How Much Are Closing Costs For A Buyer

Not every buyer will pay the same amount in closing costs. Some costs are lender requirements, some are government requirements and others may be optional will vary depending on the situation. What youll need to pay for will depend on where you live, your specific lender and what type of loan you take.

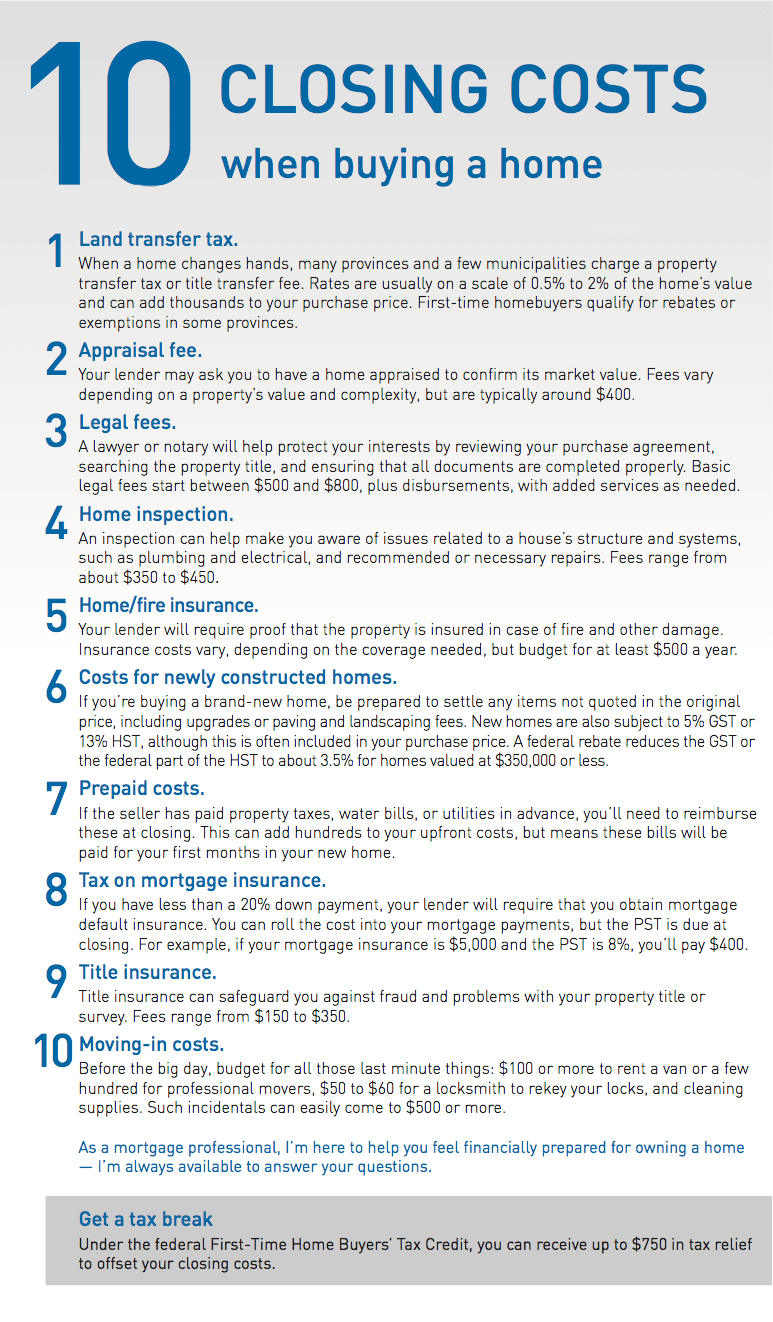

At least 3 days before you attend your closing meeting, your lender will give you a document called your Closing Disclosure. This will list out every closing cost you need to cover and how much you owe. Here are some of the most common closing costs you might see on your disclosure.

Know Where You Stand Financially

Are you afraid to check your credit rating? Its time to get over that.

Lenders look at a variety of factors when approving someone for a home loan and determining the specific interest rates and terms offered.

In general, a relatively high credit score and good debt-to-income and loan-to-value ratios will help borrowers secure the best terms, says Kevin Parker, vice president of field mortgage originations at Navy Federal Credit Union.

