Whether You Buy Points

Lenders sometimes offer borrowers a lower interest rate if they buy “points” or “mortgage discount points.” Points are prepaid interest. A point usually costs you 1% of your mortgage amount and lowers your rate by one-eighth to one-quarter percent . Whether points are worth buying depends on how long you intend to live in the house — for them to be cost-effective, you need to own the home long enough to save more in interest than you pay up front. The longer you keep the house, the more likely you are to save money by purchasing points.

Mortgage Critical Illness Insurance

Mortgage critical illness insurance provides a benefit if you suffer a life-threatening issue, such as cancer, heart attack, or stroke. Critical illness insurance usually has a smaller coverage benefit, and it has slightly higher premiums. Some policies might not cover pre-existing conditions up to 24 months before the start of your coverage. You might also need to complete a health interview.

Should I Use A Mortgage Broker In Nova Scotia

The job of a mortgage broker is to compare the products and rates of multiple mortgage providers on behalf of their clients. This means that by using a mortgage broker, you’ll have access to multiple mortgage products without having to do the hard work yourself. Brokers are mortgage experts, and can quickly identify the products that are available on the market that will suit your needs.

Mortgage brokers also have access to a range of mortgage rates that are not accessible to the retail market. This is because they are often given volume discounts from lenders, along with unique, broker-exclusive products.

It may be convenient to apply for a mortgage directly with your current bank, but it will only be able to offer you its own products. This means you could be missing out on a mortgage with lower rates, or that better suits your needs.

So should you use a broker when you compare mortgage rates in Nova Scotia? Consultations with mortgage brokers are free, so you have nothing to lose by speaking with one.

Let us help you determine which rate best suits your individual needs by answering a few short questions about your home and financial history.

Getting a mortgage is a big financial commitment, and finding a great mortgage rate is one of the best things you can do to make your mortgage more manageable. Luckily, how to get a lower mortgage rate isnât a secret – all you need to do is plan ahead.

You May Like: Who Is Rocket Mortgage Owned By

/1 Arm Flat For The Week

The average rate on a 5/1 ARM is 2.93 percent, unchanged from a week ago.

Adjustable-rate mortgages, or ARMs, are mortgage loans that come with a floating interest rate. To put it another way, the interest rate can change from time to time throughout the life of the loan, unlike fixed-rate loans. These types of loans are best for those who expect to refinance or sell before the first or second adjustment. Rates could be materially higher when the loan first adjusts, and thereafter.

Monthly payments on a 5/1 ARM at 2.93 percent would cost about $415 for each $100,000 borrowed over the initial five years, but could ratchet higher by hundreds of dollars afterward, depending on the loans terms.

How To Compare Mortgage Rates

While online tools, , allow you to compare current average mortgage rates by answering a few questions, you’ll still want to compare official Loan Estimates from at least three different lenders to ensure you are getting the best mortgage rate with the lowest monthly payment.

After applying for a mortgage, the lender will provide a Loan Estimate with details about the loan. Pay specific attention to which lender has the lowest mortgage rate, APR, and projected principal and interest payment. Then review the Origination Charges located on the Loan Estimate under Loan Costs to see how much the lender is charging in fees . The higher the fees and APR, the more the lender is charging to procure the loan. The remaining costs are generally applicable to all lenders, as they are determined by services and policies the borrower chooses, in addition to local taxes and government charges.

Also Check: Can You Get A Reverse Mortgage On A Condo

A Realists Guide To Winners And Losers In The Wave Of Interest Rate Hikes That Just Began

The new normal is rising interest rates.

The first step up for rates from the emergency low of the pandemic has been taken by the Bank of Canada and more increases are ahead. The Globes personal finance columnist on whos better and worse off as we adjust to the move away from what could be the lowest borrowing costs well see in our lives.

– Rob Carrick

10:02 a.m. ET

How Do You Lock In Your Va Loan Interest Rate

Buyers have to be under contract in order to be eligible for a rate lock. Once thats in hand, the timeline can vary depending on a host of factors, including the type of loan, the overall economic environment and more.

If you’re ready to see where rates are right now, or if you have more questions, contact a home loan specialist at 1-800-884-5560 or start your VA Home Loan quote online.

There’s no obligation, and you’ll be one step closer to owning your brand new home.

Read Also: Can You Refinance A Mortgage Without A Job

Amerisave Mortgage Corporation: Best For Refinancing

AmeriSave Mortgage Corporation is an online mortgage lender, available in every state except New York, offering an array of loan products. Along with conventional loans and refinancing, the lender also offers government loans, and is one of Bankrates best FHA lenders in 2021.

