Two Smart Homebuying Moves: Mortgage Prequalification And Preapproval

Find out how much house you can borrow before you start looking and how you can make the strongest offer possible on the property you choose.

If youre ready to make your dream of owning a home a reality, youve probably already heard that you should consider getting prequalified or preapproved for a mortgage. Its time to understand exactly what each of those terms means and how they might help you. And when youre working toward a goal this big, you want every advantage.

Ready to prequalify or apply? Get started

How The Mortgage Preapproval Process Works

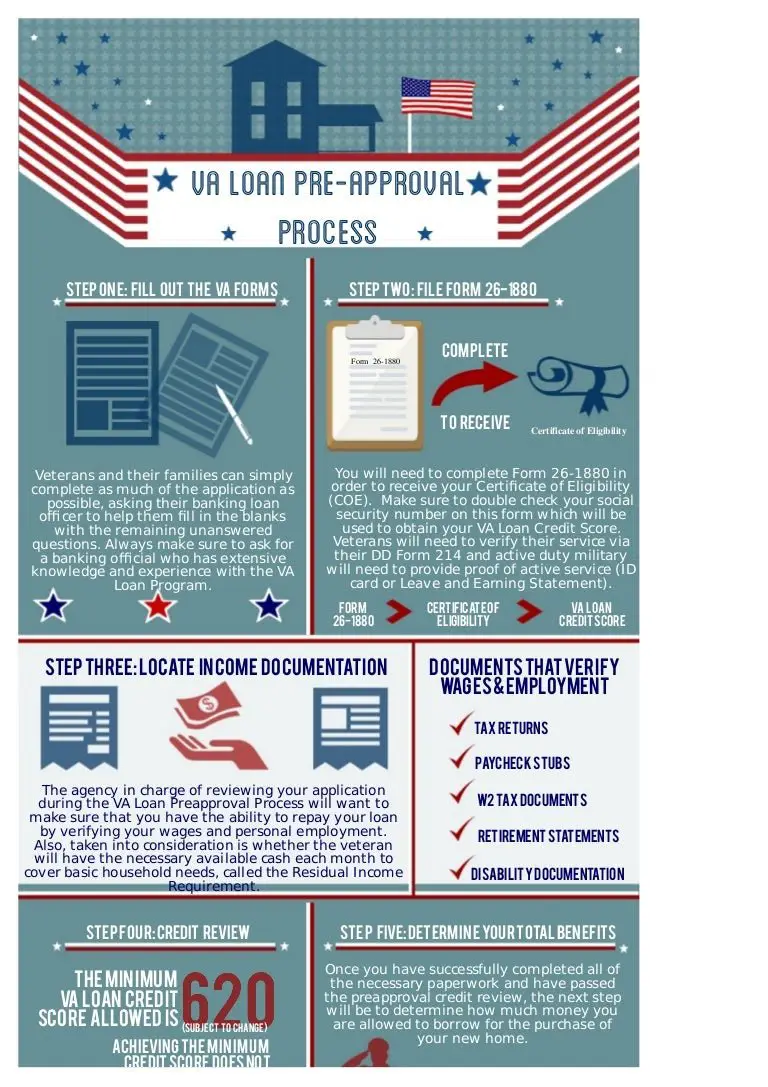

There are five basic steps in the mortgage preapproval process.

What Is The First Step In Handling The Mortgage Pre

Before trying to get pre-approval for the process of a home loan, check your credit reports and credit score. Youll have a better idea of the kind of loan and interest rates you are looking at to qualify according to the current rules and regulations. If your credit rating isnt sufficient, take the time to clean up and improve your credit report before you start shopping for a new home.

Don’t Miss: Chase Recast Calculator

Get Preapproved For A Loan

Once youve estimated your own budget, you might start looking at homes within your price range. This is also when you take the first step toward getting a mortgage.

That first step is to get a preapproval letter from a mortgage lender. This letter shows how much money a mortgage lender has approved you to borrow, based on your savings, credit, and income.

Youll want to do this before you make an offer on a house.

Having a preapproval letter gives your offer a lot more clout, because the seller has solid evidence youre qualified for a loan to purchase the home.

Realtors generally prefer a preapproval letter over a prequalification letter, because a preapproval has been vetted to prove your eligibility.

Note: getting prequalified is different from getting a preapproval.

