Calculate The Number Of Payments

The most common term for a fixed-rate mortgage is 30 years or 15 years. To get the number of monthly payments you’re expected to make, multiply the number of years by 12 .

A 30-year mortgage would require 360 monthly payments, while a 15-year mortgage would require exactly half that number of monthly payments, or 180. Again, you only need these more specific figures if you’re plugging the numbers into the formula an online calculator will do the math itself once you select your loan type from the list of options.

Find The Best Mortgage Rates

We just looked at the mortgage rates generally offered in the UAE and also the range in which they all fall. But for those looking to buy a property in a DAMACâs project, you can get much better rates than all of these. There is no need for you to look at other options when you can easily get the best mortgage rates with DAMAC Mortgage Assist.

You can get an interest rate of 1.99% for seven years, which is significantly less than all other mortgage options available in the country. So donât miss out on this amazing opportunity of buying some of the most astonishing properties of the country with the most beneficial financing options. Contact the representatives of DAMACâs Mortgage Assist today and start preparing to move from your existing home to a dream residence.

Calculate The Principle Of Your Mortgage

The mortgage principal refers to the initial loan amount. For example, someone with AED 100,000 in cash can put down 20% on an AED 500,000 home, but will need to borrow $400,000 from a bank to finish the transaction. The loan amount is AED 400,000 in total.

You’ll pay the same amount each month if you have a fixed-rate mortgage. More money will go toward your principal and less toward your interest with each monthly mortgage payment.

Don’t Miss: Reverse Mortgage On Mobile Home

What These Mortgage Rate Forecast Mean For Homebuyers

Even with a steady increase in mortgage interest rates, homebuyers will still have access to historically low rates for the foreseeable future. Most homebuyers may only see a marginal uptick in their home loans interest rate. Given how much goes into the decision to buy a home, the current mortgage rate trends shouldnt have a large impact for most homebuyers.

The good news for homebuyers, is that the housing market is expected to moderate slightly in 2022. Even with a slight cold down in the housing market, it will still heavily favor sellers. Home prices are expected to rise in 2022, but much more slowly than their rates of appreciation in 2022. And overall rates should still remain historically favorable.

Calculate Your Mortgage Payment

Mortgages and mortgage lenders are often a necessary part of purchasing a home, but it can be difficult to understand what youre paying forand what you can actually afford.

Using a mortgage calculator can help you estimate your monthly mortgage payment based on your interest rate, purchase price, down payment and other expenses.

To calculate your monthly mortgage payment, heres what youll need:

- Home price

Also Check: Recast Mortgage Chase

How To Use The Mortgage Loan Calculator

DAMAC takes good care of its customers and goes out of the way to enhance their convenience and ease. Along with offering the most luxurious real estate solutions and most beneficial mortgage rates, it also helps you calculate your mortgage with immense ease.

Here is how you can use the mortgage calculator:

Step 1

Enter the price of the property you are looking to buy to the loan calculator.

Step 2

Enter % or amount of the down payment.

Step 3

Enter your preferred loan term

Step 5

Hit the âCalculateâ button to get the results. You will get the following details.

Your down payment in AED

Your monthly EMI

Interest On Debt Vs Savings

Of course earning 1% per day is exceptionally hard to achieve, but many people who take out short term unsecured loans may be charged similar rates of interest without being aware of the true cost. A person who gets a payday loan and rolls it over a few times can pay usurious interest rates quickly running into the hundreds or thousands of percent after accounting for various fees and penalties.

These exploitative rates have led to the number of payday loan operations in the United States exploding more than 100-fold over the past 20 years. What’s more, many of the payday lenders are financed by some of the big banks.

What’s more, outside of mortgages most personal debt interest typically can’t be wrote off against income taxes, which means people carrying personal debt need an exceptionally high rate of return to beat the returns offered by extinguishing their debts.

Also Check: Does Getting Pre Approved Hurt Your Credit

Calculate The Interest Rate On A Monthly Basis

The interest rate is essentially the percentage cost that a bank charges you to borrow money. A buyer with a good credit score, a large down payment, and a low debt-to-income ratio would typically get a cheaper interest rate because the risk of lending money to them is lower than it would be for someone in a less stable financial condition.