Strengths: Like other online mortgage lenders, AmeriSave Mortgage Corporation has some of the most competitive rates out there, and about half of consumers have had their loans closed in 25 days. The lender also doesnt charge a separate origination fee.

Weaknesses: Youll still need to pay a flat $500 fee.

> > Read Bankrate’s full AmeriSave Mortgage Corporation review

Which Is Better: Fixed Or Variable Mortgage Rates

The choice between fixed or variable rates depends on your personal circumstances. Fixed rates offer more stability than variable rates, as they have steady monthly payments, and protect you from changes to the prime rate.

Variable rates have been historically cheaper over the long term. However, they carry more risk than fixed rates. If you’re worried that your household budget won’t be able to accommodate increased mortgage payments, variable rates might not be the best option. However, if you think rates are likely to drop, and your budget has enough space to increase your monthly payments in case you’re wrong, variable rates might suit you.

Read our guide on fixed vs. variable mortgage rates for more details.

Read Also: Recasting Mortgage Chase

Why Does My Mortgage Interest Rate Matter

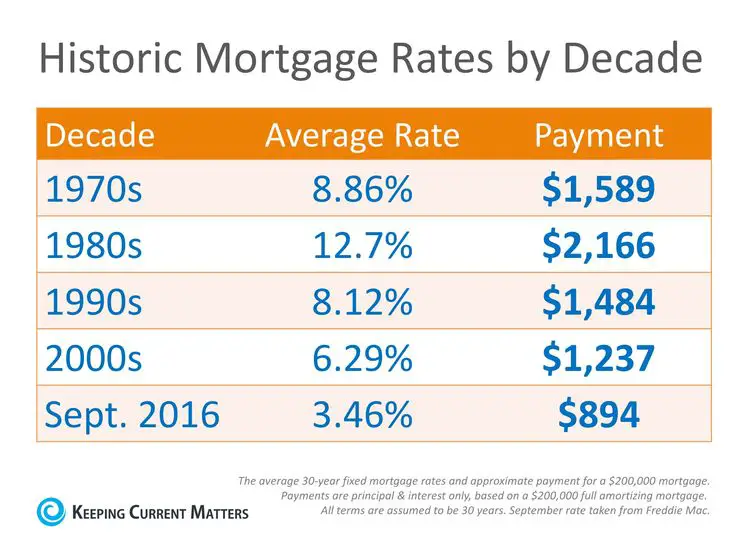

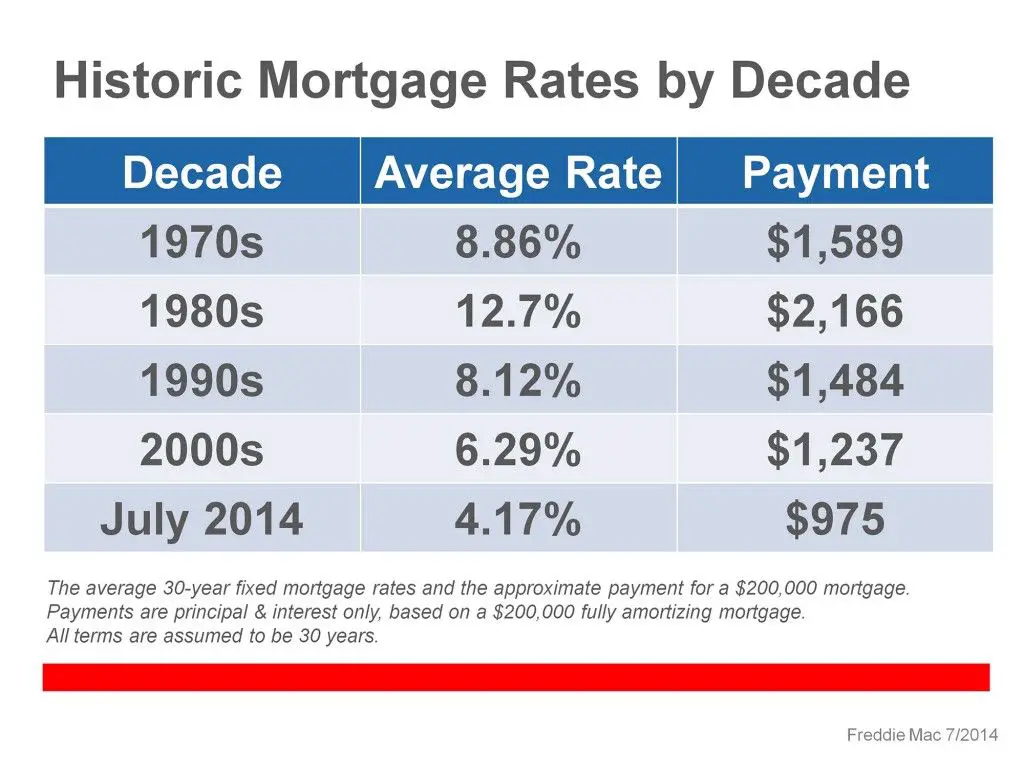

Your mortgage interest rate impacts the amount youll pay monthly as well as the total interest costs youll pay over the life of your loan. While it may not seem like a lot, a lower interest rate even by half of a percent can add up to significant savings for you.

For example, a borrower with a good credit score and a 20 percent down payment who takes out a 30-year fixed-rate loan for $200,000 with an interest rate of 4.25% instead of 4.75% translates to almost $60 per month in savings in the first five years, thats a savings of $3,500. Just as important is looking at the total interest costs too. In the same scenario, a half percent decrease in interest rate means a savings of almost $21,400 in total interest owed over the life of the loan.

How Does The Federal Reserve Affect Mortgage Rates

Home loans with variable rates likeadjustable-rate mortgages andhome equity line of credit loans are indirectly tied to the federal funds rate. When thefederal funds rates increase, it becomes more expensive for banks to borrow from other banks. The higher costs for the bank can mean a higher interest rate on your mortgage. ARM loans that are in their fixed period are not impacted by this increase. However if you suspect a federal increase is about to happen or it has just happened, you’ll want to move fast if you’re looking to make changes or have yet to lock in a fixed-rate mortgage.

Recommended Reading: Reverse Mortgage Manufactured Home

Should I Work With A Bank Or A Mortgage Broker

