Quitclaim Deed Vs Grant Deed

In many cases, a quitclaim deed is not enough for transferring ownership. That’s because it offers no guarantees. Often, a more firm and declaration of ownership is needed, as is the case with a grant deed.

Unlike a quitclaim deed, a grant deed explicitly promises that the current owner has rights to the property and is transferring them. This guards against any potential title issues that could have happened during the grantor’s tenure of ownership.

It does not, however, guarantee there are no title issues that occurred outside that ownership period. For that, some states use an even stronger deed, called a warranty deed, along with title insurance.

Grant deeds and warranty deeds are the most common types of deeds used in sales transactions.

Quitclaim Vs Warranty Deeds: Whats The Difference

A warranty deed is another, more common way to transfer a title in real estate. Its common in sale and purchase transactions and offers more protection to both the buyer and the seller. It takes longer and is more formal than a quitclaim title transfer. Warranty deeds involve monetary compensation and legal clauses that protect the buyer against any liens or future title issues. You will likely use a warranty deed when you purchase your primary residence. Thats not to say quitclaim deeds are uncommon or not needed, but theyre used in different types of transactions.

Quitclaim deeds are a popular way to get real estate transferred between two trusted parties in a fast and efficient way. As the potential new owner in a quitclaim transaction, its important to remember that youre inheriting a title as is, which is why this transaction is less common than a warranty deed in a traditional sale and purchase real estate agreement.

Tips For Buying A Home

- Talk to a financial advisor about how buying a home will factor into your larger financial plan. This is important, as you want to ensure you can purchase a home without sacrificing your other financial goals. To connect with up to three advisors in your area, try SmartAssets free financial advisor matching tool. If youre ready, get started now.

- Make sure that your is in good shape. With a high credit score, you can get lower mortgage rates, which translates to lower monthly mortgage payments.

Also Check: 10 Year Treasury Yield Mortgage Rates

Types Of Deeds Of Release

Employment agreements are another scenario where a deed of release might be used. The document can free both the employer and the employee of any obligations that they had under their employment agreement. In some cases, a deed of release might give an employee a designated payment. This can occur in the case of a severance package.

The deed of release can include the terms of the severance, including payment and the length of time that payments will last following the release. It might also identify confidential information that cannot be shared by the employee after termination, or restraint clauses that prevent a departing employee from forming a similar business or soliciting customers or clients.

Will A Quit Claim Deed Affect My Title Insurance

Quitclaim deeds can have an impact on the continuance of title insurance. Executing a deed can also create issues with your mortgage such as triggering a due on sale clause. Check with your title insurance provider or lender prior to executing a deed to see if there will be any affect on your policy coverage or mortgage.

Also Check: 70000 Mortgage Over 30 Years

How Does A Quit Claim Deed Work In Florida

A quitclaim deed in Florida transfers whatever title the grantor has in real property to a grantee. No warranty is given with the transfer. If the grantee does not have good title to the property, the grantee may end up with nothing.

Once the quitclaim deed is signed, the deed is recorded in the county public records.

Can You Sell A House If Someone Else Is On The Deed

A house cannot be sold without the consent of all owners listed on the deed. When selling a home, there are different decisions that need to be made throughout the process. Decisions such as hiring a listing agent or negotiating a price are often challenging enough without having to agree with the co-owner.