Allow us to translate: Debt-to-income ratio refers to the amount of your monthly income that goes toward paying off debt. Loan-to-value ratio compares the mortgage amount to the homes appraised valuethat is, whether you are hoping to finance, say, 50% or 80% of the purchase price. A higher loan-to-value ratio is a riskier proposition for a lender.

Knowing your credit score, income, and total monthly bills puts you in a better position to find the best lender. Homebuyers with excellent credit scores and a healthy savings account are sometimes in the best position to negotiate. But simply knowing your numbers is a step in the right direction.

How Much Are Closing Costs On A House

This closing costs calculator lets you see an estimate of costs without waiting to apply for a mortgage. Having an estimate while you are saving and shopping for a home puts you in the drivers seat by giving you time to plan how youll pay the total amount due at settlement.

Home shoppers know they need to save a lot for their down payment. However, you may be surprised by the thousands of dollars in closing costs that will be due when you sign your mortgage contract.

During the mortgage process, the lender gives you two official notices of your loans closing costs:

The Loan Estimate is given to prospective borrowers within three days of applying for a mortgage.

The Closing Disclosure, which has the final numbers, is delivered three days before closing.

Look at the services in your results that say Shop under them. It might be possible to save hundreds of dollars, particularly on the most expensive items, such as title insurance and settlement services.

» MORE:8 strategies for lowering your closing costs

Also Check: How Much Is Mortgage On A 1 Million Dollar House

Fha Loan For A $200000 Home

- Due upfront: $14,860

What youll pay at closing

Here are your figures for a typical cash requirement on closing:

- Minimum down payment: $7,000

- Possible closing costs: $7,720

- Upfront MIP: $3,375

You can normally roll up your initial MIP payment into your loan and pay it down along with your mortgage. Most people do that.

If you do, your total loan amount will be the original $193,000 plus your initial MIP payment of $3,735, which makes $196,375.

Because youre borrowing more, your 4% closing costs will inch up to $7,855 from $7,720.

So you could close on your FHA loan for a $200,000 home with as little as $14,860. Indeed, if you find a lender that charges lower closing costs of 2%, it might be as little as $10,930.

Remember, if youre eligible for help from a down payment assistance program, you might get all or some of that paid for you through a loan, forgivable loan, or grant.

Ongoing FHA loan costs

Assuming youve rolled up your initial MIP payment into your loan, youll be borrowing $196,375. And, remember, were assuming a fixed mortgage rate of 3.474%, which may have changed by the time you read this.

Based on those assumptions, our FHA loan calculator says your monthly mortgage payment should be $1,220. That breaks down as:

- Principal and interest: $879

- Monthly mortgage insurance fee: $139

- Property taxes: $162

- Homeowners insurance: $40

So take these as useful but rough estimates rather than firm figures.

Consider Your Choices For Paying For These Costs

All mortgage loans include some costs that you pay upfront, at the time of closing, and some you pay over time, in your monthly payment. You have some choices for how much you pay, and when.

If you want to lower your interest rate, you can pay points

Points, also known as discount points, are money you pay upfront to your lender in exchange for a lower interest rate. Points increase your closing costs.

If you want to reduce your closing costs, you can ask to receive lender credits

Lender credits are money you receive from the lender to offset your closing costs. You agree to pay a higher interest rate in exchange for an upfront rebate that is applied to your closing costs.

You can do neither

You pay all of your closing costs out-of-pocket up front, and get an unadjusted interest rate.

You May Like: Chase Recast Calculator

B Services You Cannot Shop For

Theres a lot of administrative and legal work needed to finalize a home sale. The bank needs to make sure the loan it is making is backed by a valuable asset the government needs to make a record of the deal, and collect whatever fees and taxes are allowed by law and someone needs to deal with all of the paperwork involved. All that work can add up to a significant amount of money.

- Appraisal fee: Before the deal is finalized, your bank will likely want to hire someone to confirm the value of the house. Appraisers look at the size of the property, the features, the condition the house is in and the price of comparable properties recently sold in the area. Appraisers typically charge around $300 to $500 for their services.

- This is the cost to the bank of purchasing your credit report from one of the credit reporting agencies. Not all banks pass this fee along, but dont be surprised if they do. It should be no more than $30.