There are benefits and drawbacks to working with either a mortgage broker or a bank. Working with a mortgage broker gives you access to mortgage rates from a wide variety of lenders. That maximizes the chance that you’ll find a lower rate than you would by going directly to a bank. On the other hand, getting a mortgage from a bank can be quick and simple, especially if you already bank with them. We’d generally recommend seeing what rate your current bank will offer you, while also speaking to a local mortgage broker to see what other rates are on offer.

Let us help you determine which rate best suits your individual needs by answering a few short questions about your home and financial history.

We compare the most competitive brokers, lenders and banks in Canada to bring you today’s lowest interest rates, free of charge. Canadaâs current mortgage rates at the top of this page are updated every few minutes, so are the best rates currently on offer. to better understand what rate you could be eligible for in a few simple steps – – again, itâs completely free to use and youâre under no obligation whatsoever.

Why Mortgage Rates Change

Mortgage rates are influenced by a range of economic factors, from inflation to unemployment numbers. Typically, higher inflation means higher interest rates and vice versa. As inflation rises, the dollar loses value, which in turn drives off investors for mortgage-backed securities, causing the prices to fall and yields to climb. When yields climb, rates get more expensive for borrowers.

A strong economy usually means more people buying homes, which drives demand for mortgages. This increased demand can push rates higher. The opposite is also true less demand can trigger a drop in rates.

Don’t Miss: Can You Do A Reverse Mortgage On A Mobile Home

Take A Look At Our Mortgage Payment Calculator And Learn How Much Home You Can Afford

With a 30 year fixed mortgage, borrowers have the advantage of knowing the mortgage payments they make each month will never increase, allowing them to budget accordingly.

Each monthly payment goes towards paying off the interest and principal, to be paid in 30 years, thus these monthly mortgage payments are quite lower than a shorter-term loan. You will, however, end up paying considerably more in interest this way.

Cardinal Financial Company: Best For Low

Cardinal Financial Company, which also does business as Sebonic Financial, is a national mortgage lender that offers both an in-person and online experience and a wide variety of loan products.

Strengths: Borrowers have a range of options with Cardinal Financial, with the lender able to accept credit scores as low as 620 for a conventional loan, 660 for a jumbo loan, 580 for an FHA or USDA loan and 550 for a VA loan. The lender also offers speedy preapprovals, and some borrowers have been able to close in as little as seven days .

Weaknesses: Cardinal Financials current mortgage rates and fees arent listed publicly on its website, so youll need to consult with a loan officer for specifics pertaining to your situation.

