How To Increase Your Maximum Mortgage Affordability

If youâve used our mortgage affordability calculator, and youâre unhappy with your results, there are several steps you can take to increase your mortgage affordability:

- Increase your down payment: This will give you the ability to increase your affordability and purchase a more expensive home.

- Pay off your debts: This will lower your TDS ratio and free up more of your income for your mortgage payment, ultimately giving you the ability to carry a larger mortgage and therefore more expensive home.

- Increase your income: This is the tougher option, but it will allow you to afford a larger monthly mortgage payment, which will increase the overall size of the mortgage you can afford to borrow and repay. Alternatively, you can apply for your mortgage with your partner, or get a co-signer, such as your parents, to guarantee your mortgage.

What Is The Average Mortgage Loan Amount

The average mortgage payment in the UK is £723, with an interest rate of 2.48%. This is based on the most recent study conducted by Santander in 2018. Secondly, How much is the mortgage on a $500 000 house?. How much would the mortgage payment be on a $500K house? Assuming you have a 20% down payment , your total mortgage on a …

Apply For A 140000 Mortgage

To find out more about our range of £140,000 mortgages simply make an application with our approved mortgage experts found here on the website. Rates are available from across the market either on a fixed rate or variable rate deal. Mortgages and lenders to suit most credit types and applicants including buy to let property.

Don’t Miss: Rocket Mortgage Payment Options

National Average Monthly Mortgage Payment

What is the average monthly mortgage payment in the US? The average monthly mortgage payment in the United States is $1029*.. This payment eats up 14.84% of the typical homeowners monthly income. That may seem low, but we are looking at homeowners specifically and homeowners tend to have much higher incomes than the general population,

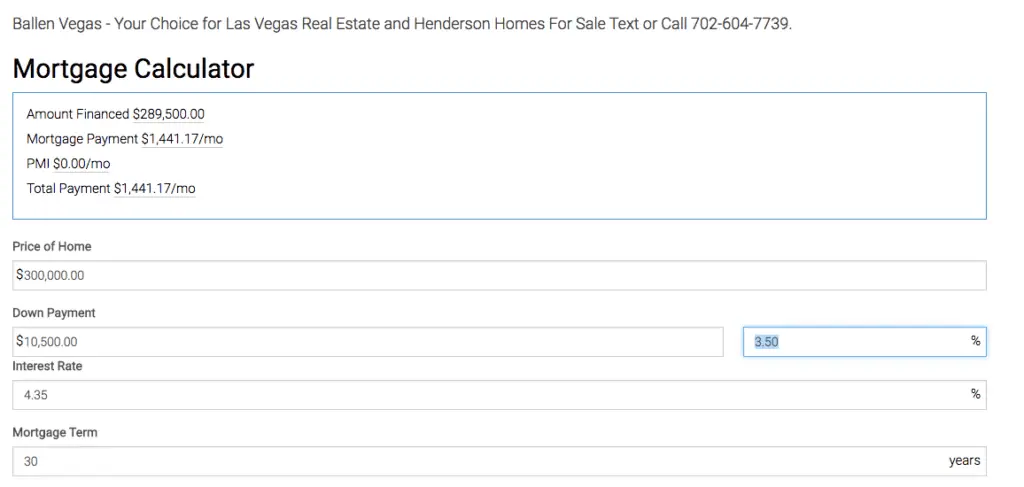

How Forbes Advisor Estimates Your Monthly Mortgage Payment

Forbes Advisors mortgage calculator makes it easy to estimate your monthly mortgage payment using your home price, down payment and other loan details. Based on that information, it also calculates how much of each monthly payment will go toward interest and how much will cover the loan principal. You can also view how much youll pay in principal and interest each year of your mortgage term.

To make these calculations, our tool uses this data:

- Home price. This is the amount you plan to spend on a home.

- Down payment amount. The amount of money you will pay to the sellers at closing. This amount is subtracted from the home price to determine the amount youll be financing with the mortgage.

- Interest rate. If youve already started shopping for a mortgage, enter the interest rate offered by the lender. If not, check out the current average mortgage rate to estimate your potential payments.

- Loan term. The loan term is the length of the mortgage in years. The most popular terms are for 15 and 30 years, but other terms are available.

- Additional monthly costs. In addition to principal and interest, the calculator considers costs associated with property taxes, private mortgage insurance , homeowners insurance and homeowners association fees.

You May Like: Reverse Mortgage Mobile Home

Can You Get A 50 Dollar Loan From Cash King

Cash King Co is not a lender and therefore can not quote you interest rates and loan terms. If you receive an instant $50 loan offer the APR and terms will be clearly defined. At this time you can decide if you want to accept the offer. Here are a few items you will want to have available during the application.

