Determining Your Down Payment

The minimum down payment when buying a home in Canada is 5% of the purchase price for a home valued at $500,000 or less and 10% for the portion of the purchase price above $500,000.

But, in order to avoid paying mortgage default insurance premiums, you must have at least a 20% down payment. See: How Much Do You Need for a Down Payment in Canada?

Example: If youre buying a home for $750,000, your minimum down payment is $25,000 for the first $500,000 and $25,000 for the remaining $250,000 = $50,000 minimum down payment

How Much Can I Borrow Detailed Considerations

Lenders presume borrowers spend about 3% to 5% of their outstanding debts on servicing costs. In our above calculation for individuals we subtract £3 for each £1 of debt for individuals and £2.4 for each £1 of debt for couples with multiple income providers.

In addition to your income level, lenders consider recent financial troubles, missed payments, and general living expenses when they determine suitability and lending limits.

Money Advice Service offers an affordability calculator which takes into account your outgoings. In general lenders do not like more than 60% of a person’s income going toward their mortgage and monthly outgoings. Nationwide also offers a similar calcualator, though it has quite a few steps in it and collects some personal data like your birthday.

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Also Check: Reverse Mortgage Mobile Home

Yikes Other Things Such As

You ready? Theres private mortgage insurance, which youll need to buy if youre putting less than 20 percent down . Theres also homeowners insurance. Theres also duh property taxes. If youre buying a condo, there will probably be HOA dues. Utilities, too, if were being thorough.

Then there are a lot of closing costs involved at the end of the sale, which dont really factor into the total monthly payment, but they sure cant be ignored when youre buying a home. Those include origination and lender fees any points you buy to lower the interest rate third-party stuff like the title insurance, home inspection and appraisal any local real estate transaction fees and prepaid expenses like the first years premium, the prorated mortgage interest between the time you close and the end of the first month, and initial deposits for property taxes.

How Mortgage Affordability Works

Mortgage affordability means two things: The first is how much a person can borrow based on current income, the amount of the downpayment, living expenses as well as debt. As an individual, the higher your mortgage affordability, the more house you can afford.

The term affordability can also mean the cost of living in a particular part of Canada relative to the average income in that area. If housing costs are high compared to local incomes, the area is considered a less affordable place to live.

Cities like Toronto, Vancouver and Hamilton are considered less affordable because housing prices have outpaced the average salary, whereas in other parts of Canada, such as Saskatoon and Regina, average salaries are more in line with housing costs, which makes them more affordable.

In the city of Toronto, for example, the average home costs $1,136,280nearly 23 times the 2019 average per capita income of $49,800according to Statistics Canada and Toronto Regional Real Estate Board data.

That means Toronto is less affordable than the entire province of Ontario, where the average person made $49,500 per year in 2019 and where homes cost an average of $887,290or roughly 18 times the average income. Meanwhile, the national average cost of a resale home in Canada is $686,650, according to the Canadian Real Estate Association, or only 14 times the national average income of $49,000.

Heres a table showing those numbers together.

| Average cost of a home | Average income |

| $49,000 | 14 |

Don’t Miss: Rocket Mortgage Payment Options

They Are A Popular Choice For Many Seeking To Find Out Quickly How Much They Can Borrow But Can They Be Relied Upon To Tell You What You Could Truly Afford

If youre thinking of applying for a mortgage, your first instinct may be to go online and find a mortgage calculator. An online search for a mortgage calculator will deliver a vast range of options. There are many different types available, provided by a range of companies. These include money advice websites, brokers and lenders themselves. Barclays for instance has a range of mortgage calculators on its website, including a quick estimate of how much you could borrow, a repayments calculator and an interest rate calculator.Property websites Rightmove and Zoopla both have a basic mortgage calculator for every property listed. These calculators tell you how much the monthly repayments would be based on the property price, your deposit and a predicted interest rate over 25 years. You can enter your deposit amount and can change both the interest rate and term and the monthly repayment amount will be updated.

Let’s Start With The Basics

Gross annual household income is the total income, before deductions, for all people who live at the same address and are co-borrowers on a mortgage. Enter an income between $1,000 and $1,500,000.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

Selecting your province or territory helps us personalize your mortgage results.

Enter your total monthly payments towards any car loans, student loans or personal loans.

Don’t Miss: Chase Mortgage Recast Fee

How Much House Can I Afford With A Conventional Loan

Conventional loans are popular for borrowers with credit scores of at least 620 and DTI ratios of 45% or less. Some conventional loan programs allow down payments as low as 3%, but you can avoid mortgage insurance if you make at least a 20% down payment. Conventional lenders often assess mortgage insurance to cover their losses if you default, and its usually part of your monthly payment.