> > Read Bankrate’s full Cardinal Financial Company review

Recommended Reading: Reverse Mortgage On Condo

How Do I Qualify For Better Mortgage Rates

Qualifying for better mortgage rates can help you save tens of thousands of dollars over the lifetime of the loan. Here are a few ways you can ensure you find the most competitive rate possible:

- Raise your credit score: A borrowers credit score is a major factor in determining mortgage rates. The higher the credit score, the more likely a borrower can get a lower rate. Its a good idea to review your credit score to see how you can improve it, whether thats by making on-time payments or disputing errors on your credit report.

- Increase your down payment: Most lenders offer lower mortgage rates for those who make a larger down payment. This will depend on the type of mortgage you apply for, but sometimes, putting down at least 20 percent could get you more attractive rates.

- Lower your debt-to-income ratio: Also called DTI, your debt-to-income ratio looks at the total of your monthly debt obligations and divides it by your gross income. Usually, lenders don’t want a DTI of 43% or higher, as that may indicate that you may have challenges meeting your monthly obligations as a borrower. The lower your DTI, the less risky you will appear to the lender, which will be reflected in a lower interest rate.

Lowest Mortgage Rates In Alberta

Alberta is one of the provinces where mortgage shoppers can find the most competitive mortgage rates. This is due in part to the higher incomes that traditionally came from the oil and gas sectors. They allow for bigger mortgages, which are more highly coveted.

Rates are also sharp thanks to the competitive mortgage broker market in the province, as well as competition from brokers outside of Alberta.

Some say the higher income per capita in the province, as well as lower educational levels , make Albertans slightly less rate sensitive than other provinces. But we think this is a generalization that does not reflect our readership. We encourage all to aggressively research the lowest mortgage rates possible.

Don’t Miss: 10 Year Treasury Yield Mortgage Rates

/1 Arm Mortgage Rates

A 5/1 ARM has an average rate of 2.92%, a downtick of 1 basis point compared to a week ago.

An ARM is ideal for households who will sell or refinance before the rate changes. If thats not the case, their interest rates could end up being remarkably higher after a rate adjusts.

For the first five years, a 5/1 ARM will typically have a lower interest rate compared to a 30-year fixed mortgage. Keep in mind that your payment could end up being hundreds of dollars higher after a rate adjustment, depending on the terms of your loan.

Look At Interest Rate And Apr

Most borrowers tend to focus on mortgage rates. But the APR you pay on a loan is often just as or even more important than the basic interest rate.

Annual percentage rate looks at all your costs of borrowing and spreads them over the potential life of your loan. So APRs are higher than straight rates. And they can tell you about what youre actually going to pay.

Just note, APR assumes youll keep your loan its full term, which most borrowers dont. They either sell or refinance before the mortgage term ends.

So look at APR, but remember that its not always the last word on what youll pay. You can learn more about how to compare interest rates and APR effectively in this article.

Read Also: 70000 Mortgage Over 30 Years

What Is The Difference Between Interest Rate And Apr

Interest rate is a percentage of the total loan balance paid to the lender on a monthly basis . The annual percentage rate, or APR, is the total borrowing cost as a percentage of the loan amount, which includes the interest rate plus any additional fees like discount points and other costs associated with procuring the loan.

How To Navigate The World Of Mortgage Rates

The trick is knowing what a good mortgage rate looks like for you. And that will depend on a few different factors, including:

Clearly, there are a lot of variables affecting your interest rate. Whats an attractive rate for one borrower may be way too high for another.

And all lenders weigh these factors differently. So making the same application with three different lenders will most likely get you three different rates and sets of fees.

Don’t Miss: How Does Rocket Mortgage Work

Rate Trends: Where Are Mortgage Rates Headed

Mortgage rates plunged early in the pandemic and scraped record lows below 3 percent at the start of 2021. The new year, however, has been characterized by rising rates. The days of sub-3 percent mortgage interest on the 30-year fixed are behind us, and many experts think the average rate on this loan will be 3.5 to 4 percent by the end of 2022. Thats still great by historical standards though. The ultra-low rates of 2020 and 2021 were an anomaly, but even 4 percent is a deal in the scheme of things.

Mortgage rates continue to surge, as they have since the beginning of the year, as the outlook takes shape for Fed rate hikes that are sooner and faster than previously expected, McBride says. Mortgage rates are still well below 4 percent but in an environment of already sky-high home prices, more would-be homebuyers are priced out with each move higher in mortgage rates.