Pros Of A Large Down Payment

Lower monthly payments. Besides saving with a lower mortgage rate, youll be borrowing less overall and therefore paying back less each month.

Bigger and better home. You can afford a more expensive home with the same monthly payment if you put more down more.

Cheaper borrowing. The less you borrow, the lower the total cost of the interest youll pay over the lifetime of your mortgage.

How Much Do You Need For A Down Payment

First, letâs talk about the law. In Canada, you must pay at least 5% of the homeâs purchase price in cash. This percentage is the minimum for homes valued under $500,000, but you are allowed to put down more. For homes priced between $500,000 and $1 million, youâll need at least 10% of the part of the price above $500,000 in cash. If the homeâs purchase price is over $1 million, youâll need a full 20% deposit.

The minimum legal deposits are easier to understand with examples, which weâve included in this table.

| Purchase price | |

| $1,000,000 * 20% | $200,000 |

Youâll also need a full 20% down payment if the home is not your primary residence .

If you put down between 5% â 20%, your mortgage is considered a high-ratio mortgage, and youâll need to purchase mortgage default insurance. This insurance protects your lender in case you default on your loan.

The premium for your mortgage default insurance is calculated as a percentage of the homeâs purchase price, and that percentage decreases as your down payment increases. Our mortgage down payment calculator can show you how your down payment size affects your mortgage insurance premium. You can pay the premium out of pocket, but most homebuyers opt to add it to their mortgage and pay it off over the life of the loan.

If you put down a 20% down payment or more, your mortgage is considered a conventional mortgage, and you donât need to purchase mortgage default insurance.

What Happens If You Can’t Put Down 20%

If your down payment is less than 20% and you have a conventional loan, your lender will require private mortgage insurance , an added insurance policy that protects the lender if you can’t pay your mortgage.

Other types of loans might require you to buy mortgage insurance as well. Depending on the type of loan and its terms and conditions, the mortgage insurance might be added to your loan amount, thereby also increasing the amount of interest you pay over the life of the loan. In addition, you might have to keep paying mortgage insurance even after you achieve 20% equity in your home.

Recommended Reading: Mortgage Recast Calculator Chase

How Much Do You Have To Put Down On A House

First things first: The idea that you have to put 20 percent down on a house is a myth.

The average firsttime home buyer puts just 6% down, and certain loan programs allow as little as 3% or even zero down.

You shouldnt think its conservative to make a large down payment on a home, or risky to make a small down payment. The right amount depends on your current savings and your home buying goals.

If you can buy a house with less money down and become a homeowner sooner, thats often the right choice.

Minimum Down Payment Requirements

Putting at least 20% down on a home will increase your chances of getting approved for a mortgage at a decent rate, and will allow you to avoid mortgage insurance.

But you can put down less than 20%. The minimum down payment required for a house varies depending on the type of mortgage:

-

FHA loans, which are backed by the Federal Housing Administration, require as little as 3.5% down.

-

VA loans, guaranteed by the U.S. Department of Veterans Affairs, usually do not require a down payment. VA loans are for current and veteran military service members and eligible surviving spouses.

-

USDA loans, backed by the U.S. Department of Agriculture’s Rural Development Program, also have no down payment requirement. USDA loans are for rural and suburban home buyers who meet the program’s income limits and other requirements.

-

Some conventional mortgages, such as the Fannie Mae HomeReady and Freddie Mac Home Possible mortgages, require as little as 3% down. Conventional loans are not backed by the government, but follow the down payment guidelines set by the government-sponsored enterprises Fannie Mae and Freddie Mac.

Down payment requirements can also vary by lender and the borrower’s credit history. The minimum down payment for an FHA loan is just 3.5% with a credit score of 580 or higher, for example, but the minimum is 10% with a credit score of 500 to 579.

Don’t Miss: Can You Refinance A Mortgage Without A Job

Va Loans Are A Special Case

There are no continuing mortgage insurance monthly premiums for those with VA loans, even if you put down nothing. Instead, theres a VA funding fee.

