Conventional Loans With Pmi

Many people believe that if they want to get a conventional loan, they need a 20% down payment. This isnt actually true. Depending on your lender, you can get a loan with as little as 3% down. The confusion comes from the private mortgage insurance requirement.

Your lender will require you to pay PMI as a condition of your loan if your down payment is less than 20% of the loan amount. PMI is a type of insurance that protects your lender if you stop making payments on your loan. Regardless of the fact that youre the one paying for it, PMI offers no benefits. As a result, most people want to cancel PMI as soon as possible. You can contact your lender and request that they cancel your PMI plan as soon as you reach 20% equity in your home.

What Is A Down Payment

A down payment is the initial, upfront payment you make when purchasing a home. This money comes out of pocket from your personal savings or eligible gifts.

Traditionally, a mortgage down payment is at least 5% of a home’s sale price. Down payments are often, but not always, part of the normal homebuying process.

If a buyer put 10-20% down, they may be more committed to the home and less likely to default. If there is more equity in the property the lender is more likely able to recover its loss in the event of foreclosure.

Further, putting 20% down on your home when you purchase can help show the bank and yourself that you’re financially ready to purchase a house.

A down payment on a house also protects you as the buyer. If you want to sell your home and the market drops, you might owe more on your property than it’s worth. If you made a larger down payment when you purchased your house you may break even, or possibly make money when you sell.

The 20% Myth: What You Really Need For Your Down Payment

While many people still believe it’s necessary to put down 20% when buying a home, that isn’t always the case. In fact, lower down payment programs are making homeownership more affordable for new home buyers. In some cases, you might even be able to purchase a home with zero down.

How much down payment you’ll need for a house depends on the loan you get. While there are benefits to putting down the traditional 20% or more it may not be required.

For many first-time homebuyers, this means the idea of buying their own house is within reach sooner than they think.

