What Are Your Plans

First, you should consider your future plans. While you might not have a crystal ball telling you what you will do in the next five to ten years, a basic idea will help. For example, if you know you need to move in the next two to three years, refinancing might not be the right option. You have to consider the costs involved with refinancing. Dont overlook the fact that you start over on the principal and interest you pay each month as well. If you are already 7 years into a 30-year mortgage, you likely pay a significant amount of principal every month. If you start over on a new 30-year mortgage, you start right back at square one. A majority of your payment pays for interest. If you move in a few years, you still have to pay off the large principal balance. On the other hand, if you didnt refinance, your principal balance might be lower, giving you more money in your pocket when you sell the home.

Benefits Of An Early Mortgage Payoff

There are two main benefits of paying a mortgage early less interest paid and more home equity faster.

But paying off the mortgage is not necessarily always the best choice if you have more expensive debt, like outstanding credit card balances. Or if you havent yet saved for retirement. You may also want that money to purchase additional real estate, as opposed to it being locked up in your home.

This calculator can at least do the math portion to illustrate the power of paying extra and paying off your mortgage ahead of schedule. Youll then need to weigh those savings against other options like paying your credit cards or ensuring youve saved for retirement.

In other words, make sure youre actually saving money by allocating a larger amount of money toward paying off the mortgage as opposed to putting it elsewhere.

If you want to see the payment schedule, which details every monthly payment based on your inputs, simply tick the box. This will also show you your loan balance each month along with the home equity you are accruing at an ideally faster rate thanks to those additional payments.

To determine your home equity, simply take your current property value and subtract the outstanding loan balance. For example, if your home is worth $500,000 and your loan balance is $300,000, youve got a rather attractive $200,000 in home equity!

And thats all it takes to use this mortgage calculator with extra payments. Happy mortgage saving!

Making Extra Payments On Mortgage: Is It The Right Move

The short answer is, it depends. Some homeowners will want to explore the possibility of a future lower mortgage payment by paying down principal now. You may feel strongly that shortening the length of your loan is ideal. Or you may want to build wealth separately and save the difference. Essentially it comes down to a few financial and homeownership goals that help you either save time, money, or a little of both.

Not every homeowner will benefit from making an additional mortgage principal payment here and there. Before doing anything else, use the above extra mortgage payment calculator and see how much you may save in the long run.

Don’t Miss: Chase Recast Mortgage

Pretend You Refinanced Without Actually Refinancing

You may decide that doing a formal refinance is not appropriate for you. However, that doesnt mean that you cant ACT like you refinanced. Simply pretend that your monthly mortgage bill has increased and pay more toward the loans principal.

For example, suppose your monthly payment is $1000. Pretend that you refinanced and your payment is now $1400. Applying that extra $400 each month to principal reduction is equivalent to making several more mortgage payments each year.

Because this cash is applied directly to the principal, you are taking big chunks out of the amount that interest is based on.

Pro tip: Make sure that extra $400 goes towards principal and is not counted as an additional payment towards interest and principal.

Understanding Principal Balance

Before you start making extra principal payments, contact your lender and identify the terms of your loan. There are a few mortgage companies that will not allow you to pay extra towards the principal whenever you want.

Avoid Prepayment Penalties

Some contracts only allow you to make extra payments at a specific interval. If you make the extra payment outside of the allowed times, you may be charged a prepayment penalty. Be sure your lender will accept extra payments before you write that check.

When Paying Off Your Mortgage Early Works

You might assume that you need to shell out hundreds of extra dollars each month to pay off your mortgage early. The truth is, even a very small monthly or one annual payment can make a major difference over the course of your loan.

Contributing just $50 extra a month can help you pay off your mortgage years ahead of schedule. You dont need to find a way to earn an extra $10,000 a year to pay off your mortgage.

Play around with our Rocket Mortgage® mortgage amortization calculator to see for yourself how a small amount of money can impact your loan. It might surprise you. Most people can manage to save at least a few thousand dollars in interest with a small monthly extra payment. This is especially true if you start paying more on your loan in the early years of your mortgage.

The best candidates for early mortgage payoffs are those who already have enough money to cover an emergency. Youll want at least 3 6 months worth of household expenses in liquid cash before you focus on paying off your mortgage. This is because its much more difficult to take money out of your home than it is to withdraw money from a savings account.