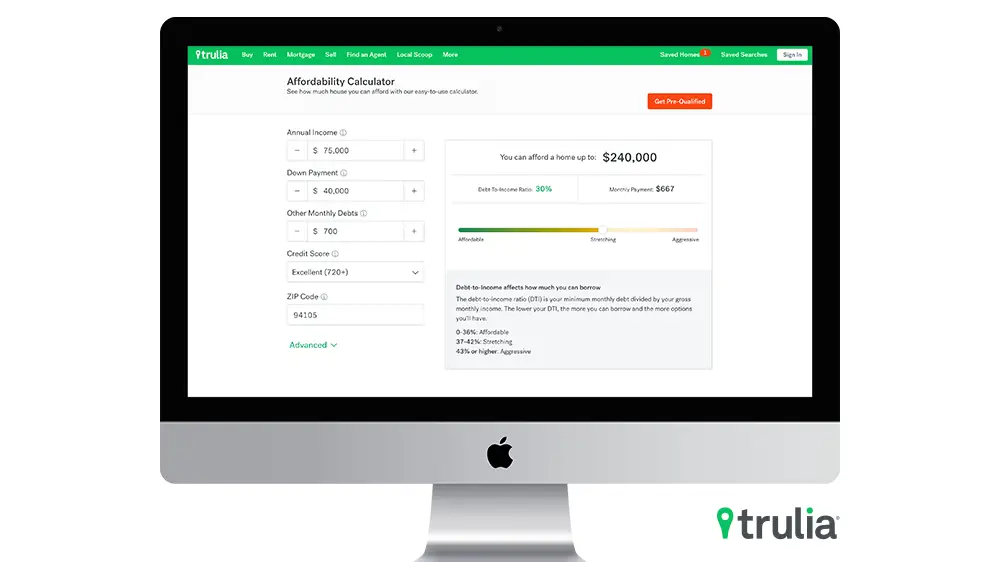

Why Use An Affordability Calculator

Determining your budget is an important step before beginning your house search. Mortgage Maestros affordability calculator can help you understand your borrowing limit by providing some simple information. Our tools are designed to help you find the perfect mortgage solution and make the approval process easier. To get an even more accurate estimate of your affordability, get a quote and one of our experts can help you find a mortgage that fits comfortably within your budget.

Recommended Reading: Rocket Mortgage Loan Requirements

Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understanding how large a mortgage you can afford to borrow and the cash requirements involved will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

Also Check: Does Prequalifying For A Mortgage Affect Your Credit

Impact Of New Cmhc Rules On Borrowers

Gross/Total Debt Service Ratios

The higherdebt service ratiorequirements will allow more borrowers to participate with higher leverage and take out larger mortgages relative to their income. Debt service ratios measure how much of your income will be spent on paying the mortgage, bills associated with your home and payments on other debt.

The lower credit score requirement of 600 will allow borrowers who have missed bill payments or have a limited credit history to participate in the CMHC insurance program and be eligible for a downpayment as low as 5%.

Mortgage Down Payment And Affordability

Yourmortgage down paymentcan impact your mortgage affordability. A larger down payment can reduce your mortgage borrowing, lowering your interest costs andCMHC mortgage insurance premiums. A smaller down payment could lead to higher interest costs, more expensive mortgage insurance and potentially even disqualify you from an insured mortgage if your debt servicing ratios are too high.

Recent changes to CMHC regulations has made it harder to get an insured mortgage, making your down payment even more important. With a down payment of 20% or more, you can have a conventional mortgage without mortgage insurance and skip both the fees and requirements of CMHC mortgage insurance.

Recommended Reading: Mortgage Rates Based On 10 Year Treasury

Advice On Mortgage Calculations In The Uk And How Much You Could Borrow

Were often asked, Is there a calculator I can use to see how much mortgage I can afford? Quick online mortgage affordability calculators can give inaccurate estimates because they dont take into consideration that each lender may accept or not accept varying factors.

This can make calculating how much you can borrow for a mortgage confusing, so to get a more detailed picture about the mortgage affordability checks for your situation, speak to a mortgage broker.

How Much Should I Spend On A House

Anaffordability calculatoris a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

Don’t Miss: How Does 10 Year Treasury Affect Mortgage Rates

What About Calculators For Specific Homes

Zillows popular Zestimates, which people tend to view as almost an appraisal of a homes value might not accurately value a particular home because of this records issue or it might not recognize improvements made to a home, like adding an extra bathroom or it might not have a lot of data to work with for neighborhoods that dont have a lot of recent home sales.

