Other Requirements For Obtaining A Mortgage

Applicants must apply for a mortgage loan in order to be considered for one. Most lenders want government-issued identification, proof of residency, proof of job and employment history, a credit history report, a credit score, and a Canadian bank account. Using the Gross Debt Service and Total Debt Service Ratios, a broker or lender will be able to assess what your budget is and how much you can pay.

Can You Get A Mortgage In The Usa As A Uk Resident

The answer is yes, it is possible to get a US home mortgage as an international resident.

Getting a mortgage in the USA can be surprisingly quick, with some buyers completing in as little as four weeks. If youre a British ex-pat, the process tends to be far simpler because the chances are youll have a Green Card or work visa.

Whatever your situation, there are a few things to be aware of when buying property in this country. For example, if youre a first-time foreign buyer in the USA you may be required to pay your first years home insurance in advance, as well as some local taxes.

How Does A Mortgage Work In Usa

Repayment mortgages – with a repayment mortgage you pay back both interest and the capital amount borrowed over the term. … Fixed rate mortgages – the interest rate is fixed for a set period of time, up to 30 years. Adjustable or Variable rate mortgages – the amount you pay in interest can be changed by the bank.

Also Check: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Putting Money Aside For A Down Payment

Despite the fact that the down payment is merely a part of the total purchase price, it shows lenders that the buyers are financially stable and capable of making regular mortgage payments.

Start saving for a down payment for your new Canadian house before looking for a mortgage broker and a mortgage rate. It may be tough to obtain a home loan unless you have a substantial amount of money set up.

Taking Advantage Of A Competitive Marketplace

If you’re interested in buying real estate in the US, the most important point to remember is that the mortgage lending market is extremely competitive. The overall interest rates are similar to those found in many European countries, but there is a lot of competition between different banks and brokers. That’s why it’s vital to shop around before you settle on a lender.

One of the easiest ways to obtain a mortgage loan is to work with your existing bank. If you already have a relationship with a bank in the US, the process of applying for a mortgage is relatively painless. However, you may find that your bank can’t provide you with the best possible deal. It can pay off to speak with underwriters at different financial institutions. In addition to mortgage rates, you should also ask them about their origination fees and various closing costs and fees.

Mortgage brokers deal with many different lenders, so they can often find the best deals. However, it’s sometimes less expensive to deal directly with a bank. When dealing with an underwriter at a mortgage brokerage, it’s especially important to ask about the additional fees they charge.

Also Check: Does Chase Allow Mortgage Recast

Applying For A Mortgage Loan In The Us

When you apply for a mortgage loan in the US, you will typically deal with an underwriter. Most underwriters work for banks, but you can also choose to work with a brokerage. Mortgage brokers don’t provide loans directly, but have relationships with a number of lenders. Regardless of the type of underwriter you work with, you will typically be required to:

- submit to a credit check.

- verify your employment and income.

- list your places of residence over the past two years.

- document your savings, checking, and other financial account information.

- provide a copy of your purchase and sale agreement.

In some cases, you may not be required to provide all of that information. Some loans are referred to as low doc or no doc because they don’t require you to prove any of the statements that you make to your underwriter. These loans are normally more expensive, but can be easier to obtain. Additionally, you can obtain a preauthorization before you submit an offer on a home you would like to buy. That can speed up the process, and also shows the seller that you are serious about the purchase.

Most mortgage loans in the US require a significant down payment. Traditional mortgages often call for down payments of 20 percent, but larger amounts are usually required for low doc and no doc loans. It’s also possible to obtain 100 percent financing if you qualify for it.

Can You Get A Mortgage In Canada For Us Real Estate

If you are considering financing the purchase of your U.S. vacation home with a mortgage against the U.S. property, its important to understand that Canadian lenders dont offer mortgages against U.S. real estate, as they dont have legal jurisdiction in the U.S.

Accordingly, youll need to get a mortgage from a lender in the U.S. Your best bet will almost always be to get a mortgage from a Canadian lender with operations in the U.S. – more on this later.

Recommended Reading: Reverse Mortgage Manufactured Home

Complete These Five Simple Steps To Get To The Closing

Okay. Youve found your dream home and the seller has accepted your offer. Heres what you can expect during the mortgage process, from application to closing.

Dream About Owning A Home In The Us

We’re with you. RBC U.S. HomePlusTM Advantage is built exclusively for Canadians. You’ll get access to cross-border real estate, tax, legal and financing experts.

U.S. Mortgage & Refinancing

Whether youâre buying your first U.S. home8, upgrading, investing or renewing your mortgage, we can walk you through your options and help you find the solution that best fits your needs.

Shop with Confidence. Get Pre-Approved.

Get pre-approved for a mortgage to know how big you can dream – and show sellers youâre a serious buyer.

- Your pre-approval is good for 120 days

Don’t Miss: Does Prequalification For Mortgage Affect Credit Score

Sheriffs Deputy Ryan Proxmire Kalamazoo Sheriffs Office Mi

Sheriffs Deputy Ryan Proxmire of the Kalamazoo Sheriffs Office died in the line of duty on August 15, 2021 from injuries he sustained from gunshot wounds he received during a high-speed chase.