Also Check: How To Get Preapproved For A Mortgage With Bad Credit

Downsides To Paying Off Your Mortgage Early

Most financial experts encourage homeowners to put their extra money into retirement accounts instead of paying off mortgages early.

The reason? For almost a century, the stock market has earned a 10% average annual rate of return. That means homeowners could potentially earn more by investing in the stock market than theyd save by paying down their mortgage balance.

Plus, some homeowners write off their mortgage interest payments as a tax deduction which means they could get some of that money back at tax time.

There are other potential drawbacks to consider before paying off your mortgage early:

Finally, before paying extra on the mortgage, many personal finance experts recommend building an emergency fund in case you lose a job, get injured, or face other financial troubles. Without emergency funds in a savings account, you may have to use higherinterest credit cards to pay unexpected expenses.

Questions to ask before paying off your mortgage early

Is paying off your mortgage early the best financial decision for you and your family? It depends on your unique situation and financial goals.

Here are a few questions to help guide your decision:

If your main objective is to be debtfree as soon as possible, then look into one of the five strategies above to pay off your mortgage faster. You may have already paid off other personal debt like student loans or credit cards it could make sense to target your mortgage, too.

Put Your Tax Refund Towards Your Principal

While many people face tax season with dread, some people anticipate it excitedly, as they are expecting a tax refund. That refund feels like found money, doesnt it? Many people either use it as fun money or to fund a vacation or to go on a shopping spree.

However, applying your tax refund towards the principal of your mortgage loan would be one way to make a long-term and significant difference in paying down your mortgage faster.

Don’t Miss: Reverse Mortgage For Condominiums

Consider A Larger Down Payment

Your down payment plays a big role in your mortgage payment calculations. The more you put down, the less you need to borrow. But your down payment affects more than that. Most conventional loans require one of two things 20% down or private mortgage insurance . If you put less than 20% down, your lender requires PMI as a form of insurance in case you default on your loan.

If you increase the size of your down payment, you could avoid the extra cost of PMI and reduce your loan amount or term. The money you would be spending on PMI could be used to make extra payments on your loan, helping pay your mortgage off sooner.

Should You Make An Extra Mortgage Payment

Even if youre excited to get a mortgage, you might also like the idea of owning a home free and clear. Hey, youre not alone. A 30-year mortgage can feel like foreverbut it doesnt have to.

What if you could pay off your mortgage early and keep your monthly payment roughly the same?

This might seem impossible, but the truth is, paying off your mortgage early is easier than many people think, thanks to the power of making an extra principal payment .

Now, an extra mortgage payment isnt going to lower your scheduled monthly payment. This will remain the same until you pay off the loan. It does, however, reduce the amount of interest you pay over the life of the loan.

Basically, your remaining loan balance determines the amount of interest owed. Since extra principal payments reduce your principal balance little-by-little, you end up owing less interest on the loan. And when you owe less interest, youre able to shave years off your mortgage term.

Lets say you have a $200,000 mortgage with a 30-year fixed rate of 3.9%. In this scenario, an extra principal payment of $100 per month can shorten your mortgage term by nearly 5 years, saving over $25,000 in interest payments.

If youre able to make $200 in extra principal payments each month, you could shorten your mortgage term by eight years and save over $43,000 in interest.

You May Like: Does Rocket Mortgage Sell Their Loans

Make Extra Or Higher Principal Payments

Additional small principal payments add up over time! On a $150,000 loan for 30 years at 3.75%, with no additional payments, more than $100,000 will be paid in interest over the course of the loan. By adding just $100 per month in principal payments, the total interest paid is reduced by nearly $25,000 and the loan will be paid off more than six years sooner!

Another way to do this is by making biweekly mortgage payments. Instead of making 12 monthly payments, this equals out to 26 half-payments or 13 full payments per year. But beware, explains Harper, not all loan servicers make it easy to apply these extra payments to the principal. Make sure to speak to yours and ensure they arent simply holding on to the extra money and applying it toward the interest.

Recap Of Ways To Pay Off Your Mortgage Faster

If you decide you want to pay off your mortgage early, ask your mortgage lender about:

Whatever you choose, make sure youve weighed all your options to find the best use for your hardearned cash.

You May Like: How Does The 10 Year Treasury Affect Mortgage Rates

What The Mortgage Payoff Calculator Tells You

The Summary Results section has two subheadings:

How to reach your goal describes how much you would have to pay in principal and interest every month to meet the payoff goal. It lists the original principal-and-interest payment, and how much you would have to add to the minimum monthly payment to meet your goal.