Both terms mean a lender is likely willing to loan you a certain amount of money. But Realtors generally prefer a preapproval letter over a prequalification letter.

Thats because prequalification letters are not verified. Theyre just an estimate of your budget based on a few questions.

A preapproval letter, on the other hand, has been vetted against your credit report, bank statements, W2s, and so on. Its an actual offer from a mortgage company to lend to you not just an estimate.

You are NOT required to stick with the lender you use for preapproval when you get your final mortgage. You can always choose a different lender if you find a better deal.

Why Is It Important To Secure Pre

When youre ready to make an offer on a house, your lender and broker might want confirmation of the approval letter. This document proves youll likely be able to make the purchase, so always take it seriously. In a competitive housing market, brokers prefer a pre-approved buyer to buy a new home and close the deal accordingly.

In such cases, mortgage pre-approval is a plus point. It can help you understand what level of loan you can get and whether you can make the decision of mortgage proposals accordingly. It can also give you a resolution of what price range you are actually looking for your new home.

You May Like: How Does Rocket Mortgage Work

Youre The Only One Who Can Decide How Much You Can Afford To Spend On A Home

Lenders preapprove you by looking at your income, assets, debts, and credit record. But your financial life is much more complicated than that. Only you can decide how much youre comfortable paying upfront and each month which means only you can decide how much to spend on a home.

- If you were preapproved for more than the home price budget you set for yourself, you can use the preapproval letter to shop for homes without changing your target home price. If youre happy with the amount you planned to spend, stick with your original budget.

- If you were preapproved for less than you were planning to spend on a home, talk with the lender. Ask if there was a particular factor that limited the preapproval amount. You may need to adjust your home price expectations.

- Be upfront with your real estate agent. If you dont want to see homes above a certain price, say so. Limiting your search is a good way to avoid falling in love with a home that costs more than you want to spend.

When Should You Get Pre

Pre-approvals do expire, which is why you want to talk to a lender to determine the best next steps for your process. Getting pre-approved can help you identify problems in your finances that may make it difficult to get a mortgage and allow you to fix any issues before you make an offer on a home.

Many experts recommend that you go through the pre-approval process up to a year before looking for a home. You will be able to make any improvements before the next pre-approval process, and you can save money for a down payment or closing costs.

Most mortgage pre-approval letters will expire within 30 to 90 days because your financial picture can change rapidly. Once that happens, youll need to go through the process again.

Read Also: Chase Mortgage Recast Fee

What Is The Difference Between Pre

Both pre-qualification and pre-approval involve a review of an applicant’s credit report. The difference is the degree of credit review. Pre-qualification involves a quick review of one’s credit and only provides a potential borrower with a general idea of how much mortgage they could qualify for and under what terms. Pre-approval involves a full credit review, while only offered for a limited time window, provides the potential borrower with a solid offer of credit from a lender with which they can use to make good faith offers on homes for sale.

What Happens If Your Mortgage Pre

Rejection hurts. But if you arent pre-approved, or you arent approved for a large enough mortgage to buy the house you want, you also arent powerless. You can ask the lender why it said no. This will give you an idea about what you might need to work on in order to secure the mortgage you want.

Then you may want to work on the factors that your lender saw as a sticking point to pre-approval. You can continue to work to boost your credit score, lower your DTI ratio or save for a higher down payment.

If youre able to pay more upfront, you will typically lower your monthly mortgage payments. Once youve worked to make yourself a better candidate for a mortgage, you can apply for pre-approval again.

Recommended: Guide to Buying, Selling and Updating Your Home

Read Also: Mortgage Rates Based On 10 Year Treasury

Which Is Right For Me

First-time homebuyers are more likely to find that getting prequalified is helpful, especially when they are establishing their homebuying budget and want an idea of how much they might be able to borrow.

Preapproval can be extremely valuable when it comes time to make an offer on a house, especially in a competitive market where you might want to stand out among other potential buyers. Again, a seller will be more likely to consider you a serious buyer because you have had your finances and creditworthiness verified.

Ready to prequalify, get preapproved or apply? Get started with the Digital Mortgage Experience.