Deputy Proxmire was taken to the hospital where he died the next day. He was posthumously promoted to the rank of Sergeant. Deputy Proxmire was a nine year veteran with the Kalamazoo Sheriffs Department. He is survived by his wife Roanna and their four children.

Develop Your Work And Job

- Get in-person counseling, training, support, and services to help you find and keep a job. Contact:

Don’t Miss: Are Discount Points Worth It

Florida Mortgages For Uk Residents

If youre a foreigner seeking a mortgage in Florida, youre in luck a number of new mortgage products have recently been introduced in the Sunshine State with overseas nationals in mind, and there are plenty of willing lenders available.

So if youre looking to add a new investment to your property portfolio, there are some very attractive mortgage loan interest rates available in Florida, for a number of different property types even for non-residents.

To get the most bang for your buck, make sure to contact a specialist Florida mortgage broker who is in contact with both high-street and private lenders, and will calculate the most competitive rates based on your specific circumstances.

For a mortgage in Florida, you will generally need a deposit of around 20-30%, which will be secured on the property youre buying. Most Florida mortgages are issued on a repayment basis, with terms ranging from 10 to 30 years.

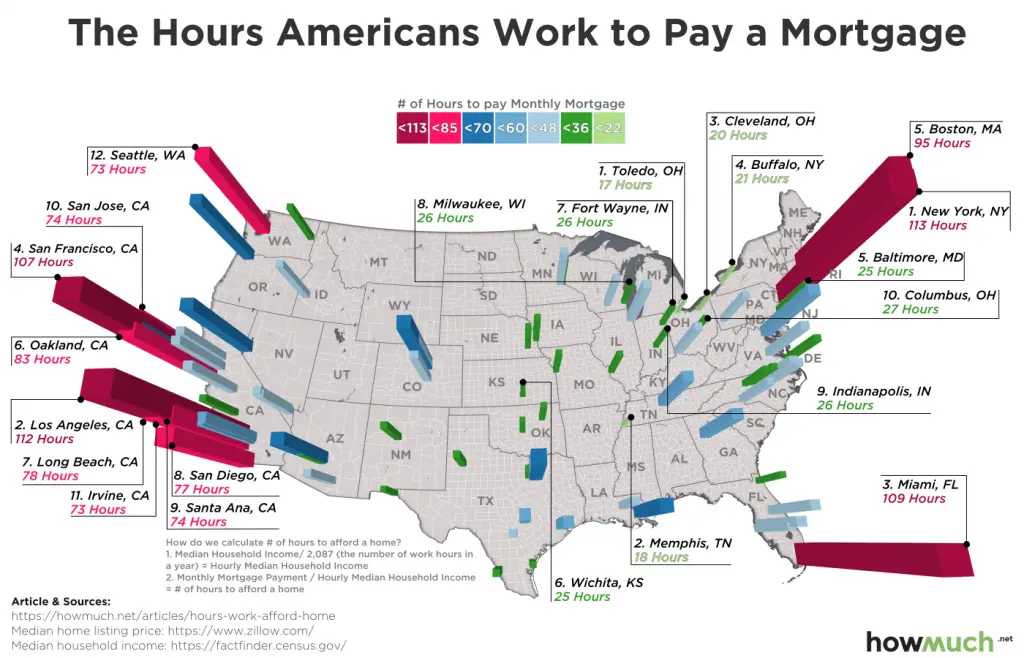

Mortgages in Miami

This sunny Florida city is full of culture and diversity, and home to plenty of popular holiday destinations. Its easy to see why many overseas citizen are seeking a mortgage for a Miami home.

As with the rest of the state, there are a number of different mortgage providers offering competitive rates who are happy to consider lending to non-citizens or expats for a property in Miami.

How Does A Mortgage Loan Work

When you get a mortgage, your lender gives you a set amount of money to buy the home. You agree to pay back your loan with interest over a period of several years. You dont fully own the home until the mortgage is paid off.

The interest rate is determined by two things: current market rates and the level of risk the lender takes to lend you money. You cant control current market rates, but you can have some control over how the lender views you as a borrower. The higher your credit score and the fewer red flags you have on your credit report, the more youll look like a responsible lender. In the same sense, the lower your DTI, the more money youll have available to make your mortgage payment. These all show the lender you are less of a risk, which will benefit you by lowering your interest rate.

The amount of money you can borrow will depend on what you can reasonably afford and, most importantly, the fair market value of the home, determined through an appraisal. This is important because the lender cannot lend an amount higher than the appraised value of the home.

You May Like: Reverse Mortgage For Condominiums

Getting A Job In The Us As A Foreign Worker

Based on your skills, circumstances, and the job that you plan to do, you may be able to come to the U.S. as either a:

-

Temporary or permanent foreign worker, or a

-

Temporary visitor for business

Under certain circumstances, you may also be able to work in the U.S. if youre a foreign student or an exchange visitor.