Loan comparison summary describes the total cost of the mortgage in principal and interest payments, the original monthly principal-and-interest payment, the total cost in principal and interest if you pay it off early, and the new monthly principal-and-interest payment to reach your payoff goal.

“New monthly P& I” and “Original monthly P& I” comprise only the principal and interest portions of your monthly payments. Your full monthly payment will include principal and interest, plus the other monthly costs, such as taxes, homeowners insurance and mortgage insurance .

The early mortgage payoff calculator also lets you enter different numbers into the “In how many years from now do you want to payoff your mortgage?” box to see how those changes affect your total savings.

For more information about how the process of gradually paying off a mortgage works, see this explanation of mortgage amortization.

Overview: Paying Off Your Mortgage Early

Every time you make a mortgage payment, its split between your principal and your interest. Most of your payment goes toward interest during the first few years of your loan. You owe less in interest as you pay down your principal, which is the amount of money you originally borrowed. Most of your payment goes toward interest during the first few years of your loan. You owe less in interest as you pay down your principal. At the end of your loan, a much larger percentage of your payment goes toward principal.

You can apply extra payments directly to the principal balance of your mortgage. Making additional principal paymentsreduces the amount of money youll pay interest on before it can accrue. This can knock years off your mortgage term and save you thousands of dollars.

Lets say you borrow $150,000 to buy a home at 4% interest with a 30-year term. By the time you pay off your loan, you will have paid a whopping $107,804.26 in interest. This is in addition to the $150,000 you initially borrowed.

Now, lets say that you pay an extra $100 every month toward a loan with the exact same term, principal and interest rate. At the end of the term, you will have paid $82,598.49 total in interest. Thats $25,205.77 less than you would have paid if you didnt make any extra payments. Youll also pay your loan off 74 months earlier than you would if you only paid your premium each month.

You May Like: Mortgage Recast Calculator Chase

Ready To Refinance Your Mortgage

If you want to refinance to a mortgage you can pay off fast, talk to our friends at Churchill Mortgage. The home loan specialists at Churchill Mortgage show you the true costand savingsof each loan option. They coach you to make the best decision based on your budget and goals.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