For mortgages, lenders issue an annual interest rate. If you wish to calculate your monthly mortgage payment by hand, you’ll need the monthly interest rate, which you can get by dividing the annual interest rate by 12 months . The monthly interest rate, for example, would be 0.33 percent if the yearly interest rate is 4%.

How We Calculate Our Mortgage Rates

To get an idea of the current mortgage rate trends, we rely on information collected by Bankrate, which is owned by the same parent company as NextAdvisor. The daily rates survey focuses on home loans where the borrower has a FICO score of 740 or more, a loan-to-value ratio of 80% or better, and the home is a primary residence.

This table has current average rates based on information provided to Bankrate by lenders nationwide:

Todays mortgage interest rates| Loan term |

|---|

You May Like: Chase Recast Mortgage

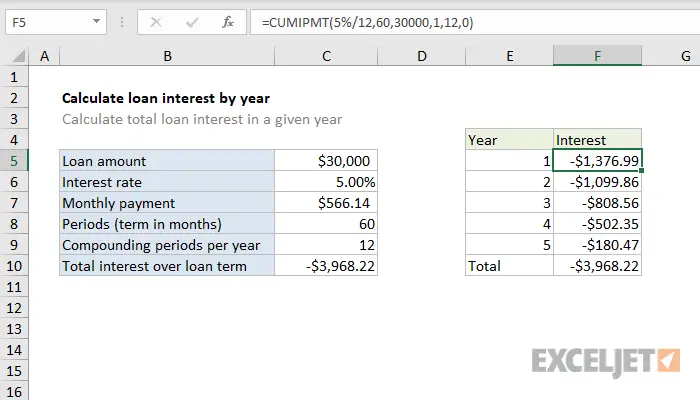

What Is Amortization

Amortizing a mortgage allows borrowers to make fixed payments on their loan, even though their outstanding balance keeps getting lower. Early on, most of your monthly payment goes toward interest, with only a small percentage reducing your principal. At the tail end of repayment, that switchesmore of your payment reduces your outstanding balance and only a small percentage of it covers interest.

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

Don’t Miss: Reverse Mortgage For Condominiums

Calculating A Mortgage Payment

A loan taken out with monthly payments at an annual rate of interest of 6% would be calculated as 6%/12, for a monthly rate of 0.5%. Calculating a mortgage rate is relatively straightforward and easily understood by most people.

For standard loans, this formula works fine, but mortgages are another story entirely. The main reason for the complexity is that mortgages have compound interest Compound interest is, essentially, interest paid on interest.

Consider that when you take out a mortgage, the repayment follows an amortization schedule. Interest begins accruing immediately. To calculate your monthly payment, the lender multiplies the monthly interest rate by the outstanding balance. The lender will calculate and deduct the interest from the payment first, and then apply the remainder to the principal. This means that more of your initial payments go to interest than the principal, so even though you are making monthly payments, interest is still increasing.

It is only after many years that the pendulum swings and you begin to make a dent in the actual principal.

To add another wrinkle into the formula, by law, all fixed-rate mortgages in Canada are compounded semi-annually. According to Alan Marshall at Torontos York University:

Is it any wonder Canadians find mortgage rates confusing?

What Is An Interest

An interest-only mortgage is a home loan that allows you to only pay the interest for the first several years you have the mortgage. After that period, you’ll need to pay principal and interest, which means your payments will be significantly higher. You can make principal payments during the interest-only period, but you’re not required to.

Recommended Reading: Can I Get A Reverse Mortgage On A Condo

How To Figure Mortgage Interest On Your Home Loan

Elizabeth Weintraub is a nationally recognized expert in real estate, titles, and escrow. She is a licensed Realtor and broker with more than 40 years of experience in titles and escrow. Her expertise has appeared in the New York Times, Washington Post, CBS Evening News, and HGTV’s House Hunters.

All homeowners should know how to figure mortgage interest. Whether you are financing the purchase of a home or refinancing your existing mortgage loan with a new loan, you will prepay interest.