How To Use This Mortgage Payment Calculator

Our mortgage payment calculator computes payments based on your home value, equity, mortgage term and amortization.

To calculate your mortgage payment:

- Select your mortgage type: purchase, refinance or renewal

- Input the province, home value, down payment / mortgage amount and amortization period

- Choose your desired mortgage term and rate type

The calculator will update the calculations each time you change a number.

Tip: If youre renewing or refinancing your mortgage, select the Renewal/Refinance tab to estimate your potential mortgage payments without having to input a down payment.

You can even compare two rates side by side to see which saves you more.

Also Check: Mortgage Rates Based On 10 Year Treasury

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Mortgage payment calculator

Save & exit

Loan termThe amount of time you have to pay back the loan. Usually 15 or 30 years for common loan types.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

For you home gamers, heres how we calculate your monthly mortgage payments on a fixed-rate loan:

M = P /

The variables are:

The longer the term of your loan say 30 years instead of 15 the lower your monthly payment but the more interest youll pay.

Must Reads

Considerations Before Committing To A Mortgage

WOW: Look at those figures above! The amount of interest you will pay your bank over the period of the loan is outrageous, particularly when we consider what we have done to bail out the banks in our recent history. I know, you have no choice, you need a mortgage but, save what you can, while you can. Use a bigger deposit if you can, repay your mortgage early to save thousands on interest payments. Think about your financial future, when do you really want to pay of that mortgage, the answer should be as soon as possible.

Affordability: Be sure you can really afford to make the Mortgage repayments. Only you really know if you can afford a Mortgage or not and committing to a mortgage which you will struggle to repay will only cause you financial hardship and pain in the future. Remember,

Mortgages: READ THE SMALL PRINT: Your home may be repossessed if you do not keep up your Mortgage repayments .

Shop around: It always pays to shop around and see what deals are available. Most banks and building societies run promotions at various points of the year. Never assume that one lender is better than the other, look for the good deals as they could save you a lot of money.

Borrow Little, Repay Quickly: The best Mortgage is one repaid quickly. A quick repayment means less interest paid and less stress about your debt.

Recommended Reading: Who Is Rocket Mortgage Owned By

Whats The Fastest Way To Pay Off My Mortgage

The fastest way to hammer down your loan principal is with big lump-sum prepayments.

Barring that, opting for accelerated mortgage payments is the next best thing.

How do lump-sum payments affect my mortgage?

About 900,000 borrowers made a total of $23 billion in lump-sum mortgage prepayments in 2019, according to MPC.

A lump-sum mortgage payment is a one thats applied directly towards your mortgage principal. Depending on your lender, you may be allowed to prepay up to 5%, 10%, 15%, 20%, 25% or 30% of the original principal amount of your mortgage each year.

Even if you pay small amounts, the effect is magnified over time, reducing your interest expense every month until the mortgage is paid off.

Lump-sum prepayments also help increase your home equity faster. If necessary, that allows you to use your equity for further borrowing someday, such as adding a HELOC.

The average lump-sum prepayment in 2019 was $19,100, reports MPC.

What Will My Mortgage Cost

See examples of costs for different mortgage types, payment terms and interest rates.

The monthly payment and rate you’ll pay until your introductory period ends.

Follow-on payments and rate

The payments and rate you’ll pay after your introductory period ends if you dont change anything.

Use the annual percentage rate of charge to compare the cost of our mortgages, including interest and fees, with those from other lenders.

Mortgage fee

You can pay this fee when you submit a mortgage application, or add it to the amount you borrow.

Total of monthly payments

The information below shows roughly how your monthly payments will affect your mortgage balance over time. But they don’t include any other fees or payments you may need to make.

Loan to value

The percentage of the property value that you’re going to borrow. We divide your mortgage amount by the property value to work out the LTV.

Early repayment charge

The amount you’ll pay if you want to pay off the mortgage early or make an overpayment that’s more than we’ve agreed to.

Fixed-rate

Your rate stays the same for a set period, so your monthly payments remain the same even if our base rate changes.

Tracker

Your rate is a certain amount above our base rate. If base rate goes up or down, your payments will too .

Offset

Money you have in another account with us is used to lower the mortgage balance we charge interest on. All our offset mortgages are trackers.

Filter your results

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

How Do You Lower Your Interest Expense

These are the most common ways to lower your interest costs. Some of these methods are similar to above and some are the exact opposite:

- Lower the purchase price

- Make a larger down payment

- Find a lower interest rate

- Reduce the amortization

- Choose accelerated payments

- Make lump-sum prepayments

Things that save you interest generally lower your amortization, resulting in you paying off your mortgage sooner.