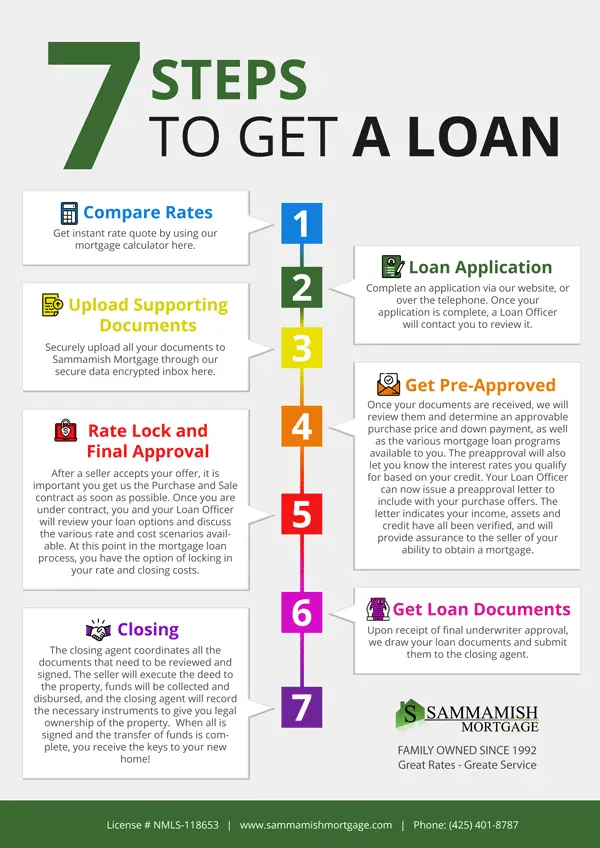

Go Rate Shopping And Choose A Lender

You may have already decided on a mortgage company when you got preapproved.

But if youre still shopping, now that youve found a home and your offer has been accepted, its time to make a final decision about your lender.

When shopping for a mortgage, remember your rate doesnt depend on your application alone. It also depends on the type of loan you get.

Look at a few different lenders rates and fees, but also ask what types of loans you qualify for. This will affect your rates and eligibility.

Of the four major loan programs, VA mortgage rates are often the cheapest, beating conventional mortgage rates by as much as 0.40% on average. Next are USDA mortgage rates. Third come FHA mortgage rates, followed by conventional rates.

So look at a few different lenders rates and fees, but also ask what types of loans you qualify for.

There may be much better deals available than what you see advertised online.

For a detailed explanation of how to compare offers and choose a mortgage lender, see: How to shop for a mortgage and compare rates

Read Also: Does Prequalifying For A Mortgage Affect Your Credit

Go Through Underwriting Process

The next stage is for your application to be assessed by underwriters.

Though you are unlikely to deal with them directly, mortgage underwriters are actually the key decision-makers in the mortgage approval process and are the people who will give final approval for your mortgage.

Underwriters will check every aspect of your mortgage application and carry out a number of other steps. For instance, borrowers are required to have an appraisal conducted on any property they take out a mortgage against. The underwriter orders this appraisal and uses it to determine if the funds from the sale of the property are enough to cover the amount you will be lent in your mortgage.

Once underwriters have assessed your application, they will give you their decision. This will either be to accept the loan as it is proposed, reject it, or approve it with conditions. Your mortgage might be approved, for instance, on the condition that you supply more information about your credit history.

If your application is approved, you will then lock in your interest rate with your lender. This is the final interest rate you will pay for the remainder of your mortgage term.

Reasons To Switch Lenders

Karl Yeh: What are some reasons you would actually do that?

Mujtaba Syed:

It could be the fact that you were uncomfortable with their rate, right? The lender is not looking at budgeting at the rate.

You find that the other lender is wanting to be more flexible with their rate, and you feel like they’re going to give you a better rate, better terms and conditions on your mortgage.

It fits in your budgeting guidelines a lot better than, let’s say, lender A, or you can just find it more comfortable dealing with the bank.

You could switch for all those multitude of reasons.

Karl Yeh: Just in terms of a credit question,

Recommended Reading: Rocket Mortgage Qualifications

How A Mortgage Preapproval Affects Your Credit

The credit check required for a mortgage preapproval is identical to the one performed when you apply for a mortgage. This check is considered a hard inquiry on your credit report, which can temporarily lower your credit score a few points.

If you fill out several applications in the process of shopping for a new loan, credit scoring systems treat the credit checks related to those applications as a single event, as long as you make them within a few weeks of each other. Note that the various FICO® Score models will combine inquiries made within the same 45-day period and treat them as one event the VantageScore® system uses a rolling two-week window that resets each time you make a similar loan application within two weeks of the one that preceded it.