Don’t Miss: How Does Rocket Mortgage Work

Whats A Quitclaim Deed

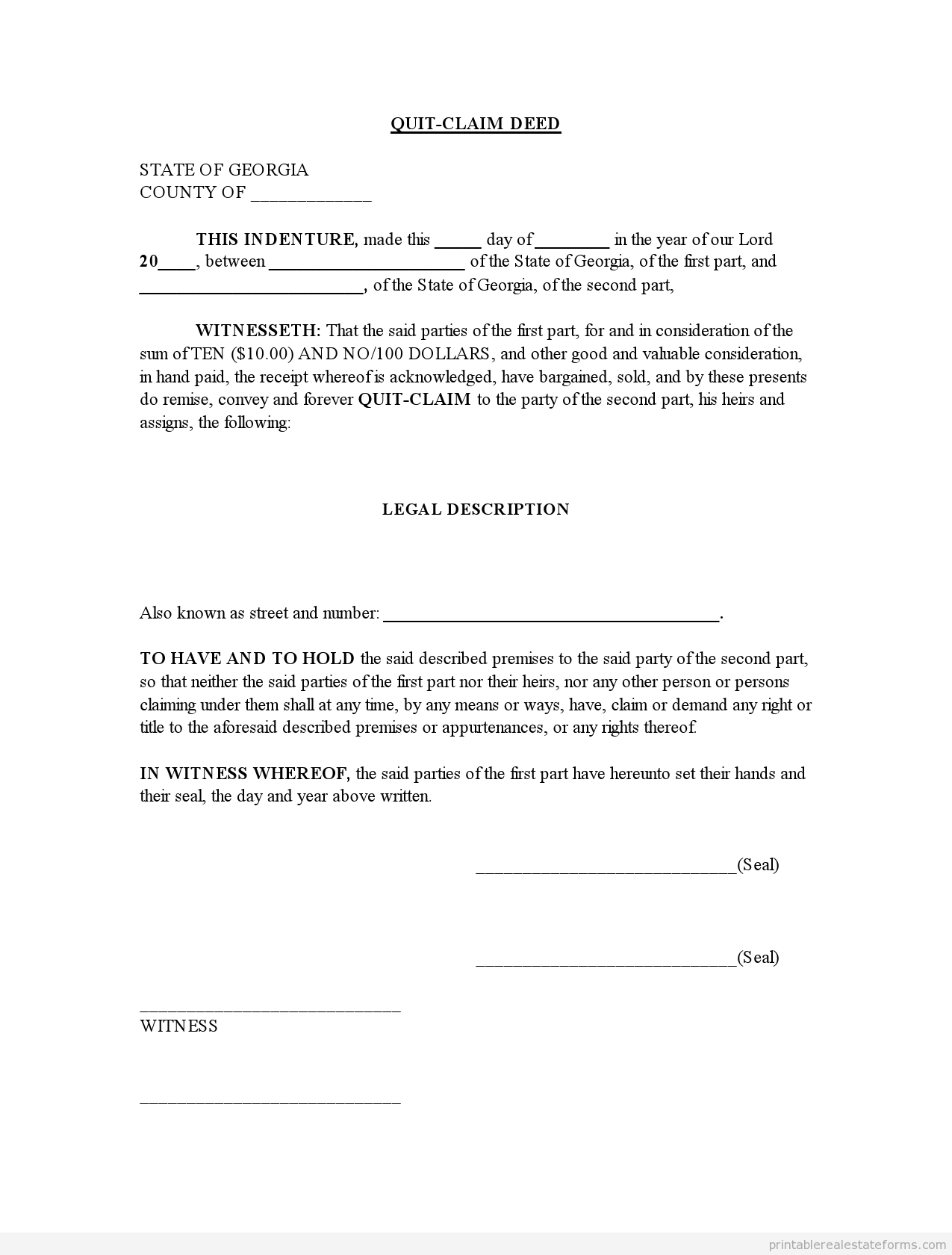

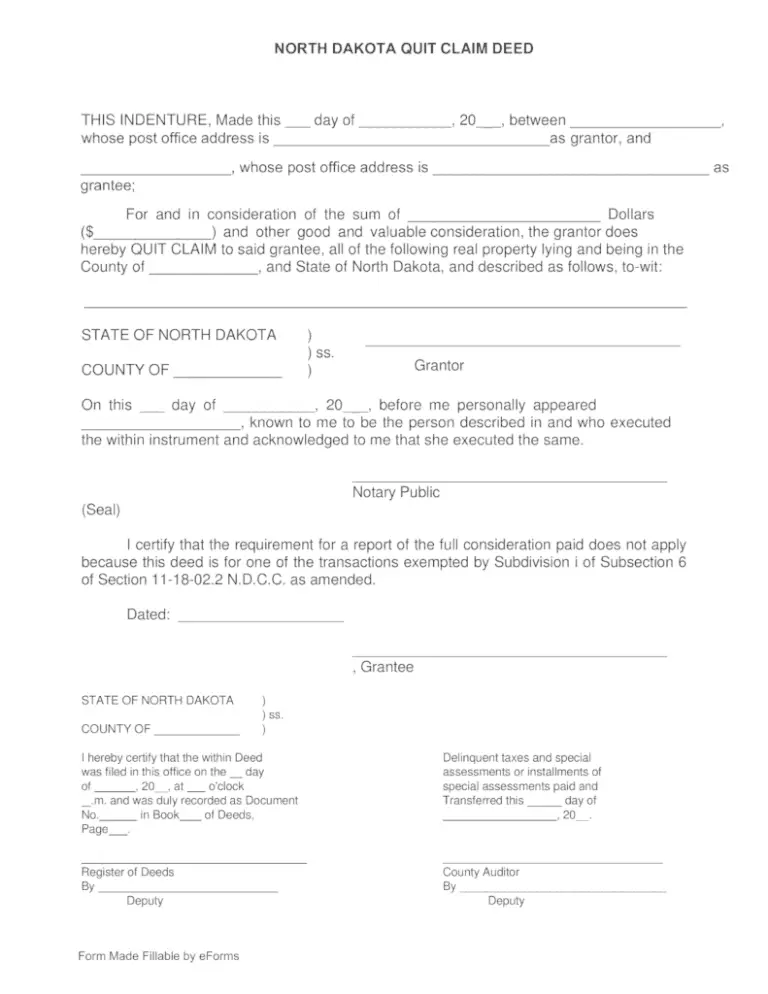

A quitclaim deed is a legal document that transfers any and all ownership rights held by the grantor to a grantee. It offers no assurances regarding what property rights are conveyed, and it creates no liability for the grantor should a future claim against title arise. You may sometimes hear a quitclaim deed be incorrectly called a quickclaim deed.

These deeds are used for a grantor to convey whatever ownership interests they might have to another party, the grantee. Quitclaim deeds can be cheaper to execute than other types of deeds as you may be able to do them without an attorney, but people should use caution when doing so.

What makes a quitclaim deed different is that there are no guarantees. You dont get guarantees that you would with a general warranty deed. No title search is completed to verify ownership, and there isnt any title insurance issued. That why these types of deeds often are used between parties that know and trust each other.

You’re Buying The Least Amount Of Protection Of Any Deed

Also called a non-warranty deed, a quitclaim deed conveys whatever interest the grantor currently has in the property if any. The grantor only “remises, releases, and quitclaims” their interest in the property to the grantee. There are no warranties or promises regarding the quality of the title. The deed will clarify this by including language such as, “The Grantor makes no warranty, express or implied, as to title in the property herein described.”

In situations where the grantor under a quitclaim deed has no interest in the property, the grantee acquires nothing by virtue of the quitclaim deed and acquires no right of warranty against the grantor.

Read Also: Does Rocket Mortgage Service Their Own Loans

What Is A Warranty Deed

A warranty deed is a document often used in real estate that provides the greatest amount of protection to the purchaser of a property. It pledges or warrants that the owner owns the property free and clear of any outstanding liens, mortgages, or other encumbrances against it.

The two parties involved in a warranty deed are the seller or owner, also known as the grantor, and the buyer or the grantee. Either party can be an individual or a business, and are often strangers to each other.

There are different types of deeds such as the warranty deed, special warranty deed, and the quitclaim deed. The difference between these deeds is usually defined by what warranties and covenants are being conveyed from the seller to the buyer.

Can My Parents Give Me 100k

As of 2018, IRS tax law allows you to give up to $15,000 each year per person as a tax-free gift, regardless of how many people you gift. Lifetime Gift Tax Exclusion. For example, if you give your daughter $100,000 to buy a house, $15,000 of that gift fulfills your annual per-person exclusion for her alone.