Recommended Reading: Can I Get A Reverse Mortgage On A Condo

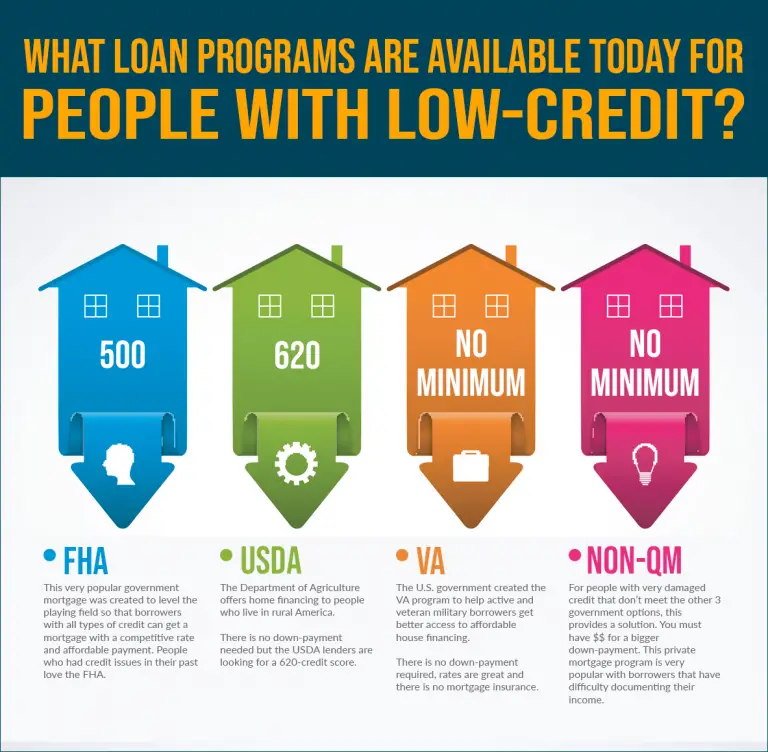

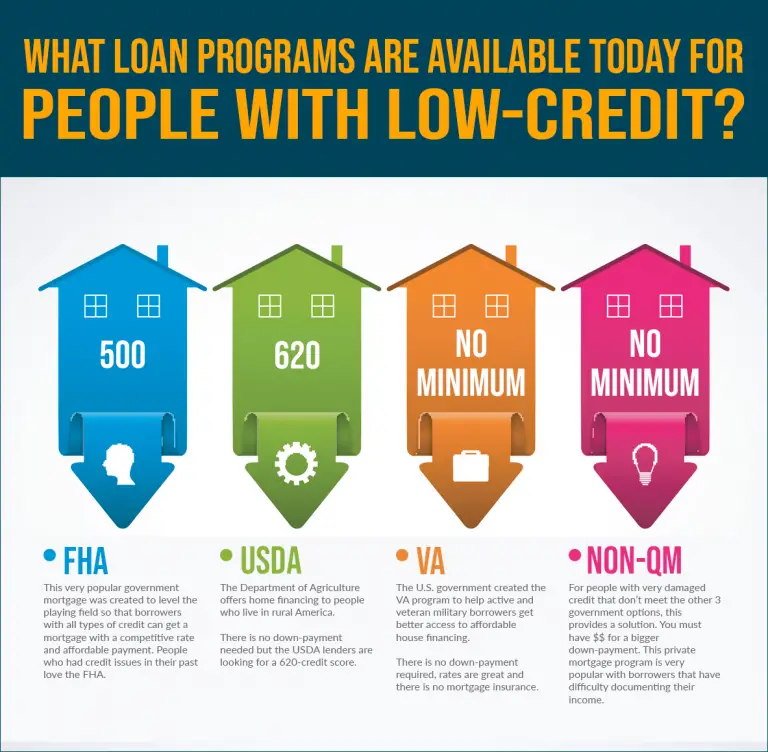

Do You Need Stellar Credit For A Zero Down Home Loan

July 22, 2018 By JMcHood

Does a zero down home loan seem out of reach for you? Do you worry that your credit score isnt high enough to qualify for it?

We have good news for you. You dont need exceptional credit to score one of the no money down home loans. Many of the zero down payment home loans also have flexible underwriting guidelines, including low credit score requirements.

Example: How To Calculate Your Minimum Down Payment

The calculation of the minimum down payment depends on the purchase price of the home.

If the purchase price of your home is $500,000 or less

Suppose the purchase price of your home is $400,000. You need a minimum down payment of 5% of the purchase price. The purchase price multiplied by 5% is equal to $20,000.

If the purchase price of your home is more than $500,000

Suppose the purchase price of your home is $600,000. You can calculate your minimum down payment by adding 2 amounts. The first amount is 5% of the first $500,000, which is equal to $25,000. The second amount is 10% of the remaining balance of $100,000, which is equal to $10,000. Add both amounts together which gives you total of $35,000.

You May Like: Chase Recast Mortgage

What Are The Downsides

Unfortunately, going with this option gives you little to no equity. This means the option to use the equity in case of an emergency is gone. Your interest rates may also be higher if a lender views you as more of a risk.

There may also be extra fees that youll have to pay, such as extra funding fees. Youll have to decide if the risks outweigh the rewards of this loan.

What To Provide To Your Lender Or Mortgage Broker

Before preapproving you, a lender or mortgage broker will look at:

- your assets

- your income

Youll need to provide the following:

- identification

- proof you can pay for the down payment and closing costs

- information about your other assets, such as a car, cottage or boat

- information about your debts or financial obligations

For proof of employment, you may have to provide:

- a proof of your current salary or hourly pay rate (for example, a recent pay stub

- your position and length of time with the employer

- notices of assessment from the Canada Revenue Agency for the past 2 years, if youre self-employed

Your lender or mortgage broker may ask you to provide recent financial statements from bank accounts or investments. This will help them determine if you have the down payment.

Your debts or financial obligations may include your monthly payments for:

Read Also: Rocket Mortgage Qualifications

Will I Qualify For A Mortgage +

To know if you will qualify for a mortgage based on your current income, try our Mortgage Required Income Calculator. You will need to supply information about the cost of the Mortgage, down-payment, interest rates, and other liabilities, after which the calculator responds with the required minimum income to qualify for the loan.

Usda Loans Have Been Cheaper Since 2016

On October 1, 2016, USDA reduced its monthly fee from 0.50% to 0.35%. Your monthly cost equals your loan amount or remaining principal balance, multiplied by 0.35%, divided by 12.

Additionally, the upfront fee fell from 2.75% to just 1.00%. This is a good opportunity for home buyers to get lower monthly payments with this loan program.