Thats 2.3% of the loan amount for first-time use, and 3.6% for subsequent uses, payable on closing. However, you can often roll it up into your new mortgage.

The Math Behind Putting Less Than 20% Down

May 19, 2021

A down payment is the amount of cash that you put toward the purchase of your home at the time of purchase. In short, the more you put down, the less youll have to borrow from your lender.

Did you know that you could buy a home with a down payment of less than 20%? Lots of people do. In fact, according to the National Association of Realtors, the average down payment among repeat buyers in 2016 was 14%. For first-time homebuyers, the average down payment was just 6%–and it’s possible to put down even less. But first, you need to understand some other important numbers and how they add up.

Recommended Reading: How Much Is Mortgage On A 1 Million Dollar House

Reasons To Save For A Larger Down Payment

If you have the minimum down payment required to buy a house, you might decide you’re ready to get the ball rolling. But you also may want to consider saving even more for a down payment. Here are some advantages of paying more up front:

- Lower interest rate. Lenders reward a higher down payment with a lower interest rate. This could save you tens of thousands of dollars over the years.

- Lower monthly payments. When you take out a 30-year mortgage, for example, the amount you borrow is spread out into monthly payments for 30 years. The less you borrow, the less money you’ll pay every month.

- Less or no mortgage insurance. If you put 20% down on a conventional mortgage, you won’t have to pay for private mortgage insurance, which typically costs between 0.2% and 2% of your mortgage amount. Other types of mortgages require different kind of insurance that cost a percentage of your loan, so the less you borrow, the less you’ll pay for insurance.

There are always pros to having a bigger down payment. But it’s up to you whether you’re ready to buy now or want to save more.

What’s The Minimum You Should Have Saved

Conventional loans, sometimes known as regular loans, typically require a down payment anywhere between 3% and 20%. Anything lower than 20% requires you to pay private mortgage insurance, so thats an increase in your monthly payment to consider when saving for a down payment.Based on your income, credit, and state that you live in, you could qualify for grants and down payment assistance programs that a lender could walk you through.

Don’t Miss: Rocket Mortgage Loan Requirements

Can I Use A Gift For A Down Payment

If you cant come up with all the money for a down payment on your own, but you have a really great person in your life who wants to help you out, youre in luck: You can accept a financial present from someone else. However, who can give that money to you depends on the type of loan. For conventional loans, it will need to be a family member. For FHA loans, there is a bit more flexibility to use gift funds from friends, labor unions and even employers. Regardless of your loan, getting a gift isnt as simple as cashing a check. Be sure to read the rules for using gift funds for your down payment before receiving any money.

How Can I Minimize Cmhc Insurance Premiums

For example, on a $500,000 home, here are the insurance premiums for various down payment percentages.

| Down Payment | |

|---|---|

| 20% | $0 |

Using a down payment of 20% or more exempts you from paying CMHC insurance. However, mortgage lenders may require you to get CMHC insurance even if you make a down payment greater than 20%, depending on your financial situation. Lenders can still be responsible for CMHC insurance premiums, but they generally pass it on to you by putting it on the mortgage, and that can increase your monthly payment slightly. That is a reason why the mortgage rate that you can get for a 35% down payment is lower than for a 20% down payment, since lenders need to pay less CMHC mortgage default insurance.

You May Like: Does Prequalifying For A Mortgage Affect Your Credit

How Much Mortgage Can I Get If I Earn 30000 A Year

If you were to use the 28% rule, you could afford a monthly mortgage payment of $700 a month on a yearly income of $30,000. Another guideline to follow is your home should cost no more than 2.5 to 3 times your yearly salary, which means if you make $30,000 a year, your maximum budget should be $90,000.

How much house can I afford 80k salary? So, if you make $80,000 a year, you should be looking at homes priced between $240,000 to $320,000. You can further limit this range by figuring out a comfortable monthly mortgage payment. To do this, take your monthly after-tax income, subtract all current debt payments and then multiply that number by 25%.