How much interest is prepaid will determine when you want your first regular payment to begin. Many borrowers prefer to make a mortgage payment on the first of every month. Some prefer the 15th. Sometimes, lenders will choose that payment date for you, so if you have a preference, ask.

Interest Rate And The Apr

Whenever you see a mortgage interest rate, you are likely also to see an APR, which is almost always a little higher than the rate. The APR is the mortgage interest rate adjusted to include all the other loan charges cited in the paragraph above. The calculation assumes that the other charges are spread evenly over the life of the mortgage, which imparts a downward bias to the APR on any loan that will be fully repaid before term which is most of them.

Don’t Miss: Rocket Mortgage Loan Requirements

What Is A Mortgage Loan

Mortgage loans are the best financial tools to buy properties conveniently. The mechanism involves a bank, financial institution or service provider bearing a large chunk of the price of any property on behalf of the buyer, and receiving it back over a long period.

The buyer has to pay interest or cost of financing along with the principal amount. Mortgage financing is a popular model for buying properties all over the world, with banks offering very lucrative options and services. Top real estate developers, like DAMAC, have also introduced mortgage service of their own to facilitate their customers.

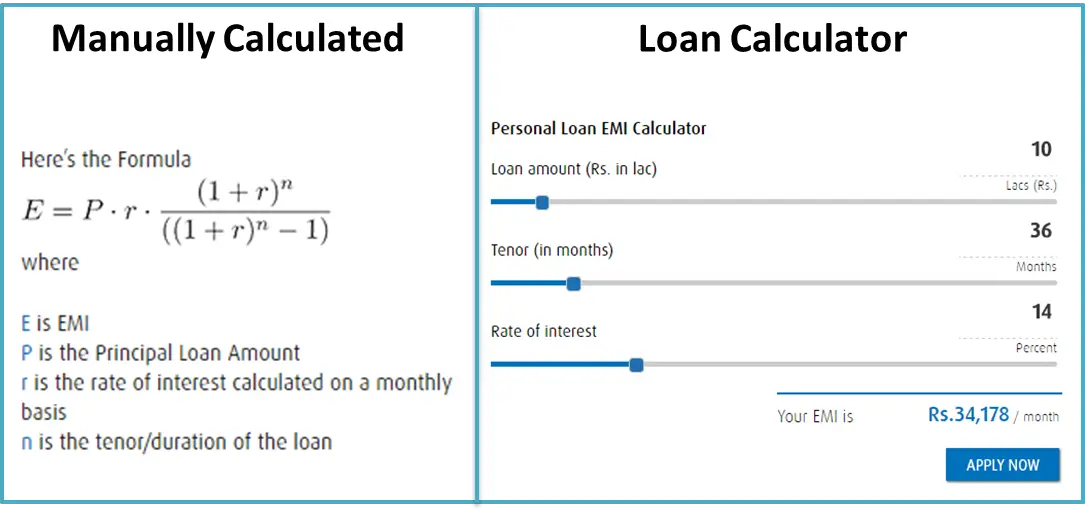

What Is Mortgage Formula

The formula for mortgage basically revolves around the fixed monthly payment and the amount of outstanding loan.

Fixed Monthly Mortgage Repayment Calculation = P * r * n /

where P = Outstanding loan amount, r = Effective monthly interest rate, n = Total number of periods / months

On the other hand, the outstanding loan balance after payment m months is derived by using the below formula,

Outstanding Loan Balance=P * /

You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Mortgage Formula

You May Like: Will Mortgage Pre Approval Hurt Credit Score

Fixed Rate Vs Adjustable Rate

A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment.

Principal And Interest Vs Interest

Another factor that impacts your mortgage payment is whether youre making principal and interest payments or interest only payments.

- Principal and interest payments: These are the most common way to pay off a mortgage. In this case, a portion of your monthly payment goes towards the principal and the other portion goes towards the interest you owe.

- Interest only payments: These loans are designed to make interest only payments for a certain period of time. Property investors with an investment mortgage or those building a new property often use interest only mortgage structures. The reason is that the monthly payment is typically reduced.