- Flood certification: If your house is situated on or near a flood plain, your bank may want documentation confirming its status. This involves paying for a certification from the Federal Emergency Management Agency , and should be around $15 to $20.

What Closing Costs Can I Deduct On My Taxes

You can write off some closing costs at tax time. Mortgage closing costs typically range between 2% and 6% of your loan amount. When youre determining what to claim on taxes, it helps to know the IRS rules. Because each persons tax situation may be different, you may want to consult a tax professional for specific guidance.

Tax-deductible closing costs can be written off in three ways:

Read Also: 10 Year Treasury Yield And Mortgage Rates

Mortgage Loan Processor Salaries Things To Consider

Anyone who wants to start a mortgage loan processor career can find a niche in the industry by checking out mortgage loan processor salary. The mortgage loan processor salary varies depending on many factors such as location, industry, level and type of mortgage loan processor. However, there are some common trends that apply across mortgage loan processor salary categories. These include experience, type of mortgage loan processor, industry and the mortgage loan processor salary structure. Some of these include industry, salary structure and level.

What is mortgage loan processor salary? The mortgage loan processor salary refers to the financial position of mortgage loan originators. In essence, mortgage loan originators are responsible for providing mortgage loan processing services to mortgage lenders. This includes processing application loans, loan origination requests and mortgage loan offers. The mortgage loan processor salary is usually set by the mortgage loan originators employer. However, this may vary from company to company.

Are Closing Costs Tax Deductible

Some closing costs may be tax deductible. For example, you may be able to deduct the cost of mortgage insurance premiums, property taxes, prepaid interest, points, or origination fees from your taxes. On the other hand, the cost of things like home appraisals, inspections, title insurance, and HOA fees are usually not tax deductible. Consult a tax advisor for information regarding the deductibility of interest and charges.

You May Like: Rocket Mortgage Conventional Loan

Understand What The Seller Pays For

Who pays what closing costs? While the buyer pays some of the closing costs, the seller is typically obligated to pay others, such as the real estate agent commission. You can ask your seller to chip in for your portion, which would be reflected as seller credits on the loan estimate form. Keep in mind that this strategy might not work in a market like the one were in today, however, when sellers have much more leverage.

How Much Will I Pay In Closing Costs

The total tab for your closing costs depends on three key factors:

- The price of the home

- Its location

- Whether youre buying or refinancing

As of the first half of 2021, the average closing costs for buying a single-family home added up to $6,837, according to real estate data firm ClosingCorp. The average closing costs for a refinance came in at $2,398.

Those costs vary widely across the country, however, partly due to tax differences. Homebuyers in Washington, D.C., for example, paid the highest average closing costs, at $30,352. Delaware and New York came in second and third, respectively, with average closing costs above $17,000. The cheapest closing costs were found in the middle of the country: Missouri , Indiana and North Dakota .

Also Check: Does Rocket Mortgage Service Their Own Loans

How Long Does It Take To Close On A House

Many factors go into determining how long the closing process is likely to take it depends primarily on your lender. You should receive a closing date on your purchase agreement. The type of mortgage loan can also impact how long it takes to close on a house. FHA loans typically take a little longer than conventional loans. Its important to check in with your mortgage loan officer and real estate agent to get regular updates throughout the course of the process.

Examples Of Typical Closing Costs

Other items in addition to the above may be common in some jurisdictions, and some transactions may include unusual or unique items as closing costs. In the United States, federal law requires that all residential transactions financed by a mortgage have all closing costs documented in detail upon the standard HUD-1 form. This information must be provided to the principals but does not have to be sent to the government. Instead a Declaration or Statement by Buyer and/or Seller is often required to be provided to the government office recording the deed. Form 1099-S may be required to be sent to the United StatesInternal Revenue Service, but Federal law does not allow a charge for this.

Read Also: Who Is Rocket Mortgage Owned By

Other Costs At Closing

Closing costs may also include:

- Federal Housing Administration fees

- Veterans Affairs fees

- Rural Housing Service fees associated with mortgages guaranteed by the government

- A flood determination fee, to investigate whether the property is in an area prone to flooding

- A land survey to verify the propertys boundaries

- Title charges

A host of other miscellaneous costs may include a courier/delivery fee, endorsements, recording fee, transfer tax, and an optional home warranty.