What salary do I need to afford a 350k house?

How Much Income Do I Need for a 350k Mortgage? You need to make $107,668 a year to afford a 350k mortgage. We base the income you need on a 350k mortgage on a payment that is 24% of your monthly income. In your case, your monthly income should be about $8,972.

How much house can I afford 75k salary? I make $75,000 a year. How much house can I afford? You can afford a $255,000 house.

What Happens If I Make Less Than A 20% Down Payment

If you take out a conventional loan and put down less than 20%, youll pay private mortgage insurance. This cost is added to your monthly mortgage payment and can be removed after you reach an 80% LTV ratio.

If you have an FHA loan, youll pay for upfront and annual FHA mortgage insurance regardless of your down payment amount. You can get rid of it after 11 years if you put down at least 10% at your mortgage closing, or by refinancing into a conventional loan after you reach an 80% LTV ratio.

You May Like: Chase Mortgage Recast

How Much Down Payment Is Required To Avoid Private Mortgage Insurance

Most people only escape mortgage insurance by making a down payment of 20% or more or by waiting until their equity reaches the required amount. Then they can stop paying premiums or refinance, depending on their type of loan.

But some lenders offer ways around this:

1. Lender-paid mortgage insurance. The lender picks up the tab for the premiums. However, these loans come with higher mortgage rates, so you end up paying for mortgage insurance anyway.

2. Piggyback loans. You borrow the difference between your savings and a 20% down payment with a second mortgage. For instance, you can secure a second loan for 10% of the purchase price and pay 10% down. This is known as an 80-10-10 loan.

But both those options tend to be costly. The first typically brings a higher mortgage rate and the second a further loan to maintain.

But for some homebuyers, these alternatives can be attractive. And remember that if you dont pay PMI, you can expect to pay a higher interest rate which means higher monthly mortgage payments.

How Much Should You Put Down On A House

Should you put 20% down on a house, even though its not required? In many cases, the answer is no. In fact, most people put only 612% down. But the right amount depends on your situation.

For instance: If you have a lot of money saved up in the bank, but relatively low income, making the biggest down payment possible can be smart. Thats because a large down payment shrinks your loan amount and reduces your monthly mortgage payment.

Or maybe your situation is reversed.

Maybe you may have a good household income but very little saved in the bank. In this instance, it may be best to use a , while planning to at some point in the future.

At the end of the day, the right downpayment depends on your finances and the home you plan to buy.

Recommended Reading: Chase Mortgage Recast Fee

What Is Down Payment Assistance

If you could use a little help making your down payment, there are down payment assistance programs available at a local and national level. These programs offer funding, typically from the government, nonprofits, unions, employers or lenders that reduce the amount of money you need to put down.

Some programs are more like loans or second mortgages you pay back , while others are grants that you dont have to pay back. Common eligibility requirements are typically a minimum credit score and a certain household income threshold that is based on the areas median income.

There are down payment assistance programs across the country, including for first-time home buyers. For programs in your state, check out the FHAs list of down payment grants for 2020.

How Does Your Down Payment Affect Your Home Offer

Unless your bid is over the asking price, the down payment probably won’t sway the seller. They’ll get the same amount at closing. Making a bigger down payment may give you some negotiating power in a competitive housing market, however. For instance, if you’re paying more than 20% down and buying with a conventional mortgage, you have the flexibility to make your home offer more attractive with concessions like waiving appraisal and inspection contract contingencies. Paying less money down and shopping with an FHA or VA loan means you cant skip the appraisal or the inspection to make a stronger bid.

Also Check: What Does Gmfs Mortgage Stand For

How To Decide How Much To Spend On Your Down Payment

Buying a home is exciting. Its also one of the most important financial decisions youll make. Choosing a mortgage to pay for your new home is just as important as choosing the right home.

You have the right to control the process. Check out our other blogs on homebuying topics, and join the conversation on Facebook and Twitter using #ShopMortgage.