How Much Deposit Do I Need To Buy A 140000 House

In exceptional circumstances, lower deposits of 5 – 10% could be achievable, though currently, the majority of lenders are asking their borrowers to put down 15 – 20% of the properties market value.

The table below shows the relationship between deposit size and mortgage amount for a property with a market value of £140,000.

|

Property value |

Also Check: Chase Mortgage Recast

What Is The Average Monthly Mortgage Payment

The mean or average monthly mortgage payment for U.S. homeowners is $1,487, according to the latest American Housing Survey from the U.S. Census Bureau. The Census also reports that the median monthly mortgage payment for U.S. homeowners is $1,200. Thats up slightly from the last study when the median monthly payment was $1,100. 1.

Mortgage Loan Calculator For Refinancing Or Home Purchase Payments

Get estimates for home loan payments to help you decide what you can afford.

This simple Mortgage Loan Calculator enables you to calculate what your monthly mortgage payments will be – including the principal, interest, property taxes and home insurance . The result you get will be relevant for a wide variety of different mortgage types. It will also display your projected repayment schedule, taking into account your principal loan amount, interest rate, and any additional prepayments you intend to make

You May Like: Chase Recast Calculator

How Can We Help You

The Independent review organisation Reviews.co.uk report that 100% of reviewers recommend Lending Expert

Lending Experts

Were mortgage experts. This means we know our stuff when it comes to all types of mortgages. We know where the best rates are and have access to exclusive deals just for Lending Expert customers.

Huge Market Comparison

Were not tied to one lender which means we can search the wider market to find you the cheapest mortgages from across the UK.

Lending Expert is an FCA regulated credit broker which means you can be assured you are dealing with a legitimate and reputable finance company.

Flexible Lending

If you have bad credit or have previously been refused a mortgage we can consider your application. Whatever your circumstances please get in touch and we’ll do our best to help find you the perfect mortgage deal.

If A Sports Shop Sold 1500 Dozengolf Balls Last Week

Add your answer/comments in just seconds. No signup necessary.Just put your answer in the box below and hit Save.

Can you help us by answering one of these related questions?We need your help! Please help us improve our content by removing questions that are essentially the same and merging them into this question. Please tell us which questions below are the same as this one:Q: How much are monthly payments for a 280 000 mortgage?

The following questions have been merged into this one. If you feel any of these questions have been included in error help us improve our content by splitting these questions into seperate discussions. Please unmerge any questions that are not the same as this one:Q: How much are monthly payments for a 280 000 mortgage?

- If a sports shop sold 1 500 dozen golf balls last week how many individual golf balls did the shop sell a 12 500 b 18 000 c 180 d 125? – Mortgagae of 280 000 in fl

- If i make extra mortgage payment of 150 monthly and my current mortgage is 379 000 what effect will the extra payment make? – Monthly mortgage payment on 280 000

- What compound interest rate will be on mortgage of 240000 4 75 for 30 years? – Mortgage on 280000