Its probably not a coincidence that algorithms lowball the value of specific homes, or that calculators spit out a low number by omitting crucial information. Again, its not unfair to assume its all for marketing purposes. Every retailer ever in human history knows that its good business to advertise low prices and stupid to advertise anything else it gets the customer in the door, or clicking around on your website. Once a customer lands on the spider web, its game on for a realtor, lender or any kind of salesperson.

How To Increase Your Mortgage Affordability

If you have found that your maximum affordability is lower than you expected, here are some reasons that might beand what you can do about it.

- GDS ratio: If your GDS ratio is limiting your mortgage affordability, youll need to increase your gross household income.

- TDS ratio: If its your TDS ratio, the likely culprit is existing debt. Focus on paying off your credit card balances or car loans to increase your mortgage affordability.

- Down payment: Youll need to save at least 5% of your homes purchase price or more, depending on the desired purchase price. If this is a limiting factor, consider options to increase your down payment, such as putting more money aside each month, accessing up to $35,000 in RRSP funds through the Home Buyers Plan or asking a family member for a monetary gift.

- Get a co-signer: Having a family member co-sign your mortgage will add their income to your application, increasing how much mortgage you can afford. Keep in mind that if you default on your payments, your co-signer will be responsible for the debt.

You May Like: 10 Year Treasury Vs 30 Year Mortgage

The Value Of A Mortgage Calculator

Should you use a mortgage calculator? Yes! We offer a range of different mortgage calculators that our current and future clients can use to gain insight into everything from what their monthly mortgage payment might look like to a comparison between fixed and adjustable mortgage rates for the same loan amount.

However, its important to put the information you get from a mortgage calculator into perspective. Like any other online tool, such as a symptom checker on a health website, mortgage calculators have their value, and they also have their limits. Calculator tools can help you get some good preliminary information, and theyre also useful for providing insight into the homebuying process, introducing you to some ideas you may not yet be familiar with.

For example, if youre just playing around with the idea of buying a house within the next year, a mortgage calculator can help you determine whether the monthly budget youre thinking about is realistic. Its a way of throwing out some numbers and having a reliable, accurate tool that takes complexities like interest rate into account.

How Much Can I Afford

How much you can afford to spend on a home in Canada is most determined by how much you can borrow from a mortgage provider. That is, unless you have enough cash to purchase a property outright, which is unlikely. Use the mortgage affordability calculator above to figure out how much you can afford to borrow, based on your current situation.

Also Check: Chase Recast Calculator

Td Bank Mortgage Affordability

Before you get a mortgage from TD Bank, it is important to know how TD calculates your mortgage affordability. TD takes into account the following factors:

- The location of your future home

- Whether your future home is a detached home or condo

- Your household income

- Your down payment

- Your monthly bills and expenses including groceries, transportation, shopping, and insurance.

- Your monthly debt payments to loans and lines of credit including credit cards, car loans, student loans, and leases.

Your location and property type are used to provide estimates for your potential property taxes, utilities, and condo fees.

TD calculates your mortgage limit using the current qualification rate and a maximum gross debt service ratio of 39% and a maximum total debt service ratio of 44%. This means that your mortgage payment, property tax, heating costs, and half of your condo fees cannot take up more than 39% of your gross income. In addition, this amount plus your total debt payments cannot take up more than 44% of your gross income.

Another factor in determining your mortgage affordability is your down payment. According to TD, home buyers must have a minimum 5% down payment for homes worth less than $500K. For homes between $500K and $1M, home buyers must have at least 5% for the first $500K and 10% for the remaining amount. For homes worth more than $1M, home buyers must have a minimum 20% down payment.

Debt Service Ratios And Mortgage Calculations

Canadians have a lot of mortgage debt. According to an August 2021 press release by Equifax, the average new home loan was $355,000, which was an increase of 22% from the year before.

Thats important because lenders look at whats called the gross debt service ratio and total debt service ratio when determining the amount they will lend you. Both consider your overall debt load, income and monthly housing costs.

The GDS ratio considers the mortgage principal, interest, taxes and heating expenses. If youre going to buy a condo, it also considers half the monthly maintenance fee. The total amount is calculated as a percentage of your total gross annual income.

The TDS ratio calculations are similar but factor in all the other debt you may havesuch as monthly car payments, credit card interest and other loansas a percentage of your gross annual income.

If you meet the 32% GDS and 40% TDS guidelines and have good credit, you are likely to get your requested mortgage amount and possibly even a bit more. .

On July 1, 2020, the CMHC issued new GDS and TDS limits for the mortgages it insures, capping the maximum for GDS at 35% and TDS at 42%. If you go beyond those numbers, the CMHC can refuse to insure your mortgage.

While these guidelines can be helpful in figuring out how much you can afford, Cooper is skeptical of putting too much weight behind these, especially when looking to purchase in the major cities.

Also Check: Recasting Mortgage Chase