One of the toughest parts of buying a home for the first time is coming up with a down payment. You may have heard that in order to buy, you should have 20 percent of the total cost of the home saved up for the down payment. Actually, you can choose how much to put down based on what works best for your situation.

Putting 20 percent down has a lot of benefits. However, saving enough money for a 20 percent down payment can be challenging, especially for first-time homebuyers.

What Is The Minimum Down Payment On A House

There is no law or rule for a universal minimum down payment, but the more you pay upfront, the lower your monthly mortgage payments, the lower the interest rate you will qualify for, and the less likely you will be to have to pay mortgage insurance or other fees. Generally, however, 3%-5% would be the absolute minimum, and only for certain borrowers.

Don’t Miss: Can You Get A Reverse Mortgage On A Mobile Home

Reasons For Not Putting 20% Down

While a 20% down payment may help save costs, there are plenty of reasons why it might not be possible. For some, waiting to save up 20% for a down payment may cost too much time. While youre saving for your down payment and paying rent, the price of your future home may go up. So putting less than 20% down might be worth it to get into your first home sooner and start building valuable equity.

If you have high-interest credit card debt or other debt, its wise to work to pay down your balances even if that means youll have less for a down payment. Also, private mortgage insurance is an extra monthly cost, but its not a bad idea to weigh the pros and cons of PMI to become a homeowner.

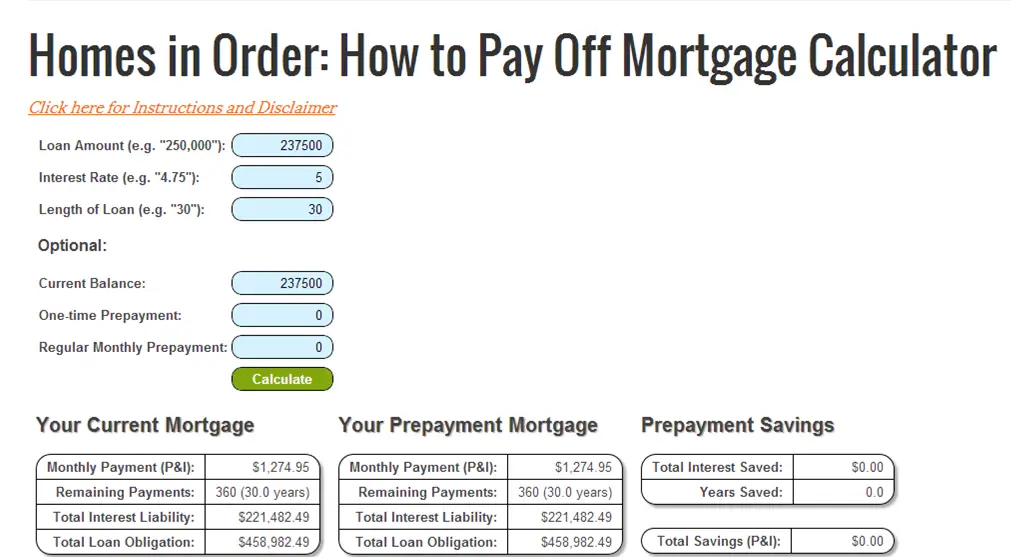

Our down payment calculator can help you understand the costs and benefits of different down payment amounts so you can decide what makes the most sense for you.

The down payment amount thats right for one person, wont necessarily be right for another. Its important to consider the benefits of different down payment amounts and get advice from loved ones, your real estate agent and a mortgage loan officer to determine whats right for you.

Good Neighbor Next Door

The Good Neighbor Next Door program from the U.S. Department of Housing and Urban Development is available to law enforcement officers, teachers, firefighters and emergency medical technicians buying homes in certain communities designated as revitalization areas.

The program offers eligible borrowers 50% off the list price of the home if the borrower commits to using a property in one of these communities as their primary residence for three years. Eligible buyers can purchase a home with as little as $100 down if they take out an FHA loan.

You May Like: How Much Is Mortgage On 1 Million