tips recommended to ensure the process goes smoothly! If you have additional questions, its important to work with a financial advisor before making any big financial moves.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Mortgage Terms To Know

Before we get too deep into different types of mortgage loans, we need to understand the conventional mortgage and some of the lingo involved.

Typically, a mortgage is comprised of several different parts:

Are you a first-time homebuyer? Learn more about the first-time home buyer incentiveright here.

Recommended Reading: Who Is Rocket Mortgage Owned By

How A Mortgage Will Affect Your Credit

This is a double-edged sword. On one hand, a good mortgage payment history is generally the strongest credit component on your credit report. Thats because its a secured loan, and generally your largest debt.

But the other side of that sword is that your credit will affect both your ability to be approved for your mortgage, as well as the interest rate youll pay.

As you can see from the myFICO Loan Savings Calculator below, a credit score higher than 760 can get you an interest rate of 3.443%, while a score of 620 will result in a rate of 5.032%. The difference between the two payments on the same loan amount is almost $200 per month.

The moral of the story:It pays to do everything possible to improve your credit score before applying for a mortgage. Due to the high cost of low credit, it will be well worth it to you to take several months to work on repairing your credit before applying.

Can You Get A Home Loan With Bad Credit

Its possible to qualify for a mortgage even if your credit score is low. Its more difficult, though. A low credit score shows lenders that you may have a history of running up debt or missing your monthly payments. This makes you a riskier borrower.

To help offset this risk, lenders will typically charge borrowers with bad credit higher interest rates. They might also require that such borrowers come up with larger down payments.

If your credit is bad, be prepared for these financial hits. You can qualify for a mortgage, youll just have to pay more for it.

Recommended Reading: Chase Recast Calculator

How Lenders Verify Nontraditional Credit Histories

Even with documentation provided by the potential borrower, lenders will generally take additional steps to verify the payment history. Often, this comes in the form of an Anthem Report a type of nontraditional credit report that can be provided to independently verify all the information if you arent able to provide canceled checks or bank statements for alternative credit accounts. This will generally only work if the accounts that need to be verified are verifiable through a third party.

For example, the credit reporting company can contact a property manager if you rent an apartment in an apartment complex, or can get a payment history directly from an electric or cable company. Some lenders may require this in addition to the documents you provide, so that all of the information is verified.

Your lender will indicate if an Anthem Report is necessary, and they will order the report. You will need to provide them with the name, contact number and account information for each item for the report to be completed, and may need to provide some of the proof of payment documentation needed to produce the report.