Also Check: Reverse Mortgage Mobile Home

Home Possible Freddie Mac Loans 3% Option

The Home Possible® loan is a great option for very low to low-income borrowers. It requires a 3% minimum down payment which is one of the best options for those who are low-income but dont qualify for no down payment home loans. Some features of this loan are:

- Flexible sources of down payments

- PMI is required but can be canceled after loan balance drops below 80%

- Must be condo or PUD home type, and manufactured home with some restrictions

- Income limit of 80% of AMI for parties listed on loan

Top Methods To Buy A Home With A Zero Down Fha Loan

Using these three tactics below, you can buy a home without using your own money:FHA Gift Funds FHA guidelines clearly point out that your down payment can be a gift from a relative. Here are some other approved sources for your gift funds:

- A close friend

- Your employer

- A charitable organization

In our discussions with home buyers on a daily basis, many of them are able to buy their homes using gift funds. Read our article on FHA gift funds to learn more about what is needed to use gift funds for your own payment.

The FHA guidelines on gifts indicates that you must provide the FHA lender with a gift letter. In this letter, the individual who is providing the gift verifies that the money is truly a gift with no expectation of being repaid.

FHA Down Payment Assistance Mortgage There are a limited number of lenders who offer a true zero down payment FHA mortgage. It is called the FHA loan with down payment assistance. With this mortgage, the lender will have a different closing cost structure and all of the fees can be rolled into the loan.

We have lenders who offer this program in a limited number of states. Fill out the short contact form and we will pair you with one of those lenders.

Lender Credit Your FHA lender may offer a lender credit to cover your closing costs. However, this lender credit comes with a trade-off. You will likely have a slightly higher interest rate to offset those costs.

Seller contributions may cover some or all of these closing costs items:

Read Also: Does Rocket Mortgage Sell Their Loans

Can You Buy A House With No Money Down

A nodownpayment mortgage allows firsttime home buyers and repeat home buyers to purchase property with no money required at closing, except standard closing costs.

Other options, including the FHA loan, the HomeReady mortgage, and the Conventional 97 loan, offer low down payment options with a little as 3% down. Mortgage insurance premiums typically accompany low and no down payment mortgages, but not always.

Furthermore, mortgage rates are still low.

Rates for 30year loans, 15year loans, and 5year ARMs are historically cheap, which has lowered the monthly cost of owning a home.

Check Credit Unions And State Housing Agencies

- Be sure to check out your local credit union

- And/or state housing finance agency

- Both may offer a zero down mortgage solution

- Often times these special loan programs arent widely publicized

However, that doesnt mean its impossible to score a no down payment mortgage. For example, NASA and other government agencies offer so-called high loan-to-value mortgages to select customers.

Additionally, there are so-called doctor mortgages for physicians that provide 100% financing in some cases when ordinary folk must come in with a down payment.

And some private lenders even exceed 100 percent financing despite the recent housing bust!

Also be sure to look into whats being offered by your state housing finance agency.

The California Housing Finance Agency offers silent seconds that go behind first mortgages, which can be conventional or government mortgages .

They feature deferred payments, meaning you dont need to pay a dime until the property is sold, the loan refinanced, or otherwise paid in full.

For example, California home buyers can take advantage of the MyHome Assistance Program, which offers up to 3.5% of the purchase price to cover the down payment and/or closing costs.

Combined with a first mortgage, this could give buyers the opportunity to purchase a home with nothing out of pocket.

Some of these silent seconds are even forgivable after a certain period of time, meaning they dont ever need to be paid back if you stay in the home long enough.

You May Like: Mortgage Rates Based On 10 Year Treasury

Notes On Using The Mortgage Income Calculator

This calculator provides a standard calculation of the income needed to obtain a mortgage of a certain amount based on common industry guidelines. These guidelines assume that your mortgage payments, including taxes, insurance, association fees and PMI/FHA insurance, should be no greater than 28 percent of your monthly gross income.

- FAQ: These guidelines assume that your mortgage payment and other monthly debt obligations combined should not exceed 36 percent of your monthly gross income.

Those are the base guidelines however, borrowers with excellent credit and healthy financial reserves can often exceed those guidelines, going as high as 41 percent of gross monthly income for mortgage payments and debt obligations combined. You may wish to take that into account when considering your own situation.

If I Qualify For A Usda Loan Do I Need Any Money Out Of Pocket

Yes. There are closing costs with any loan, and these usually add up to 3-5% of the loan amount.