Mortgage payments

Susie is borrowing $700,000 to buy a house and she wants to save as much money on interest as possible. She decides to calculate the impact on the total cost of the mortgage using two APRs with a 0.25% difference.

If she can find a loan with an interest rate of 4% APR on a 30-year loan term, her monthly principal and interest payments will be $3,328.63. The total interest she will end up paying over the life of the loan is $498,307.00.

If Susie finds a loan with a marginally lower interest rate of 3.75% APR, her monthly payments will be $3,230.31 and the total interest over the life of the loan will be $462,915.00. With the lower rate, Susie will save $35,392.00 in interest costs.

Don’t Miss: Rocket Mortgage Vs Bank

Interest And Mortgage Formula Calculation

If you loaned a bank $100,000 at a 5% interest rate, compounded annually, the bank would pay you $5,000 per year. So why can’t you get a $100,000 mortgage and pay the bank $5,500 a year, let them earn a 10% profit? The reason is that traditional mortgages are designed so you end up owning the house when the mortgage is paid off. Our simple example above would apply to an “interest only” mortgage, where you are really just renting the house from the bank. After 30 years, zero equity. It’s the reverse of your loaning $100,000 to the bank and earning $5,000 per year in interest. The bank doesn’t get to keep your $100,000, they’re just paying for the use of it. In essence, the bank is renting the principal from you, the same way you rent a house from the bank with an interest only mortgage.

The next complication in mortgage interest rate calculations is that interest is compounded. Going back to our loaning the bank money example, lets say you agreed to loan the bank $100,000 for 10 years, with the interest being compounded onto the principal annually. Using simple interest compounded annually, the situation would look like this.

Year 155132.84 7756.64

| Year |

| 1,140.7 | 12,000 |

So, after ten years you’ve paid the bank $120,000 on your $100,000 mortgage, and you still owe them another $22,814.05, but at least the end is in near, and in another two years the loan will be paid off.

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

You May Like: What Information Do You Need To Prequalify For A Mortgage

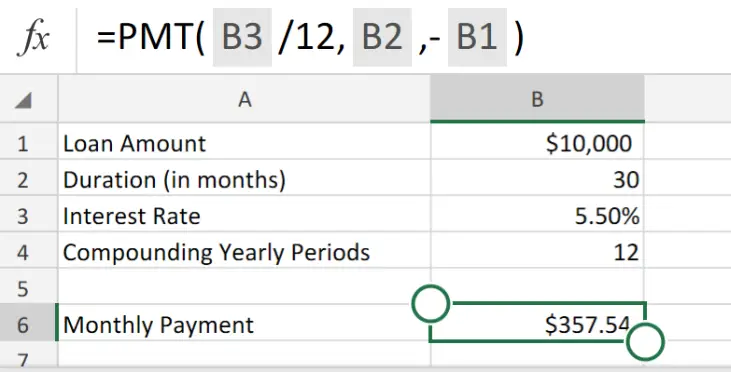

How Do I Calculate Mortgage Interest

It is important to calculate mortgage interest when deciding the length of your mortgage term. The percentage of interest paid is almost 95% for the first five years of a 30-year mortgage. Over time, the rate decreases, so that more of the payment is applied to the principle.

The formula used to calculate mortgage interest is a standard formula used by all financial institutions and the income tax department. Mortgage interest is also known as monthly compounding interest. There is a two-part method to identify how much you have paid in mortgage interest.

The first step is to determine the monthly payment required to pay off the amount owed in a specific number of payments. The formula is M = P / divided by 12. M is the monthly payment, P is the amount of principle or the amount borrowed and i is the interest rate divided by 12 and n is the total number of payments.

To demonstrate how this formula works, use the following values. The purchase price of the home is $200,000 US Dollars , with a seven percent interest rate on a 30-year term.

i = 0.07 / 12 = 0.00583 and n = 12 x 30 = 360

Calculate n by substituting 0.00583 for i and 360 for n. The answer is 8.10.

M = P / then divide by 12

M = $1,330 USD monthly payment.