Recommended Reading: Rocket Mortgage Requirements

What Happens If You Are On The Deed But Not The Mortgage

If your name is on the deed but not the mortgage, it means that you are an owner of the home, but are not liable for the mortgage loan and the resulting payments. If you default on the payments, however, the lender can still foreclose on the home, despite that only one spouse is listed on the mortgage.

File The Quit Claim Deed

The final step is to file the quit claim deed with the recorders office. This is the only way to make it official. Its not enough to complete the form. The recorder needs to make it official by recording it as a public record. At this point, the new owners take public ownership of the home.

Typically, borrowers use a quit claim deed when there is a divorce and one spouse wants off the mortgage or when a newly married spouse wants to add their spouse to the deed. Of course, there are other reasons to use the quit claim deed. Whatever your reason, make sure you follow the proper steps so that the deed gets properly recorded in your county.

Also Check: Rocket Mortgage Launchpad

Does A Quitclaim Deed Affect Your Credit

You should not lose out on credit if you sign over a condo with a quitclaim deed according to this interpretation. A lot of people who do these kinds of financing dont disclose their credit histories to the credit bureaus unless they do a large number of buying and selling properties to people whose chances of being able to secure mortgages appear slim.

Who Is Responsible For A Mortgage With A Quitclaim Deed

Related Articles

A quitclaim deed is commonly used to remove a persons name from a real estate title, giving full ownership to a spouse, partner or other person whose name was also on the title. Its often used in the case of a divorce, with one party signing over all rights to the spouse who is awarded the home. Despite the fact that a quitclaim deed removes a persons name from a title along with all rights of ownership, it does not absolve the person of responsibility for the mortgage.

Tip

A quitclaim deed can quickly remove you from a property’s title and terminate your ownership interests. A quitclaim does not however, remove you from the mortgage or the responsibility to make payments.

Also Check: How Much Is Mortgage On A 1 Million Dollar House

Are Quitclaim Deeds Reported To Irs

Taxable events such as canceled claims are common myths related to claim ownership. They commonly refer to the belief that they transfer tax-free assets. The truth is, that is not always the case. According to the IRS, if your claim does not go to your spouse but to the bank, then it is usually a taxable event and should be reported.

Does The Grantor Have A Mortgage

Family members are the most common people to use quitclaim deeds, especially for transferring property, instead of the sale of property. For this reason, most real properties involved in quitclaim deeds do not have outstanding mortgages it would be difficult for most grantors to pay off mortgages without proceeds from the sale of the land. If there is no mortgage, there is of course no way for the quitclaim deed to affect the mortgage.

In some cases, the grantor does have a mortgage while filing a quitclaim deed. In the event that the grantor has an outstanding mortgage on the property, he or she remains legally responsible for the mortgage even after transferring ownership through a quitclaim deed. This is because a quitclaim merely transfers ownership not any debts or claims to the property. The new owner will have the title of the property, but the original grantor will still be liable for the outstanding mortgage.

Recommended Reading: Reverse Mortgage For Mobile Homes

You’re Still Responsible For Taxes

Once youve signed a quitclaim deed, you wont accumulate new tax debt, but you are responsible for taxes that were due as of the day you signed the deed. If you dont pay, the property tax authority in your area can take legal action and force you to pay. The property may be sold to pay any back taxes, but you can also be sued for the debt. To minimize your tax liability, file the signed deed with your county recorder immediately, so that theres no question about when you signed.

Can I Sell My House With A Quit Claim Deed

- 02/10/2020

Unless youve had experience with one, the term quitclaim deed may not be one you are fully familiar with.

According to Legalzoom.com, a quitclaim deed conveys a sellers interest in a property to a buyer. This means that a seller who owns a building or other property can give a quitclaim deed to a buyerand thereby transfer the sellers entire interest in that property to the buyer.

Often, they are used between family and friends because there is a certain amount of trust required between the parties.

Many people who receive property through a quitclaim deed wonder if and how they can sell it afterward. While theres absolutely nothing wrong with using a quitclaim deed to transfer property, there are a few considerations to take into account when selling the property later. We also suggest you speak with an attorney or legal professional to ensure you fully understand any potential risks before making any decisions.