But if you qualify for a USDA loan and dont have the cash to cover closing costs, that doesnt mean the dream of homeownership is over for you.

You have a few ways to handle closing costs on a USDA loan:

- Roll them into the loan

- Ask relatives or friends to make a gift toward closing costs.

- Apply for closing cost assistance through a state or local program. Your lender may be able to help you determine what you qualify for

While USDA loans require a 0% down payment, there are some upfront costs. The good news is that there are plenty of ways to get those taken care of. No need to give up on your dream home if you dont have the cash right now.

Also Check: Can You Get A Reverse Mortgage On A Mobile Home

One Of The Last Remaining 100% Financing Options

No money down loans appeared to have vanished during the housing bust, but USDA loans remained available throughout that time and are still available today. The growing popularity of the USDA loan has proven that zero-down loans are still in high demand.

Borrowers in designated rural areas should consider themselves lucky to have access to this low-cost, zero down loan option. Anyone looking for a home in a small town, suburban or rural area should contact a USDA loan professional to see whether they qualify for this great program.

Fannie Mae Homeready Loan

With as little as 3% down, you can get a Fannie Mae HomeReady loan. Youll need to complete a housing counseling or homebuyer education program to qualify. Your credit score can be as low as 620.

But if your debt-to-income ratio is higher than 36%, youll need a score of at least 720 unless you have six months of cash reserves. The maximum DTI is 45%.

Read Also: Monthly Mortgage On 1 Million

Community Experts Loan Program

The Community Experts program provides home financing to those that serve as experts in their communities, including accountants , CFAs, Ph.D.s, and more. These titles come with years of education and certifications, so the Community Experts program was designed to make homeownership more affordable by offering no down payment requirement.

How Do You Improve Your Chances Of Being Approved For A No Down Payment Mortgage

Being approved for a no down payment mortgage can be a challenge. However, there are a few factors you can work on to improve your chances of being approved.

- While each lender has its own set of criteria, generally, lenders will want you to have a good to excellent credit score. This means youll need a of at least 650. In addition to that, youll want to make sure that you have no prior late or missed payments on any of your credit products within the last year or two.

- Employment There are three things a lender looks at when evaluating your employment.

- Income How much money you make in comparison to how much you want to borrow.

- Stability How long have you had your job and how stable it is.

- Loss is income If you were to have a drop in income would you still be able to make your payments.

Check out these hidden costs of buying a home.

Recommended Reading: How Much Is Mortgage On A 1 Million Dollar House

Can I Use A Mortgage Calculator Based On Income +

You can gauge how much of a mortgage loan you qualify based on your income with our Mortgage Required Income Calculator. You will need to work backward by altering the mortgage cost and supplying details of your other financial commitments. The calculator will then reply with an income value with which you compare your current income.

How To Get 100% Mortgage Financing Today

- FHAs $100 down payment loan program

- HUD Good Neighbor Next Door program

- Various state housing finance agency programs

- Fannie Mae with a Community Second

- Freddie Mac with an Affordable Second

I provided a little background above about the rise and fall of zero down home loan financing. Now lets look at whats left.

Also Check: Rocket Mortgage Payment Options

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

A 0% Down Payment Whats The Catch

There is no catch, per se. The USDA loan program was created to help people purchase homes in rural and some suburban areas and encourage economic development in these communities. Theyre also meant to help low- to moderate- income families accelerate their path to homeownership.

Its no free lunch, but its a discounted one, for sure.

You can get a no down payment USDA loan as long as you meet the eligibility criteria:

- The borrower must be a U.S. citizen, U.S. permanent resident or a foreign national who cant qualify for a conventional mortgage

- Purchase a home in a qualifying USDA area

- Meet the USDA loan income limits

- Home needs to be the buyers primary residence. Some examples of USDA eligible properties include:

- Planned Unit Developments

- Manufactured homes

- Approved condo units

If you can meet all of the criteria, a USDA loan with a 0% down payment may be on your horizon.

You May Like: Can You Do A Reverse Mortgage On A Condo

Low Down Payment Firsttime Home Buyer Loans

Not everyone will qualify for a zerodown mortgage. But it may still be possible to buy a house with no money down by choosing a lowdownpayment mortgage and using an assistance program to cover your upfront costs.

If you want to go this route, here are a few of the best lowmoneydown mortgages to consider.