Upfront And Ongoing Mip

All FHA loans come with mortgage insurance, which is an additional cost paid by the borrower to protect the lender in case of default.

FHA mortgage insurance premium comes in two parts:

With a mortgage backed by the FHA, you have to pay MIP for as long as your loan lasts . And you have to move or refinance to escape the premiums.

If your credit score is 620 or better, you might be better off getting a conforming loan. Because you can stop paying mortgage insurance on those when your equity reaches 20%. Oh, and conforming loans require a lower down payment: just 3%.

Read Also: 10 Year Treasury Vs Mortgage Rates

So What Are All Of These Itemized Closing Costs

Excellent question. After all, Loan Estimates and Closing Disclosures are 35 pages long and theyre an alphabet soup of fees, taxes, and jargon thats only familiar to people in the real estate industry. Whats more, there are different tax and insurance regulations from state to state, and some use different terms for the same types of charges. The kind and number of itemized fees you could see on a LE or CD can also vary dramatically. For this reason, its challenging to find a detailed list that explains what each and every one of these fees mean.

Page 2 of your LE or CD divides all your closing fees into two categories: Loan Costs, and Other Costs. Loan Costs are charges for services provided to the lender so that they can accurately process the loan. Other Costs include taxes, prepaid costs, initial escrow payments, and other itemized costs.

At the end of this article we explain the most common closing fees and charges. Theyre broken down into the same sections as your LE or CD so you can easily follow along.

- If theres a fee on your loan estimate thats not listed below, your loan consultant or processing expert will be able to explain it for you.

- If you need more information about the itemized fees on your Closing Disclosure, your closing expert can help you.

Better Mortgage is committed to eliminating unnecessary fees wherever possible and not passing on costs to our customers. Youll see how our Loan Estimates compare when you start the process.

Ask About Discounts And Rebates

Did you ever go to buy a car and find out about rebates you didnt know existed? The same may be true with mortgage loans, as some lenders offer incentives to attract borrowers. These rebates can knock down various costs a few hundred dollars easy money for the time it takes you to ask. You never know what you may find.

Recommended Reading: Recasting Mortgage Chase

Prepaid Daily Interest Charges

You prepay interest on your loan from the day your loan closes to the end of the month. For example, if you close on the 15th of the month, then you prepay 15 days of interest in advance. If your loan funds at the end of the month, this charge will be small. Basically, if you close near the start of the month and you have a big loan amount, then the charge may be substantial.

Veterans Affairs Funding Fee

If you have a VA Loan, this fee, charged as a percentage of the loan amount, helps offset the programs costs to U.S. taxpayers. The amount of the fee depends on your military service classification and loan amount the fee can be paid at closing or rolled into your mortgage. Some military members are exempt from paying the fee.

Real estate commissions represent one of the highest costs at a typical closing. Buyers dont pay this fee, though sellers do. Typically, the commission is 5% to 6% of the homes purchase price, and it’s split evenly between the seller’s agent and the buyer’s agent.

You May Like: Chase Recast Mortgage

Final Thoughts On Closing Costs

Closing costs are processing fees you pay to your lender when you close on your loan. Closing costs on a mortgage loan usually equal 3% 6% of your total loan balance. Appraisal fees, attorneys fees and inspection fees are examples of common closing costs.

The specific closing costs youll pay depend on the type of loan you have, your homes value and your states laws. Sellers may also need to pay for closing costs, depending on the sale agreement.

You might be able to save on your closing costs by negotiating with your lender. You may also want to ask your seller to pay a percentage of your closing costs or take a no-closing-cost loan. In addition to your funds, make sure you review everything you need to bring to closing.

Ready to buy a house? Get approved with Rocket Mortgage® and start your real estate journey today!

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

How Closing Costs Affect Your Mortgage Interest Rate

Mortgage loan pricing is flexible. You can choose the fee structure that works best for your financial situation.

For instance, maybe you want the lowest interest rate and monthly mortgage payment possible and youre willing to pay extra upfront to get it.

Or, you might accept a slightly higher interest rate if your lender will cover the closing costs and get your outofpocket expense to zero.

You should be aware of your options so you can choose the structure thats most affordable for you.

Read Also: Can You Do A Reverse Mortgage On A Mobile Home