You May Like: Chase Recast Mortgage

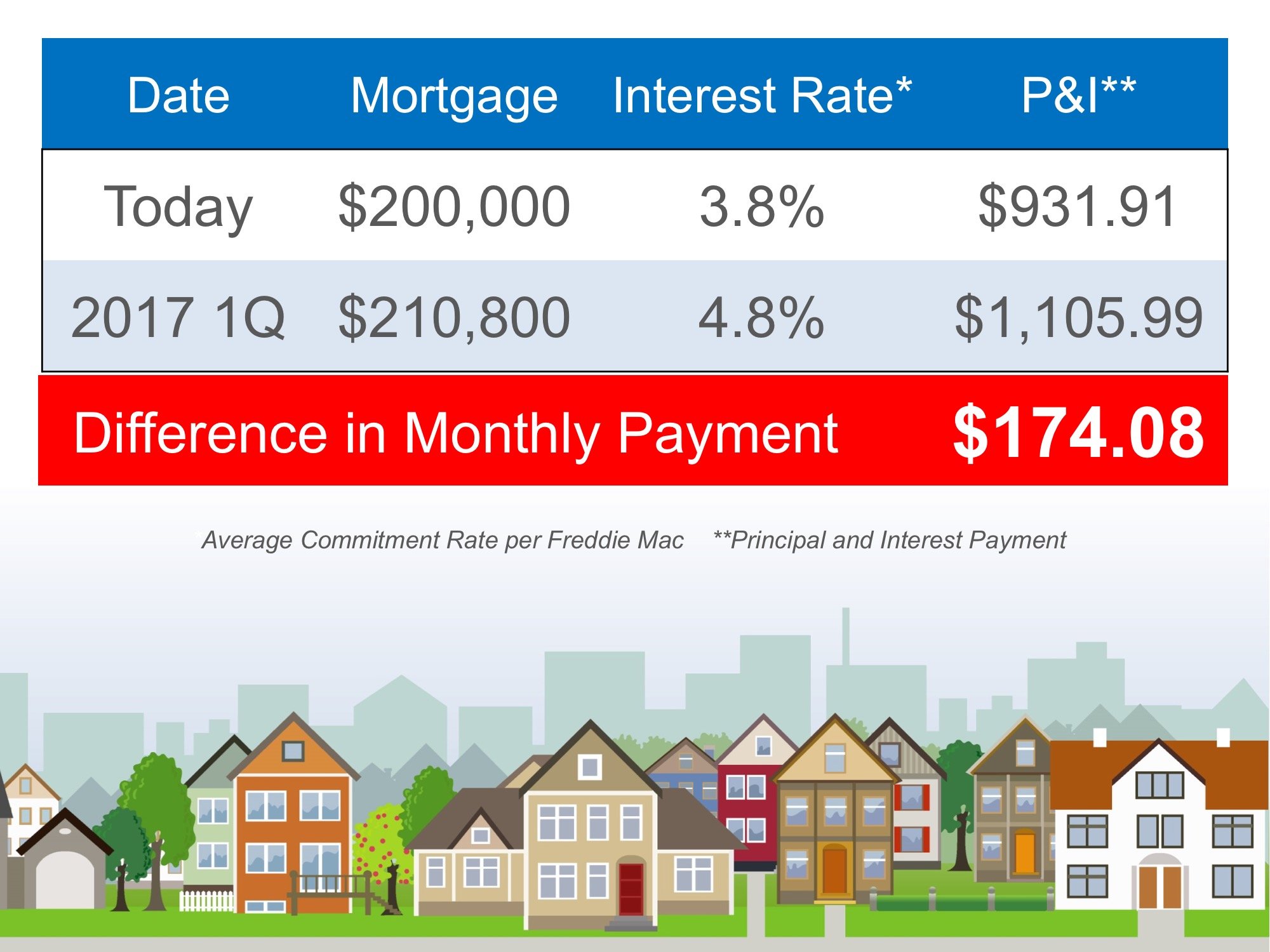

How To Calculate A House Payment On A $300000 Loan

Multiply the result by your $300,000 loan to find your monthly payment. For example, pretend you have a 30-year mortgage at 4.8 percent. You will follow these steps: Divide 0.048 by 12 to get 0.004. Add 1 to get 1.004. Raise 1.004 to the -360th power to get 0.2376. Subtract 0.2376 from 1 to get 0.7624. Divide 0.004 by 0.7624 to get 0.005247.

A Sample Maximum Affordability Calculation

Let’s look at an example where your gross annual income is $75,000. You’re buying a home with annual property taxes of $3,600, monthly heating costs are $200 and, since you’re buying a house, there are no condo fees. In addition to your housing expenses, you have a monthly car loan at $300 and must make minimum monthly payments of $250 on your credit card debt. You have $20,000 saved up for a down payment.

Example Parameters

÷ 12 months in the year

= Max monthly mortgage payment: $1,450

Since both your GDS and TDS ratios must be less than or equal to the maximum, the largest mortgage payment you can afford is $1,450. Though your GDS suggests you can afford $1,500, at that monthly payment, your TDS will be over 40% and therefore $1,450 is the maximum payment that ensures both debt service ratios fall within the allowable range.

With a monthly mortgage payment of $1,450 per month, you can afford a $300,000 mortgage with a 5-year fixed interest rate of 3.28% and an amortization period of 25 years. Finally you must ensure you have the minimum down payment of 5%. Since $20,000 / $300,000 = 6.67% you can satisfy the minimum down payment requirement.

After calculating your GDS ratio, TDS ratio and down payment percent, you can determine your maximum affordability at $300,000. Since your TDS ratio is limiting your affordability, you could try paying off some of your credit card or car debt to increase your maximum affordability.

You May Like: Rocket Mortgage Vs Bank

How To Get A $150000 Mortgage

Applying for a mortgage isnt as hard to come by as most people think. It just takes a little preparation. Using a tool like Credible puts that $150,000 loan well within reach.

Here are the steps youll want to follow to get a mortgage and buy that dream house:

Credible makes getting a mortgage easy