This allows you to shop around for the best possible terms without worrying that each credit inquiry will harm your ability to qualify for a new loan.

What Factors Are Considered For Preapproval

In addition to considering your credit score, lenders will want to verify your employment and income. Theyll also be considering your debt-to-income ratio , which is a calculation of your total monthly debts, divided by your monthly income. This ratio, expressed as a percentage, helps lenders make sure you have enough income to reasonably cover your debts.

The exact DTI needed for mortgage approval varies by loan type. But generally speaking, youll want your debt-to-income ratio to be 50% or lower.

Recommended Reading: Can I Get A Reverse Mortgage On A Condo

What Types Of Mortgages Can You Apply For Online

You can apply for many mortgages with the online mortgage pre-approval process. Mortgages come in a lot of varieties. There are 10, 15, and 30-year fixed-rate mortgages. There are also variable-rate mortgages. These mortgages change based on the current interest rates. They can increase when rates are rising and drop when rates decline. Often you can lock in variable-rate mortgages after five or seven years. These are good mortgages to use when interest rates are falling. Your Capital Bank mortgage originator will help you understand your options before going through the online mortgage pre-approval application.

Mortgage Loan Process Faq

Whats the best loan term for a mortgage?

The loan term or repayment period on your mortgage determines how large your mortgage payments will be. It also determines how much interest youll pay in total. Therefore, the best loan term balances your loan costs with your monthly budget. Shorter loan terms cost less over time but have higher monthly payments. Most mortgages have 15 or 30year loan terms. You can also find 10 or 12year loan terms. You could even find an 8year term through Rocket Mortgages Yourgage loan.

Is a fixed-rate mortgage better than an adjustable-rate mortgage?

A fixedrate mortgage locks in an interest rate and payment for the life of the loan. With todays fixed rates hovering around historic lows, a fixedrate loan makes a lot of sense. An adjustablerate loan features a fixed rate for a while, but then the interest rate fluctuates with the market each year. Some borrowers choose an adjustablerate mortgage if they plan to sell or refinance the home within the first few years. Otherwise, ARMs can be quite risky.

How much down payment is required?How long does the loan process take for a mortgage?

For most lenders, the mortgage loan process takes approximately 30 days. But it can vary quite a bit from one lender to the next. Banks and credit unions tend to take a bit longer than mortgage companies. Also, high volume can alter turn times. It may take 45 to 60 days to close a mortgage during busy months.

How long does underwriting take?

Read Also: Who Is Rocket Mortgage Owned By

What Else Do You Need For The Mortgage Pre

- Income Information. Be prepared to supply all the information relating to T4 on taxes and rates, with a calibration of your last two years records on property and any amount relating to it. Examples of making more money for needful things include a second job, overtime, commissions and bonuses, interest and dividend income, other payments, VA and retirement benefits, too.

- Asset Information. This documentation can include bank account statements with recordings. If a family member is giving you money, youll also want to bring a report for them.

- Personal Information. Youll need to submit a valid form of identification which carries a trust factor. Youll also need to provide your social security number.

Make Your Bid More Competitive

In Toronto, Hamilton and Ottawa, we see one of the most competitive real estate markets in decades. Homes are on the market for mere days and are getting hundreds of offers from would-be home buyers. This ultra-competitive market means making your bid as attractive as possible is the name of the game. One of the ways to do that is to remove the financing condition on your offer. You can feel a little better about doing this as you have already spoken to a lender for those with pre-approved mortgages. Removing this condition is a risk and should be done only after talking to a mortgage broker and your realtor. However, it can be a difference-maker between winning and losing a bid.

Don’t Miss: Chase Recast Mortgage

What Is The Mortgage Pre

To get pre-approved for a home loan, submitting a loan application and going through the mortgage pre-approval process can be challenging. It takes time and effort to assemble and submit all of the necessary paperwork to your lender. And, it takes time for the lender to conduct their evaluation. However, the steps of the process are pretty straightforward:

- Submit mortgage application to your lender

- Submit all required documentation to your lender

- Lender conducts thorough evaluation of submitted documents

- Lender will provide you with a loan estimate

- Lender will provide you with a pre-approval letter