Heres a high-level view of what you need to know about selling a home with a quitclaim deed.

You May Like: How Does 10 Year Treasury Affect Mortgage Rates

Your Guide To Quitclaim Deeds

When transferring ownership of real estate, you need a deed to make the transaction official. A deed is a legal document that officially transfers the title of a property from one person to another. A quitclaim deed is a type of deed used to transfer the title of a property in a faster, yet higher risk manner, and its usually done between two trusted individuals.

How Do I Do A Quit Claim Deed In Virginia

Virginia Requirements for Quit Claim Deeds A legal description of the property must be included, and there should be a statement regarding how the grantor came to be in possession of the property. The deed should be notarized both parties must sign the deed in the presence of a notary public, who will also sign it.

Don’t Miss: Mortgage Rates Based On 10 Year Treasury

How Much Does It Cost To File A Quit Claim Deed In New York

When your income tax return was due and you completed an Illinois company tax return on your New York state quit claim deed, your county fee will differ based on your county. The rate of applying for a quitclaim deed New York residential or farm property will be $125, and $250 for all other properties.

How Do I Remove My Husband From The Deed

You usually do this by filing a quitclaim deed, in which your ex-spouse gives up all rights to the property. Your ex should sign the quitclaim deed in front of a notary. One this document is notarized, you file it with the county. This publicly removes the former partners name from the property deed and the mortgage.

Read Also: Does Rocket Mortgage Sell Their Loans

How To File A Quitclaim Deed In Florida

To file, or record, a quitclaim deed, you first have to enter the relevant details in a quitclaim deed form. In Florida, quitclaim deeds should have the name and address of both the grantor and the grantee . There should also be a designation if the property is the homestead of the grantor.

Ensure to include spousal signatures if appropriate, even if the grantors spouse does not own the property.

Then, you need to take the quitclaim deed to the county comptrollers office for the county where the property is located.

The comptrollers office will charge you a small fee for the recording. However, expect a larger fee if there is a mortgage on the property.

When you record the quitclaim deed in Florida, the office will enter a copy of the deed into the countys official records. The original will be returned to you.

Important: Make sure the quitclaim deed is properly drafted. Just because the county accepts your document for recording does not mean that the county reviews the deed for legal sufficiency.

Provide Your Lender With Your Personal Financial Information

If you are the person transferring property, you must present this legal documentation. This financial documentation has to stand as proof of your ability to be responsible for the mortgage loan.

You have to prove to whatever financial institution you are making use of that you are capable of making your mortgage payments on your real estate property monthly.

You May Like: Chase Mortgage Recast

Types Of Deeds To Transfer Ownership Of Real Property

The legal document that transfers ownership of the property can be a warranty deed or a quitclaim deed.

Warranty deed: Used in most real estate sales transactions, this deed says that the grantor is the owner of the property and has the right to transfer the property to you . In addition, the deed serves as a statement that there are no liens against the property from a mortgage lender, the Internal Revenue Service, or any creditor, and that the property cant be claimed by anyone else. Title insurance provides the financial backup to the warranty deed, and requires a title search to verify that no other claims, encumbrances, easements, or liens on the property are outstanding.

Quitclaim deed: Used when a real estate property transfers ownership without being sold. No money is involved in the transaction, no title search is done to verify ownership, and no title insurance is issued. A quitclaim deed real estate transaction sometimes occurs between family members.

When Do You Need A Quitclaim Deed

A quitclaim deed can be an efficient way to transfer interest in a property. When you execute this transaction, the original owner can have their name removed from the deed and transfer the title and ownership rights to another party.

However, the execution of a quitclaim deed does not absolve the original owner from any mortgage responsibilities. In fact, the mortgage details are not changed at all.

With that, a quitclaim deed is not ideal in traditional real estate transactions involving an unrelated buyer and seller. But in some circumstances, this type of deed can be the perfect fit.

Here are some instances when a quitclaim deed could suit your needs:

If youre considering a quitclaim deed, you should consult a real estate attorney before moving forward. They can help to assess your situation and determine if this is the right step.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Recommended Reading: Reverse Mortgage On Condo