This Is The Key To Paying Off Your Mortgage Early

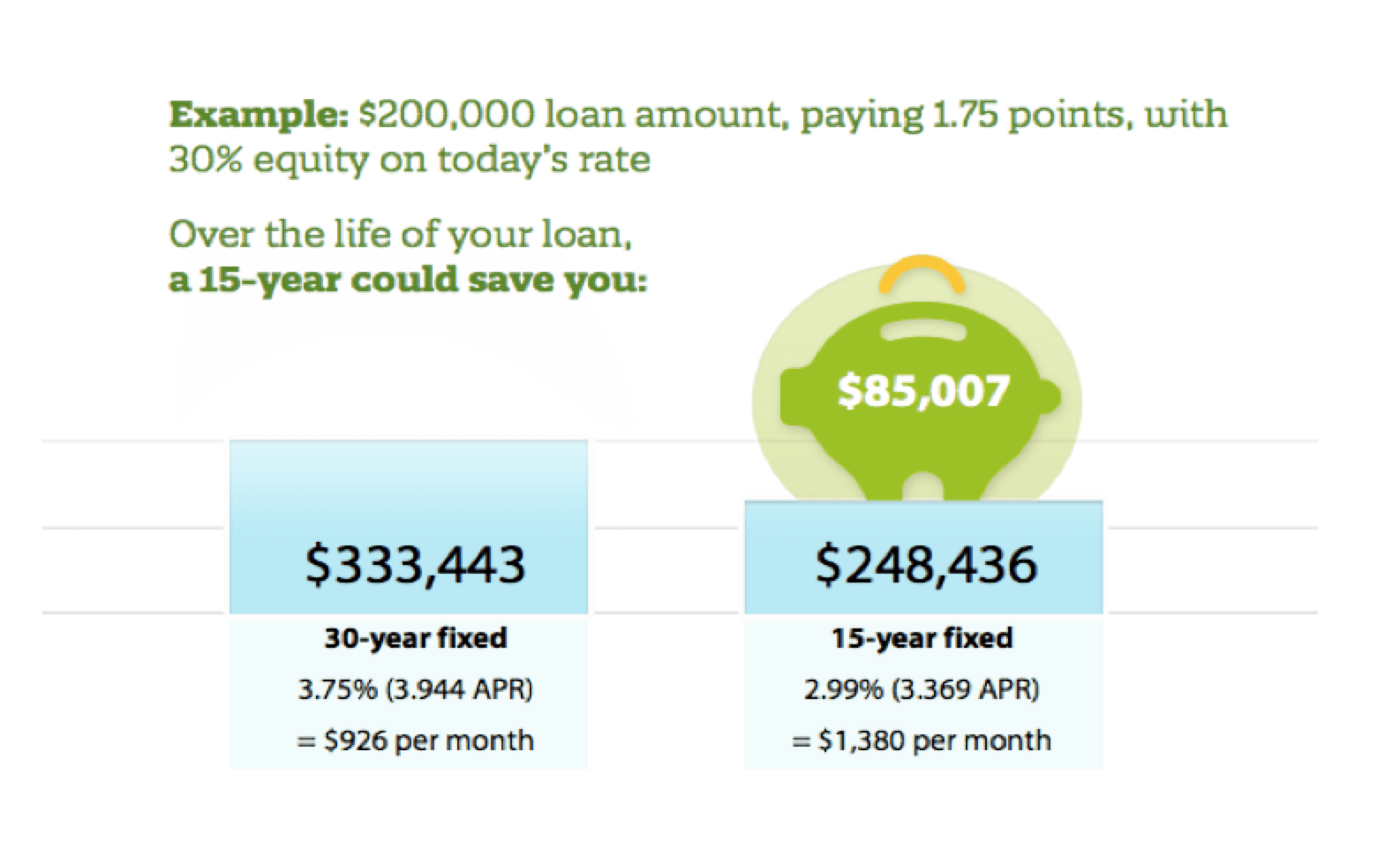

If you are a first time home buyer and wondering what type of mortgage you should choose, ideally, you want a 15 year fixed rate mortgage over a 30 year one. The payments are higher, so you need to make sure you can handle the monthly costs. Your target should be about 25% of your monthly earnings. You can offset the monthly mortgage payment by putting more money down, but that all depends on what you have saved. The reason for applying for a 15-year mortgage rather than a 30-year mortgage is that you are out of debt in half the time and you pay less money in interest.

A 15-year mortgage is not always the best idea because you have to be practical in assessing what you can afford. If you bite off more than you can chew, you will wind up suffering from repercussions that far outway the money saved on interest payments. However, be cautious about choosing a 30-year mortgage too hastily. Lots of people opt for the 30-year plan with the idea that they will pay it off in 15. However, its very uncommon that they actually accomplish this. With that said, If you find yourself in a 30-year mortgage and you want to pay it down in half the time, there are some measures you can take to reach that end goal of paying off your mortgage and lowering the amount of interest you pay. Heres a quick guide on how to pay off a 30-year mortgage in 15 years.

Don’t Miss: Can You Refinance A Mortgage Without A Job

In Fact Put All Your Extra Money Toward Your Mortgage

The same principle holds true for any extra money you have while youre still paying off your mortgage. Whether youve got extra money from a raise, bonus, gift, tax return, inheritance, or even a lucrative night at bingo, put it toward the mortgage and get it paid off faster.

Michael Saves is a finance blogger who started writing about savings after paying off his $86,000 mortgage in just two years. A big part of his strategy was working more so hed have more money to put toward the mortgage.

First, I made a commitment to work 10 extra hours per week, so 50 hours total. In addition to volunteering for overtime at my full-time job, I waited tables on the weekends and took care of pets around the holidays, he says.

He also used apps like Mint to track his spending and make sure that he wasnt wasting too much money in other areas.

On top of scrimping and saving as much as he could, another big part of his approach was making sure every penny went to the mortgage: Any extra money that came my way went to the mortgage, including work bonuses, birthday cash and credit card rewards, he says.

Understand Your Mortgage Payment

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator. When you pay extra on your principal balance, you reduce the amount of your loan and save money on interest.

Keep in mind that you may pay for other costs in your monthly payment, such as homeowners insurance, property taxes, and private mortgage insurance . For a breakdown of your mortgage payment costs, try our free mortgage calculator.

You May Like: Can You Do A Reverse Mortgage On A Condo