What Exactly Is A Mortgage

Its a loan with your house and land used as collateral. If you dont pay back the loan, the lender will foreclose. That doesnt mean the bank owns the house until you pay it off. It means theyve got a lien against the property. A lien is the right to take possession of someone elses property, in this case your home, until a debt is paid off. So you really are a homeowner even if you have a mortgage. You just own a home with a lien. Zillows Mortgage Learning Center offers extensive information about mortgages and is a great resource for anyone in the market for a home loan.

Don’t Miss: What Does Gmfs Mortgage Stand For

Whats A Good Interest Rate

Oftentimes, rates you see in advertisements online arent necessarily for the loans you qualify for. So youll need to investigate. Interest rates vary by location and can change daily. And they vary depending on your specific financial picture, such as income, credit score, and debts. A good place to get an idea of what rates are available to you right now is to search for interest rates on Zillow. You can get free quotes anonymously, based on your specific financial picture, so you dont have to worry about being hassled. Youll also be able to see mortgage rates from multiple lenders so you can easily compare rates.

How Can I Get A Mortgage In The Usa As A Foreigner

The options open to you for getting a mortgage in the USA vary somewhat from state to state as different lenders operate in different areas. Anywhere you go though, your application will be subject to a number of checks to ensure that you can afford the loan, and youll usually be asked to pay a fairly high deposit. Offers vary, so its worth talking to a few brokers or banks to see what deals they can offer you.

Recommended Reading: Does Chase Allow Mortgage Recast

When Is The Right Time To Apply For A Mortgage Loan

When applying for a mortgage loan, timing is everything and plays a critical role in your mortgage experience.

If you are not a United States citizen, the best time to apply for a mortgage loan is after 2 years. Most financial institutions require a minimum work and credit history of 2 years in the United States.

However, you must consider your employment and your financial situation as well before you apply for a mortgage loan as a non-citizen.

All financial institutions that give out mortgage loans have a regular monthly business cycle, making the best time to get a mortgage loan at the beginning of the month. Generally, the beginning of the month is devoted to acquiring and setting up new loans.

If you have decided to get a loan, contact your financial institution during the first business days of the month. Furthermore, dont be late with your paperwork and have all documents prepared on time!

In the middle of the month, financial institutions gather documents and get loans ready for the end of the month, so they want to get as many loans set up as possible.

What Happens If Your Loan Is Sold

Because mortgage investors buy your loan from originators, its likely youll receive a notification that your loan has been sold to an investor within a month or two after your closing. However, that doesnt necessarily mean your relationship with your lender is ending.

Closing will typically take 30 50 days. After closing, you enter the servicing phase of your loan transaction until the house is sold, refinanced or otherwise paid off. In addition to collecting your monthly principal and interest payments, the servicer will collect monthly for your property taxes and homeowners insurance, if you have an escrow account, as well as for your mortgage insurance, if applicable. You should also contact your servicer if you were to run into financial trouble and need payment assistance.

While lenders do sell the servicing rights to their loans, Rocket Mortgage is proud to service most loans we originate. Were your lender for life and will stay with you from application until you make your last payment.

Read Also: Rocket Mortgage Launchpad

Proof Of Assets/balance Sheet

To prove you have enough funds for the downpayment , you need to present various bank statements and investment account statements.

For example, an FHA loan requires that you make a downpayment of at least 3.5% of the cost of the home, whereas for a traditional loan you need to make a downpayment of 10% to 20%.

And, in case you receive help or assistance in the form of cash from a relative or friend, you will need a letter that declares it as a gift to prove that it is not a loan.

Before You Go Shopping Get Prequalified

Before you start looking for your winter dream home, it is best to go through the pre-qualification process first. This pre-qualification process can be done over the phone or online within a few days and helps you establish your purchase budget, as the bank can provide you with an amount they are willing to lend based on the financial information you provide and your credit history/score.

Although it is not a firm commitment letter, it represents a good financial planning start before looking for a new property. Also, in some very competitive U.S. real estate markets, many realtors wont start working with a potential buyer if you dont have a pre-qualification letter.

It can also give you an edge in a situation where there are multiple offers on the same property – while a pre-qualification letter may not be as good as a cash buyer, youll be in a better position than a buyer who does not have a pre-qualification letter and needs to apply for a mortgage.

Recommended Reading: Rocket Mortgage Vs Bank

How Does A Mortgage Work In Simple Terms

A mortgage loan is typically a long-term debt taken out for 30, 20 or 15 years. Over this time , youll repay both the amount you borrowed as well as the interest charged for the loan. Youll pay the mortgage back at regular intervals, usually in the form of a monthly payment, which typically consists of both principal and interest charges.

Each month, part of your monthly mortgage payment will go toward paying off that principal, or mortgage balance, and part will go toward interest on the loan, explains Robert Kirkland, vice president, Divisional Community and affordable lending manager with JPMorgan Chase. Over time, more of your payment will go toward the principal.

If you default on your mortgage loan, the lender can reclaim your property through the process of foreclosure.

You dont technically own the property until your mortgage loan is fully paid, says Bill Packer, executive vice president and COO of American Financial Resources in Parsippany, New Jersey. Typically, you will also sign a promissory note at closing, which is your personal pledge to repay the loan.